Market Overview:

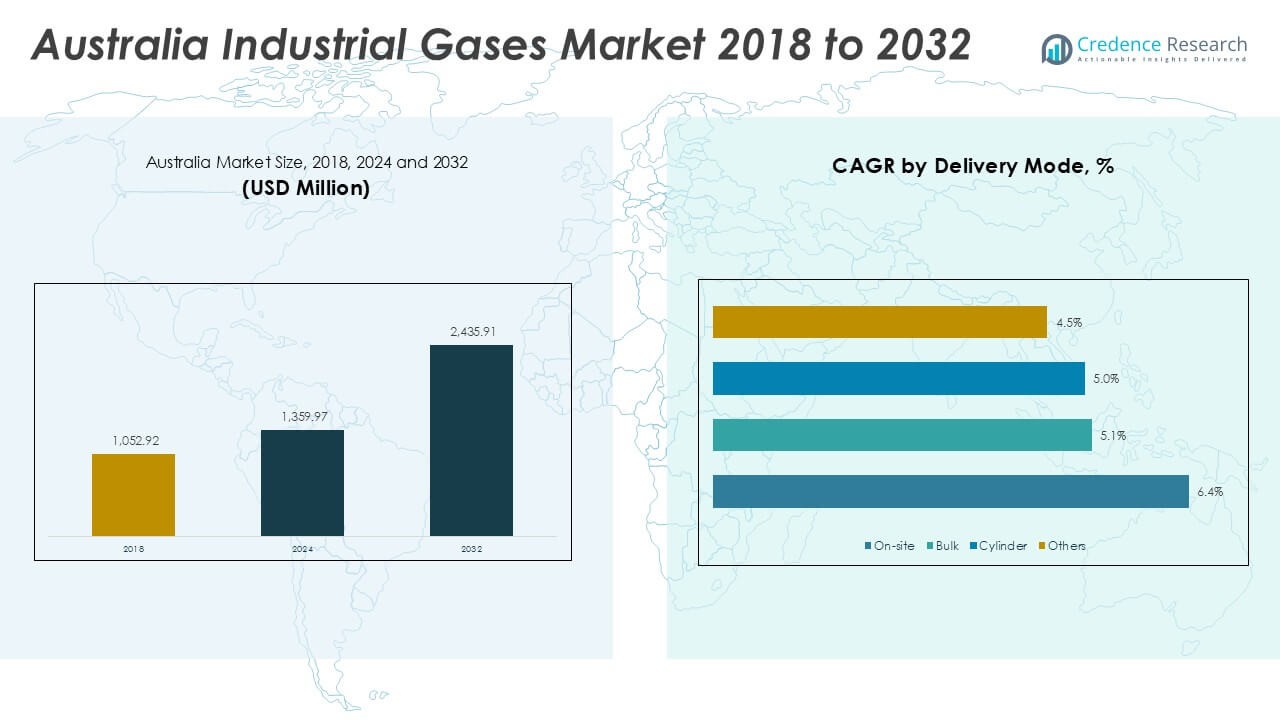

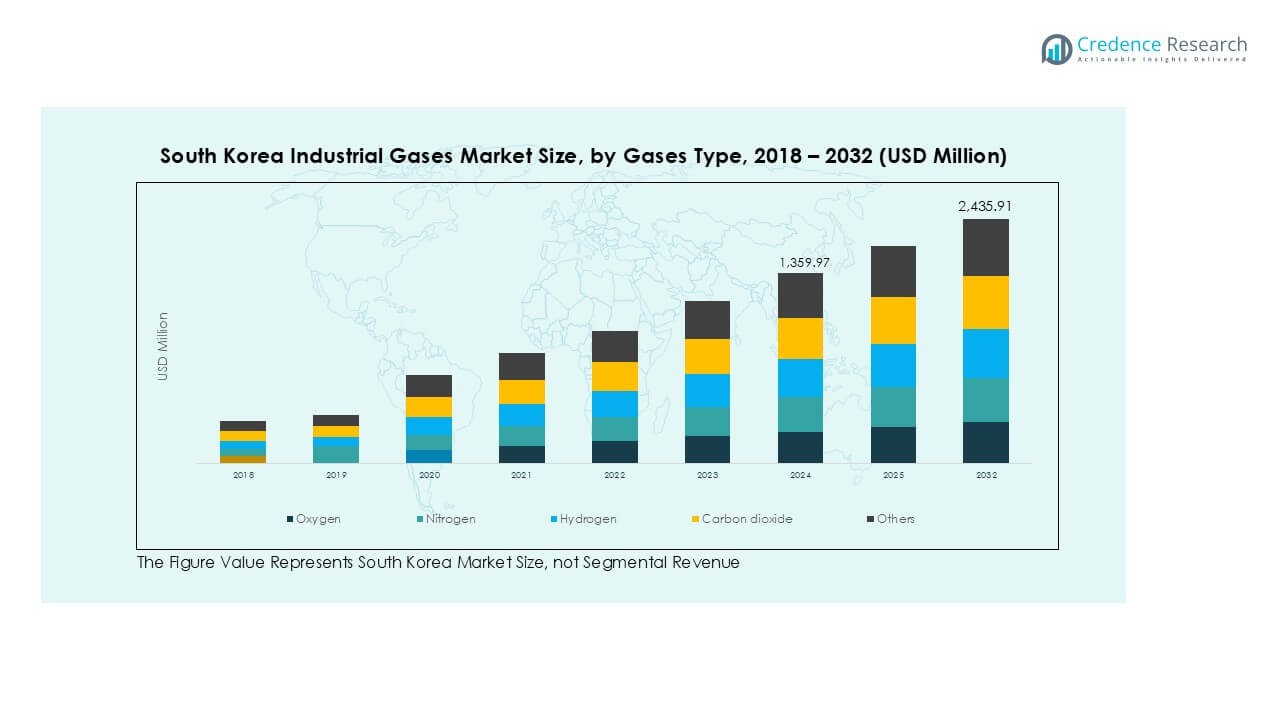

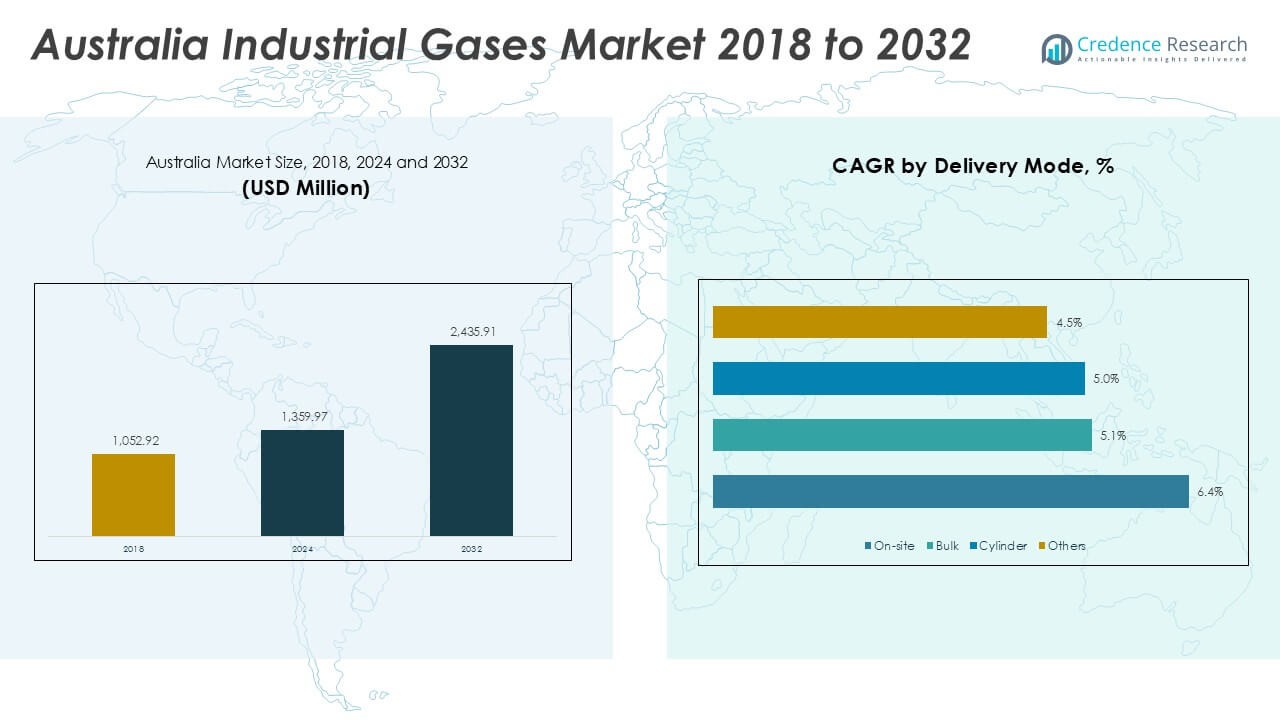

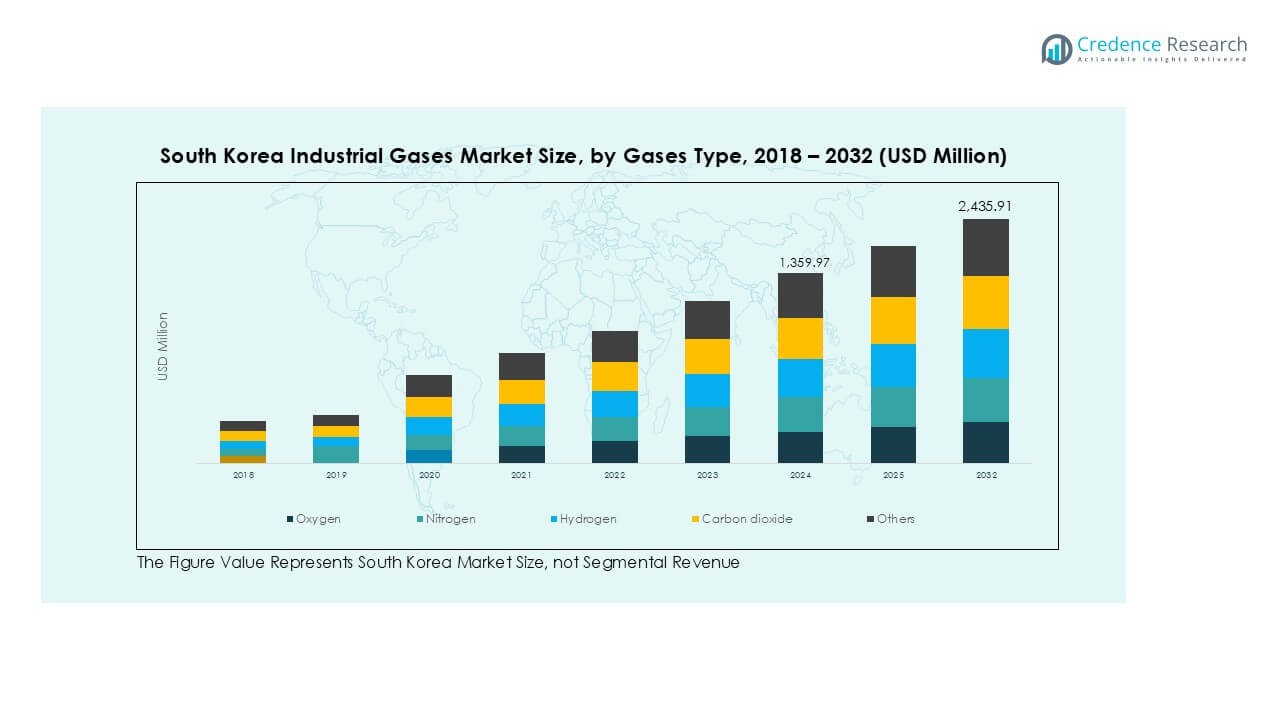

The Australia Industrial Gases Market size was valued at USD 1,052.92 million in 2018 to USD 1,359.97 million in 2024 and is anticipated to reach USD 2,435.91 million by 2032, at a CAGR of 7.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Industrial Gases Market Size 2024 |

USD 1,359.97 million |

| Australia Industrial Gases Market, CAGR |

7.56% |

| Australia Industrial Gases Market Size 2032 |

USD 2,435.91 million |

Growth is driven by strong demand from healthcare, food and beverage, and mining industries. Oxygen plays a vital role in medical treatments, while nitrogen and carbon dioxide are critical for packaging and carbonation in the food sector. Mining and metallurgy require gases like oxygen and acetylene for extraction and refining. Rising investments in clean energy and hydrogen projects also expand new opportunities. Sustainability pressures further strengthen adoption across industries.

Regionally, eastern Australia leads due to established healthcare systems, advanced manufacturing, and strong food processing bases. Western Australia shows significant demand supported by mining and natural resource industries. Northern and southern regions, including Queensland and South Australia, are emerging with growth in food processing, research, and clean energy projects. The Australia Industrial Gases Market demonstrates a balanced landscape, where mature regions sustain demand and developing regions create fresh opportunities for expansion.

Market Insights

- The Australia Industrial Gases Market size was USD 1,052.92 million in 2018, reached USD 1,359.97 million in 2024, and is projected to hit USD 2,435.91 million by 2032, at a CAGR of 7.56%.

- The Global Industrial Gases Market size was valued at USD 87,600.00 million in 2018 to USD 1,10,625.01 million in 2024 and is anticipated to reach USD 1,95,368.52 million by 2032, at a CAGR of 7.44% during the forecast period.

- Eastern Australia held 41% share in 2024, driven by healthcare, advanced manufacturing, and food processing; Western Australia accounted for 33% due to mining and energy demand; Northern and Southern regions together made up 26%, supported by food, research, and clean energy projects.

- Queensland within Northern Australia is the fastest-growing region, holding part of the 26% share, fueled by food processing expansion, medical applications, and renewable energy investments.

- Oxygen led the gases type segment in 2024 with 34% share, supported by demand from healthcare, metallurgy, and mining sectors.

- Nitrogen accounted for 28% share, largely driven by its extensive use in packaging and food preservation industries across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand From Healthcare Sector With Focus On Medical Applications Of Industrial Gases

The healthcare industry creates consistent demand for oxygen, nitrogen, and other medical-grade gases. Hospitals require oxygen for respiratory treatments and surgical operations, making it a core necessity. Nitrous oxide remains vital for anesthesia, and medical nitrogen supports cryopreservation and equipment sterilization. The growth of chronic respiratory diseases boosts reliance on oxygen supply chains. The Australia Industrial Gases Market benefits from rising healthcare infrastructure investments across metropolitan and regional centers. Government programs supporting advanced medical facilities further drive gas consumption. Pharmaceutical production also depends on sterile gas applications. It ensures strong long-term demand growth within the healthcare ecosystem.

Expansion Of Food And Beverage Industry With High Reliance On Preservative Applications

Food and beverage companies adopt gases like nitrogen and carbon dioxide to enhance product safety. Nitrogen protects packaged foods by reducing oxidation and extending shelf life. Carbon dioxide plays a crucial role in carbonation and storage stability of beverages. The Australia Industrial Gases Market gains strength from its integration in dairy, meat, and processed food industries. Food export growth also expands gas requirements for preservation during long shipments. Large retail networks and changing consumer preferences increase packaged food adoption. This reliance makes gases indispensable for ensuring consistent product quality. It highlights the sector as a key driver of gas demand.

- For instance, BOC, a Linde company, opened the South Pacific’s largest merchant carbon dioxide processing facility in Longford, Victoria in December 2024, with a capacity to produce more than 60,000 tonnes of beverage-grade CO2 annually enough to carbonate 7.5 billion liters of drinks, supporting large-scale food and beverage operations across Australia.

Rising Role Of Mining And Energy Sectors Requiring Specialty Gases For Efficiency

The mining industry remains a dominant pillar of the Australian economy. Specialty gases support mineral extraction, refining, and environmental safety processes. Oxygen improves combustion efficiency in metal smelting, reducing operational costs. The Australia Industrial Gases Market benefits from mining projects expanding in Western Australia and Queensland. Energy companies depend on industrial gases for refining oil and natural gas. Hydrogen plays a growing role in clean energy projects, creating new applications. Government emphasis on low-emission technologies supports this trend. It enhances the demand outlook across mining and energy-related industries.

Adoption Of Cleaner Production And Rising Sustainability Standards Across Industries

Sustainability requirements influence industrial operations across Australia. Manufacturers adopt eco-friendly gases to meet emission reduction goals. Carbon capture projects rely on gases for storage and processing, encouraging investments. The Australia Industrial Gases Market strengthens through alignment with decarbonization strategies. Environmental regulations create new demand for gas solutions in industrial applications. Industrial users adopt gases to replace older, pollutive fuels. Hydrogen and bio-based gases gain focus for long-term energy transition. It positions the sector as a core enabler of cleaner operations across industries.

- For instance, BOC and bp Australia officially opened the nation’s first hydrogen refuelling station at the bp Port of Brisbane Truckstop in August 2023, with the on-site BOC electrolyser powered by solar energy and producing hydrogen that enables fleet vehicles to fully refuel within approximately 3–5 minutes, demonstrating the practical deployment of clean hydrogen infrastructure for industrial use.

Market Trends

Integration Of Digital Technologies Into Production And Distribution Systems For Efficiency Gains

Gas producers adopt digital monitoring tools to improve supply chain visibility. Smart sensors track storage conditions and enable predictive maintenance of equipment. Companies employ automation to enhance cylinder filling and distribution. The Australia Industrial Gases Market shows steady integration of IoT platforms in logistics. Remote monitoring improves safety and reduces operational disruptions. Predictive analytics allows producers to forecast demand and optimize inventory. Digital platforms strengthen customer service by ensuring timely delivery. It reflects a shift toward technologically advanced supply networks.

Growing Role Of Hydrogen Economy Driving New Demand For Sustainable Gas Solutions

Hydrogen adoption gains momentum across transportation and energy projects. Public and private initiatives highlight hydrogen’s role in decarbonization. Pilot projects for hydrogen fueling stations are expanding in major states. The Australia Industrial Gases Market captures growth from hydrogen’s integration in energy systems. Companies invest in infrastructure for production, storage, and distribution. Partnerships between gas suppliers and energy developers accelerate hydrogen scaling. Industries view hydrogen as a long-term clean energy carrier. It positions industrial gases as essential to future energy solutions.

- For instance, Viva Energy launched Australia’s largest hydrogen refuelling station in Geelong, Victoria, in June 2025, featuring a 2.5-megawatt electrolyzer and the capacity to supply up to 1,000 kilograms of renewable hydrogen per day for fleets of heavy transport vehicles and buses.

Increasing Use Of Specialty Gases In Electronics, Manufacturing, And Research Applications

Specialty gases gain traction in semiconductor and electronics manufacturing. High-purity gases are critical for etching and deposition processes. Research labs also require consistent gas supply for advanced testing. The Australia Industrial Gases Market benefits from the growing technology manufacturing ecosystem. Global firms expand their presence in Australia, fueling higher demand. Specialty gases support precision operations where impurities cannot be tolerated. The trend highlights diversification beyond traditional bulk gas consumption. It creates sustained growth opportunities in knowledge-intensive industries.

Rising Investments In Renewable Energy And Carbon Neutral Projects Influencing Gas Adoption

Renewable energy projects rely on gases for storage, efficiency, and processing. Companies adopt carbon dioxide in carbon capture and utilization projects. The Australia Industrial Gases Market sees rising demand for gases in energy transition activities. Gas producers partner with renewable developers to expand application areas. Investment in wind, solar, and bioenergy drives complementary gas usage. Companies explore blending gases into renewable storage solutions. The push for net-zero targets creates new customer segments for suppliers. It demonstrates long-term alignment with national energy goals.

- For instance, Coregas operates a hydrogen refuelling facility at Port Kembla, commissioned in July 2023, with a refuelling capacity of 400 kilograms of hydrogen per day for heavy transport vehicles, marking a critical step in supporting Australia’s clean energy and decarbonization strategy.

Market Challenges Analysis

High Production And Distribution Costs Impacting Pricing And Supply Reliability For Customers

The cost structure of industrial gas production requires heavy capital investments. Setting up air separation units and liquefaction plants increases financial pressure. The Australia Industrial Gases Market faces challenges in balancing cost and affordability. Energy prices contribute significantly to production costs, raising overall expenses. Distribution logistics add further pressure, particularly in remote regions. Transporting gases requires specialized infrastructure and compliance with safety rules. Smaller companies struggle to compete with larger players due to scale advantages. It creates barriers for new entrants and reduces competitive flexibility.

Regulatory Pressures And Environmental Concerns Limiting Traditional Production Practices

Strict environmental rules affect traditional gas production and storage methods. Authorities demand adherence to sustainability guidelines across industrial sectors. The Australia Industrial Gases Market adapts operations to comply with emissions limits. Producers face costs for retrofitting facilities with cleaner technologies. Community opposition to large-scale projects also creates regulatory delays. Safety standards add complexity to distribution in densely populated areas. Transition toward hydrogen and bio-based gases requires additional investment. It increases operational risks for companies unable to adapt quickly.

Market Opportunities

Expanding Hydrogen Economy Creating New Demand Pathways For Energy Transition Projects

The hydrogen economy emerges as a transformative opportunity across Australia. Government strategies support investments in hydrogen production and export. The Australia Industrial Gases Market gains a growth platform through its integration with energy policies. Companies scale infrastructure to capture demand from transportation and power generation. Exports position Australia as a global hydrogen supplier. Hydrogen blending into natural gas pipelines adds domestic demand. It secures long-term opportunities in renewable-aligned industrial ecosystems.

Technological Innovation And Strategic Partnerships Strengthening Application Scope Across Industries

Innovation in energy-efficient separation and liquefaction enhances competitiveness of producers. The Australia Industrial Gases Market benefits from partnerships between suppliers and end-users. Collaboration accelerates adoption in healthcare, food, and mining sectors. Investments in digital platforms open new revenue models for companies. Expansion of storage solutions enables more reliable supply. Companies focus on developing bio-based gases for eco-conscious customers. It strengthens opportunities across industries seeking efficiency and sustainability.

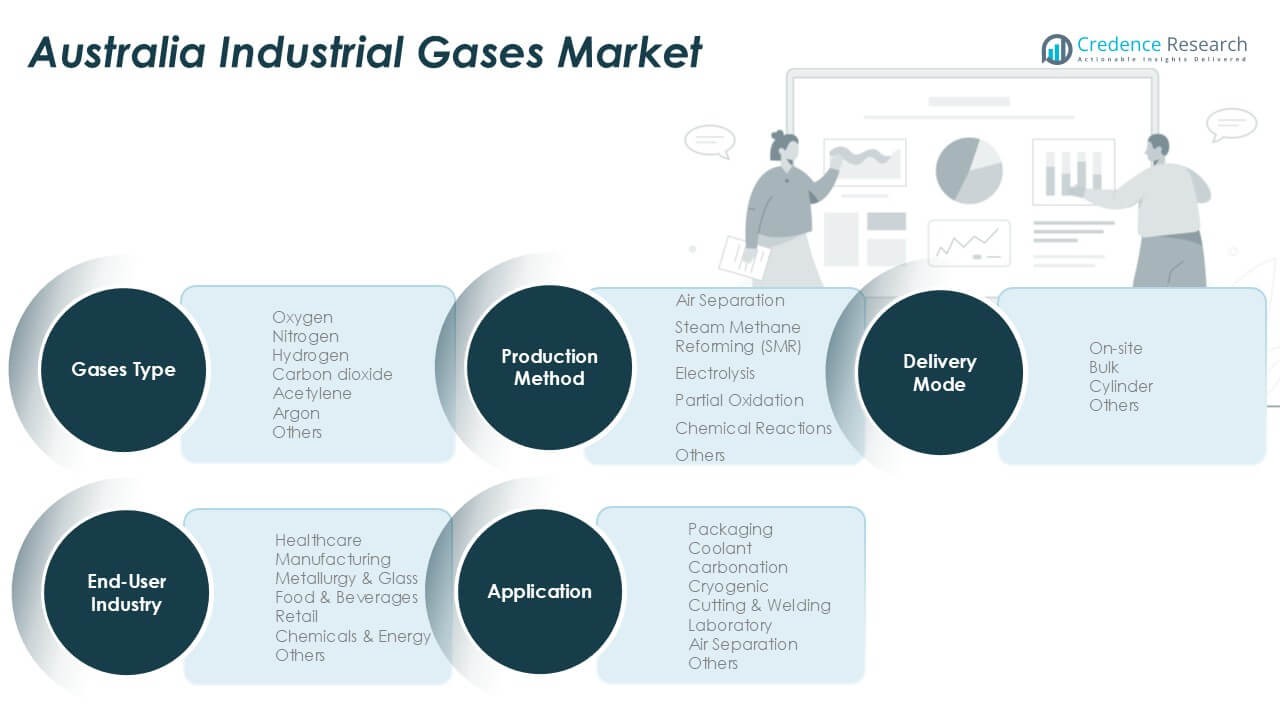

Market Segmentation Analysis

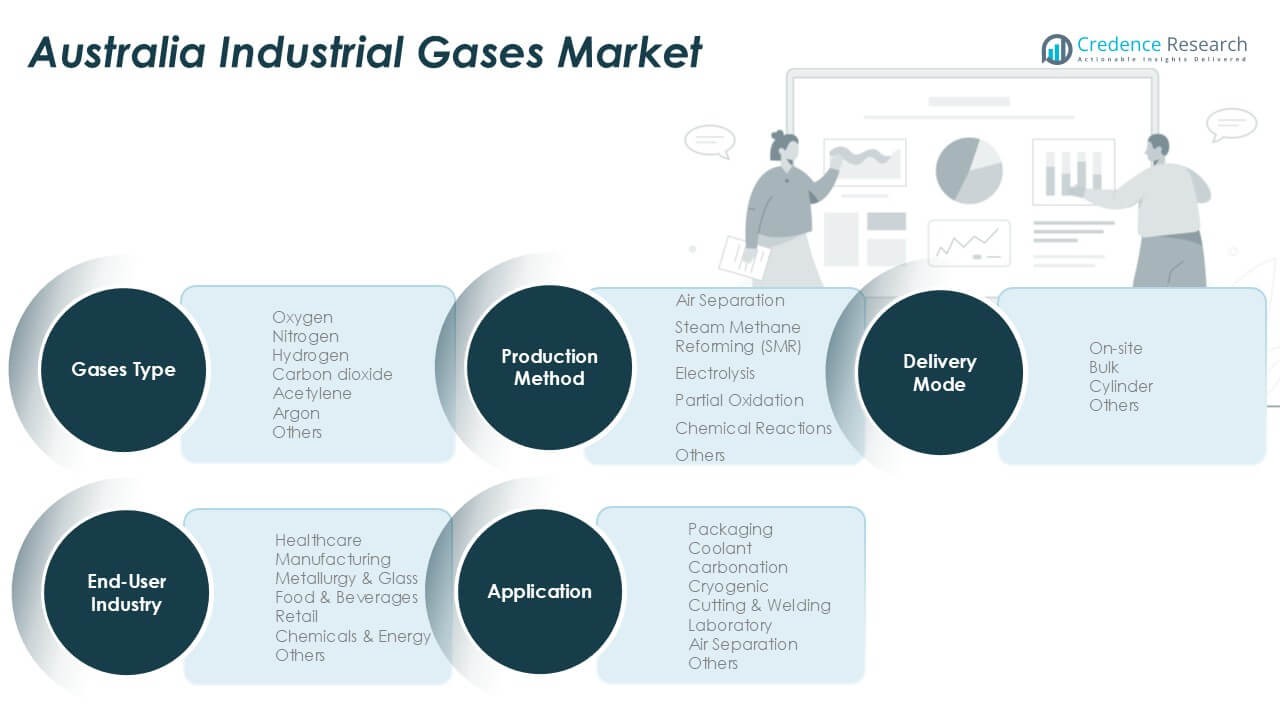

By Gases Type

The Australia Industrial Gases Market by gases type is dominated by oxygen, which is essential for healthcare, metallurgy, and mining. Nitrogen plays a strong role in packaging, preservation, and chemical processes. Hydrogen is expanding quickly with energy transition projects and clean fuel applications. Carbon dioxide supports beverage carbonation and water treatment industries. Acetylene and argon serve niche welding, fabrication, and industrial needs. Other specialty gases cater to research and advanced manufacturing sectors. It shows balanced demand across diverse categories.

By Application

Packaging and carbonation remain leading applications due to strong food and beverage demand. Cryogenic applications are expanding with medical, energy, and space-related activities. Cutting and welding support construction, automotive, and heavy industries. Laboratory demand is rising with research and biotechnology advancements. Air separation is a core application driving gas production efficiency. Other uses continue to emerge across smaller industries. The Australia Industrial Gases Market benefits from versatile usage across multiple application areas.

- For instance, Linde Engineering signed an agreement in March 2024 to deliver an air separation unit with a capacity of 63,000 Nm³/h of oxygen and a nitrogen wash unit of 392,000 Nm³/h syngas to Australia’s largest urea plant in Karratha, directly supporting expanded fertilizer and food sector inputs.

By End-User Industry

Healthcare accounts for high demand due to oxygen and nitrogen usage in hospitals and treatment facilities. Manufacturing relies on gases for cooling, cutting, and production efficiency. Metallurgy and glass industries depend on oxygen for smelting and processing. Food and beverages adopt nitrogen and carbon dioxide for packaging and carbonation. Chemicals and energy sectors drive hydrogen and other industrial gas demand. Retail contributes through smaller-scale supply. Other industries add incremental opportunities. It reflects the broad adoption of gases across the economy.

- For instance, in May 2025, Air Liquide Australia signed an agreement with Manildra Group to build the country’s largest food and beverage-grade carbon dioxide plant in Bomaderry, New South Wales, with an annual production capacity exceeding 90,000 tonnes to support food, water treatment, and manufacturing sectors.

By Production Method

Air separation is the dominant production method due to its efficiency and scalability. Steam methane reforming supports hydrogen production for industrial and energy applications. Electrolysis is gaining attention for green hydrogen generation. Partial oxidation and chemical reactions provide niche production capabilities. Other methods serve specialized industry requirements. The Australia Industrial Gases Market continues to evolve as companies invest in advanced, energy-efficient production systems. It supports the transition to sustainable gas supply models.

By Delivery Mode

On-site delivery dominates for large-scale industrial users such as healthcare facilities, refineries, and manufacturing hubs. Bulk delivery provides reliable supply for medium to large operations across food and mining industries. Cylinder distribution supports smaller enterprises and specialized applications requiring portability. Other delivery modes address custom requirements for niche industries. The Australia Industrial Gases Market ensures flexible supply systems tailored to varying industry demands. It highlights adaptability as a key competitive advantage for suppliers.

Segmentation

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

Regional Analysis

Eastern Australia

Eastern Australia, led by New South Wales and Victoria, holds the largest share of 41% in the Australia Industrial Gases Market. Strong industrial bases, healthcare infrastructure, and advanced manufacturing clusters drive high consumption. The healthcare sector creates stable demand for oxygen and nitrogen across hospitals and research facilities. Manufacturing and food industries rely on nitrogen and carbon dioxide for packaging and preservation. Energy projects in this region also support growth through hydrogen adoption. It remains the core hub for suppliers, with steady demand across diversified applications.

Western Australia

Western Australia captures 33% share due to its dominant mining and resource-driven economy. Mining operations depend on oxygen and specialty gases for extraction and refining processes. Energy projects across LNG and natural gas increase gas consumption significantly. Regional infrastructure supports large-scale supply chains for both bulk and on-site deliveries. The Australia Industrial Gases Market benefits here from high resource activity and export-focused demand. It provides consistent opportunities for suppliers due to long-term mining and energy reliance. The subregion remains critical for growth in industrial-grade gases.

Northern and Southern Australia

Northern and Southern Australia collectively account for 26% share of the market. Northern areas like Queensland show rising demand from food processing, medical services, and packaging applications. Southern regions, including South Australia and Tasmania, see adoption in manufacturing and clean energy projects. Growing investment in hydrogen and renewable energy initiatives further boosts prospects. The Australia Industrial Gases Market finds new opportunities in these regions due to expanding healthcare and sustainability programs. It demonstrates stable but emerging growth potential in secondary industrial hubs. These areas provide new avenues for suppliers expanding beyond the eastern and western strongholds.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BOC Australia

- Air Liquide Australia

- Linde (Linde Material Handling)

- Coregas

- Supagas

- BASF Australia

- Wesfarmers Kleenheat Gas

- Iwatani Australia

- Messer & Opie

- Air Products & Chemicals, Inc.

Competitive Analysis

The Australia Industrial Gases Market features a competitive landscape shaped by global leaders and regional players. BOC Australia, Air Liquide, Linde, and Air Products maintain strong dominance through large production facilities, on-site supply models, and long-term contracts. Domestic firms such as Coregas, Supagas, and Wesfarmers Kleenheat Gas secure niche positions with regional supply networks and customized services. BASF Australia and Iwatani Australia expand portfolios by integrating specialty and energy-focused gases, including hydrogen. Competition centers on innovation, cost control, and expanding customer reach across healthcare, mining, and energy sectors. It is defined by strategic expansions, mergers, and technology adoption aimed at strengthening market positions.

Recent Developments

- In September 2025, Envision Energy established a new strategic partnership in Australia targeting renewable energy advancement, the development of net zero industrial parks, as well as new green hydrogen and ammonia projects, strengthening its long-term commitment to Australia’s industrial gases and sustainable energy sectors.

- In May 2025, Air Liquide Australia signed an agreement with Manildra Group to build the country’s largest food and beverage grade carbon dioxide (CO₂) plant in Bomaderry, New South Wales. The new facility, planned for construction starting in the second half of 2025, will have a production capacity of over 90,000 tonnes annually, supporting numerous sectors including food, hospitality, water treatment, and manufacturing.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method and Delivery Mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Industrial Gases Market will strengthen with growing healthcare reliance on oxygen and nitrogen.

- Mining and energy sectors will sustain demand for oxygen, hydrogen, and other specialty gases.

- Food and beverage applications will expand through packaging and carbonation, boosting nitrogen and carbon dioxide usage.

- Hydrogen adoption will accelerate as clean energy projects and national policies advance.

- Technological upgrades in air separation and electrolysis will enhance efficiency and supply reliability.

- Regional demand diversification will rise, with Queensland and South Australia emerging as high-growth areas.

- Digital integration in distribution and monitoring will improve logistics and customer service.

- Strategic mergers and partnerships will increase competition and expand product portfolios.

- Specialty gas applications in electronics and research will broaden beyond traditional industrial use.

- Sustainability pressures will shape investment in eco-friendly production and renewable-aligned gases.