Market Overview

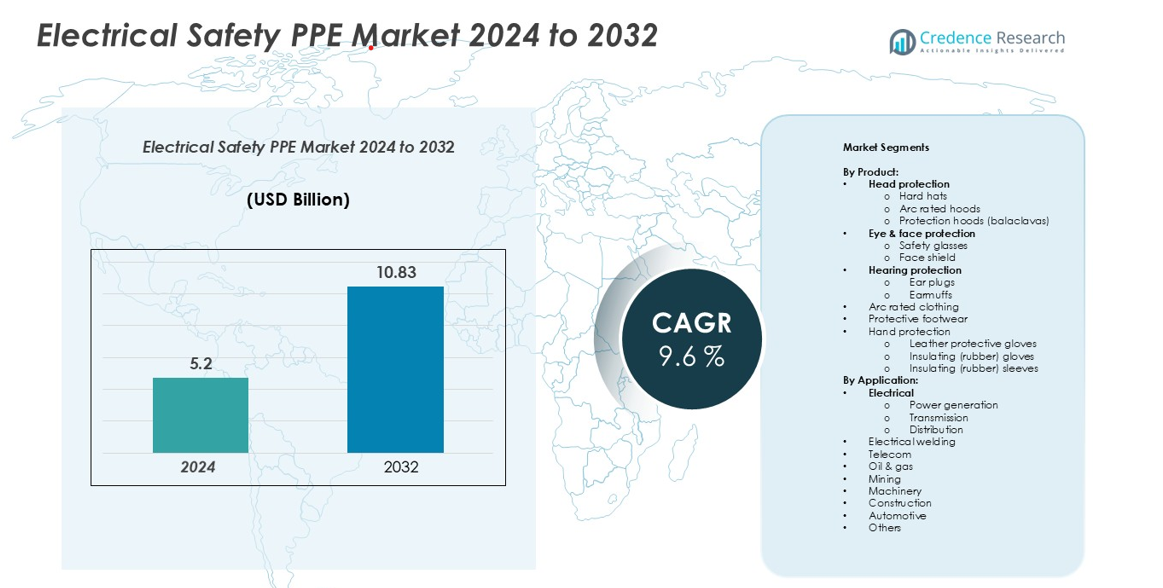

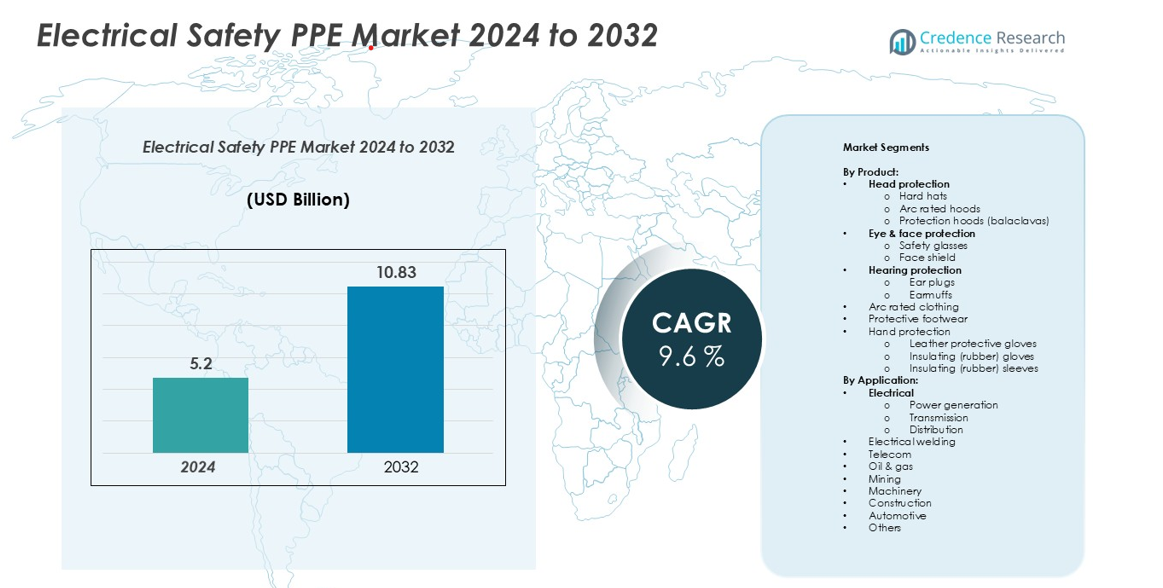

Electrical Safety Personal Protective Equipment (PPE) Market size was valued USD 5.2 billion in 2024 and is anticipated to reach USD 10.83 billion by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Safety PPE Market Size 2024 |

USD 5.2 billion |

| Electrical Safety PPE Market , CAGR |

9.6% |

| Electrical Safety PPE Market Size 2032 |

USD 10.83 billion |

The Electrical Safety PPE market is dominated by key players such as 3M, Honeywell, DuPont de Nemours, MSA (Mine Safety Appliances), Ansell Ltd., Bullard, Black Stallion, COFRA S.R.L., GB Industries, National Safety Apparel, Oberon Co., and Boddingtons. These companies lead the market through continuous innovation, compliance with global safety standards, and diversified product portfolios, including arc-rated clothing, insulating gloves, head protection, and protective footwear. North America holds the largest market share at approximately 30%, driven by stringent OSHA regulations and advanced industrial infrastructure, followed by Asia-Pacific with 28% due to rapid industrialization and energy sector growth. Europe accounts for 25%, supported by strict EU safety directives, while Latin America and the Middle East & Africa represent 10% and 7%, respectively. Strategic expansions and technological advancements enable these players to maintain leadership across high-growth regions.

Market Insights

- The Electrical Safety PPE market was valued at USD 5.2 billion in 2024 and is projected to reach USD 10.83 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

- Growth is driven by stringent safety regulations, increasing industrial electrification, and rising adoption of advanced PPE such as arc-rated clothing, insulating gloves, and protective footwear across power, construction, and oil & gas sectors.

- Key trends include the adoption of smart and connected PPE with sensors for real-time hazard detection, expansion in emerging economies, and a focus on ergonomic and lightweight designs to improve comfort and compliance.

- The market is highly competitive, led by 3M, Honeywell, DuPont, MSA, and Ansell Ltd., with companies emphasizing product innovation, compliance, and regional expansion to maintain leadership.

- North America holds 30% of the market, Asia-Pacific 28%, Europe 25%, Latin America 10%, and Middle East & Africa 7%, with head protection and power generation segments leading product and application shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Electrical Safety PPE market, by product, is primarily driven by rising workplace safety regulations and increasing awareness of electrical hazards. Head protection, including hard hats, arc rated hoods, and balaclavas, dominates this segment, with hard hats accounting for the largest market share of approximately 28%. Eye and face protection, hearing protection, arc rated clothing, protective footwear, and hand protection follow in demand. The market growth is fueled by technological advancements in PPE materials, improved ergonomics, and adoption of high-durability protective gear across industries with high electrical exposure.

- For instance, some of Honeywell’s Class E hard hats are designed to protect against high-voltage electrical conductors, proof-tested at up to 20,000 volts (20kV), providing enhanced protection for workers in high-risk environments.

By Application

In terms of application, the electrical sector, including power generation, transmission, distribution, and electrical welding, leads the market. Power generation emerges as the dominant sub-segment, representing nearly 32% of the application market share. This growth is driven by the increasing installation of renewable energy plants and modernization of electrical grids, which demand stringent safety protocols. Applications in telecom, oil & gas, mining, construction, machinery, and automotive sectors also contribute to the market, supported by regulatory compliance and rising adoption of safety standards in industrial workplaces.

- For instance, 3M provides a wide range of personal protective equipment (PPE) and other electrical products that are used in power generation facilities for worker safety during electrical maintenance and other operations.

Key Growth Drivers

Stringent Regulatory Compliance and Safety Standards

Stringent occupational safety regulations and electrical safety standards are a primary growth driver for the Electrical Safety PPE market. Governments and industrial safety authorities across regions are increasingly enforcing standards to protect workers from electrical hazards, including arc flashes, electric shocks, and high-voltage exposure. Compliance with OSHA, NFPA 70E, and IEC standards mandates the use of certified PPE, driving adoption across industries such as power generation, oil & gas, construction, and manufacturing. Companies are investing in advanced PPE solutions, including arc-rated clothing, insulating gloves, and protective footwear, to meet these requirements. Regulatory enforcement not only enhances workplace safety but also creates a continuous demand pipeline for manufacturers, contributing to market growth and innovation in material technologies, durability, and ergonomic design.

- For instance, Honeywell’s Salisbury® Class 0 Electrical Insulating Rubber Gloves are available in 11 and 14-inch lengths. Some versions are made from Type I natural rubber, while others are available in Type II SALCOR® synthetic rubber for better ozone resistance. These gloves are designed for a maximum use voltage of 1,000 volts AC and are also proof-tested at 5,000 volts AC. They meet or exceed stringent safety standards, including ASTM D120 and IEC EN60903. For protection against cuts, abrasions, and punctures, it is critical to wear Type I gloves with leather protectors.

Growing Industrial Electrification and Infrastructure Development

The accelerating pace of industrial electrification and infrastructure expansion fuels the demand for electrical safety PPE. Increased installation of power grids, renewable energy projects, and industrial automation exposes workers to higher electrical risks, necessitating advanced protection solutions. Sectors like power transmission, telecom, construction, and mining require comprehensive PPE, including head protection, gloves, eye protection, and arc-rated apparel. Rising investment in modernizing electrical distribution networks, coupled with large-scale infrastructure development in emerging economies, intensifies the need for protective equipment. This trend supports market growth by encouraging manufacturers to expand product portfolios, enhance safety certifications, and develop PPE that balances comfort with high-performance protection in complex industrial environments.

- For instance, MSA Safety’s EVOTECH and Workman Arc Flash Harnesses are designed to prevent melting or dripping and to self-extinguish quickly if an arc flash occurs. These harnesses are engineered for increased safety in high-risk electrical settings.

Technological Advancements in PPE Materials and Design

Innovations in material science and ergonomic design significantly drive the market by improving protection efficiency and user comfort. Modern PPE incorporates flame-resistant fabrics, high-durability polymers, and insulating materials that offer superior resistance to electrical hazards. Developments such as lightweight arc-rated clothing, anti-fog safety glasses, and thermally resistant gloves enhance usability while maintaining compliance with safety standards. Additionally, smart PPE technologies, including sensors for arc flash detection or heat exposure, are gradually entering the market. These innovations attract industries seeking advanced solutions to minimize workplace injuries and downtime. The adoption of technologically enhanced PPE strengthens market growth by differentiating products, improving worker productivity, and addressing increasingly complex electrical hazards.

Key Trends & Opportunities

Adoption of Smart and Connected PPE

A notable trend in the electrical safety PPE market is the integration of smart and connected devices. PPE equipped with sensors, IoT-enabled monitoring, and wearable technologies can detect electrical hazards, alert workers in real-time, and track compliance with safety protocols. For instance, arc flash detection vests and temperature-monitoring gloves provide proactive protection against potential incidents. This trend presents significant opportunities for PPE manufacturers to differentiate products, offer value-added solutions, and expand into digital safety services. The growing emphasis on worker safety in high-risk industries, combined with increasing digitalization, is likely to drive demand for advanced PPE solutions that combine protection with real-time monitoring and data analytics capabilities.

- For instance, Honeywell’s Pro-Wear® Plus 40 Cal/cm² garments are engineered to be lightweight, more breathable, better fitting, and softer to the touch, providing enhanced comfort and protection for workers in hazardous environments.

Expansion in Emerging Economies

Emerging economies present strong growth opportunities due to rapid industrialization, infrastructure development, and increasing workforce safety awareness. Countries in Asia-Pacific, the Middle East, and Latin America are witnessing large-scale power generation, construction, and mining projects, fueling demand for certified PPE. Governments in these regions are introducing stricter safety regulations, prompting companies to adopt high-quality protective equipment. Additionally, rising awareness among employees about occupational safety encourages businesses to invest in advanced PPE solutions. Expansion into these high-growth markets enables manufacturers to increase revenue, establish localized production facilities, and customize products according to regional safety standards and environmental conditions.

- For instance, MSA Safety’s Workman® Arc Flash Harnesses feature durable nylon webbing that is tested to protect workers from a fall event after an arc flash exposure of 40 cal/cm² and meet ASTM F887 standards, but the nylon material is not self-extinguishing and does not contain Kevlar.

Integration of Ergonomics and Comfort in PPE Design

A growing focus on ergonomics and comfort is shaping product development in the market. Manufacturers are designing PPE that reduces fatigue, enhances mobility, and supports long working hours without compromising safety. Lightweight helmets, breathable arc-rated clothing, and flexible gloves are increasingly preferred across industries. This trend provides an opportunity for companies to innovate in material engineering, user-centric design, and modular PPE systems. By improving wearer comfort, manufacturers not only ensure higher compliance with safety regulations but also enhance productivity, making ergonomically designed PPE a key differentiator and growth lever in the competitive market landscape.

Key Challenges

High Cost of Advanced PPE

The cost of high-performance electrical safety PPE remains a significant market challenge. Arc-rated clothing, insulating gloves, and smart PPE devices often involve advanced materials, testing certifications, and innovative designs, resulting in higher prices compared to conventional equipment. Small- and medium-sized enterprises (SMEs) in emerging economies may find it difficult to adopt these products due to budget constraints, limiting market penetration. Additionally, frequent replacement due to wear and regulatory expiration adds to operational costs. Manufacturers must balance affordability with compliance, driving the need for cost-effective production, scalable manufacturing, and localized sourcing strategies to overcome adoption barriers and maintain steady growth in price-sensitive markets.

Limited Awareness and Training in Workplace Safety

A key challenge impeding market growth is the lack of awareness and training on proper PPE usage among workers and employers. Incorrect use, maintenance, or selection of PPE can reduce its effectiveness, leading to accidents despite equipment availability. In many regions, especially in developing markets, insufficient safety education, inadequate compliance monitoring, and low prioritization of electrical hazards hinder adoption. Overcoming this challenge requires awareness campaigns, on-site training programs, and demonstration of PPE benefits. Manufacturers and safety organizations must collaborate to educate end-users, ensuring proper utilization and maximizing protection, which is crucial for sustaining demand and reinforcing the importance of electrical safety standards.

Regional Analysis

North America

North America leads the Electrical Safety PPE market with a dominant share of around 30%, driven by stringent workplace safety regulations, such as OSHA and NFPA standards, and the presence of major industrial and power infrastructure projects. The region witnesses high adoption of arc-rated clothing, insulating gloves, and protective footwear across power generation, construction, and oil & gas sectors. Increasing awareness of electrical hazards and investment in advanced PPE solutions, including smart and ergonomic designs, further bolster market growth. Manufacturers in the U.S. and Canada are focusing on technological innovation, durability, and compliance to capture expanding demand in industrial and commercial applications.

Europe

Europe accounts for approximately 25% of the Electrical Safety PPE market, supported by rigorous safety standards, including EU directives and IEC certifications. High industrialization, modernization of energy grids, and large-scale construction projects drive demand for head protection, hand protection, and arc-rated clothing. Countries such as Germany, France, and the U.K. exhibit strong adoption of PPE in electrical, oil & gas, and manufacturing sectors. The market growth is accelerated by increasing safety awareness, focus on reducing workplace accidents, and adoption of innovative ergonomic PPE solutions, including lightweight arc flash clothing and advanced insulating gloves, which enhance worker protection and compliance.

Asia-Pacific

Asia-Pacific represents nearly 28% of the market, fueled by rapid industrialization, infrastructure development, and growing power generation and distribution projects. Countries like China, India, Japan, and South Korea are witnessing significant demand for head protection, eye & face protection, and hand protection equipment. Expanding construction, mining, and manufacturing activities, coupled with rising workforce safety awareness and regulatory enforcement, are major growth drivers. Manufacturers are expanding production capacity, localizing supply chains, and introducing cost-effective and certified PPE to meet regional requirements. The region also presents opportunities for smart PPE adoption and technological innovations in material durability and comfort.

Latin America

Latin America contributes approximately 10% to the Electrical Safety PPE market, driven by growing industrialization, power sector investments, and mining operations. Brazil and Mexico are leading markets, with rising adoption of arc-rated clothing, protective gloves, and headgear to safeguard workers against electrical hazards. Government initiatives to improve occupational safety and stricter regulatory compliance encourage PPE utilization. Market expansion is supported by awareness campaigns and modernization of electrical infrastructure. However, adoption is partially constrained by cost sensitivity and limited penetration in smaller enterprises, prompting manufacturers to focus on affordable, durable, and compliant PPE solutions to enhance market growth.

Middle East & Africa

The Middle East & Africa holds around 7% of the Electrical Safety PPE market, driven by oil & gas, construction, and power generation activities in countries such as Saudi Arabia, UAE, and South Africa. High-voltage operations, harsh working environments, and increasing safety regulations push the demand for arc-rated clothing, insulating gloves, protective footwear, and helmets. Industrial growth and infrastructure development, particularly in energy and mining sectors, create opportunities for both global and regional PPE manufacturers. Challenges include limited awareness in smaller enterprises and cost constraints, which necessitate product customization, training programs, and compliance-driven solutions to expand adoption across diverse sectors in the region.

Market Segmentations

By Product

- Head protection

- Hard hats

- Arc rated hoods

- Protection hoods (balaclavas)

- Eye & face protection

- Safety glasses

- Face shield

- Hearing protection

- Arc rated clothing

- Protective footwear

- Hand protection

- Leather protective gloves

- Insulating (rubber) gloves

- Insulating (rubber) sleeves

By Application

- Electrical

- Power generation

- Transmission

- Distribution

- Electrical welding

- Telecom

- Oil & gas

- Mining

- Machinery

- Construction

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrical Safety PPE market is highly competitive, characterized by the presence of global leaders and regional manufacturers offering a diverse range of protective solutions. Key players, including 3M, Honeywell, DuPont de Nemours, MSA (Mine Safety Appliances), Ansell Ltd., and Bullard, focus on product innovation, technological advancements, and compliance with stringent safety standards to strengthen their market position. Companies are expanding their portfolios to include arc-rated clothing, insulating gloves, head protection, eye & face protection, and smart PPE solutions. Strategic initiatives, such as mergers, acquisitions, regional partnerships, and localized manufacturing, enable players to enhance distribution networks and cater to growing demand in North America, Europe, and Asia-Pacific. The competitive environment drives continuous investment in research and development, ensuring superior ergonomics, durability, and compliance, which helps companies differentiate themselves while meeting the increasing safety requirements across industrial, construction, energy, and mining sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

1

Key Player Analysis

- Honeywell

- Black Stallion

- DuPont de Nemours, Inc.

- MSA (Mine Safety Appliances)

- 3M

- Bullard

- Ansell Ltd.

- GB Industries

- Oberon Co.

- COFRA S.R.L.

- National Safety Apparel

- Boddingtons

Recent Developments

- In July 2024, Ansell completed its purchase of Kimberly-Clark PPE businesses, including brands such as Kimtech and KleenGuard, and adding sustainable and contamination control solutions to its global leadership in protection solutions.

- In April 2024, Honeywell’s launched Clover, SC, plant for the manufacture of electrical safety gloves, thus enhancing capacities and speeding the delivery of gloves.

- In January 2024, SureWerx acquired Unlimited PPE Inc., launching a brand-new Technical Services Division focusing on electrical safety, compliance, and PPE management, which draws from Unlimited PPE’s extensive expertise in arc flash and shock protection, as well as its unparalleled technical consulting throughout North America.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart PPE with real-time hazard detection is expected to increase across industries.

- Demand for lightweight and ergonomic protective clothing will grow to enhance worker comfort.

- Expansion in emerging economies will drive regional market growth.

- Arc-rated clothing and insulating gloves will continue to dominate product demand.

- Industrial electrification and renewable energy projects will create new opportunities for PPE adoption.

- Regulatory enforcement and workplace safety standards will remain a key growth driver.

- Integration of IoT and wearable technologies in PPE will support digital safety solutions.

- Manufacturers will focus on material innovations to improve durability and thermal resistance.

- Training and awareness programs will enhance proper PPE usage and compliance.

- Strategic partnerships and regional expansions will help companies strengthen market presence.