Market Overview

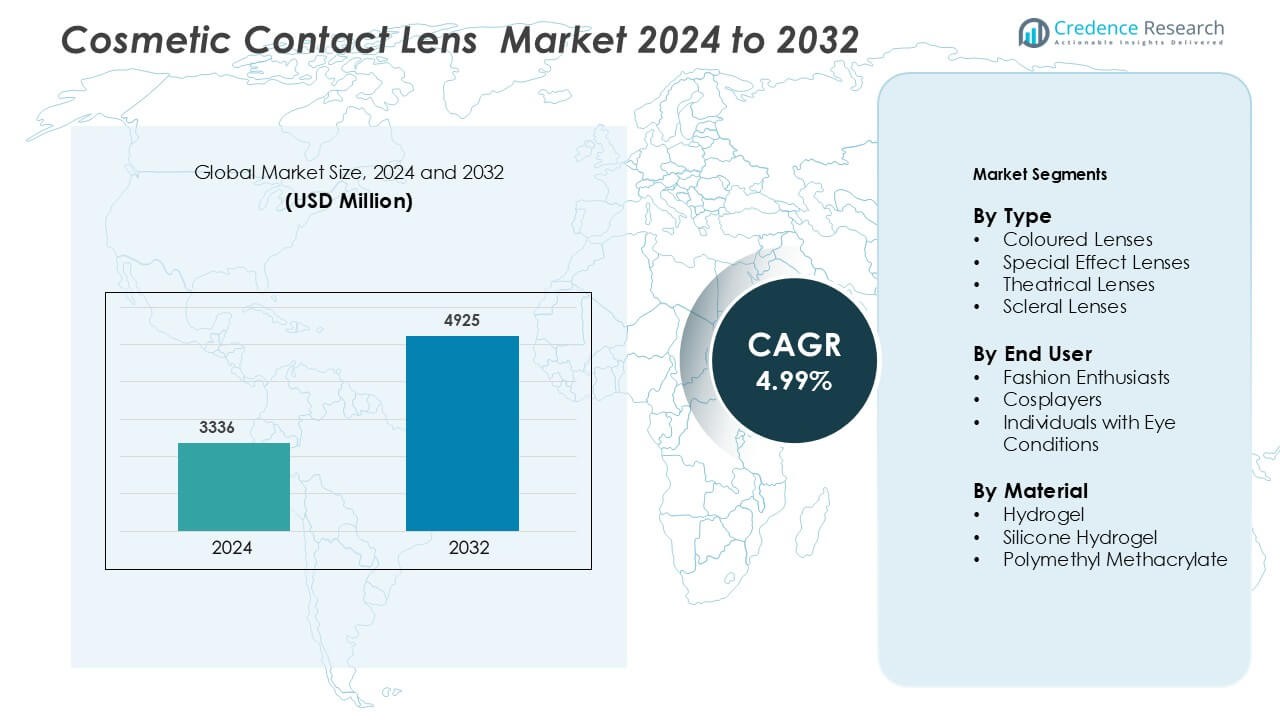

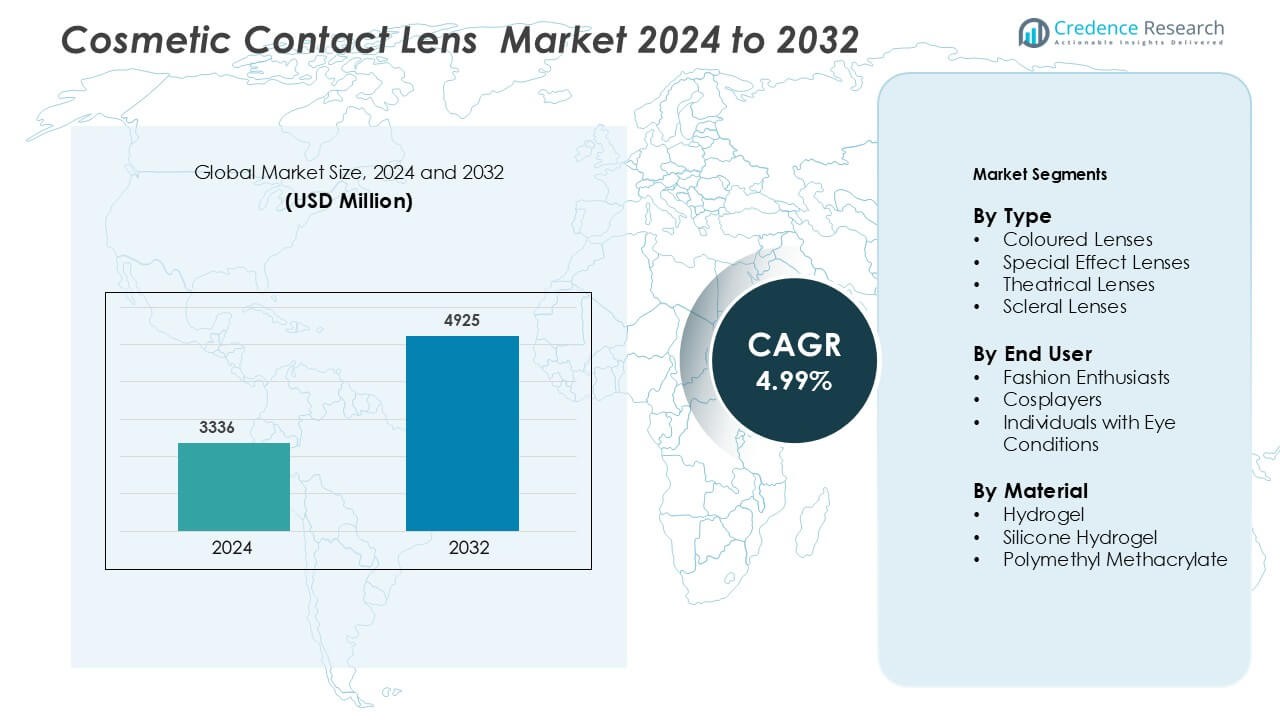

Cosmetic Contact Lens Market was valued at USD 3336 million in 2024 and is anticipated to reach USD 4925 million by 2032, growing at a CAGR of 4.99 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Contact Lens Market Size 2024 |

USD 3336 Million |

| Cosmetic Contact Lens Market, CAGR |

4.99% |

| Cosmetic Contact Lens Market Size 2032 |

USD 4925 Million |

In the global cosmetic contact lens market, competition remains moderately concentrated with the top firms collectively securing around 45%–50% of total share. Johnson & Johnson Vision, Bausch + Lomb, and Alcon Inc. lead this segment by focusing on continuous product innovation in colored and decorative lenses. These players emphasize advancements in lens material, comfort enhancements, UV‑protection features and multi‑layer color design. Regional and niche players also contribute by catering to local aesthetic preferences and offering cost‑effective alternatives, which intensifies competitive pressure and drives diversification across price tiers and design variants.

Market Insights

Market Insights

- Global cosmetic contact lens market size reached USD 3336 million in 2023 and is projected to grow at a CAGR of 4.99% from 2024 to 2032.

- Growing fashion and aesthetic consciousness among younger consumers drives demand for colored, circle and patterned lenses, while technology‑enhanced materials improve comfort and safety, supporting market expansion.

- Trends include personalization and customization of lenses based on color, shape and prescription, plus rising integration of eye‑health features (UV protection, moisture retention) in cosmetic lenses, creating new opportunities.

- Competitive landscape features major players such as Johnson & Johnson Vision Care, Inc., Bausch + Lomb and Alcon Inc. focusing on innovation, which raises market entry barriers and restricts growth of smaller regional firms.

- Regulatory and safety concerns, including risks of eye infections and allergies from misuse or low‑quality lenses, limit adoption in certain regions and serve as a key restraint on market growth

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The cosmetic contact lens market is segmented into colored lenses, circle lenses, and tinted lenses. Colored lenses dominate the market with a significant share due to their versatility in enhancing eye appearance and aesthetic appeal. The rising popularity among young adults and social media influencers drives adoption. Circle lenses are gaining traction for their eye-enlarging effect, especially in Asian markets. Increasing awareness of eye fashion trends, coupled with growing availability through online and retail channels, further supports growth across all lens types, while tinted lenses maintain steady demand for subtle enhancement applications.

- For instance, Johnson & Johnson Vision Care’s Acuvue Define colored lenses use advanced multi-layer pigment technology, achieving consistent color coverage while maintaining oxygen permeability at 25.5 Dk/t.

By Material

Segments include hydrogel and silicone hydrogel lenses, with hydrogel lenses holding the dominant market share. Hydrogel lenses are favored for their superior comfort, moisture retention, and affordability. Silicone hydrogel lenses are growing in popularity due to higher oxygen permeability, supporting extended wear and healthier eyes. Market expansion is fueled by rising consumer preference for comfortable and long-wearable lenses, alongside advancements in material technology enhancing lens durability, hydration, and ease of handling. Ongoing R&D ensures product innovation, strengthening the position of hydrogel lenses while increasing consumer confidence in eye safety.

- For instance, CooperVision’s Biofinity® silicone hydrogel lenses deliver oxygen permeability of 160 Dk/t, reducing hypoxia risk during extended

By Wearing Schedule

The market is divided into daily disposable, monthly, and yearly lenses, with daily disposable lenses emerging as the dominant sub-segment. Daily disposables are preferred due to hygiene benefits, convenience, and reduced risk of infections. Monthly and yearly lenses retain demand for cost-conscious consumers seeking longer usage cycles. Drivers include increasing health awareness, ease of use, and growing online and retail distribution networks that enhance accessibility. Technological improvements in lens hydration, oxygen transmission, and surface smoothness further reinforce consumer adoption of daily disposables in both cosmetic and corrective applications.

Key Growth Drivers

Rising Fashion and Aesthetic Consciousness

Increasing consumer focus on personal appearance and eye aesthetics is a major growth driver in the cosmetic contact lens market. Colored and circle lenses allow users to enhance eye color, size, and overall appearance, which is particularly appealing to millennials and Gen Z consumers. Social media influence and celebrity endorsements have further popularized lens usage as a fashion accessory. The demand is boosted by festivals, events, and photo-sharing trends, driving regular purchases. Additionally, online platforms offering diverse lens styles and virtual try-on technologies make it easier for consumers to experiment with eye looks safely. These factors collectively increase adoption rates, especially in urban markets, strengthening market growth and encouraging manufacturers to develop innovative designs and materials tailored to aesthetic preferences.

- For instance, CooperVision Biofinity® Circle lenses utilized Aquaform® technology, ensuring a water content of 48% and 12-hour surface hydration, improving both comfort and aesthetic appearance for extended wear.

Advancements in Lens Material and Technology

Technological innovations in lens materials and manufacturing processes are supporting market expansion. Modern hydrogel and silicone hydrogel lenses offer enhanced oxygen permeability, moisture retention, and comfort for extended wear. Innovations such as ultra-thin lenses, anti-UV coatings, and high-definition optics improve visual clarity while maintaining safety standards. Companies are investing in research to produce lenses with reduced dryness, improved durability, and lightweight designs, which increase consumer confidence and adoption. For instance, improvements in surface wettability and antimicrobial coatings reduce infection risk and support longer usage cycles. These material and technological enhancements address key consumer pain points, making cosmetic lenses safer, more comfortable, and attractive, thus driving sustained growth across global markets.

- For instance, CooperVision’s Biofinity® silicone hydrogel lenses have an oxygen transmissibility of approximately 160 Dk/t (at -3.00D power) and a 48% water content, utilizing Aquaform® Technology to attract and bind water within the lens material for continuous comfort and natural wettability.

Expansion of Online and Retail Distribution Channels

The widespread availability of cosmetic contact lenses through online portals, optical retail chains, and e-commerce platforms is a significant growth driver. Consumers benefit from easy access to a variety of lens types, colors, and brands, often with home delivery and trial options. Retail expansion in emerging economies increases product penetration in regions with rising disposable incomes and growing youth populations. E-commerce platforms integrate virtual try-on tools, subscription models, and educational content, improving user experience and promoting repeat purchases. The combination of convenience, broader product choices, and awareness campaigns through digital channels drives adoption across both urban and semi-urban areas, strengthening market reach and supporting manufacturers’ revenue growth globally.

Key Trend & Opportunity

Personalization and Customization

Personalized and customizable cosmetic contact lenses are emerging as a significant market trend. Consumers increasingly seek lenses tailored to their eye color, shape, and desired effect, including circle lenses, gradient designs, and specialty patterns. Companies are leveraging AI and online visualization tools to offer virtual try-on experiences and precise product recommendations. This trend creates opportunities for premium product lines and limited-edition collections, catering to niche preferences. Additionally, customization allows brands to differentiate themselves in a competitive market while increasing consumer loyalty. Rising consumer willingness to pay for unique, tailored designs further strengthens the potential for growth in personalized cosmetic lenses globally.

- For instance, L’Oréal’s Perso device analyzes 2,000 facial data points and environmental conditions to dispense 1.5 mL of a custom blend with precise concentrations of bioactives.

Integration of Eye Health with Cosmetic Lenses

There is growing consumer demand for cosmetic lenses that combine aesthetic appeal with eye health benefits. Features such as UV protection, moisture retention, and anti-allergic coatings are increasingly integrated into lens designs. For instance, lenses with silicone hydrogel technology ensure higher oxygen permeability, reducing dryness and discomfort. This dual focus on safety and appearance creates opportunities for product differentiation and encourages adoption among health-conscious consumers. Brands emphasizing clinical testing, certification, and innovative coatings can capture consumer trust and expand market share. The convergence of cosmetic enhancement with functional benefits represents a key opportunity for long-term growth and sustained consumer engagement.

- For instance, The Bausch Lomb Ultra® lenses, which use MoistureSeal® technology, actually have a material water content of 46%.

Key Challenge

Regulatory and Safety Compliance

Stringent regulatory standards for contact lens safety and quality pose a significant challenge for market players. Lenses must comply with national and international guidelines for materials, oxygen permeability, sterility, and labeling. Non-compliance or lack of clinical validation can result in product recalls, reputational damage, and legal issues. Emerging markets often face challenges in enforcing consistent regulatory frameworks, increasing risk for manufacturers entering new regions. Additionally, the need for continuous monitoring, certification, and quality control increases production costs. Companies must invest in rigorous testing and regulatory expertise to ensure safe, compliant products, which can impact pricing, scalability, and market penetration.

Risk of Eye Infections and Adverse Effects

The risk of eye infections, allergic reactions, and other complications is a major challenge for the cosmetic contact lens market. Improper lens handling, extended wear, and non-compliance with hygiene practices can lead to keratitis, conjunctivitis, and corneal abrasions. These health concerns may reduce consumer confidence, particularly among first-time users. Public awareness campaigns and clear guidance on safe usage are critical, but inconsistent education across regions can limit effectiveness. Manufacturers face the challenge of designing lenses with antimicrobial properties and comfort-enhancing features while maintaining aesthetic appeal. Addressing these risks is essential to ensure sustained market adoption and reduce liability concerns.

Regional Analysis

North America

North America holds about 40% of the global cosmetic contact lens market share, making it the dominant region. This strong position is driven by high consumer spending on aesthetic products, well‑developed retail and e‑commerce channels, and extensive awareness of contact lens varieties and trends. Advanced healthcare infrastructure ensures safe distribution and regulatory compliance. Meanwhile, the region’s large youth and millennial demographic actively adopts colored and circle lenses as fashion accessories, further boosting demand and brand innovation.

Europe

Europe accounts for approximately 28% of the global cosmetic contact lens market. Consumer preference for premium beauty and fashion accessories supports widespread uptake of colored lenses and specialized designs. Well‑established optical retail networks and stringent safety regulations also foster market growth by increasing consumer confidence. Additionally, growing e‑commerce penetration and localized marketing strategies in countries such as Germany, France and the UK drive expansion of niche cosmetic lens products.

Asia‑Pacific

Asia‑Pacific holds about 23% of the global cosmetic contact lens market share. Rapid urbanization, rising disposable incomes, and strong demand for beauty and aesthetic enhancements fuel growth. Social media trends and cultural influences encourage colored and circle lens adoption in countries like China, India and South Korea. Online retail platforms enable deeper reach into semi‑urban areas, while local manufacturers tailor product designs to regional fashion tastes.

Latin America

Latin America contributes roughly 5% of the global cosmetic contact lens market. This smaller share reflects still‑emerging consumer demand and limited product availability compared to mature markets. However, rising beauty consciousness, improving optical retail infrastructure, and increased access to online platforms offer growth potential in countries like Brazil and Mexico. Brands targeting local trends and affordable pricing may accelerate adoption.

Middle East & Africa (MEA)

The Middle East & Africa region represents around 2% of the global cosmetic contact lens market. Its modest share stems from comparatively lower penetration of aesthetic contact lenses and variable regulatory frameworks. Growth is supported by improving eye‑care awareness, wealth concentration in Gulf countries, and increasing online shopping. Nevertheless, challenges such as logistical access and consumer education limit rapid expansion.

Market Segmentations:

By Type

- Colored Lenses

- Special Effect Lenses

- Theatrical Lenses

- Scleral Lenses

By End User

- Fashion Enthusiasts

- Cosplayers

- Individuals with Eye Conditions

By Material

- Hydrogel

- Silicone Hydrogel

- Polymethyl Methacrylate

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the cosmetic contact lens market, competitive dynamics are characterised by moderate concentration alongside strong regional diversification. Major players such as Johnson & Johnson Vision, Bausch + Lomb and Alcon Inc. These leading firms dominate through ongoing product innovation—such as enhanced silicone hydrogel colour lenses, UV‑protection coatings, and moisture‑retaining surfaces. Meanwhile, numerous regional and niche manufacturers compete by tailoring lens designs to specific aesthetic preferences in local markets and offering cost‑competitive alternatives. Significant first‑mover advantage and large‑scale R&D investments create high entry barriers, which limit new entrants. At the same time, partnerships and acquisitions between global leaders and emerging brands provide strategic pathways for growth and innovation in decorative and cosmetic lens segments.

Key Player Analysis

- EssilorLuxottica

- SEED Co., Ltd.

- CooperCompanies (CooperVision)

- Bausch + Lomb

- Menicon Co., Ltd.

- Johnson & Johnson Services, Inc. (Johnson & Johnson Vision Care, Inc.)

- HOYA CORPORATION (HOYA Corporation Contact Lens Division)

- Contamac

- Euclid Vision Group

- ALCON INC.

Recent Developments

- In October 2023, XPANCEO, a deep tech startup, raised $40 million in a seed funding round to develop the first contact lenses featuring augmented reality (AR) capabilities. Opportunity Ventures (Asia), based in Hong Kong, led this funding round. The capital will be utilized to advance the next prototype, which aims to integrate multiple features into a single device.

- In November 2022, Carter Ledyard’s client CooperVision, Inc. finalized its acquisition of SynergEyes, Inc., which offers a diverse array of specialty contact lenses, including unique hybrid lenses. These products enhance CooperVision’s portfolio, particularly its Onefit scleral lenses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End-User, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cosmetic contact lens market will expand steadily, supported by rising demand among teens and young adults seeking aesthetic eyewear options.

- Product innovation will drive growth, with more lenses offering UV protection, moisture‑retaining surfaces, and advanced pigments that improve comfort and appearance.

- Online retail channels will play a key role in future growth as brands enhance virtual try‑on tools and subscription services to make purchasing lenses more convenient.

- Regional growth will accelerate in Asia‑Pacific as urbanization, social media influence, and disposable incomes increase consumer interest in colored and circle lenses.

- Premium segment adoption will gain traction as consumers shift towards higher quality materials such as silicone hydrogel and more detailed designs, creating opportunities for upscale brands.

- Personalization will become more common, with lenses tailored to eye shape, color, and environment becoming available through AI–driven tools and custom manufacturing.

- Regulations and safety standards will strengthen worldwide, encouraging manufacturers to improve sterilization, fit consultations, and material transparency, boosting consumer confidence.

- Brand collaborations with fashion, entertainment, and influencer markets will generate new niche collections and limited‑edition styles, driving consumer engagement and repeat purchases.

- Sustainability will become a differentiator as companies adopt eco‑friendly packaging, biocompatible materials, and recyclable components to meet consumer environmental expectations.

- Educating consumers about safe use and hygiene practices will remain critical, as adoption increases and manufacturers emphasize health‑first messaging in cosmetic contact lens marketing.

Market Insights

Market Insights