| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Casting and Splinting Products Market Size 2024 |

USD 1,450.9 million |

| Casting and Splinting Products Market, CAGR |

5.10% |

| Casting and Splinting Products Market Size 2032 |

USD 2,162.5 million |

Market Overview:

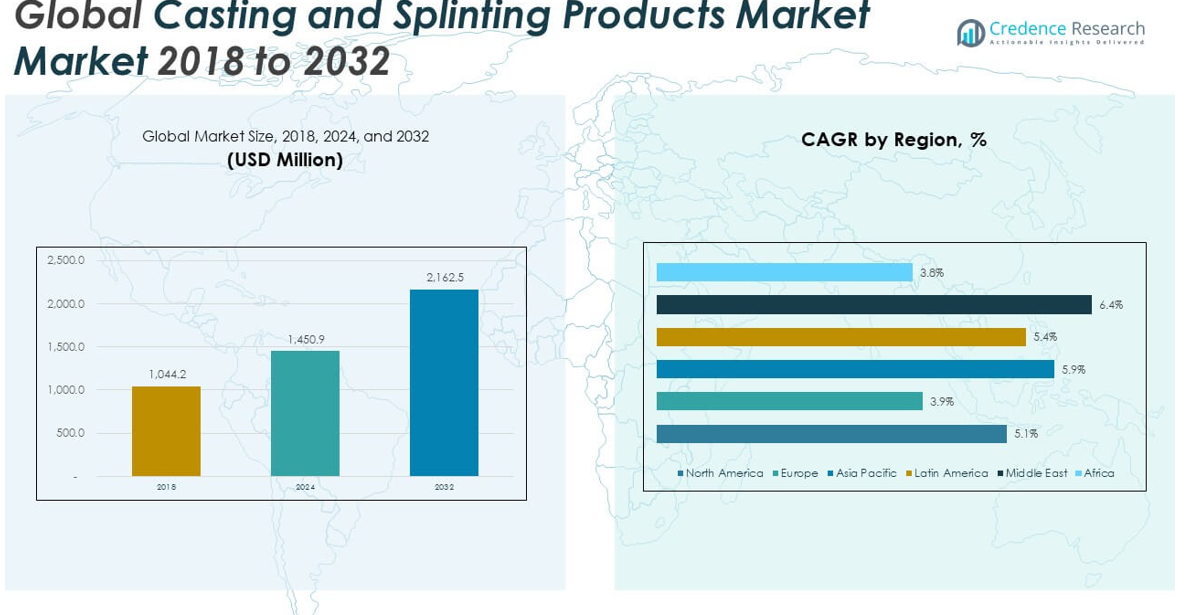

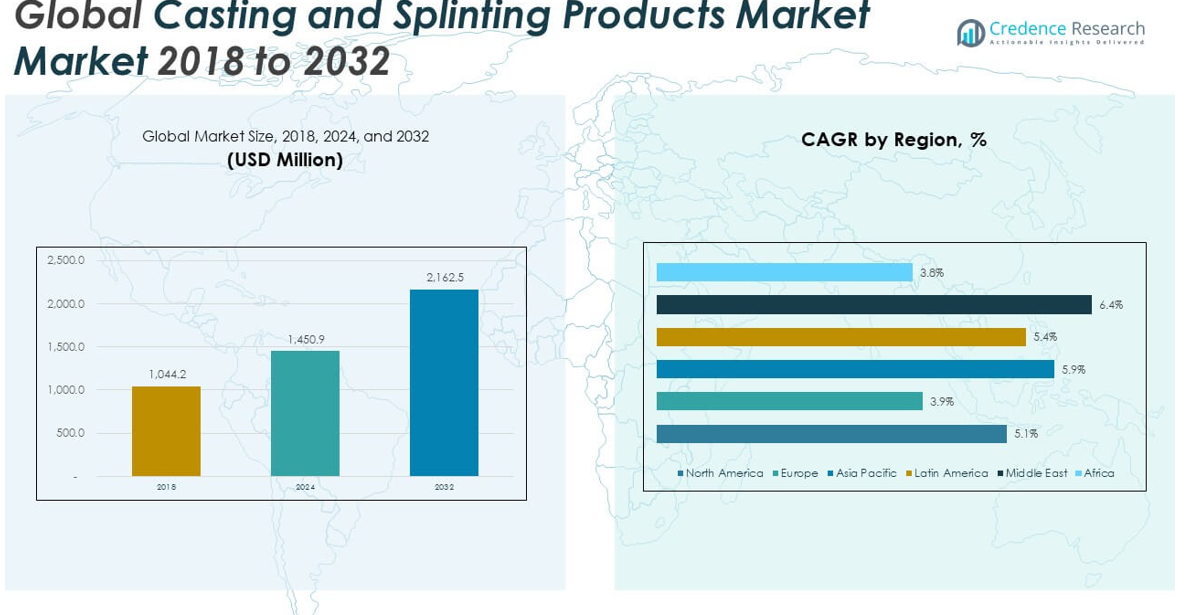

The Casting and Splinting Products Market size was valued at USD 1,044.2 million in 2018 to USD 1,450.9 million in 2024 and is anticipated to reach USD 2,162.5 million by 2032, at a CAGR of 5.10% during the forecast period.

The growth of the casting and splinting products market is largely driven by the increasing prevalence of musculoskeletal disorders, sports injuries, and fractures, particularly among the aging population. As the global population continues to age, the demand for orthopedic care, including casting and splinting solutions, is expected to rise. Moreover, advancements in materials like fiberglass and synthetic polymers have significantly improved the quality of casts and splints, making them more durable, comfortable, and efficient. Innovations in technology, such as the integration of artificial intelligence in treatment processes, further enhance patient outcomes and operational efficiencies in healthcare settings, contributing to the expansion of the market.

North America dominates the casting and splinting products market, driven by its advanced healthcare infrastructure and high healthcare spending. The region’s well-established orthopedic care systems, along with a large patient base, create strong demand for these products. Europe also represents a significant market, with a high incidence of age-related orthopedic disorders and a robust healthcare system. In contrast, the Asia Pacific region is expected to witness the highest growth during the forecast period, as the increasing prevalence of musculoskeletal injuries, osteoporosis, and aging populations fuels demand. Emerging economies in this region are expected to contribute to the market’s expansion due to improving healthcare access and rising awareness of orthopedic care.

Market Insights:

- The Casting and Splinting Products Market was valued at USD 1,044.2 million in 2018 and is projected to reach USD 2,162.5 million by 2032, growing at a CAGR of 5.10%.

- The aging population and the increasing prevalence of musculoskeletal disorders, such as osteoporosis and arthritis, are key drivers of the market, leading to higher demand for orthopedic treatments, including casts and splints.

- Technological advancements in materials like fiberglass and synthetic polymers are improving comfort, durability, and application speed, contributing significantly to market growth.

- The rising global participation in sports and physical activities has led to a higher number of sports-related injuries, increasing the need for effective casting and splinting solutions.

- Healthcare infrastructure improvements in regions like Asia Pacific and Latin America are driving the demand for orthopedic services, expanding the market in emerging economies.

- High costs associated with advanced materials and customized solutions remain a barrier to broader adoption, particularly in low-income regions where affordability is a concern.

- Challenges such as improper application and patient non-compliance can lead to complications, highlighting the need for better healthcare provider training and improved patient education.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Musculoskeletal Disorders

The increasing prevalence of musculoskeletal disorders is one of the primary drivers of the casting and splinting products market. With the global aging population, the incidence of conditions such as osteoporosis, arthritis, and other bone-related diseases has escalated. These conditions often lead to fractures and injuries that require orthopedic treatments, including casts and splints. As the need for effective immobilization solutions grows, healthcare providers are turning to advanced casting materials and splinting products to improve patient outcomes. The market will continue to expand as the demand for orthopedic care rises, especially in older demographics.

Technological Advancements in Casting and Splinting Materials

Advancements in materials used for casting and splinting have contributed significantly to the market’s growth. Modern materials such as fiberglass, synthetic polymers, and advanced composites offer several advantages over traditional plaster, including increased durability, lighter weight, and faster application. These innovations have improved the comfort, efficiency, and effectiveness of casting and splinting products. Healthcare providers now have access to a wider range of options that enhance patient care and reduce treatment times. The continuous development of these materials ensures that the casting and splinting products market will keep expanding to meet the evolving needs of healthcare practitioners and patients alike.

- Fiberglass casting tapes, for instance, are now the industry standard due to their superior strength-to-weight ratio, moisture resistance, and patient comfort.

Growth in Sports and Physical Activity-Related Injuries

Sports injuries are another significant factor driving the demand for casting and splinting products. With an increasing global focus on fitness, recreational sports, and physical activities, the frequency of sports-related injuries, such as fractures, sprains, and ligament tears, is on the rise. As more individuals participate in sports, the need for effective treatment methods, including casts and splints, becomes critical. Athletes and active individuals require specialized products that ensure proper immobilization and support during the healing process. This trend is fueling the growth of the casting and splinting products market as a response to the growing number of sports injuries worldwide.

Rising Demand for Orthopedic Treatments in Emerging Markets

The demand for orthopedic treatments is also growing in emerging markets, where healthcare systems are advancing, and access to quality care is improving. As countries in regions such as Asia Pacific and Latin America experience economic growth, healthcare infrastructure is becoming more robust, driving greater access to orthopedic services. The increasing awareness of musculoskeletal conditions and the availability of modern treatment options have led to higher adoption of casting and splinting products in these regions. As the market for orthopedic care continues to expand in these areas, the casting and splinting products market is poised for significant growth, driven by rising healthcare investments and an expanding patient base.

- For instance, Smith+Nephew’s 2024 Annual Report highlights a 12% year-over-year revenue growth in the Asia-Pacific region, attributing this to increased adoption of advanced casting and immobilization solutions, including their Dynacast® product line.

Market Trends:

Shift Towards Lightweight and High-Performance Materials

One of the key trends in the casting and splinting products market is the growing shift towards lightweight and high-performance materials. Traditional plaster casts have been largely replaced by fiberglass and synthetic polymer materials due to their superior strength-to-weight ratio. These materials offer several advantages, such as lighter weight, increased comfort, and faster application times, which directly contribute to enhanced patient satisfaction. The improved durability and ease of use of these materials also support faster healing and increased mobility for patients. As healthcare providers and patients demand more efficient and comfortable treatment options, this trend will continue to shape the market.

- For example, FIIXIT Orthotic Lab manufactures 3D-printed splints weighing approximately 100 grams significantly lighter than conventional plaster casts, which typically weigh several hundred grams for comparable immobilization.

Growth of Customizable and Patient-Specific Solutions

Customization has become an important trend within the casting and splinting products market. Patients increasingly seek personalized solutions that cater to their specific needs, especially in terms of comfort and support during the healing process. Advanced technologies now allow for the production of custom-fit casts and splints, ensuring better alignment, optimal immobilization, and reduced discomfort. These patient-specific solutions are made possible through innovations in 3D printing and scanning technologies, which allow for the creation of customized orthopedic devices. The rising demand for individualized care and improved treatment outcomes is expected to continue driving the adoption of customizable casting and splinting products.

- ActivArmor, for instance, utilizes proprietary software and 3D scanning to create custom-fitted casts at the point of care, allowing for in-clinic production and same-day application

Integration of Digital Technologies in Casting and Splinting

The integration of digital technologies in casting and splinting is another significant trend within the market. Innovations such as smart casts and splints are gaining traction, where sensors are embedded into the devices to monitor healing progress and alert healthcare providers if adjustments are needed. These digital devices help track parameters like temperature, pressure, and movement, offering real-time feedback on the patient’s recovery. The ability to monitor healing remotely is especially beneficial for patients in remote or underserved areas, reducing the need for frequent hospital visits. This integration of technology is poised to revolutionize the way orthopedic care is delivered, contributing to the market’s continued expansion.

Increase in Home Care and Outpatient Treatment Options

There is an increasing trend toward home care and outpatient treatments for casting and splinting products. The rise of home healthcare services and outpatient orthopedic treatments is driven by a demand for more convenient and cost-effective solutions. With technological advancements, patients can now receive treatments and monitor their recovery from the comfort of their homes, significantly reducing hospital stays. This trend is also being fueled by the growing preference for minimally invasive procedures and non-hospital care settings. The demand for portable and easy-to-use casting and splinting products that can be utilized outside of traditional hospital environments will continue to grow as healthcare systems focus on improving patient outcomes while reducing costs.

Market Challenges Analysis:

High Costs and Accessibility Issues

One of the primary challenges faced by the casting and splinting products market is the high cost associated with advanced materials and custom solutions. While modern materials such as fiberglass and synthetic polymers offer significant advantages over traditional plaster, they are often more expensive. This can create affordability issues, especially in low-income regions or among patients without adequate insurance coverage. The cost of customization and the integration of digital technologies, such as 3D printing for personalized casts, further exacerbate the financial burden. Despite the growing demand for more efficient and comfortable solutions, the affordability of these products remains a significant barrier to widespread adoption, particularly in emerging markets where healthcare budgets are limited.

Complications from Improper Usage and Compliance

Another challenge in the casting and splinting products market revolves around complications arising from improper usage and patient non-compliance. While advanced materials and technologies have improved the effectiveness of casts and splints, improper application or failure to follow medical instructions can lead to complications such as skin irritation, infections, or improper healing. Patients may also experience discomfort if the device is not correctly fitted or if they fail to follow guidelines for movement and mobility. These issues can result in longer recovery times or the need for additional treatments, adding to the overall healthcare costs. Ensuring proper training for healthcare providers and improving patient education on the correct use and maintenance of casting and splinting products is critical to overcoming this challenge.

Market Opportunities:

Growing Demand in Emerging Markets

The casting and splinting products market presents significant opportunities in emerging markets, where increasing healthcare access and improving infrastructure are driving demand for orthopedic treatments. As these regions experience economic growth, the need for advanced healthcare solutions, including casting and splinting products, continues to rise. Increased awareness of musculoskeletal conditions and expanding healthcare coverage further contribute to this growth. Manufacturers can capitalize on this trend by offering affordable and efficient casting solutions tailored to the specific needs of these markets. This presents a key opportunity for companies to expand their footprint and penetrate new regions with innovative and cost-effective products.

Advancements in Digital and Customization Technologies

Advancements in digital technologies, such as 3D printing and smart cast systems, offer a promising opportunity for growth in the casting and splinting products market. The integration of smart technologies into casts allows for remote monitoring and real-time feedback, improving patient outcomes and recovery times. Customization technologies enable the creation of patient-specific solutions, ensuring better comfort and support. These innovations not only enhance the healing process but also provide opportunities for differentiation in the market. Companies investing in these technologies can gain a competitive edge by meeting the growing demand for personalized and high-tech orthopedic products.

Market Segmentation Analysis:

By Type, the casting and splinting products market is segmented into two primary categories: Casting Products and Splinting Products, each with distinct subcategories. Casting Products include plaster casts, casting tapes, cast cutters, and casting tools and accessories. Plaster casts are traditional options, while casting tapes are more modern and durable. Cast cutters and tools ensure the safe and efficient removal of casts. On the other hand, Splinting Products encompass fiberglass splints, plaster splints, other types of splints, and splinting tools and accessories. Fiberglass splints are becoming increasingly popular due to their lightweight and durable properties, while plaster splints are a cost-effective choice in certain markets.

- For example, 3M Scotchcast Plus Casting Tape, a fiberglass-based tape, is known for its durability and moisture resistance, and is referenced in 3M’s official product brochure.

By End User, which includes hospitals, clinics, and ambulatory surgical centers (ASCs). Hospitals hold the largest share of the market due to their extensive orthopedic departments and patient base. Clinics also play a significant role, providing specialized care in outpatient settings. ASCs are growing in importance as they offer cost-effective, efficient treatments for various musculoskeletal conditions. The demand for casting and splinting products is rising in all these settings as the need for orthopedic care, including fracture management and rehabilitation, continues to increase across various demographics.

- For example, Mayo Clinic’s orthopedic department employs various types of casts and splints such as plaster and fiberglass for fracture management and rehabilitation, as outlined in their clinical guidelines and patient education resources.

Segmentation:

By Type:

- Casting Products

- Plaster Casts

- Casting Tapes

- Cast Cutters

- Casting Tools and Accessories

- Splinting Products

- Fiberglass Splints

- Plaster Splints

- Other Splints

- Splinting Tools and Accessories

By End User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Casting and Splinting Products Market size was valued at USD 344.58 million in 2018, reached USD 480.10 million in 2024, and is anticipated to reach USD 718.16 million by 2032, at a CAGR of 5.1% during the forecast period. North America holds a significant market share in the casting and splinting products sector, primarily due to its advanced healthcare infrastructure, high healthcare spending, and the widespread adoption of modern orthopedic care solutions. The region’s aging population, which experiences a higher incidence of musculoskeletal conditions, is a key driver for market growth. The increasing prevalence of sports-related injuries, coupled with the availability of advanced materials and customized solutions, further boosts demand for casting and splinting products. The market is supported by well-established healthcare facilities and increased awareness about orthopedic care. Companies in this region focus on innovation, offering lightweight, durable, and digitally integrated products to meet the needs of both patients and healthcare providers.

Europe

The Europe Casting and Splinting Products Market size was valued at USD 279.63 million in 2018, reached USD 365.04 million in 2024, and is expected to reach USD 497.37 million by 2032, at a CAGR of 3.9% during the forecast period. Europe accounts for a substantial share of the market, driven by a high prevalence of orthopedic disorders, especially among the elderly population. The region’s well-established healthcare systems and increasing demand for advanced, customized orthopedic solutions contribute to market growth. Countries like Germany, France, and the UK have seen significant investments in healthcare technologies, supporting the adoption of more efficient casting and splinting products. The European market is also influenced by increasing public awareness regarding the benefits of advanced materials and digital innovations in orthopedic care, which is driving the demand for lightweight and patient-specific products.

Asia Pacific

The Asia Pacific Casting and Splinting Products Market size was valued at USD 216.77 million in 2018, reached USD 315.13 million in 2024, and is expected to reach USD 497.37 million by 2032, at a CAGR of 5.9% during the forecast period. The Asia Pacific region is expected to experience the highest growth rate in the casting and splinting products market due to increasing healthcare investments, rising patient awareness, and a growing population suffering from musculoskeletal disorders. The rapidly aging population in countries like Japan and China, coupled with increasing sports injuries in younger demographics, is driving market demand. Technological advancements, such as the use of 3D printing and smart casting technologies, are also fueling growth in this region. The expanding healthcare infrastructure and improving access to quality orthopedic care further support the demand for casting and splinting solutions.

Latin America

The Latin America Casting and Splinting Products Market size was valued at USD 109.85 million in 2018, reached USD 155.62 million in 2024, and is anticipated to reach USD 237.87 million by 2032, at a CAGR of 5.4% during the forecast period. Latin America represents a growing market for orthopedic products due to increased healthcare access and the rising incidence of musculoskeletal disorders, particularly among the elderly population. Advancements in healthcare infrastructure, supported by government initiatives and private sector investments, are driving demand for advanced casting and splinting solutions. The market benefits from the increasing awareness of orthopedic treatments and the availability of cost-effective yet high-quality products. Countries like Brazil and Mexico are leading the demand for these products, driven by the expanding healthcare market and rising orthopedic care needs.

Middle East

The Middle East Casting and Splinting Products Market size was valued at USD 66.20 million in 2018, reached USD 99.82 million in 2024, and is expected to reach USD 164.35 million by 2032, at a CAGR of 6.4% during the forecast period. The Middle East is one of the fastest-growing regions in the casting and splinting products market due to rapid economic development and significant investments in healthcare infrastructure. The demand for orthopedic care has increased as healthcare facilities expand and modernize. High healthcare spending and growing awareness of musculoskeletal disorders contribute to the growing demand for advanced casting solutions. The region’s increasing number of sports-related injuries and road accidents also boosts the need for effective immobilization products. Additionally, rising demand for personalized and digitally integrated casting solutions presents opportunities for market expansion in the Middle East.

Africa

The Africa Casting and Splinting Products Market size was valued at USD 27.15 million in 2018, reached USD 35.17 million in 2024, and is anticipated to reach USD 47.36 million by 2032, at a CAGR of 3.8% during the forecast period. The African market is witnessing steady growth, driven by improvements in healthcare infrastructure and rising awareness of musculoskeletal conditions. The demand for orthopedic care, including casting and splinting products, is increasing as countries across the region continue to develop their healthcare systems. The growing prevalence of fractures and sports injuries is also contributing to the expansion of the market. However, the market faces challenges such as limited access to advanced medical products and lower healthcare spending in certain areas. Despite these challenges, increasing healthcare investments and the gradual adoption of advanced orthopedic solutions are expected to support future market growth in Africa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Solventum

- BSN Medical GmbH

- DeRoyal Industries

- DJO Global

- Össur

- Patterson Medical Holdings Inc.

- Prime Medical Inc.

- Spencer Italia S.r.l.

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Other Key Players

Competitive Analysis:

The casting and splinting products market is highly competitive, with several key players focusing on innovation, product differentiation, and expanding their market presence. Leading companies are investing in advanced materials such as fiberglass, synthetic polymers, and smart technologies to offer more durable, lightweight, and customizable solutions. Market players like 3M, Zimmer Biomet, and Össur dominate with strong product portfolios and widespread distribution networks. These companies are also leveraging partnerships and acquisitions to enhance their capabilities and gain a competitive edge. The rise of 3D printing and digital technologies has created opportunities for new entrants to offer personalized and patient-specific products, disrupting traditional market dynamics. Pricing strategies play a significant role, with companies offering a range of products to cater to both high-end and cost-sensitive segments. Competitive strategies are centered on improving product comfort, effectiveness, and the overall patient experience.

Recent Developments:

- In December 2024, DeRoyal Industries announced a strategic partnership with S2S Global, set to commence in January 2025. This collaboration will see the sales teams of both companies working together to serve their combined customer base, expanding market reach and enhancing customer support.

- In September 2024, Solventum, formerly 3M Health Care, launched two innovative dental products: 3M™ Clinpro™ Clear Fluoride and 3M™ Filtek™ Easy Match Universal Restorative. These products were introduced at the FDI World Dental Congress, reflecting Solventum’s commitment to advancing healthcare technology and enhancing patient-centered care.

- In January 2024, Össur executed a strategic acquisition of FIOR & GENTZ, a leading manufacturer of lower limb neuro orthotic components. This move aligns with Össur’s Growth’27 strategy, which prioritizes mergers and acquisitions alongside organic growth. The acquisition is expected to strengthen Össur’s position in the neuro orthotics market and create additional value for shareholders by expanding its technological capabilities and product offerings.

Market Concentration & Characteristics:

The casting and splinting products market is moderately concentrated, with a few key players holding significant market share. Leading companies, such as 3M, Zimmer Biomet, and Össur, dominate the market through strong brand recognition, extensive distribution networks, and advanced product offerings. These companies focus on innovation and technological advancements to maintain their competitive edge. Despite the dominance of major players, the market also features numerous smaller firms offering specialized or cost-effective solutions, particularly in emerging markets. The market is characterized by a high degree of product differentiation, driven by innovations in materials, such as fiberglass and smart technologies, and customization options. Regulatory requirements and the need for constant product development contribute to the competitive landscape, where companies must balance product efficacy, cost, and comfort to meet patient needs effectively. The overall market structure is supportive of both large-scale players and niche segments.

Report Coverage:

The research report offers an in-depth analysis based on type and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global casting and splinting products market will continue to grow, driven by an increasing aging population and rising incidences of musculoskeletal disorders.

- Advancements in materials, such as fiberglass and synthetic polymers, will enhance the comfort and durability of casts and splints.

- Technological innovations like 3D printing and smart casting systems will offer more personalized and efficient solutions for patients.

- The market will see increased adoption of digital monitoring technologies for real-time recovery tracking.

- Growing healthcare infrastructure in emerging markets will fuel demand for orthopedic care, including casting and splinting products.

- The increasing focus on patient comfort and rapid healing will push demand for lightweight and customizable products.

- The demand for cost-effective solutions will rise, particularly in low-income regions with limited healthcare budgets.

- Rising sports-related injuries and road accidents will contribute to a steady demand for casting and splinting solutions.

- The expansion of home healthcare services will drive the need for portable and user-friendly orthopedic products.

- Companies will focus on strategic partnerships and acquisitions to strengthen their market position and expand product portfolios.