Market Overview:

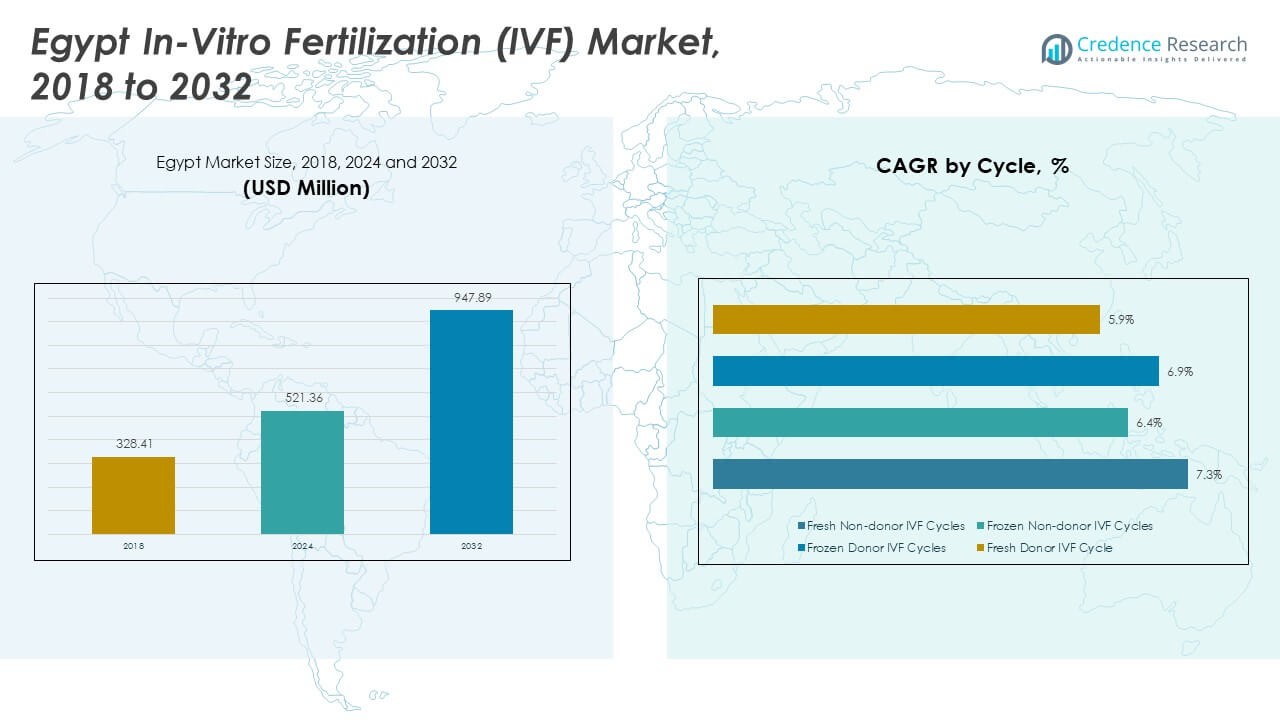

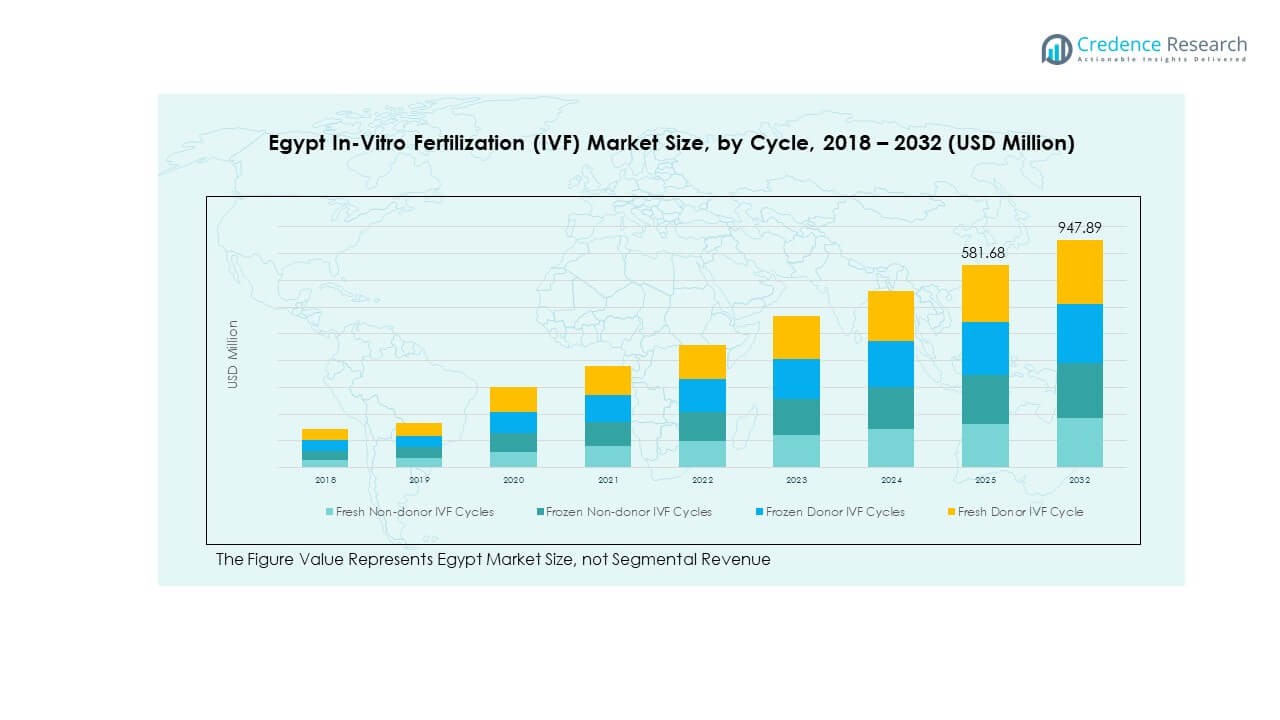

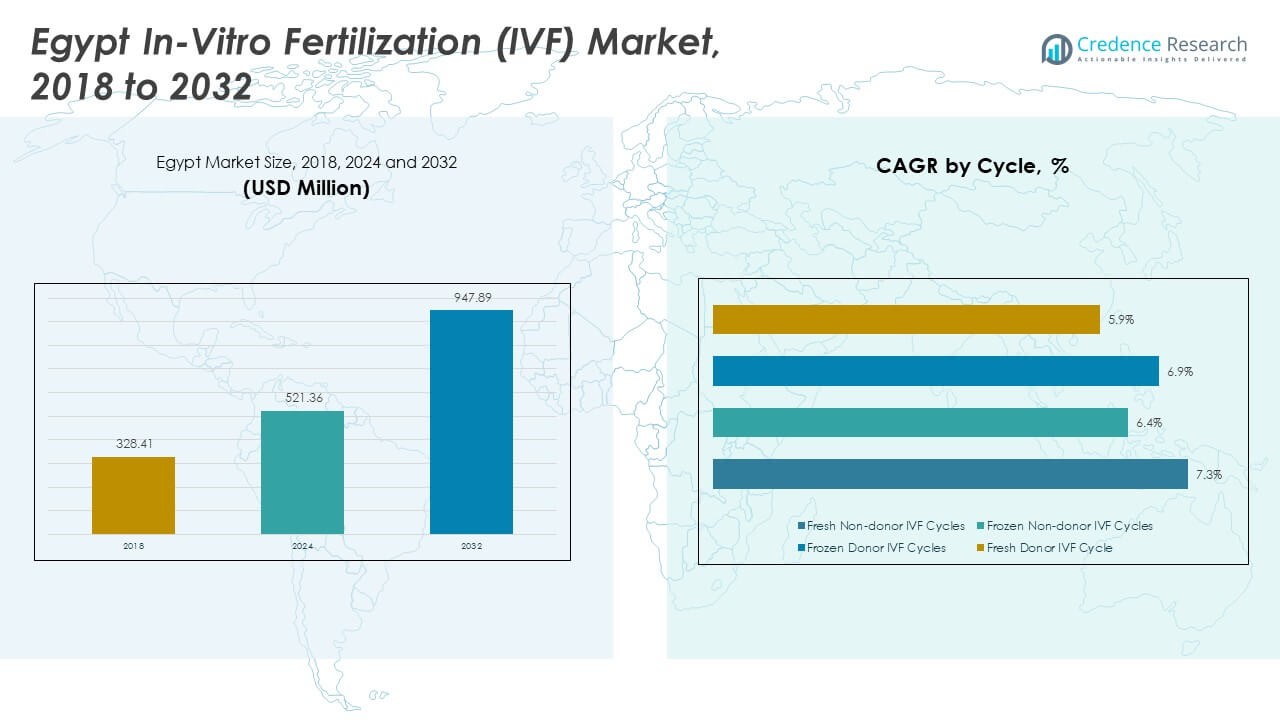

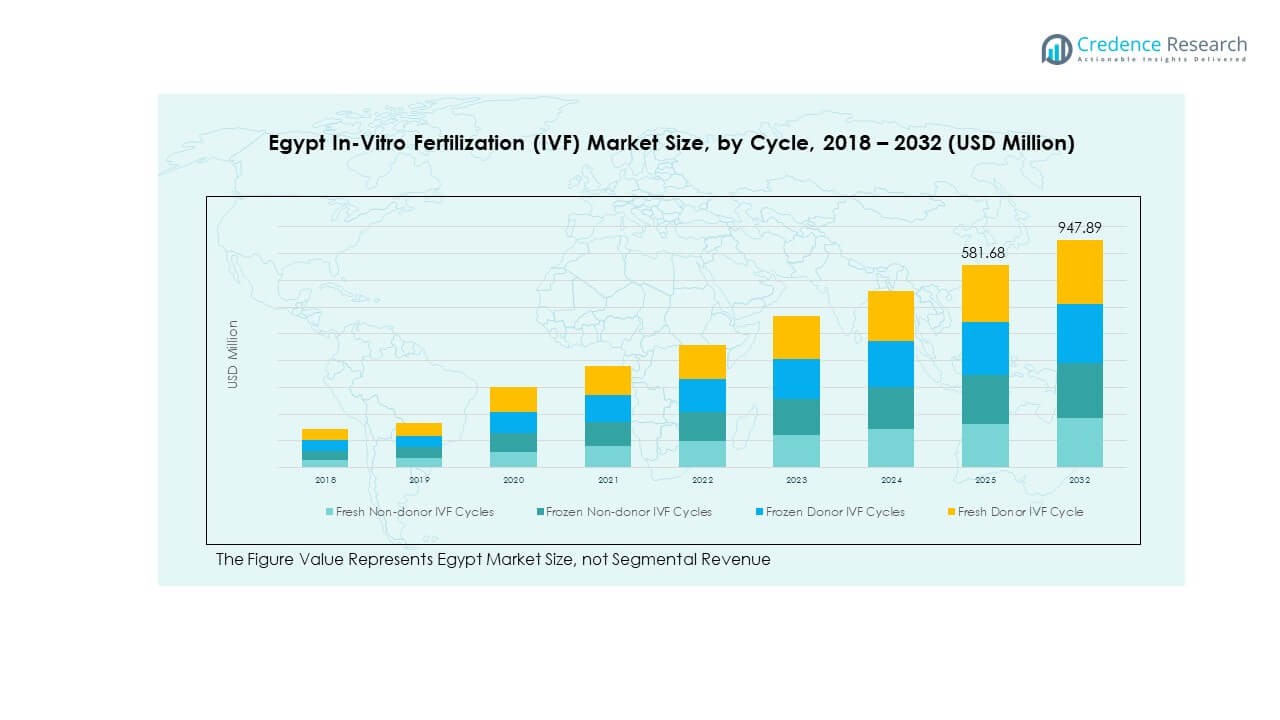

The Egypt In-Vitro Fertilization (IVF) Market size was valued at USD 328.41 million in 2018 to USD 521.36 million in 2024 and is anticipated to reach USD 947.89 million by 2032, at a CAGR of 7.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egypt In-Vitro Fertilization (IVF) Market Size 2024 |

USD 521.36 Million |

| Egypt In-Vitro Fertilization (IVF) Market, CAGR |

7.23% |

| Egypt In-Vitro Fertilization (IVF) Market Size 2032 |

USD 947.89 Million |

Rising infertility rates, delayed pregnancies, and lifestyle shifts are key factors driving market growth. Improved awareness of assisted reproductive technologies and advancements in treatment success rates are encouraging more patients to seek IVF services. Increasing investments in fertility clinics and the introduction of AI-enabled embryo selection systems are enhancing efficiency. Strong private sector participation and better insurance support are making IVF treatments more accessible across urban areas. Expanding medical tourism further strengthens the market outlook.

Cairo holds the largest market share due to its advanced fertility infrastructure, specialist availability, and strong patient inflow. Alexandria follows with expanding fertility service networks and clinic modernization. Upper Egypt and emerging subregions are gaining momentum through growing healthcare investments and outreach programs. It reflects a wider distribution of fertility services across the country, supported by rising awareness and infrastructure development. This regional diversification positions the market for sustainable long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Egypt In-Vitro Fertilization (IVF) Market was valued at USD 328.41 million in 2018, reached USD 521.36 million in 2024, and is projected to hit USD 947.89 million by 2032, growing at a CAGR of 7.23%.

- Cairo and Greater Cairo lead with 42.5% share due to advanced fertility infrastructure, high awareness, and strong clinic concentration. Alexandria follows with 29.6%, supported by healthcare investments, while Upper Egypt holds 27.9%, reflecting rising treatment demand.

- Upper Egypt is the fastest-growing region with a 27.9% share, driven by infrastructure expansion, outreach programs, and growing accessibility in underserved areas.

- Frozen non-donor IVF cycles hold the largest segment share at 38%, supported by flexible scheduling, improved success rates, and better embryo preservation technologies.

- Fresh non-donor IVF cycles account for 33% of the segment share, while frozen donor and fresh donor IVF cycles represent 17% and 12% respectively, reflecting balanced growth across treatment options.

Market Drivers

Rising Infertility Rates and Changing Lifestyle Patterns Accelerating the Demand for IVF Procedures

The growing number of infertility cases drives the need for advanced reproductive treatments. Sedentary lifestyles, obesity, stress, and delayed marriages contribute to declining fertility rates. It fuels the adoption of assisted reproductive technologies across both urban and semi-urban regions. Women are seeking IVF earlier due to growing awareness of fertility timelines. Clinics offer specialized services to support personalized treatment plans. Healthcare campaigns are influencing more couples to consider IVF as a reliable option. Egypt In-Vitro Fertilization (IVF) Market benefits from evolving social attitudes toward fertility care. The trend creates strong momentum for procedure volumes and infrastructure expansion.

Government and Private Sector Investments Expanding IVF Infrastructure and Accessibility

Strong support from healthcare authorities and private investors strengthens the fertility ecosystem. Clinics receive incentives to upgrade laboratories and introduce modern reproductive technologies. It improves patient accessibility and boosts treatment capacity. Government-backed awareness programs are creating a favorable environment for service expansion. The private sector’s role in developing advanced clinics enhances regional coverage. Investments focus on high-quality embryo culture systems and automated monitoring tools. Fertility centers gain higher operational efficiency through new equipment and trained specialists. The expansion supports growing patient demand while improving treatment outcomes.

Technological Advancements Improving IVF Success Rates and Treatment Efficiency

Rapid innovation in reproductive medicine is increasing procedural accuracy and patient trust. Modern techniques like time-lapse embryo imaging and AI-powered embryo selection improve success rates. It ensures better embryo development tracking and selection. Clinics integrate digital monitoring systems to enhance care delivery. These advancements reduce procedural risks and improve pregnancy rates. Patients benefit from reduced cycle failure and higher cost efficiency. Technology adoption makes fertility care more standardized and effective. Continuous R&D ensures that clinics stay aligned with international best practices.

- For instance, Madina–Endocare Fertility Center in Cairo reports IVF pregnancy success rates of up to 70% among women aged 30–35, supported by advanced reproductive technologies such as AI-assisted embryo scoring and time-lapse incubators. This positions the center among Egypt’s leading fertility facilities.

Growing Medical Tourism and Rising Awareness Enhancing Market Penetration

Egypt is attracting international patients for affordable and quality fertility care. Advanced clinic infrastructure and skilled medical professionals strengthen its reputation. It positions the country as a competitive destination in regional fertility tourism. Awareness campaigns are informing couples about available treatment options. Fertility centers provide flexible packages and multilingual support to international patients. It boosts cross-border patient flow and drives revenue growth. Positive success stories further build trust among local and foreign couples. Strong demand from regional and African patients is supporting sustainable expansion.

- For example, Bedaya Hospital reports IVF success rates between 50 % and 60 % depending on patient profile, and welcomes many international patients from Africa and the Middle East for advanced fertility treatments.

Market Trends

Adoption of Digital Health Platforms and Teleconsultation Transforming Fertility Care Delivery

The integration of digital platforms improves patient engagement and treatment coordination. Clinics offer teleconsultation to simplify the initial assessment process. It reduces waiting times and enhances convenience for patients in remote regions. Fertility specialists use secure platforms to monitor treatment cycles. Patients access virtual counseling, follow-up sessions, and treatment planning. Digital integration improves operational efficiency and patient satisfaction. Egypt In-Vitro Fertilization (IVF) Market is aligning with global digital healthcare trends. This shift strengthens continuity of care and patient experience.

- For instance, the Egypt Healthcare Authority launched a Virtual Hospital project in Ismailia that includes 9 telemedicine clinics and 4 tele-ICU clusters linked to the UHIS network. This initiative enhances digital healthcare access and supports virtual consultations across governorates.

Shift Toward Personalized Fertility Treatments and Tailored Protocols

Fertility clinics are adopting individualized treatment strategies based on patient profiles. Genetic testing and hormone mapping help design more accurate stimulation protocols. It leads to optimized embryo transfer and improved pregnancy outcomes. Advanced diagnostic tools enable clinics to detect specific fertility issues. Patients receive tailored plans that reduce cycle failures and treatment burden. This approach boosts clinical success rates and patient confidence. Clinics gain a competitive edge through better personalization and technology adoption. Personalized care is reshaping patient expectations and treatment standards.

Integration of AI and Automation Enhancing Procedural Accuracy and Laboratory Efficiency

Artificial intelligence supports embryo grading, timing optimization, and clinical decision-making. Automation in laboratories reduces human errors and improves consistency. It ensures precise handling of gametes and embryos. AI algorithms support embryo viability prediction, improving implantation rates. Clinics adopt automated cryostorage systems and data tracking platforms. This enhances lab workflows and maintains treatment quality. Egypt In-Vitro Fertilization (IVF) Market is leveraging these tools to enhance procedural outcomes. Technology-driven precision boosts patient trust and clinical performance.

- For instance, Conceivable Life Sciences’ AURA system uses AI and robotics to automate key steps in IVF laboratory workflows. Early trials and clinical validations highlight its potential to improve standardization and efficiency in fertility treatments.

Growing Male Infertility Awareness Encouraging Comprehensive Treatment Approaches

Rising awareness of male infertility is shifting focus to inclusive fertility care. Clinics offer advanced diagnostic services and sperm selection techniques. It improves treatment planning and overall success rates. Social campaigns address stigma, encouraging more men to undergo evaluation. Healthcare providers emphasize equal participation in fertility management. Specialized procedures like ICSI are gaining wider acceptance. This evolution creates a balanced approach to fertility treatment. Changing awareness patterns drive more complete and effective patient pathways.

Market Challenges Analysis

High Cost of Fertility Treatments and Limited Insurance Coverage Restricting Patient Access

The high cost of IVF procedures remains a major barrier to wider adoption. Treatment cycles often require multiple attempts, increasing the financial burden. It limits access for middle-income and rural populations. Insurance coverage for fertility treatments is limited, creating affordability gaps. Patients face out-of-pocket expenses that discourage timely treatment. Clinics struggle to expand services in lower-income regions due to limited demand. Egypt In-Vitro Fertilization (IVF) Market faces pricing pressure as competition grows. Cost barriers slow penetration and create inequality in access.

Limited Specialized Workforce and Regulatory Complexity Slowing Market Expansion

A shortage of skilled embryologists and reproductive specialists affects service quality. Regulatory guidelines around IVF vary and create operational uncertainty. It complicates the licensing and compliance process for clinics. Delays in approvals hinder new clinic setups and expansions. Training programs for fertility professionals remain insufficient. Inconsistent oversight impacts patient confidence and procedural outcomes. Clinics must invest heavily in staff development to maintain standards. A more structured regulatory environment is essential to support sustainable growth.

Market Opportunities

Rising Public-Private Partnerships and Infrastructure Modernization Creating Expansion Scope

Collaboration between government agencies and private clinics is strengthening healthcare delivery. Fertility centers gain access to improved facilities, equipment, and funding. It supports broader treatment coverage and improved patient experience. Training initiatives create skilled professionals to meet rising demand. Egypt In-Vitro Fertilization (IVF) Market benefits from infrastructure modernization. Public-private alliances create a stable platform for long-term growth. Expanding outreach to underserved regions enhances nationwide accessibility.

Growing Demand from Regional Patients Strengthening Egypt’s Position as a Fertility Hub

Egypt is emerging as a regional hub for cost-effective and high-quality fertility services. Neighboring countries rely on Egypt’s advanced clinics for treatment. It boosts cross-border patient flow and strengthens healthcare reputation. Competitive pricing attracts patients from Africa and the Middle East. Enhanced transportation and communication networks support medical tourism. Expanding service packages create additional revenue opportunities. International patient demand reinforces Egypt’s role as a key fertility destination.

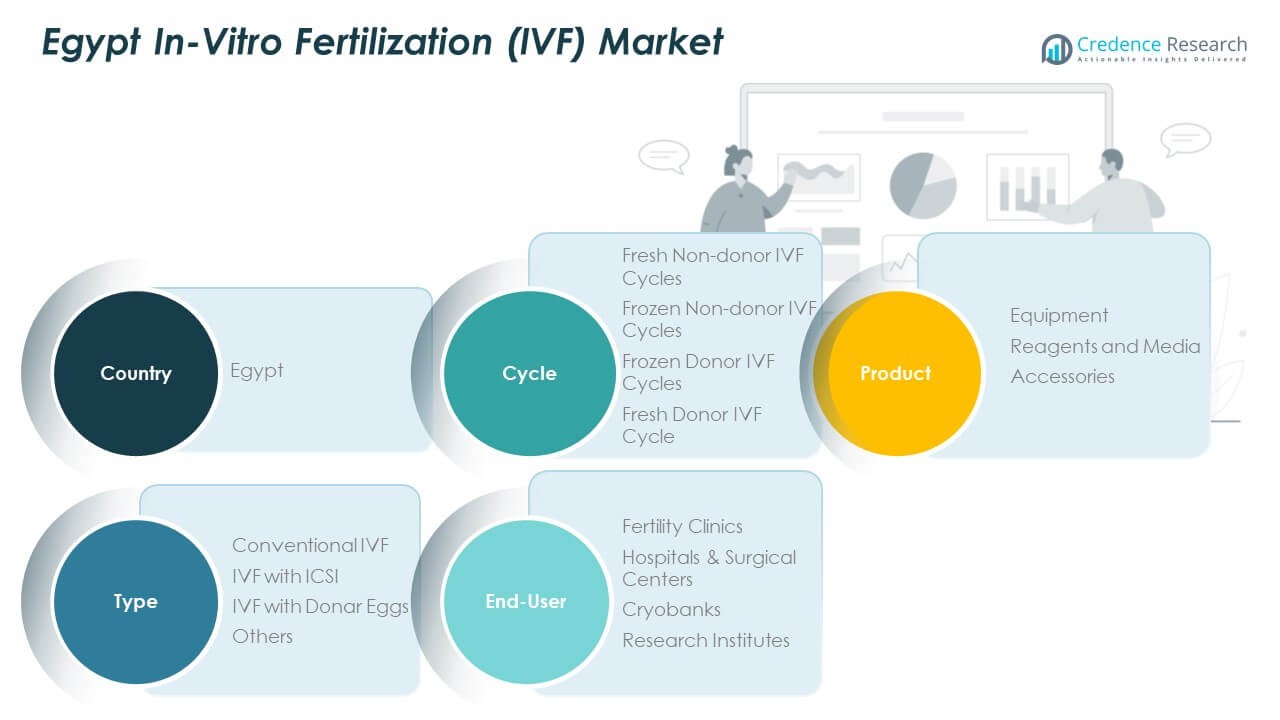

Market Segmentation Analysis

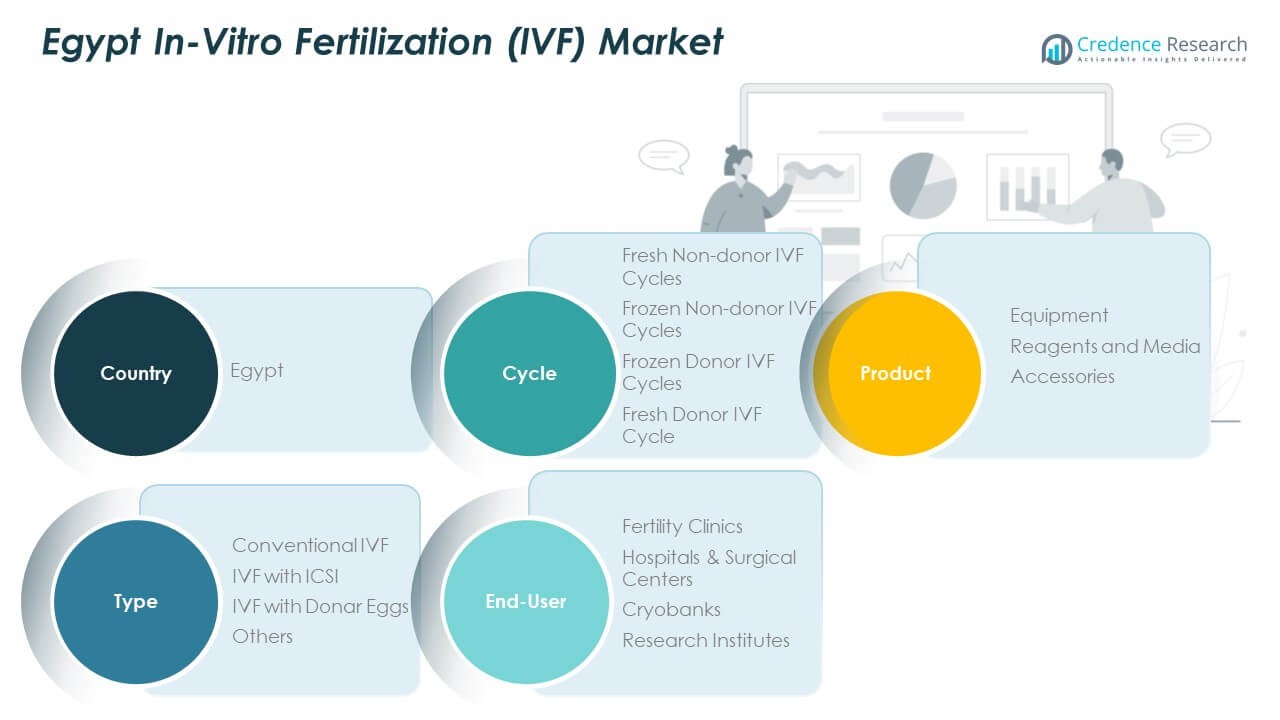

By cycle, the market is structured around four key segments: fresh non-donor IVF cycles, frozen non-donor IVF cycles, frozen donor IVF cycles, and fresh donor IVF cycles. Frozen non-donor IVF cycles dominate due to higher success rates and lower treatment risks. It supports greater scheduling flexibility and better embryo quality, which attracts more patients. Clinics are expanding cryopreservation capabilities to meet rising demand for frozen cycles. Donor cycles hold a steady share, supported by advanced matching programs and regulatory support.

- For instance, Bedaya Hospital in Cairo reports IVF success rates of 50% to 60% for both fresh and frozen cycles. The clinic is known for using advanced embryo freezing and transfer techniques to improve pregnancy outcomes and support a growing international patient base.

By product, the market is segmented into equipment, reagents and media, and accessories. Reagents and media hold a significant share due to their essential role in culture and fertilization processes. It drives procurement priorities for clinics and research centers. Equipment demand is rising with the adoption of advanced monitoring systems and automated incubators. Accessories provide support for improved handling and accuracy during procedures.

- For instance, Madina–Endocare IVF Center in Cairo reports IVF pregnancy success rates of up to 80% for women under 30 and 70% for women aged 30–35. The clinic uses time-lapse incubators and AI-assisted embryo selection to enhance success rates and improve procedural precision.

By type, the market includes conventional IVF, IVF with ICSI, IVF with donor eggs, and others. IVF with ICSI leads due to its effectiveness in male infertility treatment. It improves fertilization rates and strengthens treatment outcomes. Conventional IVF maintains relevance in standard cases with lower complexities.

By end-user, the market covers fertility clinics, hospitals and surgical centers, cryobanks, and research institutes. Fertility clinics dominate due to specialized infrastructure, skilled staff, and strong patient preference. It supports higher treatment volumes and faster technology integration. Hospitals and cryobanks complement this growth through supportive services and broader healthcare coverage in the Egypt In-Vitro Fertilization (IVF) Market.

Segmentation

By Cycle

- Fresh Non-donor IVF Cycles

- Frozen Non-donor IVF Cycles

- Frozen Donor IVF Cycles

- Fresh Donor IVF Cycles

By Product

- Equipment

- Reagents and Media

- Accessories

By Type

- Conventional IVF

- IVF with ICSI

- IVF with Donor Eggs

- Others

By End-User

- Fertility Clinics

- Hospitals & Surgical Centers

- Cryobanks

- Research Institutes

Regional Analysis

Cairo and Greater Cairo Leading the Market with 42.5% Share

Cairo and the surrounding metropolitan area represent the largest subregional share in the Egypt In-Vitro Fertilization (IVF) Market with 42.5%. The dominance is driven by advanced healthcare infrastructure, a dense network of fertility clinics, and a strong concentration of specialized reproductive centers. It benefits from high awareness levels, skilled medical professionals, and better access to modern technologies. Patients prefer this region due to shorter waiting times and higher success rates. International patients also contribute to clinic revenues through medical tourism. Strong public and private investments continue to strengthen IVF infrastructure across Cairo.

Alexandria and Coastal Regions Holding 29.6% Share

Alexandria ranks second with a 29.6% market share, supported by growing fertility treatment adoption and expanding clinic capacity. It serves as a strategic hub for both local and international patients due to its developed healthcare ecosystem and proximity to major transport routes. The subregion benefits from increased investments in laboratory equipment and cryopreservation facilities. Fertility clinics are upgrading services to match the standards seen in Cairo. It supports balanced regional distribution of fertility care and reduces patient migration to the capital. Demand is rising among couples in urban and semi-urban districts surrounding Alexandria.

Upper Egypt and Other Emerging Subregions Capturing 27.9% Share

Upper Egypt and other emerging subregions together account for 27.9% of the market share. These areas are witnessing rising investments in fertility infrastructure and outreach programs. It reflects growing demand from underserved populations seeking accessible treatment options. Clinics are expanding operations through partnerships, satellite centers, and mobile care programs. Regional awareness campaigns are improving treatment acceptance rates. Lower procedural costs compared to metropolitan areas support patient inflow. The expansion of services in these subregions indicates a shift toward more inclusive national fertility care coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Corporation

- Mitsubishi Rayon Co., Ltd.

- SGL Carbon SE

- Solvay SA

- Hexcel Corporation

- Huntsman Corporation

- Owens Corning

- Advanced Composites Group

Competitive Analysis

The competitive landscape of the Egypt In-Vitro Fertilization (IVF) Market is defined by strong participation from global and regional players. Leading companies such as Thermo Fisher Scientific, Cook Medical, Vitrolife AB, Irvine Scientific, and EMD Serono focus on advanced reproductive solutions and laboratory innovations. It emphasizes high-quality reagents, precision equipment, and digital embryo monitoring platforms to strengthen clinical outcomes. Regional players like BioART Fertility Centre enhance market accessibility through localized service networks and cost-effective offerings. Cooper Surgical and OvaScience invest in product development to support personalized treatment plans. Strategic moves include mergers, acquisitions, product launches, and clinic expansions to secure competitive positions. Hospitals such as Siriraj and Ramathibodi strengthen their capabilities through partnerships with fertility technology providers. Continuous innovation, infrastructure expansion, and advanced fertility protocols define competitive differentiation, creating a dynamic and rapidly evolving landscape.

Recent Developments

- In October 2025, Thermo Fisher Scientific announced a research partnership with AstraZeneca BioVentureHub to promote next-generation biotechnological innovation. Dated October 1, 2025, the collaboration aims to boost life science research capabilities relevant to IVF drug development by combining Thermo Fisher’s analytical tools and AstraZeneca’s life science applications.

- In October 2025, EMD Serono, a branch of Merck KGaA, entered a strategic partnership with the U.S. government under President Donald Trump’s administration. The initiative aims to broaden affordable access to IVF therapies, delivering up to 84% discounts on drugs like Gonal-f and Ovidrel. Though U.S.-focused, this move underscores EMD Serono’s increasing role in expanding IVF accessibility globally—including regions like Africa through affiliated fertility partnerships.

- In May 2025, Vitrolife AB became the lead investor in AutoIVF, a MedTech company that created OvaReady™, an automated system that enhances egg retrieval and preparation. The investment aligns with Vitrolife’s mission to improve access and affordability of IVF treatments worldwide by automating processes and scaling innovation across fertility clinics, including emerging fertility markets like Egypt.

- In April 2025, CooperSurgical collaborated with The Wyatt Foundation and Conceive Fertility Foundation to launch the 2025 IVF Grant Program, which provides financial assistance to patients undergoing IVF treatments. CooperSurgical contributes preimplantation genetic testing (PGT) grants, supporting advanced fertility diagnostics globally and offering applications for clinics in emerging IVF hubs like Egypt.

Report Coverage

The research report offers an in-depth analysis based on Cycle, Product, Type and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing investments in fertility clinics and reproductive technology will strengthen clinical infrastructure.

- Expanding digital health adoption will improve patient monitoring and personalized treatment plans.

- Integration of AI and automation in laboratories will boost procedural accuracy and embryo selection.

- Increasing cross-border fertility tourism will position Egypt as a key regional fertility hub.

- Expanding cryopreservation capabilities will drive demand for frozen cycles and flexible treatment options.

- Rising public awareness campaigns will increase early diagnosis and treatment adoption.

- Regional clinic expansion will enhance service accessibility in underserved areas.

- Strategic partnerships between private and public healthcare providers will accelerate technology diffusion.

- Continuous training and development programs will address the shortage of skilled fertility specialists.

- Strengthened regulatory frameworks will improve procedural standards and patient trust in fertility care.