Market Overview

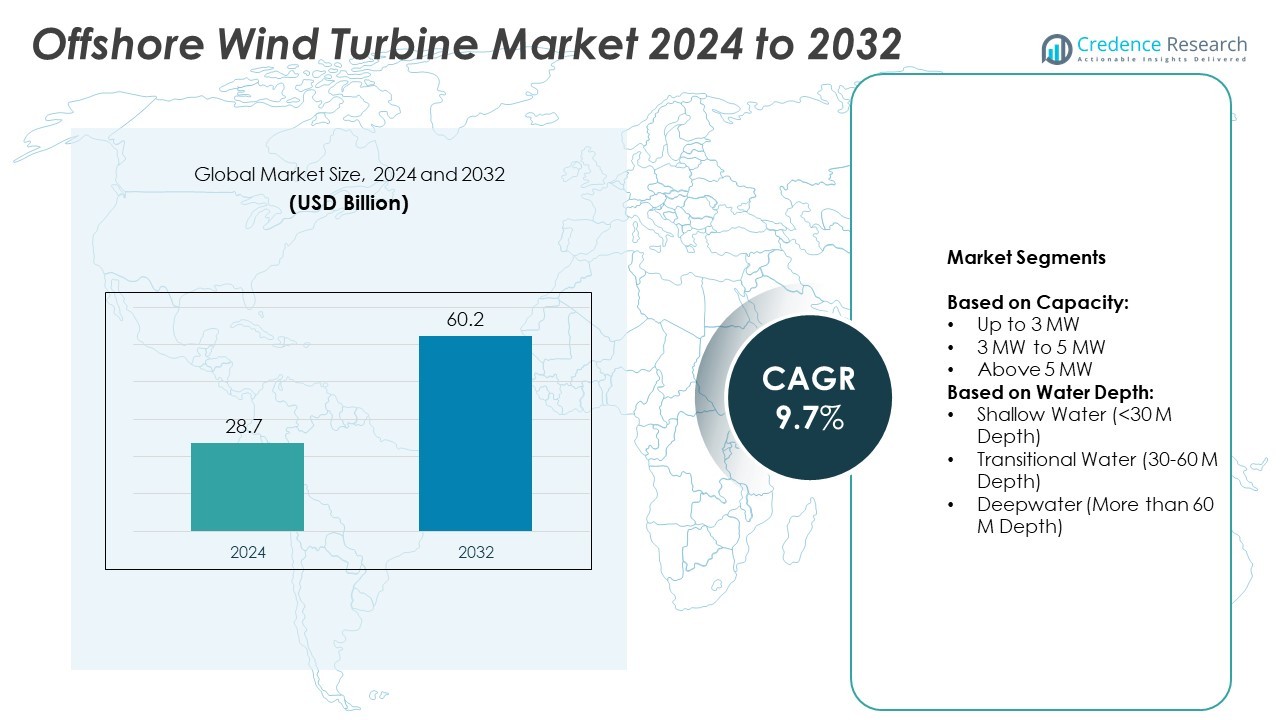

Offshore Wind Turbine Market size was valued at USD 28.7 billion in 2024 and is anticipated to reach USD 60.2 billion by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Wind Turbine Market Size 2024 |

USD 28.7 Billion |

| Offshore Wind Turbine Market, CAGR |

9.7% |

| Offshore Wind Turbine Market Size 2032 |

USD 60.2 Billion |

The Offshore Wind Turbine market grows rapidly due to rising investments in renewable energy and supportive government policies. Advancements in turbine technology, including larger capacities and floating offshore solutions, improve efficiency and enable deepwater deployment. Increasing corporate commitments to sustainable energy and favorable regulatory frameworks further accelerate adoption. Digitalization, predictive maintenance, and smart monitoring systems enhance operational reliability and reduce costs. Expanding offshore projects worldwide strengthen market growth, driven by global clean energy goals and the rising demand for sustainable power solutions.

The Offshore Wind Turbine market shows strong growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe leads in technological advancements and large-scale offshore projects, while Asia Pacific witnesses rapid expansion driven by China, Japan, and South Korea. North America focuses on large-capacity installations supported by government initiatives. Key players such as Mitsubishi Heavy Industries, Siemens, General Electric Company, and Goldwind drive innovation, strategic partnerships, and project development to strengthen their global market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Offshore Wind Turbine market was valued at USD 28.7 billion in 2024 and is projected to reach USD 60.2 billion by 2032, growing at a CAGR of 9.7%.

- Rising government support, clean energy targets, and increased renewable energy investments drive strong market expansion worldwide.

- Technological advancements, including floating offshore wind platforms and high-capacity turbines, improve efficiency and enable deployment in deeper waters.

- Leading companies focus on research, innovation, and strategic collaborations to enhance global presence and strengthen competitive positioning.

- High installation costs, supply chain constraints, and complex regulatory processes remain significant challenges for industry growth.

- Europe leads in offshore installations due to advanced infrastructure, while Asia Pacific experiences rapid growth supported by China, Japan, and South Korea.

- North America invests in large-scale offshore projects, while Latin America and the Middle East & Africa emerge as developing markets with growing renewable energy initiatives.

Market Drivers

Rising Investments in Renewable Energy Projects

The Offshore Wind Turbine market benefits from significant investments in renewable energy infrastructure worldwide. Governments and private players allocate large funds to accelerate clean energy transition targets. It gains support through favorable tax incentives, subsidies, and public-private partnerships. Growing energy demand pushes authorities to explore offshore wind potential for sustainable power generation. Global decarbonization initiatives further strengthen capital inflows into offshore installations. Developers prioritize advanced turbine technologies to improve efficiency and project returns. Expanding financial backing ensures consistent project development in established and emerging economies.

- For instance, Ørsted is a global leader in offshore wind, their installed capacity is 10.2 GW., positioning them as a global leader in the sector. The company is aiming for a total of 27 GW by the end of 2027.

Advancements in Turbine Technology and Efficiency

The Offshore Wind Turbine market expands due to continuous improvements in turbine design and performance. Manufacturers develop larger and more efficient turbines capable of generating higher energy outputs. It benefits from advanced blade structures, optimized power electronics, and enhanced load management systems. Floating offshore wind technology enables installations in deepwater locations, unlocking vast untapped wind resources. Automation and digital monitoring tools improve operational reliability and reduce maintenance costs. Reduced levelized cost of energy (LCOE) makes offshore wind competitive with traditional energy sources. Rising adoption of smart technologies drives sustainable market growth.

- For instance, Vestas launched the V236-15.0 MW turbine in February 2021. It has a 236-meter rotor diameter and is capable of generating around 80 GWh annually from a single unit, which is enough to power approximately 20,000 European households and displace over 38,000 tonnes of CO2 every year.

Supportive Government Policies and Energy Transition Goals

The Offshore Wind Turbine market witnesses strong growth driven by policy support and sustainability goals. Governments enforce renewable energy targets to reduce dependence on fossil fuels. It benefits from green energy mandates, competitive bidding processes, and regulatory frameworks supporting offshore wind projects. International climate agreements accelerate adoption through funding and cross-border collaborations. Regional energy diversification plans encourage faster offshore wind deployment to secure power supply. Streamlined approval processes reduce project delays and encourage investor participation. Policy-driven expansion creates long-term stability and confidence for stakeholders.

Growing Corporate Demand and Power Purchase Agreements (PPAs)

The Offshore Wind Turbine market experiences rising demand due to increasing corporate commitments to clean energy. Large organizations secure long-term PPAs to source electricity from offshore wind farms. It supports businesses aiming to achieve carbon neutrality and energy cost optimization. Energy-intensive sectors such as technology, manufacturing, and transportation drive bulk power procurement. Strategic alliances between developers and corporations enhance large-scale project feasibility. Offshore wind’s scalability attracts investments from global enterprises seeking sustainable energy solutions. Accelerating corporate adoption complements government-led initiatives, creating steady market opportunities worldwide.

Market Trends

Expansion of Floating Offshore Wind Projects

The Offshore Wind Turbine market sees a growing shift toward floating offshore wind farms. Traditional fixed-bottom structures limit installation to shallow waters, but floating technology enables deployment in deeper seas. It allows developers to access high-wind regions previously unreachable with conventional systems. Advancements in floating platforms enhance stability, efficiency, and scalability. Several countries invest heavily in pilot projects to test cost-effective solutions. Increasing global focus on maximizing offshore wind capacity strengthens adoption of floating infrastructure. Emerging deepwater markets accelerate technology integration and drive sector growth.

- For instance, Equinor’s Hywind Scotland floating wind farm, with 30 MW capacity, achieved a record capacity factor of 57.1% in the 12 months to March 2021.

Integration of Digitalization and Smart Monitoring Systems

The Offshore Wind Turbine market benefits from rapid adoption of digital tools and predictive technologies. Operators use artificial intelligence, IoT sensors, and data analytics to optimize turbine performance. It enables real-time monitoring, fault detection, and predictive maintenance, reducing operational downtime. Digital twin technology simulates turbine performance, improving energy yield and extending equipment lifespan. Cloud-based platforms provide remote asset management and streamlined operations. Companies focus on automation and machine learning to enhance reliability and efficiency. Integration of smart technologies drives cost savings and operational improvements across the industry.

- For instance, DEME Group’s offshore installation vessels cost over 200 million euros each, reflecting the heavy investment required for turbine deployment.

Growing Focus on Larger Turbine Capacity and Efficiency

The Offshore Wind Turbine market advances with the introduction of high-capacity turbines for greater energy output. Manufacturers design models exceeding 15 MW to improve production efficiency and reduce per-unit costs. It supports economies of scale and lowers project development timelines. Larger rotor diameters and optimized blade designs capture more wind energy. Developers favor advanced drive-train technologies for reduced maintenance and improved operational performance. Increased investments in next-generation turbines improve competitiveness against traditional power sources. Scaling up turbine size remains a key trend shaping the sector’s future.

Strategic Partnerships and Global Project Collaborations

The Offshore Wind Turbine market grows through expanding collaborations among developers, energy firms, and governments. Companies form strategic alliances to manage large-scale offshore projects and secure financing. It supports technology sharing and accelerates research to improve operational efficiency. Cross-border joint ventures drive expansion in emerging offshore markets with high energy potential. Governments partner with private players to accelerate infrastructure development and ensure energy security. Global energy leaders invest in long-term supply chain resilience and cost optimization. Rising collaborative efforts enable faster adoption and competitive advancements in offshore wind solutions.

Market Challenges Analysis

High Installation Costs and Supply Chain Constraints

The Offshore Wind Turbine market faces significant challenges due to high capital expenditure requirements. Developing large-scale offshore projects demands heavy investments in turbine manufacturing, transportation, and installation. It is further impacted by complex engineering needs and reliance on specialized vessels and equipment. Supply chain disruptions, component shortages, and rising raw material prices increase project delays and operational costs. Limited availability of skilled labor and infrastructure adds pressure to project timelines. Developers often struggle to secure financing, especially in emerging markets where policies are less mature. Managing costs while maintaining efficiency remains a critical industry challenge.

Environmental Concerns and Regulatory Barriers

The Offshore Wind Turbine market encounters obstacles related to environmental impacts and strict regulatory approvals. Offshore projects require extensive assessments to minimize effects on marine life, fishing zones, and coastal ecosystems. It often faces opposition from local communities and environmental groups, delaying project execution. Lengthy permitting processes and complex jurisdictional requirements slow deployment timelines. Variations in policies across regions create uncertainty for developers and investors. Meeting sustainability standards while ensuring compliance with safety and environmental regulations adds operational complexity. Balancing environmental protection with rapid capacity expansion remains a central industry challenge.

Market Opportunities

Expansion into Emerging Offshore Wind Markets

The Offshore Wind Turbine market offers strong opportunities through expansion into untapped regions with high wind potential. Countries in Asia-Pacific, South America, and the Middle East increasingly invest in offshore energy projects. It benefits from supportive policies and rising demand for clean power generation. Governments encourage foreign investments and partnerships to develop large-scale offshore infrastructure. Advances in floating wind technology allow deployment in deepwater locations, unlocking new resource-rich areas. Growing urbanization and industrialization drive the need for sustainable electricity sources. Expanding into developing markets ensures long-term growth and global adoption.

Technological Innovation and Corporate Energy Transition Goals

The Offshore Wind Turbine market creates opportunities through advancements in turbine technology and automation. Manufacturers focus on high-capacity models, predictive maintenance systems, and smart monitoring solutions to improve efficiency. It supports cost reductions, higher energy yields, and extended turbine lifespans. Increasing corporate commitments to renewable energy accelerate demand for power purchase agreements (PPAs). Technology-driven solutions enable developers to optimize operations and deliver competitive pricing models. Collaboration between global companies and governments enhances large-scale project feasibility. Growing innovation and sustainability-focused investments unlock new revenue streams across the offshore wind sector.

Market Segmentation Analysis:

By Capacity:

The Offshore Wind Turbine market is segmented into up to 3 MW, 3 MW to 5 MW, and above 5 MW categories. Turbines up to 3 MW are widely used in small-scale projects and regions with limited energy demand. It is preferred for cost-effective installations requiring minimal infrastructure and shorter timelines. The 3 MW to 5 MW segment dominates due to balanced efficiency, reliability, and adaptability in medium-sized offshore farms. Above 5 MW turbines experience the fastest growth due to rising demand for high-capacity energy generation. Manufacturers invest in advanced designs and larger rotor diameters to optimize performance. Growing focus on maximizing energy output strengthens adoption across utility-scale projects.

- For instance, the U.S. Vineyard Wind project underwent more than three and a half years of environmental review before receiving its final Record of Decision from the Bureau of Ocean Energy Management (BOEM) in May 2021. Construction approval was for its final capacity of 804–806 MW.

By Water Depth:

The Offshore Wind Turbine market is also categorized by shallow water, transitional water, and deepwater installations. Shallow water projects below 30 meters remain the most cost-efficient, attracting investments in regions with favorable seabed conditions. It allows simpler foundations, lower operational costs, and faster construction timelines. Transitional water projects, ranging between 30 and 60 meters, gain traction with technological innovations enabling efficient deployment. Developers increasingly focus on deepwater projects exceeding 60 meters to exploit higher wind resources. Floating offshore platforms play a vital role in accessing these regions with strong and consistent wind speeds. Investment in deepwater infrastructure is expanding rapidly, driven by global energy transition goals and rising clean power demand.

- For instance, Brazil’s Petrobras is evaluating offshore wind projects with potential capacity exceeding 14 GW along its coastline.

Segments:

Based on Capacity:

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

Based on Water Depth:

- Shallow Water (<30 M Depth)

- Transitional Water (30-60 M Depth)

- Deepwater (More than 60 M Depth)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Offshore Wind Turbine market, accounting for 24% in 2024. The region benefits from strong government support, large-scale renewable energy investments, and growing corporate adoption of offshore wind projects. The United States leads market growth with substantial federal and state-level initiatives, including tax credits and streamlined permitting for offshore developments. It focuses on high-capacity projects, particularly along the East Coast, supported by favorable seabed conditions and growing electricity demand. Strategic collaborations between developers, utility companies, and policymakers drive regional expansion. Advancements in turbine technology, coupled with competitive power purchase agreements, strengthen North America’s position as a growing offshore energy hub.

Europe

Europe dominates the Offshore Wind Turbine market with the largest share of 42% in 2024. The region leads global offshore wind adoption, supported by robust infrastructure, advanced technology, and ambitious carbon neutrality goals. Countries such as the United Kingdom, Germany, Denmark, and the Netherlands drive growth through large-scale installations and supportive regulatory frameworks. It benefits from extensive government funding, innovation in floating wind technology, and cross-border energy collaborations. Offshore farms in the North Sea and Baltic Sea contribute heavily to Europe’s high generation capacity. Growing demand for sustainable power among industrial sectors further accelerates development. Europe remains the global leader, setting benchmarks for technological advancements and clean energy strategies.

Asia Pacific

Asia Pacific secures the second-largest share of the Offshore Wind Turbine market, holding 28% in 2024. The region experiences rapid growth driven by rising energy demand, large-scale investments, and expanding urban infrastructure. China leads the segment with extensive offshore capacity additions, while Japan, South Korea, and Taiwan contribute significantly through advanced deepwater projects. It benefits from favorable government policies, financial incentives, and technological innovations supporting faster deployment. Floating wind solutions play a crucial role in regions with challenging seabed conditions. Strategic collaborations between global energy firms and local developers drive competitive project execution. Asia Pacific continues to emerge as a key contributor to future offshore wind capacity expansion.

Latin America

Latin America holds a growing share of the Offshore Wind Turbine market, contributing 4% in 2024. The region focuses on developing offshore energy capacity to diversify power generation and reduce dependence on fossil fuels. Brazil leads growth with strong government initiatives and strategic investments in large-scale offshore wind projects. It benefits from favorable wind resources along the Atlantic coastline, attracting global developers to invest in advanced infrastructure. Chile and Colombia also explore offshore opportunities to meet rising renewable energy targets. Partnerships between local authorities and international energy companies accelerate project execution. Latin America is expected to see steady expansion as policies and financing options become more supportive.

Middle East & Africa (MEA)

The Middle East & Africa region represents 2% of the Offshore Wind Turbine market in 2024, showing early-stage development but significant long-term potential. Countries such as Saudi Arabia, the UAE, and South Africa invest in offshore wind projects to support energy diversification and sustainability goals. It benefits from government-backed renewable initiatives and increasing foreign investments to strengthen clean energy infrastructure. Deepwater resources in Africa and favorable coastal conditions in the Gulf region create opportunities for future growth. Limited local expertise and high initial costs pose current challenges but are mitigated by technology-driven collaborations with global developers. MEA is positioned to emerge as a growing offshore wind hub over the coming decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Heavy Industries, Ltd

- Naval Group

- Nordex SE

- General Electric Company

- MODEC, Inc.

- Goldwind

- Siemens

- ABB

- Iberdrola, S.A.

- Equinor ASA

Competitive Analysis

The Offshore Wind Turbine market is highly competitive, with leading players including Mitsubishi Heavy Industries, Ltd, Naval Group, Nordex SE, General Electric Company, MODEC, Inc., Goldwind, Siemens, ABB, Iberdrola, S.A., and Equinor ASA. These companies focus on developing advanced turbine technologies, optimizing efficiency, and reducing operational costs to strengthen their market presence. They invest heavily in research and development to design high-capacity turbines, enhance floating offshore solutions, and integrate digital monitoring systems. Strategic partnerships and joint ventures with governments, energy firms, and developers accelerate project deployment across key regions. Companies expand global footprints by entering emerging markets with high offshore wind potential. Continuous innovation, competitive pricing models, and sustainable practices drive long-term growth while meeting increasing demand for renewable energy. Intense rivalry fosters rapid adoption of new technologies, improving scalability and lowering energy costs. The market landscape remains dynamic, with players strengthening supply chain capabilities and focusing on large-scale offshore installations to maintain a competitive edge.

Recent Developments

- In July 2025, Nordex SE reported strong results with higher profitability, robust order growth, and solid free cash flow

- In May 2025, Equinor ASA construction on the Empire Wind project resumed after obtaining project financing and securing government approvals

- In February 2025, Mitsubishi Heavy Industries, Ltd said it would review its Japanese offshore wind projects due to a significantly changed business environment

Report Coverage

The research report offers an in-depth analysis based on Capacity, Water Depth and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Floating offshore platforms reach deeper waters and unlock high-wind zones.

- High-capacity turbines above 15 MW dominate utility-scale deployment.

- Digital twins and predictive maintenance boost performance and reduce downtime.

- Cross-border partnerships accelerate project development and share risk.

- Emerging markets in Asia-Pacific and Latin America attract large investments.

- Streamlined permitting processes improve deployment speed and project cost.

- Supply chain ramp-up and local manufacturing strengthen global resilience.

- Integrated energy storage solutions improve grid reliability and flexibility.

- Hybrid offshore farms combine wind, hydrogen, and solar to maximize returns.

- Policy support and renewable targets continue to drive global adoption.