Market Overview

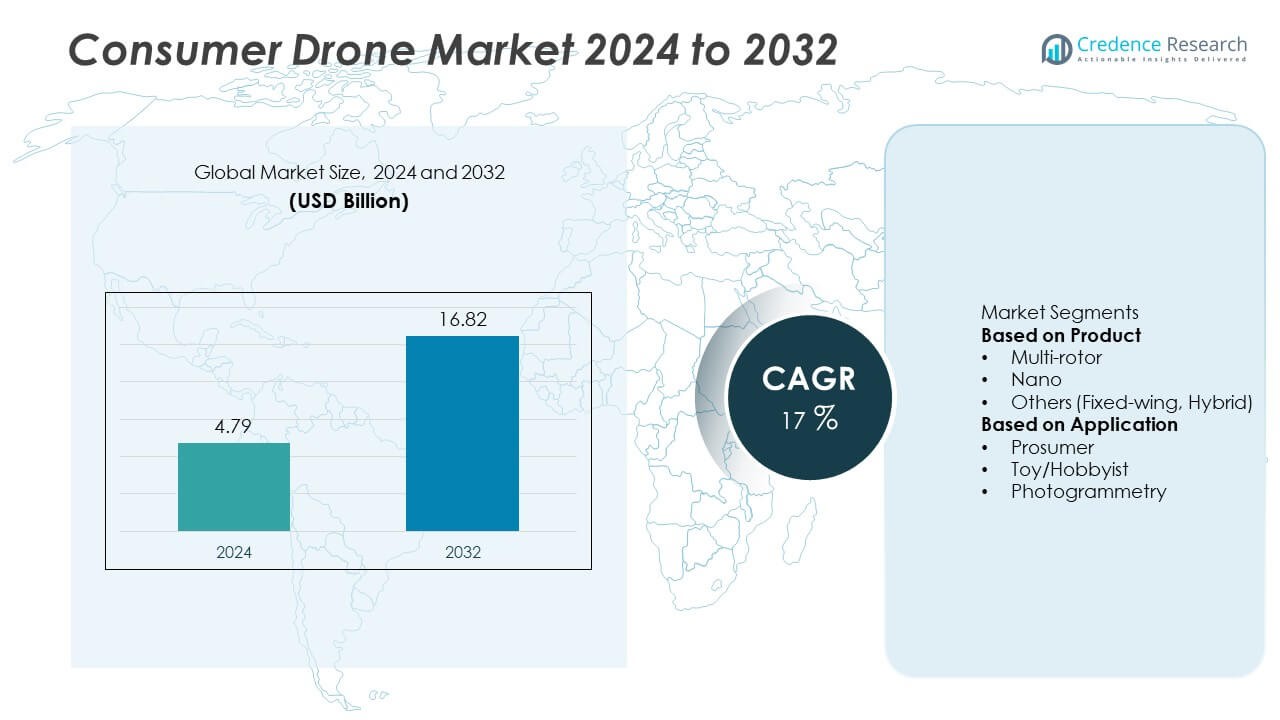

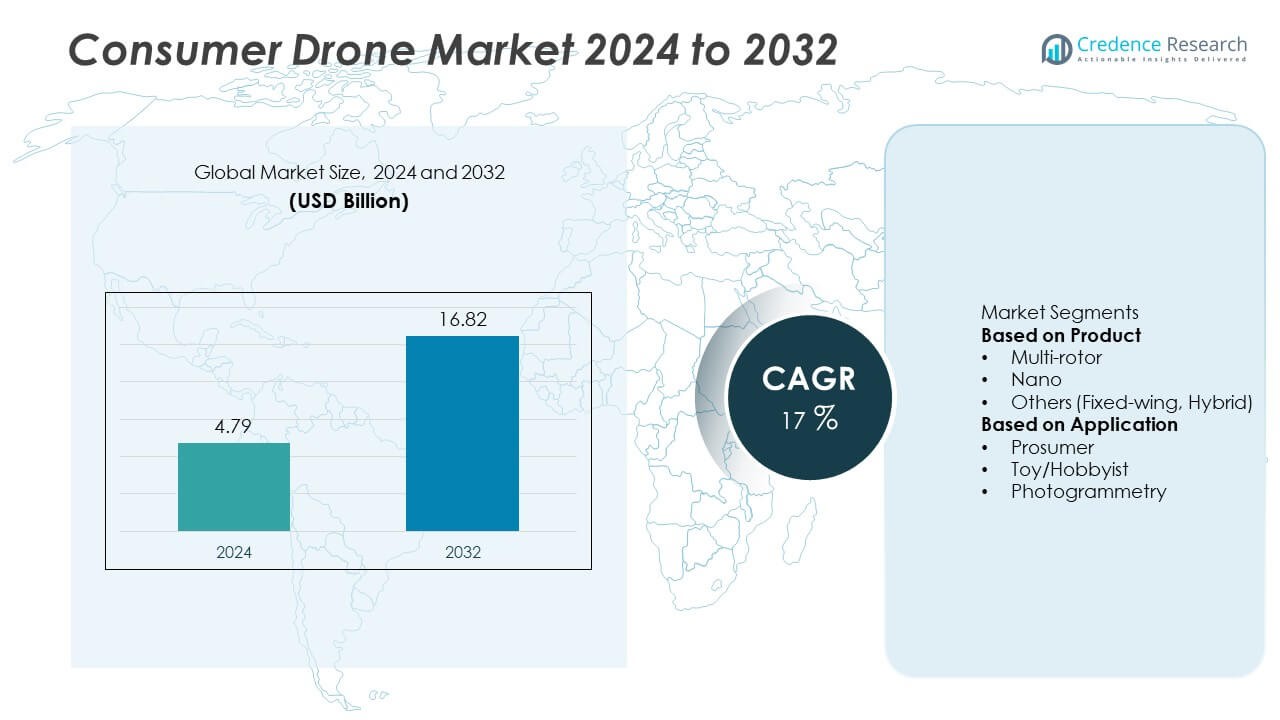

The Consumer Drone Market was valued at USD 4.79 billion in 2024 and is projected to reach USD 16.82 billion by 2032, growing at a strong CAGR of 17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer Drones MarketSize 2024 |

USD 4.79 Million |

| Consumer Drones Market, CAGR |

17% |

| Consumer Drones Market Size 2032 |

USD 16.82 Million |

The consumer drone market is led by key players such as SZ DJI Technology Co., Ltd., Parrot Drone SAS, Yuneec International Co., Ltd., Horizon Hobby, LLC, and 3D Robotics, Inc. (Kitty Hawk). These companies dominate through continuous innovation in flight stability, autonomous navigation, and high-resolution imaging technologies. DJI holds a commanding presence due to its extensive product range and strong brand recognition in both prosumer and hobbyist segments. Regionally, Asia-Pacific led the market with a 39% share in 2024, driven by large-scale drone production and affordability trends in China and Japan. North America followed with 30%, supported by rising recreational use and strong technological advancements in camera and battery systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The consumer drone market was valued at USD 4.79 billion in 2024 and is projected to reach USD 16.82 billion by 2032, growing at a CAGR of 17% during the forecast period.

- Market growth is driven by increasing demand for aerial photography, videography, and recreational applications among professionals and hobbyists.

- Key trends include advancements in AI-based flight automation, obstacle avoidance, and the miniaturization of camera and sensor systems for compact drones.

- The market is competitive with major players such as DJI, Parrot Drone SAS, and Yuneec focusing on innovation, battery efficiency, and consumer-friendly drone designs.

- Asia-Pacific led with a 39% share in 2024, followed by North America with 30% and Europe with 23%, while the multi-rotor segment dominated with 58% share due to its versatility and widespread use in prosumer and hobbyist applications.

Market Segmentation Analysis:

By Product

The multi-rotor segment dominated the consumer drone market in 2024, accounting for a 72% share. Its dominance is driven by superior stability, ease of control, and versatility across both recreational and semi-professional applications. Multi-rotor drones are widely used for aerial photography, videography, and personal entertainment due to their compact design and ability to hover precisely. Manufacturers are integrating intelligent flight modes, obstacle avoidance, and 4K camera systems to enhance user experience. The growing popularity of social media content creation and vlogging continues to fuel demand for multi-rotor drones among tech-savvy consumers.

- For instance, SZ DJI Technology Co., Ltd. launched the DJI Mini 5 Pro equipped with a 50-megapixel 1-inch CMOS sensor, offering up to 36 minutes of continuous flight with the standard battery, 4K/60 fps video recording with HDR, and omnidirectional obstacle detection powered by LiDAR.

By Application

The prosumer segment held the largest share of 54% in 2024, driven by increasing adoption among photography enthusiasts, travel bloggers, and independent filmmakers. These users prefer advanced drones equipped with high-resolution cameras, GPS stabilization, and automated flight paths. Expanding use of drones for semi-professional aerial imaging and mapping also supports this segment’s growth. The rising affordability of high-performance models and integration of AI-assisted editing features are enhancing usability. Demand for professional-grade imaging capabilities in consumer-friendly designs continues to make the prosumer segment the key driver of market expansion.

- For instance, Yuneec International Co., Ltd. introduced the Typhoon H Plus drone, with an optional Intel RealSense module enabling 3D obstacle detection. The drone has a maximum flight altitude of 500 meters, but local regulations such as the FAA limit flying height to 122 meters (400 feet). It features a maximum speed of up to 72 km/h in sport mode.

Key Growth Drivers

Rising Demand for Aerial Photography and Videography

The growing popularity of aerial photography and videography among consumers is a major driver of the consumer drone market. Content creators, vloggers, and travelers are increasingly using drones for high-quality visuals and cinematic perspectives. Social media platforms and streaming content trends are fueling demand for compact drones with 4K cameras and automated flight modes. Companies are enhancing camera stability, image sensors, and battery life to meet user expectations. This rising adoption of drones for creative and recreational purposes continues to accelerate global market expansion.

- For instance, Parrot Drone SAS developed its ANAFI Ai drone featuring a 48-megapixel HDR sensor and 4G LTE transmission system, capable of transmitting live 1080p footage with unlimited range via 4G connectivity, setting new standards for aerial content creation.

Technological Advancements in Drone Design and Features

Ongoing innovation in drone technology, including AI-assisted flight, GPS stabilization, and obstacle avoidance, is reshaping the consumer experience. Smart features such as automated tracking, gesture control, and real-time data transmission are making drones more intuitive and accessible. Lightweight materials and foldable designs improve portability and endurance. These advancements attract both hobbyists and semi-professional users seeking high performance with user-friendly interfaces, driving market growth and expanding consumer adoption across multiple demographics.

- For instance, Guangdong Syma Model Aircraft Industrial Co., Ltd. launched the X500 Pro GPS Drone featuring two 1,700 mAh lithium batteries, enabling a flight time of approximately 25–28 minutes per battery (totaling up to 50 minutes) and 5G real-time video transmission up to 300 meters, enhancing accessibility for entry-level aerial photography enthusiasts.

Growing Affordability and Wider Availability

Decreasing production costs and increasing competition among drone manufacturers are making consumer drones more affordable and accessible. Entry-level models are now available with advanced imaging capabilities and stable flight control, attracting first-time users. Global e-commerce platforms are expanding distribution, improving product reach in emerging economies. Manufacturers are also introducing mid-range drones offering professional-grade features, further bridging the gap between enthusiasts and prosumers. This combination of affordability and accessibility continues to broaden the market base worldwide.

Key Trends & Opportunities

Integration of AI and Automation in Consumer Drones

The integration of artificial intelligence and automation is transforming drone functionality and performance. AI-powered features such as automated flight planning, object recognition, and tracking enhance flight safety and control precision. Consumers increasingly prefer drones with intelligent flight paths, self-return functions, and autonomous filming modes. These advancements simplify drone operation, even for inexperienced users, while improving creative output. The continued development of smart flight algorithms presents significant opportunities for manufacturers to differentiate their products in a competitive market.

- For instance, H.B. Fuller is a global adhesives manufacturer, and the Polish company SkyTech Drones (SkyTech Drones Sp. z o.o.) specializes in intelligent and autonomous drone technology featuring components like nine-axis MEMS sensors. The drone industry as a whole is advancing features like enhanced AI flight control and precision return capabilities.

Expansion of Drone Use in Recreational and Competitive Activities

Drone racing and recreational flying are emerging as strong opportunities in the consumer drone market. Organized drone racing leagues and local clubs are encouraging enthusiasts to invest in high-speed, agile drones. Manufacturers are responding with improved propulsion systems and customizable models for performance flying. Additionally, drone hobbyists are driving growth in do-it-yourself kits and modular components. This expansion of recreational use beyond photography is diversifying market demand and strengthening community engagement in drone culture worldwide.

- For instance, Horizon Hobby’s Blade brand launched the Fusion 360 Smart RC helicopter, featuring a 3400Kv brushless outrunner motor and a Spektrum Avian Smart 45 amp ESC, with real-time telemetry through Spektrum Smart technology.

Key Challenges

Regulatory Restrictions and Airspace Limitations

Strict government regulations regarding drone flight zones, altitude limits, and registration requirements remain a challenge for market growth. Varying laws across countries create operational uncertainty for consumers and manufacturers alike. Privacy and safety concerns have led to stricter enforcement in urban areas, limiting drone use for casual users. While governments are gradually introducing structured drone policies, compliance complexity continues to hinder widespread adoption. Clearer regulatory frameworks are essential to balance safety concerns and promote responsible drone operation globally.

Short Battery Life and Limited Flight Time

Battery performance remains a major limitation for consumer drones, restricting flight duration and overall usability. Most compact drones operate for only 20–30 minutes per charge, posing challenges for continuous filming and long-distance operation. Although advancements in lithium-polymer and solid-state batteries are underway, improvements remain incremental. Frequent recharging requirements affect user convenience and productivity. Manufacturers are exploring solar-assisted and swappable battery technologies to overcome these constraints, but achieving extended flight endurance remains a key engineering challenge in the consumer drone industry.

Regional Analysis

North America

North America held a 34% share of the consumer drone market in 2024, driven by strong adoption in recreational photography, videography, and drone racing activities. The United States leads the region with widespread consumer awareness and availability of advanced drone models. Supportive FAA regulations for personal drone use and growing interest in aerial content creation further stimulate market growth. Key manufacturers are investing in smart flight technologies and improved battery systems. Expanding e-commerce distribution channels and the increasing popularity of drones for entertainment and creative projects continue to strengthen regional demand.

Europe

Europe accounted for a 28% share of the consumer drone market in 2024, supported by rising interest in photography, travel videography, and hobbyist drone flying. Countries such as Germany, France, and the United Kingdom lead adoption, encouraged by innovation in lightweight and foldable designs. The region’s strict safety and privacy regulations promote responsible drone usage, while sustainable material advancements drive product innovation. The emergence of drone racing leagues and growing consumer enthusiasm for outdoor recreation are fueling steady sales. Expanding online retail networks and increasing consumer spending on tech-driven hobbies further enhance Europe’s market position.

Asia-Pacific

Asia-Pacific dominated the market with a 32% share in 2024, fueled by rapid urbanization, expanding middle-class populations, and rising disposable incomes. China, Japan, and India are the key contributors, with China serving as a global hub for drone manufacturing and exports. Increasing consumer engagement in aerial photography, tourism, and entertainment applications drives regional growth. Government initiatives supporting recreational drone usage and innovation are further strengthening adoption. The availability of affordable models with advanced features attracts both beginners and prosumers, making Asia-Pacific the fastest-growing market for consumer drones globally.

Middle East & Africa

The Middle East & Africa region captured a 4% share of the consumer drone market in 2024, supported by expanding consumer interest in digital imaging and outdoor leisure activities. Countries such as the UAE and Saudi Arabia are witnessing rising demand for drones used in travel and recreational photography. High internet penetration and social media influence are driving drone adoption among content creators. Government-backed smart city initiatives and drone-friendly policies are improving accessibility. Increasing retail presence and consumer awareness are contributing to gradual yet steady growth across the region.

South America

South America held a 2% share of the consumer drone market in 2024, led by growing consumer interest in aerial videography, tourism, and outdoor entertainment. Brazil and Argentina are emerging as key markets supported by improving economic conditions and expanding online retail. Increasing affordability of entry-level drones and growing enthusiasm among hobbyists are encouraging adoption. Regional distributors are partnering with global brands to expand product availability. Despite regulatory and logistical challenges, the region’s rising digital content creation trends and increasing awareness of drone technology continue to support gradual market development.

Market Segmentations:

By Product

- Multi-rotor

- Nano

- Others (Fixed-wing, Hybrid)

By Application

- Prosumer

- Toy/Hobbyist

- Photogrammetry

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

Competitive landscape of the consumer drone market features major players such as SZ DJI Technology Co., Ltd., Parrot Drone SAS, Yuneec International Co., Ltd., Horizon Hobby, LLC, 3D Robotics, Inc. (Kitty Hawk), Guangzhou Walkera Technology Co., Ltd. (Walker), Guangdong Syma Model Aircraft Industrial Co., Ltd. (Syma), Guangdong Cheerson Hobby Technology Co., Ltd., SkyTech Drone Sp. z o. o, and Eachine. These companies focus on innovation, automation, and AI-based flight technologies to improve stability, battery performance, and imaging capabilities. DJI dominates the global market through its advanced product portfolio and superior camera integration. Parrot and Yuneec are expanding through product diversification and affordability strategies. Manufacturers are integrating GPS tracking, 4K imaging, and autonomous flight features to attract prosumer and hobbyist users. Strategic collaborations, mergers, and R&D investments remain central to sustaining competitiveness. The market is witnessing rapid expansion as drone technology becomes more accessible, regulated, and commercially viable.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SZ DJI Technology Co., Ltd.

- Parrot Drone SAS

- Yuneec International Co., Ltd.

- Horizon Hobby, LLC

- 3D Robotics, Inc. (Kitty Hawk)

- Guangzhou Walkera Technology Co., Ltd. (Walker)

- Guangdong Syma Model Aircraft Industrial Co., Ltd. (Syma)

- Guangdong Cheerson Hobby Technology Co., Ltd.

- SkyTech Drone Sp. z o. o

- Eachine

Recent Developments

- In September 2025, SZ DJI Technology Co., Ltd. launched the DJI Mini 5 Pro, weighing 249.9 g, featuring a 1-inch 50 MP CMOS sensor and up to 36 minutes flight time.

- In June 2025, Parrot Drone SAS unveiled the ANAFI UKR with a 35× zoom RGB camera and FLIR thermal sensor, 3.2 lb max takeoff weight, and flight time between 38 to 50 minutes (depending on battery).

- In May 2025, SZ DJI Technology Co., Ltd. released the Mavic 4 Pro, powered by a 6,654 mAh battery giving 51 minutes of flight time, and a 100 MP Hasselblad camera with a 360° rotating gimbal.

- In February 2025, SZ DJI rolled out the DJI Dock 3 system, enabling Matrice 4D/4TD drones to launch from moving vehicles, with operation range of 10 kilometers (extendable to 25 km via relays).

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with growing adoption of drones for photography and videography.

- AI integration will enhance flight automation, navigation, and real-time image analytics.

- Compact and foldable drone designs will gain popularity among hobbyists and travelers.

- Regulatory standardization will support broader adoption across emerging economies.

- Battery efficiency improvements will extend flight time and overall operational performance.

- 5G connectivity will enable faster data transmission and improved control responsiveness.

- The multi-rotor segment will continue dominating due to its ease of use and versatility.

- Asia-Pacific will remain the leading region supported by strong manufacturing and consumer demand.

- Partnerships between drone makers and software firms will boost mapping and imaging capabilities.

- Long-term growth will rely on innovation in autonomous systems and affordability for mass consumers.