Market Overview:

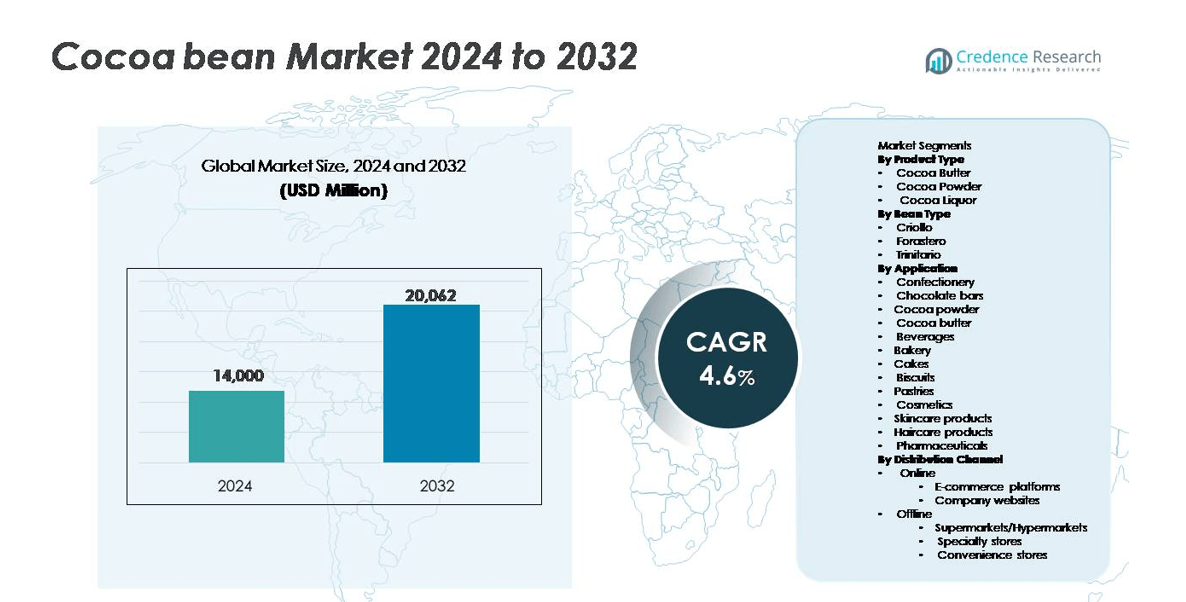

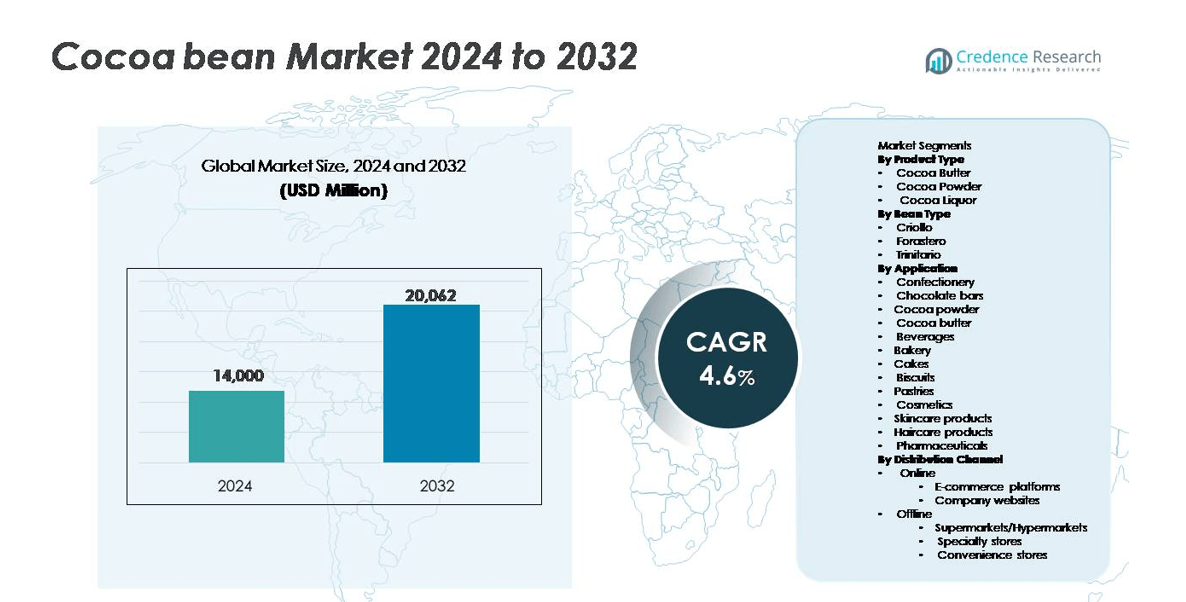

The cocoa bean market size reached USD 14,000 million in 2024 and is projected to rise to USD 20,062 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocoa Bean Market Size 2024 |

USD 14,000 million |

| Cocoa Bean Market, CAGR |

4.6% |

| Cocoa Bean Market Size 2032 |

USD 20,062 million |

Global leaders shape sourcing, grinding, and distribution across origins. Key players include Barry Callebaut, Cargill, ofi (Olam Food Ingredients), ECOM Agroindustrial, Touton, CEMOI, and Blommer Chocolate. Europe leads the market with 35% share, followed by Asia Pacific at 28% and North America at 22%, while Latin America holds 8% and Middle East & Africa 7%. These companies secure long-term origin contracts, expand regional grinding capacity, and invest in traceability and sustainability programs to meet premium, dark, and ethically sourced demand across retail, bakery, beverage, and cosmetics channels.

Market Insights

- Market size 2024: USD 14,000 million; 2032: USD 20,062 million; CAGR: 4.6%.

- Demand rises with premium and dark chocolate. Bakery, beverages, and RTD mixes expand cocoa use. Cosmetics adopt cocoa butter for moisturization, lifting butter offtake.

- Brands push traceable, deforestation-free cocoa and single-origin lines. Barry Callebaut, Cargill, ofi, ECOM, Touton, and Blommer expand grinding and digital traceability, strengthening supply security and quality.

- Volatile prices, weather shocks, and disease threaten yields in West Africa. Labor and compliance requirements raise costs. Smallholder fragmentation limits quality control and farm investment.

- Europe holds 35%, Asia Pacific 28%, North America 22%, Latin America 8%, Middle East & Africa 7%. Dominant segments: cocoa butter 46%, confectionery 38%, Forastero beans 82%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Cocoa butter held the dominant share with 46% of the product segment due to its wide use in chocolate, bakery fillings, and cosmetics. Producers prefer cocoa butter for its smooth texture, natural aroma, and stability in confectionery applications. The demand grows as premium and artisan chocolate brands expand. Cocoa powder follows as a key ingredient for beverages and bakery, supported by rising consumption of flavored milk and ready drink mixes. Cocoa liquor also gains use for dark chocolate production, driven by rising consumer focus on rich cocoa flavor profiles and clean-label products.

- For instance, Barry Callebaut operates cocoa processing facilities in Abidjan and San Pedro, Côte d’Ivoire. The Abidjan facility was planned to have a capacity of 100,000 tonnes per year as part of an expansion in 2019, while the total combined capacity for the country was set to reach approximately 230,000 tonnes per year by 2022.

By Bean Type

Forastero beans accounted for 82% of the overall bean supply due to high yield, resistance to diseases, and consistent flavor. Major chocolate and confectionery companies rely on Forastero for large-scale processing, especially in West Africa where production capacity remains strong. Criollo holds a small share but drives premium and specialty chocolate demand because of its fine flavor and low bitterness. Trinitario combines traits of both varieties and continues to gain traction in premium blends as consumers shift toward gourmet and high-cocoa products.

- For instance, Valrhona incorporates Trinitario beans from the Dominican Republic to support its Grand Cru chocolate series through established, long-term partnerships with local producers, such as the Rizek cacao cooperative

By Application

Confectionery remained the dominant application with 38% share due to strong demand for chocolates, cocoa-based candies, and flavored fillings. Chocolate bars drive heavy cocoa usage, supported by growth in premium dark chocolate and sugar-free options. The bakery segment also expands, especially in cakes, biscuits, and pastries, where cocoa powder enhances color and flavor. Beverage manufacturers use cocoa for flavored milk, shakes, and hot chocolate mixes. Cosmetics and skincare brands increase cocoa butter use in creams and lotions due to natural moisturizing properties, while pharmaceuticals apply cocoa derivatives in coatings and health supplements.

Key Growth Drivers

Rising Demand for Premium and Dark Chocolate

The rising consumption of premium and dark chocolate acts as a major driver for cocoa bean demand. Consumers show stronger preference for rich cocoa flavors, clean-label products, and lower sugar content. Dark chocolate remains widely associated with health benefits such as antioxidants and flavonoid content, which increases its appeal among health-aware buyers. Global brands expand premium assortments and single-origin chocolate lines, pushing manufacturers to source high-quality beans, especially Criollo and Trinitario. In major consuming regions such as Europe and the U.S., artisan and bean-to-bar companies boost demand for traceable cocoa supply. Asian markets also experience faster adoption of dark and luxury chocolate as incomes rise and gifting traditions grow. This shift supports long-term growth for the cocoa bean industry by creating stronger value for premium beans, improving price realization for farmers, and encouraging sustainable farming practices.

- For instance, in September 2015, Mondelez opened a new, state-of-the-art chocolate production line at its Skarbimierz factory in Poland with a $30 million investment to increase production capacity for its European confectionery business.

Expanding Food, Beverage, and Bakery Industries

Cocoa bean demand increases as food and beverage manufacturers launch new products in confectionery, bakery, dairy, and beverages. Cocoa powder and butter remain core ingredients for biscuits, pastries, filled chocolates, flavored milk, and drink mixes. Urbanization and the expansion of supermarkets boost packaged food consumption, especially in developing nations. Ready-to-eat snacks, cocoa-based breakfast products, and sweet spreads continue attracting younger consumers and children. Global fast-food and café chains introduce more cocoa-based desserts, cakes, and beverages, which supports large-scale supply. Growing preference for indulgent flavors, premium bakery items, and seasonal confectionery collections strengthens bulk cocoa usage among large processors. At the same time, vegan and allergen-free brands increase cocoa use as a plant-based flavoring. These diverse applications ensure steady demand across industries, creating a stable market outlook for cocoa bean producers.

- For instance, Mondelez operates biscuit and chocolate facilities in India with a combined annual production capacity above 350,000 metric tons, enabling continuous demand for cocoa powder and butter in brands such as Cadbury and Oreo.

Growth of Cocoa Use in Cosmetics and Personal Care

Cocoa butter plays a major role in creams, lotions, and haircare products because it offers strong moisturizing, anti-oxidative, and skin protection properties. As consumers adopt natural and chemical-free personal care, manufacturers increase cocoa sourcing for body butters, lip balms, massage oils, and premium soap formulations. The clean beauty and organic cosmetics trend fuels higher demand from skincare brands seeking ethically sourced ingredients. Personal care giants launch cocoa-enriched creams and anti-aging solutions, promoting cocoa’s natural vitamins and fatty acids. Cocoa extracts also enter haircare for smoothening and scalp nourishment. As cosmetic producers expand into emerging economies and e-commerce rises, cocoa butter gains stronger distribution across global markets. This segment supports price stability and encourages cocoa farmers to adopt quality-focused and sustainable cultivation practices to meet industrial supply standards.

Key Trends & Opportunities

Rising Demand for Sustainable and Traceable Cocoa

Sustainability becomes a key trend as consumers and manufacturers prioritize ethically sourced and traceable cocoa. Major chocolate brands invest in fair-trade certification, farmer income improvement, and deforestation-free farming to meet global compliance standards. Blockchain-based tracking systems, digital farm monitoring, and GPS-based supply chain mapping help guarantee transparency from farm to chocolate bar. Demand for traceable products grows fastest in Europe and North America, and premium chocolate makers use traceability as a brand differentiator. This trend creates opportunities for farmers and cooperatives that adopt certified farming practices, leading to higher income and better market access. Sustainable sourcing also drives partnerships between processors, NGOs, and governments to support climate-resilient cocoa cultivation.

- For instance, Cargill’s 2023 progress report, the company’s traceability platform has digitally mapped 95% of farmers in its direct cocoa supply chain in Côte d’Ivoire and Ghana. This mapping captures GPS coordinates for an area exceeding 400,000 hectares, linking each farmer to a verified supply record via a digital system.

Innovation in Cocoa-Based Functional Foods and Beverages

Manufacturers incorporate cocoa derivatives into functional snacks, energy bars, protein beverages, and health-focused desserts. The antioxidant and mood-enhancing attributes of cocoa attract health-conscious consumers. Sugar-free and high-cocoa formulations gain attention among diabetic and fitness-oriented buyers. Brands develop ready-to-drink cocoa beverages, vegan chocolates, and probiotic bakery products with cocoa flavors. Food scientists experiment with alkalized cocoa for improved color and taste, enhancing appeal in milkshakes and ice-cream toppings. This trend opens new opportunities for ingredient suppliers, especially in sports nutrition and plant-based food categories. As global snacking and on-the-go consumption grow, functional cocoa products deliver strong commercial potential.

- For instance, Mars Edge produces “CocoaVia,” a cocoa-flavanol supplement line standardized to deliver 450 mg of cocoa flavanols per serving, validated through clinical studies.

Key Challenges

Price Volatility and Supply Dependency on Few Regions

Cocoa supply remains heavily concentrated in West Africa, making the market vulnerable to climate shifts, political instability, and crop diseases. Fluctuations in temperature, pests, aging plantations, and soil degradation reduce yield consistency. Poor farmer income and lack of infrastructure slow adoption of advanced cultivation methods. As a result, cocoa prices often show sharp volatility, creating cost uncertainty for global processors and chocolate manufacturers. Reliance on small-scale farmers also makes quality control difficult, especially in periods of low harvest. Addressing these supply challenges requires long-term investment in improved farming practices, irrigation, disease-resistant seedlings, and farmer training programs.

Sustainability and Labor Concerns

Labor issues, including reports of child labor and poor working conditions, influence global perception of the cocoa industry. Several countries mandate strict import regulations and sustainability certifications, which increases pressure on farmers and exporters. Meeting ethical sourcing standards requires monitoring, documentation, and compliance costs. Environmental concerns such as deforestation and use of agrochemicals increase scrutiny from regulators and consumers. Brands face reputational risk if supply chains do not meet traceability requirements. Developing responsible sourcing frameworks, community programs, and transparent trade systems remains essential for long-term industry stability.

Regional Analysis

Europe

Europe held 35% market share, anchored by premium chocolate consumption and processing strength. Belgium, Switzerland, and Germany drive gourmet demand and technical innovation. Dark and organic ranges expand shelf space across supermarkets and specialty shops. Bean-to-bar makers promote single-origin stories and higher cocoa content. Retailers emphasize traceable, deforestation-free sourcing and farmer programs. Seasonal gifting boosts fourth-quarter volumes across major economies. Bakery and beverage manufacturers further lift cocoa powder usage.

North America

North America accounted for 22% share, led by strong U.S. demand. Consumers buy more high-cocoa, sugar-free, and clean-label chocolate bars. Premium brands expand single-origin lines through specialty retail and e-commerce. Café chains popularize cocoa beverages and indulgent desserts. Large processors secure sustainable supply through certification programs. Canada adds steady growth in artisanal and functional chocolates. Holiday promotions and limited editions keep volumes resilient.

Asia Pacific

Asia Pacific held 28% share and remains the fastest-growing region. China and India expand premium chocolate and bakery consumption rapidly. Japan and South Korea favor high-quality desserts and cocoa beverages. International brands invest in local plants and digital channels. Gifting occasions and café culture lift year-round demand. Beauty categories add incremental pull for cocoa butter. Convenience stores widen access beyond metros.

Latin America

Latin America captured 8% share, combining supply strength with rising consumption. Brazil and Mexico scale confectionery and bakery manufacturing. Ecuador, Peru, and Colombia lead fine-flavor exports. Bean-to-bar tourism supports premium positioning and farmer incomes. Local processors increase grinding capacity for value addition. Organic and single-origin launches gain visibility in urban retail. E-commerce accelerates reach for niche chocolate brands.

Middle East & Africa

Middle East & Africa held 7% share, with distinct demand and supply roles. Gulf markets import premium chocolates for tourism and gifting. UAE and Saudi Arabia grow specialty retail and duty-free channels. West Africa anchors global supply through Côte d’Ivoire and Ghana. Governments promote local grinding to retain value domestically. Urbanization spreads packaged bakery and cocoa beverages. Certification efforts address sustainability and labor expectations.

Market Segmentations

By Product Type

- Cocoa Butter

- Cocoa Powder

- Cocoa Liquor

By Bean Type

- Criollo

- Forastero

- Trinitario

By Application

- Confectionery

- Chocolate bars

- Cocoa powder

- Cocoa butter

- Beverages

- Bakery

- Cakes

- Biscuits

- Pastries

- Cosmetics

- Skincare products

- Haircare products

- Pharmaceuticals

By Distribution Channel

- Online

- E-commerce platforms

- Company websites

- Offline

- Supermarkets/Hypermarkets

- Specialty stores

- Convenience stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cocoa bean market features a competitive mix of global processors, specialty chocolate makers, farmer cooperatives, and certified sustainable suppliers. Major companies secure long-term contracts with producing nations to ensure stable supply and consistent bean quality. Large processors invest in grinding facilities, flavor development, and traceability systems that meet compliance requirements in mature markets. Specialty chocolate manufacturers focus on single-origin sourcing, fine-flavor beans, and ethical trade, creating strong demand for Criollo and Trinitario varieties. Farmers collaborate with cooperatives and NGOs to improve yields, adopt disease-resistant seedlings, and gain certifications such as Fairtrade, Rainforest Alliance, and UTZ. Investment in local processing rises across Latin America and West Africa to add value before export. Sustainability, transparency, and premiumization remain key strategies as consumers favor clean labels and responsible supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Barry Callebaut announced a long-term partnership with startup Planet A Foods for cocoa-free chocolate alternatives, while reaffirming cocoa remains central to its business.

- In July 2025, Hershey raised chocolate product prices by double-digit percentages to counter high cocoa bean costs.

- In May 2024, a Hyderabad-based craft chocolate company sought to elevate Indian cacao globally, combining scientific precision with farmer collaboration. It delivered traceable, single-origin chocolate, meticulously cultivated, fermented, and transformed from bean to bar under a disciplined, business-centric framework.

- In April 2024, Nestlé S.A. partnered with Cargill, Incorporated, to achieve net-zero emissions by 2050 through an innovative agroforestry scheme focused on cocoa communities. This collaboration is part of a broader commitment to enhance environmental practices within the cocoa supply chain, addressing climate change and cocoa farmers’ socio-economic challenges.

Report Coverage

The research report offers an in-depth analysis based on Product type, Bean type, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium dark chocolate demand will keep accelerating global bean purchases.

- Asia will drive volume growth through gifting, cafés, and bakery expansion.

- Agroforestry adoption will rise to improve yields and climate resilience.

- Traceability systems will expand, covering farm mapping and lot-level identities.

- Fine-flavor beans will gain premiums as single-origin lines scale.

- Local grinding in origin countries will increase value retention.

- Price volatility will persist, requiring stronger hedging and inventory discipline.

- Disease-resistant seedlings and better fermentation control will boost quality.

- Ethical sourcing programs will broaden, linking payments to verified outcomes.

- Non-food uses, led by cosmetics, will steadily lift cocoa butter demand.