Market Overview:

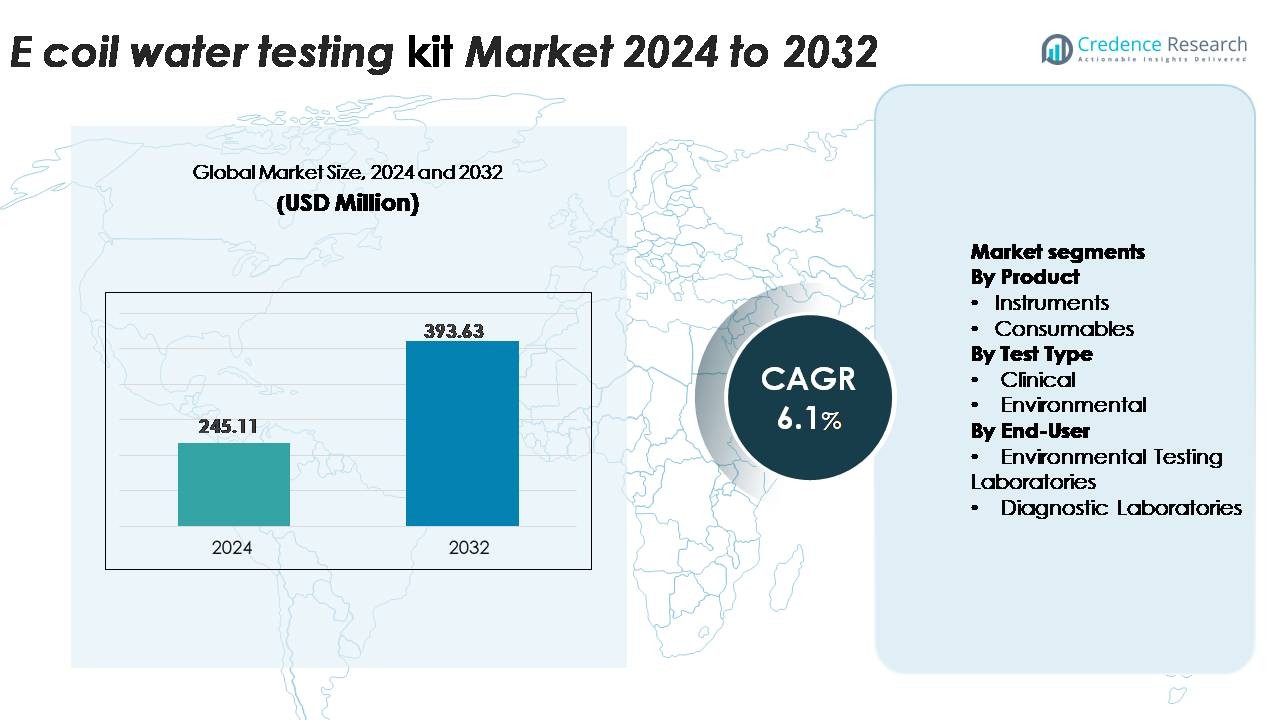

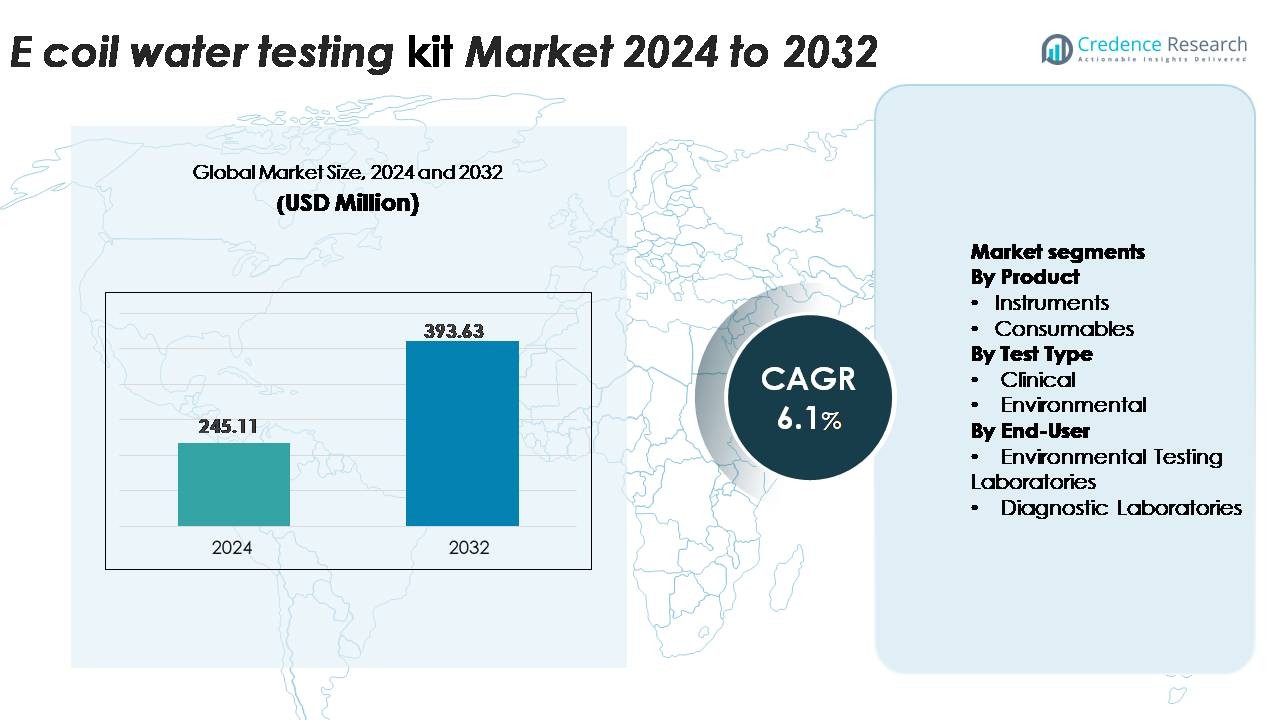

The global E.Coli Water Testing Kit Market, valued at USD 245.11 million in 2024, is projected to reach USD 393.63 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E.Coli Water Testing Kit Market Size 2024 |

USD 245.11 Million |

| E.Coli Water Testing Kit Market, CAGR |

6.1% |

| E.Coli Water Testing Kit Market Size 2032 |

USD 393.63 Million |

The E. coli water testing kit market is shaped by a strong competitive presence, led by global diagnostics and water-quality technology companies such as BIOMÉRIEUX, Pro-Lab Diagnostics, BD, F. Hoffmann-La Roche, Meridian Bioscience, Rapid Test Methods Ltd., Thermo Fisher Scientific, Bio-Rad Laboratories, and IDEXX. These players compete through rapid microbiological methods, digital data integration, and expanded consumable portfolios. North America leads the market with an approximate 35% share, driven by stringent regulatory requirements and advanced laboratory infrastructure. Asia Pacific follows with about 30%, supported by expanding water networks and rising contamination risks, while Europe accounts for over 25%, reflecting strong compliance standards and robust environmental monitoring frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The E. coli water testing kit market reached USD 245.11 million in 2024 and is projected to achieve USD 393.63 million by 2032, registering a 6.1% CAGR, supported by rising global emphasis on water safety compliance.

- Demand accelerates as utilities, industries, and environmental agencies adopt high-frequency microbial monitoring; consumables hold the dominant product share due to continuous replenishment needs, while environmental testing leads test-type adoption.

- Rapid-testing trends such as enzyme-substrate assays, portable immunoassays, and digitally connected fluorometers are reshaping workflows, enabling faster field decisions and expanding decentralized monitoring.

- Competition remains strong, with leading players expanding portfolios through rapid microbiological methods and digital reporting platforms; however, cost constraints and variable accuracy among low-cost kits continue to restrain adoption in budget-limited regions.

