Market Overview

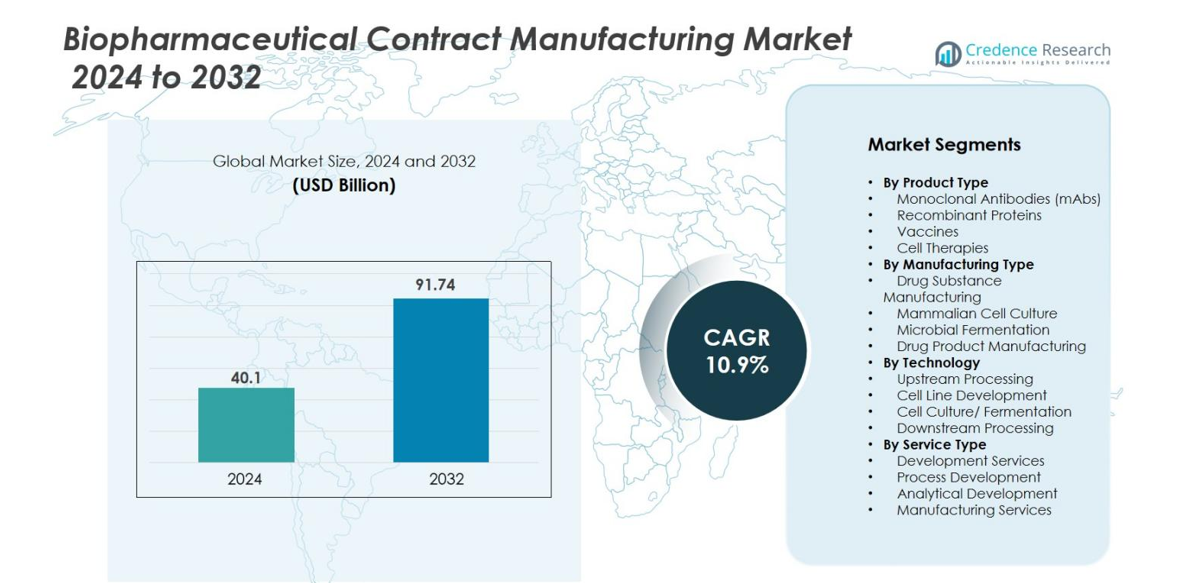

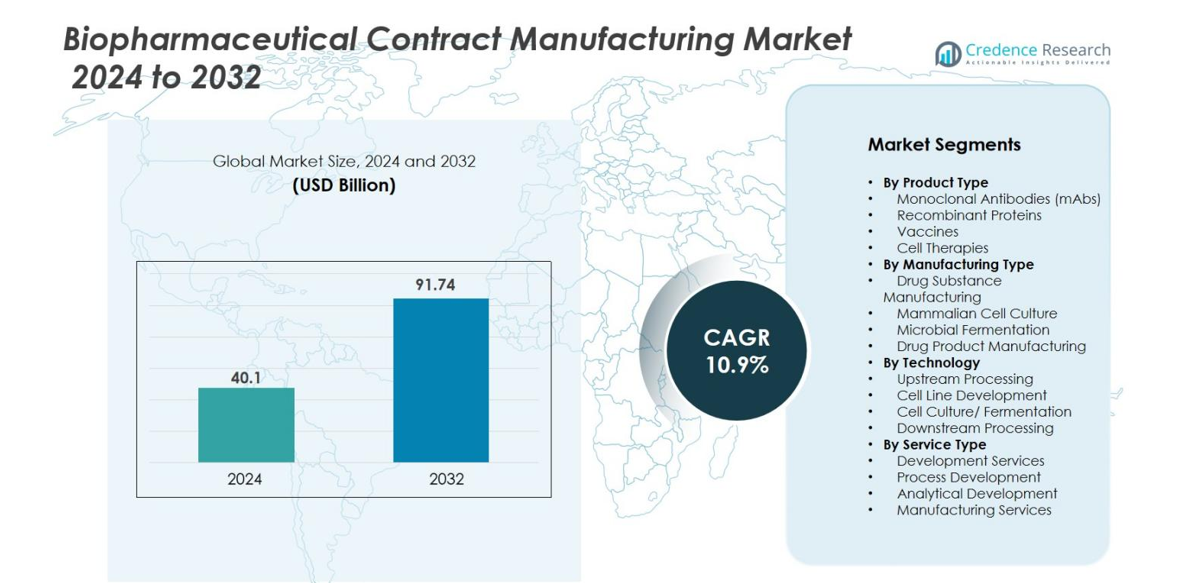

The Biopharmaceutical Contract Manufacturing Market size was valued at USD 40.1 billion in 2024 and is anticipated to reach USD 91.74 billion by 2032, growing at a CAGR of 10.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biopharmaceutical Contract Manufacturing Market Size 2024 |

USD 40.1 billion |

| Biopharmaceutical Contract Manufacturing Market, CAGR |

10.9% |

| Biopharmaceutical Contract Manufacturing Market Size 2032 |

USD 91.74 billion |

The Biopharmaceutical Contract Manufacturing Market features prominent players such as Lonza Group AG, Boehringer Ingelheim GmbH, AGC Biologics, Rentschler Biotechnologie GmbH, ProBioGen, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., Toyobo Co., Ltd., Samsung Biologics Co., Ltd., and Inno Biologics Sdn Bhd. These companies are advancing the market through strategic capacity expansions, specialized service portfolios, and global footprint enhancement. The North American region leads the market with a 40.0% share in 2024, capitalising on its deep biopharma ecosystem and mature regulatory environment. Europe follows with a 30.0% share, supported by a robust contract manufacturing infrastructure and strong biosimilar activity. The Asia Pacific region holds 23.0%, driven by emerging markets, cost‑efficient operations and increasing outsourcing demand.

Market Insights

- The Biopharmaceutical Contract Manufacturing Market size was valued at USD 40.1 billion in 2024 and is projected to reach USD 91.74 billion by 2032, at a CAGR of 10.9%.

- Growing demand for biologics such as mAbs (with a 42.5% share) and biosimilars drives outsourcing of manufacturing to contract organizations.

- Trends include expansion of end‑to‑end manufacturing services, rising adoption of biosimilars and regionally diversified capacity in Asia Pacific.

- Competitive analysis reveals established CDMOs investing in scale, advanced cell culture and global footprints to capitalise on high entry‑barriers.

- Restraints include supply chain disruptions, raw material shortages and evolving regulation that may delay project timelines.

- Regional analysis shows North America leading with a 40.0% share, Europe following at 30.0%, Asia Pacific at 23.0%, Latin America at 5.0% and Middle East & Africa at 2.0%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis

By Product Type

The Monoclonal Antibodies (mAbs) segment is the dominant sub-segment in the Biopharmaceutical Contract Manufacturing market, holding a 42.5% share in 2024. mAbs are extensively used in cancer treatments and immunotherapies, driving significant demand in the contract manufacturing industry. The increasing need for targeted therapies and the development of novel mAb-based drugs is fueling this growth. Other key segments, including Recombinant Proteins and Biosimilars, are also expanding, benefiting from advancements in protein expression systems and regulatory support for biosimilars.

- For instance, WuXi Biologics has deployed hundreds of single-use, modular bioreactors across its global facilities, enabling flexible production of monoclonal antibodies (mAbs), recombinant proteins, and biosimilars and supporting over 800 ongoing biologics projects.

By Manufacturing Type

The Drug Substance Manufacturing segment is the largest in the Biopharmaceutical Contract Manufacturing market, commanding a 50.7% market share in 2024. This is primarily due to the demand for efficient production of biologic drugs, which require specialized manufacturing processes. Mammalian Cell Culture is also a significant contributor, accounting for 30.4% of the market share, as it is widely used for producing monoclonal antibodies and therapeutic proteins. The growth of biologics is expected to continue driving the expansion of both drug substance and drug product manufacturing services.

- For instance, Lonza’s mammalian drug-substance facility in Portsmouth operates multiple bioreactors with capacities up to 20,000 liters, supporting large-scale production of biologics for global biopharma customers.

By Technology

The Upstream Processing segment dominates the technology category, holding a 37.8% share in 2024. This segment includes critical processes like cell culture and fermentation, which are essential for the production of biologic drugs. Cell Line Development and Purification (Chromatography, Filtration) are also key drivers, with increasing investments in technology to improve yield, purity, and process efficiency. As biopharmaceutical companies focus on increasing throughput and scalability, these technologies continue to see significant growth, particularly in the production of monoclonal antibodies and vaccines.

Key Growth Drivers

Increasing Demand for Biologics

The growing demand for biologics, particularly monoclonal antibodies (mAbs) and recombinant proteins, is a major growth driver in the Biopharmaceutical Contract Manufacturing market. Biologics offer targeted and personalized treatments for complex diseases like cancer, autoimmune disorders, and genetic conditions. With ongoing advancements in research and development, biopharmaceutical companies are increasingly outsourcing the manufacturing of these high-value products to contract manufacturers. This trend is further supported by favorable regulatory environments and an expanding pipeline of biologic drugs, fueling the demand for contract manufacturing services.

- For instance, Samsung Biologics’ Plant 4 features 240,000 liters of installed capacity, making it one of the world’s largest biologics manufacturing facilities, designed specifically to support complex biologic and biosimilar programs

Cost-Effectiveness of Outsourcing Manufacturing

The shift toward outsourcing biopharmaceutical manufacturing to contract organizations has accelerated as companies seek to reduce operational costs. Contract manufacturers offer cost-effective, scalable solutions that help biopharma companies focus on research and innovation while leaving the complex, resource-intensive production processes to specialized manufacturers. This trend is particularly important as companies look to reduce capital investment in manufacturing facilities and streamline operations, making contract manufacturing an attractive option for the production of both drug substances and drug products.

- For instance, Thermo Fisher Scientific’s St. Louis biologics site operates multiple single-use bioreactors up to 5,000 liters, allowing clients to avoid multimillion-dollar facility investments while accessing end-to-end manufacturing capacity.

Advancements in Technology and Innovation

Technological advancements in biopharmaceutical manufacturing processes, such as cell line development, purification, and upstream processing, are driving market growth. The development of more efficient and robust manufacturing techniques enables higher yield, reduced production costs, and improved product quality. Innovations in areas like gene therapy and biosimilars are expanding the scope of contract manufacturing services, as these technologies require specialized expertise. The continuous evolution of manufacturing technologies not only enhances the efficiency of drug production but also ensures compliance with stringent quality standards.

Key Trends & Opportunities

Expansion of End-to-End Manufacturing Services

There is a growing trend toward integrated, end-to-end contract manufacturing services that cover the entire product lifecycle, from drug development to commercial production. This trend is driven by the increasing complexity of biologic drug development, which requires expertise across multiple stages, including formulation development, analytical testing, and final product manufacturing. Contract manufacturers offering end-to-end services are particularly attractive to small and mid-sized biopharmaceutical companies, as they provide a seamless and cost-effective solution for the entire process, ensuring faster time to market and regulatory compliance.

- For instance, Catalent’s gene therapy campus in Maryland operates integrated facilities with over 30 analytical labs and multiple production suites capable of scaling vector manufacturing from 50-liter to 500-liter bioreactors within the same workflow.

Rising Demand for Biosimilars

The rising adoption of biosimilars presents significant growth opportunities for contract manufacturers. As patents for several blockbuster biologic drugs expire, biosimilars offer a cost-effective alternative, making them increasingly attractive to healthcare systems worldwide. With many biosimilars currently in development, biopharmaceutical companies are outsourcing the manufacturing of these complex molecules to specialized contract manufacturers. This trend is expected to continue as regulatory agencies across various regions, such as the FDA and EMA, create favorable pathways for the approval of biosimilars, opening up significant opportunities for growth in the market.

