Market Overview

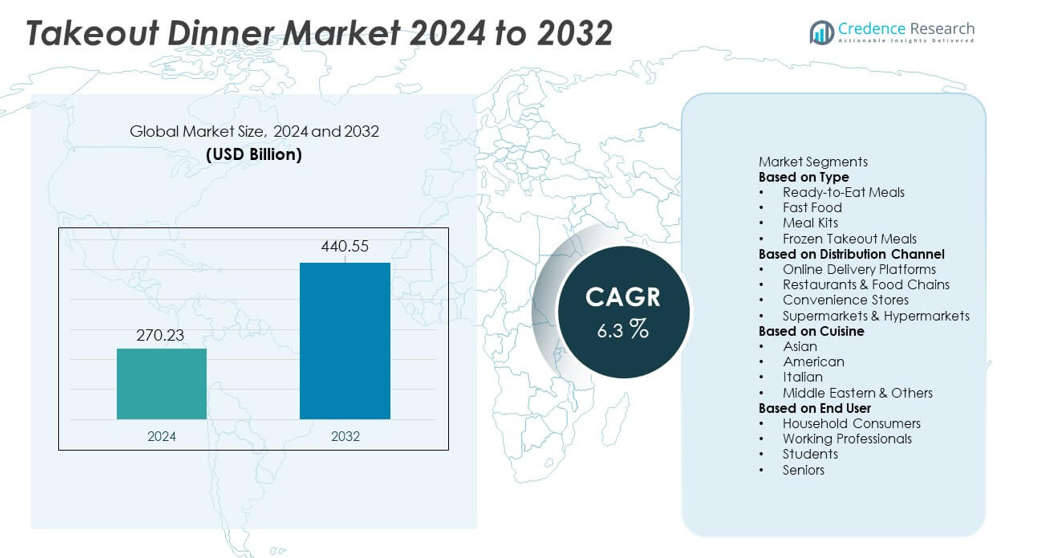

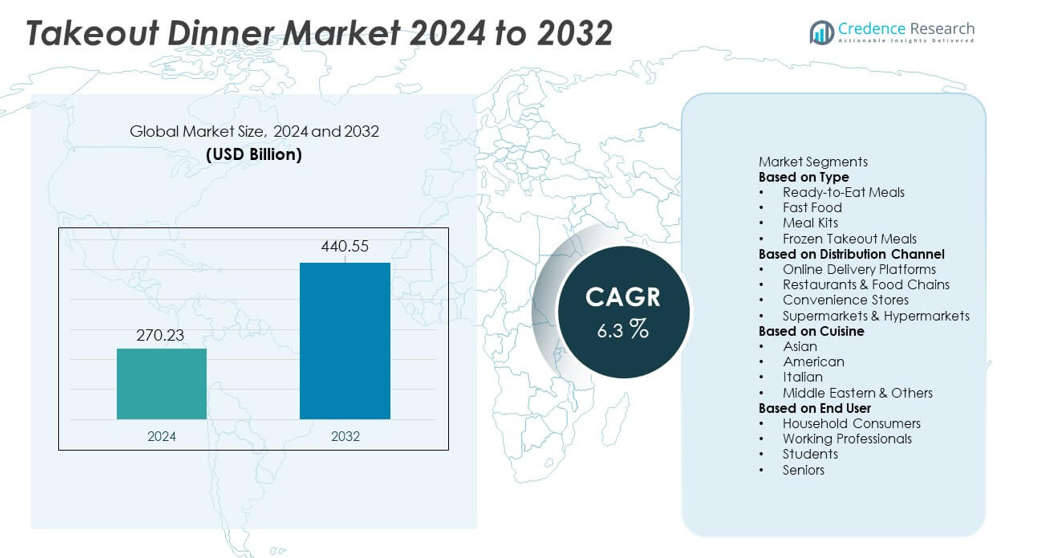

The Takeout Dinner market reached USD 270.23 billion in 2024 and is projected to grow to USD 440.55 billion by 2032, reflecting a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Takeout Dinner market Size 2024 |

USD 270.23 billion |

| Takeout Dinner market, CAGR |

6.3% |

| Takeout Dinner market Size 2032 |

USD 440.55 billion |

The Takeout Dinner market is driven by major players such as McDonald’s, Domino’s Pizza, Yum! Brands, Starbucks, DoorDash, Uber Eats, Just Eat Takeaway, Chipotle Mexican Grill, Panera Bread, and Grubhub, all of which expand their reach through strong delivery partnerships, digital ordering systems, and diverse menu offerings. These companies invest in faster delivery models, improved packaging, and loyalty programs to enhance customer retention. Regionally, North America leads the market with 37% share, supported by high digital adoption and strong delivery platform usage, while Europe follows with 28% share, driven by widespread restaurant participation and growing demand for convenient evening meals.

Market Insights

- The Takeout Dinner market reached USD 270.23 billion in 2024 and will grow at a CAGR of 6.3% through 2032, supported by strong demand for convenient evening meals.

- Strong market drivers include busy consumer routines, rapid growth of digital ordering, and rising demand for ready-to-eat meals, with ready-to-eat meals holding 36% share in the segment.

- Key trends include the rise of healthier takeout choices, rapid expansion of subscription-based meal kits, and increased use of AI-based delivery optimization among major players.

- Competitive pressure grows as companies enhance menus, speed up delivery, and introduce loyalty programs, while restraints include high delivery fees, food freshness concerns, and rising operational costs.

- Regionally, North America leads with 37% share, followed by Europe at 28% and Asia Pacific at 26%, driven by strong online ordering use and expanding restaurant and cuisine diversity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Ready-to-eat meals lead the segment with 39% share, driven by rising demand for quick, convenient dining solutions among busy consumers, working professionals, and urban families. These meals gain popularity due to their time-saving nature, diverse options, and improved packaging that maintains freshness and flavor. Fast food continues to grow with strong brand visibility and wide accessibility, while meal kits appeal to consumers seeking partially prepared, customizable options. Frozen takeout meals maintain steady demand as households prioritize affordability and longer shelf life. Growth in convenience-driven lifestyles and expanding product innovation strengthen ready-to-eat meal dominance.

- For instance, Nestlé continually introduces new products and invests in its manufacturing capabilities to meet demand and adapt to consumer trends. The company has invested millions of dollars to expand its U.S. production facilities for frozen meals, such as the Gaffney, South Carolina, plant, which produces items under the Stouffer’s and Lean Cuisine brands.

By Distribution Channel

Online delivery platforms dominate the market with 46% share, supported by strong adoption of food delivery apps and increasing consumer preference for doorstep service. Digital platforms offer wide cuisine choices, promotional pricing, and real-time order tracking, making them the preferred option for takeout dinners. Restaurants and food chains follow as they expand takeaway and curbside pickup models. Convenience stores gain momentum through ready-to-eat sections and grab-and-go offerings, while supermarkets and hypermarkets serve households seeking packaged meal solutions. Rising mobile penetration and app-based ordering continue to drive online platform leadership.

- For instance, DoorDash grew its logistics network to reach over 42 million monthly active users and added approximately 600,000 merchant partners across North America. The platform also handled over 2.5 billion delivery orders in the last operating year (2024).

By Cuisine

Asian cuisine holds the largest share at 34%, driven by widespread consumer preference for flavorful, affordable, and diverse meal options such as Chinese, Indian, Thai, and Japanese dishes. American cuisine follows with strong demand for burgers, sandwiches, and comfort foods, supported by established fast-food chains. Italian cuisine remains popular with takeout staples like pizza and pasta. Middle Eastern and other global cuisines grow steadily as consumers explore new flavors and healthier meal choices. Expanding multicultural populations, rising global food trends, and strong representation on delivery apps reinforce the leading position of Asian cuisine in the takeout dinner market.

Key Growth Driver

Rising Demand for Convenience and Time-Saving Meals

Busy lifestyles and growing work commitments drive strong demand for convenient takeout dinner options. Consumers increasingly prefer ready-to-eat meals, fast food, and quick-service offerings that reduce time spent on cooking. Urbanization and increasing dual-income households further support this shift. Delivery apps make access easier by offering fast ordering and diverse menu choices. As consumers prioritize convenience, the takeout dinner market continues to expand across both metropolitan and suburban regions.

- For instance, McDonald’s generates income globally through its business model. The company has a significant international presence, operating in numerous countries worldwide. The business strategy involves both company-operated restaurants and a large number of franchised locations.

Expansion of Online Delivery Platforms

Online delivery apps accelerate market growth by offering improved accessibility, personalized recommendations, and multiple payment options. These platforms allow customers to browse menus, track orders, and receive doorstep delivery with minimal effort. Restaurants benefit from higher visibility and extended reach through app-based promotions. Growth in smartphone usage and digital payments further drives adoption. As online platforms integrate loyalty rewards and faster delivery models, demand for takeout dinners rises significantly.

- For instance, Uber Eats facilitates millions of food delivery trips regularly. The platform maintains extensive global coverage and partners with a vast network of restaurants worldwide, operating at a massive scale across numerous regions.

Increased Menu Diversity and Global Cuisine Adoption

Growing interest in global cuisines supports wider acceptance of takeout dinners across diverse consumer groups. Asian, Italian, American, and Middle Eastern meals gain popularity due to variety, affordability, and strong representation on delivery apps. Restaurants expand menus to include healthier options, plant-based meals, and customizable dishes. Multicultural populations and exposure to international flavors also boost demand. As consumers explore more diverse food categories, takeout providers benefit from higher order frequency and broader meal preferences.

Key Trend & Opportunity

Growth of Healthier and Premium Takeout Options

Consumers increasingly seek healthier takeout meals, including low-calorie, plant-based, and protein-rich offerings. Restaurants and delivery brands respond by introducing nutritious dishes, premium ingredients, and clean-label packaging. Wellness-driven dining habits support opportunities for meal kits, frozen meals with better nutrition value, and fresh ready-to-eat bowls. Rising awareness of diet quality and lifestyle-related health issues accelerates demand for premium and health-forward takeout options. This shift encourages innovation across product development and menu expansion.

- For instance, Chipotle continues to see strong demand for protein-rich and plant-based options. The company sources a significant amount of responsibly grown produce each year and has achieved its goal of using wholesome ingredients without artificial colors, flavors, or preservatives in all of its core ingredients.

Rising Adoption of Technology in Delivery and Order Management

Technology plays a key role in improving order accuracy, delivery speed, and customer experience across the takeout dinner market. Restaurants adopt automated kitchen tools, digital menu boards, and AI-driven demand forecasting to optimize operations. Delivery platforms use route optimization, subscription models, and real-time tracking to enhance service reliability. Contactless payments and mobile ordering boost consumer trust. As digital tools evolve, technology-driven innovation creates significant opportunities for operational efficiency and better consumer engagement.

- For instance, Domino’s runs numerous “Domino’s AnyWare” digital ordering integrations and processes a significant percentage of phone orders through its AI system, DOM Voice. The company also uses GPS-enabled delivery tracking for orders across key markets.

Key Challenge

High Operational and Delivery Costs

Rising food prices, labor shortages, and delivery charges create cost pressures for restaurants and delivery partners. Maintaining quality, speed, and affordability becomes difficult as expenses increase across cooking, packaging, and last-mile delivery. Smaller restaurants struggle to match the scale and pricing of large chains. High commission fees from delivery platforms add further strain. Balancing cost efficiency while maintaining service standards remains a major challenge in sustaining profit margins.

Food Quality and Consistency During Delivery

Ensuring food freshness and maintaining taste during transportation remain persistent challenges. Meals may lose texture or temperature due to delays or handling issues. Packaging limitations can affect quality, especially for fried or delicate dishes. These issues impact customer satisfaction and repeat purchases. Restaurants and delivery providers must invest in better packaging, improved handling technologies, and more efficient logistics systems. Maintaining consistent food quality across long distances is essential for long-term customer retention.

Regional Analysis

North America

North America holds 37% share of the takeout dinner market, supported by strong adoption of online delivery platforms, high consumer spending, and a well-developed quick-service restaurant ecosystem. The United States leads the region with widespread use of apps offering fast delivery and diverse cuisine choices. Busy work schedules and growing preference for convenient meals further drive demand. Restaurants expand digital ordering, curbside pickup, and subscription-based meal services to attract customers. Canada contributes with rising urbanization and stronger interest in global cuisines. High digital maturity and strong food-service infrastructure continue to reinforce North America’s leadership.

Europe

Europe accounts for 28% share, driven by expanding food delivery networks, increasing demand for restaurant-quality meals at home, and strong penetration of multinational fast-food and casual dining chains. Countries such as the United Kingdom, Germany, and France lead with advanced delivery ecosystems and high consumer preference for convenient meals. Growth in healthier takeout options and premium ready-to-eat meals strengthens market adoption. Rising urban lifestyles, busy work schedules, and wider availability of international cuisines support steady demand across major cities. Strong digital payment systems and regulatory support for food safety enhance Europe’s position in the market.

