Market Overview

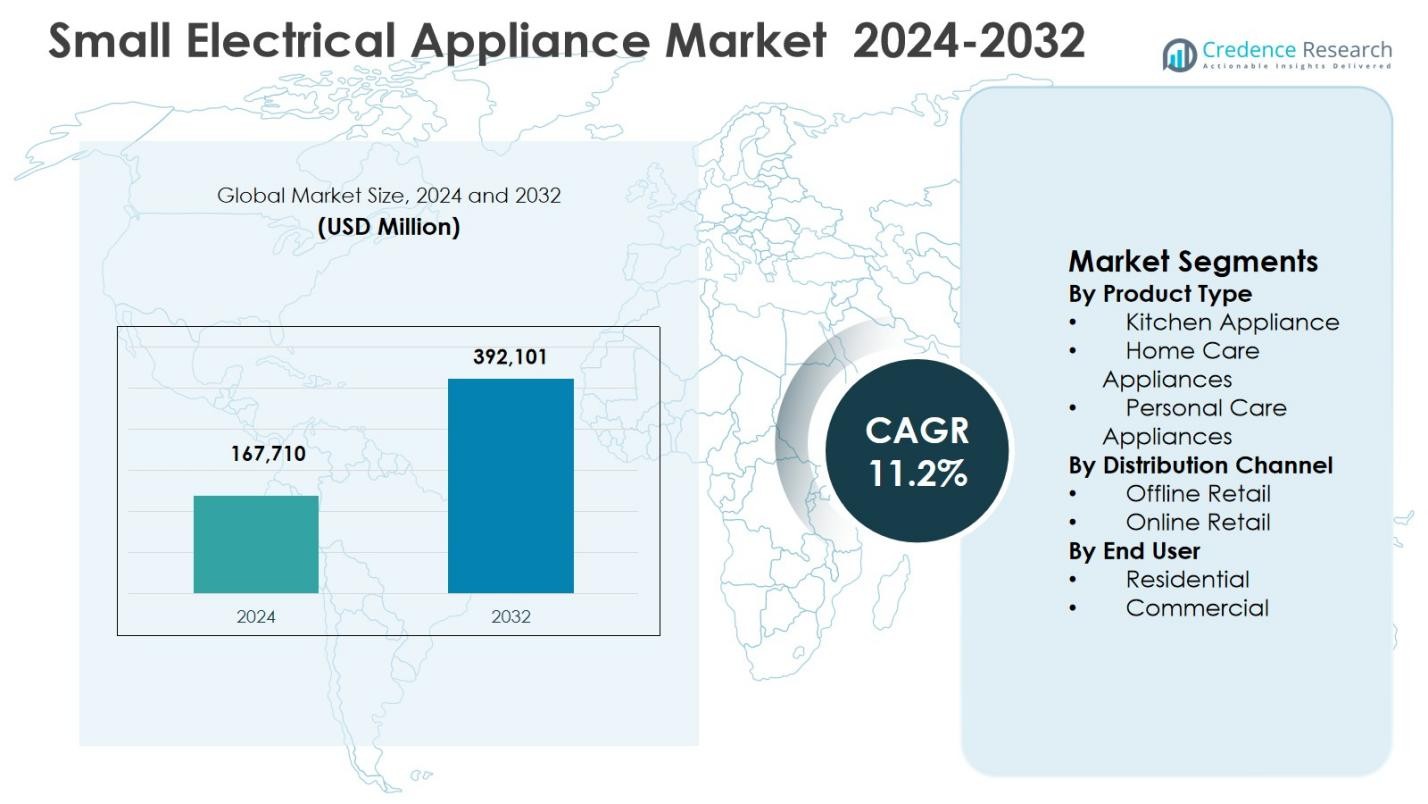

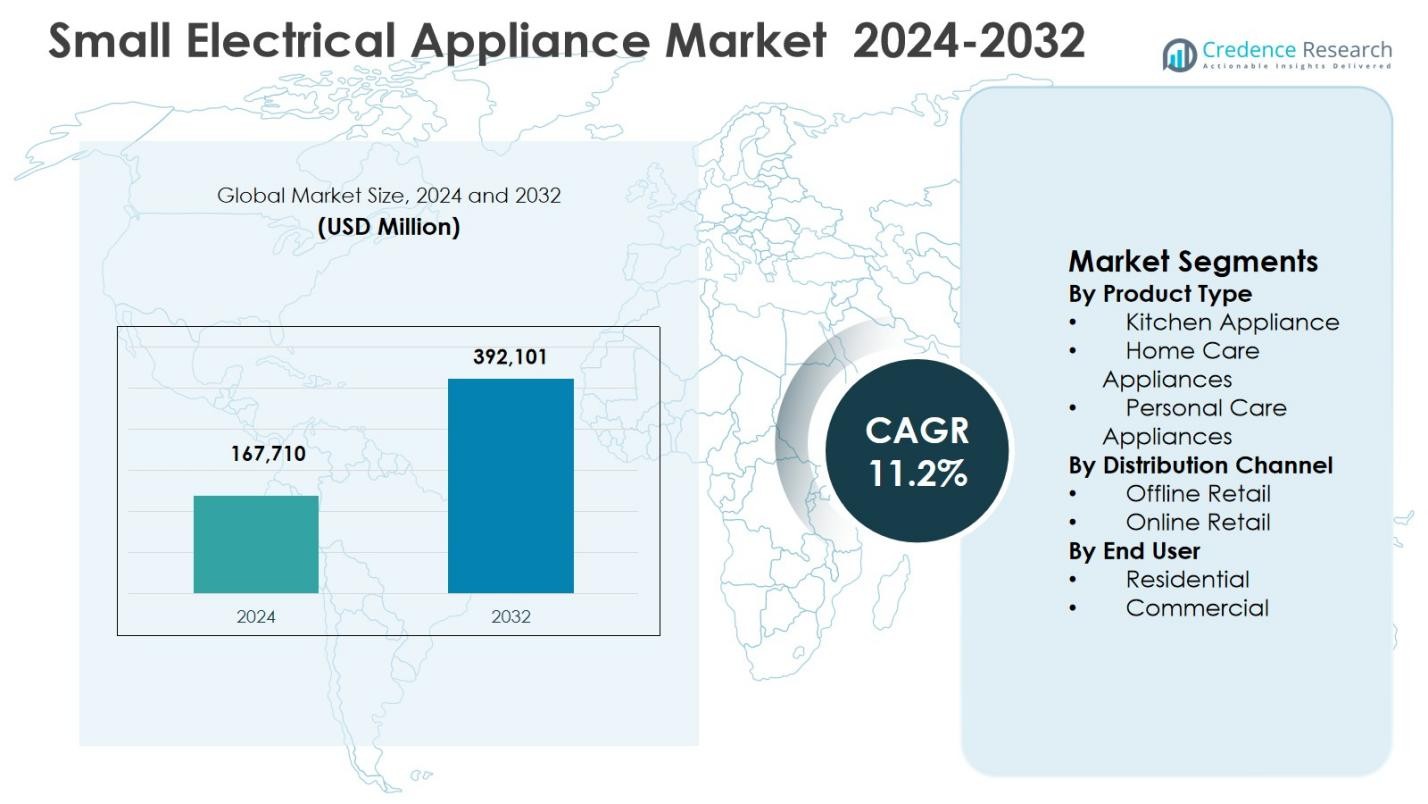

The Small Electrical Appliance Market size was valued at USD 167,710 million in 2024 and is anticipated to reach USD 392,101 million by 2032, growing at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Electrical Appliance Market Size 2024 |

USD 167,710 Million |

| Small Electrical Appliance Market, CAGR |

11.2% |

| Small Electrical Appliance Market Size 2032 |

USD 392,101 Million |

The Small Electrical Appliance Market is led by key players such as Whirlpool Corporation, LG Electronics Inc., Samsung Electronics Co., Panasonic Holdings Corporation, Koninklijke Philips N.V., BSH Hausgeräte GmbH, Electrolux AB, Haier Group Corporation, SEB Group, and Breville Group Ltd. These companies drive growth through continuous product innovation, technological advancements, and expansion of distribution networks across both offline and online channels. North America emerges as the leading region with 31.5% market share in 2024, followed by Europe at 28.4% and Asia-Pacific at 25.7%, reflecting strong demand for kitchen, personal care, and home care appliances. Manufacturers focus on smart, energy-efficient, and multifunctional devices to cater to urban lifestyles, rising disposable incomes, and growing awareness of convenience and hygiene. Regional expansions, product launches, and after-sales services further enhance brand presence and adoption across residential and commercial segments worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small Electrical Appliance Market was valued at USD 167,710 million in 2024 and is projected to reach USD 392,101 million by 2032, growing at a CAGR of 11.2%. Kitchen Appliances led the product type segment with 42.8% market share in 2024.

- Rising urbanization, increasing disposable incomes, and demand for time-saving, multifunctional appliances are driving growth across residential and commercial segments globally. Smart and energy-efficient appliances further support adoption.

- The market is witnessing trends such as IoT-enabled and app-controlled devices, eco-friendly and low-power consumption products, and growth of online retail platforms enhancing accessibility and product visibility.

- Leading players like Whirlpool Corporation, LG Electronics, Samsung Electronics, Panasonic Holdings, and Koninklijke Philips are driving innovation, expanding distribution networks, and focusing on after-sales services to strengthen market position.

- Regionally, North America leads with 31.5% share in 2024, Europe holds 28.4%, Asia-Pacific 25.7%, Latin America 8.6%, and Middle East & Africa 5.8%, reflecting strong demand across both developed and emerging markets.

Market Segmentation Analysis:

By Product Type:

The Small Electrical Appliance Market by product type is dominated by Kitchen Appliances, which accounted for 42.8% market share in 2024. Strong demand for coffee makers, blenders, mixers, and toasters supports this leadership, driven by rising home cooking trends, busy urban lifestyles, and growing adoption of convenient, time-saving appliances. Increasing penetration of smart kitchen devices, energy-efficient designs, and compact multifunctional products further strengthens demand. Continuous product innovation focused on performance, durability, and aesthetics also encourages frequent replacement cycles, reinforcing the dominance of kitchen appliances within the overall Small Electrical Appliance Market.

- For instance, KitchenAid’s bowl-lift stand mixers feature 11 speeds including a half-speed for folding, with up to 7-quart capacity for dense doughs, offering 2x the bowl power of tilt-head models.

By Distribution Channel:

In the Small Electrical Appliance Market, Offline Retail emerged as the dominant distribution channel, capturing 58.6% market share in 2024. Specialty stores, supermarkets, and hypermarkets benefit from strong consumer preference for physical product evaluation, brand comparison, and immediate availability. In-store demonstrations, promotional discounts, and bundled offers further enhance purchasing decisions. Offline channels also maintain strong after-sales service networks, which remain critical for appliances requiring maintenance or warranty support. These advantages continue to sustain higher sales volumes through brick-and-mortar retail despite the growing presence of digital commerce platforms.

- For instance, Dyson operates demo stores where customers receive hands-on styling sessions with the Supersonic hair dryer, allowing hair analysis and real-time demonstrations of features like reduced heat damage, which drives conversions through direct product trials.

By End User:

The Residential segment led the Small Electrical Appliance Market by end user, holding 71.3% market share in 2024. High ownership rates of kitchen, personal care, and home care appliances across urban and semi-urban households drive this dominance. Rising disposable incomes, increasing focus on convenience, and growing awareness of hygiene and personal grooming contribute to sustained residential demand. Additionally, expanding nuclear families and higher adoption of smart and energy-efficient appliances support frequent upgrades. These factors collectively strengthen the residential segment’s position over commercial applications such as hotels, cafés, and offices.

Key Growth Drivers

Rising Urbanization and Changing Lifestyles

Rapid urbanization and busier lifestyles are driving demand for small electrical appliances, particularly in kitchens and personal care. Consumers increasingly prefer time-saving, convenient, and multifunctional devices such as blenders, coffee makers, and hair dryers. Growing nuclear households and dual-income families fuel the need for appliances that enhance efficiency and reduce manual effort. Additionally, awareness of energy-efficient and compact products supports adoption in apartments and urban homes, sustaining continuous growth across residential segments in the Small Electrical Appliance Market.

- For instance, Breville’s BOV900BSS Smart Oven Air uses Element IQ technology with six quartz elements for precise cooking, accommodating a 14-pound turkey in its 21.4″ x 17.2″ x 12.8″ footprint, perfect for urban homes needing multifunctional baking and air frying without heating the entire kitchen.

Technological Advancements and Smart Appliances

Integration of smart technologies in small electrical appliances significantly drives market growth. IoT-enabled devices, app-controlled kitchen appliances, and automated personal care tools improve usability, convenience, and energy efficiency. Features such as remote monitoring, programmable functions, and safety enhancements attract tech-savvy consumers seeking modern, connected lifestyles. Continuous innovation by manufacturers, including AI-based smart cooking devices and self-cleaning appliances, strengthens product differentiation and encourages repeat purchases, positioning technology as a key growth engine for the Small Electrical Appliance Market.

- For instance, Philips HomeID app connects to Wi-Fi-enabled Airfryers, allowing remote control of temperature and cooking duration from smartphones, along with recipe sending directly to the appliance.

Rising Disposable Incomes and Consumer Spending

Increasing disposable incomes across emerging and developed economies are driving higher adoption of small electrical appliances. Consumers are willing to invest in premium, durable, and energy-efficient products that enhance lifestyle quality. Spending on personal care, home care, and kitchen convenience products grows in tandem with awareness of health, hygiene, and comfort. This trend, combined with urbanization and lifestyle shifts, encourages households to upgrade existing appliances, fueling sales growth. Manufacturers benefit from this demand through diversified portfolios catering to mid- and high-income consumer segments.

Key Trends & Opportunities

Shift Towards Online Retail and E-Commerce Expansion

The growing penetration of online retail platforms presents significant opportunities for the Small Electrical Appliance Market. E-commerce enables manufacturers to reach wider audiences, offer competitive pricing, and provide product customization. Consumers increasingly prefer online purchases due to convenience, detailed product information, and doorstep delivery. Digital marketing campaigns, brand-owned websites, and online-exclusive product launches enhance visibility. This trend allows brands to tap into emerging markets and expand regional reach, complementing offline retail while creating growth potential for new product categories and innovative appliance models.

- For instance, Dyson launched an interactive virtual store on its website, featuring three-dimensional product views and explosive technology displays for small appliances like air purifiers and hair stylers.

Sustainability and Energy-Efficient Products

Sustainability is emerging as a critical trend and opportunity in the Small Electrical Appliance Market. Consumers increasingly favor energy-efficient, recyclable, and environmentally friendly appliances. Manufacturers are responding with low-power consumption devices, eco-certified products, and compact designs that reduce material usage. Government initiatives promoting energy-saving appliances and consumer awareness about environmental impact further drive adoption. This trend encourages innovation in product design, materials, and manufacturing processes, providing a growth pathway while aligning with global sustainability objectives and enhancing brand reputation.

- For instance, Bosch dishwashers feature PerfectDry with Zeolith technology, which activates natural minerals to dry loads perfectly using minimal energy.

Key Challenges

High Product Costs and Price Sensitivity

High upfront costs of premium small electrical appliances can limit adoption, particularly in price-sensitive emerging markets. Consumers often prioritize affordability over advanced features, slowing the penetration of smart and energy-efficient products. Frequent competition from low-cost local brands further intensifies pricing pressure. Manufacturers must balance innovation and cost-effectiveness, invest in localized production, and offer financing or bundled solutions to overcome resistance. Price sensitivity remains a critical challenge in achieving widespread market penetration without compromising profit margins or brand positioning.

Regulatory Compliance and Safety Standards

Stringent safety regulations, energy efficiency standards, and certification requirements pose challenges for manufacturers in the Small Electrical Appliance Market. Variations in regional compliance norms necessitate product adaptations, increasing production complexity and costs. Non-compliance risks penalties, recalls, or reputational damage. Additionally, evolving regulations on electrical safety, materials, and environmental impact require continuous monitoring and adjustment. Ensuring adherence to international and local standards remains essential to maintain market credibility, consumer trust, and seamless distribution across multiple geographies.

Regional Analysis

North America

The North America Small Electrical Appliance Market is led by the United States, capturing 31.5% market share in 2024. Strong consumer demand for kitchen, home care, and personal care appliances drives growth, supported by high disposable incomes, urban lifestyles, and increasing smart home adoption. The presence of established brands, extensive retail networks, and e-commerce penetration enhances product accessibility. Continuous product innovation, particularly in energy-efficient and IoT-enabled appliances, fuels replacement cycles. Rising health awareness and convenience-focused consumption further stimulate adoption across residential and commercial segments, positioning North America as a significant contributor to global Small Electrical Appliance Market growth.

Europe

Europe holds a 28.4% market share in 2024 in the Small Electrical Appliance Market, driven by strong demand in Germany, France, and the UK. Consumers prioritize energy-efficient, smart, and aesthetically designed kitchen, home care, and personal care appliances. Government incentives promoting eco-friendly and low-power consumption appliances encourage adoption. Mature retail infrastructure, including specialty stores and supermarkets, along with growing e-commerce platforms, supports extensive distribution. Lifestyle trends emphasizing convenience, health, and hygiene accelerate replacement and upgrade cycles. Continuous technological innovation by key players in smart and connected devices further strengthens Europe’s leadership in the Small Electrical Appliance Market.

Asia-Pacific

The Asia-Pacific Small Electrical Appliance Market captured 25.7% market share in 2024, with China, Japan, and India driving growth. Rising urbanization, expanding middle-class populations, and increasing disposable incomes fuel demand for kitchen, home care, and personal care appliances. E-commerce platforms and growing offline retail networks enhance product accessibility. Rapid adoption of smart, compact, and energy-efficient devices is driven by busy lifestyles and limited urban living spaces. Government initiatives promoting electrification and appliance penetration, coupled with increasing brand awareness, support sustained growth. Asia-Pacific represents a high-growth region for Small Electrical Appliance Market players targeting both residential and commercial consumers.

Latin America

Latin America accounts for 8.6% market share in 2024 in the Small Electrical Appliance Market, with Brazil and Mexico leading demand. Rising disposable incomes, urbanization, and growing interest in convenience appliances drive adoption across residential households. Offline retail channels remain dominant, complemented by increasing online retail penetration in urban centers. Demand for affordable, durable, and energy-efficient kitchen, home care, and personal care appliances supports market expansion. Government policies promoting household electrification and safety standards encourage adoption. Regional players and global brands leverage distribution networks to tap into both premium and value segments, positioning Latin America as an emerging growth market.

Middle East & Africa

The Middle East & Africa Small Electrical Appliance Market held 5.8% market share in 2024, led by the UAE, Saudi Arabia, and South Africa. Rising urbanization, increasing disposable incomes, and modernization of households drive demand for kitchen, personal care, and home care appliances. Strong retail infrastructure, including specialty stores and e-commerce platforms, enhances market reach. Growing preference for premium, energy-efficient, and smart appliances among urban consumers supports market growth. Regional investments in residential and commercial construction, along with rising lifestyle-oriented consumption, create opportunities for manufacturers. Market players focus on product customization, after-sales service, and regional partnerships to expand their presence.

Market Segmentations:

By Product Type

- Kitchen Appliance

- Home Care Appliances

- Personal Care Appliances

By Distribution Channel

- Offline Retail

- Online Retail

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Small Electrical Appliance Market features key players such as Whirlpool Corporation, LG Electronics Inc., Samsung Electronics Co., Panasonic Holdings Corporation, Koninklijke Philips N.V., BSH Hausgeräte GmbH, Electrolux AB, Haier Group Corporation, SEB Group, and Breville Group Ltd. The market is characterized by intense competition driven by continuous product innovation, technological advancements, and expanding distribution networks. Leading players focus on launching smart, energy-efficient, and multifunctional appliances to cater to evolving consumer preferences. Strategic initiatives, including mergers, acquisitions, partnerships, and regional expansions, enhance market presence and brand visibility. Companies also emphasize marketing campaigns, after-sales services, and customization to strengthen customer loyalty. The competition is further intensified by regional and local players offering affordable alternatives, compelling global brands to differentiate through quality, design, and technological superiority. Innovation in IoT-enabled and compact appliances continues to be a key driver shaping market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Whirlpool Corporation

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- BSH Hausgeräte GmbH

- Electrolux AB

- Haier Group Corporation

- SEB Group

- Breville Group Ltd

Recent Developments

- In July 2025, Reliance Retail acquired the iconic home appliance brand Kelvinator, strengthening its portfolio in consumer durables and expanding its presence in the small electrical appliance segment in India.

- In December 2025, LG Electronics continued its innovation trajectory by introducing a new range of AI‑powered washing machines in India, enhancing household convenience through intelligent fabric detection and energy‑efficient performance.

- In September 2025, Dyson unveiled 11 new and upgraded small electrical appliances, including the PencilVac™ the world’s slimmest vacuum cleaner at 38mm diameter and the V16 Piston Animal cordless vacuum with AI-driven cleaning.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness sustained growth driven by rising urbanization and busy lifestyles.

- Increasing adoption of smart and IoT-enabled appliances will shape future product demand.

- Energy-efficient and eco-friendly appliances will gain prominence due to environmental awareness.

- E-commerce expansion will enhance accessibility and accelerate regional market penetration.

- Continuous innovation in multifunctional and compact appliances will drive replacement cycles.

- Rising disposable incomes in emerging economies will boost consumer spending on premium appliances.

- Expansion of after-sales services will strengthen customer loyalty and repeat purchases.

- Growth in residential and commercial construction will support appliance adoption across sectors.

- Partnerships and collaborations among global and regional players will drive market consolidation.

- Increasing focus on health, hygiene, and convenience will create new opportunities for product development.