Market Overview:

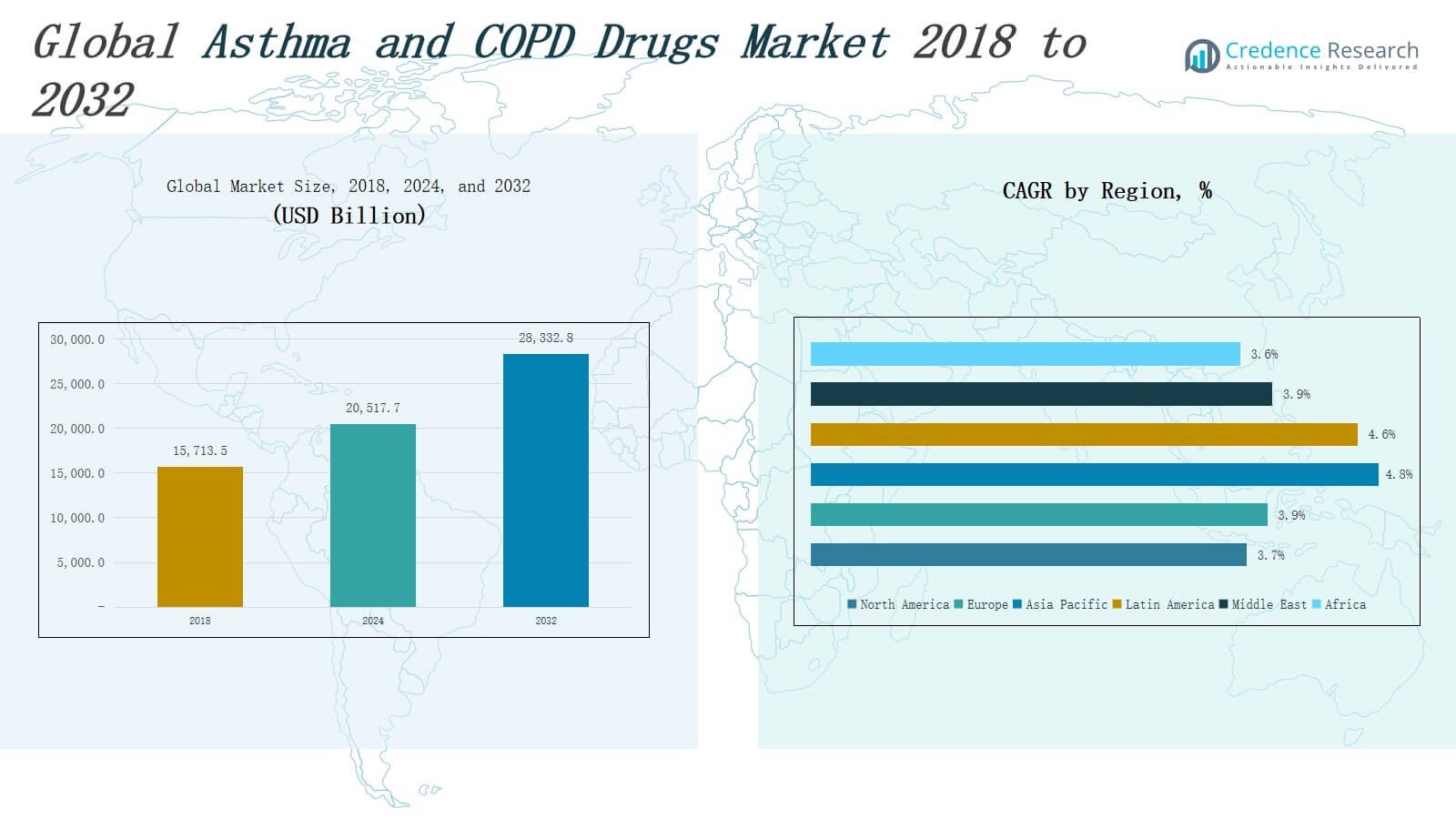

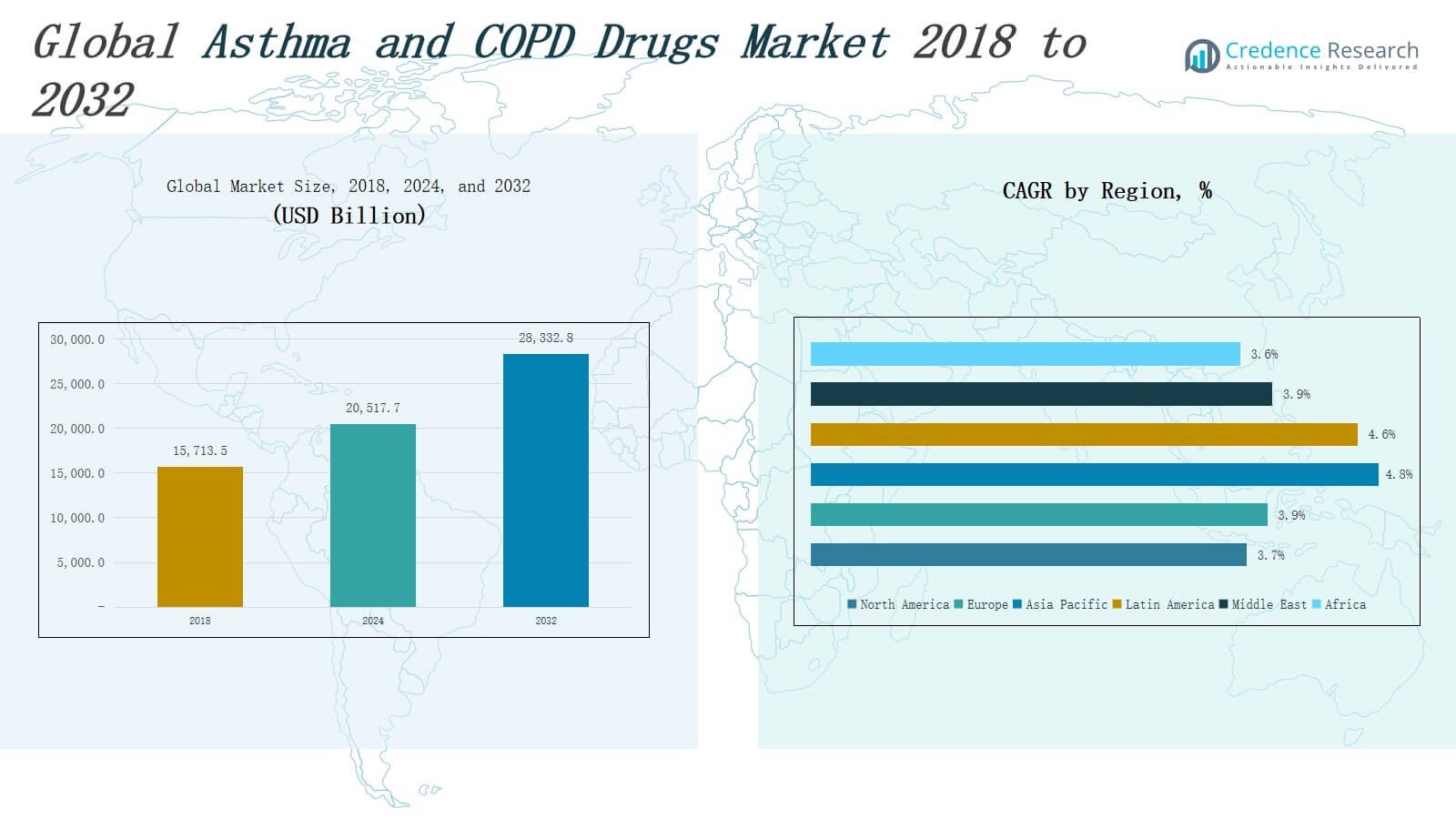

The Asthma and COPD Drugs Market size was valued at USD 15,713.5 million in 2018 to USD 20,517.7 million in 2024 and is anticipated to reach USD 28,332.8 million by 2032, at a CAGR of Z% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asthma and COPD Drugs Market Size 2024 |

USD 20,517.7 million |

| Asthma and COPD Drugs Market, CAGR |

Z% |

| Asthma and COPD Drugs Market Size 2032 |

USD 28,332.8 million |

The Asthma and COPD Drugs Market is driven by the rising global prevalence of respiratory conditions, increasing exposure to environmental pollutants, and growing elderly populations prone to chronic airway diseases. The demand for maintenance therapies and quick-relief medications continues to rise, supported by enhanced disease awareness and improved access to healthcare services. Technological advancements in inhalation devices, such as smart inhalers and digital dose counters, are improving patient compliance and treatment outcomes. Pharmaceutical companies are investing in the development of biologics and combination therapies that offer targeted action with fewer side effects. Market trends include the shift toward personalized medicine and the integration of digital health tools for real-time monitoring of symptoms and medication adherence. Regulatory support for faster drug approvals and expanded reimbursement coverage is accelerating the launch of novel therapeutics. Strategic collaborations between biotech firms and major drug manufacturers are further driving innovation, shaping a competitive and evolving landscape in asthma and COPD treatment.

The Asthma and COPD Drugs Market spans North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America leads in market share, supported by high disease prevalence and advanced healthcare infrastructure. Europe follows with strong regulatory support and public health initiatives. Asia Pacific records the fastest growth due to rising pollution, urbanization, and expanding access to care. Latin America, the Middle East, and Africa show steady progress driven by improving healthcare coverage and increasing awareness. It presents opportunities for both branded and generic drug manufacturers across all regions. Key players operating globally include AstraZeneca PLC, GlaxoSmithKline PLC, Boehringer Ingelheim GmbH, Novartis AG, Pfizer Inc., Sanofi SA, F. Hoffmann-La Roche Ltd, Grifols SA, Sun Pharmaceutical Industries Ltd, Merck & Co., Inc., and Sumitomo Dainippon Pharma Co., Ltd., each contributing to innovation and competition in the respiratory drug segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asthma and COPD Drugs Market was valued at USD 15,713.5 million in 2018, reached USD 20,517.7 million in 2024, and is projected to reach USD 28,332.8 million by 2032.

- Rising global prevalence of asthma and COPD, coupled with increasing pollution exposure and aging populations, is driving demand for both maintenance and rescue medications.

- Technological advancements such as smart inhalers and digital dose counters are improving treatment outcomes and enhancing patient adherence.

- The market is seeing strong investment in biologics and combination therapies offering targeted action with improved safety profiles.

- North America leads the market, followed by Europe, while Asia Pacific records the fastest growth due to urbanization, pollution, and expanding healthcare access.

- Major challenges include high treatment costs in low-income regions and regulatory delays that restrict access to novel drugs in emerging markets.

- Key players such as AstraZeneca, GSK, Boehringer Ingelheim, Novartis, Pfizer, and others are driving innovation and global market competition.

Market Drivers

Rising Prevalence of Chronic Respiratory Disorders

The Asthma and COPD Drugs Market is primarily driven by the increasing global burden of chronic respiratory diseases. Growing air pollution levels, rising tobacco consumption, and occupational exposures are contributing to higher incidence rates, especially in urban areas. Asthma affects over 260 million people worldwide, while COPD remains a leading cause of death. The expanding patient population is fueling consistent demand for both maintenance and rescue medications. It presents substantial growth opportunities for pharmaceutical manufacturers.

- For instance, AstraZeneca received regulatory approval to launch Breztri Aerosphere, a triple-combination inhaler containing budesonide, glycopyrronium, and formoterol, in India in January 2025, providing maintenance therapy to relieve symptoms and prevent exacerbations in COPD patients.

Technological Advancements in Drug Delivery and Devices

Innovation in inhalation technologies is significantly enhancing treatment efficacy and patient adherence in the Asthma and COPD Drugs Market. Smart inhalers, breath-actuated devices, and digital health-enabled platforms support accurate dosage and real-time symptom monitoring. These tools help reduce hospitalizations and improve long-term disease control. Companies are investing in user-friendly and portable drug delivery systems. It reflects the growing focus on personalized care and outcome-based treatment models across global healthcare systems.

Expanding Geriatric Population and Lifestyle Changes

The growing aging population is a major demand driver in the Asthma and COPD Drugs Market. Older adults face a higher risk of respiratory conditions due to declining lung function and long-term exposure to risk factors. Sedentary lifestyles, poor indoor air quality, and comorbidities further elevate susceptibility. It is increasing pressure on healthcare systems to provide long-term therapeutic solutions. The market benefits from rising demand for inhaled corticosteroids, bronchodilators, and combination therapies.

- For instance, GlaxoSmithKline’s Advair Diskus is widely prescribed for older adults with asthma and COPD, with millions of prescriptions annually in the United States, reflecting the high demand for combination inhaler therapies among the elderly.

Government Initiatives and Access to Healthcare

Supportive healthcare policies and government programs are promoting wider access to respiratory care treatments, boosting the Asthma and COPD Drugs Market. Subsidized medication programs, awareness campaigns, and reimbursement reforms are improving treatment coverage across developing regions. National health bodies and NGOs are actively educating the public about early diagnosis and disease management. It is enabling faster adoption of prescribed therapies. Market players are responding with cost-effective and region-specific drug portfolios.

Market Trends

Growing Adoption of Biologics and Targeted Therapies

The Asthma and COPD Drugs Market is witnessing a shift toward biologics and targeted therapies, particularly for severe and treatment-resistant cases. Monoclonal antibodies such as mepolizumab, benralizumab, and dupilumab offer improved disease control by targeting specific inflammatory pathways. These therapies are expanding beyond asthma into subsets of COPD, showing promise in clinical trials. It is helping reduce exacerbation rates and steroid dependency. Market players are expanding pipelines to meet the rising demand for precision medicine.

- For instance, GlaxoSmithKline’s mepolizumab (Nucala) has demonstrated a 53% reduction in annual exacerbation rates for severe eosinophilic asthma, according to Phase III clinical trials.

Integration of Digital Health and Smart Inhaler Technologies

Smart inhalers and digital therapeutics are transforming disease management in the Asthma and COPD Drugs Market. Devices equipped with sensors and Bluetooth connectivity allow remote monitoring of patient adherence, inhalation technique, and symptom tracking. Physicians can use this data to personalize treatment plans and reduce emergency visits. It supports better long-term outcomes and enhances treatment transparency. Companies are partnering with tech firms to integrate these innovations into approved drug-device combinations.

- For instance, Sanofi’s amlitelimab showed a reduction of more than 70% in asthma exacerbations at week 60 among patients with both high eosinophil and neutrophil counts in the TIDE-Asthma phase 2 study, with clinically meaningful improvements in lung function and asthma control.

Combination Therapies Driving Prescription Trends

Combination drugs that integrate corticosteroids with long-acting bronchodilators are becoming the standard of care in the Asthma and COPD Drugs Market. Fixed-dose combinations offer convenience, improve compliance, and provide synergistic efficacy. Triple therapies are gaining momentum, especially for patients with frequent exacerbations or mixed asthma-COPD phenotypes. It is prompting regulatory bodies to accelerate approvals and expand labeling indications. Pharma companies are leveraging lifecycle management strategies to retain market exclusivity and address unmet clinical needs.

R&D Focus on Long-Acting and Once-Daily Formulations

Extended-release and once-daily formulations are gaining traction in the Asthma and COPD Drugs Market due to their potential to improve adherence and reduce dosing errors. Companies are investing in next-generation inhalers that deliver drugs more efficiently into the lower respiratory tract. It supports better pharmacokinetic profiles and longer symptom relief. Research is also targeting novel anti-inflammatory agents with fewer side effects. These trends are reinforcing innovation-driven growth across the global respiratory drug market.

Market Challenges Analysis

High Treatment Costs and Limited Access in Low-Income Regions

The Asthma and COPD Drugs Market faces a major challenge in affordability and accessibility, particularly in low- and middle-income countries. Many advanced biologics and combination therapies remain unaffordable for a large portion of the global population. Limited healthcare infrastructure and lack of insurance coverage further restrict timely diagnosis and treatment. It creates a gap between innovation and equitable care delivery. Governments struggle to subsidize high-cost treatments, leading to under-treatment or reliance on outdated drugs. These barriers hinder long-term disease management and raise morbidity risks.

Regulatory Complexities and Delayed Approvals for Novel Drugs

Navigating diverse regulatory environments poses another significant challenge in the Asthma and COPD Drugs Market. New drug approvals require extensive clinical trials and post-marketing surveillance, often leading to long development timelines and high R&D expenditure. It delays the introduction of potentially life-saving therapies, especially in emerging markets with limited regulatory harmonization. Differences in labeling, pricing frameworks, and pharmacovigilance expectations add complexity for global market players. These hurdles impact the speed and efficiency of bringing innovative products to market.

Market Opportunities

Expansion Potential in Emerging Markets and Underserved Populations

The Asthma and COPD Drugs Market offers strong growth opportunities in emerging economies with large, untreated patient populations. Increasing awareness, expanding urbanization, and rising pollution levels are driving disease incidence in countries across Asia, Latin America, and Africa. Governments are improving healthcare infrastructure and encouraging public-private partnerships to enhance access. It creates a favorable environment for multinational pharmaceutical firms to introduce cost-effective therapies. Companies that tailor pricing strategies and localize manufacturing can gain significant market share. Addressing unmet needs in rural and peri-urban areas will further accelerate growth.

Advancement in Personalized Medicine and Companion Diagnostics

Personalized treatment strategies and biomarker-based diagnostics present long-term opportunities in the Asthma and COPD Drugs Market. With increasing understanding of inflammatory phenotypes and genetic predispositions, targeted therapies can deliver better outcomes with fewer adverse effects. It allows for optimized drug selection and dosage based on individual profiles. Companion diagnostic tools are gaining regulatory support, facilitating earlier intervention and patient stratification. Pharmaceutical companies can invest in R&D to develop niche therapies supported by real-time digital monitoring. This trend aligns with the growing shift toward precision healthcare across respiratory care pathways.

Market Segmentation Analysis:

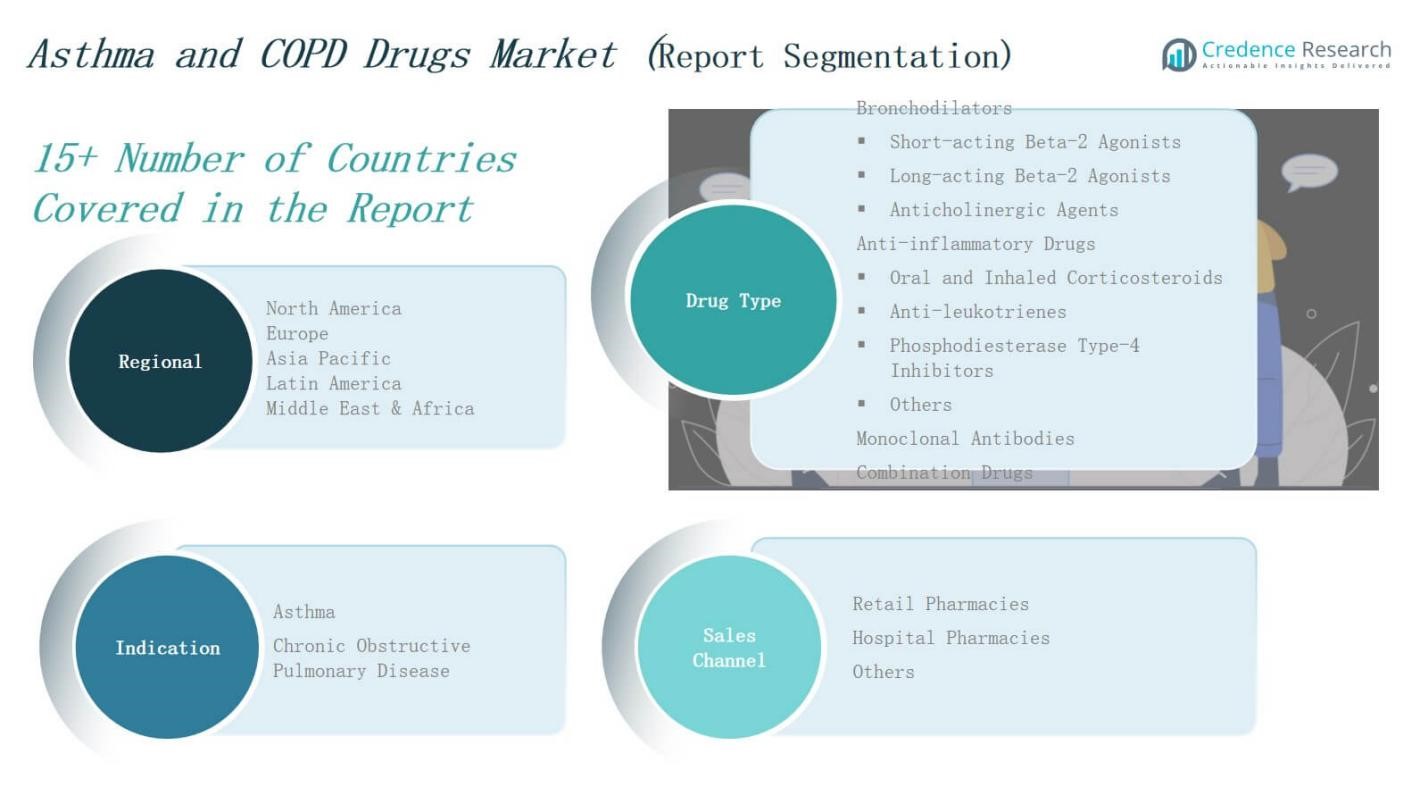

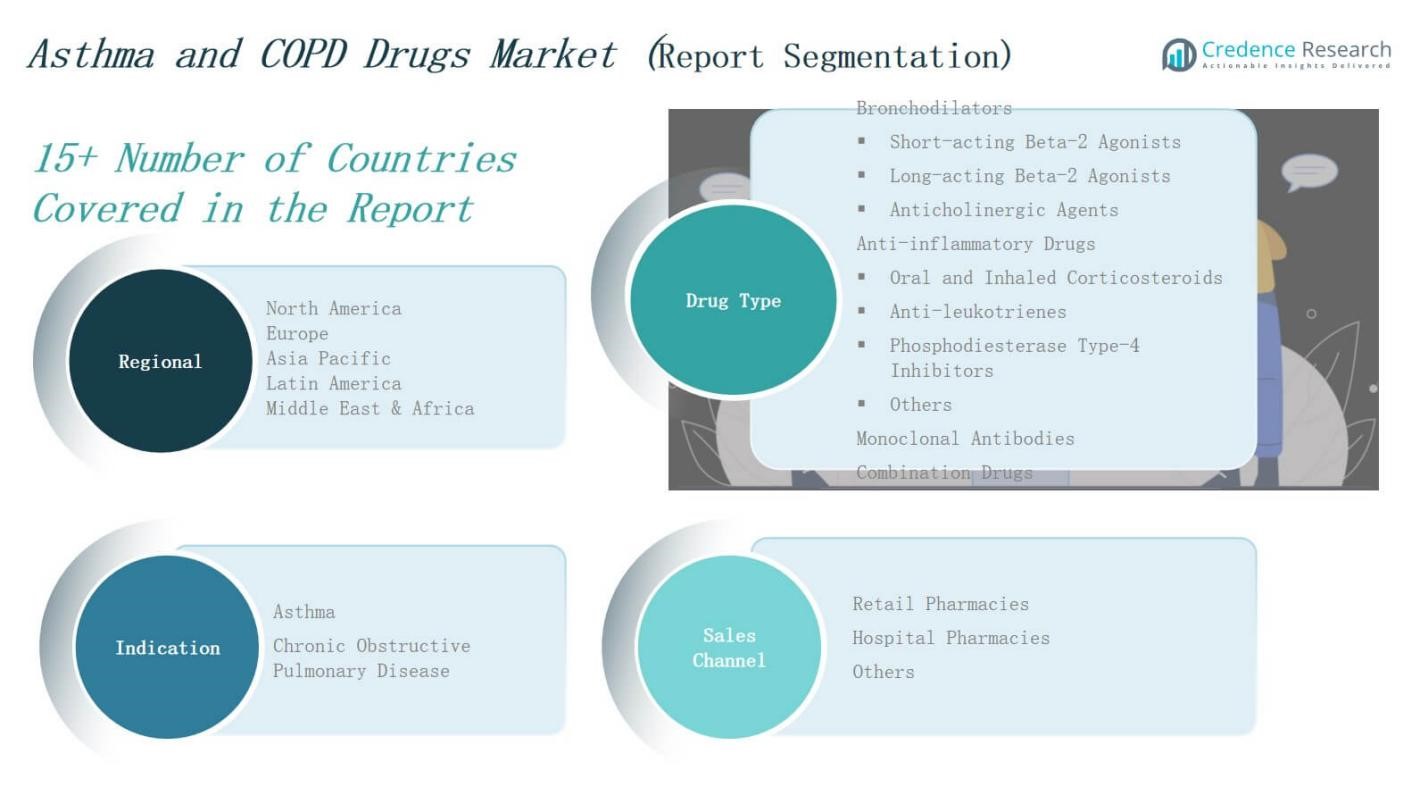

By Drug Type

The Asthma and COPD Drugs Market is segmented into bronchodilators, anti-inflammatory drugs, monoclonal antibodies, and combination drugs. Bronchodilators, including short-acting beta-2 agonists, long-acting beta-2 agonists, and anticholinergic agents, dominate due to their rapid symptom relief. Anti-inflammatory drugs, such as oral and inhaled corticosteroids, anti-leukotrienes, and phosphodiesterase type-4 inhibitors, are critical for long-term disease control. Monoclonal antibodies are gaining traction for severe asthma cases. Combination drugs continue to expand their share due to convenience and clinical efficacy.

- For instance, Glenmark Pharmaceuticals launched Indamet (Indacaterol plus Mometasone) in June 2022, a once-daily fixed-dose combination inhaler for asthma, available in three strengths to address varying patient needs.

By Indication

Based on indication, the Asthma and COPD Drugs Market is categorized into asthma and chronic obstructive pulmonary disease (COPD). Asthma represents a substantial share, driven by high global prevalence and increasing diagnosis in pediatric and adult populations. COPD drugs are witnessing steady demand due to rising smoking rates, aging populations, and pollution exposure. It supports growth in maintenance and rescue medication segments. Drug manufacturers are focusing on developing indication-specific formulations to improve patient outcomes.

- For instance, in March 2025, AstraZeneca announced a new phase 3 trial for its triple combination inhaled therapy, Breztri Aerosphere (budesonide/glycopyrrolate/formoterol fumarate), targeting COPD patients with elevated cardiopulmonary risk, demonstrating ongoing innovation in this therapeutic area.

By Sales Channel

The Asthma and COPD Drugs Market is distributed through retail pharmacies, hospital pharmacies, and others. Retail pharmacies hold the largest share due to wide availability and growing prescription volumes for chronic respiratory conditions. Hospital pharmacies play a key role in acute care and biologics distribution. It benefits from the rising use of inpatient treatment for severe exacerbations. Other channels, including online platforms, are gaining importance with the expansion of telehealth and e-prescription services.

Segments:

Based on Drug Type

Bronchodilators

- Short-acting Beta-2 Agonists

- Long-acting Beta-2 Agonists

- Anticholinergic Agents

Anti-inflammatory Drugs

- Oral and Inhaled Corticosteroids

- Anti-leukotrienes

- Phosphodiesterase Type-4 Inhibitors

- Others

Monoclonal Antibodies

Combination Drugs

Based on Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

Based on Sales Channel

- Retail Pharmacies

- Hospital Pharmacies

- Others

Based on Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis

North America

The North America Asthma and COPD Drugs Market size was valued at USD 5,150.88 million in 2018 to USD 6,569.18 million in 2024 and is anticipated to reach USD 8,783.17 million by 2032, at a CAGR of 3.7% during the forecast period. North America holds the largest share of the global Asthma and COPD Drugs Market, driven by high disease prevalence, advanced healthcare infrastructure, and widespread access to prescription medications. It benefits from strong regulatory frameworks and continuous R&D investment by leading pharmaceutical companies. The U.S. contributes significantly through the adoption of biologics and smart inhalers. Favorable reimbursement policies and high awareness levels support patient adherence. The region continues to lead in innovation and early adoption of advanced respiratory therapies.

Europe

The Europe Asthma and COPD Drugs Market size was valued at USD 4,347.92 million in 2018 to USD 5,598.99 million in 2024 and is anticipated to reach USD 7,587.53 million by 2032, at a CAGR of 3.9% during the forecast period. Europe ranks second in market share and shows consistent demand across major countries such as Germany, the UK, and France. It benefits from strong public health policies and emphasis on reducing air pollution. Government initiatives promote early diagnosis and subsidize essential respiratory drugs. Aging demographics and increasing smoking-related illnesses continue to drive COPD drug consumption. Companies are focusing on expanding access to combination therapies and biosimilars.

Asia Pacific

The Asia Pacific Asthma and COPD Drugs Market size was valued at USD 3,428.68 million in 2018 to USD 4,668.66 million in 2024 and is anticipated to reach USD 6,799.88 million by 2032, at a CAGR of 4.8% during the forecast period. Asia Pacific is the fastest-growing regional segment, supported by rising air pollution, rapid urbanization, and a growing middle-class population. Countries such as China, India, and Japan are investing in expanding healthcare access and modernizing hospital infrastructure. It witnesses increasing adoption of both branded and generic respiratory drugs. Awareness campaigns and mobile health platforms are improving patient education and adherence. Local manufacturers are gaining ground with cost-effective inhalers and oral medications.

Latin America

The Latin America Asthma and COPD Drugs Market size was valued at USD 1,676.63 million in 2018 to USD 2,257.83 million in 2024 and is anticipated to reach USD 3,244.11 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America shows stable growth driven by an increasing burden of respiratory diseases, especially in urban and industrial regions. Brazil and Mexico dominate the market through public health initiatives and improved pharmaceutical supply chains. It faces challenges in affordability and uneven access, but ongoing reforms are expanding healthcare coverage. Global and regional firms are introducing generic versions to meet rising demand. Investment in community clinics and patient outreach programs supports market expansion.

Middle East

The Middle East Asthma and COPD Drugs Market size was valued at USD 645.82 million in 2018 to USD 833.60 million in 2024 and is anticipated to reach USD 1,133.31 million by 2032, at a CAGR of 3.9% during the forecast period. The Middle East market is driven by rising rates of asthma linked to sandstorms, allergens, and industrial emissions. Countries like Saudi Arabia and the UAE are enhancing respiratory care services through digital health systems and specialized centers. It benefits from government-funded healthcare and high pharmaceutical import rates. Multinational companies are forming partnerships to distribute advanced therapies. Public awareness campaigns and school-based asthma screening are increasing diagnosis rates across the region.

Africa

The Africa Asthma and COPD Drugs Market size was valued at USD 463.55 million in 2018 to USD 589.44 million in 2024 and is anticipated to reach USD 784.82 million by 2032, at a CAGR of 3.6% during the forecast period. Africa holds the smallest market share but presents long-term growth opportunities due to rising population and increasing urban pollution. Many regions face underdiagnosis and limited access to consistent treatment. It is slowly adopting affordable generics through support from NGOs and international health agencies. South Africa leads the market through better healthcare infrastructure. Investment in public health education and mobile clinics is expected to drive gradual improvement in asthma and COPD management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grifols SA

- AstraZeneca PLC

- Sanofi SA

- Sun Pharmaceutical Industries Ltd

- Pfizer Inc.

- Boehringer Ingelheim GmbH

- Novartis AG

- Merck & Co., Inc.

- Sumitomo Dainippon Pharma Co., Ltd.

- GlaxoSmithKline PLC

- Hoffmann-La Roche Ltd

Competitive Analysis

The Asthma and COPD Drugs Market features a competitive landscape dominated by global pharmaceutical companies focused on respiratory care innovation. Key players include AstraZeneca PLC, GlaxoSmithKline PLC, Boehringer Ingelheim GmbH, Novartis AG, and Pfizer Inc., each maintaining extensive portfolios across bronchodilators, anti-inflammatory drugs, and biologics. It reflects strong investment in R&D, pipeline expansion, and regulatory approvals for targeted therapies. Companies are leveraging strategic collaborations, regional expansions, and lifecycle management to retain market share. Biologics and combination therapies are central to competition, supported by rising demand for personalized treatments. Generic drug manufacturers and regional firms are intensifying price competition, especially in emerging markets. Technological integration into inhaler devices and real-world evidence generation are differentiating factors in market positioning. The Asthma and COPD Drugs Market continues to evolve as firms prioritize advanced drug delivery systems, biosimilars, and sustainable pricing strategies to strengthen their presence across both developed and developing regions.

Recent Developments

- In July 2025, Merck & Co. acquired Verona Pharma for $10 billion to expand its respiratory portfolio, gaining rights to the FDA-approved COPD drug Ohtuvayre (ensifentrine).

- In May 2025, GSK received U.S. FDA approval for Nucala (mepolizumab) as an add-on maintenance treatment for adult patients with eosinophilic COPD.

- In March 2025, Sanofi secured regulatory approval in Japan for Dupixent to treat COPD, marking its sixth approved indication for chronic diseases.

- In May 2025, AstraZeneca gained UK approval for Trixeo Aerosphere, a triple-combination inhaler using a near-zero global warming potential propellant.

- In July 2025, Upstream Bio initiated a Phase 2 clinical trial for Verekitug, dosing the first patient for its investigational COPD treatment.

Market Concentration & Characteristics

The Asthma and COPD Drugs Market exhibits moderate to high market concentration, with a few global pharmaceutical giants accounting for a significant share of total revenue. It is characterized by strong brand loyalty, high regulatory compliance, and consistent innovation in both drug formulation and delivery technologies. Leading companies focus on biologics, fixed-dose combinations, and inhalation therapies to maintain competitive advantage. Entry barriers are substantial due to complex clinical trial requirements, patent protections, and high R&D costs. The market favors firms with global distribution networks, diverse respiratory portfolios, and the ability to secure regulatory approvals across multiple regions. It responds actively to shifting healthcare demands, including the growing need for personalized medicine and digital health integration. Generic drug manufacturers are expanding in emerging markets, intensifying price competition. The Asthma and COPD Drugs Market continues to evolve with advancements in patient-centric care models, increasing emphasis on treatment adherence, and the global burden of chronic respiratory diseases.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Indication, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologics will continue to rise, especially for patients with severe asthma and steroid-resistant COPD.

- Smart inhalers and digital health tools will gain traction for improving adherence and tracking treatment outcomes.

- Pharmaceutical companies will focus on developing once-daily and long-acting formulations to enhance convenience.

- Personalized therapies based on genetic markers and inflammatory phenotypes will see increased adoption.

- Generic drug availability will expand in emerging markets, improving access and affordability.

- Collaborations between biotech firms and major pharmaceutical companies will drive innovation in drug delivery.

- Governments will introduce new guidelines and reimbursement policies to support chronic respiratory disease management.

- Environmental regulations aimed at air quality improvement may influence disease prevalence and treatment trends.

- Investments in pediatric asthma care will rise, supported by early diagnosis and targeted therapies.

- Companies will prioritize sustainability in manufacturing and packaging of respiratory drug products.