Market Overview

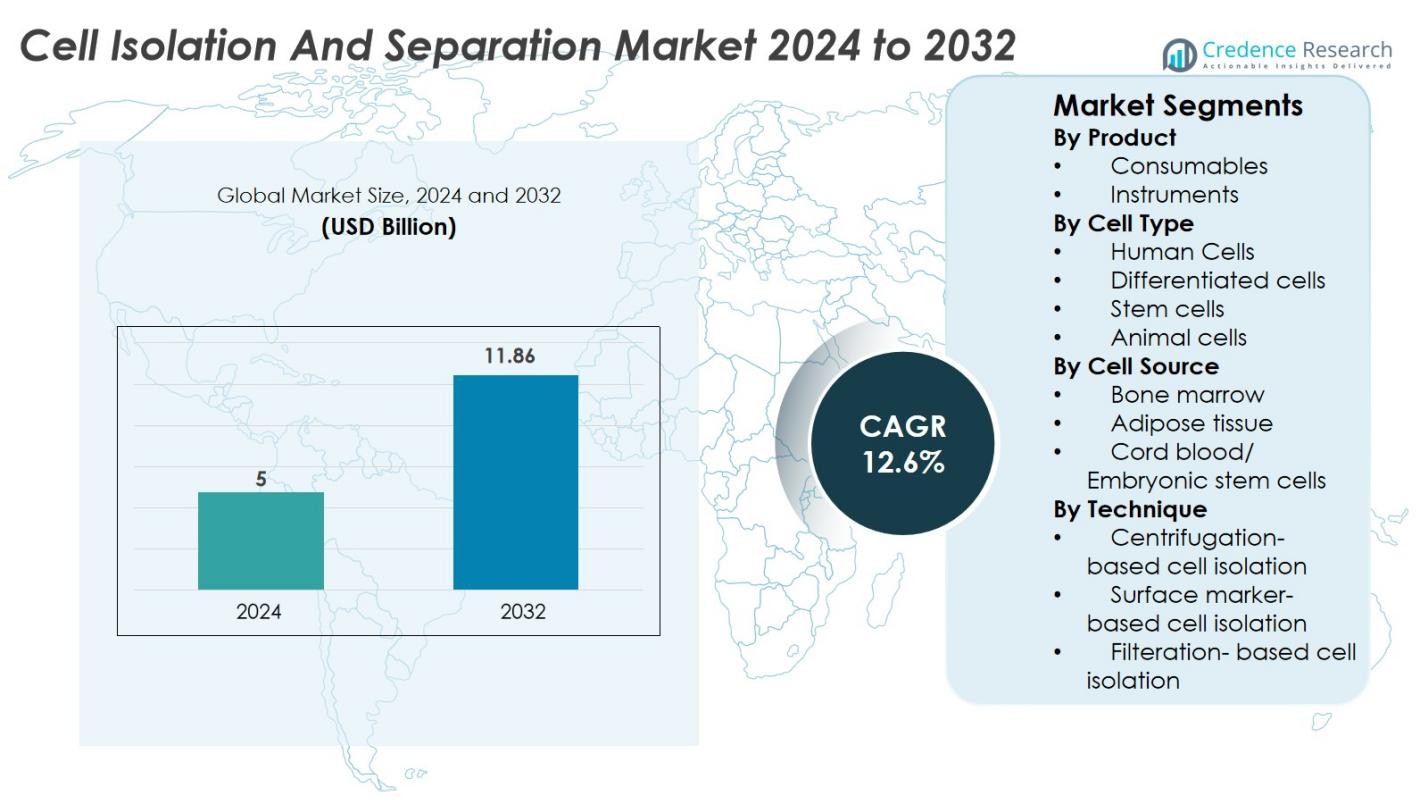

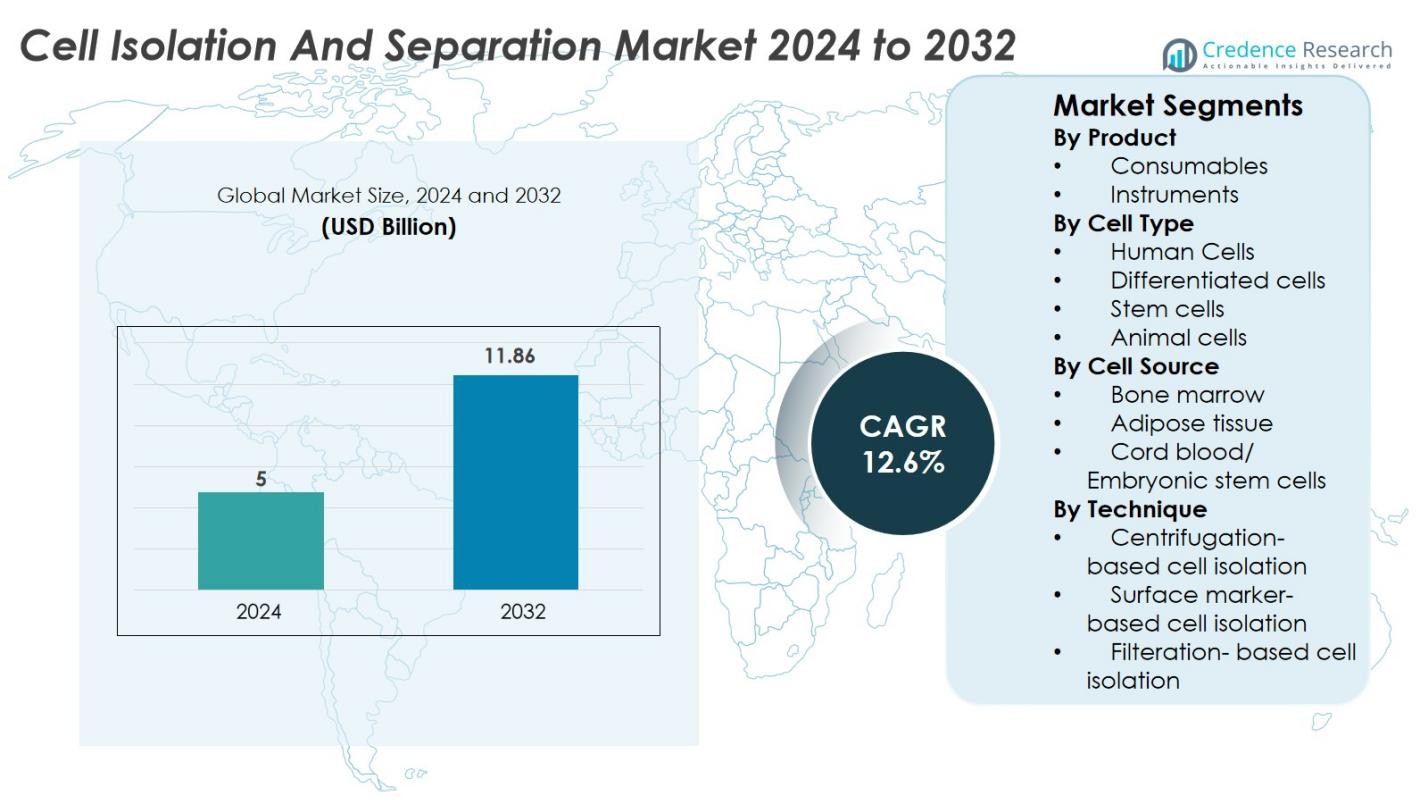

The Cell Isolation and Separation Market size was valued at USD 5 billion in 2024 and is anticipated to reach USD 11.86 billion by 2032, at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Isolation and Separation Market Size 2024 |

USD 5 Billion |

| Cell Isolation and Separation Market, CAGR |

12.6% |

| Cell Isolation and Separation Market Size 2032 |

USD 11.86 Billion |

The Cell Isolation and Separation Market feature prominent players including Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, Merck KGaA, Bio‑Rad Laboratories, Inc., Miltenyi Biotec GmbH, STEMCELL Technologies Inc., Terumo BCT, Inc. and pluriSelect Life Science UG & Co. KG. Thermo Fisher leads with 20% market share, followed by BD and Merck with shares 17%. Regionally, North America dominates with 32% of the global market, driven by strong R&D investment and infrastructure, while Asia‑Pacific follows with 25%, emerging rapidly due to rising biotech activity and healthcare spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Cell Isolation and Separation Market was valued at USD 5 billion in 2024 and is expected to reach USD 11.86 billion by 2032, with a CAGR of 12.6% during the forecast period.

- The rising demand for personalized medicine is a key driver, as it requires precise cell isolation techniques for individualized treatments. This demand is particularly strong in oncology and regenerative medicine, boosting market growth.

- Increasing integration of automation and AI into cell isolation processes is a notable trend, improving efficiency and precision in clinical and research applications.

- Leading companies such as Thermo Fisher Scientific, Becton Dickinson, and Merck KGaA hold significant market shares, with ongoing investments in R&D and strategic partnerships to enhance product portfolios and regional reach.

- North America dominates the market with 36.5% share, followed by Europe at 30% and Asia Pacific at 25%, with the fastest growth expected in emerging Asia-Pacific markets.

Market Segmentation Analysis

By Product

The Cell Isolation and Separation Market is segmented into consumables and instruments. Consumables dominate this segment, accounting for approximately 65% of the market share due to their critical role in maintaining the efficiency and functionality of cell isolation processes. Consumables, including reagents, kits, and media, are essential for separating and isolating cells from samples. The growing demand for consumables is driven by the increasing use of cell-based therapies and research applications in biotechnology and pharmaceuticals. Instruments, while important, follow with 35% market share, as they are typically higher in cost and require regular updates and maintenance.

- For instance, Beckman Coulter’s high-performance flow cytometry instruments, including the CytoFLEX SRT, enable precise and automated cell sorting, improving operational throughput and accuracy by handling up to 20,000 events per second.

By Cell Type

The cell type segment is categorized into human cells, differentiated cells, stem cells, and animal cells. Human cells lead this segment, holding 70% of the market share due to their extensive use in clinical applications such as drug development, regenerative medicine, and cancer research. Stem cells, accounting for around 20% of the market share, are growing rapidly due to advancements in regenerative medicine and stem cell therapies. Differentiated and animal cells, while smaller in market share, contribute to the segment’s diversity, with stem cells being a key driver for market growth.

- For instance, ViaCyte’s stem cell-based therapies, designed for diabetes treatment, have demonstrated the potential to generate insulin-producing cells in clinical trials, marking a significant breakthrough in stem cell research and regenerative medicine.

By Cell Source

The cell source segment includes bone marrow, adipose tissue, and cord blood/embryonic stem cells. Bone marrow is the dominant sub-segment, capturing nearly 50% of the market share, attributed to its critical role in hematopoietic stem cell therapy and regenerative medicine. Adipose tissue follows with 30% market share, gaining traction due to its less invasive collection methods and potential for use in a variety of regenerative treatments. Cord blood/embryonic stem cells account for around 20% of the market, driving innovation in stem cell therapies and contributing to the segment’s growth.

Key Growth Drivers

Rising Demand for Personalized Medicine

The growing demand for personalized medicine is one of the key drivers of the Cell Isolation and Separation Market. Personalized medicine involves tailoring medical treatment to individual characteristics, including genetic makeup, which requires precise cell isolation and analysis. As personalized therapies, especially in oncology and regenerative medicine, gain prominence, the demand for efficient cell separation techniques increases. Cell isolation allows for the extraction of specific cells needed for these personalized treatments, enhancing therapeutic outcomes. Additionally, the use of patient-derived cells for drug testing, as part of personalized treatment protocols, further contributes to the rising need for cell separation technologies.

- For instance, Illumina’s next-generation sequencing platforms are widely used to analyze patient genomes, enabling the precise identification of genetic markers to develop tailored therapies, particularly in oncology, where early detection of genetic mutations is crucial for targeted treatments.

Growth in Regenerative Medicine and Stem Cell Therapy

The expanding field of regenerative medicine, particularly stem cell therapy, is a significant driver for the Cell Isolation and Separation Market. Stem cells have shown great potential in treating a wide range of conditions, including degenerative diseases, spinal injuries, and heart disease, which has spurred increased investment in stem cell-based therapies. The ability to isolate and purify specific stem cells from tissue samples is crucial for these applications. As the research and clinical adoption of stem cell therapies expand, the demand for advanced cell separation technologies grows. Innovations in stem cell therapies are expected to further accelerate, with applications in organ regeneration, wound healing, and immune system reprogramming, driving the demand for highly specialized cell isolation methods in the coming years.

- For instance, Thermo Fisher Scientific’s Gibco™ stem cell media are used extensively in stem cell therapy research, providing a reliable platform for culturing stem cells and advancing clinical trials in areas like heart disease and neurological conditions.

Advancements in Biotechnology and Research

Ongoing advancements in biotechnology and research are fueling the growth of the Cell Isolation and Separation Market. With new technologies emerging in genomics, proteomics, and cell-based therapies, the need for accurate and efficient cell isolation techniques has grown significantly. Biotech companies are increasingly focused on developing advanced cell isolation methods that can process large volumes of samples with greater accuracy and speed. Innovations like microfluidic devices, automated systems, and high-throughput technologies are making it easier to isolate rare and difficult-to-isolate cells. This enables researchers to make groundbreaking discoveries in drug development, disease mechanisms, and therapeutic applications. As the global investment in biotechnology research continues to increase, the demand for specialized cell separation technologies will continue to drive market growth.

Key Trends & Opportunities

Integration of Automation and AI in Cell Isolation

One of the most significant trends in the Cell Isolation and Separation Market is the integration of automation and artificial intelligence (AI) into the process. Automation improves the efficiency, accuracy, and scalability of cell isolation by reducing human error and increasing throughput. AI technologies enable more precise sorting and analysis, allowing for the identification of rare cell types and improving the quality of isolated samples. With the growing demand for high-throughput cell isolation in research and clinical applications, the adoption of automated systems equipped with AI is poised to be a key growth factor. These systems not only improve the speed of cell separation but also offer better reproducibility and consistency, making them essential tools in both laboratory and clinical settings.

- For instance, the AutoMACS Pro Separator from Miltenyi Biotec automates cell isolation using magnetic beads, improving throughput and reducing human error in large-scale cell-based research applications, which is critical in clinical settings like immunotherapy development.

Emergence of Point-of-Care Diagnostics

Point-of-care (POC) diagnostics is emerging as a significant opportunity within the Cell Isolation and Separation Market. The ability to quickly and accurately isolate and analyze cells at the point of care—such as in emergency rooms, remote clinics, or even home settings—is revolutionizing diagnostics and treatment. POC testing for infectious diseases, cancer, and other conditions requires rapid cell isolation techniques to ensure timely and accurate results. As healthcare systems move toward decentralized models and patient-centric care, the demand for portable, easy-to-use cell separation devices at the point of care is growing.

- For instance, Applied Cells’ MARS® Atlas system automates point-of-care cell manufacturing, integrating cell selection, transduction, and expansion into a compact platform capable of producing CAR-T cell therapies within 72 hours, significantly accelerating treatment timelines.

Key Challenges

High Cost of Advanced Cell Isolation Technologies

One of the key challenges faced by the Cell Isolation and Separation Market is the high cost of advanced technologies. The development and implementation of specialized equipment, reagents, and consumables for cell separation can be expensive, particularly for smaller laboratories and healthcare facilities with limited budgets. High capital expenditures for instruments and operational costs associated with consumables and maintenance are barriers to widespread adoption, especially in emerging markets. Additionally, the complexity of integrating advanced automation and AI into existing workflows adds to the overall cost. As a result, many organizations may be reluctant to invest in cutting-edge technologies, hindering market growth.

Regulatory and Quality Control Challenges

The regulatory environment and the need for stringent quality control are significant challenges in the Cell Isolation and Separation Market. Given that the technologies involved are used in clinical and therapeutic applications, such as stem cell therapy and personalized medicine, regulatory approvals are critical. Meeting the required regulatory standards for safety, efficacy, and manufacturing processes can be time-consuming and costly. Furthermore, ensuring the consistency and purity of isolated cells is essential for clinical applications, and failures in quality control can lead to safety concerns and affect the effectiveness of treatments. As the market grows, maintaining compliance with evolving regulations and ensuring robust quality control processes will remain key challenges for companies operating in this space.

Regional Analysis

North America

The North America region commands the largest share of the global Cell Isolation and Separation Market, capturing 36.5% of revenue in 2024. This dominance stems from the presence of mature biopharmaceutical and biotechnology industries, heavy investments in research and development across the U.S. and Canada, and strong adoption of advanced cell-separation technologies in both clinical and academic settings. High incidence of chronic diseases, robust healthcare infrastructure, and favorable regulatory frameworks further reinforce the region’s leadership in market uptake.

Europe

Europe holds the second-largest regional share, estimated at around 30%, driven by strong activity across Germany, the UK, France, and the Nordics. The region benefits from extensive academic research, government support for regenerative medicine, and a rapidly growing cell-therapy ecosystem. A key driver is the high demand for precision cell separation in oncology and immunotherapy research, with manufacturers leveraging Europe as a base for commercialization of new consumables and instruments. Cross-border regulatory harmonization and increasing adoption in emerging EU markets further support growth.

Asia Pacific

The Asia Pacific region is poised to register the fastest growth rate, though currently holds a smaller share of 25% of the market. Growth is propelled by expanding life-science research infrastructure in China, India, Japan, and South Korea, increasing healthcare expenditure, and rising adoption of cell-based therapies. Emerging economies within the region are investing heavily in biotechnology and diagnostics, creating significant opportunity for suppliers of instruments and consumables. The large patient populations and growing awareness of advanced therapy offerings underpin this rising regional importance.

Latin America

Latin America controls a modest market share, estimated at roughly 10-12%, with Brazil and Mexico being the primary contributors. Growth in the region is driven by improving healthcare infrastructure, increased investment in stem-cell research and regenerative medicine applications, and a rising need for diagnostics and cell therapy platforms. While still emerging, the region offers vendors opportunities to establish early-mover positions as research and clinical adoption accelerate, especially in private-sector specialized treatment centers.

Middle East & Africa

The Middle East & Africa region holds the smallest share of the market 8%, but is expected to experience steady expansion. Growth drivers include rising government expenditure in healthcare systems (especially in Gulf Cooperation Council countries), increasing partnerships for cell-therapy development, and the establishment of biotechnology hubs in select African nations. However, lower per-capita research funding and limited access to advanced technologies still restrain rapid uptake.

Market Segmentations

By Product

By Cell Type

- Human Cells

- Differentiated cells

- Stem cells

- Animal cells

By Cell Source

- Bone marrow

- Adipose tissue

- Cord blood/ Embryonic stem cells

By Technique

- Centrifugation- based cell isolation

- Surface marker- based cell isolation

- Filteration- based cell isolation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Cell Isolation and Separation Market is dynamic and increasingly driven by technological innovation and strategic consolidation among key players. Industry leaders such as Thermo Fisher Scientific, Inc., Becton, Dickinson and Company (BD), Danaher Corporation, Bio‑Rad Laboratories, Inc., Merck KGaA, Miltenyi Biotec GmbH, STEMCELL Technologies Inc. and Terumo Corporation consistently invest in enhancing their portfolios of instruments, consumables and automation. For instance, Thermo Fisher holds a broad product range spanning magnetic bead‑based kits, reagents and instruments and maintains a dominant global position. The market features a moderate level of concentration, with the top firms controlling well over half of total market share, yet continues to invite smaller niche players that compete via specialised microfluidics, label‑free sorting or AI‑enabled platforms. Mergers, acquisitions and partnerships remain pivotal strategies for competitive differentiation and geographic expansion, as companies strive to address emerging demands in cell therapy, regenerative medicine and single‑cell analysis.

Key Player Analysis

- Merck KGaA (Germany)

- Becton, Dickinson and Company (U.S.)

- Bio-Rad Laboratories Inc. (U.S.)

- GE Healthcare (U.S.)

- Beckman Coulter Inc. (U.S.)

- Miltenyi Biotec (Germany)

- STEMCELL Technologies Inc. (Canada)

- pluriSelect Life Science UG & Co. KG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Terumo BCT, Inc. (U.S.)

Recent Developments

- In August 2025, Akadeum Life Sciences partnered with Lonza Group and Excellos to integrate flotation‑based cell separation with cell‑therapy manufacturing workflows.

- In June 2025, STEMCELL Technologies Inc. acquired Cellular Highways Ltd, a company specialising in advanced cell‑sorting technologies for cell and gene therapy.

- In April 2024, Miltenyi Biotec and MiLaboratories announced a strategic partnership to combine MiLaboratories’ RNA‑kit and software technology with Miltenyi’s production capabilities to drive next‑generation therapies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Cell Type, Cell Source, Technique and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to continue its strong growth, driven by the increasing demand for advanced cell-based therapies and personalized medicine.

- Technological advancements in automation and AI will further enhance the precision and efficiency of cell isolation processes, facilitating high-throughput applications.

- The increasing adoption of cell isolation technologies in emerging markets, particularly in Asia-Pacific and Latin America, will provide new growth opportunities.

- Ongoing investments in regenerative medicine and stem cell therapies will drive demand for specialized cell isolation techniques, especially for stem cell research and treatment applications.

- Companies will continue to focus on the development of microfluidic-based and automated systems to reduce human error and improve scalability in cell separation processes.

- The trend towards point-of-care diagnostics will lead to the emergence of portable and user-friendly cell isolation devices.

- Regulatory advancements and approval for new cell-based therapies will expand the market scope, particularly in oncology and immunology.

- Rising healthcare expenditure globally, especially in biotechnology and pharmaceuticals, will support continued market growth and innovation.

- Strategic mergers and acquisitions among key players will continue, allowing for greater market consolidation and regional expansion.

- Increased focus on high-quality consumables, reagents, and kits will drive market competition, with a focus on cost-efficiency and product differentiation.