Asia Pacific

Asia Pacific holds 25% share, supported by rapid urbanization, growing middle-class populations, and strong adoption of mobile-based food delivery services. China and India lead with large user bases, expanding quick-service chains, and high demand for affordable meal options. Southeast Asia shows strong growth driven by rising smartphone penetration and popularity of app-based takeout services. Diverse culinary preferences, increasing disposable incomes, and busy work environments encourage consumers to opt for convenient dinner solutions. Expansion of cloud kitchens and competitive delivery pricing further strengthens Asia Pacific’s role as one of the fastest-growing regions in the takeout dinner market.

Latin America

Latin America captures 6% share, supported by expanding digital delivery platforms, increasing consumer interest in convenient dining, and growing participation of fast-food chains. Brazil and Mexico lead the region due to strong urban populations and higher adoption of mobile ordering. Economic recovery and rising middle-class spending support growth in ready-to-eat meals and quick takeout options. Despite challenges such as inconsistent delivery infrastructure, large cities show strong demand driven by busy lifestyles and affordability. Rising popularity of regional cuisines on delivery apps further boosts market momentum across Latin America.

Middle East & Africa

The Middle East and Africa hold 4% share, driven by expanding food-service sectors, rising expatriate populations, and high demand for convenient meals among urban consumers. Gulf countries, especially the UAE and Saudi Arabia, lead with strong digital delivery ecosystems and diverse international cuisine offerings. Africa shows gradual growth supported by improving internet access and increasing adoption of fast-food and ready-to-eat meals in metropolitan areas. Restaurants and delivery apps invest in better logistics and wider menu availability to meet rising consumer expectations. Continuous digitalization and lifestyle changes sustain long-term growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Ready-to-Eat Meals

- Fast Food

- Meal Kits

- Frozen Takeout Meals

By Distribution Channel

- Online Delivery Platforms

- Restaurants & Food Chains

- Convenience Stores

- Supermarkets & Hypermarkets

By Cuisine

- Asian

- American

- Italian

- Middle Eastern & Others

By End User

- Household Consumers

- Working Professionals

- Students

- Seniors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis shows strong participation from major players such as McDonald’s, Domino’s Pizza, Yum! Brands, Starbucks, DoorDash, Uber Eats, Just Eat Takeaway, Chipotle Mexican Grill, Panera Bread, and Grubhub. These companies strengthen their market position through extensive delivery networks, menu innovation, and strong partnerships with third-party delivery platforms. Leading restaurant chains expand digital ordering, loyalty programs, and curbside pickup to enhance customer convenience. Delivery platforms invest in route optimization, subscription models, and faster delivery capabilities to increase order volume. Cloud kitchens and virtual restaurant brands further intensify competition by offering diverse meals with lower overhead costs. Companies focus on improving packaging quality, reducing delivery time, and offering personalized promotions to boost customer retention. As consumer demand for convenience grows, competition centers on delivery efficiency, menu variety, digital experience, and value-driven offerings.

Key Player Analysis

- McDonald’s

- Domino’s Pizza

- Yum! Brands (KFC, Pizza Hut, Taco Bell)

- Starbucks

- DoorDash

- Uber Eats

- Just Eat Takeaway

- Chipotle Mexican Grill

- Panera Bread

- Grubhub

Recent Developments

- In November 2025, Yum! Brands began a formal strategic review of Pizza Hut — its parent company said Pizza Hut may be sold or restructured to improve performance.

- In August 2025, McDonald’s and DoorDash announced a further expansion of their global partnership, which included a new online ordering experience in the U.S.

- In April 2025, Domino’s Pizza and DoorDash announced a strategic partnership where Domino’s would begin offering delivery orders via the DoorDash app across the U.S., with a nationwide launch planned to begin in May 2025. Plans were also in place to expand to Canada later in 2025.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel, Cuisine, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Takeout dinner demand will rise as consumers continue to prioritize convenience.

- Online delivery platforms will expand services with faster and more reliable delivery options.

- Restaurants will invest more in kitchen automation to improve preparation speed and accuracy.

- Health-focused and clean-label takeout meals will gain stronger customer interest.

- Meal kit subscriptions will grow as households seek flexible at-home dining solutions.

- AI-based route planning will improve delivery efficiency and reduce delays.

- Cloud kitchens will expand across urban areas to support rising digital food orders.

- Personalization in menus and portion sizes will increase through data-driven insights.

- Sustainability practices will improve with recyclable packaging and reduced food waste.

- Global cuisine variety will grow as consumers explore diverse and premium takeout options.