Market Overview

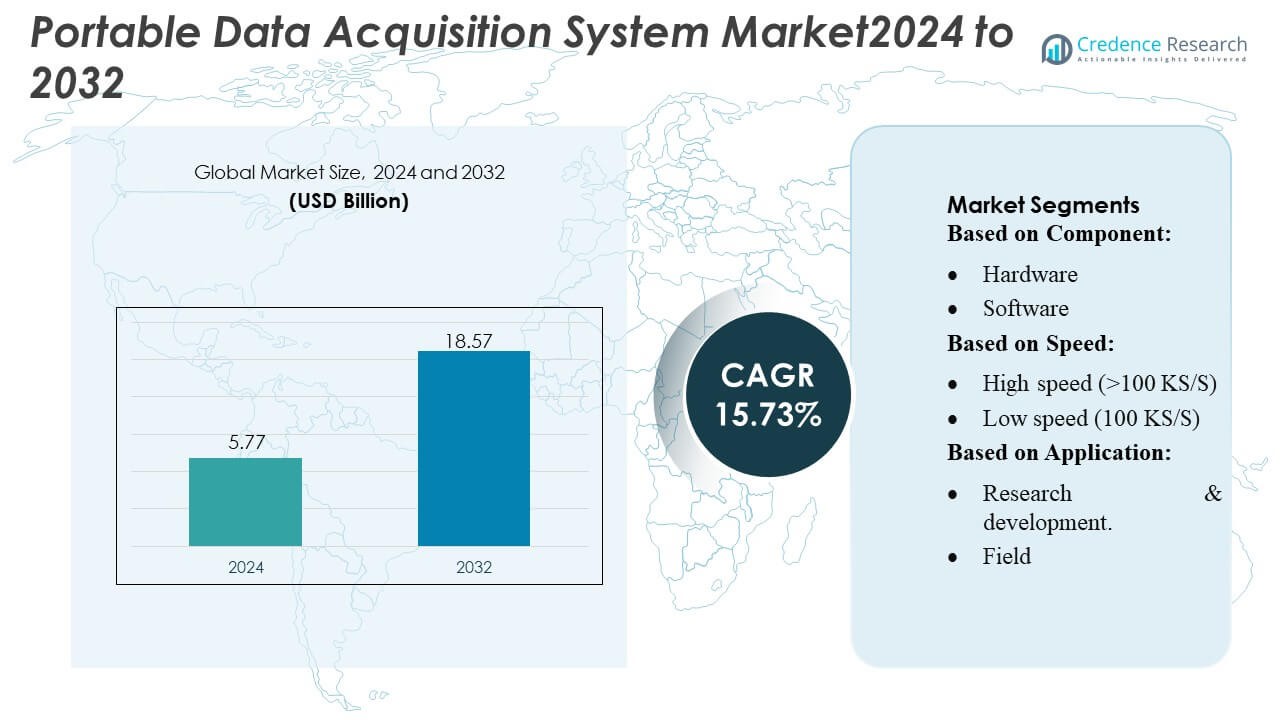

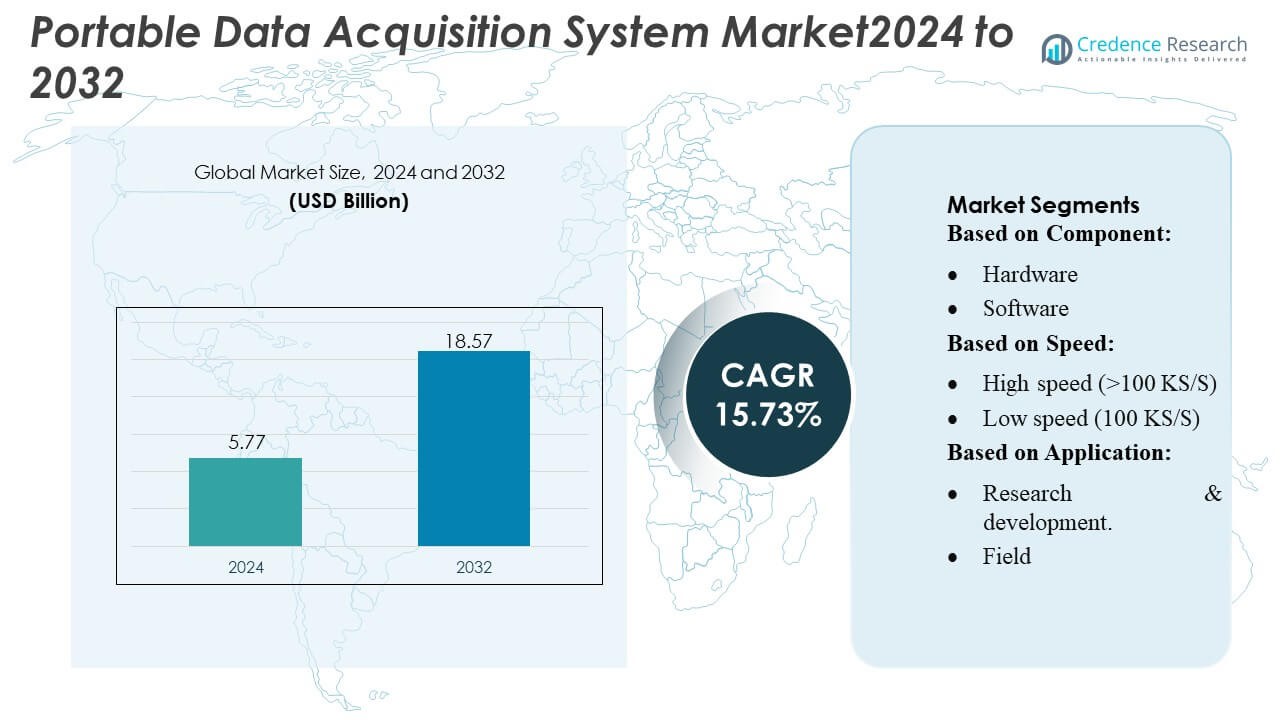

Portable Data Acquisition System Market size was valued USD 5.77 billion in 2024 and is anticipated to reach USD 18.57 billion by 2032, at a CAGR of 15.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Data Acquisition System Market Size 2024 |

USD 5.77 Billion |

| Portable Data Acquisition System Market, CAGR |

15.73% |

| Portable Data Acquisition System Market Size 2032 |

USD 18.57 Billion |

The Portable Data Acquisition System Market is shaped by a strong mix of global automation, measurement, and industrial technology leaders that compete through advancements in high-speed data capture, wireless connectivity, and cloud-enabled analytics. These companies focus on developing compact, rugged, and multi-functional platforms that support real-time monitoring across research, field, and industrial applications. Their strategies emphasize modular hardware, intelligent software, and seamless integration with sensors and enterprise systems to meet evolving testing and diagnostic requirements. Asia Pacific leads the global market with approximately 30–32% share, supported by rapid industrialization, expanding electronics manufacturing, and rising investments in R&D and digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Portable Data Acquisition System Market was valued at USD 5.77 billion in 2024 and is projected to reach USD 18.57 billion by 2032, registering a CAGR of 15.73% during the forecast period.

- Strong market drivers include rising demand for high-speed data capture, real-time monitoring, and compact multi-functional systems across R&D, field testing, and industrial diagnostics.

- Key trends focus on wireless integration, cloud-enabled analytics, and modular architectures, with hardware leading the component segment with around 65–68% share.

- Competitive activity intensifies as global automation and measurement companies enhance rugged designs, software intelligence, and sensor interoperability while facing restraints related to high system costs and technical complexity.

- Asia Pacific leads the market with 30–32% share, followed by North America at 32–34% and Europe at 27–29%, driven by industrial expansion, electronics manufacturing growth, and increased investment in digitalization and R&D.

Market Segmentation Analysis:

By Component

The hardware segment dominates the Portable Data Acquisition System Market with an estimated 65–68% market share, driven by the widespread integration of advanced sensors, converters, and modular interfaces that support high-accuracy data capture across diverse environments. Demand strengthens as industries prioritize rugged, portable, and multi-channel hardware platforms capable of delivering real-time insights in field and laboratory settings. Manufacturers focus on compact designs, enhanced connectivity, and improved signal conditioning, enabling hardware systems to remain the preferred choice for critical measurement tasks. Software continues to grow steadily as analytics and visualization capabilities expand.

- For instance, Huawei Technologies Co., Ltd. launched its FusionModule2000 smart modular data center, which supports an IT load of up to 310 kilowatts per module (depending on the specific configuration).

By Speed

High-speed systems (>100 KS/S) lead the market with approximately 58–60% share, supported by their adoption in applications requiring rapid signal acquisition, dynamic testing, and high-frequency measurement accuracy. Industries such as automotive, aerospace, and advanced manufacturing rely on high-speed units to capture transient events and complex waveforms with precision. This dominance is reinforced by ongoing advancements in high-bandwidth channels, low-latency processing, and real-time data streaming features. Low-speed systems retain relevance for basic monitoring and long-duration testing but occupy a smaller share due to limited performance flexibility.

- For instance, ABB offers various I/O modules for the AC 800M controller under the S800 I/O system, such as the AI810 analog input module (which has 8 channels for 4–20 mA inputs) and separate digital input and output modules (like the 16-channel DI801 and DO801).

By Application

Research & development represents the dominant segment with nearly 45–48% market share, driven by the rising need for precise measurement tools in product prototyping, material testing, environmental analysis, and engineering validation. Portable DAQ systems are preferred in R&D environments because they offer flexibility, multi-functionality, and high accuracy across a wide range of experimental setups. Field applications continue to expand as remote monitoring and on-site diagnostics grow, while manufacturing adopts portable units for quality assurance, equipment assessment, and process optimization.

Key Growth Drivers

Rising Demand for Real-Time Data Monitoring

The Portable Data Acquisition System Market grows significantly due to rising demand for real-time monitoring across industries such as automotive, aerospace, energy, and manufacturing. Organizations increasingly rely on accurate, immediate data insights to improve operational efficiency, validate prototypes, and optimize performance in dynamic environments. Portable DAQ systems enable on-site measurements, high-speed recording, and instant diagnostics, supporting faster decision-making. Their compact design, advanced connectivity, and multi-channel capabilities make them essential for field testing and R&D workflows, strengthening adoption across both established and emerging industries.

- For instance, HPE’s Modular Data Center (MDC) containers incorporate direct liquid-cooling technology that reduces overall energy consumption by about 20% and enables deployment timelines as short as 6 months instead of 18 months.

Expansion of R&D Activities Across Sectors

The expanding scope of research and development activities serves as a key driver, as institutions, laboratories, and industrial R&D units invest in advanced tools for experimentation and validation. Portable DAQ systems support diverse testing environments and enable engineers to record high-quality data without reliance on fixed laboratory infrastructure. Their precision, flexibility, and ability to interface with multiple sensor types help accelerate innovation cycles in electronics, materials science, automotive engineering, and renewable energy. This broader R&D investment landscape reinforces the sustained need for high-performance portable acquisition systems.

- For instance, Fuji Electric Co., Ltd. delivers containerized power systems equipped with uninterruptible power supply units rated up to 2,000 kVA, supporting high-density IT loads in modular data centers.

Integration of IoT and Wireless Technologies

The increased integration of IoT and wireless communication enhances system capabilities and drives market growth. Portable DAQ systems equipped with Bluetooth, Wi-Fi, and cloud connectivity enable seamless remote monitoring, data transmission, and predictive analytics. These capabilities reduce downtime, improve asset management, and support continuous field assessment in hard-to-reach locations. As manufacturing and industrial facilities shift toward digitalization, demand grows for portable platforms that support real-time data exchange and interoperability with smart sensors, edge devices, and cloud ecosystems, positioning these systems as essential components of modern data infrastructures.

Key Trends & Opportunities

Shift Toward High-Speed and Multi-Functional DAQ Platforms

A key trend in the Portable Data Acquisition System Market is the shift toward high-speed, multi-functional units capable of handling complex and high-frequency measurements. Industries seek compact devices that consolidate multiple testing functions—such as vibration, temperature, pressure, acoustics, and electrical signal analysis—into a single platform. This consolidation reduces equipment cost and enhances operational efficiency. Opportunities emerge for manufacturers offering scalable architectures, customizable modules, and cloud-integrated analytics solutions, enabling end users to expand system capabilities while maintaining field mobility and accuracy.

- For instance, Eaton Corporation supplies modular power systems for edge data centers using its 93PM UPS platform, which supports power ratings up to 200 kilowatts per enclosure and provides battery runtime extensions through lithium-ion modules rated at 40 kilowatt-hours each.

Growing Adoption of Wireless and Battery-Powered Systems

Wireless and battery-powered portable DAQ systems are gaining traction as industries prioritize mobility, remote accessibility, and reduced dependence on fixed infrastructure. These systems enhance usability in field inspections, environmental monitoring, and outdoor research applications. Advances in battery efficiency, low-power electronics, and long-range wireless communication create opportunities for developing rugged, autonomous units suitable for extended deployment. Manufacturers offering cloud-enabled dashboards, automated alerts, and seamless device integration stand to benefit as end users demand greater flexibility, real-time control, and uninterrupted data acquisition.

- For instance, Rittal RiMatrix S Standard Container (Article No. DK 7998.506) is a specific, standardized, and pre-configured containerized data center solution that is explicitly designed and built for outdoor siting requirements.

Rising Demand for Cloud-Based Data Analytics

An emerging opportunity lies in cloud-integrated DAQ platforms that enable users to store, analyze, and interpret large datasets remotely. Cloud-based analytics support machine learning algorithms, predictive maintenance strategies, and advanced visualization, creating value for industries that manage complex or long-duration testing cycles. This trend allows stakeholders to access data from multiple locations, enabling collaborative decision-making and improving operational transparency. As cloud ecosystems expand, vendors offering secure, scalable, and user-friendly analytics solutions will capture strong growth potential.

Key Challenges

High Initial Cost and Technical Complexity

The market faces a challenge due to the high initial investment required for advanced portable DAQ systems, especially those offering high-speed, multi-channel capabilities and rugged designs. Smaller organizations and academic institutions may struggle with budget limitations, slowing adoption. Additionally, technical complexity in system configuration, sensor integration, and calibration requires skilled personnel. Limited in-house expertise can delay deployment and impact data accuracy, prompting the need for enhanced user training, simplified interfaces, and cost-effective product variants.

Data Accuracy Issues in Harsh or Unstable Environments

Achieving reliable data output in harsh or rapidly changing environments presents another challenge. Field applications often involve temperature fluctuations, electromagnetic interference, vibration, and moisture exposure, which may compromise signal stability and measurement precision. Ensuring accuracy requires robust shielding, high-quality components, and advanced filtering techniques, raising development costs. Manufacturers must address durability concerns and maintain measurement integrity to support industries that rely heavily on precise, real-time data—particularly in automotive testing, energy monitoring, and outdoor research applications.

Regional Analysis

North America

North America holds a leading position in the Portable Data Acquisition System Market with an estimated 32–34% share, driven by strong adoption across aerospace, automotive, energy, and advanced research sectors. The region benefits from a well-established industrial base and heavy investment in real-time monitoring technologies that support product development, compliance testing, and field diagnostics. The presence of major DAQ manufacturers and technological innovators accelerates the integration of wireless, high-speed, and cloud-enabled systems. Growing demand for portable solutions in environmental monitoring, smart infrastructure projects, and renewable energy assessments further strengthens the region’s market dominance.

Europe

Europe accounts for approximately 27–29% market share, supported by its mature manufacturing ecosystem, stringent regulatory standards, and continuous R&D expenditure across automotive, industrial automation, and energy sectors. The region’s emphasis on laboratory precision, sustainable engineering, and advanced product validation drives the need for portable, high-accuracy data acquisition tools. Increasing investments in electrification, renewable power, and smart mobility testing contribute to expanding deployment of portable DAQ systems. Countries such as Germany, the U.K., and France lead demand due to strong engineering capabilities, robust testing infrastructure, and adoption of high-speed, multi-channel acquisition platforms.

Asia Pacific

Asia Pacific captures around 30–32% share, emerging as the fastest-growing region due to rapid industrialization, expanding electronics manufacturing, and increasing R&D activities across automotive, semiconductor, and renewable energy sectors. China, Japan, South Korea, and India drive significant demand for portable DAQ systems as companies enhance testing efficiency and accelerate product development cycles. The region’s focus on industrial automation, field diagnostics, and infrastructure modernization boosts the need for compact and rugged data acquisition platforms. Growing investment in IoT, wireless measurement technologies, and real-time monitoring strengthens APAC’s position as a major growth engine.

Latin America

Latin America holds an estimated 5–6% market share, with growth driven by expanding industrial operations, energy projects, and field testing requirements in Brazil, Mexico, and Argentina. The region increasingly adopts portable DAQ systems for equipment diagnostics, environmental monitoring, and quality assurance across manufacturing and utilities. Infrastructure modernization and rising investments in renewable energy and mining operations contribute to broader deployment. Although technological adoption is slower compared with major regions, growing demand for cost-effective, durable, and user-friendly portable testing solutions supports steady market expansion.

Middle East & Africa

The Middle East & Africa region represents roughly 3–4% market share, supported by increasing demand for portable testing equipment in oil & gas, power generation, construction, and transportation sectors. Field-based monitoring needs in harsh environments drive preference for rugged, high-reliability DAQ platforms. Countries such as the UAE, Saudi Arabia, and South Africa invest in advanced measurement technologies to support industrial maintenance, infrastructure development, and environmental monitoring initiatives. While adoption remains at an early stage, rising digitalization and modernization efforts position the region for gradual but consistent market growth.

Market Segmentations:

By Component:

By Speed:

- High speed (>100 KS/S)

- Low speed (100 KS/S)

By Application:

- Research & development.

- Field

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Portable Data Acquisition System Market features a diverse mix of global automation leaders and technology innovators, including Octavic, ABB, Oracle, Rockwell Automation, Dassault Systèmes, General Electric, Siemens, SAP GmbH, Honeywell International Inc., and Schneider Electric. the Portable Data Acquisition System Market is defined by continuous technological innovation, strong product differentiation, and an expanding focus on real-time, high-accuracy measurement solutions. Companies compete by enhancing system portability, increasing channel density, and integrating wireless communication and cloud-based analytics to support advanced data processing. The market sees growing emphasis on modular architectures, rugged designs for field use, and seamless interoperability with sensors, controllers, and enterprise platforms. R&D investments remain central as vendors work to improve measurement precision, battery efficiency, and device intelligence. Strategic partnerships, software-driven enhancements, and aftersales service capabilities further shape competition in a sector increasingly driven by digital transformation and industry-wide automation initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Octavic

- ABB

- Oracle

- Rockwell Automation

- Dassault Systèmes

- General Electric

- Siemens

- SAP GmbH

- Honeywell International Inc.

- Schneider Electric

Recent Developments

- In August 2024, NVIDIA partnered with the Singapore-based AI cloud provider, Sustainable Metal Cloud (SMC), to launch HyperCubes. These are containerized servers featuring NVIDIA GPUs and using immersion cooling, which submerges servers in a synthetic oil to remove heat more efficiently than traditional air-cooling methods.

- In February 2024, Penske Logistics began implementing Blue Yonder’s AI-powered yard management solution, which uses computer vision and machine learning to identify trailers and track their locations within a yard.

- In January 2023, Axiometrix Solutions’ imc Test & Measurement brand, designed for flexible testing and monitoring in automotive and machine applications. Its modular design allows users to snap together the base unit with amplifier and fieldbus interface modules, such as the CAN FD, to create customized setups without additional cables.

Report Coverage

The research report offers an in-depth analysis based on Component, Speed, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance through wider adoption of high-speed, multi-channel portable acquisition units across engineering and industrial applications.

- Wireless, cloud-connected, and IoT-integrated DAQ platforms will gain stronger traction as industries prioritize remote monitoring.

- Demand for rugged, battery-efficient systems will rise due to increased field testing in harsh and remote environments.

- Software-centric enhancements will drive growth as users seek improved analytics, visualization, and real-time diagnostic capabilities.

- R&D-intensive sectors will expand system usage to support rapid prototyping, experimental validation, and precision testing.

- AI-enabled data processing will enhance predictive maintenance, fault detection, and automated decision-making.

- Modular and customizable architectures will attract users seeking scalable and flexible measurement solutions.

- Growing digitalization in manufacturing will boost deployment of portable DAQ tools for equipment monitoring and process optimization.

- Environmental monitoring initiatives will increase demand for compact, accurate, and energy-efficient portable systems.

- Industry partnerships and ecosystem integration will strengthen product interoperability and broaden application opportunities.