Market Overview:

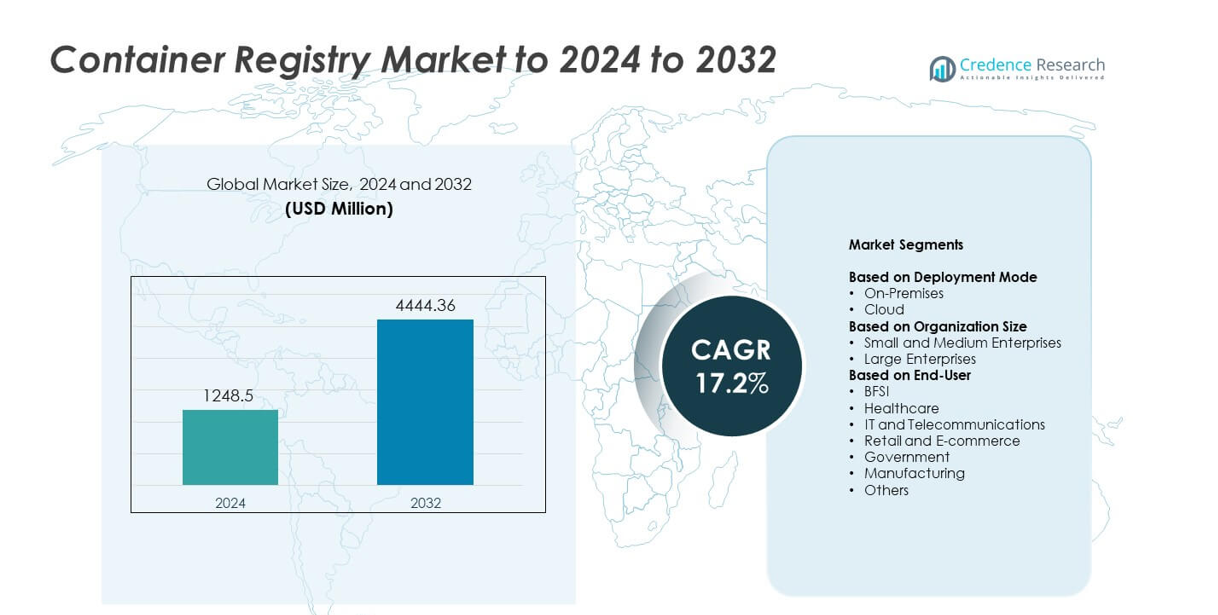

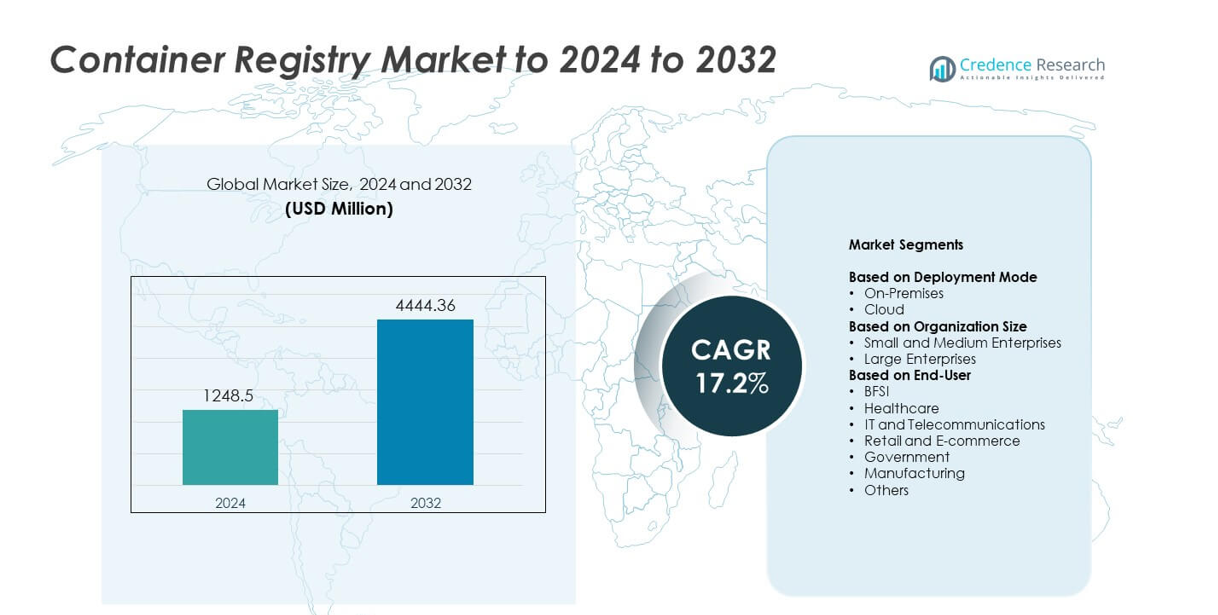

Container Registry Market size was valued USD 1248.5 million in 2024 and is anticipated to reach USD 4444.36 million by 2032, at a CAGR of 17.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Container Registry Market Size 2024 |

USD 1248.5 million |

| Container Registry Market, CAGR |

17.2% |

| Container Registry Market Size 2032 |

USD 4444.36 million |

The Container Registry Market includes major players such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, Docker Inc., GitHub, GitLab, Red Hat, JFrog, Harbor, Quay, Oracle Cloud Infrastructure, and Alibaba Cloud, each competing through secure image storage, automated vulnerability scanning, and deep CI/CD integration. These providers focus on strengthening supply-chain security and supporting multi-cloud deployments to meet rising DevSecOps demand. North America led the market in 2024 with about 38% share due to strong enterprise cloud adoption and advanced digital infrastructure, while Europe and Asia Pacific followed with growing investment in cloud-native development.

Market Insights

- The Container Registry Market reached USD 1248.5 million in 2024 and is projected to hit USD 4444.36 million by 2032, growing at a CAGR of 17.2 %.

- Strong adoption of cloud-native development drives demand, with cloud deployment holding about 67 % share in 2024 due to higher scalability, automated updates, and better DevSecOps integration.

- Trends highlight rising use of AI-driven scanning, wider multi-cloud adoption, and growing reliance on managed registry services that reduce operational load and improve software supply-chain security.

- Competition intensifies as major vendors enhance automation, global replication, image integrity controls, and compliance features, while enterprises seek deeper CI/CD and Kubernetes ecosystem integration.

- Regional growth is led by North America with 38 % share, followed by Europe at 29 % and Asia Pacific at 25 %, supported by expanding cloud investments and rapid modernization across IT, telecom, retail, and regulated industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Mode

Cloud deployment held the dominant position in 2024 with about 67% share due to rising adoption of containerized workloads on managed Kubernetes platforms. Many enterprises prefer cloud registries because they offer strong scalability, automated security scanning, and reduced infrastructure overhead. Cloud vendors also provide integrated workflow pipelines that help teams streamline image storage and distribution. On-premises deployment maintained steady use among firms with strict data-control needs, but the shift toward multi-cloud and DevOps practices continued to push broader demand for cloud registries.

- For instance, Docker reported over 20 million registered developers using its platform in 2024.

By Organization Size

Large enterprises led the segment in 2024 with nearly 61% share as they manage high container volumes across complex, distributed architectures. These companies rely on advanced registry features such as role-based access, automated image validation, and multi-region replication to reduce latency and ensure compliance. Large organizations also invest in DevSecOps pipelines that need secure, high-availability image storage. Small and medium enterprises expanded adoption as cloud-native development grew, but their share remained lower due to smaller deployment scales.

- For instance, JFrog’s Software Artifact State of the Union draws on data from over 7,000 Artifactory customers worldwide.

By End-User

IT and telecommunications dominated the end-user segment in 2024 with about 34% share because digital service providers rely heavily on microservices, CI/CD pipelines, and cloud-native production systems. The sector uses container registries to support rapid image delivery, version control, and automated updates for large application fleets. BFSI and healthcare increased adoption as cybersecurity and compliance demands rose. Retail, government, and manufacturing adopted registries to modernize workloads, but their usage remained lower compared to IT-focused enterprises.

Key Growth Drivers

Rising Adoption of Cloud-Native Applications

The growing shift toward cloud-native architectures drives strong demand for container registries. Many enterprises deploy microservices on Kubernetes, which requires reliable and secure image storage. This trend boosts the need for automated image scanning, high-availability repositories and faster version control. Organizations also expand DevSecOps practices, making secure registries essential for managing continuous delivery cycles. As cloud workloads scale, companies prioritize registries that improve deployment speed and reduce operational risks.

- For instance, the HashiCorp Terraform Registry hosts over 3,000 providers (as of May 2025) and more than 12,000 modules.

Expansion of DevSecOps and Security Requirements

Security compliance pushes companies to adopt advanced registry solutions with integrated scanning and policy enforcement. Cyberattacks targeting container images continue to rise, encouraging firms to harden software supply chains. Many enterprises adopt registries that check vulnerabilities, manage signing keys and prevent unverified images from entering pipelines. Strong access control and automated auditing support regulatory needs in sensitive sectors like BFSI and healthcare. This shift increases demand for registries that enhance security posture across development teams.

- For instance, Aqua Security’s Nautilus research team analyzed more than 700,000 real cloud-native attacks in one study.

Growth in Multi-Cloud and Hybrid Deployments

The rapid move toward hybrid and multi-cloud environments increases the need for cross-platform image management. Companies want registries that replicate images across regions, reduce latency and support consistent deployments across various cloud providers. This flexibility helps teams manage distributed workloads while improving performance and reliability. Many enterprises also reduce vendor lock-in by using registries that integrate with multiple orchestration platforms. Broader multi-cloud adoption continues to elevate demand for scalable registry infrastructure.

Key Trends & Opportunities

Rising Use of Private and Managed Registries

Organizations increasingly adopt private or fully managed registries to enhance security and streamline operations. Managed offerings reduce overhead by providing automated updates, strong encryption and built-in CI/CD integration. Many companies shift from open public registries to controlled environments that verify image integrity. This trend creates opportunities for vendors offering compliance-focused, enterprise-grade registry services. Growth in regulated industries further accelerates adoption of controlled and secure registry platforms.

- For instance, the Harbor container registry project, a graduated CNCF project, has tallied contributions from 762 companies as of a September 2023 report, representing a 437% increase in contributing companies since the project joined the CNCF in 2018.

Integration of AI-Driven Scanning and Automation

Vendors introduce AI-enabled scanning tools that detect vulnerabilities faster and reduce false positives. These enhancements help development teams maintain secure images without slowing release cycles. Automated risk assessment and policy enforcement support stronger DevSecOps pipelines, creating opportunities for platforms offering intelligent quality gates. As enterprises adopt more complex container ecosystems, demand grows for registries that use automation to streamline image validation, reduce manual checks and improve deployment safety.

- For instance, Snyk’s analysis of Docker Hub found that each of the ten most popular images contained more than 30 known vulnerabilities.

Expansion of Edge and Serverless Deployments

More companies deploy edge and serverless workloads, creating new demand for light, high-performance registry solutions. Edge applications require fast image delivery, local caching and high-availability replication. Serverless platforms depend on optimized images that load quickly, pushing vendors to offer registry features tailored to emerging computing models. This trend expands opportunities for providers offering distributed registries that support low-latency environments.

Key Challenges

Rising Security Risks in the Software Supply Chain

Growing attacks on container ecosystems create major security pressures. Vulnerable images, misconfigured access controls and unverified sources expose organizations to risk. Development teams must secure each stage of the pipeline, but rapid release cycles make this difficult. Registries need strong signing, automated scanning and strict access governance to address threats. Many enterprises struggle to maintain consistent policies across hybrid environments, slowing adoption and increasing compliance burdens.

Complexity of Managing Large-Scale Distributed Environments

As enterprises scale container usage, managing image replication, versioning and storage across regions becomes challenging. High availability demands, combined with multi-cluster deployments, increase operational complexity. Teams must handle synchronization delays, storage costs and integration issues with CI/CD systems. Many organizations lack the in-house expertise needed to operate large, distributed registry infrastructures. This complexity pushes companies toward managed solutions but raises concerns around performance and vendor dependence.

Regional Analysis

North America

North America held the largest share of about 38% in 2024 due to strong enterprise adoption of cloud-native technologies and rapid expansion of DevSecOps practices. Companies across IT, telecom, and BFSI invested in secure and scalable registry platforms to support containerized workloads. The region benefited from early uptake of Kubernetes, strong digital infrastructure, and high spending on security automation. Demand grew further as firms adopted multi-cloud strategies and advanced supply-chain security frameworks. Government and healthcare sectors also accelerated investments as compliance and data protection requirements strengthened across the region.

Europe

Europe accounted for nearly 29% share in 2024, supported by rising containerization across financial services, automotive, and manufacturing industries. Many enterprises adopted registry platforms to meet strict data protection and cybersecurity regulations. The region saw expanding use of hybrid cloud environments, which increased the need for distributed image storage and secure replication. Growth remained strong in countries with advanced digital transformation programs, while public-sector cloud initiatives boosted adoption. Increased focus on secure software supply chains and open-source integration continued to drive investments across both large enterprises and mid-sized organizations.

Asia Pacific

Asia Pacific captured around 25% share in 2024, driven by rapid cloud adoption and strong investment in digital infrastructure. Technology, telecom, and e-commerce companies expanded use of container registries to support large-scale application deployments. Many enterprises adopted cloud-native architectures to improve agility, which boosted demand for automated image management and security tools. Growing regional startup ecosystems also accelerated uptake of managed registry services. Government digital policies and rising adoption of Kubernetes platforms across India, China, and Southeast Asia further supported market expansion, positioning the region for the fastest growth ahead.

Latin America

Latin America held about 5% share in 2024 as enterprises gradually expanded cloud-native development and digital modernization efforts. Adoption grew in sectors such as banking, retail, and telecommunications, which required secure and scalable image storage. Many companies favored managed registry services to reduce operational complexity and address talent shortages in advanced DevOps practices. Investments in hybrid cloud environments increased across major economies, improving readiness for container technologies. Although overall adoption remained lower than other regions, expanding digital transformation projects continued to create steady demand for registry platforms.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share in 2024, supported by growing cloud deployments and rising interest in containerized workloads. Enterprises in banking, government, and energy sectors adopted registries to enhance security and streamline application delivery. The region saw increasing investment in digital infrastructure, which improved the foundation for cloud-native development. Managed registry services gained traction as organizations sought cost-effective solutions with strong compliance features. While adoption remained at an early stage, expanding national digital strategies and cloud investments indicated steady long-term growth potential.

Market Segmentations:

By Deployment Mode

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Healthcare

- IT and Telecommunications

- Retail and E-commerce

- Government

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Container Registry Market features leading companies such as GitHub, Oracle Cloud Infrastructure, Docker Inc., Harbor, JFrog, Alibaba Cloud, GitLab, Google Cloud Platform, Red Hat, Quay, Microsoft Azure, and Amazon Web Services in a highly competitive environment driven by security, scalability, and integration strength. Vendors focus on offering secure image storage with automated scanning and strong access control to support enterprise DevSecOps workflows. Many providers enhance performance through global replication and multi-region delivery to meet the needs of large, distributed applications. Integration with CI/CD pipelines remains a major differentiator as development teams seek faster image delivery and simplified governance. Providers also expand managed services that reduce operational complexity and support growing multi-cloud adoption. Rising demand for compliance-ready registries pushes vendors to improve auditing, vulnerability detection, and policy enforcement features. Competition continues to intensify as enterprises shift toward cloud-native architectures, driving ongoing innovation across automation, image validation, and hybrid deployment support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Azure added new built-in RBAC roles for Azure Container Registry. Roles such as Container Registry Tasks Contributor and Transfer Pipeline Contributor give more precise access control.

- In 2025, Amazon Web Services (AWS) introduced several enhancements to its Amazon Elastic Container Registry (ECR).

- In 2023, Docker Introduced Docker Scout, a comprehensive solution for container image security, and integrated new security scanning features directly into its core platform.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as more enterprises adopt cloud-native architectures.

- Multi-cloud and hybrid deployments will increase demand for cross-platform registries.

- DevSecOps expansion will push vendors to offer stronger built-in security features.

- AI-driven image scanning and automation will become a standard capability.

- Edge and serverless computing will boost need for lightweight, high-speed registries.

- Managed registry services will gain traction due to lower operational burden.

- Software supply-chain security rules will accelerate adoption in regulated sectors.

- Integration with CI/CD and GitOps pipelines will become more advanced.

- Vendor competition will intensify around compliance, scalability, and global replication.

- Adoption will rise in emerging markets with growing digital transformation programs.