Market Overview

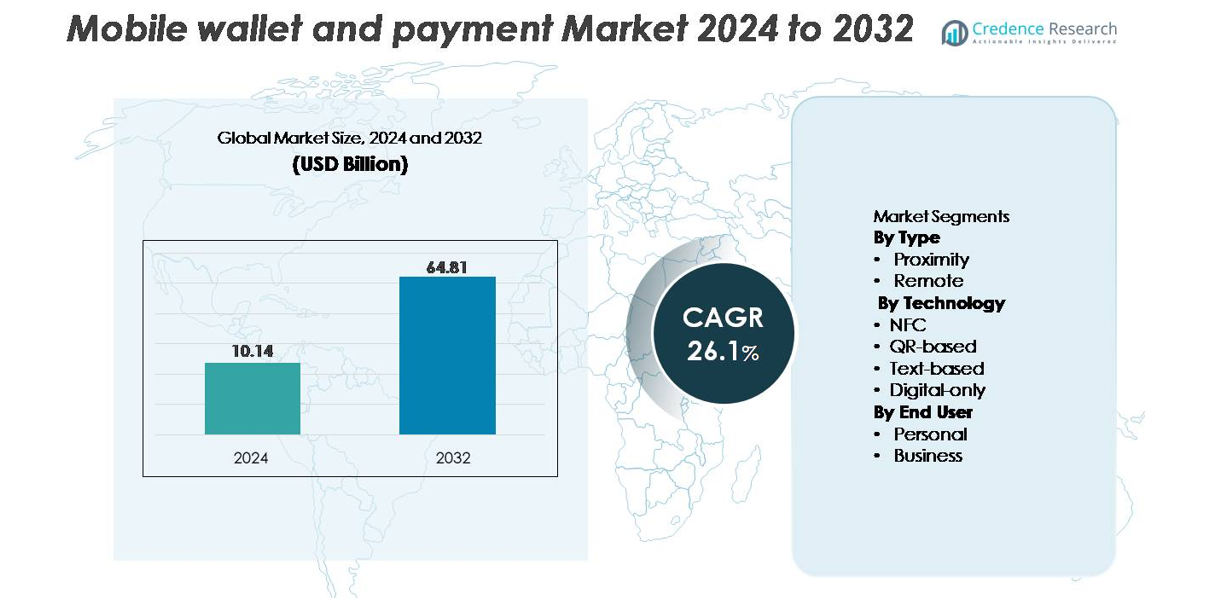

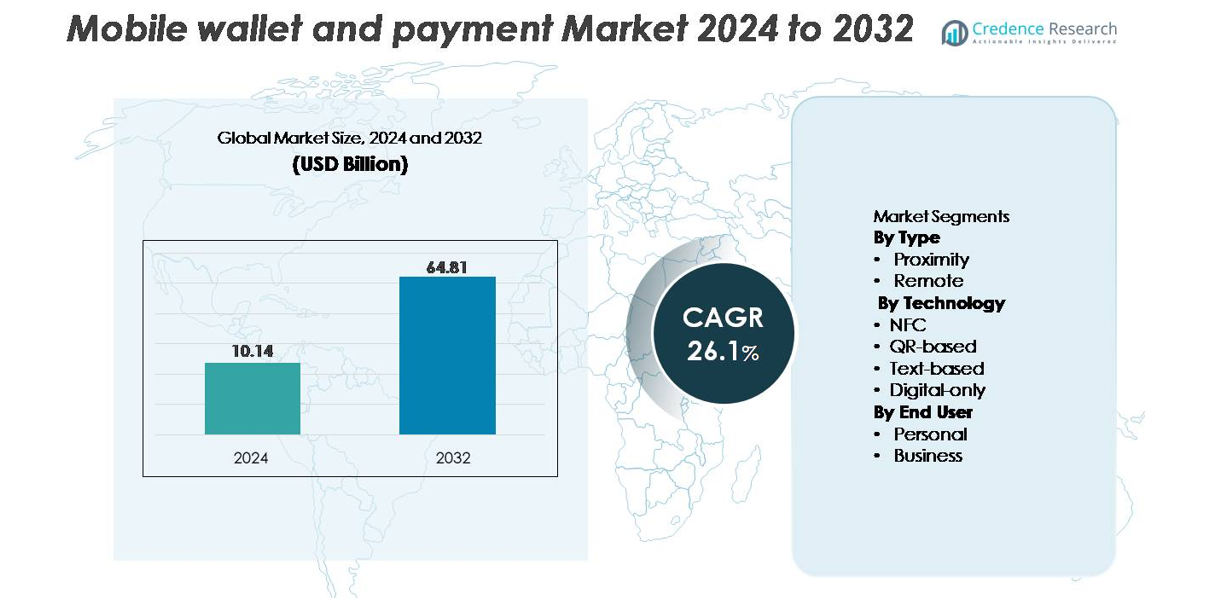

The global mobile wallet and payment market was valued at USD 10.14 billion in 2024 and is projected to reach USD 64.81 billion by 2032, expanding at a CAGR of 26.1% over the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Wallet and Payment Market Size 2024 |

USD 10.14 billion |

| Mobile Wallet and Payment Market, CAGR |

26.1% |

| Mobile Wallet and Payment Market Size 2032 |

USD 64.81 billion |

The mobile wallet and payment market is shaped by the strong presence of global technology leaders, payment networks, and fintech innovators. Key players including Visa Inc, Apple Inc, Samsung Electronics Co Ltd, Mastercard Inc, American Express, Alphabet Inc, PayPal Holdings Inc, AT and T Inc, Thales SA, and ACI Worldwide Inc compete by expanding secure digital payment ecosystems, enhancing tokenization and biometric authentication, and strengthening merchant acceptance networks. Asia Pacific remains the leading region with 36% market share, driven by mobile first consumers and large scale QR based payment adoption. North America follows with 32%, supported by advanced NFC infrastructure and high spending on digital financial services.

Market Insights

- The mobile wallet and payment market was valued at USD 10.14 billion in 2024 and is projected to reach USD 64.81 billion by 2032, registering a CAGR of 26.1% during the forecast period.

- Growing consumer demand for fast, secure, and cashless transactions supported by rising smartphone penetration and strong merchant adoption continues to drive market expansion, with proximity payments emerging as the dominant segment due to widespread NFC enabled POS deployments.

- Key trends include rapid growth of QR based ecosystems, super app integrations, biometric authentication advances, and increasing adoption of embedded financial services that enhance user engagement and transaction frequency.

- Competition intensifies as global leaders such as Apple, Visa, Samsung, PayPal, Mastercard, and Alphabet innovate through tokenization, AI led fraud detection, and interoperable payment infrastructure, while regulatory complexities and fragmented acceptance networks remain key restraints.

- Regionally, Asia Pacific leads with 36% share, followed by North America at 32% and Europe at 27%, reflecting strong digital ecosystems, retailer digitalization, and accelerating mobile first financial inclusion across markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type (Proximity and Remote)

Proximity wallets represent the dominant sub segment, capturing the largest market share due to their seamless tap and pay convenience, rapid transaction speeds, and strong integration with retail point of sale systems. Widespread adoption of NFC enabled smartphones, rising merchant acceptance, and the increasing shift toward contactless payments in physical stores reinforce this lead. Remote wallets continue to expand steadily, driven by e commerce growth, app based payments, and digital platforms supporting bill payments and online transactions. However, proximity wallets maintain a stronger adoption curve as consumers prioritize frictionless in store experiences and merchants accelerate contactless POS upgrades.

- For instance, “Samsung’s mobile payment service processes over 6 billion transactions annually, with an estimated 85% of those being NFC based payments.”

By Technology (NFC, QR based, Text based, Digital only)

NFC technology holds the dominant market share among payment technologies, supported by secure tokenization, biometric authentication, and ultra fast checkout capabilities. Its broad adoption in smartphones and POS terminals makes NFC the preferred mode for high frequency retail transactions. QR based payments show strong growth momentum, particularly in cash heavy economies and small businesses due to zero hardware requirements. Digital only wallets are expanding through app centric ecosystems, while text based payments retain niche use cases. Despite these alternatives, NFC remains the leading technology because of its superior security, reliability, and compatibility with global payment standards.

- For instance, Alipay’s QR ecosystem connects over 80 million merchants, enabling scalable adoption without specialized POS hardware.

By End User (Personal and Business)

The personal end user segment dominates the market, accounting for the largest share as individuals rely heavily on mobile wallets for daily transactions, including retail purchases, transit payments, peer to peer transfers, and bill settlements. Convenience, faster checkout experiences, and integrated loyalty features drive widespread personal adoption. The business segment is growing as enterprises adopt mobile based payment solutions for expense management, vendor payments, and customer facing digital transactions. Still, personal users maintain their lead supported by rising smartphone penetration, increasing preference for cashless payments, and expanding interoperability across financial and e commerce ecosystems.

Key Growth Drivers:

Rapid Expansion of Contactless and Cashless Payment Ecosystems

The accelerated global shift toward contactless and cashless transactions continues to propel mobile wallet adoption. Governments, financial regulators, and retail ecosystems are actively promoting digital payments to enhance transparency and financial inclusion. The widespread deployment of NFC enabled POS terminals and the proliferation of QR based payment infrastructure have improved accessibility for both urban and rural users. Mobile wallet platforms also benefit from integrated features such as loyalty points, instant refunds, recurring payments, and seamless bill settlements, increasing user stickiness. As merchants adopt interoperable digital payment standards and transit systems embrace tap and pay systems, transaction volumes through mobile wallets continue to rise sharply. The ecosystem wide push toward reducing cash dependence ensures sustained growth momentum.

- For instance, Alipay’s QR ecosystem connects to more than 80 million active merchants, supporting instant in store and remote digital payments across China and international markets.

Growing Smartphone Penetration and Improved Mobile Internet Connectivity

The continuous rise in smartphone ownership and faster mobile internet connectivity is a key driver strengthening the mobile wallet and payment landscape. Affordable devices, widespread 4G penetration, and rapid 5G rollout have made mobile transactions more reliable, faster, and easily accessible. Consumers increasingly prefer mobile first financial interactions, from micro transactions to large value payments, reinforcing wallet usage frequency. Enhanced processing power, biometric authentication, and secure device level encryption further improve user confidence in mobile based financial activities. In emerging markets, low cost digital wallets offer a convenient alternative to traditional banking, supporting millions of unbanked and underbanked users. The convergence of device affordability, improved security, and uninterrupted connectivity continues to expand the active user base worldwide.

- For instance, Samsung’s total annual smartphone shipments are consistently below 300 million, with around 261 million devices shipped globally in 2022 and 226.6 million in 2023, most of which support NFC and secure payment functions, expanding the base of wallet ready users.

Integration of Value Added Services and Embedded Financial Features

Mobile wallets are evolving beyond basic payment functions by incorporating value added services that enhance user engagement and platform monetization. Features such as micro lending, insurance distribution, savings tools, investment modules, transit ticketing, and merchant loyalty programs drive higher usage frequency. Embedded financial services within super app ecosystems create a holistic digital experience, enabling users to manage payments, shopping, mobility, and financial products within a single interface. Partnerships between fintechs, banks, and retailers further expand service offerings, boosting consumer adoption. The ability to deliver personalized offers through data analytics such as targeted discounts or spend based rewards enhances platform relevance. This ecosystem wide integration transforms mobile wallets into multi functional financial hubs, strengthening long term market growth potential.

Key Trends & Opportunities:

Rise of Super Apps and Unified Digital Commerce Platforms

Super app ecosystems are emerging as a major transformative trend, enabling mobile wallet providers to expand into shopping, food delivery, transport bookings, bill payments, and financial services within a unified interface. This consolidation of digital experiences increases transaction frequency, enhances consumer loyalty, and provides new monetization streams. The integration of mobile wallets into super apps allows providers to leverage enormous cross platform data for personalized recommendations, credit assessment, and promotional targeting. Businesses also gain opportunities to tap into embedded commerce capabilities using API driven integration. As consumer preference shifts toward multifunctional, high convenience platforms, mobile wallet adoption accelerates, creating new growth avenues in digital lifestyle services and embedded finance.

- For instance, Alipay’s super app ecosystem supports over 1 billion active users and connects to more than 80 million merchants, demonstrating the scale at which unified digital services operate.

Advancements in Secure Authentication and Tokenization Technologies

Sophisticated security enhancements such as biometric authentication, tokenized transaction processing, and AI driven fraud monitoring create significant opportunities for market expansion. These technologies provide high transactional safety and minimize exposure to credential theft, enabling wider acceptance among both consumers and businesses. Innovations such as on device machine learning for fraud detection and dynamic QR code authentication further strengthen security layers. As regulatory authorities mandate stronger authentication frameworks such as multi factor verification and real time risk scoring mobile payment platforms gain increased credibility. The resulting improvement in trust and reliability encourages adoption in high value transactions, subscription billing, and corporate payments, expanding the overall market scope.

- For instance, Visa’s global tokenization network has issued more than 10 billion active payment tokens, replacing sensitive card data with dynamic credentials for secure mobile transactions.

Growing Opportunity in Cross Border and Real Time Payment Solutions

Cross border mobile payments are gaining traction as consumers engage more frequently in international e commerce, global travel, and remittances. Mobile wallets integrated with real time payment networks and digital currencies enable faster, lower cost transactions compared to traditional banking channels. Partnerships between global payment providers, fintech startups, and regional wallet platforms are reducing bottlenecks associated with currency conversion and processing delays. The expansion of ISO 20022 standards and interoperable global payment rails enhances the ability of mobile wallets to support seamless international transfers. This trend opens new revenue streams for providers while addressing rising consumer demand for affordable global payment solutions.

Key Challenges:

Security Risks, Fraud Incidents, and Regulatory Compliance Complexities

Despite improvements in security technologies, mobile wallet ecosystems continue to face challenges related to phishing, credential theft, SIM swap fraud, and unauthorized transactions. Increasing digital transaction volumes have attracted sophisticated cybercriminal activity, putting pressure on providers to continually upgrade authentication and monitoring systems. Additionally, complying with diverse regulatory frameworks spanning data privacy, KYC/AML mandates, tokenization rules, and cross border transaction norms creates operational complexity. Frequent changes in cybersecurity requirements and payment regulations add further compliance burdens. These factors elevate costs for wallet providers and slow down market expansion, particularly in regions with stringent regulatory oversight.

Fragmented Payment Infrastructure and Limited Interoperability

The mobile wallet market remains fragmented due to the coexistence of multiple wallet platforms, incompatible QR formats, and inconsistent merchant acceptance. Lack of interoperability between wallets restricts seamless peer to peer transfers and complicates merchant integration, especially for small businesses. Variations in payment standards across countries and financial institutions create additional barriers to scalability. Users also face inconsistent acceptance at physical retail points, reducing trust and transaction frequency. For wallet providers, the need to integrate with numerous banks, POS systems, and regional payment networks increases technical and operating costs. These fragmentation issues hinder streamlined user experience and slow unified market development.

Regional Analysis

North America

North America holds a market share of around 32%, driven by rapid adoption of contactless payments, widespread NFC enabled smartphone usage, and strong digital banking penetration. The U.S. leads the region with mature fintech ecosystems, high merchant acceptance of mobile POS terminals, and expanding super app integrations. Canada continues to advance open banking frameworks and digital identity initiatives that further accelerate wallet usage. Strategic partnerships between banks, telecom operators, and fintech providers promote seamless cross platform interoperability. Growing demand for transit based mobile ticketing and loyalty integrated payment platforms strengthens North America’s position as a technologically advanced and innovation driven market.

Europe

Europe accounts for an estimated 27% market share, supported by strong regulatory frameworks such as PSD2, which encourages secure digital payments and open banking innovation. Countries including the U.K., Germany, and the Nordics demonstrate high adoption of mobile wallets due to widespread contactless card infrastructure and growing trust in biometric authentication. EU wide initiatives promoting cross border digital payments further strengthen market alignment. Merchant digitalization in retail and hospitality sectors, along with rising preference for QR based and instant payment solutions, continues to boost wallet usage. Europe’s emphasis on data security and consumer protection fosters stable long term growth momentum.

Asia Pacific

Asia Pacific leads the global market with the largest share at approximately 36%, driven by massive smartphone penetration, mobile first financial behavior, and strong government led cashless economy initiatives. China, India, and Southeast Asia dominate the region through expansive super app ecosystems and widespread QR based payment acceptance among small merchants. Real time payment networks and unified digital platforms such as India’s UPI continue to accelerate transaction volumes. Growing e commerce penetration, digital lending integration, and cross border wallet interoperability further strengthen APAC’s dominance. The region’s youthful population and rapid urbanization also contribute to sustained adoption across personal and business payment segments.

Latin America

Latin America captures around 8% of the global market, with rapid fintech expansion and improving financial inclusion driving mobile wallet adoption. Brazil, Mexico, and Colombia are the leading contributors, supported by government backed instant payment systems such as Brazil’s PIX, which has significantly accelerated mobile led transactions. High reliance on cash historically has created fertile ground for digital wallets that offer secure, low cost alternatives. E commerce growth, rising gig economy participation, and increasing demand for remittances further support wallet usage. Despite infrastructure gaps, strong innovation from regional fintechs is transforming digital payment accessibility across urban and semi urban markets.

Middle East & Africa (MEA)

MEA represents approximately 7% market share, driven by rising digital banking penetration, increasing smartphone adoption, and expanding government backed digital payment initiatives. Gulf countries like the UAE and Saudi Arabia lead in wallet adoption due to high income consumers, rapid POS modernization, and strong fintech investment. In Africa, mobile money ecosystems particularly in Kenya, Ghana, and Tanzania play a crucial role in enabling financial inclusion, with wallets serving as primary transactional tools. Cross border remittances, utility payments, and micro merchant digitalization are major growth catalysts. Despite regional disparities, MEA continues to show strong momentum toward mobile first financial services.

Market Segmentations:

By Type

By Technology

- NFC

- QR based

- Text based

- Digital only

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The mobile wallet and payment market is highly competitive, characterized by the dominance of global technology firms, regional fintech leaders, and traditional financial institutions expanding into digital payment services. Companies such as Apple, Google, Samsung, PayPal, and Alipay leverage extensive user ecosystems, advanced security architectures, and strong merchant partnerships to expand transaction volumes. Emerging fintechs in Asia Pacific, Latin America, and Africa are driving localized innovations through QR based payments, instant settlements, and low cost merchant onboarding. Banks and telecom operators are increasingly collaborating with wallet providers to enhance interoperability and customer reach. Competitive strategies focus on integrating value added services such as lending, loyalty rewards, micro insurance, and embedded financial offerings to increase user engagement. Continuous investment in biometric authentication, fraud prevention, and tokenization technologies strengthens platform credibility. As super app ecosystems grow and cross border payment capabilities expand, competition intensifies around ecosystem integration, user retention, and differentiated digital experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Visa Inc

- Thales SA

- Samsung Electronics Co Ltd

- ACI Worldwide Inc

- Apple Inc

- American Express

- Alphabet Inc

- Mastercard Inc

- PayPal Holdings Inc

- AT and T Inc

Recent Developments

- In November 2025, Visa Inc rolled out its “Scan to Pay” QR payment solution across Asia Pacific, enabling consumers to pay via QR codes through participating digital wallets and banking apps greatly expanding merchant acceptance across the region.

- In April 2025, Visa also unveiled a suite of innovations including tokenization, “Tap to Add Card,” digital identity passes, and a flexible credential model at its Global Product Drop, aiming to simplify digital wallet onboarding and strengthen security for checkout and peer to peer transfers.

- In February 2025, American Express entered into a strategic partnership with Alipay, enabling American Express cardholders to link their cards to the Alipay digital wallet thereby enabling payments at tens of millions of merchants across mainland China.

Report Coverage

The research report offers an in depth analysis based on Type, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mobile wallets will evolve into comprehensive financial hubs integrating payments, lending, insurance, and wealth services within unified digital ecosystems.

- NFC, QR, and biometric authentication technologies will continue to advance, enabling faster, more secure, and frictionless transactions across all retail environments.

- Cross border mobile payments will expand as interoperability between global payment networks and regional platforms strengthens.

- Super app models will gain wider adoption, boosting transaction frequency and increasing user dependence on mobile first financial services.

- AI driven fraud detection and real time risk scoring will become standard, significantly enhancing security across digital payment channels.

- Merchant adoption of mobile POS systems will grow, driven by lower infrastructure costs and increased consumer demand for contactless checkout.

- Open banking frameworks will accelerate wallet integration with banking data, enabling personalized financial insights and smart spending recommendations.

- Mobile wallets will gain higher penetration in rural and emerging markets through government led cashless initiatives.

- Business payments will increasingly shift to mobile platforms, supporting automated invoicing, vendor settlements, and digital expense management.

- Loyalty driven payment experiences will expand, with real time rewards, cashback engine integration, and behavior based offers improving user engagement.