Market Overview

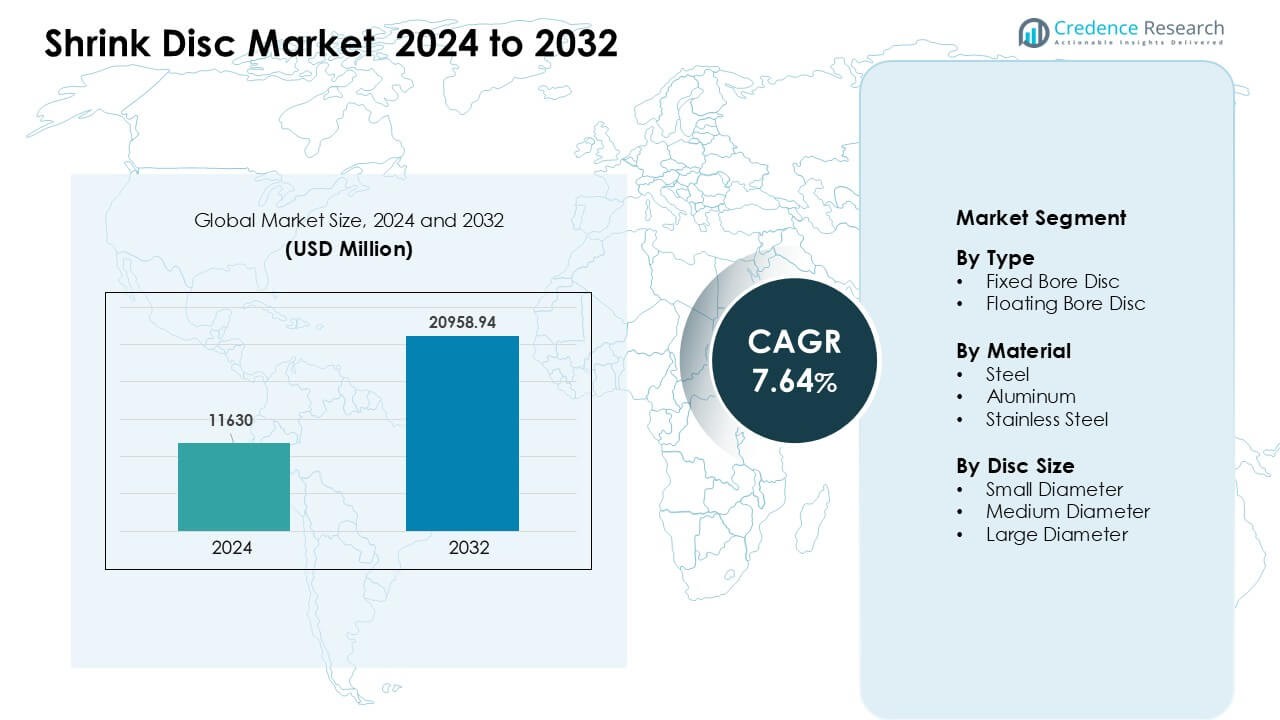

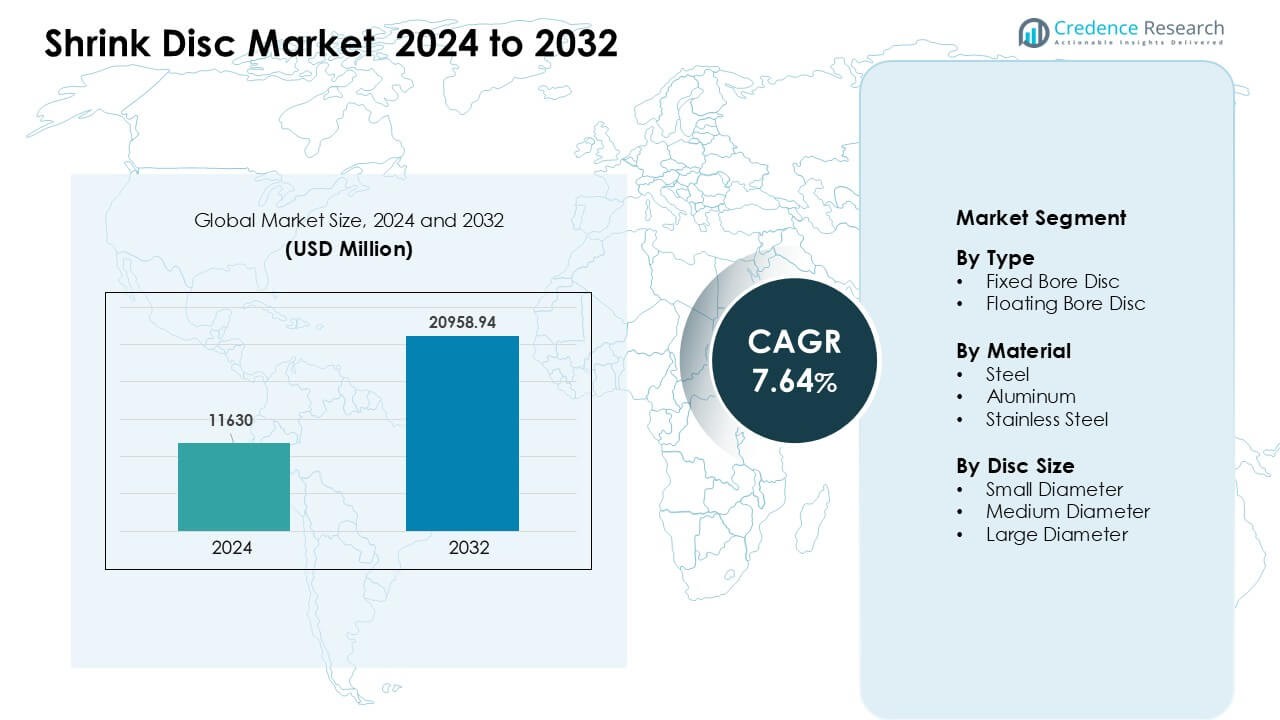

Shrink Disc Market was valued at USD 11630 million in 2024 and is anticipated to reach USD 20958.94 million by 2032, growing at a CAGR of 7.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shrink Disc Market Size 2024 |

USD 11630 Million |

| Shrink Disc Market, CAGR |

7.64% |

| Shrink Disc Market Size 2032 |

USD 20958.94 Million |

The Shrink Disc Market features strong competition among key manufacturers such as RINGSPANN GmbH, Longwin Group, Shanghai Shuangqing Machinery, MAV, Ringfeder, Norelem, VULCAN Industrial Engg, Stuewe, Yuhuan Fittings, and Ringspann. These companies expand their reach through high-torque designs, corrosion-resistant materials, and precision engineering suited for automated and heavy-duty machinery. Many players focus on improving fatigue strength and offering flexible disc sizes to support wider industrial use. Asia-Pacific remained the leading region in 2024 with about 38% share, driven by rapid industrial growth, strong machinery production, and rising automation across manufacturing and logistics sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Shrink Disc Market was valued at USD 11630 million in 2024 and is projected to reach USD 20958.94 million by 2032, growing at a CAGR of 7.64%.

- Demand rises as industries adopt high-torque, maintenance-free shaft connections, with fixed bore discs leading the type segment at about 61% share.

- Key trends include wider use of stainless-steel and aluminum discs and growing adoption in robotics, precision tools, and compact automated systems.

- Major players such as RINGSPANN GmbH, Longwin Group, Shanghai Shuangqing Machinery, MAV, and Ringfeder compete through advanced clamping designs and durable materials.

- Asia-Pacific led the market in 2024 with around 38% share, followed by North America at 34% and Europe at 31%, supported by strong automation growth and broad machinery adoption across key sectors.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Fixed bore disc led the type segment in 2024 with about 61% share. Users preferred fixed designs because they offer strong torque transfer, simple alignment, and high stability under continuous loads. Demand remained strong in heavy machinery, packaging systems, and conveyor drives where precise shaft connection matters. Floating bore discs grew at a steady pace as factories adopted flexible coupling parts that reduce stress during misalignment. Growth in this sub-segment came from rising use in automated equipment, improved vibration control, and broader availability across mid-range industrial machines.

- For instance, a coupling model from RINGFEDER its TND OCO steel-disc coupling delivers transmissible torque up to 1,750 Nm (and a maximum torque limit around 3,000 Nm) at speeds reaching 8,400 revolutions per minute, making it ideal for heavy conveyor-drive applications under continuous load.

By Material

Steel dominated the material segment in 2024 with nearly 58% share. Buyers selected steel because it provides high strength, long fatigue life, and better performance under heavy torque. Growth stayed strong in metal processing, mining, and high-load manufacturing units where durability is the main need. Stainless steel expanded due to better corrosion resistance and stronger use in food, chemical, and marine plants. Aluminum grew through lightweight machinery demand, especially in compact automation lines and material-handling equipment.

- For instance, the steel disc packs in RINGFEDER’s HT-type disc coupling are FEM-optimized spring steel designed to transmit high torque while ensuring minimal backlash and are rated for use temperatures from –20 °C up to 240 °C, enabling reliable operation even in harsh mining or heavy-metal-processing environments.

By Disc Size

Medium diameter discs held the leading position in 2024 with around 46% share. Industries preferred medium sizes because they offer a balance of torque capacity, compact design, and easy installation across standard motor-driven systems. These discs saw strong demand in pumps, compressors, and automated conveyors. Large diameter discs expanded with the rise of heavy-duty drives, mining equipment, and large industrial mixers. Small diameter discs gained traction in robotics, lab automation, and compact machinery due to high precision needs and rapid equipment miniaturization.

Key Growth Drivers

Rising Need for High-Torque and Maintenance-Free Shaft Connections

Global demand for high-torque, backlash-free shaft connections continues to rise across heavy machinery, conveyors, compressors, and automated plant equipment. Many factories now replace traditional keyed connections with shrink discs to gain stronger clamping force, better torque transfer, and reduced wear during long operating cycles. This shift grows faster in sectors using high-load rotating systems, where maintenance downtime directly affects output. Shrink discs support stable performance without lubrication, which appeals to plants seeking cleaner and more reliable coupling systems. As industries automate further, the preference for long-life, maintenance-free torque solutions strengthens market expansion.

- For instance, the RINGFEDER Shrink Disc 4061 can transmit torques in a wide range from 30 Nm up to 87,200 Nm offering a backlash-free, force-locked shaft-hub connection that remains maintenance-free throughout its service life.

Rapid Automation Growth Across Manufacturing and Logistics

Automation expansion across packaging, robotics, material handling, and smart factories has strengthened the adoption of shrink discs. Automated machines need precise shaft alignment, smooth torque transmission, and stable running at varied speeds. Shrink discs meet these needs by offering uniform pressure, stronger fatigue resistance, and easier assembly during equipment upgrades. Logistics systems, including conveyors and automated storage units, also use shrink discs to improve accuracy and reduce mechanical stress. As more industries adopt sensor-based and robotic operations, demand for coupling components that ensure consistent, vibration-free motion continues to grow, driving steady market acceleration.

- For instance, hydraulic shrink-disc variants (as offered by several European suppliers) allow secure, backlash-free shaft-hub connections to be clamped under hydraulic pressure enabling rapid assembly or disassembly even on large shafts where conventional mechanical methods would take hours.

Growing Preference for Safer and Fail-Safe Power Transmission Components

Companies now prioritize safer and fail-safe power transmission components to meet tightened workplace and machine-safety norms. Shrink discs support this shift by eliminating loose parts, reducing the chance of slippage, and ensuring predictable clamping performance under overload. Industries deploying high-speed rotating shafts value the improved stability and enhanced safety margins these discs offer. The push to reduce accidental machine failures further boosts adoption in sectors like mining, chemical processing, and food manufacturing. As OEMs redesign equipment with higher safety compliance, shrink discs gain wider acceptance for dependable and secure shaft coupling.

Key Trend & Opportunity

Rising Adoption in Robotics, Miniaturized Machines, and Precision Equipment

Growing robotics deployment fuels demand for small and medium shrink discs engineered for precision motion. Compact automation tools, laboratory systems, and semiconductor equipment require backlash-free shaft connections to maintain accuracy during high-speed cycles. This trend opens opportunities for manufacturers to design miniaturized discs with tighter tolerances, smoother clamping, and enhanced stability. Rising global investment in electric mobility, battery assembly lines, and precision fabrication further extends demand. As industries push for higher accuracy and more compact machine footprints, precision-focused shrink discs gain strategic importance.

- For instance, RINGFEDER s mini-series RfN 4073 shrink disc supports inner diameters from 14 mm to 160 mm with transmissible torque from 9 Nm up to 7,260 Nm making it particularly well suited for small gearboxes, robotic actuators or compact automation modules in semiconductor or battery-assembly lines.

Increasing Use of Lightweight and Corrosion-Resistant Materials

A key trend involves broader use of aluminum and stainless-steel shrink discs to support lightweight machinery and corrosion-sensitive environments. Many industries now shift toward compact, energy-efficient equipment that needs lighter coupling components without compromising torque capacity. Stainless steel also provides hygienic advantages in food, pharmaceutical, and marine systems, creating new growth avenues. This material shift encourages manufacturers to expand portfolios with hybrid and advanced alloy discs that offer better strength-to-weight balance. As sustainable machine design accelerates, lightweight and corrosion-resistant shrink discs become a major commercial opportunity.

Key Challenge

High Initial Cost Compared to Conventional Shaft Connections

Shrink discs deliver strong long-term value, but their initial price remains higher than keyed, splined, or tapered bush systems. Price sensitivity limits adoption in small manufacturing units and low-cost equipment markets. Many buyers still choose cheaper options despite lower reliability and higher long-term maintenance needs. The higher upfront cost also restricts penetration in developing regions where capital budgets remain limited. While lifecycle benefits are strong, the investment barrier slows faster adoption, especially in cost-driven industries that avoid premium coupling components.

Installation Precision and Skilled Workforce Requirements

Shrink discs require accurate installation, controlled tightening, and proper alignment to deliver full performance. Many plants lack skilled technicians familiar with shrink-fit assemblies, which leads to improper mounting, uneven pressure, and reduced torque capability. This challenge is more visible in small factories and developing regions where training resources are limited. Errors during fitting can increase fatigue stress or cause early failure, discouraging some buyers from adopting shrink-fit connections. Without better training tools and standardized installation practices, skill-related challenges continue to slow widespread market adoption.

Regional Analysis

North America

North America held about 34% share of the Shrink Disc Market in 2024, driven by high adoption of automation, robotics, and heavy industrial machinery. Strong demand came from material-handling systems, mining equipment, and advanced manufacturing plants that rely on high-torque and maintenance-free shaft connections. The United States led the region due to rapid upgrades in factory automation and rising investment in precision motion systems. Canada followed with growing adoption across packaging, food processing, and energy machinery. Technical standards, stronger OEM presence, and replacement demand supported steady regional growth.

Europe

Europe accounted for nearly 31% share in 2024, supported by strong engineering capabilities and a mature industrial base. Germany, Italy, and France led demand due to high machinery production, advanced automotive manufacturing, and widespread use of precision mechanical components. Shrink discs gained traction in heavy-duty drives, pumps, and robotics used in automated factories. The region also saw rising demand for stainless-steel shrink discs in food, chemical, and marine industries. Strict safety rules, higher equipment quality expectations, and ongoing Industry 4.0 upgrades strengthened Europe’s share in the global market.

