Market Overview

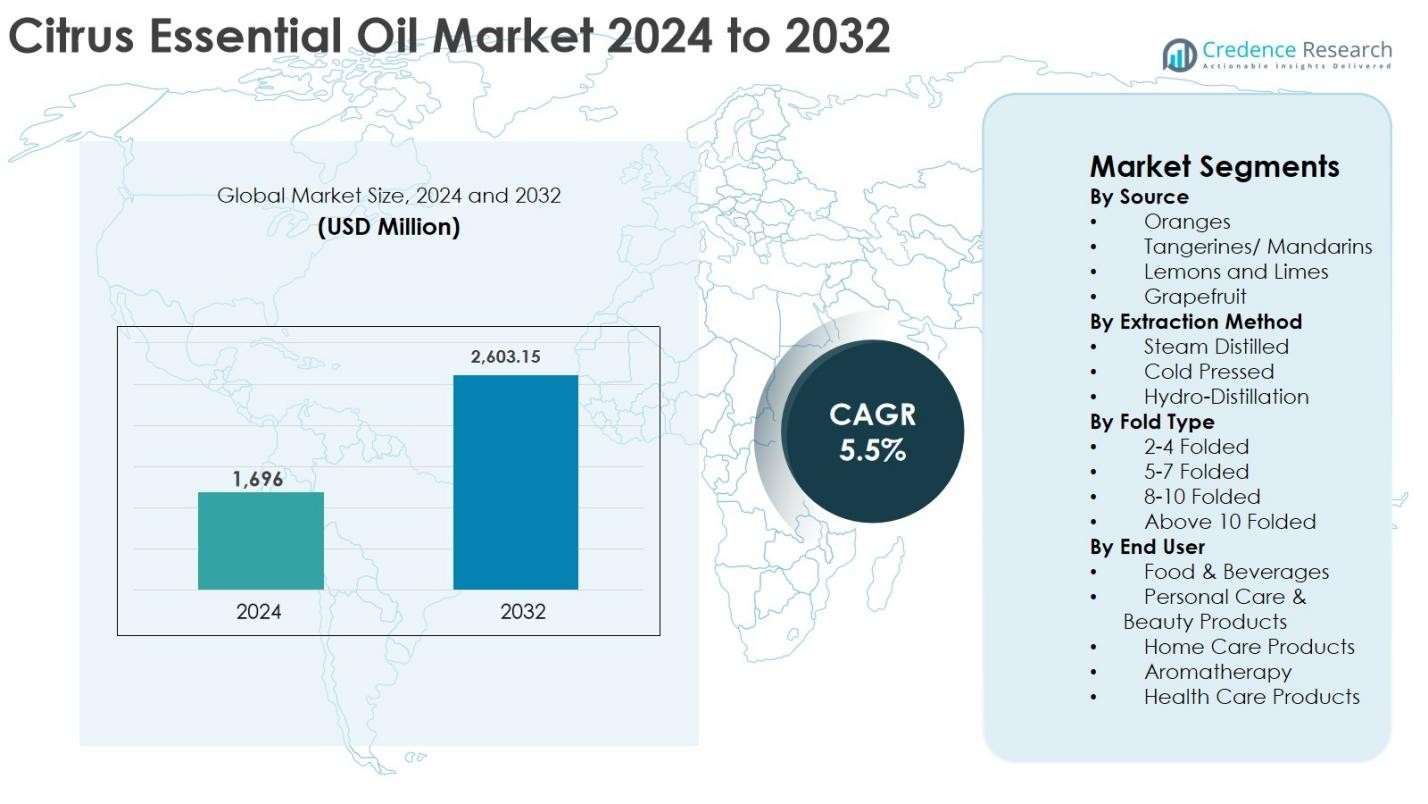

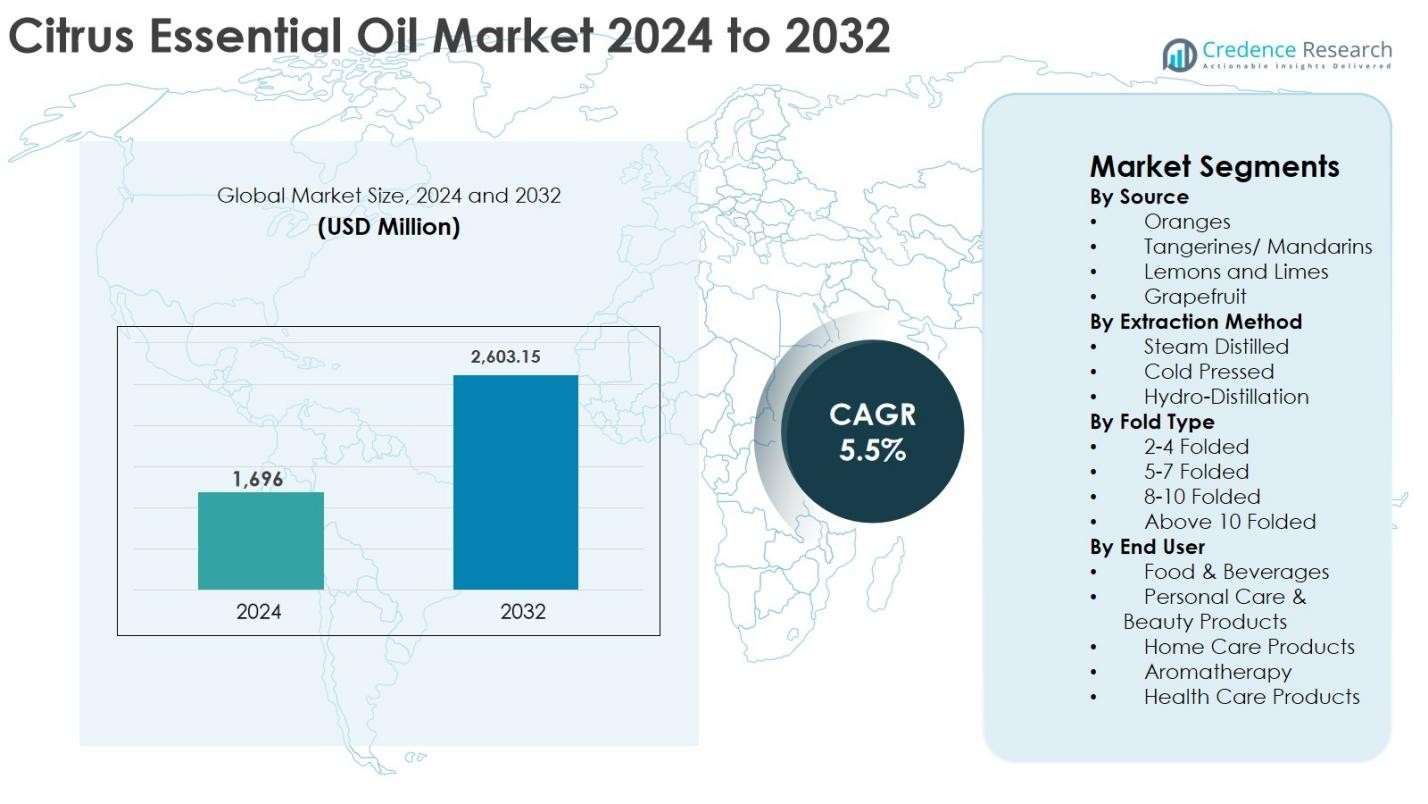

The Citrus Essential Oil Market size was valued at USD 1,696 million in 2024 and is anticipated to reach USD 2,603.15 million by 2032, expanding at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Citrus Essential Oil Market Size 2024 |

USD 1,696 Million |

| Citrus Essential Oil Market, CAGR |

5.5% |

| Citrus Essential Oil Market Size 2032 |

USD 2,603.15 Million |

The Citrus Essential Oil market is led by established fragrance and flavor manufacturers alongside specialized citrus processors, including Givaudan, Firmenich SA, Symrise AG, Bontoux S.A.S., Citrosuco, Citrus Oleo, Ultra-International B.V., and Lionel Hitchen (Essential Oils) Ltd, which collectively drive innovation, large-scale production, and global distribution. Wellness-focused players such as doTERRA International LLC, Mountain Rose Herbs Inc., and Phoenix Aromas & Essential Oils LLC strengthen demand in premium and therapeutic applications. Regionally, North America dominated the Citrus Essential Oil market with a 32.4% share in 2024, supported by strong food, personal care, and aromatherapy consumption, followed by Europe with 28.7% driven by perfumery and cosmetics, and Asia-Pacific holding 24.1%, reflecting rapid growth in food processing and wellness industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Citrus Essential Oil market was valued at USD 1,696 million in 2024 and is projected to reach USD 2,603.15 million by 2032, growing at a CAGR of 5.5% during the forecast period.

- Market growth is driven by rising demand for natural flavoring agents and fragrances across food & beverages, personal care, aromatherapy, and household cleaning products, supported by clean-label and plant-based product trends.

- Cold-pressed extraction dominated with a 51.2% segment share in 2024, while orange-based oils led the source segment with a 42.6% share due to wide availability, cost efficiency, and broad application scope.

- Key players such as Givaudan, Firmenich SA, Symrise AG, Citrosuco, and Citrus Oleo focus on sustainable sourcing, capacity expansion, and premium multi-fold citrus oils to strengthen market presence.

- North America led the market with a 32.4% share in 2024, followed by Europe at 28.7% and Asia-Pacific at 24.1%, with Asia-Pacific emerging as the fastest-growing regional market.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Source

The Citrus Essential Oil market by source is led by oranges, which accounted for 42.6% market share in 2024, driven by their wide availability, cost efficiency, and extensive use across food & beverages, fragrances, and aromatherapy applications. Orange essential oil benefits from strong demand in flavoring agents and natural cleaning products due to its pleasant aroma and antimicrobial properties. Lemons and limes followed with a 28.4% share, supported by rising usage in cosmetics and personal care formulations. Tangerines/mandarins and grapefruit oils are gaining traction due to niche demand in premium perfumery and wellness applications.

- For instance, doTERRA’s Wild Orange essential oil is promoted for household surface cleaning and diffusing, while Young Living’s Orange essential oil is commonly used in DIY cleaners and diffusers for its fresh scent.

By Extraction Method

By extraction method, cold-pressed citrus essential oils dominated the market with a 51.2% share in 2024, owing to their ability to preserve natural aroma compounds and bioactive properties. Cold pressing is widely preferred for citrus peels, particularly in food-grade and therapeutic oils. Steam distillation held a 34.1% share, supported by its scalability and suitability for industrial fragrance production. Hydro-distillation accounted for the remaining share, primarily used in small-scale or traditional processing. Growing consumer preference for minimally processed, natural oils continues to drive demand for cold-pressed extraction methods.

- For instance, Symrise highlights cold-pressed orange and lemon oils in its citrus flavor portfolio for beverages and confectionery, and Givaudan uses cold-pressed citrus fractions in its “TasteSolutions Citrus” range to deliver fresh, top-note authenticity in foods and drinks.

By Fold Type

In terms of fold type, 2–4 folded citrus essential oils led the market with a 46.8% share in 2024, driven by their balanced concentration, cost-effectiveness, and suitability for mass-market food, beverage, and household products. These oils are widely used where moderate flavor or aroma intensity is required. The 5–7 folded segment accounted for 29.5%, supported by demand from premium fragrances and cosmetics. Higher folds, including 8–10 folded and above 10 folded, are witnessing steady growth due to increasing applications in high-end perfumery and specialty aromatherapy formulations.

Key Growth Drivers

Rising Demand from Food & Beverage Industry

The Citrus Essential Oil market is experiencing strong growth driven by increasing adoption across the food and beverage industry, particularly as natural flavoring agents in beverages, confectionery, baked goods, and functional foods. Manufacturers are actively replacing synthetic additives with clean-label and plant-based ingredients to align with evolving consumer preferences. Citrus essential oils offer distinctive flavor profiles, natural preservative properties, and regulatory acceptance across major markets. Growing consumption of flavored beverages, ready-to-drink juices, and health-oriented products is reinforcing demand. In addition, expanding applications in natural food preservation and shelf-life enhancement further support market growth, especially in North America and Europe.

- For instance, Coca-Cola has developed citrus-forward variants in its Fanta and Minute Maid portfolios using natural flavors, and PepsiCo emphasizes natural citrus flavors in products like 7UP and certain Tropicana juice blends.

Expansion of Aromatherapy and Wellness Applications

The rapid expansion of aromatherapy and wellness applications is a major driver for the Citrus Essential Oil market. Increasing awareness of mental well-being, stress reduction, and holistic health solutions has accelerated the use of citrus oils such as orange, lemon, and grapefruit in diffusers, massage oils, and personal care products. Citrus essential oils are widely recognized for their mood-enhancing, refreshing, and antimicrobial properties, making them popular in spa therapies and home wellness routines. Rising disposable incomes, growth of the wellness tourism sector, and increasing penetration of essential oil-based products through e-commerce channels are further strengthening demand across both developed and emerging economies.

- For instance, online platforms like Amazon and specialty sites such as iHerb and Vitacost list extensive ranges of citrus essential oils and aromatherapy kits from brands like NOW Foods and Plant Therapy, making these products more accessible to consumers worldwide.

Growth in Natural Personal Care and Cleaning Products

The shift toward natural and organic personal care and household cleaning products is significantly boosting the Citrus Essential Oil market. Citrus oils are increasingly used in skincare, haircare, soaps, and natural detergents due to their fragrance appeal, antibacterial properties, and biodegradability. Regulatory pressure on synthetic chemicals and growing consumer concerns regarding product safety are encouraging manufacturers to reformulate products using plant-based ingredients. The rising popularity of eco-friendly cleaning solutions and sustainable packaging is also reinforcing demand. This driver is particularly strong in urban markets where consumers actively seek environmentally responsible and health-conscious product alternatives.

Key Trends & Opportunities

Product Innovation and Premiumization of Citrus Oils

Product innovation and premiumization represent a key trend in the Citrus Essential Oil market, with manufacturers focusing on high-purity, multi-fold, and specialty citrus oils to cater to premium applications. Increasing demand from high-end perfumery, cosmetics, and therapeutic formulations is encouraging investments in advanced extraction and concentration technologies. Certified organic, traceable, and sustainably sourced citrus oils are gaining traction, particularly among premium brands. This trend creates opportunities for producers to differentiate offerings, command higher margins, and expand into niche segments such as therapeutic-grade oils and customized fragrance blends.

- For instance, Givaudan and Symrise offer refined citrus fractions and folded oils tailored for fine fragrances and luxury personal care, enabling more stable, intense, and sophisticated citrus notes.

Expansion in Emerging Markets and E-commerce Channels

Emerging markets present significant growth opportunities for the Citrus Essential Oil market due to rising urbanization, increasing disposable incomes, and growing awareness of natural products. Asia-Pacific and Latin America are witnessing strong demand growth across food, cosmetics, and wellness sectors. Simultaneously, the expansion of e-commerce platforms is improving product accessibility and enabling small and mid-sized producers to reach global consumers. Online retail channels support direct-to-consumer sales, educational marketing, and subscription-based models, creating new revenue streams and accelerating market penetration.

- For instance, Symrise offers citrus specialties and folded oils designed for fine fragrance and high-end personal care, and Givaudan’s citrus ingredients portfolio includes concentrated and fractionated oils that deliver more stable and intense citrus top notes.

Key Challenges

Volatility in Raw Material Supply and Pricing

Raw material supply volatility poses a significant challenge for the Citrus Essential Oil market, as production heavily depends on citrus fruit availability and agricultural output. Climate variability, crop diseases, seasonal fluctuations, and geopolitical disruptions can affect citrus yields and pricing. This volatility directly impacts production costs and profit margins for manufacturers. Additionally, competition between fresh fruit consumption and essential oil extraction can further strain supply. Companies must invest in diversified sourcing strategies, long-term supplier contracts, and inventory management to mitigate supply risks and ensure consistent product availability.

Quality Standardization and Regulatory Compliance

Maintaining consistent quality and meeting regulatory standards remain key challenges in the Citrus Essential Oil market. Variations in extraction methods, fold concentration, and raw material quality can lead to inconsistencies in aroma, purity, and chemical composition. Regulatory frameworks governing food-grade, cosmetic, and therapeutic essential oils vary across regions, increasing compliance complexity for global suppliers. Ensuring traceability, certification, and adherence to international standards requires continuous investment in quality control, testing, and documentation, which can be particularly challenging for small and medium-sized producers.

Regional Analysis

North America

North America held a 32.4% share of the Citrus Essential Oil market in 2024, supported by strong demand from food & beverages, aromatherapy, and natural personal care products. The region benefits from high consumer awareness of clean-label ingredients and widespread adoption of essential oils in wellness and household cleaning applications. The United States dominates regional demand due to its large food processing industry, mature aromatherapy market, and strong presence of leading essential oil brands. Growing preference for organic and sustainably sourced citrus oils, along with expanding e-commerce penetration, continues to drive steady market growth across North America.

Europe

Europe accounted for 28.7% of the Citrus Essential Oil market share in 2024, driven by robust demand from cosmetics, perfumery, and food flavoring industries. Countries such as France, Germany, Italy, and the United Kingdom play a key role due to their well-established fragrance and personal care sectors. Strict regulations on synthetic additives have accelerated the shift toward natural citrus oils in food and cosmetic formulations. Additionally, strong emphasis on sustainability, organic certification, and traceability supports premium citrus oil consumption, reinforcing Europe’s position as a major revenue-generating region.

Asia-Pacific

Asia-Pacific captured 24.1% of the Citrus Essential Oil market in 2024 and is witnessing the fastest growth during the forecast period. Rising disposable incomes, rapid urbanization, and increasing awareness of natural wellness products are key growth drivers. Countries such as China, India, and Japan are experiencing expanding demand from food & beverages, traditional medicine, and personal care industries. The growing popularity of aromatherapy, coupled with increased local citrus production and cost-effective extraction, supports market expansion. Additionally, strong growth of online retail channels is improving product accessibility across the region.

Latin America

Latin America held a 9.2% share of the Citrus Essential Oil market in 2024, supported by abundant availability of citrus raw materials and expanding export activities. Brazil and Mexico are key contributors due to their large citrus cultivation base and established essential oil processing infrastructure. The region benefits from growing demand for citrus oils in flavorings, fragrances, and industrial cleaning applications. Increasing investments in processing capacity and rising exports to North America and Europe are strengthening regional revenues. However, market growth remains moderate due to limited penetration of premium applications.

Middle East & Africa

The Middle East & Africa accounted for a 5.6% share of the Citrus Essential Oil market in 2024, driven by increasing use in personal care, fragrances, and traditional wellness practices. Demand is growing in the Gulf countries due to rising consumer spending on premium cosmetic and aromatherapy products. In Africa, expanding food processing industries and improving awareness of natural ingredients support gradual market growth. However, limited local production capabilities and reliance on imports constrain faster expansion. Ongoing investments in distribution networks and retail channels are expected to improve market penetration across the region.

Market Segmentations:

By Source

- Oranges

- Tangerines/ Mandarins

- Lemons and Limes

- Grapefruit

By Extraction Method

- Steam Distilled

- Cold Pressed

- Hydro-Distillation

By Fold Type

- 2-4 Folded

- 5-7 Folded

- 8-10 Folded

- Above 10 Folded

By End User

- Food & Beverages

- Personal Care & Beauty Products

- Home Care Products

- Aromatherapy

- Health Care Products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Citrus Essential Oil market features a moderately consolidated competitive landscape characterized by the presence of global fragrance and flavor manufacturers alongside specialized citrus oil producers. Leading companies such as Givaudan, Firmenich SA, Symrise AG, and Bontoux S.A.S. leverage advanced extraction technologies, strong sourcing networks, and diversified product portfolios to maintain market leadership. Players including Citrus Oleo, Citrosuco, Ultra-International B.V., Lionel Hitchen (Essential Oils) Ltd, and Citrus and Allied Essences Ltd focus on large-scale citrus processing and supply consistency, supporting demand from food, beverage, and fragrance industries. Meanwhile, companies such as doTERRA International LLC, Mountain Rose Herbs Inc., and Phoenix Aromas & Essential Oils LLC cater to premium and wellness-oriented segments through high-purity and specialty citrus oils. Strategic initiatives such as capacity expansions, sustainable sourcing, product innovation, and long-term supply partnerships remain central to strengthening competitive positioning and expanding global market presence.

Key Player Analysis

- Givaudan

- Citrus and Allied Essences Ltd

- Mountain Rose Herbs Inc.

- Firmenich SA

- Citrus Oleo

- Symrise AG

- Bontoux S.A.S.

- Phoenix Aromas & Essential Oils LLC

- Lionel Hitchen (Essential Oils) Ltd

- Ultra-International B.V.

Recent Developments

- In October 2025, Bontoux SAS expanded its product portfolio with new citrus essential oil offerings aimed at meeting the growing demand for premium, natural, and organic citrus oils across food, beverage, cosmetics, and wellness applications.

- In July 2025, Symrise AG enhanced its cold-pressed citrus oil portfolio by investing in sustainable bergamot sourcing in Calabria, Italy, to ensure premium quality and support biodiversity in natural citrus oils.

- In April 2024, Berjé Inc. acquired Global Citrus International (GCI) and Acelim del Peru, two Peruvian growers and producers of lime-based products including lime essential oils, expanding Berjé’s citrus essential oil production and international footprint

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Extraction Method, Fold Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Citrus Essential Oil market is expected to witness steady expansion driven by sustained demand from food, beverage, and wellness industries.

- Increasing consumer preference for natural and clean-label ingredients will continue to support long-term market growth.

- Adoption of citrus essential oils in aromatherapy and mental wellness applications is likely to accelerate globally.

- Product innovation in multi-fold and high-purity citrus oils will create opportunities in premium fragrance and cosmetic segments.

- Growing use of citrus oils in natural household cleaning and hygiene products will strengthen market penetration.

- Expansion of e-commerce and direct-to-consumer channels will improve product accessibility and brand visibility.

- Emerging markets in Asia-Pacific and Latin America will contribute significantly to future demand growth.

- Investments in sustainable sourcing and traceability will become increasingly important for market participants.

- Technological advancements in extraction and processing will enhance oil quality and operational efficiency.

- Strategic partnerships and capacity expansions will shape competitive dynamics and global supply networks.

Market Segmentation Analysis:

Market Segmentation Analysis: