Market Overview

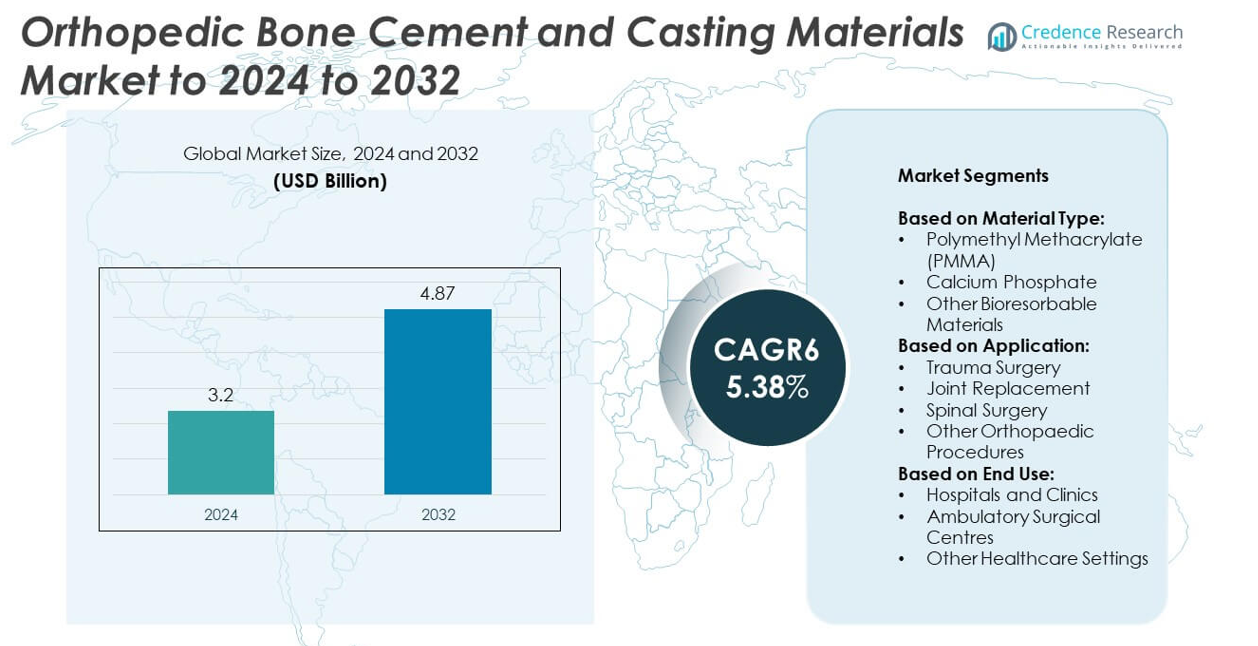

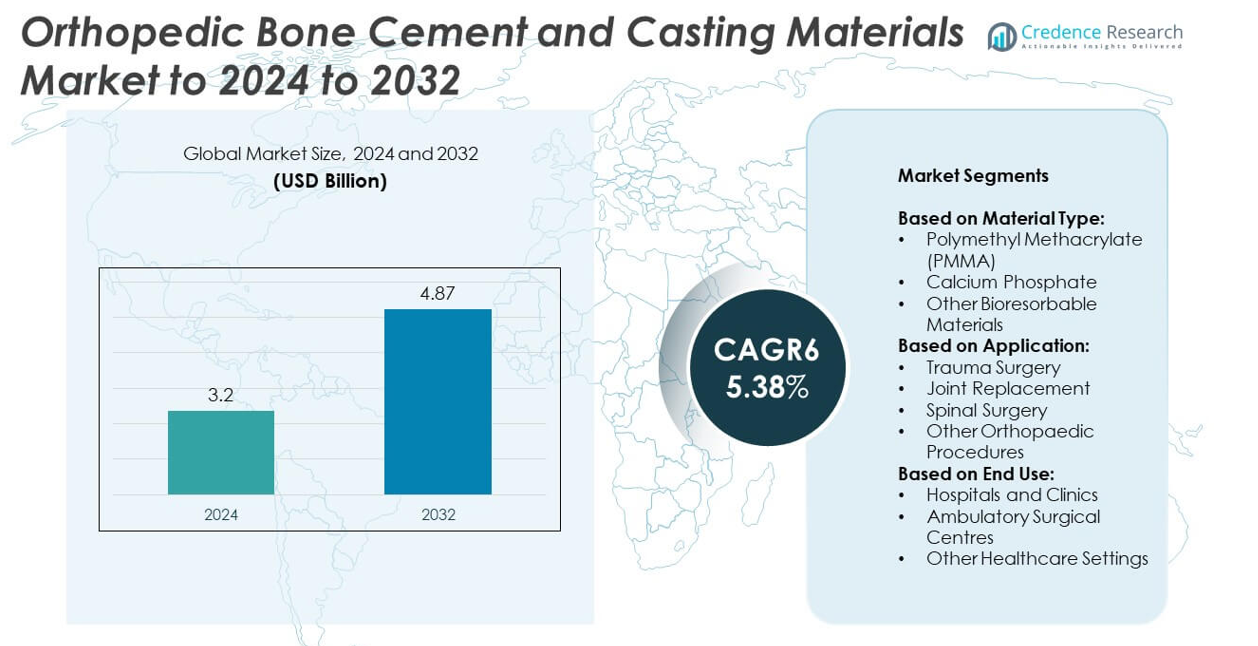

The Orthopedic Bone Cement and Casting Materials Market size was valued USD 3.2 Billion in 2024 and is anticipated to reach USD 4.87 Billion by 2032, at a CAGR of 5.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Orthopaedic Bone Cement and Casting Materials Market Size 2024 |

USD 3.2 Billion |

| Orthopaedic Bone Cement and Casting Materials Market, CAGR |

5.38% |

| Orthopaedic Bone Cement and Casting Materials Market Size 2032 |

USD 4.87 Billion |

The orthopedic bone cement and casting materials market is shaped by major players including TRUMATCH, Medtronic, CeraMed, Biomet, Wright Medical, Heraeus, Zimmer Biomet, Smith Nephew, Stryker, BD, REVARY, Osteopore, OSTEONICA, eMPe Scientific, and DePuy Synthes. These companies compete through innovations in PMMA formulations, antibiotic-loaded cements, and bioresorbable materials tailored for joint replacement, trauma, and spinal surgeries. North America emerged as the leading region in 2024, holding nearly 38% of the market share, supported by advanced healthcare infrastructure, high surgical volumes, and strong presence of global manufacturers. Europe followed with 28%, while Asia Pacific accounted for 22% and is projected to grow at the fastest rate.

Market Insights

- The orthopedic bone cement and casting materials market was valued at USD 3.2 Billion in 2024 and is projected to reach USD 4.87 Billion by 2032, growing at a CAGR of 5.38%.

- Rising cases of arthritis, osteoporosis, and trauma injuries are fueling demand, supported by the increasing volume of joint replacement and spinal surgeries across aging populations.

- Market trends highlight a shift toward bioresorbable materials like calcium phosphate and growing adoption of antibiotic-loaded PMMA cements, addressing infection risks and enhancing surgical outcomes.

- Competition is intense with global players focusing on R&D, strategic collaborations, and expansion into emerging economies, where cost-effectiveness and innovative formulations provide strong differentiation.

- North America leads with 38% share, Europe follows with 28%, and Asia Pacific holds 22% while recording the fastest growth; Latin America captures 7% and the Middle East & Africa contributes 5%, reflecting varying adoption driven by healthcare infrastructure and economic factors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Polymethyl Methacrylate (PMMA) dominated the orthopedic bone cement and casting materials market in 2024, holding over 60% share. Its dominance is driven by superior mechanical strength, proven biocompatibility, and widespread use in joint replacement procedures. PMMA’s long track record in orthopedic applications supports surgeon preference and regulatory approvals across global markets. Calcium phosphate, while gaining traction due to its bioresorbable nature and natural bone regeneration properties, remains secondary. Other bioresorbable materials are emerging but still represent a smaller share, limited by higher costs and restricted clinical adoption.

- For instance, Heraeus announced in December 2024 that the number of arthroplasty surgeries using its PALACOS bone cement had exceeded 40 million worldwide for the first time. The company noted that this milestone was reached over 60 years after the cement’s introduction in Germany.

By Application

Joint replacement accounted for the largest share of applications in 2024, representing more than 45% of the market. Rising prevalence of osteoarthritis, an aging population, and increasing hip and knee replacement surgeries have significantly boosted demand. Trauma surgery remains another strong segment, driven by accident-related fractures and emergency procedures. Spinal surgery and other orthopedic procedures contribute steadily but are comparatively smaller. Joint replacement’s dominance is reinforced by innovations in minimally invasive surgical techniques and growing reimbursement support for hip and knee arthroplasty worldwide.

- For instance, Stryker and its peers (DePuy Synthes, Zimmer Biomet, and Smith & Nephew) are the four largest joint replacement players. Their combined knee replacement sales grew by 10% in 2023, according to market analysts. Individual company growth varied, with Stryker reporting over 11% organic net sales growth for its Orthopaedics and Spine segment, driven by a recovery in elective surgical procedures.

By End Use

Hospitals and clinics led the end-use segment in 2024 with a share exceeding 55%, supported by their advanced infrastructure, skilled surgeons, and access to complex orthopedic procedures. The dominance of hospitals is also driven by their role in high-volume joint replacements and trauma cases. Ambulatory surgical centres are witnessing rapid growth, supported by shorter recovery times, reduced healthcare costs, and patient preference for outpatient care. Other healthcare settings such as specialty orthopedic centers and rehabilitation clinics contribute moderately but remain secondary compared to hospitals’ extensive procedural capacity.

Key Growth Drivers

Rising Prevalence of Orthopedic Disorders

The growing burden of orthopedic conditions, including osteoporosis, arthritis, and trauma-related fractures, is a key growth driver for the orthopedic bone cement and casting materials market. With the aging global population, cases of degenerative joint diseases are rapidly increasing, creating higher demand for surgical interventions such as joint replacement and spinal surgeries. This demographic trend directly accelerates the need for reliable fixation and bone support materials. As a result, the consistent rise in patient volumes continues to strengthen market growth worldwide.

- For instance, Osteoporosis causes more than 8.9 million fractures yearly, or one fracture every three seconds globally.

Technological Advancements in Materials

Continuous innovations in bone cement formulations and bioresorbable materials have become another key growth driver. Advances such as antibiotic-loaded PMMA cements and calcium phosphate-based bioresorbables improve infection control, patient safety, and natural bone regeneration. These technological improvements enhance clinical outcomes, support surgeon adoption, and expand product portfolios for manufacturers. With growing investment in R&D, companies are focusing on combining strength, biocompatibility, and sustainability, making advanced materials increasingly important in addressing unmet orthopedic needs.

- For instance, periprosthetic joint infection rates are about 0.85-2% for hip/knee replacements.

Expansion of Joint Replacement Procedures

The rising number of hip and knee replacement surgeries globally is a major growth driver for this market. Improved surgical techniques, favorable reimbursement policies, and better patient awareness are fueling procedural volumes. Orthopedic bone cements and casting materials are integral to these procedures, ensuring long-term fixation and stability of implants. Countries with aging populations, particularly in North America, Europe, and parts of Asia-Pacific, are seeing sharp increases in elective surgeries. This ongoing expansion solidifies joint replacement as the primary contributor to market growth.

Key Trends & Opportunities

Shift Toward Minimally Invasive Surgeries

One of the key trends and opportunities is the growing adoption of minimally invasive orthopedic surgeries. These techniques reduce hospital stays, speed up recovery, and lower procedural risks, creating greater demand for advanced bone cement and casting materials optimized for such procedures. Surgeons increasingly favor materials that allow easy handling, controlled setting times, and superior outcomes in smaller incisions. This trend also supports the rise of ambulatory surgical centers, opening opportunities for manufacturers to develop tailored solutions that meet evolving surgical needs.

- For instance, Orthopedic surgeries are migrating from hospitals to outpatient and ambulatory surgery centers (ASCs). A U.S. study found ASC utilization rose from 31% to 34% (2013 to 2018) across common orthopedic procedures.

Emergence of Bioresorbable Materials

The increasing focus on bioresorbable materials represents a strong trend and opportunity in the market. Products such as calcium phosphate and other novel bioresorbables promote natural bone healing while gradually dissolving, eliminating long-term complications associated with permanent implants. Growing regulatory support for biocompatible and sustainable products further enhances their adoption potential. As clinical evidence supporting bioresorbables strengthens, their use is expected to expand beyond niche applications into broader orthopedic procedures, providing manufacturers a clear pathway for product differentiation and market expansion.

- For instance, a multicenter retrospective study of nearly 500 total hip arthroplasties (THAs) performed with MicroPort’s SuperPath® technique between 2013 and 2014 reported an average hospital stay of 1.6 days, compared to a national average of 3.2 days reported in a healthcare database.

Key Challenges

High Cost of Advanced Materials

One of the key challenges in the orthopedic bone cement and casting materials market is the high cost associated with advanced bioresorbable materials and innovative cement formulations. These products, while offering superior outcomes, often exceed the budgets of healthcare systems in developing economies. Limited reimbursement coverage for premium materials further restricts accessibility in cost-sensitive markets. As a result, despite their benefits, affordability remains a barrier to widespread adoption, compelling manufacturers to balance innovation with cost-effectiveness to ensure broader market penetration.

Regulatory and Safety Concerns

Another key challenge is the stringent regulatory landscape and safety concerns associated with orthopedic materials. Issues such as implant loosening, post-operative infections, or adverse reactions to cement formulations can hinder product adoption. Regulatory authorities impose rigorous approval requirements, slowing down commercialization of new technologies. Additionally, clinical complications can lead to product recalls or lawsuits, impacting brand credibility. Companies must invest heavily in clinical validation, compliance, and post-market surveillance to overcome these barriers, making regulatory approval processes a persistent challenge for market growth.

Regional Analysis

North America

North America accounted for the largest share of the orthopedic bone cement and casting materials market in 2024, holding nearly 38%. The region’s dominance is supported by advanced healthcare infrastructure, high procedural volumes in joint replacement, and strong presence of leading manufacturers. Rising prevalence of arthritis and osteoporosis among the aging population further drives demand. Favorable reimbursement policies and adoption of innovative materials, such as antibiotic-loaded PMMA cements, enhance growth. The United States remains the primary contributor, supported by high surgical rates and strong investments in orthopedic research and development.

Europe

Europe represented around 28% of the market share in 2024, making it the second-largest region. The market is supported by a rapidly aging population, growing number of trauma and joint replacement procedures, and strong regulatory focus on safe and biocompatible materials. Countries like Germany, the United Kingdom, and France lead in surgical volumes, with extensive adoption of advanced cements and bioresorbable materials. The European Union’s emphasis on medical innovation and healthcare modernization further supports growth. Expanding outpatient care facilities and wider availability of minimally invasive orthopedic surgeries are boosting market penetration across the region.

Asia Pacific

Asia Pacific accounted for nearly 22% of the market share in 2024 and is projected to grow at the fastest pace. The region’s expansion is fueled by rising healthcare investments, an aging population, and increasing prevalence of osteoporosis and arthritis. Countries such as China, India, and Japan are experiencing rapid growth in joint replacement and trauma surgeries. Cost-effective production and favorable medical tourism also strengthen the regional market. Growing awareness of advanced orthopedic materials and expanding access to modern surgical facilities are expected to accelerate adoption, positioning Asia Pacific as a key growth hub.

Latin America

Latin America held approximately 7% of the orthopedic bone cement and casting materials market share in 2024. The region is driven by increasing surgical procedures for trauma and fracture management, particularly in Brazil and Mexico. Expanding access to healthcare facilities and rising medical tourism contribute to growth. However, limited reimbursement structures and budget constraints in public healthcare systems restrict the adoption of advanced bioresorbable materials. Despite these challenges, growing awareness and improvements in hospital infrastructure are expected to enhance adoption, with a gradual shift toward joint replacement surgeries supporting long-term demand in the region.

Middle East and Africa

The Middle East and Africa represented around 5% of the global market share in 2024, making it the smallest regional contributor. Market growth is supported by improving healthcare infrastructure in Gulf Cooperation Council countries and rising investments in orthopedic care. Trauma cases from road accidents remain a key driver of demand, along with an increasing incidence of age-related bone disorders. Limited access to advanced technologies and high product costs restrict adoption across several parts of Africa. However, rising government initiatives to modernize healthcare facilities are expected to create gradual growth opportunities in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Material Type:

- Polymethyl Methacrylate (PMMA)

- Calcium Phosphate

- Other Bioresorbable Materials

By Application:

- Trauma Surgery

- Joint Replacement

- Spinal Surgery

- Other Orthopaedic Procedures

By End Use:

- Hospitals and Clinics

- Ambulatory Surgical Centres

- Other Healthcare Settings

By Geography:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the orthopedic bone cement and casting materials market features prominent players such as TRUMATCH, Medtronic, CeraMed, Biomet, Wright Medical, Heraeus, Zimmer Biomet, Smith Nephew, Stryker, BD, REVARY, Osteopore, OSTEONICA, eMPe Scientific, and DePuy Synthes. The market is highly competitive, with companies focusing on expanding product portfolios, enhancing biocompatibility, and developing advanced formulations tailored for trauma, joint replacement, and spinal surgeries. Strategies such as partnerships with healthcare providers, regional expansion, and regulatory approvals for innovative materials strengthen market positioning. Continuous investment in research and development supports the introduction of antibiotic-loaded cements and bioresorbable alternatives that meet rising clinical demands. In addition, emphasis on cost-effectiveness and scalability helps companies tap into emerging economies where affordability is critical. Growing preference for minimally invasive surgeries and outpatient procedures further influences product innovation, as manufacturers strive to meet evolving requirements of surgeons and healthcare facilities while sustaining a competitive edge.

Key Player Analysis

- TRUMATCH

- Medtronic

- CeraMed

- Biomet

- Wright Medical

- Heraeus

- Zimmer Biomet

- Smith Nephew

- Stryker

- BD

- REVARY

- Osteopore

- OSTEONICA

- eMPe Scientific

- DePuy Synthes

Recent Developments

- In 2024, Stryker received FDA approval for shoulder reconstruction applications on its robotic system, MAKO.

- In 2024, Zimmer Biomet acquired OrthoGrid Systems, a company with AI-driven surgical guidance systems. This strategic move enhanced Zimmer Biomet’s technology offerings for hip replacement, which can be used with both cemented and cementless techniques.

- In June 2024, DePuy Synthes received 510(k) FDA clearance for its VELYS™ Robotic-Assisted Solution for use in unicompartmental knee arthroplasty.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising orthopedic surgeries worldwide.

- PMMA will continue to dominate, but bioresorbable materials will gain higher adoption.

- Joint replacement procedures will remain the primary driver of product demand.

- Hospitals will lead consumption, though ambulatory centers will record faster growth.

- North America will sustain its lead, but Asia Pacific will show the fastest growth.

- Minimally invasive surgeries will increase demand for advanced bone cements.

- Technological advancements will focus on infection control and faster healing.

- Growing elderly population will sustain long-term market opportunities.

- Cost barriers will challenge adoption in emerging economies.

- Regulatory approvals will remain crucial in shaping innovation and market entry.