Market Overview:

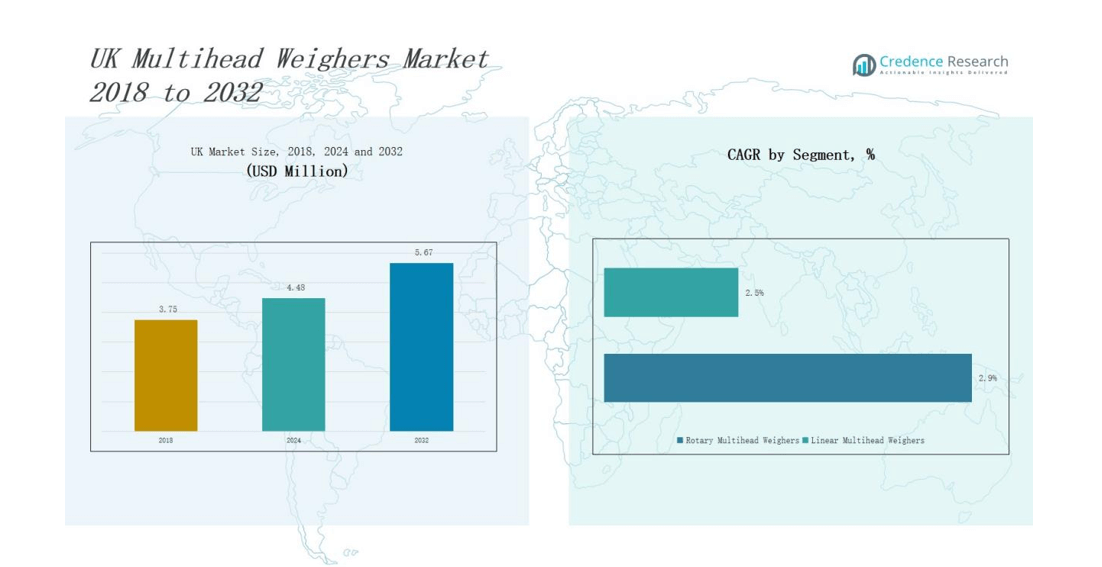

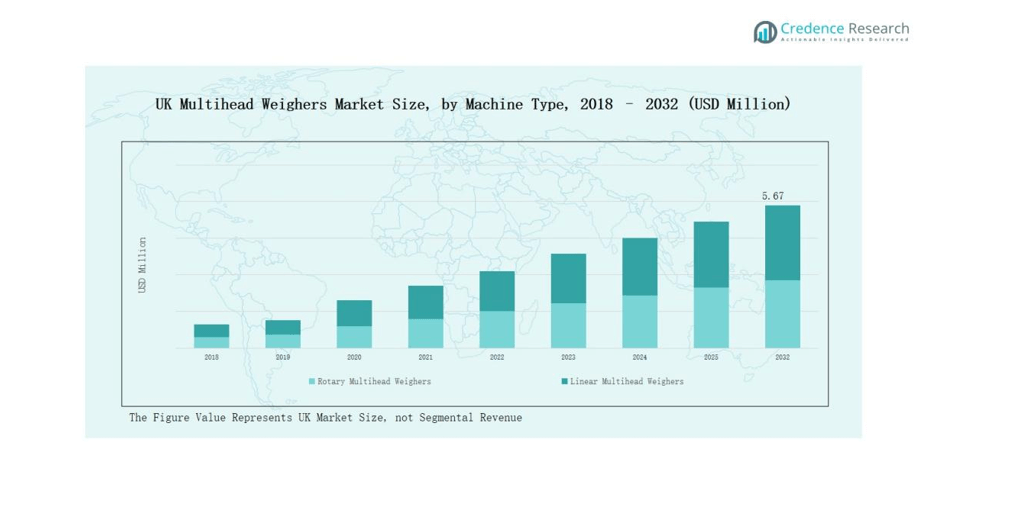

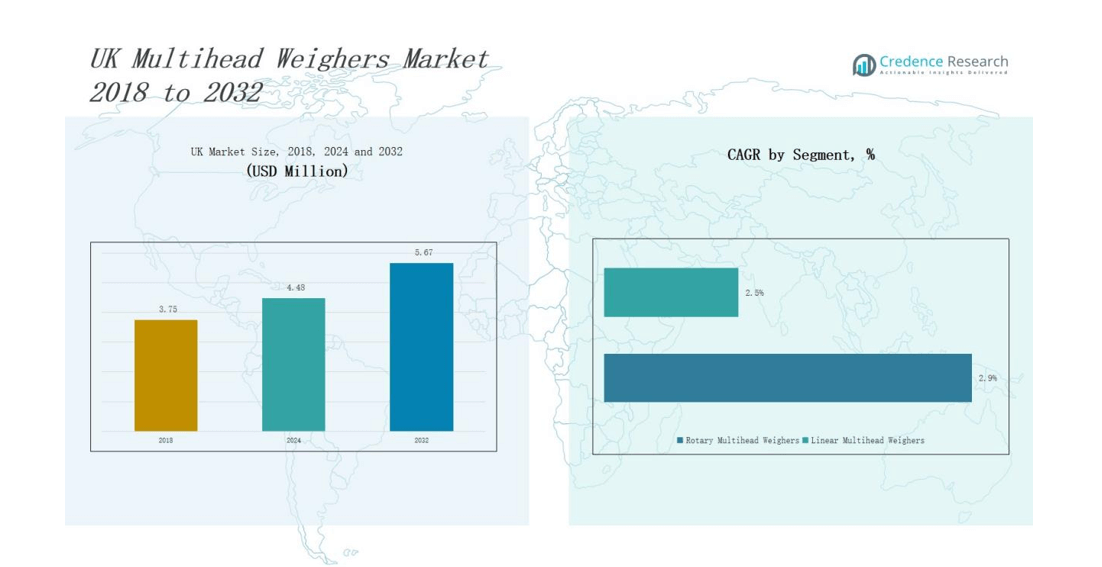

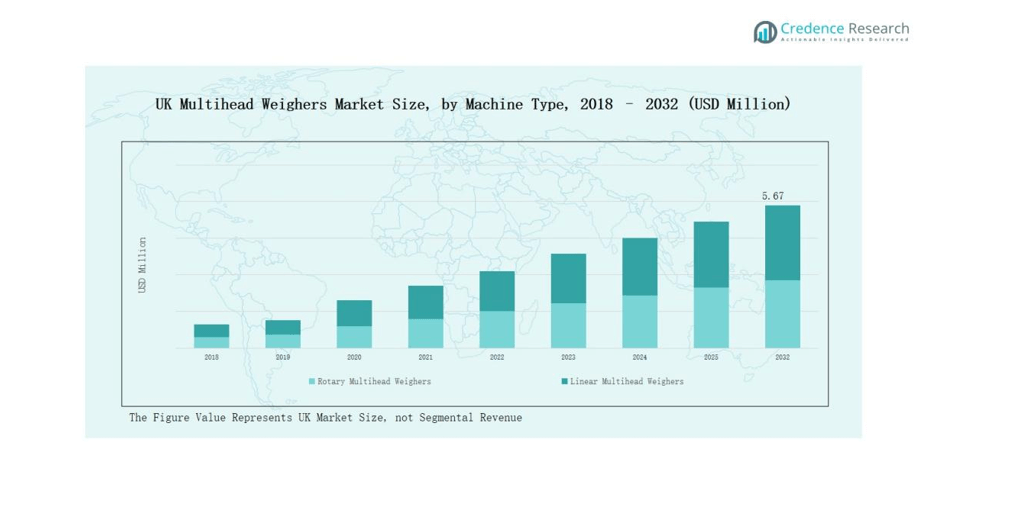

UK Multihead Weighers Market size was valued at USD 3.75 million in 2018 to USD 4.48 million in 2024 and is anticipated to reach USD 5.67 million by 2032, at a CAGR of 2.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Multihead Weighers Market Size 2024 |

SD 4.48 million |

| UK Multihead Weighers Market, CAGR |

2.78% |

| UK Multihead Weighers Market Size 2032 |

USD 5.67 million |

The UK Multihead Weighers Market is shaped by leading companies such as Cabinplant, Multipond, Paxiom Group, Comek S.r.l, ExaktaPack, Ohlson Packaging, Laurijsen Weegautomaten, Line Equipment Ltd, MBP S.r.l, and Nichrome Packaging Solutions. These players strengthen their market presence through advanced product portfolios, automation-driven innovations, and tailored solutions for food, pharmaceutical, cosmetics, and chemical industries. Cabinplant and Multipond lead with high-speed rotary weighers, while MBP S.r.l and Nichrome focus on cost-efficient systems for small and medium enterprises. Among regions, England dominates with 58% market share, supported by its robust packaged food sector, regulatory focus on efficiency, and heavy investments in automated production systems. This concentration of demand establishes England as the key hub for multihead weigher adoption in the UK.

Market Insights

- The UK Multihead Weighers Market grew from USD 3.75 million in 2018 to USD 4.48 million in 2024 and will reach USD 5.67 million by 2032 at 2.78% CAGR.

- Rotary multihead weighers lead with 62% share, driven by speed, accuracy, and efficiency in large-scale packaging, while linear weighers hold 38% with focus on compact, cost-effective operations.

- Food and beverage dominates applications with 71% share, followed by pharmaceuticals at 14%, cosmetics at 9%, and chemicals at 6%, reflecting diverse industrial adoption.

- England leads regionally with 58% share, supported by strong packaged food demand and investments in automation, while Scotland, Wales, and Northern Ireland together contribute 42%.

- Key players include Cabinplant, Multipond, Paxiom Group, Comek S.r.l, ExaktaPack, Ohlson Packaging, Laurijsen Weegautomaten, Line Equipment Ltd, MBP S.r.l, and Nichrome Packaging Solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Machine Type

Rotary multihead weighers hold the dominant share of 62% in the UK market. Their widespread adoption is driven by high-speed weighing capabilities, precision, and efficiency in large-scale food packaging lines. The growing demand for flexible packaging solutions and faster production cycles continues to strengthen the preference for rotary systems across major manufacturers. In contrast, linear multihead weighers, holding 38%, find niche applications in smaller operations where compact design and cost-efficiency are prioritized.

- For instance, Ishida’s RV Series rotary multihead weighers are widely used in UK snack factories, offering speeds of up to 200 weighments per minute without compromising accuracy.

By Application

The food and beverage industry leads with a commanding 71% share of the UK multihead weighers market. This dominance is fueled by the country’s strong packaged food sector, rising demand for ready-to-eat meals, and strict quality standards requiring accurate portioning. Pharmaceuticals account for 14%, supported by regulatory emphasis on dosage precision and sterile packaging requirements. The cosmetics sector follows with 9%, leveraging weighers for consistent product filling in personal care and beauty lines. Chemicals represent the remaining 6%, primarily for specialty powders and granules, where precision and safety drive adoption.

- For instance, Walkers (PepsiCo UK) employs multihead weighers at its Leicester plant packing over 11 million bags of crisps daily with precision.

Market Overview

Key Growth Drivers

Rising Packaged Food Consumption

The UK’s increasing demand for packaged and ready-to-eat food is a primary growth driver for the multihead weighers market. Consumers seek convenience, consistency, and quality in portion sizes, creating a strong need for high-speed and accurate weighing solutions. Food processors adopt advanced rotary weighers to meet production efficiency targets and maintain compliance with safety standards. This trend strengthens the dominance of food and beverage applications, ensuring stable demand for both rotary and linear multihead weighers across large-scale and mid-tier manufacturers.

- For instance, Greencore Group, a leading convenience foods producer, uses high-speed weighers across its ready-meal factories supplying Tesco and Sainsbury’s, where precision and speed are critical.

Regulatory Focus on Accuracy and Waste Reduction

Strict UK regulations on food safety, portion control, and sustainability drive the adoption of precision weighing equipment. Multihead weighers reduce product giveaway and minimize packaging waste, aligning with government initiatives on waste reduction and environmental goals. Manufacturers benefit from improved cost efficiency and stronger compliance records, enhancing brand reputation. This regulatory push incentivizes the use of automated weighing solutions across sectors, particularly in pharmaceuticals and food packaging, where dosage accuracy and product traceability are critical.

- For instance, Marks & Spencer enhanced sustainability by using automated portion-control weighing in ready-meal packaging, reducing overfilling and supporting its “Plan A” commitment to halve food waste by 2030.

Automation and Efficiency in Manufacturing

The shift toward Industry 4.0 and smart factory operations is fueling demand for automated weighing systems in the UK. Multihead weighers integrate with advanced packaging lines, enabling faster changeovers, remote monitoring, and predictive maintenance. Companies adopt these systems to cut labor costs, enhance production speed, and ensure consistency. Automation improves flexibility, allowing manufacturers to handle multiple product varieties without compromising accuracy. The growing emphasis on efficiency and productivity positions multihead weighers as a key investment for competitive advantage in UK manufacturing.

Key Trends & Opportunities

Integration with Smart Packaging Solutions

The integration of multihead weighers with digital packaging systems is an emerging trend in the UK market. Producers are increasingly combining weighing technology with data-driven packaging and traceability solutions to enhance supply chain visibility. This synergy offers opportunities for predictive analytics, reduced downtime, and better product tracking. As consumer demand for transparency and sustainability grows, smart packaging supported by multihead weighers provides a unique advantage for manufacturers in highly competitive industries.

- For instance, MULTIPOND, which combines multihead weighers with automated distribution systems that enable accurate, high-speed filling into varied packaging formats, reducing downtime and improving throughput.

Expansion into Non-Food Industries

While food and beverage dominate, new opportunities are emerging in pharmaceuticals, cosmetics, and specialty chemicals. These sectors demand precise weighing for powders, granules, and high-value formulations, making multihead weighers increasingly relevant. The cosmetics industry, in particular, benefits from accurate portioning in beauty products and sample packaging. Expanding applications beyond food create growth potential for suppliers targeting diversified end-user needs. Companies investing in customized solutions for non-food industries stand to capture untapped market opportunities in the UK

- For instance, BASF employs precision dosing in specialty chemicals production to control reactive powder blends, improving product stability and safety.

Key Challenges

High Initial Investment Costs

One of the biggest challenges for the UK multihead weighers market is the high capital investment required. Advanced rotary weighers equipped with automation and digital integration demand significant upfront expenditure, which can deter small and medium enterprises. The cost burden restricts adoption across niche sectors such as cosmetics and specialty chemicals, where volumes are lower. Balancing affordability with technological advancement remains a pressing challenge for suppliers aiming to widen market penetration.

Maintenance and Technical Complexity

Multihead weighers require regular calibration, skilled operators, and advanced maintenance to ensure accuracy and efficiency. Technical complexity poses a barrier for companies with limited expertise or resources. Any operational downtime due to breakdowns can disrupt production schedules and increase costs. Ensuring reliable after-sales service and training support is vital for manufacturers to overcome this challenge and maintain confidence among UK buyers.

Intense Competition and Price Pressure

The UK market faces intense competition among domestic and global suppliers, leading to significant price pressure. Manufacturers often compete on cost rather than innovation, which can compress margins. Customers demand high-performance equipment at competitive prices, challenging suppliers to balance quality with affordability. The entry of low-cost alternatives from international players further intensifies the competitive landscape, making differentiation through service, technology, and customization essential for long-term success.

Regional Analysis

England

England holds the largest share of the UK Multihead Weighers Market with 58%. Its strong packaged food and beverage industry drives the highest adoption of advanced weighing systems. Leading manufacturers invest in rotary weighers to support high-volume operations across urban centers like London and Manchester. The region’s regulatory focus on waste reduction and efficiency further accelerates uptake. Pharmaceutical and cosmetics companies in southern England also rely on multihead weighers to meet quality standards. Continuous innovation and demand from both large-scale and mid-tier firms sustain growth in this region.

Scotland

Scotland accounts for 18% of the UK market, supported by a growing food processing sector. The country emphasizes exports of seafood, meat, and bakery products, where accuracy in portioning strengthens global competitiveness. Local producers adopt linear weighers to manage smaller batch operations, while larger firms use rotary systems for speed. Strong government support for automation in food and beverage industries improves adoption. It also sees rising use of weighers in pharmaceuticals due to investments in life sciences. Scotland’s balanced mix of industries provides a stable market environment.

Wales

Wales represents 13% of the market, with food and beverage manufacturing as the main driver. Dairy, confectionery, and snack producers adopt weighers to maintain portion consistency and reduce waste. Small and medium enterprises dominate the sector, creating demand for cost-effective linear machines. It is also experiencing steady growth in cosmetics packaging, supported by niche personal care brands. Government support for local manufacturing encourages investments in automation technologies. Though smaller in size, the region contributes significantly to overall adoption across specialized industries.

Northern Ireland

Northern Ireland contributes 11% to the UK market, with food production forming the backbone of demand. Meat processing and bakery industries require advanced weighers to maintain high export standards. Adoption is rising in chemicals and pharmaceuticals, where precision in handling powders and granules is critical. It benefits from increasing cross-border trade with Ireland, strengthening equipment demand. Local manufacturers prefer flexible systems that integrate with packaging lines to reduce labor reliance. Though the smallest region, Northern Ireland shows consistent growth and steady adoption trends.

Market Segmentations:

By Machine Type

- Rotary Multihead Weighers

- Linear Multihead Weighers

By Application

- Food and Beverage Industry

- Pharmaceuticals

- Cosmetics

- Chemicals

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Multihead Weighers Market is highly competitive, with both global and domestic players shaping industry dynamics. Leading companies such as Cabinplant, Multipond, and Paxiom Group hold strong positions by offering advanced rotary and linear systems tailored to high-volume production needs. Nichrome Packaging Solutions and MBP S.r.l. enhance competitiveness through cost-effective machines designed for small and medium enterprises. Firms emphasize innovation in automation, precision, and integration with packaging lines to secure contracts across food, pharmaceutical, and cosmetics industries. Intense competition has created pressure on pricing, encouraging players to differentiate through after-sales services, training, and customized solutions. Strategic collaborations, product upgrades, and focus on sustainability goals are common strategies to strengthen market presence. The landscape reflects a blend of well-established multinational suppliers and specialized regional manufacturers, ensuring diverse offerings and steady technological progress across the UK market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cabinplant

- Multipond

- Paxiom Group

- Comek S.r.l

- ExaktaPack

- Ohlson Packaging

- Laurijsen Weegautomaten

- Line Equipment Ltd

- MBP S.r.l

- Nichrome Packaging Solutions

Recent Developments

- In June 2025, Ishida Europe Ltd. launched its redesigned CCW-AS multi-head weigher, improving accuracy, speed, and reducing food waste in UK confectionery production.

- In February 2024, Prima Cheese adopted Ishida’s CCW-AS after trials, boosting throughput by 30–40% with precise portioning and vision monitoring.

- In February 2025, Aviko upgraded its UK site with Ishida’s CCW-RV weighers, raising packing speed to 70 packs per minute while maintaining tight accuracy.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed rotary weighers will continue to rise in large-scale food operations.

- Linear weighers will gain traction among small and medium enterprises for cost efficiency.

- Integration with smart packaging systems will become a standard feature across industries.

- Food and beverage will remain the dominant sector driving adoption of multihead weighers.

- Pharmaceuticals will expand usage due to strict compliance and precision requirements.

- Cosmetics manufacturers will increasingly adopt weighers for consistent product filling.

- Chemical applications will create demand for specialized systems handling powders and granules.

- Automation and digital connectivity will enhance machine performance and reduce downtime.

- Competition among global and domestic players will intensify with emphasis on service quality.

- Sustainability goals will push manufacturers to develop energy-efficient and low-waste weighing solutions.