Market Overview

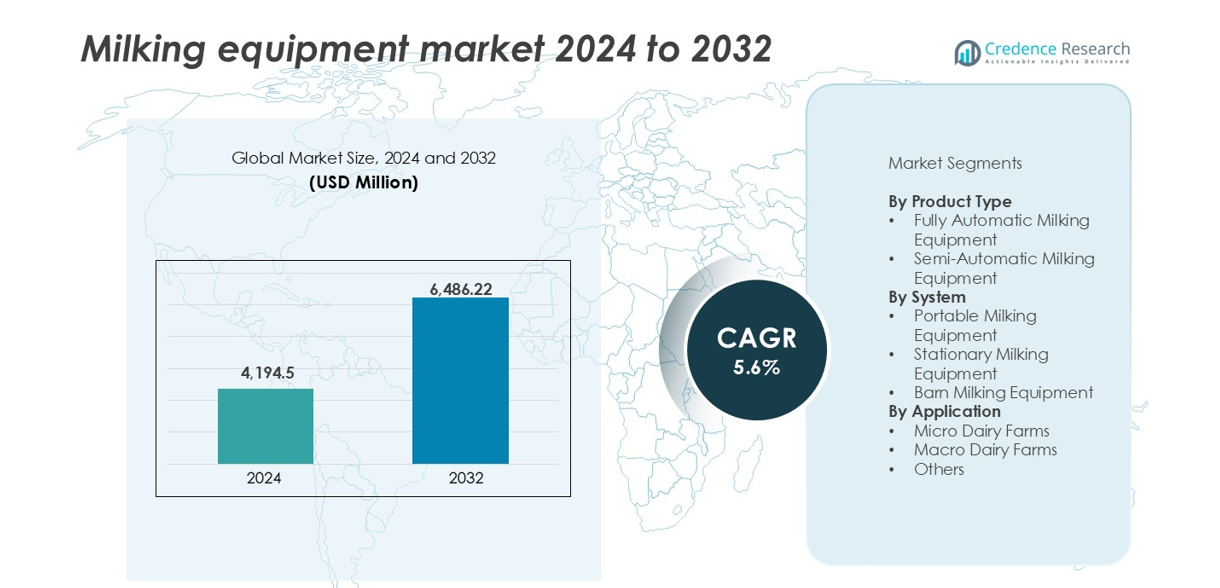

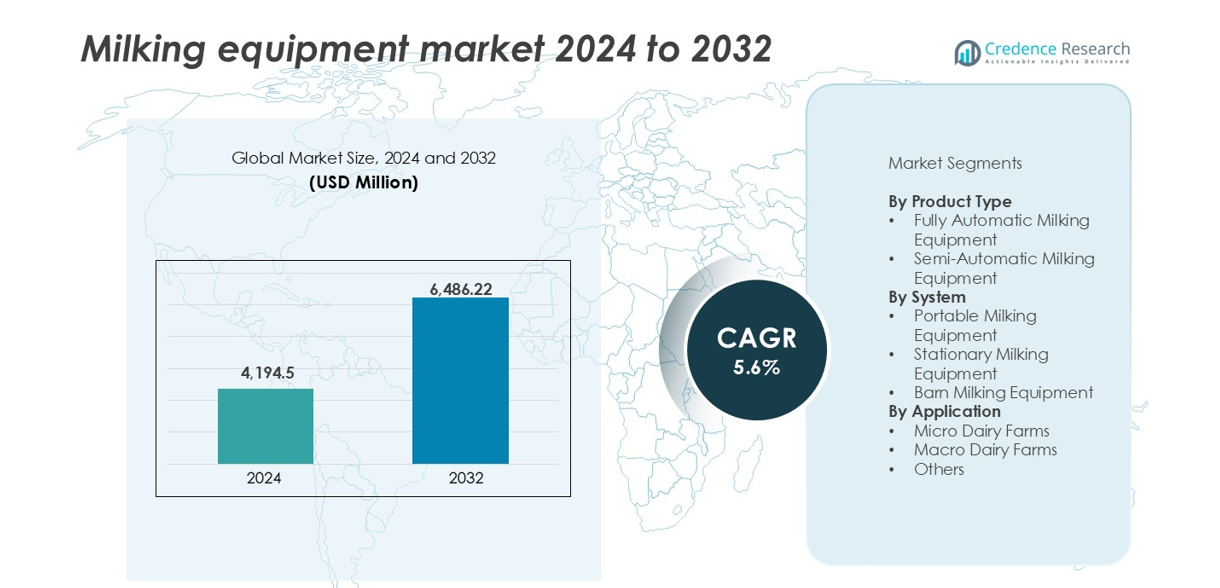

The Milking equipment market size was valued at USD 4,194.5 million in 2024 and is anticipated to reach USD 6,486.22 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Milking Equipment Market Size 2024 |

USD 4,194.5 million |

| Milking Equipment Market, CAGR |

5.6% |

| Milking Equipment Market Size 2032 |

USD 6,486.22 million |

The milking equipment market is led by established players such as Lely, GEA Group Aktiengesellschaft, BouMatic Robotics B.V., and Fullwood Packo, known for their advanced robotic and automated systems. These companies dominate in regions with mature dairy infrastructure, offering high-throughput solutions and precision herd management. Europe holds the largest regional market share at 32%, driven by strict animal welfare regulations and widespread automation adoption. Other notable companies include Agrifac Machinery BV, AMS-Galaxy, and regional suppliers like Vansun Technologies Pvt Ltd and Prompt Dairy Tech, which focus on cost-effective systems for emerging markets. Competitive focus centers on innovation, product reliability, and digital integration.

Market Insights

- The milking equipment market was valued at USD 4,194.5 million in 2024 and is projected to reach USD 6,486.22 million by 2032, growing at a CAGR of 5.6%.

- Rising automation in dairy farms and increasing labor costs are driving demand for fully automatic milking systems.

- Smart dairy trends like IoT integration, herd analytics, and robotic milking units are gaining strong traction globally.

- Lely, GEA Group, BouMatic Robotics, and Fullwood Packo lead the market, while regional players offer affordable systems for smaller farms.

- Europe holds the largest share at 32%, followed by North America at 28% and Asia-Pacific at 21%; by product type, fully automatic milking systems dominate due to efficiency and hygiene benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Fully automatic milking equipment holds the largest share in the milking equipment market. This segment dominates due to rising labor shortages, the need for consistent milking routines, and efficiency in large dairy operations. Farmers prefer automatic systems to boost productivity, ensure hygiene, and track milk yield digitally. These machines reduce manual labor, lower operating costs, and increase throughput. Semi-automatic systems continue to serve small and medium farms but lack the automation depth of high-end units. Full automation improves udder health through precision-controlled processes and optimal milking intervals. Demand for animal welfare and data-driven dairy management supports further adoption.

- For instance, DeLaval’s VMS™ V300 robotic milking system delivers over 3,000 liters of milk per robot per day, supporting real-time data tracking and automated teat cleaning.

By System

Stationary milking equipment leads the system segment with the highest revenue share. This preference stems from its integration in large dairy barns and fixed infrastructure, offering high throughput and consistent performance. Stationary setups suit high-volume operations where cows follow fixed routines. Portable milking equipment is more popular among small farms needing flexibility. Barn milking equipment, typically integrated into farm layouts, supports semi-automatic and automatic systems. Stationary units deliver lower maintenance downtime and better hygiene control, which appeals to commercial dairy producers. System selection depends on farm size, herd volume, and investment capacity, with large farms opting for durability and speed.

- For instance, BouMatic’s Xcalibur™ 360EX rotary milking system is designed for large-scale commercial dairy operations, accommodating between 40 and 150 stalls. At its maximum configuration, the system can process up to 1,200 cows per hour, supporting continuous 24/7 milking for herds exceeding 4,000 cows.

By Application

Macro dairy farms represent the dominant application segment with the largest market share. These operations benefit from economies of scale and invest in advanced milking systems to optimize yield and reduce labor. Macro farms demand fully automated, stationary units to handle high herd counts efficiently. Micro dairy farms adopt semi-automatic or portable units due to limited herd sizes and budget constraints. The “Others” category includes educational, research, and niche farms with tailored needs. Growth in commercial dairy farming and herd expansion in emerging markets fuels the macro segment. High milk demand and export opportunities further support advanced equipment adoption.

Key Growth Drivers

Rising Demand for Automation in Dairy Farming

The shift toward automation is a primary driver of the milking equipment market. Dairy farms face increasing labor shortages and pressure to maintain productivity. Fully automatic milking systems reduce dependency on manual labor while ensuring consistent milking cycles and higher hygiene standards. Automation also enables real-time monitoring of milk output, animal health, and equipment performance. Large farms benefit from improved efficiency, better udder health, and optimized operations through software integration. In emerging economies, rising herd sizes and dairy demand are prompting farmers to invest in automated systems. Governments and industry bodies are also encouraging mechanization to boost rural productivity. The ability to scale operations while reducing costs further reinforces the move toward automatic systems. This shift directly supports market growth, especially across North America, Europe, and parts of Asia.

- For instance, Lely’s Astronaut A5 robotic milking system records over 120 data points per cow per day, helping farmers optimize yield and detect health issues early.

Expansion of Large-Scale Commercial Dairy Farms

Commercial dairy operations continue to expand globally, fueling demand for advanced milking systems. Macro dairy farms require high-throughput equipment capable of processing hundreds of cows per day. These operations often deploy stationary, fully automated systems that optimize labor and improve yield quality. Increased consumer demand for dairy products, including milk, cheese, and yogurt, is pushing commercial farms to scale production efficiently. Countries like India, China, and Brazil are witnessing a rapid rise in organized dairy operations, backed by government incentives and private investments. The need to manage large herds, maintain milk hygiene, and meet regulatory standards drives the adoption of precision milking technology. Commercial farms view such investments as critical to achieving long-term profitability and export readiness. The growth of this segment has a direct impact on the sales of durable, high-capacity milking equipment.

- For instance, Fonterra operates rotary parlors in New Zealand capable of milking 54 cows every 8 minutes, with automated cleaning and real-time tracking.

Emphasis on Animal Welfare and Milk Quality

Growing awareness around animal health and milk hygiene standards drives investment in advanced milking equipment. Modern systems are designed to minimize stress on cows by using gentle milking techniques and ensuring timely milking intervals. Equipment with sensors and analytics features allows early detection of infections, irregularities, or yield drops. This improves animal well-being and ensures consistent milk quality. Regulatory pressure across the EU and the U.S. for safer dairy production practices accelerates the use of automated and hygienic milking solutions. Consumers are also increasingly aware of traceability, demanding clean-label dairy sourced from well-managed farms. As farms focus on improving cow comfort, disease prevention, and herd management, demand for smarter and cleaner equipment grows. These priorities align with market offerings such as robotic arms, automatic teat cleaning systems, and milk sampling technologies.

Key Trends & Opportunities

Integration of IoT and Data-Driven Dairy Management

IoT integration is reshaping milking operations through data analytics, cloud platforms, and remote monitoring tools. Modern milking systems now include smart sensors that track milk yield, temperature, cow activity, and equipment performance in real time. This shift allows farms to make data-backed decisions that improve productivity and animal health. Predictive maintenance alerts reduce downtime, while cloud-linked herd records streamline veterinary and breeding processes. Startups and established equipment vendors are investing in digital tools to offer complete herd management solutions. As smart farming gains momentum, the demand for connected milking systems will accelerate, especially in tech-ready dairy regions. The opportunity lies in offering scalable platforms tailored to both medium and large farms seeking performance visibility and cost control.

- For instance, DeLaval’s DelPro™ Farm Management platform and its integrated DeLaval Plus ecosystem process billions of data points daily across installations supporting over 5 million cows globally. This real-time analysis allows farmers to optimize milking intervals, maximize feed efficiency, and proactively manage cow health through advanced AI-driven insights.

Key Challenges

High Capital Costs and Return on Investment Concerns

The high upfront cost of milking equipment remains a significant barrier, especially for small and medium farms. Fully automated systems, while efficient, require substantial investment in hardware, installation, and training. Many dairy farmers struggle to justify the cost due to uncertain milk prices, volatile input costs, and slow payback periods. Financing options and government subsidies are not always accessible or sufficient in developing markets. In addition, some farmers remain cautious about technology adoption due to maintenance risks and lack of technical expertise. These factors limit the penetration of premium equipment into rural and fragmented markets. Without scalable, cost-effective models or rental options, equipment adoption may remain concentrated in wealthier regions.

Technical Complexity and Maintenance Burden

Advanced milking systems often involve complex mechanical and electronic components that require regular maintenance. For farmers unfamiliar with digital systems, this creates dependency on vendor support. Downtime due to technical issues can disrupt daily operations and reduce milk yield. In remote or underdeveloped areas, lack of access to trained technicians and spare parts further compounds the issue. Software glitches, sensor misalignment, or mechanical failures can erode trust in automation. Manufacturers must address these concerns by improving equipment reliability, offering robust training, and ensuring responsive service networks. Simplifying user interfaces and integrating auto-diagnostics may help mitigate maintenance-related challenges over time.

Regional Analysis

North America

North America accounts for around 28% of the global milking equipment market share in 2024. The U.S. leads this region with strong adoption of fully automated milking systems in large commercial dairy farms. High labor costs, advanced dairy infrastructure, and government support for precision agriculture drive automation. Canada also contributes with modern dairy practices and rising herd productivity. Integration of IoT in herd management supports demand for smart milking units. Regional players invest heavily in R&D and service networks. Consistent demand for premium dairy products and strong export orientation sustain growth across both stationary and robotic systems.

Europe

Europe holds the largest share of the global market at approximately 32% in 2024. Countries like Germany, the Netherlands, and France lead in the adoption of robotic and fully automatic milking systems. Strict regulations on animal welfare, milk hygiene, and sustainability drive investment in advanced technologies. European dairy farms focus on efficiency, environmental compliance, and herd health monitoring. Government subsidies and strong cooperative structures support smaller farms in adopting semi-automated systems. The region’s mature dairy sector continues to lead innovation in automation, waste reduction, and smart dairy management. Demand remains strong for energy-efficient, high-throughput equipment across EU markets.

Asia-Pacific

Asia-Pacific captures about 21% of the global milking equipment market in 2024 and is the fastest-growing region. Rapid urbanization, rising dairy demand, and government-backed modernization programs drive growth. China and India lead regional adoption, supported by large-scale dairy expansions and co-operative farming initiatives. Southeast Asian countries are witnessing increasing investments in portable and semi-automatic systems due to fragmented dairy structures. The shift from manual to mechanized milking improves productivity and milk safety. International players are localizing production and service centers to support long-term growth. Increasing consumer demand for quality dairy and herd traceability strengthens the market outlook.

Latin America

Latin America holds around 10% of the market share in 2024, with Brazil, Argentina, and Mexico leading regional demand. Expanding commercial dairy farms and higher milk yield targets fuel equipment adoption. Brazilian dairy processors invest in automation to meet domestic and export demand. Regional governments support dairy modernization through rural development schemes. Most farms still use semi-automatic and stationary systems, but interest in full automation is rising. Technical support, training, and cost-effective equipment are critical for further market growth. Economic fluctuations and import dependency for high-end equipment remain key barriers in smaller markets across the region.

Middle East & Africa (MEA)

MEA contributes approximately 9% to the global milking equipment market in 2024. Dairy development projects in South Africa, Egypt, and parts of the GCC drive equipment sales. Regional demand is primarily met by semi-automatic and portable systems, given the fragmented farm structure and climatic constraints. Government-led dairy self-sufficiency goals, especially in Saudi Arabia and the UAE, support investment in stationary systems. Africa sees gradual growth through NGO and cooperative-led modernization programs. Infrastructure challenges, funding gaps, and lack of skilled labor hinder faster adoption. However, rising urban milk consumption and food security concerns point to long-term market potential.

Market Segmentations:

By Product Type

- Fully Automatic Milking Equipment

- Semi-Automatic Milking Equipment

By System

- Portable Milking Equipment

- Stationary Milking Equipment

- Barn Milking Equipment

By Application

- Micro Dairy Farms

- Macro Dairy Farms

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The milking equipment market features a mix of global leaders and regional manufacturers focusing on automation, precision, and herd management technologies. Lely remains a top player with its robotic milking systems widely adopted in advanced dairy regions. GEA Group Aktiengesellschaft leverages its engineering expertise to offer integrated milking solutions and smart automation platforms. BouMatic Robotics B.V. emphasizes innovation in rotary and robotic milking units tailored for high-throughput farms. Fullwood Packo provides hybrid systems combining automation and herd comfort. Agrifac Machinery BV and AMS-Galaxy serve commercial farms with scalable milking solutions. Regional players like Kanters Holland BV, S.A. Christensen & Co., Vansun Technologies Pvt Ltd, Prompt Dairy Tech, and Bisstarr Milking Systems focus on cost-effective, semi-automatic, and portable systems catering to small and medium farms across Asia and Africa. Product reliability, after-sales support, and customization are key areas of competition. Leading firms are investing in IoT integration, mobile interfaces, and sustainability-driven innovations to strengthen market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lely

- GEA Group Aktiengesellschaft

- BouMatic Robotics B.V.

- Fullwood Packo

- Agrifac Machinery BV

- AMS-Galaxy

- Kanters Holland BV

- A. Christensen & Co.

- Vansun Technologies Pvt Ltd

- Prompt Dairy Tech

- Bisstarr Milking Systems

Recent Developments

- In April 2024, Agrifac Machinery BV expanded the corporate sector of the firm in Seward, Nebraska. This development has provided a broader space for the firm in the competitive landscape.

- In October 2023, Lely partnered with Konrad Pumpe GmbH. This move helped farmers gain more flexibility in terms of automatic feeding.

Report Coverage

The research report offers an in-depth analysis based on Product Type, System, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for robotic milking systems will rise with labor shortages and large herd management needs.

- Integration of IoT and data analytics will enhance precision in milk yield tracking and herd health.

- Portable and semi-automatic systems will gain traction in small and mid-sized dairy farms.

- Sustainability-focused designs will drive development of energy-efficient and water-saving milking units.

- Growth in dairy exports will push commercial farms to invest in high-capacity milking technologies.

- Emerging markets will adopt modern equipment through government support and dairy infrastructure upgrades.

- Predictive maintenance features will reduce downtime and improve operational reliability on large farms.

- Cloud-based herd management platforms will support remote monitoring and compliance tracking.

- Manufacturers will focus on modular designs to serve both high-end and cost-sensitive segments.

- Rising consumer demand for clean-label dairy will increase investments in hygienic and automated milking systems.