Market Overview

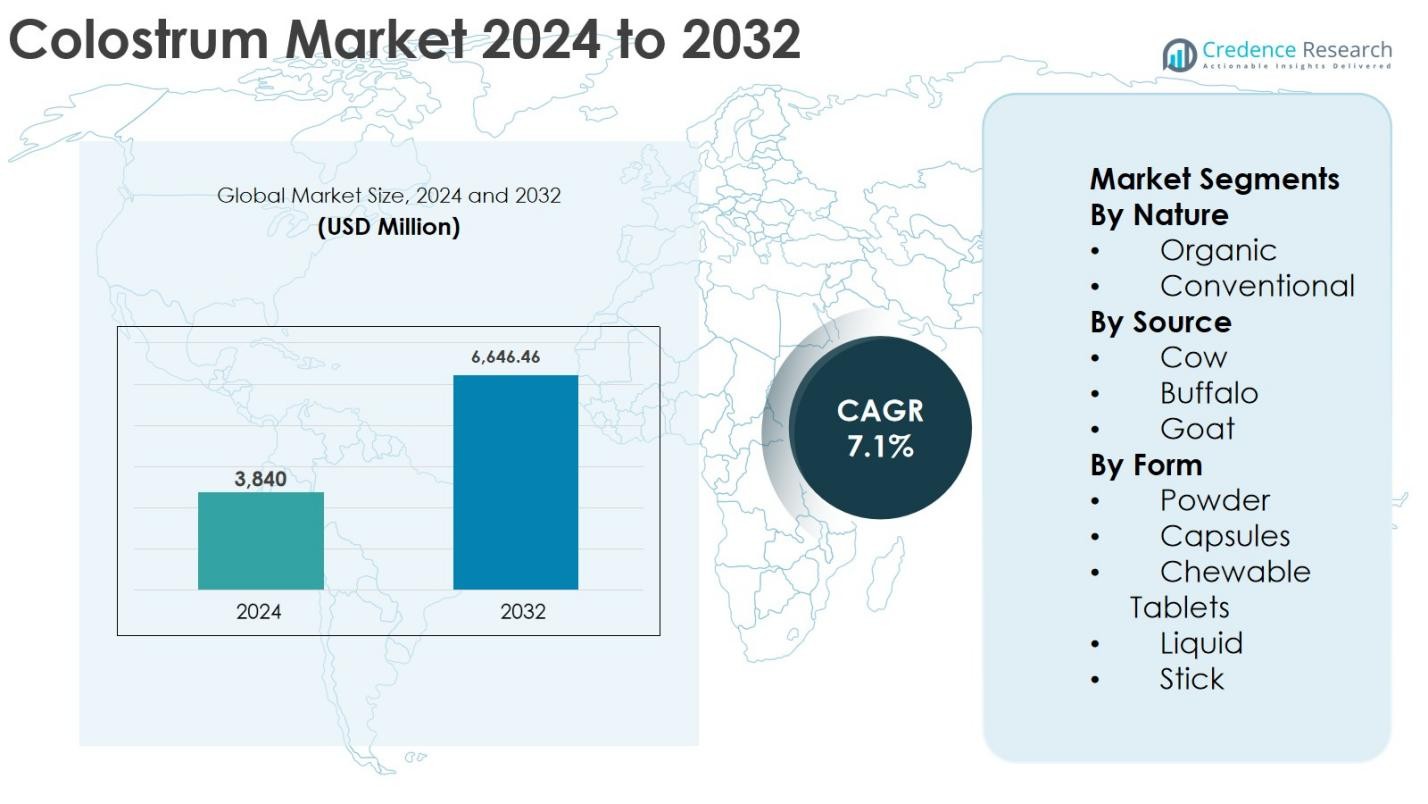

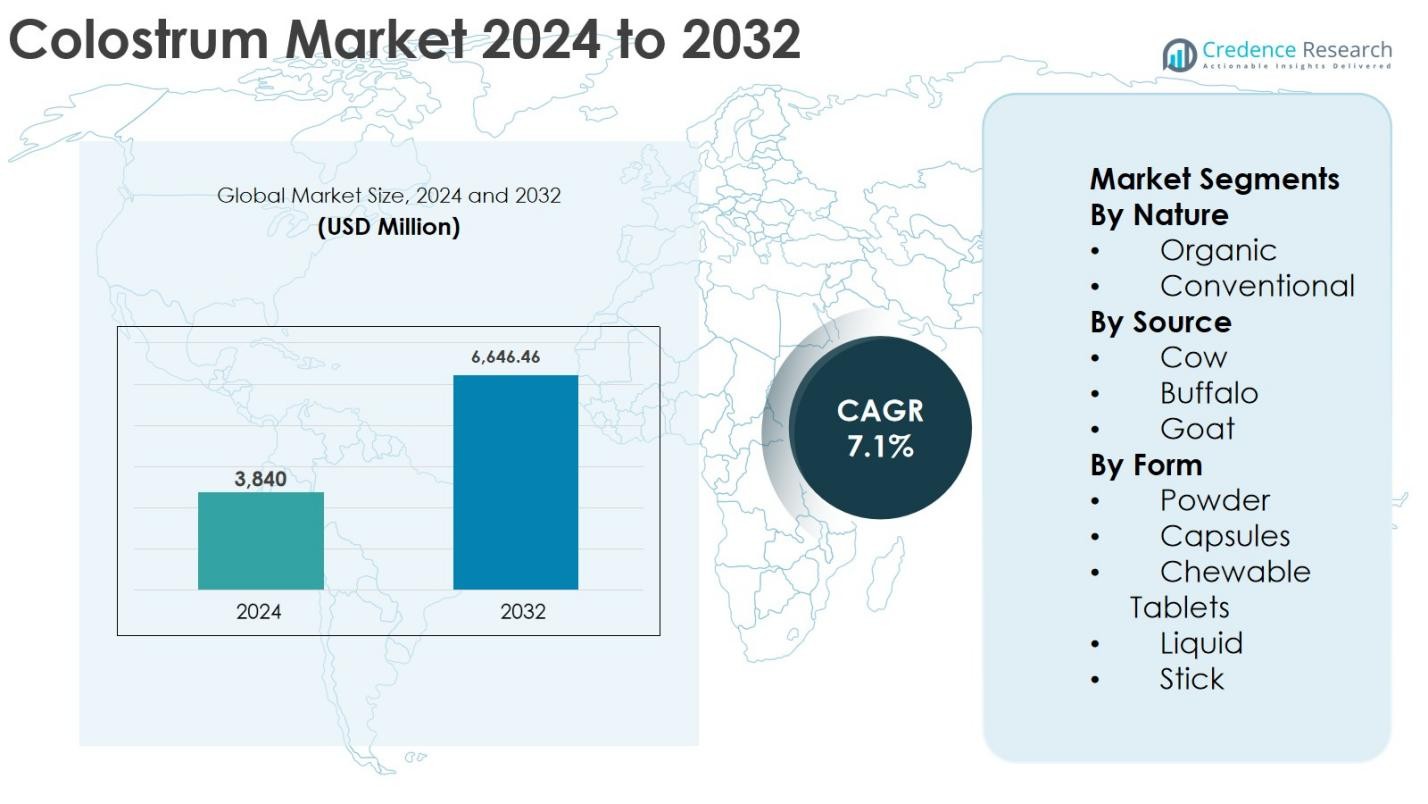

The Colostrum Market size was valued at USD 3,840 million in 2024 and is anticipated to reach USD 6,646.46 million by 2032, expanding at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Colostrum Market Size 2024 |

USD 3,840 Million |

| Colostrum Market, CAGR |

7.1% |

| Colostrum Market Size 2032 |

USD 6,646.46 Million |

The Colostrum market is driven by the presence of established players such as Colostrum BioTec GmbH, Biodane Pharma A/S, Ingredia Nutritional (Ingredia S.A.), Good Health New Zealand, Biotaris B.V., Australian by Nature, Cure Nutraceuticals Pvt. Ltd., Agati Healthcare Pvt. Ltd., Zuche Pharmaceuticals, and NIG Nutritionals Limited, which focus on high-quality sourcing, advanced processing, and diversified product portfolios. These companies actively invest in clean-label formulations, organic certifications, and innovative delivery formats to strengthen market positioning. Regionally, North America leads the Colostrum market with a 38.6% share in 2024, supported by strong demand for dietary supplements and functional nutrition, followed by Europe with 29.4%, driven by premium and organic product adoption, while Asia Pacific holds 21.8% and remains the fastest-growing region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Colostrum market size was valued at USD 3,840 million in 2024 and is projected to reach USD 6,646.46 million by 2032, expanding at a CAGR of 7.1% during the forecast period.

- Growth is driven by rising demand for immune-supporting supplements, increasing use in functional foods, sports nutrition, infant formula, and growing adoption in animal nutrition as a natural immunity enhancer.

- Key trends include increasing preference for clean-label and organic colostrum products, innovation in formats such as capsules, chewables, and sticks, and advancements in processing technologies to preserve bioactive compounds.

- The market includes players such as Colostrum BioTec GmbH, Biodane Pharma A/S, Ingredia Nutritional, Good Health New Zealand, and Biotaris B.V., focusing on product differentiation, sourcing partnerships, and portfolio expansion amid moderate market fragmentation.

- North America held a 38.6% share in 2024, followed by Europe at 29.4% and Asia Pacific at 21.8%, while powder form accounted for 56.7% share and conventional colostrum dominated with 68.4% of the market.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Nature

The Colostrum market by nature is led by the conventional segment, which accounted for 68.4% of the market share in 2024, driven by its cost-effectiveness, large-scale availability, and broad application across dietary supplements, functional foods, and pharmaceuticals. Conventional colostrum benefits from established dairy supply chains and higher production yields, enabling manufacturers to meet rising global demand efficiently. Meanwhile, the organic segment is gaining traction due to increasing consumer preference for clean-label and chemical-free products, particularly in developed markets; however, higher pricing and limited certified supply continue to constrain its overall share compared to conventional offerings.

- For instance, NOW Foods offers conventional bovine colostrum capsules and powders through major retail and e-commerce channels, positioning them as accessible immune and gut health products for mainstream consumers.

By Source

By source, cow-derived colostrum dominated the Colostrum market with a 74.9% share in 2024, supported by abundant availability, higher immunoglobulin content, and extensive clinical validation for human and animal nutrition applications. The dominance of dairy farming infrastructure globally further strengthens cow colostrum’s position. Buffalo and goat colostrum segments are witnessing steady growth, driven by niche demand for higher fat content and improved digestibility, respectively. However, limited raw material supply and higher processing costs restrict their adoption, keeping them secondary compared to cow-based colostrum products.

- For instance, APS BioGroup supplies bovine colostrum ingredients standardized for immunoglobulin G (IgG) content for use in human dietary supplements and veterinary products.

By Form

In terms of form, powder colostrum emerged as the leading sub-segment, capturing 56.7% of the market share in 2024, owing to its longer shelf life, ease of storage, and wide usage in supplements, infant nutrition, and sports nutrition products. Powdered colostrum allows precise dosing and seamless integration into functional food formulations, supporting its widespread adoption. Capsules and chewable tablets are expanding rapidly due to convenience and consumer preference for ready-to-consume formats, while liquid and stick forms remain limited to specific clinical and pediatric applications.

Key Growth Drivers

Rising Demand for Immune-Boosting and Functional Nutrition Products

The Colostrum market is significantly driven by increasing consumer awareness regarding immune health, gut health, and overall wellness, particularly in the post-pandemic period. Colostrum’s high concentration of immunoglobulins, lactoferrin, growth factors, and bioactive peptides positions it as a preferred ingredient in functional foods, dietary supplements, and medical nutrition products. Growing adoption among athletes, elderly populations, and pediatric nutrition segments further supports demand. Additionally, rising prevalence of digestive disorders and immune-related conditions has accelerated the use of colostrum-based formulations in preventive healthcare. The expansion of e-commerce and health-focused retail channels is improving product accessibility, enabling manufacturers to reach a broader consumer base and reinforcing sustained market growth.

- For instance, clinical studies published in Nutrients and Frontiers in Immunology have reported that bovine colostrum supplementation can help maintain gut barrier function and support immune defense in athletes under heavy training.

Expanding Applications in Pharmaceuticals and Animal Nutrition

Another key driver for the Colostrum market is its expanding utilization beyond human nutrition into pharmaceutical formulations and animal feed applications. In pharmaceuticals, colostrum is increasingly used in products targeting gastrointestinal health, immune modulation, and tissue regeneration due to its natural bioactive profile. In animal nutrition, particularly in calf, piglet, and poultry feed, colostrum supplements are widely adopted to enhance immunity, reduce mortality rates, and improve overall growth performance. The rising focus on antibiotic alternatives in livestock farming and stricter regulations on antibiotic usage are accelerating the demand for natural immunity-enhancing ingredients such as colostrum, thereby strengthening market growth across multiple end-use industries.

- For instance, PanTheryx supplies colostrum-based ingredients used in medical and clinical nutrition formulations aimed at supporting gut integrity and immune function.

Growth of the Sports Nutrition and Infant Formula Segments

The rapid expansion of sports nutrition and infant formula markets is strongly contributing to the growth of the Colostrum market. Athletes and fitness-focused consumers increasingly prefer colostrum for its ability to support muscle recovery, improve endurance, and enhance immune defense. Simultaneously, colostrum is gaining acceptance in premium infant nutrition products due to its similarity to early human milk and its role in supporting neonatal immune development and gut health. Rising birth rates in emerging economies, coupled with increasing spending on premium baby nutrition products, are encouraging manufacturers to incorporate colostrum into advanced formulations, thereby creating long-term growth opportunities.

Key Trends & Opportunities

Shift Toward Organic, Clean-Label, and Traceable Colostrum Products

A prominent trend in the Colostrum market is the growing preference for organic, clean-label, and sustainably sourced products. Consumers are increasingly scrutinizing ingredient transparency, sourcing practices, and processing methods, driving demand for organic and minimally processed colostrum. Manufacturers are responding by investing in certified organic dairy farms, advanced cold-processing technologies, and full traceability systems. This trend creates significant opportunities for premium product positioning, higher margins, and brand differentiation, particularly in North America and Europe, where regulatory standards and consumer awareness are high. Clean-label claims are also improving product acceptance in infant nutrition and clinical applications.

- For instance, Synertek Colostrum highlights low‑heat processing and U.S. farm‑level traceability to appeal to clean‑label, quality‑conscious buyers.

Innovation in Product Formats and Delivery Systems

Innovation in colostrum delivery formats represents a key opportunity for market players. Beyond traditional powder forms, companies are introducing capsules, chewable tablets, liquid sachets, and stick packs to improve convenience and compliance. These novel formats cater to on-the-go consumers and specific demographic groups such as children and elderly individuals. Additionally, advancements in microencapsulation and bioavailability-enhancing technologies are enabling better preservation of bioactive components. Such innovations are expanding colostrum’s application scope across functional foods, nutraceuticals, and medical nutrition, thereby supporting market diversification and long-term growth.

- For instance, Sovereign Laboratories offers flavored colostrum powders designed to be mixed into drinks, improving palatability and ease of use for daily consumption.

Key Challenges

High Production Costs and Limited Raw Material Availability

The Colostrum market faces a major challenge related to high production costs and limited availability of high-quality raw colostrum. Colostrum is only produced in small quantities during the initial lactation period, making sourcing highly time-sensitive and supply-constrained. Maintaining bioactivity requires specialized collection, storage, and processing infrastructure, which increases operational costs. These factors limit scalability and contribute to higher product prices, restricting adoption in price-sensitive markets. Smaller manufacturers, in particular, face difficulties in securing consistent supply, which can hinder production planning and market expansion.

Regulatory Complexity and Quality Standardization Issues

Regulatory variability and lack of global standardization present another significant challenge for the Colostrum market. Regulations governing colostrum usage differ across regions, particularly for infant nutrition, pharmaceuticals, and animal feed applications. Compliance with safety, labeling, and health claim requirements can be complex and time-consuming, delaying product approvals and increasing development costs. Additionally, inconsistencies in quality standards, such as immunoglobulin content and processing methods, create variability in product efficacy. These issues can affect consumer trust and complicate international market entry, posing barriers for companies seeking global expansion.

Regional Analysis

North America

North America dominated the Colostrum market with a 38.6% market share in 2024, driven by high consumer awareness of immune health, strong demand for functional nutrition, and widespread adoption of dietary supplements. The presence of well-established nutraceutical, pharmaceutical, and infant nutrition manufacturers supports consistent product innovation and commercialization. The United States leads regional demand due to high spending on preventive healthcare and sports nutrition. Favorable distribution through online platforms and specialty health stores further enhances accessibility. Additionally, strong regulatory frameworks and quality standards support consumer confidence, sustaining North America’s leading position in the global Colostrum market.

Europe

Europe accounted for 29.4% of the Colostrum market share in 2024, supported by rising demand for organic and clean-label nutrition products. Countries such as Germany, France, the UK, and Italy drive growth through strong dairy infrastructure and increasing use of colostrum in infant formula and medical nutrition. Stringent food safety regulations encourage high-quality production and traceability, benefiting premium colostrum products. Growing awareness of gut health and immunity among aging populations further boosts consumption. The region also benefits from active research initiatives and innovation in bioactive dairy ingredients, reinforcing steady market expansion.

Asia Pacific

Asia Pacific held 21.8% of the global Colostrum market share in 2024 and represents the fastest-growing region. Growth is fueled by expanding middle-class populations, rising health awareness, and increasing adoption of dietary supplements in countries such as China, India, Japan, and Australia. Rapid growth in infant nutrition, sports nutrition, and animal feed applications significantly contributes to regional demand. Improving dairy farming practices and expanding e-commerce platforms enhance product availability. Additionally, increasing investments by domestic and international manufacturers are strengthening supply chains, positioning Asia Pacific as a key growth engine for the Colostrum market.

Latin America

Latin America accounted for 6.2% of the Colostrum market share in 2024, driven by gradual growth in health supplements and animal nutrition applications. Brazil, Mexico, and Argentina lead regional demand due to expanding dairy industries and increasing awareness of immune-supportive nutrition. The region shows rising adoption of colostrum in livestock feed to improve animal health and productivity. However, limited consumer awareness and pricing sensitivity restrain faster growth. Ongoing improvements in healthcare infrastructure and growing penetration of functional foods are expected to support steady market expansion across Latin America.

Middle East & Africa

The Middle East & Africa region captured 4.0% of the Colostrum market share in 2024, supported by growing interest in nutritional supplements and pediatric nutrition. Gulf countries drive demand due to higher disposable incomes and increasing focus on preventive healthcare. In Africa, growth is primarily linked to expanding animal nutrition applications and improving dairy farming practices. However, limited local production and lower awareness levels restrict broader adoption. Gradual improvements in healthcare access, rising urbanization, and increasing imports of nutraceutical products are expected to support moderate long-term growth in the region.

Market Segmentations:

By Nature

By Source

By Form

- Powder

- Capsules

- Chewable Tablets

- Liquid

- Stick

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Colostrum market features a moderately fragmented competitive landscape, characterized by the presence of both global nutraceutical companies and specialized colostrum-focused manufacturers. Key players such as Colostrum BioTec GmbH, Biodane Pharma A/S, Ingredia Nutritional (Ingredia S.A.), Good Health New Zealand, Biotaris B.V., and Australian by Nature play a significant role through strong sourcing networks and advanced processing capabilities. Regional companies including Agati Healthcare Pvt. Ltd., Cure Nutraceuticals Pvt. Ltd., Zuche Pharmaceuticals, and NIG Nutritionals Limited strengthen market penetration in emerging economies. Market participants focus on product quality, immunoglobulin concentration, organic certification, and diversified product formats to differentiate offerings. Strategic initiatives such as capacity expansion, partnerships with dairy farms, and investment in clean-label and traceable colostrum products are widely adopted. Innovation in formulation and delivery formats remains central to sustaining competitive positioning and long-term growth.

Key Player Analysis

- Biotaris B.V.

- Good Health New Zealand

- Cure Nutraceuticals Pvt. Ltd.

- Biodane Pharma A/S

- La Belle Inc.

- Agati Healthcare Pvt. Ltd.

- Ingredia Nutritional (Ingredia S.A.)

- Australian by Nature

- Colostrum BioTec GmbH

- NIG Nutritionals Limited

Recent Developments

- In November 2025, Lemme, the wellness and supplement brand founded by Kourtney Kardashian Barker, launched two new bovine colostrum-based supplements Lemme Colostrum Gummies and Lemme Colostrum Liposomal Liquid targeting gut health and overall wellness.

- In August 2025, Kroma Wellness launched Super Core, a new dairy-free, human-optimized colostrum supplement, positioning it as an innovative entrant in the gut and immune health segment of the colostrum market.

- In July 2025, Naked Nutrition introduced new collagen and colostrum products featuring additive-free, sustainably sourced colostrum designed to mix easily into beverages, expanding its functional supplement portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Nature, Source, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Colostrum market is expected to witness sustained growth driven by increasing focus on preventive healthcare and immune health solutions.

- Demand for colostrum-based functional foods and dietary supplements will continue to rise across all age groups.

- Expansion of sports nutrition and active lifestyle products will support wider adoption of colostrum ingredients.

- Growing incorporation of colostrum in premium infant nutrition formulations will strengthen long-term market prospects.

- Technological advancements in processing and preservation will enhance product quality and bioavailability.

- Organic and clean-label colostrum products will gain stronger consumer preference, particularly in developed markets.

- Increasing use of colostrum as an antibiotic alternative in animal nutrition will support cross-sector demand.

- Emerging economies will present significant growth opportunities due to rising health awareness and expanding distribution networks.

- Strategic partnerships between manufacturers and dairy farms will improve supply stability and traceability.

- Continued innovation in convenient product formats will broaden consumer reach and improve market penetration.

Market Segmentation Analysis:

Market Segmentation Analysis: