Market Overview

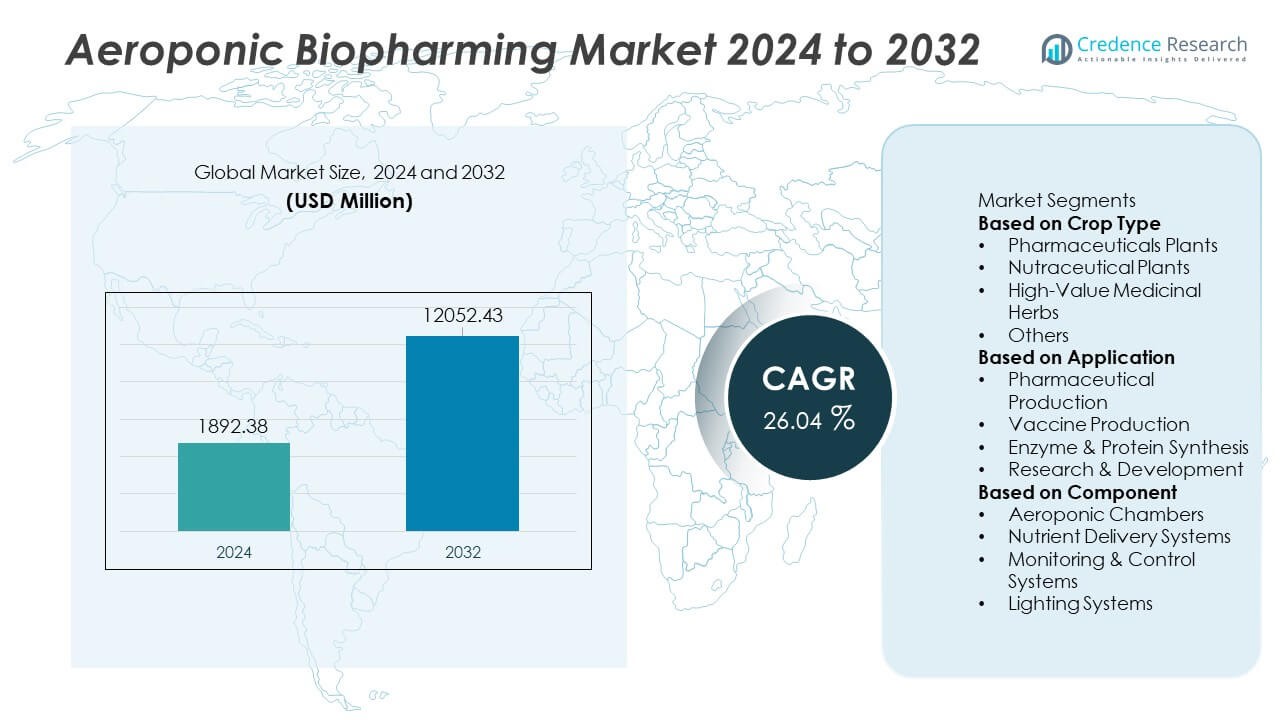

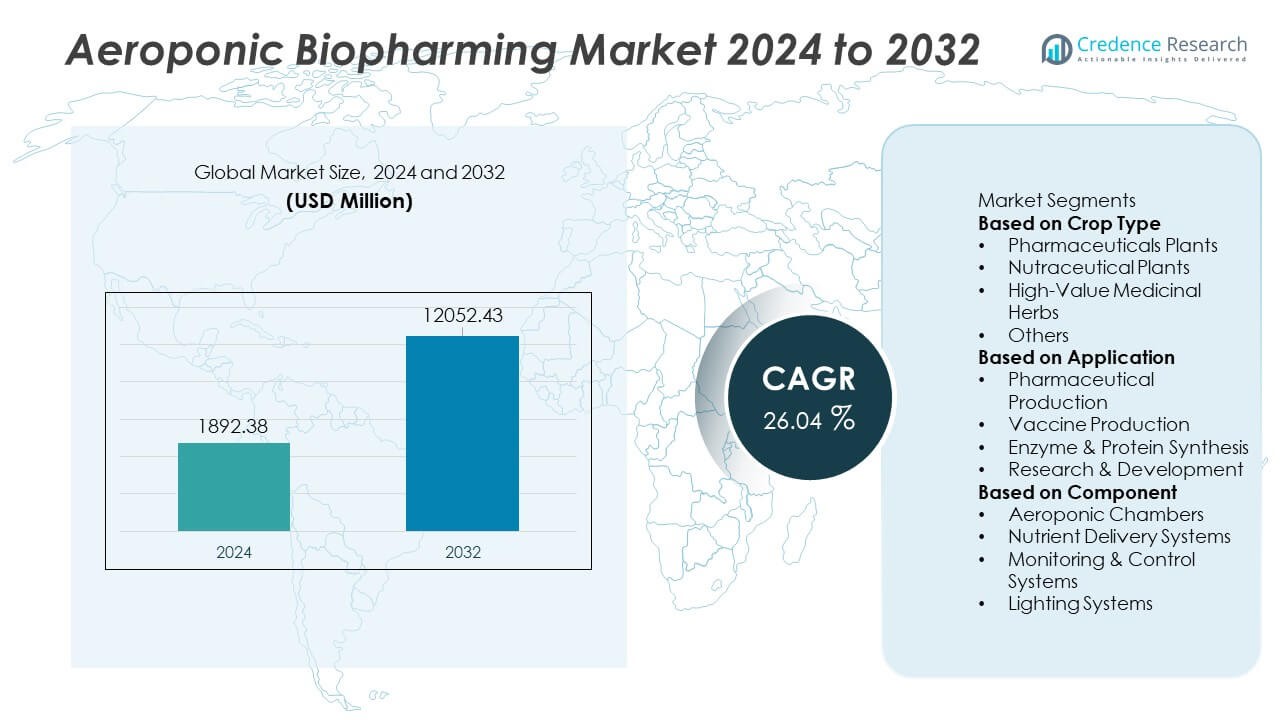

The Aeroponic Biopharming Market reached USD 1,892.38 million in 2024 and is projected to grow to USD 12,052.43 million by 2032, registering a strong CAGR of 26.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aeroponic Biopharming Market Size 2024 |

USD 1,892.38 Million |

| Aeroponic Biopharming Market, CAGR |

26.04% |

| Aeroponic Biopharming Market Size 2032 |

USD 12,052.43 Million |

Leading players in the Aeroponic Biopharming market include AeroFarms, Plenty Unlimited Inc., BrightFarms, LettUs Grow, Freight Farms, Living Greens Farm, Mirai Co. Ltd., Bowery Farming, Sky Greens, and AEssenseGrows. These companies strengthen competitiveness through advanced aeroponic systems, high-efficiency nutrient delivery, and scalable controlled-environment platforms designed for producing pharmaceutical plants, nutraceutical ingredients, and medicinal herbs. North America leads the global market with a 40% share, driven by strong biotechnology investment and rapid adoption of sustainable bioproduction methods. Europe follows with a 28% share, supported by advanced agricultural technologies and growing interest in plant-based biologics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 1,892.38 million in 2024 and will grow at a CAGR of 26.04% through 2032.

- Pharmaceutical plants lead the crop type segment with a 43% share, driven by rising demand for plant-derived biologics and faster, contaminant-free production through aeroponic systems.

- Advancements in controlled-environment technologies and AI-driven monitoring strengthen market trends as companies adopt automated nutrient delivery and precision growth management.

- Competition intensifies as AeroFarms, Plenty, BrightFarms, LettUs Grow, and AEssenseGrows expand capabilities in high-value medicinal crops while facing restraints such as high setup costs and limited regulatory clarity.

- North America leads with a 40% share, followed by Europe at 28% and Asia Pacific at 24%, reflecting strong biotech investment and rising adoption of sustainable plant-based pharmaceutical production.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Crop Type

Pharmaceutical plants lead this segment with a 43% share, driven by rising demand for plant-derived biologics, therapeutic proteins, and active pharmaceutical ingredients. Aeroponic systems support faster growth cycles, contaminant-free production, and higher yield consistency, making them ideal for pharmaceutical-grade crops. Nutraceutical plants gain traction as consumers shift toward natural supplements and functional ingredients. High-value medicinal herbs benefit from controlled environments that enhance active compound concentration. Increasing interest in sustainable biopharming and rapid scalability reinforces the dominance of pharmaceutical plants while supporting growth across medicinal and nutraceutical categories.

- For instance, Kentucky BioProcessing used plant-based aeroponic tobacco lines to produce substantial batches of purified recombinant protein material per production cycle.

By Application

Pharmaceutical production dominates this segment with a 45% share, supported by strong adoption of aeroponic systems for producing purified compounds, antibodies, and therapeutic proteins. The method reduces contamination risks and accelerates biomass generation, making it attractive for high-volume pharmaceutical workflows. Vaccine production gains momentum as aeroponic systems provide sterile environments suited for plant-based vaccine platforms. Enzyme and protein synthesis markets expand with growing interest in cost-effective alternatives to traditional bioreactors. Research and development activities strengthen overall demand, driven by universities and biotech firms exploring scalable plant-based expression systems.

- For instance, Icon Genetics advanced its magnICON platform to deliver recombinant protein yields of up to 5 grams per kilogram of plant biomass.

By Component

Aeroponic chambers hold the leading position in this segment with a 41% share, driven by their critical role in maintaining sterile growth conditions, efficient nutrient absorption, and optimal root environment control. These chambers enable precision regulation of humidity, airflow, and nutrient misting, which supports higher productivity of pharmaceutical crops. Nutrient delivery systems follow due to rising demand for automated and sensor-based nutrient management. Monitoring and control systems gain traction as users adopt AI-driven platforms for real-time crop performance tracking. Advanced lighting systems further enhance compound production, reinforcing the central role of aeroponic chambers in biopharming efficiency.

Key Growth Driver

Rising Demand for Plant-Based Biopharmaceuticals

Demand increases as pharmaceutical companies shift toward plant-derived biologics that offer faster production, lower contamination risks, and improved scalability. Aeroponic systems support sterile, soil-free environments ideal for producing therapeutic proteins, antibodies, and vaccines. Controlled growth conditions enhance consistency and reduce reliance on traditional agricultural cycles. As global interest in sustainable and cost-effective biomanufacturing grows, aeroponic biopharming becomes a preferred method for high-value pharmaceutical compounds. This shift strengthens market expansion across advanced research centers and commercial bioproduction facilities.

- For instance, Medicago’s plant-based production line demonstrated a rapid response capacity to produce large amounts of antigen output in a short time frame, which was significantly faster than traditional vaccine manufacturing methods, at its Quebec facility.

Advancements in Controlled Environment Agriculture Technologies

Improved automation, IoT sensors, nutrient-delivery systems, and climate-control technologies enhance precision and reliability in aeroponic biopharming. These innovations allow producers to optimize growth cycles, regulate nutrient absorption, and monitor plant health in real time. Enhanced control reduces crop variability, a major advantage when producing pharmaceutical-grade materials. As technology costs decrease, adoption accelerates across biotech firms and research institutions. The ability to scale production rapidly while maintaining purity and potency positions aeroponic biopharming as a powerful alternative to conventional agricultural models.

- For instance, AEssenseGrows deployed its Guardian Grow Manager, enabling real-time monitoring across more than 50,000 sensor points in commercial aeroponic sites.

Increasing Need for Rapid and Scalable Production Platforms

Global demand for vaccines, enzymes, and therapeutic proteins requires production systems that offer speed, flexibility, and high output. Aeroponic biopharming supports rapid biomass growth and high compound concentration, enabling quicker manufacturing cycles compared to traditional field cultivation. This advantage becomes critical during public health emergencies and for large-scale pharmaceutical operations. Scalable chambers and modular production units allow operators to expand capacity with minimal downtime. As biotech companies seek agile solutions that balance cost and efficiency, aeroponic biopharming emerges as a strong growth driver.

Key Trend & Opportunity

Expansion of Plant-Made Vaccines and Antibodies

Growing interest in plant-based vaccine platforms creates major opportunities for aeroponic biopharming. The method enables sterile, contained environments ideal for producing viral-like particles, antibodies, and recombinant proteins. Plant-made vaccines offer shorter production timelines and lower contamination risks than traditional cell-culture systems. As regulatory frameworks evolve and clinical trials demonstrate strong efficacy, investment in plant-derived vaccines continues to rise. This trend supports long-term growth across biopharma companies, contract manufacturers, and government research programs exploring alternative vaccine technologies.

- For instance, Kentucky BioProcessing processed recombinant batches that produced substantial amounts of purified protein per production cycle, suitable for clinical and commercial use.

Integration of AI-Driven Monitoring and Predictive Analytics

AI-enabled monitoring systems help optimize nutrient cycles, root zone conditions, and compound accumulation in aeroponic crops. Predictive analytics allow producers to adjust environmental parameters before issues affect yield or quality. These capabilities reduce waste, enhance reproducibility, and support pharmaceutical-grade production standards. Automation also minimizes labor requirements, making large-scale biopharming more efficient. As AI tools integrate with sensors and cloud-based platforms, operators gain deeper insight into plant behavior, opening opportunities for precision biomanufacturing and continuous process improvement.

- For instance, Freight Farms’ IoT-linked climate network controls multiple independent environmental parameters inside each growth module to stabilize consistency. The farmhand software gives operators complete control over factors such as temperature, humidity, CO₂, airflow, and nutrient levels to produce a consistent and high-quality harvest year-round.

Key Challenge

High Initial Investment and Operating Costs

Aeroponic biopharming systems require significant capital for advanced chambers, nutrient delivery systems, monitoring equipment, and controlled-environment infrastructure. Operating costs rise due to energy demand, maintenance, and specialized labor. Smaller biotech firms may struggle to justify these expenses without clear reimbursement paths or partnerships. These financial barriers slow adoption and limit accessibility in emerging regions. Without cost-reduction strategies, widespread commercialization faces hurdles that affect long-term market penetration.

Limited Regulatory Frameworks for Plant-Made Pharmaceuticals

Regulatory guidelines for plant-derived biologics remain inconsistent across regions, creating delays in product approval and commercialization. Variability in quality standards, safety testing, and validation requirements complicates biomanufacturing workflows. Companies must navigate complex compliance processes to ensure pharmaceutical-grade output, increasing time and cost burdens. Lack of harmonized policies also limits cross-border collaboration and global market access. Until regulatory pathways become clearer, adoption of aeroponic biopharming for large-scale pharmaceutical production will face constraints.

Regional Analysis

North America

North America leads the Aeroponic Biopharming market with a 40% share, driven by strong investment in biotechnology, advanced controlled-environment agriculture, and rapid adoption of plant-based pharmaceutical production. Major biotech firms and research institutions use aeroponic systems to develop vaccines, therapeutic proteins, and high-value biomolecules. Favorable regulatory support for innovation and strong funding for alternative bioproduction platforms enhance adoption. The region benefits from established infrastructure, skilled workforce, and growing interest in sustainable pharmaceutical manufacturing. Continuous integration of automation and AI-enabled monitoring strengthens overall efficiency and drives long-term market expansion.

Europe

Europe holds a 28% share, supported by growing emphasis on sustainable biomanufacturing, advanced agricultural technologies, and strong presence of pharmaceutical research institutes. Countries such as Germany, the Netherlands, and the UK invest heavily in controlled-environment systems to produce plant-based biologics and specialty compounds. Strict quality regulations drive adoption of aeroponic systems that ensure contamination-free and consistent output. Collaboration between biotech companies and academic institutions accelerates innovation. Rising interest in reducing dependence on traditional agriculture and improving production resilience further strengthens Europe’s market position.

Asia Pacific

Asia Pacific accounts for a 24% share, driven by expanding biotech investment, rapid urban agriculture development, and rising demand for plant-derived pharmaceuticals. China, Japan, South Korea, and India lead adoption as they strengthen research capabilities and build scalable biopharming facilities. Growing healthcare needs and increasing focus on low-cost biomanufacturing encourage broader utilization of aeroponic systems. Government support for agri-biotech innovation and controlled-environment farming drives regional growth. As biopharma companies seek faster and more flexible production platforms, Asia Pacific emerges as one of the fastest-growing markets.

Latin America

Latin America holds a 5% share, influenced by increasing interest in high-value medicinal crops and expanding biotech research capacity in countries such as Brazil and Mexico. Adoption rises as universities and emerging biotech firms explore aeroponic systems for producing specialized plant-based compounds. However, budget constraints and limited access to advanced agricultural technologies slow widespread commercialization. Partnerships with international technology providers help strengthen capabilities. Growing awareness of sustainable cultivation methods and rising demand for natural therapeutics support gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa region captures a 3% share, driven by growing investment in advanced agricultural technologies and controlled-environment systems, particularly in the UAE, Saudi Arabia, and South Africa. Aeroponic biopharming gains traction for producing pharmaceutical plants and medicinal herbs in water-scarce environments. Government-led innovation programs and research collaborations support early-stage adoption. However, high setup costs and limited technical expertise hinder broader market penetration. As healthcare demand increases and biotechnology ecosystems expand, the region shows strong long-term potential for aeroponic biopharming development.

Market Segmentations:

By Crop Type

- Pharmaceuticals Plants

- Nutraceutical Plants

- High-Value Medicinal Herbs

- Others

By Application

- Pharmaceutical Production

- Vaccine Production

- Enzyme & Protein Synthesis

- Research & Development

By Component

- Aeroponic Chambers

- Nutrient Delivery Systems

- Monitoring & Control Systems

- Lighting Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Aeroponic Biopharming market is shaped by key players such as AeroFarms, Plenty Unlimited Inc., BrightFarms, LettUs Grow, Freight Farms, Living Greens Farm, Mirai Co. Ltd., Bowery Farming, Sky Greens, and AEssenseGrows. These companies enhance competitiveness through advanced aeroponic chamber designs, precision nutrient-delivery systems, and AI-driven monitoring platforms that support high-yield and contaminant-free plant production. Many firms focus on producing pharmaceutical-grade crops, nutraceutical ingredients, and high-value medicinal herbs to meet growing biopharma demand. Strategic partnerships with research organizations strengthen innovation, while investments in automation improve scalability and operational efficiency. Companies also explore modular and energy-efficient systems to reduce production costs and expand into emerging markets. As demand rises for sustainable and rapid biopharming solutions, players differentiate themselves through technology integration, product purity, and robust quality-control capabilities.

Key Player Analysis

- AeroFarms

- Plenty Unlimited Inc.

- BrightFarms

- LettUs Grow

- Freight Farms

- Living Greens Farm

- Mirai Co., Ltd.

- Bowery Farming

- Sky Greens

- AEssenseGrows

Recent Developments

- In March 2025, Plenty Unlimited Inc. filed for voluntary petitions under Chapter 11 of the Bankruptcy Code to restructure its liabilities and streamline operations.

- In January 2025, AeroFarms announced commercialisation of its patented vertical-farming system, aiming to scale microgreens production for retail markets.

- In September 2023, AeroFarms emerged from Chapter 11 bankruptcy and refocused operations on its Danville, Virginia farm.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Crop Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-derived biologics will rise as pharma companies seek faster production methods.

- Adoption of AI-driven monitoring systems will improve yield predictability and quality control.

- Aeroponic chambers will become more efficient as automation technologies advance.

- Production of plant-based vaccines and therapeutic proteins will expand across global biotech firms.

- Research institutions will increase investment in aeroponic platforms for precision biomanufacturing.

- Modular and scalable systems will support rapid facility expansion in high-demand regions.

- Energy-efficient lighting and nutrient systems will reduce operational costs over time.

- Emerging markets will adopt aeroponic biopharming to strengthen domestic pharmaceutical supply chains.

- Collaboration between agri-tech and biopharma companies will accelerate innovation pipelines.

- Regulatory frameworks will evolve to support commercial approval of plant-made pharmaceuticals.

Market Segmentation Analysis:

Market Segmentation Analysis: