Market Overview:

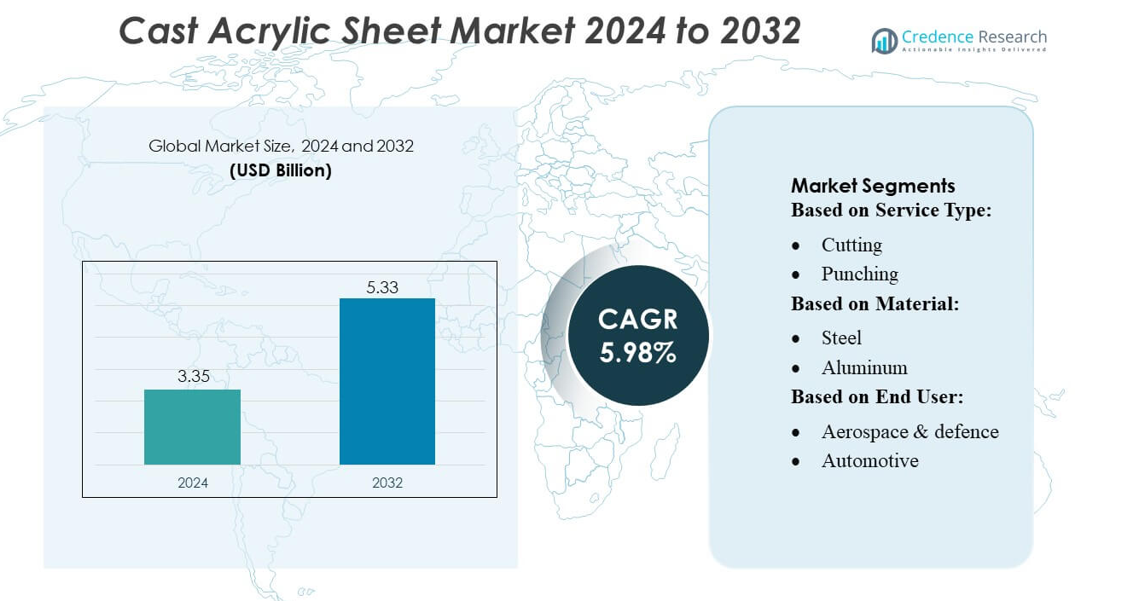

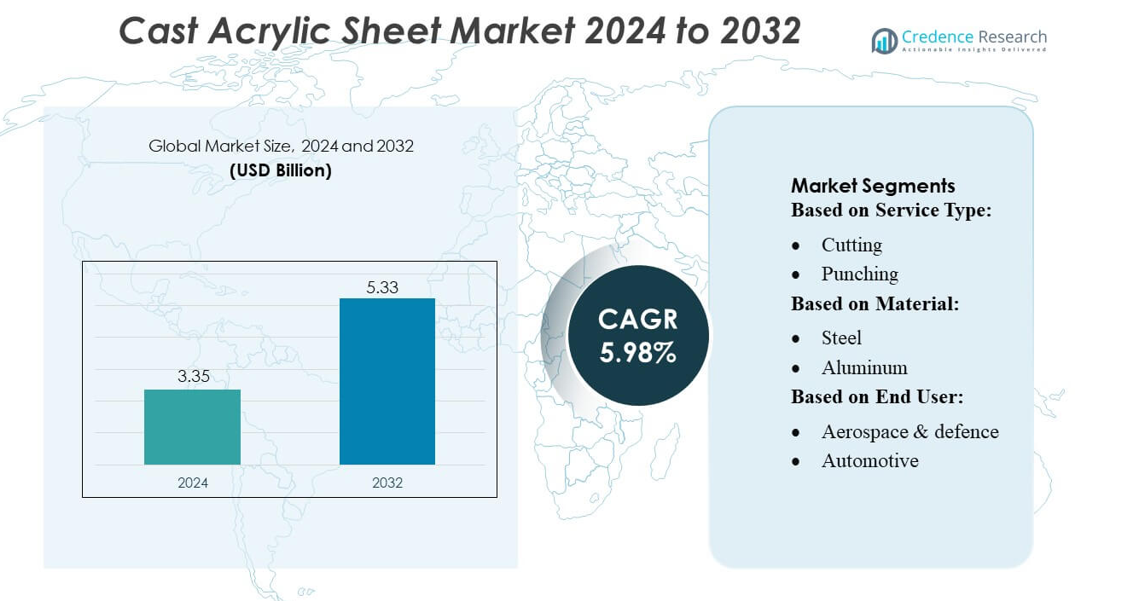

Cast Acrylic Sheet Market size was valued USD 3.35 billion in 2024 and is anticipated to reach USD 5.33 billion by 2032, at a CAGR of 5.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cast Acrylic Sheet Market Size 2024 |

USD 3.35 billion |

| Cast Acrylic Sheet Market, CAGR |

5.98% |

| Cast Acrylic Sheet Market Size 2032 |

USD 5.33 billion |

The cast acrylic sheet market is led by prominent players including Howmet Aerospace, Inc., Tata BlueScope Steel Private Limited, Nippon Steel Corporation, Ma’aden, Baosteel Group, JSW Steel Ltd, POSCO, Hindalco Industries Limited, United States Steel Corporation, and JFE Steel, who collectively drive innovation through advanced fabrication, customization, and sustainable product offerings. These companies focus on high-performance, eco-friendly, and aesthetically versatile acrylic sheets catering to construction, automotive, electronics, and industrial applications. Asia-Pacific emerges as the leading region, holding approximately 32% of the global market share, driven by rapid urbanization, infrastructure development, and industrial growth in countries such as China, India, and Japan. The region benefits from large-scale production capacities, cost competitiveness, and increasing adoption of decorative and functional acrylic panels, positioning it as the key hub for both regional and international market expansion.

Market Insights

- The cast acrylic sheet market size was valued at USD 3.35 billion in 2024 and is projected to reach USD 5.33 billion by 2032, growing at a CAGR of 5.98% during the forecast period.

- Growth is driven by rising demand in construction, automotive, and electronics sectors, along with increasing adoption of decorative and functional acrylic sheets.

- Key trends include technological advancements in cutting, bending, and forming processes, growing preference for sustainable and eco-friendly materials, and rising use of large-format and curved acrylic panels.

- The market is highly competitive, with leading players focusing on innovation, customization, and high-performance solutions to maintain market share, while price fluctuations of raw materials remain a major restraint.

- Asia-Pacific dominates the market with approximately 32% share, supported by rapid urbanization and industrial growth, while construction and automotive segments lead in terms of end-user adoption, driving regional and global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

In the cast acrylic sheet market, the cutting segment dominates the service type category, accounting for approximately 38% of the market share. The high demand for customized sizes and precision applications in signage, displays, and fabrication projects drives this growth. Forming and bending services are also gaining traction, particularly in the production of curved or complex structures for automotive and architectural applications. Advancements in CNC and laser cutting technologies have enhanced efficiency and accuracy, enabling manufacturers to meet the increasing demand for tailored acrylic solutions across industrial and commercial sectors.

- For instance, CNC and laser cutting services can deliver tolerances as tight as ±0.03 mm on acrylic or plastic sheets when utilizing high-end machinery and specialized processes, enabling fine-detail work and minimal material waste—a level of precision used to meet stringent industrial and commercial requirements.

By Material

Acrylic sheets manufactured from aluminum-reinforced composites hold the leading position in the material segment, capturing around 42% of the market. Their superior durability, lightweight nature, and resistance to corrosion make them ideal for automotive, construction, and aerospace applications. Steel-based acrylic sheets are also widely used for heavy-duty applications where structural integrity is critical. The market is further driven by technological innovations in composite materials that improve impact resistance and optical clarity, enabling wider adoption across premium electronics, signage, and industrial machinery applications.

- For instance, ZINCALUME® and COLORBOND® Steel — are described in company documentation as aluminium‑zinc (Al‑Zn) coated steels, with base metal thickness from 0.30 mm to 1.30 mm and yield strength ranging from 300 MPa to 550 MPa.

By End User

The construction sector is the dominant end-user segment, representing nearly 35% of the cast acrylic sheet market. Rapid urbanization and the growing use of acrylic panels in facades, interiors, and decorative applications drive this demand. Automotive and electronics sectors are witnessing significant growth due to the adoption of acrylic for lightweight components, dashboards, and display panels. Increased infrastructure investments, rising demand for aesthetically versatile materials, and the emphasis on energy-efficient and sustainable building solutions continue to propel the use of cast acrylic sheets across commercial and residential construction projects.

Key Growth Drivers

Rising Demand in Construction and Interior Applications

The growing use of cast acrylic sheets in residential and commercial construction drives market expansion. Architects and designers increasingly prefer acrylic for its aesthetic versatility, lightweight nature, and durability in facades, partitions, and decorative elements. Enhanced optical clarity and resistance to UV degradation make it suitable for both indoor and outdoor applications. Rapid urbanization and infrastructural development, particularly in emerging economies, further fuel demand, with manufacturers responding through high-precision, large-format sheets to meet custom requirements across modern architectural and interior design projects.

- For instance, Ma’aden’s ongoing sustainability and emissions‑reduction work includes CO₂‑capture technology tied to phosphate and phosphogypsum processing, plus production of “ultra-low carbon ammonia” (reported at 614,000 tons) as an example of environmental and operational innovation.

Increasing Adoption in Automotive and Electronics

Cast acrylic sheets are witnessing high adoption in automotive and electronics industries due to their lightweight, impact resistance, and transparency. Automotive manufacturers utilize acrylic for instrument panels, lighting covers, and decorative components, while electronics companies integrate it into display screens, protective panels, and housings. Rising emphasis on fuel efficiency through lightweight materials, along with the proliferation of consumer electronics requiring clear, durable components, drives market growth. Technological advancements in thermoforming and bending also enhance design flexibility, enabling manufacturers to cater to complex automotive and electronic applications.

- For instance, Baosteel’s sales volume of cold‑rolled automotive steel sheets reportedly exceeded 9 million tons, and its overall portfolio sales hit 27.92 million tons.

Technological Advancements in Fabrication and Customization

Advances in cutting, bending, forming, and finishing technologies accelerate the cast acrylic sheet market by enabling precision and customization. CNC machining, laser cutting, and automated thermoforming allow manufacturers to produce complex shapes, large panels, and intricate designs with minimal material wastage. These capabilities support industries demanding high-quality, tailored solutions, such as aerospace, signage, and industrial machinery. Improved fabrication techniques reduce lead times and production costs, making cast acrylic sheets more attractive to commercial, industrial, and creative applications, ultimately boosting adoption across multiple sectors.

Key Trends & Opportunities

Sustainable and Eco-Friendly Materials

There is a growing trend toward environmentally sustainable acrylic materials, with manufacturers focusing on recyclable and low-emission production methods. Biodegradable coatings, solvent-free finishing, and post-consumer recycled content are gaining attention, especially in construction and packaging applications. This focus on sustainability opens new opportunities for premium product lines and aligns with regulatory pressures and consumer demand for greener materials. Companies investing in eco-friendly innovations can differentiate themselves in a competitive market while meeting both environmental compliance and end-user expectations.

- For instance, JSW has eliminated petcoke-based steam boilers at its Rajpura plant, switching to piped natural gas (PNG), using 4,278,846 standard cubic meters (SCM) of PNG in FY 2023‑24 to generate 57,051 metric tons of steam, thereby avoiding approximately 5,300 tCO₂ per year.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities for cast acrylic sheets. Rapid urbanization, industrialization, and infrastructure investments drive demand in construction, automotive, and electronics sectors. Local manufacturers are increasingly adopting advanced fabrication technologies and establishing regional production facilities to meet rising demand. Strategic partnerships, distribution expansions, and cost-effective production techniques provide an opportunity for global players to capitalize on untapped markets while offering customized, high-quality acrylic solutions tailored to regional preferences and regulatory requirements.

- For instance, POSCO plans to expand its crude‑steel production capacity from 5.1 million tons to 23.1 million tons globally by 2030 through overseas investments — underlining focus on steel, not plastics.

Innovation in Design and Customization

Enhanced design flexibility and customization options are reshaping the market. Manufacturers are introducing patterned, colored, and textured acrylic sheets, as well as large-format and curved panels for premium applications. Integration with LED lighting and smart display systems creates opportunities in signage, retail, and architectural projects. This trend allows companies to target high-end segments and differentiate their offerings. By leveraging technological innovations in fabrication, manufacturers can provide bespoke solutions, boosting adoption across diverse sectors while increasing brand value and customer loyalty.

Key Challenges

Price Volatility of Raw Materials

Fluctuations in the cost of raw materials, such as methyl methacrylate, directly impact the profitability of cast acrylic sheet manufacturers. Supply chain disruptions, energy price variations, and geopolitical tensions can exacerbate cost volatility, leading to higher production expenses and potential price increases for end-users. Smaller manufacturers may struggle to absorb these costs, affecting market stability. Maintaining competitive pricing while ensuring product quality and consistent supply remains a critical challenge, particularly for markets where cost sensitivity is high, such as construction and automotive segments.

Competition from Alternative Materials

The cast acrylic sheet market faces strong competition from alternative materials such as polycarbonate, PETG, glass, and PVC. These substitutes often offer comparable durability, transparency, and flexibility at lower costs or with superior impact resistance. Industries like construction, automotive, and electronics may switch to alternatives depending on performance requirements and budget constraints. Manufacturers must continuously innovate, improve product quality, and differentiate through customization and value-added services to retain market share while addressing the threat of material substitution across various applications.

Regional Analysis

North America

North America holds a significant share in the cast acrylic sheet market, accounting for approximately 28% of the global market. Strong demand from the construction, automotive, and electronics sectors drives growth, with architects and manufacturers favoring acrylic for its aesthetic appeal, durability, and lightweight properties. The United States dominates the regional market due to high infrastructure investments and technological advancements in fabrication and finishing. Additionally, rising adoption in automotive interiors and electronic displays supports expansion. Government regulations promoting sustainable materials further boost demand for eco-friendly acrylic sheets, solidifying North America’s position as a key market globally.

Europe

Europe represents around 25% of the global cast acrylic sheet market, driven by construction, automotive, and industrial machinery applications. Countries like Germany, France, and the UK lead in adopting innovative and decorative acrylic solutions for facades, interiors, and industrial components. Increased urbanization, stringent environmental regulations, and rising demand for energy-efficient building materials support market growth. Technological advancements in CNC cutting, laser engraving, and thermoforming enhance design flexibility and product quality. Additionally, the region’s focus on sustainable and recyclable materials aligns with evolving consumer and regulatory expectations, creating opportunities for premium, eco-conscious cast acrylic sheet offerings.

Asia-Pacific

Asia-Pacific dominates the global cast acrylic sheet market with nearly 32% share, fueled by rapid industrialization, urbanization, and infrastructure expansion. China, India, and Japan are major contributors due to high construction activities, automotive manufacturing, and electronics production. Rising consumer awareness, growing retail and commercial projects, and increased adoption of decorative and functional acrylic panels drive demand. Local manufacturers are investing in advanced fabrication technologies to cater to diverse end-user requirements. The region’s cost competitiveness and large-scale production capacity make it an attractive hub for global players seeking market expansion and supply chain optimization.

Latin America

Latin America accounts for approximately 8% of the global cast acrylic sheet market, driven primarily by construction, automotive, and signage applications. Brazil and Mexico lead regional demand due to urban development, infrastructure projects, and industrial expansion. Rising investments in commercial buildings and interior design projects increase the adoption of decorative and functional acrylic sheets. Manufacturers are focusing on establishing localized production and distribution networks to meet growing demand and reduce import dependency. The market is further supported by initiatives to adopt eco-friendly materials and modern fabrication technologies, enabling high-quality, customized acrylic solutions for both residential and industrial applications.

Middle East & Africa

The Middle East & Africa region holds about 7% of the global cast acrylic sheet market, driven by construction, industrial machinery, and telecommunication sectors. High demand for decorative, durable, and lightweight panels in commercial and residential infrastructure projects propels growth. The UAE, Saudi Arabia, and South Africa are key markets due to ongoing urbanization and large-scale infrastructure developments. Investments in tourism, retail, and transportation sectors further increase acrylic sheet adoption. Market expansion is supported by the region’s focus on premium and customizable solutions, as well as increasing awareness of sustainable materials, creating opportunities for both domestic and international manufacturers.

Market Segmentations:

By Service Type:

By Material:

By End User:

- Aerospace & defence

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cast acrylic sheet market is highly competitive, with key players such as Howmet Aerospace, Inc., Tata BlueScope Steel Private Limited, Nippon Steel Corporation, Ma’aden, Baosteel Group, JSW Steel Ltd, POSCO, Hindalco Industries Limited, United States Steel Corporation, and JFE Steel. The cast acrylic sheet market is highly competitive, driven by innovation, quality, and customization capabilities. Companies focus on enhancing product offerings through advanced fabrication techniques such as CNC cutting, laser engraving, and thermoforming, which enable precise designs and complex shapes. Market players are increasingly investing in R&D to develop sustainable, high-performance, and specialty acrylic sheets that cater to construction, automotive, electronics, and industrial applications. Strategic expansions, capacity enhancements, and robust distribution networks strengthen market positioning, while the introduction of colored, textured, and large-format sheets addresses growing demand for aesthetic and functional solutions. Continuous innovation and superior customer support remain critical for maintaining competitiveness in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Malaysia-based BWYS Group Bhd plant in Sungai Bakap will primarily manufacture roofing sheets and trusses, as well as scaffoldings. The expansion is intended to increase the company’s production capacity for these existing product lines in response to growing demand in the construction industry.

- In January 2024, Lantek and TECHNOLOGY Italiana formed a strategic partnership to combine Lantek’s sheet metal software with TECHNOLOGY Italiana’s punching machinery to provide innovative, integrated solutions for the market. The collaboration, announced during an open house event, aims to offer clients comprehensive software and hardware packages to enhance productivity and efficiency in the sheet metal processing industry.

- In July 2023, ArcelorMittal Nippon Steel India (AM/NS India) and Festo India signed a Memorandum of Understanding (MoU) to collaborate on higher and vocational education initiatives. The partnership focuses on establishing the New Age Makers Institute of Technology (NAMTECH), a new educational institution aimed at developing industry-ready technical talent in manufacturing and sustainability

Report Coverage

The research report offers an in-depth analysis based on Service Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cast acrylic sheet market is expected to grow steadily due to rising demand in construction and interior design applications.

- Increasing adoption in automotive and electronics sectors will drive further market expansion.

- Technological advancements in cutting, bending, and forming processes will enhance customization capabilities.

- Demand for sustainable and eco-friendly acrylic sheets will influence product development and manufacturing practices.

- Growth in emerging economies will create new opportunities for regional and global manufacturers.

- The trend of large-format and curved acrylic panels will continue to gain popularity in architectural applications.

- Integration of acrylic sheets with LED and smart display systems will boost adoption in signage and retail sectors.

- Expansion of fabrication and distribution networks will improve market accessibility and supply efficiency.

- Continuous innovation in design, texture, and color will attract premium applications and end-users.

- Rising urbanization and infrastructure projects will sustain long-term demand for cast acrylic sheets globally.