Asia-Pacific

Asia-Pacific dominated the global Shrink Disc Market with about 38% share in 2024. China, Japan, South Korea, and India drove growth due to rapid industrial expansion, higher automation adoption, and strong machinery exports. Manufacturers increased use of shrink discs in conveyors, compressors, pumps, and robotic systems to improve torque stability and reduce downtime. Rising investment in automotive plants, electronics assembly, and logistics automation further supported regional demand. Asia-Pacific also benefited from competitive pricing and a strong supplier base, which boosted both domestic use and export-focused production.

Latin America

Latin America captured around 4% share in 2024, with steady demand from mining, cement, food processing, and material-handling equipment. Brazil and Mexico led adoption due to expanding industrial bases and rising machinery imports that rely on shrink disc assemblies. Companies sought robust shaft-connection solutions to reduce mechanical failures and improve machine uptime in harsh operating environments. Growth remained moderate due to limited automation levels, but ongoing investment in packaging, agriculture, and logistics equipment supported gradual uptake. Rising awareness of maintenance-free coupling components strengthened long-term prospects.

Middle East & Africa

Middle East & Africa accounted for nearly 3% share in 2024, driven by demand in oil and gas, mining, water treatment, and heavy industrial machinery. Gulf countries increased adoption in pumps, compressors, and rotating equipment used in large-scale energy projects. South Africa and Egypt grew through expanding manufacturing and material-handling operations. Despite lower automation levels, the region showed rising interest in safer and more reliable shaft-connection systems. Infrastructure modernization, industrial diversification, and increased machinery imports supported future growth for shrink discs across MEA.

Market Segmentations:

By Type

- Fixed Bore Disc

- Floating Bore Disc

By Material

- Steel

- Aluminum

- Stainless Steel

By Disc Size

- Small Diameter

- Medium Diameter

- Large Diameter

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Shrink Disc Market features a mix of global engineering firms and regional manufacturers focusing on precision coupling technologies. Key companies such as RINGSPANN GmbH, Longwin Group, Shanghai Shuangqing Machinery, MAV, Ringfeder, and Norelem strengthen their presence through advanced clamping designs, higher torque capacity products, and customized solutions for automated machinery. Many players invest in material upgrades, including stainless-steel and lightweight variants, to meet rising demand from food, chemical, robotics, and high-speed industrial systems. Strategic moves include expanding distribution networks, enhancing digital configurator tools, and improving after-sales support to serve OEMs and end-users more efficiently. Growing automation and the shift toward maintenance-free shaft connections push firms to upgrade product portfolios and compete on durability, precision, and performance reliability.

Key Player Analysis

- RINGSPANN GmbH

- Longwin Group

- Shanghai Shuangqing Machinery

- MAV

- Ringfeder

- Norelem

- VULCAN Industrial Engg

- Stuewe

- Yuhuan Fittings

- Ringspann

Recent Developments

- In 2025, Stuewe Stuewe broadened its HSD shrink disc offering on the 3DFindit / PARTcommunity CAD platform, adding multiple standard and stainless-steel HSD series models dated 17 July 2025, which supports easier integration of its shrink discs into OEM designs.

- In August 2024, RINGSPANN (product news covered in trade press) trade press coverage (Power Transmission / industry news) highlighted RINGSPANN’s RLK shrink-disc series (RLK 606 / RLK 608 etc.), emphasizing safe/easy assembly and the very wide torque/diameter coverage of the series evidence of product-range expansion and market communication in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Disc Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as factories increase automation and require stronger shaft connections.

- Demand for maintenance-free and backlash-free couplings will support wider adoption of shrink discs.

- Advanced materials like stainless steel and lightweight alloys will gain a larger share.

- Miniaturized discs will expand as robotics and compact machinery become more common.

- Precision manufacturing trends will push companies to improve tolerance and fatigue performance.

- Digital configuration tools will make product selection faster for OEMs and engineers.

- Global machinery upgrades will drive replacement demand for older coupling systems.

- Energy, mining, and heavy equipment sectors will adopt larger discs for high-load operations.

- Hygiene-focused industries will use corrosion-resistant discs more frequently.

- Asia-Pacific will keep expanding as industrial capacity and automated production lines increase.

Market Segmentation Analysis:

Market Segmentation Analysis: