Market Overview

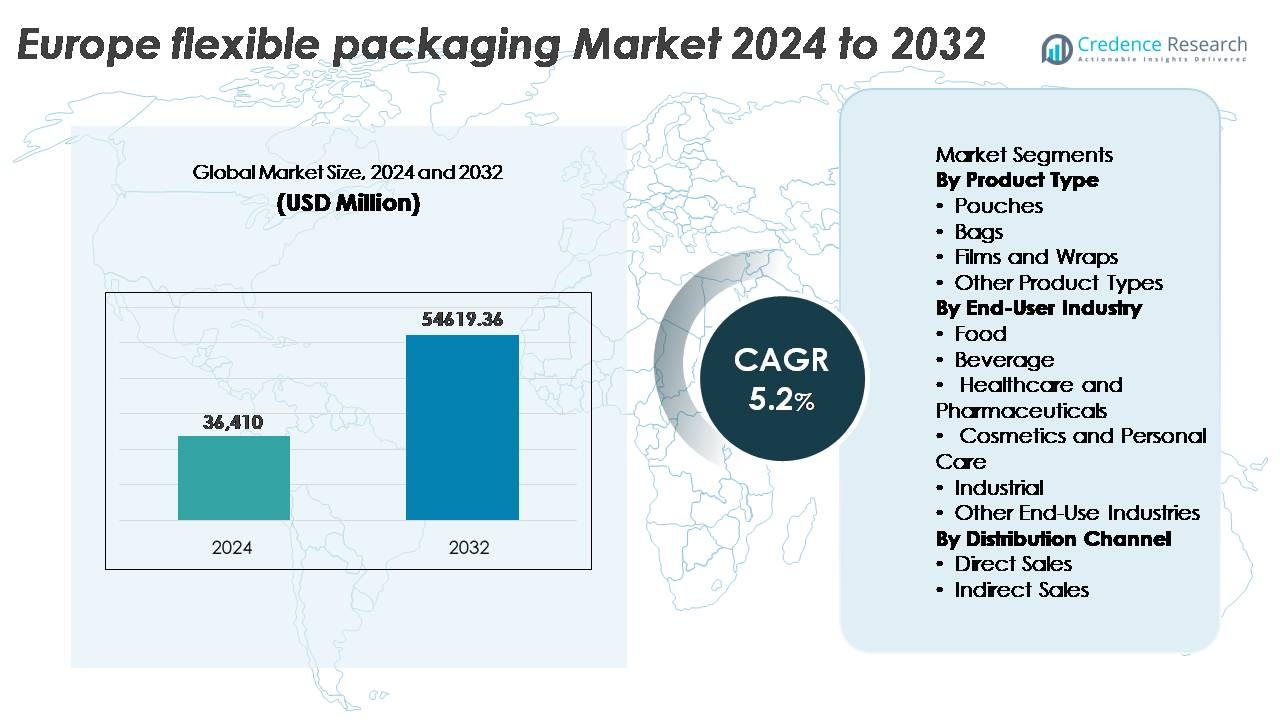

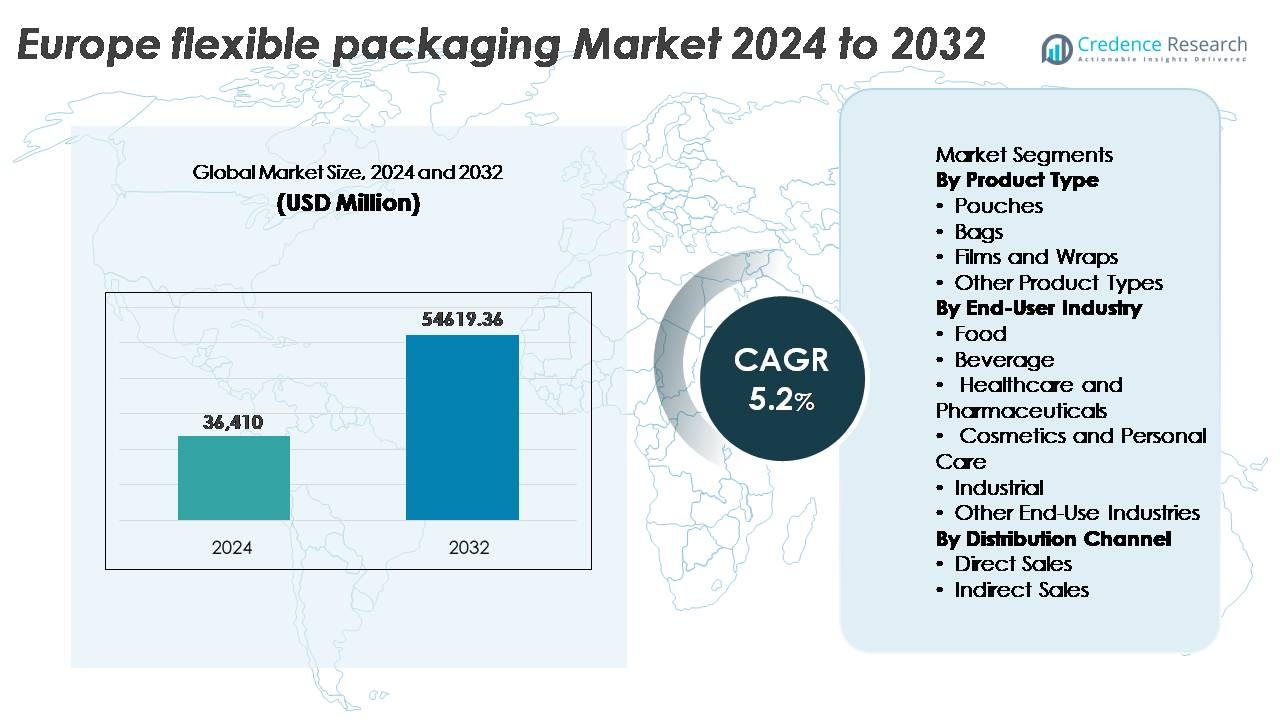

The Europe flexible packaging market was valued at USD 36,410 million in 2024 and is projected to reach USD 54,619.36 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe flexible packaging market Size 2024 |

USD 36,410 Million |

| Europe flexible packaging market, CAGR |

5.2% |

| Europe flexible packaging market Size 2032 |

USD 54,619.36 Million |

The Europe flexible packaging market is shaped by the strategic operations of leading players such as Constantia Flexibles GmbH, Amcor PLC, Huhtamaki Oyj, Mondi Group, and Wipak Group, each leveraging advanced material engineering and sustainability-focused portfolios to address regulatory expectations and brand needs. Western Europe remains the leading regional contributor, accounting for approximately 42% of the market share, supported by mature FMCG manufacturing, strong recycling frameworks, and innovation capacity in recyclable and lightweight flexible formats. The competitive environment is defined by investment in mono-material structures, digital printing capabilities, and circular economy partnerships that reinforce long-term market positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe flexible packaging market was valued at USD 36,410 million in 2024 and is projected to reach USD 54,619.36 million by 2032, registering a 5.2% CAGR during the forecast period.

- Growth is driven by rising demand for lightweight, resealable, and cost-efficient packaging solutions, supported by increasing consumption of ready-to-eat meals, convenience foods, and e-commerce distribution requirements.

- Market trends highlight strong momentum toward recyclable mono-material structures, bio-based films, and digitally printed formats enabling customization, shorter production cycles, and premium shelf appeal.

- Competitive focus intensifies among leading players introducing sustainable product portfolios and forming recycling partnerships, while cost pressures and raw material price volatility act as key restraints.

- Western Europe leads the market with around 42% share, followed by Southern Europe at 24%, while pouches remain the dominant product segment, driven by portability, barrier protection, and reduced material weight.

Market Segmentation Analysis:

By Product Type

Pouches represent the dominant product type in the Europe flexible packaging market, accounting for the largest share driven by rising demand for lightweight, resealable, and portion-controlled packaging formats. Their adoption continues to grow across food, beverage, and household products due to excellent barrier performance and reduced material usage compared to rigid alternatives. Bags follow as the second-largest segment, primarily serving bulk food, pet food, and industrial applications. Films and wraps are gaining traction with advances in mono-material films that support recyclability goals. Other product types address niche applications requiring specialized laminations or high-strength structures.

- For instance, Wipak Group supplies high-barrier stand-up pouches for food and medical applications, using multilayer structures engineered to deliver strong oxygen protection for dry and sensitive products

By End-User Industry

The food industry holds the largest market share and remains the key end-user segment, propelled by convenience food consumption, extended shelf-life expectations, and growth in frozen and ready-to-eat products. Flexible packaging offers superior preservation, cost efficiency, and branding opportunities. The beverage sector is expanding with flexible pouches replacing bottles for children’s drinks, energy supplements, and compact travel packs. Healthcare and pharmaceuticals show notable growth due to sterile barrier packaging formats, while cosmetics and personal care adopt premium flexible formats for portability. Industrial and other segments utilize flexible solutions for sealants, lubricants, and chemical containment.

- For instance, Huhtamaki developed OmniLock™ Ultra Paper packaging for dry foods with up to about 93% paper content, offering barrier performance comparable to traditional multilayer films

By Distribution Channel

Indirect sales dominate the distribution landscape for flexible packaging in Europe, supported by the strong presence of wholesalers, distributors, and packaging converters that serve fragmented food and personal care markets. Small and medium enterprises prefer indirect procurement for cost flexibility, supply reliability, and access to customization services offered by converters. Direct sales gain momentum among large FMCG companies and pharmaceutical manufacturers seeking long-term contracts to ensure consistent quality and sustainability compliance. The shift toward digital procurement, vendor-managed inventory, and integrated logistics solutions further enhances the role of indirect channels in the market.

Key Growth Drivers:

Rising Demand for Convenience and Ready-to-Eat Food

The increasing consumption of convenience, on-the-go, and single-serve food products is a central growth driver in the Europe flexible packaging market. Urban lifestyles and shrinking household sizes are pushing consumers toward packaged meals, fresh-cut produce, and portion-controlled units that require lightweight and functional packaging formats. Flexible packaging offers resealability, microwave compatibility, extended shelf life, and optimized space utilization, making it preferable for retail and e-commerce distribution. The growth of private-label food brands intensifies competition and accelerates packaging innovation centered on aesthetics and differentiation. Furthermore, advanced material engineering allows flexible packaging to maintain product integrity and limit spoilage during transportation. The rising influence of modern retail formats, including discount chains and online grocery platforms, strengthens demand for compact and cost-efficient packaging solutions. These elements combined position flexible packaging as a versatile and consumer-centric format, driving sustained market expansion.

- For instance, Amcor’s AmLite™ Ultra Recyclable high-barrier pouch replaces aluminum foil with recyclable barrier film technology, enabling long shelf life for dry snacks and supporting extended distribution cycles for private-label brands

Sustainability Mandates Accelerating Adoption of Recyclable and Lightweight Materials

Europe’s stringent regulatory environment, including packaging waste directives, recycling targets, and extended producer responsibility (EPR) frameworks, is compelling manufacturers to shift from traditional multilayer plastics to recyclable mono-material structures, bio-based polymers, and lightweight flexible alternatives. Flexible packaging consumes fewer raw materials and generates lower transport emissions compared to rigid packaging, aligning with carbon reduction objectives. Sustainability-focused innovations are enabling high-barrier flexible formats without aluminum or non-recyclable laminates. Brand owners and FMCG companies are announcing circular-economy roadmaps that prioritize packaging reduction, compostable solutions, and refillable formats. The adoption of closed-loop recycling systems and pilot chemical recycling infrastructure further supports flexible packaging growth. These environmental transitions create a long-term competitive advantage for producers capable of delivering recyclable, low-carbon, compliance-ready packaging solutions for food, pharmaceuticals, and personal care applications.

- For instance, Mondi’s MonoFlexBE and MonoFlexPE solutions contain up to about 95% polyethylene, enabling compatibility with existing PE recycling streams while delivering enhanced barrier performance for dry and selected food applications.

Growth of E-Commerce and Digital Retail Logistics

The rapid expansion of e-commerce is redefining packaging requirements across Europe, supporting flexible packaging formats with durability, cost savings, and shipping compatibility. Flexible materials enhance damage resistance, reduce dimensional weight shipping costs, and offer compact storage benefits for distribution centers and courier networks. Custom-printed mailers and flexible pouches meet branding needs and improve consumer unboxing experiences without the bulk of corrugated secondary packaging. The rise of subscription services, direct-to-consumer beauty brands, and delivery-focused meal kits further contributes to market momentum. Temperature-sensitive and tamper-evident flexible solutions address growing demand in online grocery, pharmaceuticals, and nutraceuticals. As predictive-ordering platforms and automated warehouses expand across Europe, packaging formats leveraging flexibility, traceability, and intelligent labeling technology will increasingly dominate the fulfillment ecosystem.

Key Trends and Opportunities:

Advancement in Mono-Material and Recyclable Film Technologies

The shift toward mono-material polyethylene and polypropylene structures represents a transformative trend in the European flexible packaging landscape. These materials enable high-barrier performance while maintaining compatibility with mechanical recycling streams under regional waste management frameworks. Converters and resin manufacturers are collaborating to optimize sealability, thermal resistance, and printability without compromising sustainability targets. Digital printing capability allows low-volume customization for limited-edition launches and market testing. Brands exploring carbon-footprint labeling and traceability solutions are adopting digitally enabled mono-material packaging for enhanced transparency. As recycling systems evolve and regulatory compliance tightens, mono-material technology remains a major opportunity for producers offering scalable designs that meet both performance and environmental standards.

- For instance, SABIC supplies ISCC PLUS–certified circular polyethylene for mono-material flexible films, enabling certified renewable or recycled feedstock attribution through mass-balance systems while remaining compatible with standard PE recycling streams

Growth of Smart Packaging, Functional Additives, and Digital Consumer Interaction

Smart packaging technologies, including QR-enabled traceability, freshness indicators, and anti-counterfeit markers, are gaining traction in the flexible packaging market due to rising safety, transparency, and brand authenticity demands. Functional additives help maintain product texture, prevent contamination, and enhance shelf life, particularly important in pharmaceuticals and premium food categories. Digital interaction tools provide value-added consumer engagement, loyalty programs, and sustainability education via packaging-linked content. Smart flexible formats also support supply chain tracking for temperature-controlled logistics. As consumers prioritize safety, information access, and experiential purchasing, packaging that integrates digital intelligence offers strong differentiation and long-term competitive opportunities.

- For instance, Avery Dennison’s intelligent label platforms enable item-level QR codes that support product traceability and digital consumer interaction across large-scale European retail supply chains

Key Challenges:

Complex Recycling Infrastructure and Material Recovery Limitations

Despite momentum toward recyclable and circular materials, Europe faces structural challenges in scaling collection, sorting, and reprocessing systems for flexible packaging waste. Multilayer laminates, varying material compositions, and contamination issues hinder recovery rates. Regional disparities in waste infrastructure limit consistency in recycling access and processing efficiency, affecting brand owners and manufacturers pursuing sustainability claims. The transition to mono-material packaging involves high capital investments, supply chain adjustments, and reformulation costs that may strain small and mid-sized converters. Achieving commercial viability while meeting regulatory mandates remains a critical and ongoing industry challenge.

Volatile Raw Material Prices and Cost Pressures on Manufacturers

Fluctuating prices of polymers, adhesives, inks, and bio-based feedstocks create economic uncertainty for flexible packaging producers operating under narrow margins. External shocks such as energy price increases, logistics costs, and geopolitical disruptions impact production planning and contract pricing. Brand owners and retailers exert pressure to supply sustainable, customized, and high-performance packaging at competitive price points, further compressing profitability. Investment in advanced machinery, digital printing, and recyclable material transitions introduces additional cost burdens. Balancing innovation, compliance, and affordability remains a key challenge as the market navigates price sensitivity and demand for premium-quality sustainable packaging.

Reginal Analysis

Western Europe

Western Europe accounts for the largest share of the flexible packaging market at around 42%, led by Germany, the United Kingdom, and France. Growth stems from mature FMCG production, advanced healthcare manufacturing, and strong sustainability compliance programs. Germany drives innovation in recyclable mono-material films and chemical recycling pilots, while the UK shows high adoption of lightweight pouch formats in private-label retail. France accelerates demand for bio-based packaging, influenced by regulatory restrictions on single-use plastics. The region benefits from well-established distribution networks and brand investments in digital printing, supporting faster product turnaround and premium consumer experiences.

Southern Europe

Southern Europe represents roughly 24% of the market, supported by food exports, agriculture packaging, and tourism-driven consumption. Italy acts as a significant hub for flexible laminates and high-barrier films serving dairy and confectionery brands. Spain’s growing fresh produce export sector fuels adoption of MAP-compatible films and compostable flexible packaging. Greece and Portugal increasingly implement eco-design regulations aligned with EU waste directives, driving material substitution trends. Seasonal product demand, extended logistics routes, and export-oriented manufacturing support the region’s preference for lightweight, durable packaging formats that preserve freshness and optimize transport cost efficiency.

Northern Europe

Northern Europe holds an estimated 18% market share, driven by sustainability leadership and circular-economy incentives in Sweden, Norway, Denmark, and Finland. Government-backed recycling targets and consumer preference for low-carbon packaging foster growth in bio-based polymers and fiber-flexible hybrid solutions. The cosmetics and nutraceutical industries are key contributors as premium packaging formats pair aesthetics with environmental credibility. High digital adoption accelerates smart packaging applications including QR-traceability and freshness sensors. However, elevated labor and energy costs drive demand for automation and material minimization practices to maintain competitiveness across regional converters and brand owners.

Central & Eastern Europe

Central and Eastern Europe account for approximately 16% of the flexible packaging market, benefiting from expanding manufacturing capacity, lower production costs, and increasing FMCG consumption. Poland, Czech Republic, and Romania witness rapid investment in flexible film extrusion and printing facilities serving both EU and non-EU markets. Growth in pharmaceuticals, logistics outsourcing, and discount retail formats fuels adoption of pouches and multiuse packaging solutions. However, infrastructure gaps in recycling and waste sorting pose challenges for meeting EU-wide sustainability compliance. Competitive cost structures attract contract packaging operations, positioning the region as a scalable production base for European brands.

Market Segmentations:

By Product Type

- Pouches

- Bags

- Films and Wraps

- Other Product Types

By End-User Industry

- Food

- Beverage

- Healthcare and Pharmaceuticals

- Cosmetics and Personal Care

- Industrial

- Other End-Use Industries

By Distribution Channel

- Direct Sales

- Indirect Sales

By Geography

- Western Europe

- Southern Europe

- Northern Europe

- Central & Eastern Europe

Competitive Landscape

The competitive landscape of the Europe flexible packaging market is moderately consolidated, with global packaging leaders and regional converters competing across performance, sustainability, and customization capabilities. Major players focus on expanding recyclable mono-material portfolios, bio-based alternatives, and advanced digital printing to address brand differentiation and regulatory alignment. Cross-industry collaborations are increasing between resin producers, converters, and waste management companies to scale circular recycling solutions and improve material recovery. Market participants are adopting automation and smart manufacturing practices to optimize cost structures amid raw material volatility. Private-label growth among European retail chains has intensified demand for rapid turnaround and short-run printing formats, prompting investments in flexible production lines. Mergers, acquisitions, and capacity expansions remain key strategic priorities, particularly in Central and Eastern Europe, which is emerging as a cost-efficient manufacturing hub serving pan-European supply networks. Companies with integrated recycling strategies, sustainable product portfolios, and agile production capabilities are positioned to gain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Constantia Flexibles completed the acquisition of a majority stake in Swiss packaging firm Aluflexpack AG, strengthening its technology portfolio and expanding production reach across the food and pharmaceutical flexible packaging sectors.

- In January 2025, Huhtamaki showcased its blueloop™ innovations at PharmaPack 2025 in Paris, where its Omnilock™ Ultra PAPER earned the Eco-Design Award for fully recyclable barrier packaging tailored to healthcare and pharmaceutical segments.

Report Coverage

The research report offers an in-depth analysis based on Product type, End-User industry, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue increasing as consumers prioritize convenience, portion control, and portable packaging formats.

- Adoption of recyclable mono-material films will accelerate as regulatory frameworks tighten across Europe.

- Bio-based and compostable flexible packaging solutions will see stronger uptake supported by sustainability commitments.

- Digital printing will expand rapidly, enabling personalization, short runs, and localized product campaigns.

- Smart packaging embedded with traceability and authentication features will gain traction in food and pharmaceuticals.

- E-commerce logistics will drive the need for flexible formats designed for durability and reduced shipping weight.

- Chemical recycling advancements will support the recovery of mixed plastic flexible waste at scale.

- Investment will shift toward automation and AI-enabled production lines to reduce operational costs.

- Emerging Eastern European markets will strengthen as manufacturing hubs for cost-efficient flexible packaging.

- Collaboration among converters, waste processors, and brand owners will shape circular value chain models.