- For instance, Boehringer Ingelheim supports biosimilar development at its Fremont facility equipped with 15,000-liter stainless-steel bioreactors dedicated to high-titer cell culture processes used in biosimilar monoclonal antibody production.

Key Challenges

Regulatory and Compliance Challenges

One of the primary challenges facing the Biopharmaceutical Contract Manufacturing market is the complex and evolving regulatory landscape. Biopharmaceutical manufacturing is subject to stringent regulations, including those set by the FDA, EMA, and other global authorities. Compliance with Good Manufacturing Practices (GMP) and other regulatory requirements is critical to ensuring product quality and patient safety. However, the constantly changing regulatory environment, especially with new product types such as gene therapies and biosimilars, poses challenges for contract manufacturers in terms of maintaining compliance and securing necessary approvals for production processes.

Supply Chain and Raw Material Shortages

Supply chain disruptions and raw material shortages present another significant challenge for the biopharmaceutical contract manufacturing market. The production of biologics and other advanced therapeutics often requires highly specialized and raw materials, such as growth media and cell culture supplies, which are subject to supply fluctuations. The COVID-19 pandemic highlighted vulnerabilities in the global supply chain, affecting both the availability and cost of these materials. These disruptions can lead to production delays, increased costs, and challenges in meeting demand, thus impacting the ability of contract manufacturers to deliver on time.

Regional Analysis

North America

The North American region held a market share of 40.0% in the global biopharmaceutical contract manufacturing market in 2024. This dominance is supported by a well‑established ecosystem of contract manufacturing organizations (CMOs) and a dense concentration of biologics development activities in hubs such as Boston‑Cambridge and the San Francisco Bay Area. The presence of robust regulatory frameworks, substantial R&D investments, and frequent capacity expansions by leading CDMOs further reinforce North America’s leadership position. As late‑stage and commercial biologics projects proliferate, outsourcing demand remains strong and is expected to sustain regional growth.

Europe

In 2024, Europe accounted for a market share of 30.0% in the biopharmaceutical contract manufacturing sector. The region benefits from a mature biopharma industry, a strong base of contract manufacturing infrastructure, and growing biosimilar development across key countries like Germany, Switzerland, and the UK. Initiatives to streamline regulatory pathways for biologics and support biotech innovation bolster the outsourcer ecosystem. Nevertheless, Europe is balancing cost pressures with legacy operations and must continue investing in advanced manufacturing to maintain its competitive edge.

Asia Pacific

The Asia Pacific region held a 23.0% market share in 2024 for biopharmaceutical contract manufacturing. Rapid expansion in biologics R&D, increasing outsourcing activity, and favorable government policies are driving growth. With countries such as China, India, Japan, and South Korea amplifying capacity and capabilities, Asia Pacific is emerging as the fastest‑growing regional market. Cost efficiencies, growing in‑region demand, and strategic partnerships further underpin the region’s ascent in contract manufacturing services.

Latin America

Although explicit data for Latin America’s share is less frequently published, the region is gaining traction within the global biopharmaceutical contract manufacturing market. Latin America benefits from improving regulatory frameworks, rising local biologics pipelines, and increasing interest from global CMOs seeking geographic diversification. While currently smaller in scale compared with North America, Europe, and Asia Pacific, Latin America offers a strategic growth corridor, particularly as manufacturers seek cost‑effective capacity and emerging market access. The region’s share is expected to grow steadily in the coming years and is projected to reach 5.0%.

Middle East & Africa (MEA)

The Middle East & Africa region is still nascent in the global biopharmaceutical contract manufacturing market but is gradually building momentum. While precise share figures are not frequently reported, MEA’s role is expanding as governments invest in biotech infrastructure, health‑system reforms accelerate, and regional outsourcing opportunities grow. Although it remains a smaller contributor compared with the major regions, MEA’s long‑term potential lies in localization of biologics manufacturing and strategic partnerships with global players. The market share in MEA is projected to increase and is estimated at 2.0%.

Market Segmentations

By Product Type

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines

- Cell Therapies

By Manufacturing Type

- Drug Substance Manufacturing

- Mammalian Cell Culture

- Microbial Fermentation

- Drug Product Manufacturing

By Technology

- Upstream Processing

- Cell Line Development

- Cell Culture/ Fermentation

- Downstream Processing

By Service Type

- Development Services

- Process Development

- Analytical Development

- Manufacturing Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the global biopharmaceutical contract manufacturing market is shaped by leading players such as Lonza Group AG, Boehringer Ingelheim GmbH, AGC Biologics, Rentschler Biotechnologie GmbH, ProBioGen, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., Toyobo Co., Ltd., Samsung Biologics Co., Ltd., and Inno Biologics Sdn Bhd. These firms actively invest in capacity expansion, geographic diversification, and technological advancement to maintain their competitive edge. For example, many are constructing large‑scale mammalian cell‑culture bioreactor capacity, launching biosimilar production lines, or entering strategic partnerships with drug developers to secure long‑term supply contracts. The sector remains capital‑intensive and requires high regulatory compliance, which creates barriers to entry and tends to favour players with established scale and experience. Emerging competitors often focus on niche segments such as cell or gene therapies, while the incumbents continue to widen their service portfolios to offer end‑to‑end solutions from cell line development to commercial fill/finish thereby strengthening their positioning and sustaining margin uplift in a rapidly evolving outsourcing environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AGC Biologics

- Inno Biologics Sdn Bhd

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Toyobo Co., Ltd.

- Rentschler Biotechnologie GmbH

- Samsung Biologics

- JRS PHARMA

- ProBioGen

- Lonza Group

- Boehringer Ingelheim GmbH

Recent Developments

- In July 2025, Simtra BioPharma Solutions purchased a 65-acre property near Bloomington, Indiana (300,000 sq ft under roof) to expand its U.S. injectable manufacturing capacity for its CDMO operations.

- In May 2025, Terumo Corporation announced that it will acquire WuXi Biologics’ plant in Leverkusen, Germany for EUR 150 million, to expand its drug-product CDMO capacity globally.

- In May 2025, HAS Healthcare Advanced Synthesis SA completed the acquisition of Cerbios‑Pharma SA, creating a combined global CDMO group backed by 65 Equity Partners.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Manufacturing Type, Technology, Service Type, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Outsourcing of biologics and advanced therapies will expand significantly as more pharmaceuticals opt to partner with contract manufacturers to streamline production and reduce capital investments.

- The growth of cell and gene therapies will drive increased demand for specialized contract manufacturing services catering to complex modalities requiring high-tech infrastructure and regulatory expertise.

- Rising demand for biosimilars as biologic patents expire will provide contract manufacturers with expanded opportunities to offer cost‑efficient manufacturing solutions and scale‑up capabilities.

- Geographic diversification of manufacturing capacity will accelerate, with greater investments in Asia‑Pacific and emerging markets to meet cost and regional supply‑chain efficiencies.

- Adoption of single‑use bioreactor technology and modular facility designs will boost flexibility, reduce time‑to‑market and allow contract manufacturers to handle multi‑product operations more efficiently.

- Strategic partnerships and long‑term supply agreements between biopharma companies and CDMOs will strengthen, enabling smoother commercialization of high‑value biologics and securing manufacturing capacity.

- Integration of digital manufacturing technologies—including process automation, data analytics and digital twins—will enhance yield, quality control and operational efficiency across contract manufacturing operations.

- Regulatory harmonization across regions and stricter quality demands will increase the value of contract manufacturing providers that can navigate global compliance and deliver commercially‑ready biologics at scale.

- Capacity constraints in mammalian cell‑culture manufacturing will persist, creating premium opportunities for CDMOs with large‑scale infrastructure and advanced expression‑system expertise.

- Sustainability and supply‑chain resilience will become key differentiators for contract manufacturers, with clients prioritizing partners who can provide reliable, compliant and eco‑efficient production solutions.