- Regionally, North America leads with ~35% share, followed by Asia Pacific at ~30% and Europe above 25%, while Latin America and the Middle East & Africa show steady growth driven by infrastructure upgrades and increasing contamination risks.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product (Instruments, Consumables)

Consumables represent the dominant product segment, capturing the larger market share due to their recurring use in routine E. coli detection across municipal, industrial, and field-testing environments. Reagents, media, enzyme-substrate kits, and disposable cartridges require continuous replenishment, driving steady demand. Their compatibility with multiple rapid-testing platforms and the shift toward portable, ready-to-use formats further accelerates adoption. Instruments including incubators, fluorometers, and automated detectors are essential for high-throughput testing, but their one-time purchase nature yields slower revenue cycles compared with consumables, reinforcing consumables’ leadership in overall product contribution.

· For instance, the IDEXX Colilert test uses enzyme-substrate reagents that deliver confirmed E. coli results in 24 hours using a standardized 97-well Quanti-Tray system, processing up to 100 mL of water per test, which significantly boosts daily lab throughput.

By Test Type (Clinical, Environmental)

Environmental testing holds the largest share in the E. coli water testing kit market, driven by regulatory enforcement of drinking water quality standards, expanding wastewater surveillance programs, and heightened monitoring in recreational and agricultural water systems. Utilities, food processors, and water treatment plants rely on rapid presence/absence and quantitative environmental assays to comply with microbial contamination limits. Clinical testing remains essential for healthcare-associated waterborne infection investigations, but its volume is smaller compared with the widespread, routine sampling conducted in environmental applications, reinforcing the environmental segment’s dominance.

- For instance, Thermo Fisher Scientific’s ISO-compliant membrane filtration workflow enables enumeration of E. coli colonies within 18–24 hours on chromogenic media using 0.45 µm membrane filters capable of processing sample volumes up to 100 mL, supporting high-throughput environmental screening.

By End-User (Environmental Testing Laboratories, Diagnostic Laboratories, Others)

Environmental testing laboratories account for the leading end-user share, supported by their central role in municipal water monitoring, wastewater compliance testing, and ecological surveillance. These facilities conduct large-volume, regulated testing cycles and integrate advanced quantitative methods, which increases consumption of kits and consumables. Diagnostic laboratories contribute to demand through patient-linked waterborne infection assessments but operate at comparatively lower testing frequency. The “Others” category including industrial plants, research institutions, and on-site field testing units continues to grow as decentralized water quality programs expand, yet formal environmental labs remain the primary drivers of market volume.

KEY GROWTH DRIVERS

Increasing Global Emphasis on Drinking Water Safety and Regulatory Compliance

Stringent water quality regulations and rising global concerns about microbial contamination strongly drive adoption of E. coli water testing kits. Governments in both developed and developing regions enforce compliance with safety standards for drinking water, wastewater discharge, recreational water bodies, and irrigation systems. Mandatory microbial testing under frameworks such as the Safe Drinking Water Act, WHO guidelines, and national water safety plans compels utilities and treatment plants to conduct routine E. coli surveillance at high frequency. Incidents of waterborne outbreaks linked to sanitation failures further accelerate investment in rapid testing solutions. Urbanization, expansion of piped water systems, and increasing reliance on decentralized water purification units increase the number of sampling points, boosting demand for easy-to-use kits. As regulators introduce stricter quantitative limits and require faster reporting cycles, utilities upgrade from culture-based methods to portable enzyme-substrate, immunoassay, and fluorescence-based systems, strengthening long-term market expansion.

- For instance, IDEXX’s Colilert-18 test provides confirmed E. coli results in 18 hours using a 100 mL water sample processed through a standardized 97-well Quanti-Tray/2000 system, enabling utilities to meet accelerated reporting requirements.

Rising Adoption of Rapid, Portable, and Point-of-Use Microbiological Testing Technologies

Advancements in rapid microbiological methods are transforming how water operators monitor E. coli contamination. Portable test kits, single-use enzyme-substrate vials, lateral-flow immunoassays, and handheld fluorometers enable faster, field-deployable detection, eliminating the need for fully equipped laboratories. These solutions significantly reduce turnaround time—from traditional 24–48 hours to as little as 30–60 minutes—supporting time-sensitive decision-making in industrial, environmental, and emergency-response settings. Growing demand for on-site monitoring in remote communities, agricultural zones, military camps, and disaster-stricken regions further elevates use of compact, battery-operated devices. Manufacturers innovate with integrated sample processing, multiplex detection, and digital readout systems to enhance accuracy and user convenience. The trend toward decentralized testing aligns with global efforts to build resilient water infrastructure, creating a strong market pull for rapid E. coli testing kits that balance portability, precision, and regulatory approval.

· For instance, the Bio-Rad iQ-Check real-time PCR system detects specific pathogenic E. coli targets in approximately 60 minutes after DNA extraction and processes 96 samples per run, enabling high-speed microbiological screening in various laboratory setups.

Expansion of Wastewater Surveillance, Industrial Water Management, and Environmental Monitoring

The growing need for comprehensive environmental monitoring significantly boosts demand for E. coli testing solutions across wastewater plants, food processors, beverage manufacturers, and agricultural operations. Wastewater-based epidemiology has gained prominence as municipalities monitor microbial load trends to evaluate sanitation performance and early contamination risks. Industrial operators adopt consistent microbial testing to protect equipment, maintain product quality, and meet environmental discharge permits. In agriculture and aquaculture, routine testing ensures compliance with microbial standards for irrigation water, livestock drinking water, and fishery ecosystems. Meanwhile, climate change-induced flooding, rising temperatures, and aging infrastructure increase contamination risks, prompting utilities to deploy more frequent and distributed sampling programs. This surge in environmental and industrial applications fuels long-term consumption of kits, particularly consumables, single-use reagents, and quantitative assays tailored to field and lab workflows.

Key Trends and Opportunities:

Integration of Digital Platforms, IoT Connectivity, and Automated Data Reporting

Digitization is emerging as a major opportunity in E. coli detection, transforming how results are recorded, communicated, and acted upon. Modern test kits increasingly include optical sensors, Bluetooth connectivity, and mobile app integration to automate data capture and minimize human error. IoT-enabled devices transmit real-time contamination alerts to centralized dashboards, supporting faster response in municipal networks and industrial water systems. Automated trend mapping, geotagging of sampling points, and cloud-based analytics help identify contamination hotspots and optimize sampling frequency. These technologies are particularly valuable for large utility networks, multi-site industries, and rural water programs that require coordinated monitoring. As regulators encourage digital reporting for compliance audits, manufacturers offering integrated hardware-software ecosystems stand to gain a competitive edge.

- For instance, Hach’s GuardianBlue™ Early Warning System continuously collects multi-parameter water-quality data through various sensors, including for chlorine, conductivity, pH, turbidity, temperature, pressure, and total organic carbon (TOC).

Growing Opportunity in Decentralized and Emergency Water Testing Applications

Rising climate-related events, natural disasters, and infrastructure breakdowns create demand for highly portable, field-ready E. coli testing kits. Floods, storm surges, and sewage overflows often compromise drinking water systems, requiring rapid microbiological assessment to prevent disease outbreaks. Point-of-use kits that require minimal sample preparation and operate without power or specialized training become essential in humanitarian missions, refugee settlements, and remote rural communities. NGOs, emergency response teams, and public health agencies increasingly adopt these solutions to perform widespread rapid testing. The expansion of household-level water treatment markets, including purifiers, wells, and community filtration systems, further supports adoption of small-format test kits as routine safety verification tools. This shift toward decentralized testing widens market penetration beyond traditional laboratory-centric models.

- For instance, Aquagenx’s Compartment Bag Test (CBT) enables E. coli quantification in 18–24 hours using a 100 mL sample without electricity or instruments, and the sealed incubation design supports safe field use for emergency deployments.

Innovation in Multiplex Testing and Quantitative Assay Development

Manufacturers increasingly invest in multiplex assay platforms that detect E. coli alongside other pathogens such as coliforms, Enterococcus, or specific virulence genes. This capability enhances operational efficiency for utilities and industries that require comprehensive microbiological assessment within a single workflow. Quantitative assays, including MPN-based, fluorescence-based, and molecular methods, gain traction as regulators adopt stricter numerical limits rather than simple presence/absence criteria. The trend toward quantitative microbial risk assessment (QMRA) further accelerates adoption of higher-precision tools. As these innovations reduce overall testing time and increase analytical confidence, they create robust growth opportunities for companies offering advanced, lab and field-compatible systems.

Key Challenges:

Limited Infrastructure and Skilled Workforce in Developing Regions

Despite growing demand, inadequate laboratory infrastructure and shortage of trained microbiologists in many developing regions restrict widespread adoption of advanced E. coli testing kits. Culture-based testing requires incubators, controlled environments, and precise sample handling protocols, which smaller utilities and rural water systems often lack. Even rapid test kits require proper sample collection, dilution accuracy, and interpretation training to avoid false positives or negatives. Budget constraints further limit procurement of high-quality consumables and instruments. As a result, water operators in underserved areas may rely on infrequent or inconsistent microbial monitoring, slowing market expansion. Addressing these gaps requires capacity-building programs, low-cost portable systems, and simplified workflows tailored to resource-limited environments.

Cost Constraints and High Variability in Testing Accuracy Across Technologies

Price sensitivity remains a major barrier, particularly for small utilities, agricultural operators, and low-income regions where routine microbial testing is essential but budgets are limited. Advanced rapid-testing platforms—such as fluorescence analyzers or molecular systems—offer higher accuracy but involve higher upfront and per-test costs. Variability in accuracy among low-cost kits further complicates adoption, as false results can lead to regulatory non-compliance or public health risks. Laboratories must also validate new methods against established standards, adding complexity and expense. These cost and performance challenges slow transition toward modern rapid-testing technologies, requiring manufacturers to balance affordability with precision and regulatory acceptance.

Regional Analysis

North America

North America holds the largest market share, exceeding 35%, driven by stringent drinking water standards enforced by the EPA and high testing frequency across municipal utilities, industrial plants, and environmental laboratories. The region’s advanced infrastructure supports rapid adoption of enzyme-substrate and fluorescence-based kits, while rising contamination events linked to aging pipelines sustain consistent monitoring demand. Strong presence of leading kit manufacturers and integration of digital reporting platforms further strengthen regional dominance. Expanding wastewater surveillance programs and increased funding for water infrastructure modernization continue to position North America as the most mature and commercially significant market.

Europe

Europe accounts for over 25% of the global market, supported by strict EU water directives, robust public health monitoring systems, and mandatory microbial testing in municipal and industrial sectors. Adoption of quantitative assays is higher in Western Europe due to advanced laboratory capacity, while Eastern Europe increasingly invests in rapid testing kits to modernize water quality management. The region’s strong environmental compliance culture and emphasis on sustainable resource management drive continuous testing across wastewater, recreational water, and agricultural irrigation networks. Ongoing digital transformation in laboratory workflows further supports steady growth in high-precision testing solutions.

Asia Pacific

Asia Pacific contributes close to 30% of global market share, emerging as the fastest-growing region due to large-scale urbanization, expanding water distribution networks, and rising contamination risks from industrial discharge and inadequate sanitation infrastructure. Governments in China, India, and Southeast Asia intensify microbial testing mandates, leading to widespread adoption of portable and field-deployable kits. The region’s diverse water-quality challenges ranging from agricultural runoff to flood-driven contamination create strong demand for both quantitative assays and low-cost presence/absence tests. Investments in wastewater treatment expansion and rapid infrastructure development reinforce APAC’s rising market influence.

Latin America

Latin America holds a modest but expanding share of approximately 10%, driven by increasing government initiatives to improve drinking water reliability and environmental monitoring. Countries such as Brazil, Mexico, and Chile enhance regulatory enforcement, leading utilities and industries to adopt standardized E. coli testing protocols. Frequent flooding events and aging water systems heighten microbial risk, pushing demand for rapid testing kits, particularly in peri-urban and rural areas. Emerging investments in wastewater treatment modernization and rising food and beverage industry testing requirements support steady adoption, although budget constraints continue to limit transition to advanced analytical technologies.

Middle East & Africa

The Middle East & Africa region captures around 8% of the global market, with growth shaped by rising investments in desalination, groundwater management, and urban water infrastructure. Water scarcity challenges and dependence on decentralized treatment systems increase the need for frequent microbial monitoring. Gulf countries adopt advanced laboratory-based assays, while many African nations rely more heavily on portable and cost-effective field kits due to limited testing infrastructure. International development programs and public-health initiatives actively promote E. coli surveillance in rural and humanitarian settings, gradually expanding testing capacity across the region.

Market Segmentations:

By Product

By Test Type

By End-User

- Environmental Testing Laboratories

- Diagnostic Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the E. coli water testing kit market is characterized by a mix of established diagnostics companies, specialized water-quality technology providers, and emerging innovators focused on rapid microbiological testing. Leading players compete through advancements in enzyme-substrate methods, immunoassay platforms, fluorescence-based detectors, and portable field kits designed for decentralized sampling. Companies emphasize faster turnaround times, simplified workflows, and higher sensitivity to meet increasingly stringent water safety regulations. Strategic priorities include expanding consumable portfolios, integrating digital data-reporting capabilities, and strengthening distribution networks in high-growth regions such as Asia Pacific and Latin America. Several manufacturers pursue partnerships with utilities, environmental laboratories, and public health agencies to support large-scale monitoring programs. Meanwhile, new entrants introduce compact, battery-operated devices and low-cost test formats targeting resource-limited settings. As regulatory expectations tighten and waterborne contamination risks rise globally, competition intensifies around innovation, affordability, and high-throughput testing performance.

Key Player Analysis:

- BIOMÉRIEUX (France)

- Pro-Lab Diagnostics (Canada)

- BD (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- Meridian Bioscience, Inc. (U.S.)

- Rapid Test Methods Ltd. (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- IDEXX (U.S.)

Recent Developments:

- In May 2025, Thermo Fisher Scientific (U.S.) the company announced updated water-microbiology testing solutions, including ISO-compliant media and filters, and streamlined workflows for filtration, identification, and enumeration of waterborne microorganisms. Their latest portfolio aims to help labs comply with recent regulatory updates while improving lab productivity and reliability.

- In July 2024,bioMérieux the company’s molecular assay GENE-UP® Pathogenic E. coli (PEC) was selected by USDA-FSIS as the primary screening method for Shiga-toxin producing E. coli (STEC).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Test type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of rapid, field-deployable E. coli testing kits will accelerate as utilities and industries prioritize faster contamination detection.

- Digital integration, including mobile app connectivity and automated data logging, will become standard across modern testing platforms.

- Quantitative assays with higher sensitivity will gain wider acceptance as regulators move toward stricter microbial thresholds.

- Demand for decentralized testing will rise in rural communities, emergency response operations, and resource-limited regions.

- Portable fluorescence and optical detection systems will increasingly replace traditional culture-based methods.

- Industrial sectors such as food processing, beverages, and pharmaceuticals will expand routine water microbial testing.

- Advancements in multiplex assays will enable simultaneous detection of multiple pathogens within a single workflow.

- Climate-induced contamination risks will prompt more frequent monitoring across municipal and agricultural water systems.

- Public–private partnerships will support large-scale water quality surveillance programs globally.

- Manufacturers will focus on affordability and simplified workflows to expand adoption in developing markets.

Market Segmentation Analysis:

Market Segmentation Analysis: