Market Overview

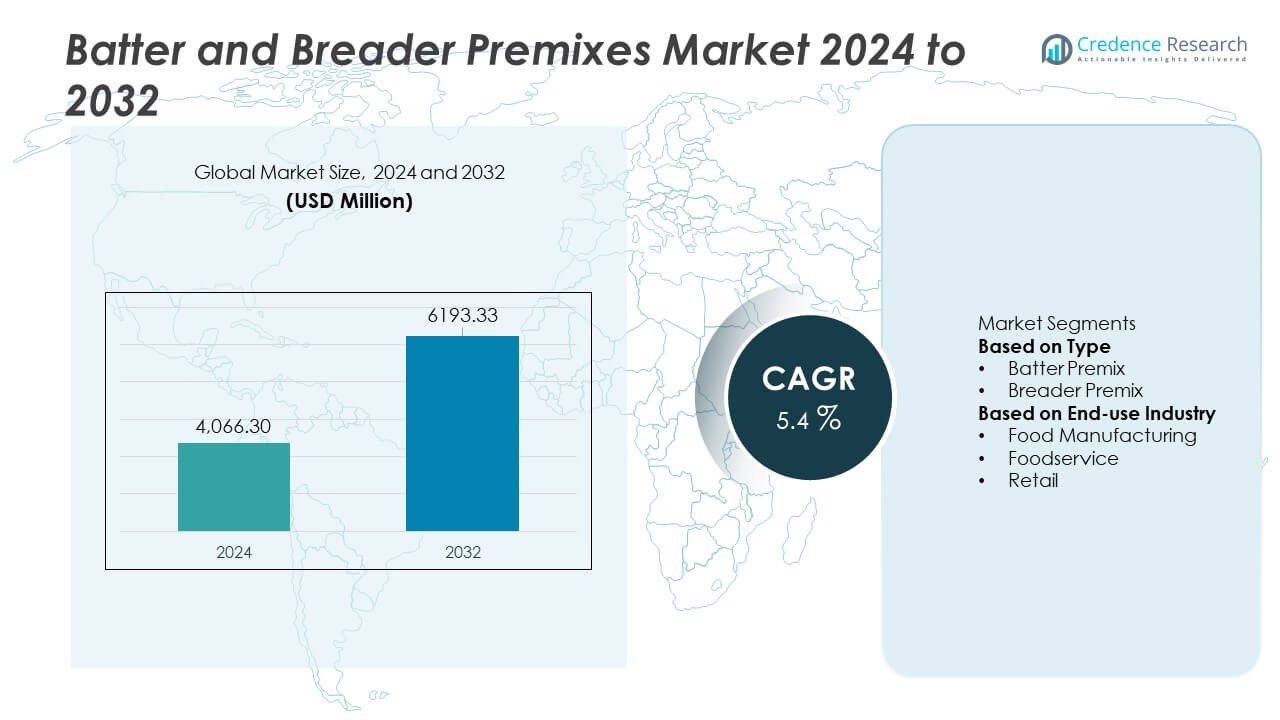

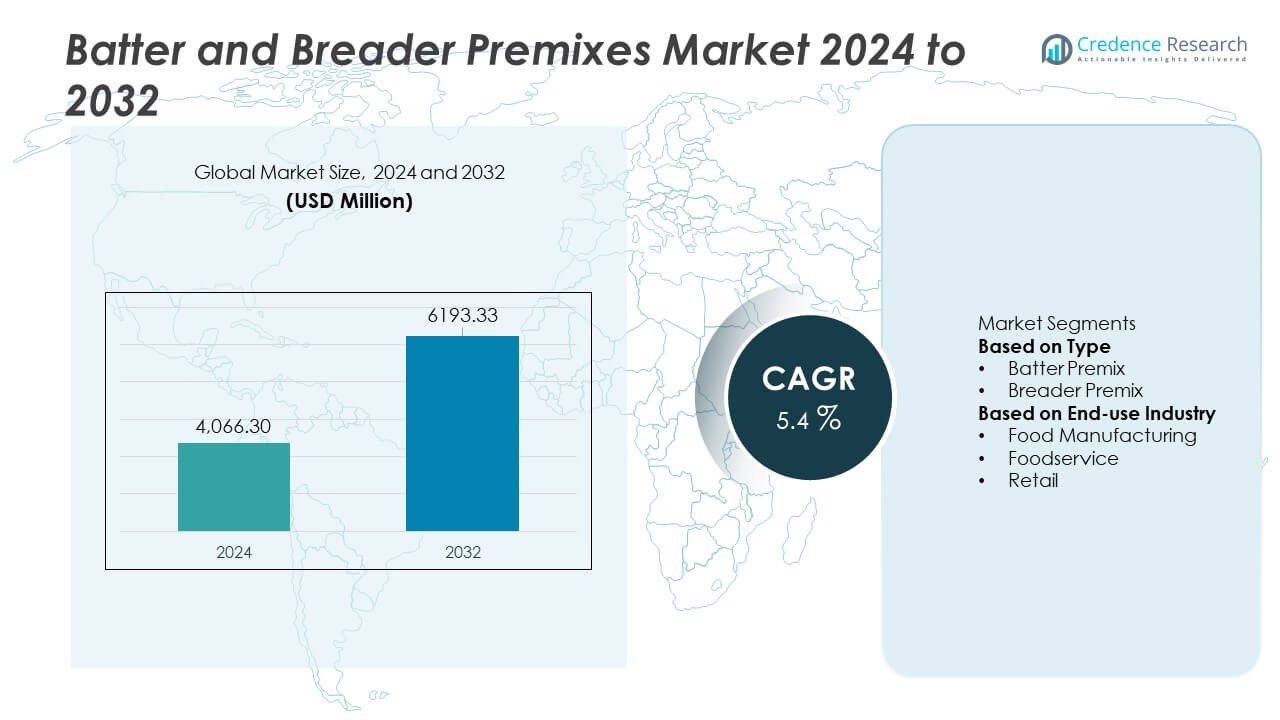

The Batter and Breader Premixes Market reached USD 4,066.30 million in 2024 and is projected to grow to USD 6,193.33 million by 2032, registering a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Batter and Breader Premixes Market Size 2024 |

USD 4,066.30 Million |

| Batter and Breader Premixes Market, CAGR |

5.4% |

| Batter and Breader Premixes Market Size 2032 |

USD 6,193.33 Million |

The Batter and Breader Premixes market is driven by key players such as Thai Nisshin Technomic Co., Ltd, House-Autry Mills Inc., Arcadia Foods, Blendex Company, BRATA Produktions, Breading & Coating Ltd., Kerry Group PLC, Shimakyu, Newly Weds, and Bowman Ingredients. These companies strengthen their position through innovative formulations, clean-label solutions, and partnerships with major food manufacturers and foodservice chains. North America leads the market with a 34% share, supported by strong demand for processed and convenience foods. Europe follows with a 28% share, while Asia Pacific holds a 27% share, driven by rapid growth in foodservice and ready-to-cook product consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Batter and Breader Premixes market reached USD 4,066.30 million in 2024 and will grow at a CAGR of 5.4% through 2032.

- Rising demand for convenience foods and ready-to-cook meals drives strong adoption of batter and breader premixes across food manufacturing and foodservice sectors.

- Key trends include growth of clean-label, gluten-free, and plant-based coating solutions, along with improved formulations for crispiness, adhesion, and flavor retention.

- Competitive activity increases as major players expand production capacity and innovate specialized premixes, while North America leads with a 34% share, followed by Europe at 28% and Asia Pacific at 27%.

- Market restraints include fluctuating raw material prices and strict food safety regulations, while batter premix holds a 56% segment share and food manufacturing leads end-use adoption with a 48% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Batter premix leads the market with a 56% share, driven by strong demand from manufacturers seeking consistent texture, flavor stability, and improved coating performance across meat, seafood, and vegetable products. Its ability to provide uniform viscosity and stronger adhesion makes it preferred in large-scale production environments. Breader premix also experiences steady growth due to rising consumption of crispy and convenience foods in global markets. However, batter premix maintains dominance because it enhances yield, reduces waste, and supports faster processing. Increasing adoption of automated coating systems further boosts demand for batter premixes across diverse food applications.

- For instance, Kerry Group introduced its functional systems that enhance coating adhesion in industrial fry lines and demonstrated a reduction of coating loss during trials across poultry plants.

By End-use Industry

Food manufacturing holds the dominant position with a 48% share, supported by the rapid expansion of processed and ready-to-cook product lines worldwide. Manufacturers rely on premixes to maintain batch consistency, reduce preparation time, and meet hygiene standards in large-volume production. The foodservice sector follows, driven by rising demand for fried and coated dishes in quick-service restaurants. Retail channels grow at a steady pace as consumers adopt home-cooking premixes for convenience. However, the manufacturing sector remains the largest contributor due to high consumption volumes and continuous innovation in product formulation and texture enhancement.

- For instance, Newly Weds Foods made a significant investment to expand a Tennessee facility to increase capacity. This expansion boosts output for clients and maintains stringent safety and quality protocols.

Key Growth Drivers

Rising Demand for Convenience and Ready-to-Cook Foods

Demand for batter and breader premixes increases as consumers shift toward convenient meal solutions and ready-to-cook products. Food manufacturers rely on these premixes to maintain consistent texture, flavor, and coating quality across large production batches. Growth in frozen snacks, coated meat, and seafood products strengthens market expansion. Busy lifestyles, expanding retail penetration, and rising adoption of packaged foods further support demand. As quick preparation becomes a key consumer preference, premixes gain wider acceptance across both foodservice and manufacturing sectors.

- For instance, Tyson Foods adopted a new automated coating line from Marel that improves batch uniformity and reduces manual mixing steps. The system supports continuous monitoring, ensuring consistent coating performance across large ready-to-cook product runs through data-driven decisions.

Expansion of Quick-Service Restaurants and Foodservice Chains

The rapid growth of quick-service restaurants boosts demand for batter and breader premixes that offer uniform coating, extended shelf life, and easy handling. Foodservice operators prefer standardized premix products that reduce preparation time and improve menu consistency. Rising consumption of fried and crispy foods, especially in urban markets, drives higher usage. Global expansion of fast-food brands, cloud kitchens, and casual dining strengthens adoption. These factors position premixes as essential ingredients for delivering consistent taste and texture across high-demand foodservice environments.

- For instance, a supply partner to quick service restaurants, such as McCain Foods, expanded its processing plants with automation enhancements to support efficient restocking of those outlets.

Technological Advancements in Food Processing and Formulation

Innovations in food processing technologies enhance premix performance by improving adhesion, crispiness, and moisture control. Manufacturers develop advanced formulations with clean-label ingredients, gluten-free options, and improved nutritional profiles. Automation in coating systems supports uniform application, reducing waste and increasing production efficiency. These advancements enable producers to meet evolving consumer expectations for healthier and higher-quality coated foods. As processing technology evolves, premix formulations become more specialized, supporting growth across diverse food categories.

Key Trends and Opportunities

Growing Shift Toward Clean-Label and Health-Focused Premixes

Rising consumer awareness of ingredient transparency encourages manufacturers to develop clean-label premixes with natural flavors, plant-based ingredients, and reduced additives. The trend toward healthier snacking increases demand for low-oil, high-fiber, and gluten-free coating solutions. Brands offering premium, health-oriented premixes capture new opportunities in retail and foodservice markets. This shift also aligns with regulatory pressure for clearer ingredient labeling. As health trends evolve globally, clean-label premixes emerge as a strong growth opportunity for manufacturers.

- For instance, Ingredion expanded its clean-label starch portfolio by adding a pea-based texturizer produced at its Nebraska facility, which sources peas sustainably from North American farms. The ingredient delivers high viscosity control in coating systems and supports clean-label premix development.

Expansion of Plant-Based and Alternative Protein Products

The growing popularity of plant-based meat and seafood alternatives creates new opportunities for specialized batter and breader premixes. Manufacturers design coatings that enhance texture, moisture retention, and flavor for plant-derived proteins. Rising adoption of vegan and flexitarian diets increases demand for innovative coating solutions tailored to non-meat products. Foodservice brands expand plant-based menu items, further strengthening this trend. As alternative protein markets grow, premix suppliers benefit from increased formulation needs and wider application diversity.

- For instance, Conagra Brands, parent company of the Gardein line of meat-free foods, is investing in its Missouri facility to increase production capacity for its frozen meals portfolio, including brands such as Healthy Choice and Marie Callender’s.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

Costs of key ingredients such as flours, starches, and seasonings fluctuate due to climate conditions, global trade shifts, and supply chain disruptions. These variations increase production costs for premix manufacturers and impact pricing stability. Food processors face challenges in maintaining consistent profit margins while meeting demand. Supply chain delays also affect ingredient availability, leading to formulation adjustments. Managing cost pressures and ensuring reliable sourcing remain major challenges for industry players.

Stringent Food Safety Regulations and Compliance Requirements

Manufacturers must comply with strict safety and quality standards across global markets, including allergen control, labeling norms, and contamination prevention. Meeting these requirements increases operational complexity and demands continuous monitoring. Non-compliance risks product recalls and brand damage. As regulatory frameworks tighten, companies must invest in advanced testing, quality assurance systems, and transparent labeling practices. These obligations increase production costs and pose challenges for smaller manufacturers aiming to compete with established brands.

Regional Analysis

North America

North America holds a 34% share of the Batter and Breader Premixes market, driven by strong demand for processed meat, seafood, and convenience snacks. Food manufacturers in the United States and Canada rely on premixes to achieve consistent coating quality and improve production efficiency. Growth in quick-service restaurants and ready-to-eat meal categories further strengthens adoption. Rising consumer preference for crispy, flavorful, and premium coated foods also boosts market expansion. Advanced food processing technologies and a mature retail sector support steady demand, positioning North America as a leading region in the global market.

Europe

Europe accounts for a 28% share, supported by high consumption of processed and breaded foods and strict quality standards across food manufacturing. Increasing demand for clean-label and gluten-free premixes drives innovation, especially in markets such as Germany, the United Kingdom, and France. Foodservice expansion and rising preference for premium fried products encourage greater use of coating solutions. Manufacturers also benefit from advanced processing technologies that improve coating uniformity and texture. Strong retail penetration of frozen and ready-to-cook products supports steady regional growth, maintaining Europe as a major contributor to the global market.

Asia Pacific

Asia Pacific holds a 27% share, driven by fast-growing foodservice sectors and rising popularity of fried and coated snacks. China, Japan, India, and Southeast Asian countries experience strong demand due to changing eating habits, urbanization, and increased disposable income. Expanding quick-service restaurant chains and growth in processed meat and seafood production strengthen market adoption. Manufacturers invest in localized flavors and specialized premixes to meet diverse consumer preferences. Rapid industrialization in the food sector and rising demand for convenience foods position Asia Pacific as one of the fastest-growing markets.

Latin America

Latin America represents a 7% share, supported by growing consumption of processed poultry, seafood, and snack foods. Brazil and Mexico lead adoption due to expanding food manufacturing capabilities and rising interest in convenient meal options. Quick-service restaurant growth and increasing use of premixes in commercial kitchens contribute to market expansion. However, economic fluctuations and higher import dependency for some ingredients pose challenges. Despite these constraints, rising demand for consistent coating performance and flavor innovation supports steady development across the region.

Middle East and Africa

The Middle East and Africa account for a 4% share, driven by expanding foodservice sectors and rising consumption of fried poultry and seafood products. Countries such as the UAE, Saudi Arabia, and South Africa show increasing adoption of premixes in both retail and commercial food production. Growth in quick-service restaurants and rising demand for convenience foods support industry expansion. Limited local production capacity and reliance on imported ingredients present challenges, yet improving cold-chain infrastructure and increasing urbanization encourage gradual market growth across the region.

Market Segmentations:

By Type

- Batter Premix

- Breader Premix

By End-use Industry

- Food Manufacturing

- Foodservice

- Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Batter and Breader Premixes market is shaped by leading players such as Thai Nisshin Technomic Co., Ltd, House-Autry Mills Inc., Arcadia Foods, Blendex Company, BRATA Produktions, Breading & Coating Ltd., Kerry Group PLC, Shimakyu, Newly Weds, and Bowman Ingredients. These companies invest in advanced formulation technologies to deliver consistent texture, enhanced adhesion, and improved crispiness across meat, seafood, and snack applications. Manufacturers focus on clean-label, gluten-free, and specialty coating solutions to meet evolving consumer preferences. Strategic partnerships with foodservice chains and major food processors strengthen market presence. Continuous innovation in processing efficiency, flavor systems, and moisture-retention capabilities further enhances competitiveness. Companies also expand production capacity and global distribution networks to meet rising demand from convenience food and quick-service restaurant sectors, supporting sustained growth in the market.

Key Player Analysis

- Thai Nisshin Technomic Co., Ltd

- House-Autry Mills Inc.

- Arcadia Foods

- Blendex Company

- BRATA Produktions

- Breading & Coating Ltd.

- Kerry Group PLC

- Shimakyu

- Newly Weds

- Bowman Ingredients

Recent Developments

- In 2024, Kerry Group PLC launched a new Biobake Fibre enzyme solution that is organic-suitable and helps bakers meet demand for high-fiber content in rye and wholemeal bakery products.

- In February 2023, Kerry Group partnered with Azelis and Caldic to strengthen distribution of its products—including those used for coatings like batters and breaders—across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for batter and breader premixes will rise as consumers continue shifting toward convenience foods.

- Clean-label and natural ingredient formulations will grow as transparency becomes a priority.

- Foodservice expansion will drive higher adoption of standardized coating solutions for consistency.

- Plant-based and alternative protein products will create new opportunities for specialized premixes.

- Advanced processing technologies will enhance coating performance and production efficiency.

- Global quick-service restaurant growth will increase demand for crispier and long-lasting coating systems.

- Innovation in gluten-free and allergen-friendly premixes will expand market reach.

- Automation in food manufacturing will boost usage of ready-to-apply coating mixes.

- Flavor customization and regional taste adaptation will become key competitive differentiators.

- Emerging markets will experience strong growth as cold-chain infrastructure and processed food consumption expand.

Market Segmentation Analysis:

Market Segmentation Analysis: