Market Overview

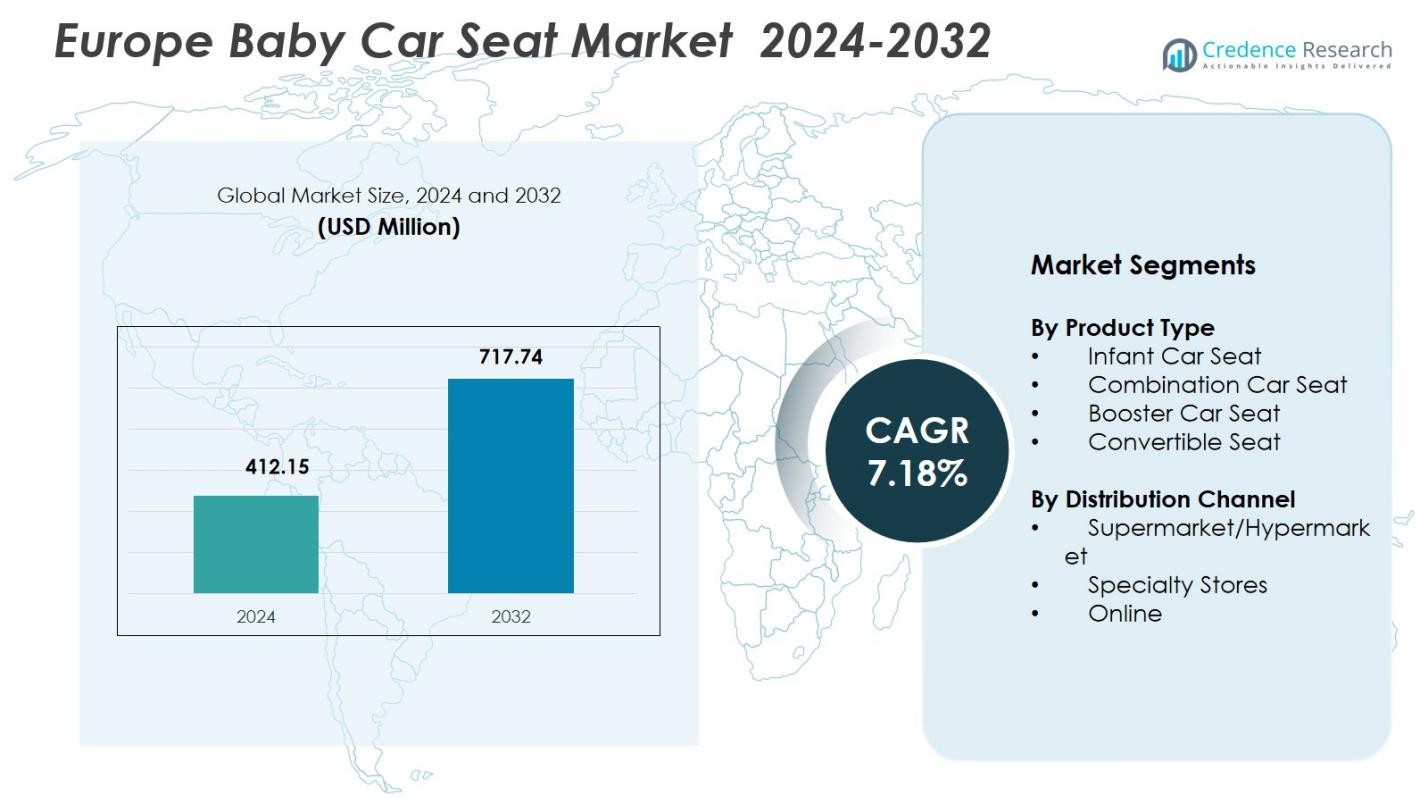

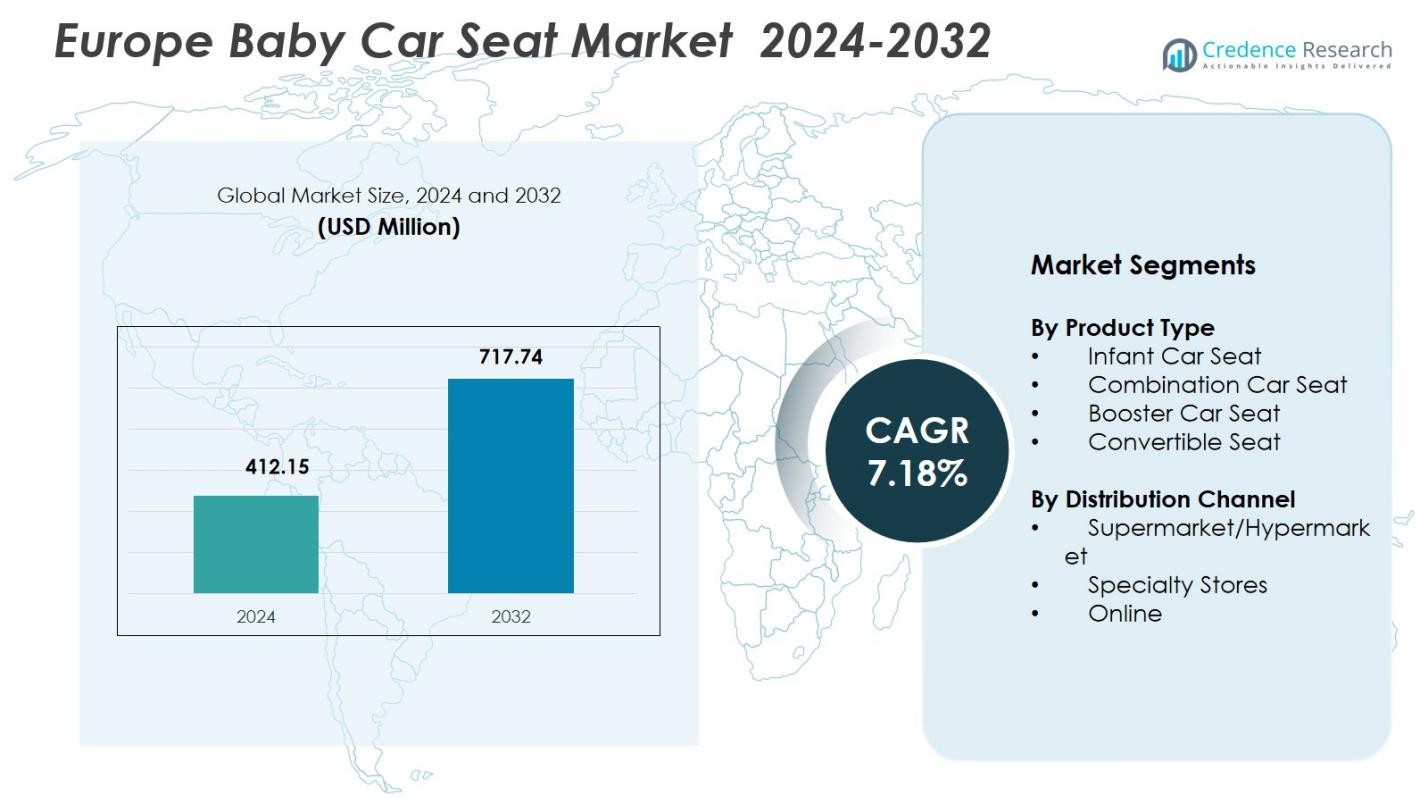

Europe Baby Car Seat Market size was valued at USD 412.15 Million in 2024 and is anticipated to reach USD 717.74 Million by 2032, at a CAGR of 7.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Baby Car Seat Market Size 2024 |

USD 412.15 Million |

| Europe Baby Car Seat Market, CAGR |

7.18% |

| Europe Baby Car Seat Market Size 2032 |

USD 717.74 Million |

Europe Baby Car Seat Market is shaped by leading players such as Britax Child Safety Inc., Artsana Group (Chicco), Goodbaby International Holdings Ltd., Dorel Industries Inc., RECARO Holding GmbH, Uppababy, Mothercare PLC, Newell Brands Inc., Renolux France Industrie, and Infa Group Pty Ltd, all contributing to product innovation, safety upgrades, and wider distribution. Western Europe remains the dominant region, holding a 41.6% share in 2024, driven by strong regulatory enforcement, high consumer awareness, and robust retail networks. Northern Europe follows with significant demand for premium, extended rear-facing, and i-Size compliant models, supporting overall market expansion across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Europe Baby Car Seat Market reached USD 412.15 Million in 2024 and will grow at a CAGR of 7.18% through 2032.

- Rising parental focus on travel safety, strict EU child restraint regulations, and growing adoption of ISOFIX systems are driving strong demand across all product categories.

- Premium, ergonomic, and multi-stage convertible seats lead the market with a 36.4% share, while online retail continues to expand due to digital comparison tools and flexible delivery options.

- Key players strengthen their position through advanced safety features, sustainability-focused materials, and diversified retail presence across specialty stores and e-commerce channels.

- Western Europe dominates with a 41.6% share, followed by Northern Europe at 24.3%, supported by high awareness and regulatory compliance, whereas specialty stores hold a leading 42.7% share in distribution.

Market Segmentation Analysis:

By Product Type:

The Europe Baby Car Seat Market shows strong demand across all product categories, with Convertible Seats leading the segment with a 36.4% share in 2024. Their dominance stems from multi-stage usability, extended safety protection, and cost efficiency for parents seeking long-term solutions. Infant Car Seats and Combination Seats continue to gain traction due to rising newborn travel safety requirements, while Booster Seats expand with increasing adoption for older children. Growth across all categories is supported by EU child safety regulations, ISOFIX system adoption, and rising awareness of advanced crash-protection technologies.

- For instance, Britax’s infant car seats feature advanced side-impact protection and adjustable harness systems aligning with rising parental preference for newborn safety and comfort, sustaining the infant seat segment’s strong market presence.

By Distribution Channel:

Within distribution channels, Specialty Stores dominated the Europe Baby Car Seat Market with a 42.7% share in 2024, driven by the availability of certified advisors, extensive product demonstrations, and a wide range of premium brands. Supermarkets/Hypermarkets maintain steady demand due to convenience and affordability, while Online Retail is expanding rapidly as parents increasingly prefer digital comparisons, home delivery, and promotional pricing. Rising e-commerce penetration, improved online authenticity checks, and influencer-led product awareness continue to elevate the online sales contribution across European markets.

- For instance, Cybex Cloud T i-Size sees strong online uptake on Amazon via verified reviews and rapid delivery, aligning with digital shopping trends in 2024.

Key Growth Drivers

Stringent Safety Regulations and Compliance Expansion

Stringent child safety regulations across Europe serve as a major catalyst for the Baby Car Seat Market. Mandatory EU standards such as UN R129 (i-Size) and ISOFIX installation requirements drive consistent product upgrades and accelerate replacement demand. Governments actively promote child restraint usage through awareness programs and enforcement measures, increasing compliance levels among parents. As regulations continue to tighten especially around side-impact protection and age-based category transitions manufacturers are compelled to introduce safer, certified, and technologically advanced car seat models, thereby driving sustained market growth.

- For instance, in the UK, regulations mandate that all children under 135 cm must use suitably sized car seats, prompting manufacturers to develop multiple models adhering to this criterion.

Rising Birth Rates and Increasing Travel Safety Awareness

Europe’s improving parental awareness towards vehicle travel safety significantly boosts baby car seat adoption. Despite regional variations in birth rates, higher mobility lifestyles, increasing car ownership, and frequent short-distance travel encourage parents to invest in high-quality restraints. Public campaigns by hospitals, child-welfare organizations, and automotive clubs further reinforce the importance of age-appropriate seats. This growing consciousness, combined with shifting consumer preference for durable, ergonomic, and comfort-enhanced models, supports rising demand across infant, toddler, and booster categories, ensuring long-term market expansion.

Shift Toward Premium, Smart, and Ergonomic Designs

Consumers increasingly prefer premium baby car seats that offer enhanced features such as side-impact energy absorption, breathable fabrics, posture support, adjustable reclining options, and integrated smart sensors. Europe’s mature retail ecosystem and high disposable income levels accelerate the adoption of technologically advanced models, especially within urban regions. Manufacturers are investing in materials innovation, modular designs, and connectivity-based safety alerts to differentiate offerings. The trend toward multi-stage, long-lifespan products also boosts value-driven purchases, contributing meaningfully to segment expansion across premium and hybrid seat categories.

- For instance, babyark’s BioArk™ system features a side wing on the door-side that opens to absorb crash forces, using layered energy-absorbing materials to shield the child’s head, neck, and torso beyond standard requirements. It integrates a smart app for correct installation verification.

Key Trends & Opportunities

Growing Penetration of E-Commerce and Omnichannel Retail

- commerce platforms are rapidly reshaping the purchasing behavior of European parents, creating strong opportunities for digital-first baby car seat brands. Online channels provide access to broader selections, real-time comparison tools, safety certifications, and customer reviews, increasing consumer confidence in virtual purchases. Retailers are also adopting omnichannel models with virtual consultations, AR-based product previews, and hybrid click-and-collect options. This seamless digital ecosystem enables brands to expand their geographic reach, launch exclusive online product lines, and capture rising demand from young, tech-savvy parents.

- For instance, Maxi-Cosi, a leading baby car seat brand, reported growing online sales across Europe driven by expanded e-commerce channels and innovative virtual product presentations that help parents compare features and certifications easily.

Expansion of Sustainable and Eco-Friendly Car Seat Materials

Sustainability has emerged as a major opportunity, with European consumers increasingly favoring baby car seats made from recycled plastics, toxin-free fabrics, and low-carbon manufacturing processes. Leading brands are adopting greener materials such as bio-based foams, organic textiles, and modular designs that enable easy recycling. Environmental certifications further influence purchase decisions, especially among eco-conscious families. This shift encourages manufacturers to innovate eco-friendly product lines, create circular business models, and align with Europe’s growing sustainability regulations and corporate responsibility frameworks.

- For instance, Silver Cross’s Motion 2 All Size 360 car seat employs sustainable outer fabrics from recycled plastic bottles, which are fully removable and machine-washable at 30°C for durability.

Key Challenges

High Product Cost and Limited Affordability in Developing Markets

Premium baby car seats in Europe often come with high pricing due to advanced safety features, durable materials, and regulatory compliance costs. This creates affordability barriers for low-income households, particularly in emerging Eastern European markets. The preference for long-lasting models also reduces frequent replacement cycles, restricting sales volume. Retailers face the added challenge of balancing affordability with safety expectations, pushing brands to introduce flexible pricing strategies or entry-level models without compromising mandatory regulatory compliance or product reliability.

Fragmented Certification Standards and Installation Complexity

Despite regulatory progress, the coexistence of multiple standards such as R44/04 and R129 causes confusion among parents, affecting purchasing decisions. Installation complexity remains another major challenge, as incorrect fitting significantly reduces seat effectiveness. Although ISOFIX adoption improves accuracy, many older vehicles lack compatible anchor points, limiting installation options. Misinterpretation of age-based categories and misuse during transitions further complicate safety compliance. Manufacturers and retailers must invest in clearer guidance, user-friendly manuals, and digital installation support to overcome these barriers and ensure correct usage.

Regional Analysis

Western Europe

Western Europe leads the Europe Baby Car Seat Market with a 41.6% share in 2024, supported by strong regulatory compliance, high consumer spending, and widespread adoption of advanced safety technologies. Countries such as Germany, France, the UK, and the Netherlands show strong demand for premium, ISOFIX-enabled, and multi-stage car seats. Strict enforcement of EU child-safety rules, mature automotive ownership, and extensive retail networks further accelerate product penetration. Growth is also reinforced by rising awareness of ergonomic designs and sustainable materials, making Western Europe the most influential region in terms of innovation and product adoption.

Northern Europe

Northern Europe accounted for a 24.3% share in 2024, driven by high awareness of child mobility safety, strong purchasing power, and robust implementation of i-Size regulations. Countries including Sweden, Norway, Denmark, and Finland prioritize rear-facing car seat usage, influencing consumer behavior and boosting demand for extended rear-facing and premium convertible models. The region also benefits from advanced automotive infrastructure and an organized retail ecosystem offering certified seat installations. Increasing interest in eco-friendly materials and smart connectivity features further strengthens product uptake across Northern Europe.

Southern Europe

Southern Europe captured a 19.8% share in 2024, with countries such as Italy, Spain, Portugal, and Greece showing growing adoption of car seats due to rising travel safety awareness and improved regulatory enforcement. Although price sensitivity remains higher compared to Western and Northern Europe, mid-range and combination models are witnessing strong demand. Expanding e-commerce access, increasing parental education initiatives, and ongoing improvements in automotive safety inspections contribute to market growth. The region’s gradual shift toward premium, comfort-focused designs is expected to enhance product penetration in the coming years.

Eastern Europe

Eastern Europe held a 14.3% share in 2024, supported by improving economic conditions, growing urbanization, and rising vehicle ownership. Countries such as Poland, Czech Republic, Hungary, and Romania are witnessing steady growth as awareness of mandatory child restraint systems increases. However, the region faces challenges including lower affordability levels and uneven enforcement of safety regulations, which slow adoption of high-end models. Despite this, expanding retail modernization, government safety campaigns, and increasing availability of cost-effective, certified car seats are driving gradual market expansion across Eastern Europe.

Market Segmentations:

By Product Type

- Infant Car Seat

- Combination Car Seat

- Booster Car Seat

- Convertible Seat

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online

By Geography

- Western Europe

- Southern Europe

- Eastern Europe

- Northern Europe

Competitive Landscape

Competitive landscape in the Europe Baby Car Seat Market features key players such as Britax Child Safety Inc., Artsana Group (Chicco), Goodbaby International Holdings Ltd., Dorel Industries Inc., RECARO Holding GmbH, Uppababy, Mothercare PLC, Newell Brands Inc., Renolux France Industrie, and Infa Group Pty Ltd. These companies actively strengthen their market positions through product innovation, advanced safety technologies, and expanded distribution networks. Brands increasingly focus on i-Size compliant designs, ISOFIX compatibility, side-impact protection systems, and multi-stage usability to meet Europe’s stringent safety regulations. Premiumization remains a central strategy, with manufacturers introducing ergonomic materials, enhanced comfort features, and smart-sensor integrations to enhance user experience. E-commerce collaborations, retail diversification, and sustainability-focused product lines further support brand competitiveness. Several players invest in R&D to launch lightweight, eco-friendly, and modular models tailored to region-specific safety norms. Overall, the market reflects steady innovation, regulatory alignment, and strong competition across product tiers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Britax Child Safety, Inc. (Nordic Capital)

- Uppababy (Monahan Products, LLC)

- RECARO Holding GmbH

- Mothercare PLC

- Artsana Group (Chicco)

- Dorel Industries, Inc.

- Goodbaby International Holdings Ltd.

- Newell Brands, Inc.

- Renolux France Industrie

- Infa Group Pty Ltd

Recent Developments

- In August 2025, Britax Child Safety Inc. launched its new backless booster car seat, Britax UpNGo™, designed for carpools and road-trips urging convenience and portability.

- In February 2024 the company Britax launched its POPLAR and POPLARS convertible car seats, offering a practical 2-in-1 design that switches easily from rear-facing to forward-facing.

- In January 2024, RECARO (via AVOVA GmbH) announced a strategic partnership to co-develop and distribute premium child car seats under the RECARO brand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as Europe strengthens child mobility safety regulations across all vehicle categories.

- Demand for i-Size compliant and extended rear-facing car seats will rise due to higher parental awareness.

- Premium, ergonomic, and comfort-focused designs will gain traction among urban families.

- Smart car seats with sensors, alerts, and monitoring features will see increased adoption.

- Sustainable and eco-friendly materials will become a core product differentiator for leading brands.

- Online sales will accelerate as digital comparison tools and virtual consultations become more common.

- Multi-stage and long-lifespan car seats will grow as parents prefer value-driven, durable solutions.

- Cross-border e-commerce will expand brand accessibility across smaller European economies.

- Retailers will focus more on installation support and safety education to improve compliance.

- Product innovation will intensify as brands invest in lightweight, recyclable, and modular car seat designs.