Market Overview

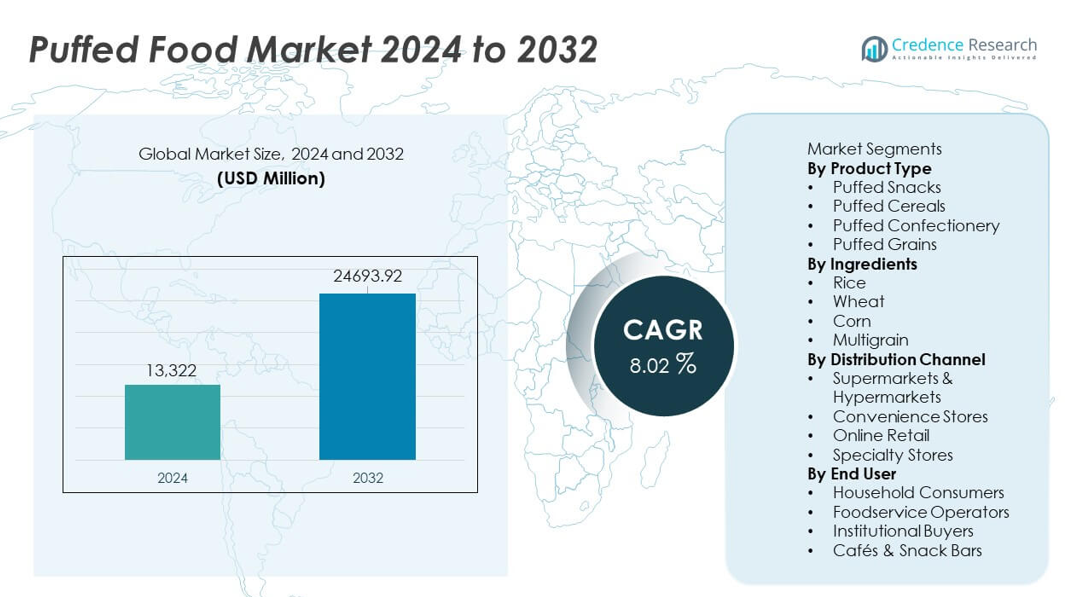

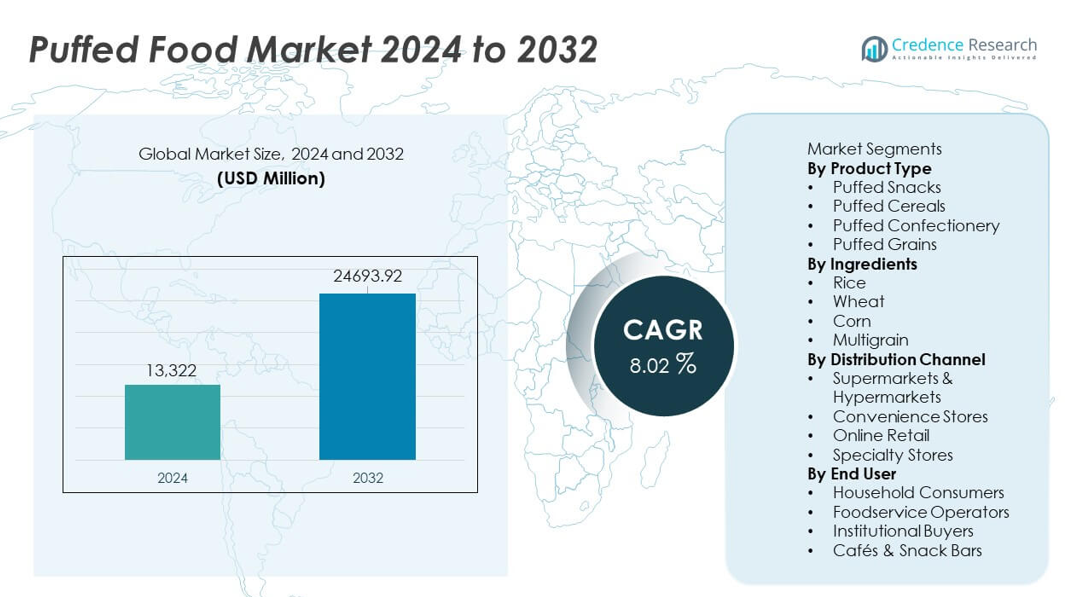

The Puffed Food Market was valued at USD 13,322 million in 2024 and is projected to reach USD 24,693.92 million by 2032, growing at a CAGR of 8.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Puffed Food Market Size 2024 |

USD 13,322 million |

| Puffed Food Market, CAGR |

8.02% |

| Puffed Food Market Size 2032 |

USD 24,693.92 million |

Top players in the Puffed Food market include Kellogg Company, General Mills Inc., PepsiCo (Frito-Lay), Nestlé S.A., Conagra Brands Inc., Ricegrowers Limited (SunRice), Arcor Group, Bagrry’s India Ltd., The Quaker Oats Company, and WEETABIX Limited. These companies lead through strong global distribution, continuous flavor innovation, and expansion of healthier, clean-label puffed products. Asia Pacific remains the dominant region with a 34% market share, driven by rising urban consumption, affordable product lines, and strong retail growth. North America follows with a 32% share, supported by high demand for nutritious, low-calorie snacks and strong brand presence across supermarkets and online channels.

Market Insights

- The Puffed Food market reached USD 13,322 million in 2024 and will grow at a CAGR of 8.02% through 2032, supported by rising global demand for light and convenient snacks.

- Health-focused consumers drive strong adoption of puffed snacks, with the product type segment led by puffed snacks holding a 42% share, supported by clean-label and low-calorie preferences.

- Innovation in flavors, multigrain blends, and fortified ingredients shapes key market trends, while leading players expand premium and plant-based ranges to strengthen competitiveness.

- Cost volatility in rice, corn, and wheat and intense competition from private-label brands restrain growth, especially in price-sensitive regions.

- Asia Pacific leads regional demand with a 34% share, followed by North America at 32% and Europe at 28%, driven by strong retail networks and rising interest in healthier puffed food options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Puffed snacks lead this segment with a 42% share, driven by rising demand for ready-to-eat products and wider flavor innovation. Consumers prefer light, low-oil snacks, which pushes brands to expand healthier formulations. Puffed cereals gain support from busy households seeking quick breakfast options with added nutrients. Puffed confectionery and puffed grains show moderate traction due to niche use in bakery and snack mixes. The focus on clean-label and fortified snacks supports long-term growth across all product types.

- For instance, Kellogg Company has implemented various energy-saving measures, including the use of advanced heat-recovery units. In 2019, the company reduced greenhouse gas emissions across its manufacturing sites by more than 20 percent, surpassing its original goal.

By Ingredients

Rice-based puffed products dominate the ingredients segment with a 38% share, supported by their use in gluten-free and low-fat snacks. Rice enables light texture and high digestibility, which attracts health-focused buyers. Wheat and corn remain widely used due to strong supply chains and established applications in snack formats. Multigrain options grow as brands blend oats, barley, and millet to raise fiber and protein content. The push toward nutritious and natural ingredients strengthens adoption across all sub-segments.

- For instance, Frito-Lay North America, a division of PepsiCo, introduced Sun Chips multigrain snacks, which use a blend of corn, oats, and wheat to offer a good source of whole grains and are made with sunflower oil, appealing to consumers seeking healthier options.

By Distribution Channel

Supermarkets and hypermarkets hold the dominant position with a 46% share, supported by wide product visibility and strong consumer footfall. These stores offer large assortments, allowing brands to promote new puffed snacks and cereals effectively. Convenience stores maintain steady demand through impulse purchases and smaller pack formats. Online retail expands due to bulk ordering, digital promotions, and home delivery advantages. Specialty stores attract buyers seeking organic or premium puffed products, further strengthening channel diversity.

Key Growth Drivers

Rising Demand for Healthy and Low-Calorie Snacks

Health-focused consumers drive strong adoption of puffed foods as they seek low-calorie, baked, and oil-free snack options. Manufacturers respond with clean-label, gluten-free, and fortified product lines that support better nutrition without compromising taste. Growing awareness of digestive health and controlled calorie intake increases interest in puffed grains, multigrain snacks, and high-fiber cereals. Brands leverage natural ingredients and simple processing methods, which strengthen consumer trust and expand category acceptance. This shift toward mindful snacking continues to boost market penetration across retail and online channels.

- For instance, Nestlé upgraded its cereal line by deploying a hot-air puffing module, which reduced oil use and cut product density for lighter texture. The system also fortified each serving with fiber using a stable chicory-root extract.

Expansion of Convenient and Ready-to-Eat Food Consumption

Urban lifestyles, busy schedules, and rising workforce participation fuel demand for convenient puffed foods that offer quick consumption and portability. Consumers prefer puffed snacks and cereals due to their long shelf life, lightweight packaging, and ease of storage. Foodservice operators add puffed ingredients in meals and dessert applications to enhance texture and improve menu variety. This convenience-driven shift encourages manufacturers to introduce single-serve packs and value-added flavor options. The broad appeal supports consistent growth across supermarkets, convenience stores, and digital retail platforms.

- For instance, General Mills improved its cereal production by developing and installing a continuous puffing gun process to increase output, which produces a more uniform product with less burned pieces compared to the previous batch method.

Product Innovation and Flavor Diversification

Continuous innovation shapes market expansion as brands develop new flavors, textures, and ingredient blends that appeal to diverse taste preferences. Companies experiment with savory, spicy, and ethnic flavor profiles to attract younger consumers seeking novel snacking experiences. Multigrain and protein-enhanced puffed variants gain momentum as consumers explore functional foods. Advanced extrusion technology improves product consistency and volume, enabling large-scale production of high-quality puffed items. This innovation-driven environment strengthens brand competitiveness and boosts category growth across global markets.

Key Trends & Opportunities

Growth of Clean-Label and Plant-Based Formulations

Clean-label and plant-based puffed foods represent a major trend as consumers shift toward natural ingredients and minimal processing. Brands introduce plant-derived proteins, whole grains, and allergen-friendly snacks to meet rising dietary expectations. Demand increases for products free from artificial colors, preservatives, and trans fats. This trend encourages manufacturers to reformulate existing lines and launch organic or non-GMO puffed items. Strong preference for sustainable and transparent labeling offers long-term opportunities, especially in health-conscious markets and premium retail channels.

- For instance, PepsiCo uses extrusion technology to produce plant-based puffed snacks using ingredients like lentil and chickpea bases, and this process can be optimized for nutrient retention.

Rising Online Retail Adoption and Direct-to-Consumer Models

Digital commerce enhances access to puffed food products through subscription packs, curated snack boxes, and personalized recommendations. Consumers benefit from wider product variety and competitive pricing online. Brands leverage e-commerce analytics to introduce targeted promotions and limited-edition flavors. Small manufacturers gain visibility through online marketplaces, improving reach without major retail investment. This trend expands opportunities for niche categories such as gourmet puffed snacks, organic cereals, and multigrain blends. The growth of home delivery further accelerates demand across developed and emerging regions.

- For instance, Weetabix Limited improved its operational efficiency through a business-led digital transformation program, leveraging a new enterprise resource planning (ERP) system.

Key Challenges

Fluctuating Raw Material Costs

Volatile prices of rice, corn, wheat, and multigrain ingredients create cost pressures for manufacturers. Weather disruptions, supply chain delays, and global commodity shifts affect stability in sourcing essential grains used in puffed products. These fluctuations raise production costs and push companies to adjust pricing, which may reduce consumer affordability. Manufacturers adopt long-term contracts, diversified sourcing, and improved processing efficiency to control cost swings. However, persistent instability remains a challenge for maintaining consistent margins and competitive pricing strategies.

Intense Competition and Product Saturation

The market faces strong competition as numerous global and regional brands offer similar puffed snacks, cereals, and grain-based products. High product saturation limits differentiation and increases promotional spending. Smaller players struggle to compete with established brands that possess stronger distribution networks and higher marketing budgets. Companies must innovate with unique flavors, healthier ingredients, and value-added packaging to maintain visibility. The challenge intensifies as private-label products gain traction, offering lower-priced alternatives that attract cost-sensitive consumers.

Regional Analysis

North America

North America holds a 32% market share, supported by strong demand for convenient and healthier snacking options. Consumers favor puffed snacks and cereals with clean-label ingredients, low fat, and added nutrients. Major brands introduce innovative flavors and protein-enhanced variants to meet evolving dietary habits. Retail expansion and strong online delivery networks improve access to premium and organic puffed products. Busy lifestyles and high consumer spending strengthen category penetration across supermarkets and convenience stores. Growing interest in plant-based and multigrain formulations continues to drive regional market growth.

Europe

Europe accounts for a 28% market share, driven by rising preference for natural, sustainable, and low-calorie puffed snacks. Consumers adopt puffed grains and cereals as part of balanced diets that focus on fiber intake and reduced additives. Strict food regulations encourage manufacturers to use clean-label ingredients and transparent sourcing. Growth accelerates through strong retail networks and increasing demand for organic puffed products in Western Europe. Flavor innovation and gluten-free variants attract health-conscious buyers. Expanding private-label offerings improve affordability and widen consumer reach across the region.

Asia Pacific

Asia Pacific leads the global market with a 34% market share, fueled by rapid urbanization, expanding middle-class consumption, and strong demand for ready-to-eat snacks. Traditional grain-based puffed foods support high regional acceptance, while modern flavored variants attract younger consumers. Manufacturers scale production with advanced extrusion technology to meet rising demand across India, China, and Southeast Asia. Growing interest in affordable, portable, and nutrient-enhanced puffed items strengthens distribution through supermarkets and convenience stores. E-commerce growth boosts direct-to-consumer sales, further accelerating regional expansion.

Latin America

Latin America holds a 4% market share, supported by rising interest in convenient snack formats and expanding retail penetration. Consumers adopt puffed snacks due to affordability, diverse flavors, and suitability for on-the-go consumption. Local brands introduce corn and multigrain-based puffed items to match regional taste preferences. Growth improves as supermarkets and neighborhood stores increase shelf space for packaged snacks. Health trends progress slowly, yet demand for low-oil and baked alternatives is rising. Digital retail platforms broaden access, helping international brands gain visibility across key markets.

Middle East & Africa

The Middle East & Africa region captures a 2% market share, driven by gradual adoption of packaged snacks and increasing exposure to global food trends. Urban consumers show growing interest in puffed cereals and light snacks that offer convenience and longer shelf life. Retail expansion and rising supermarket chains improve access to branded puffed products. Imported goods dominate, but regional manufacturers expand production to meet cost-sensitive demand. Health awareness is increasing, supporting uptake of low-fat and multigrain puffed variants. Economic growth and improving distribution networks contribute to steady market development.

Market Segmentations:

By Product Type

- Puffed Snacks

- Puffed Cereals

- Puffed Confectionery

- Puffed Grains

By Ingredients

- Rice

- Wheat

- Corn

- Multigrain

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By End User

- Household Consumers

- Foodservice Operators

- Institutional Buyers

- Cafés & Snack Bars

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive andscape

The competitive landscape features leading players such as Kellogg Company, General Mills Inc., PepsiCo (Frito-Lay), Nestlé S.A., Conagra Brands Inc., Ricegrowers Limited (SunRice), Arcor Group, Bagrry’s India Ltd., The Quaker Oats Company, and WEETABIX Limited. These companies strengthen their market position through continuous product innovation, flavor diversification, and expansion of healthier puffed snack and cereal lines. Major brands invest in advanced extrusion technology to improve texture, volume, and nutrient retention, supporting better product quality. Strategic partnerships with retailers enhance shelf visibility, while e-commerce channels expand consumer reach. Companies also focus on clean-label, gluten-free, and plant-based offerings to align with rising health trends. Private-label products intensify competition by offering lower-cost alternatives, pushing established players to prioritize branding, packaging upgrades, and targeted marketing campaigns. Regional manufacturers gain traction by introducing affordable, locally flavored puffed products, further shaping the competitive dynamics of the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kellogg Company

- General Mills Inc.

- PepsiCo (Frito-Lay)

- Nestlé S.A.

- Conagra Brands Inc.

- Ricegrowers Limited (SunRice)

- Arcor Group

- Bagrry’s India Ltd.

- The Quaker Oats Company

- WEETABIX Limited

Recent Developments

- In May 2025, General Mills, Inc. pushed a seasonal line-up that included salty snacks and sweet treats along with their cereals. The update included new snack-type items.

- In March 2025, Nestlé S.A. (via Nestlé India) introduced a new version of a cereal product under the “CEREGROW” brand that contains no refined sugar — showing a move toward healthier breakfast/snack offerings

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ingredients, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for healthier, low-calorie puffed snacks will rise as consumers shift toward mindful eating.

- Expansion of gluten-free, multigrain, and plant-based puffed products will strengthen product diversity.

- Flavor innovation will accelerate, with brands introducing regional, spicy, and protein-rich variants.

- Online retail channels will grow rapidly as consumers prefer doorstep delivery and wider product choice.

- Advanced extrusion technology will improve texture, volume, and nutrient retention in puffed foods.

- Clean-label and natural ingredient formulations will gain stronger adoption across global markets.

- Premium puffed snacks will gain traction as buyers seek high-quality, value-added offerings.

- Local manufacturers will expand presence in emerging markets through affordable and culturally aligned flavors.

- Sustainability initiatives will push brands to adopt eco-friendly packaging and transparent sourcing.

- Private-label competition will intensify, encouraging brands to invest more in branding, innovation, and targeted marketing.