Market Overview

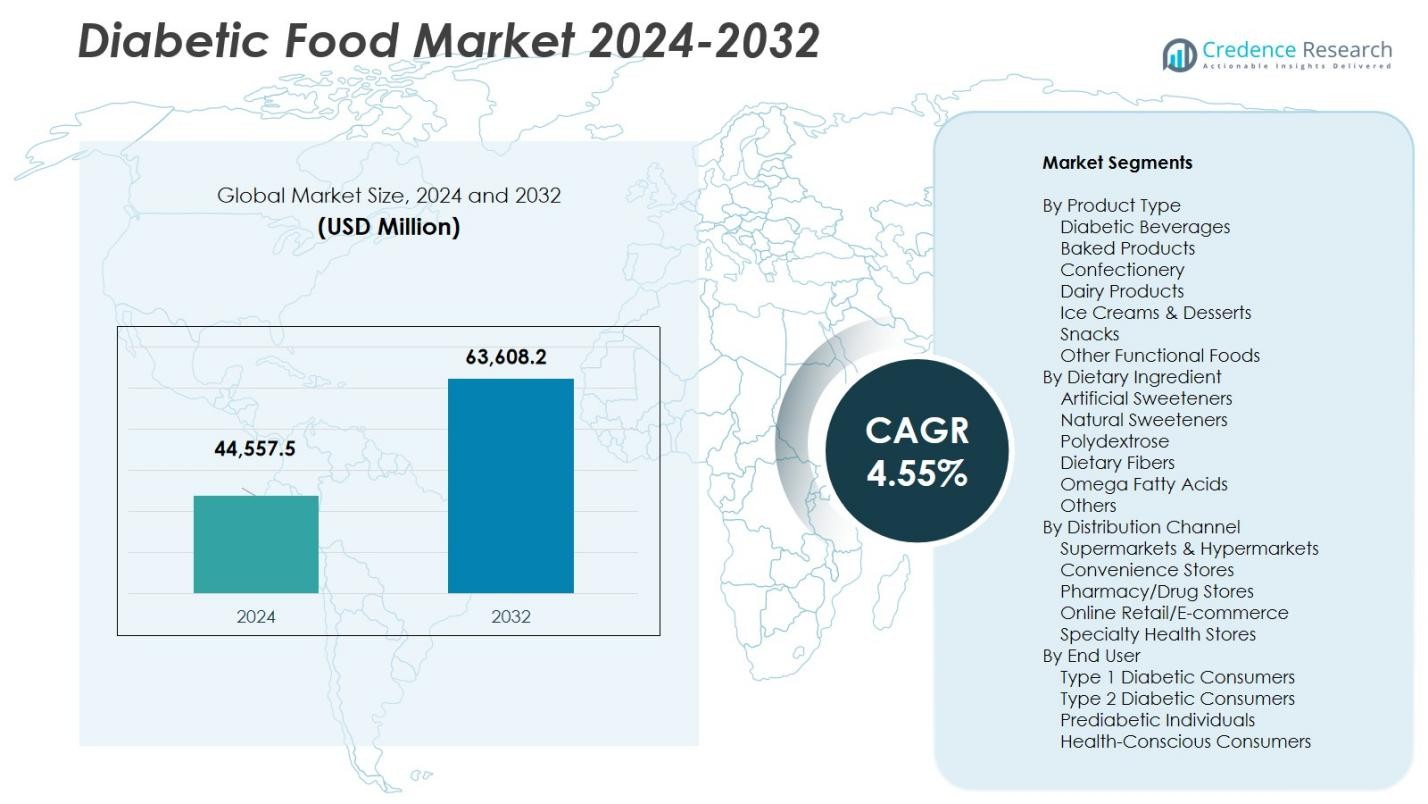

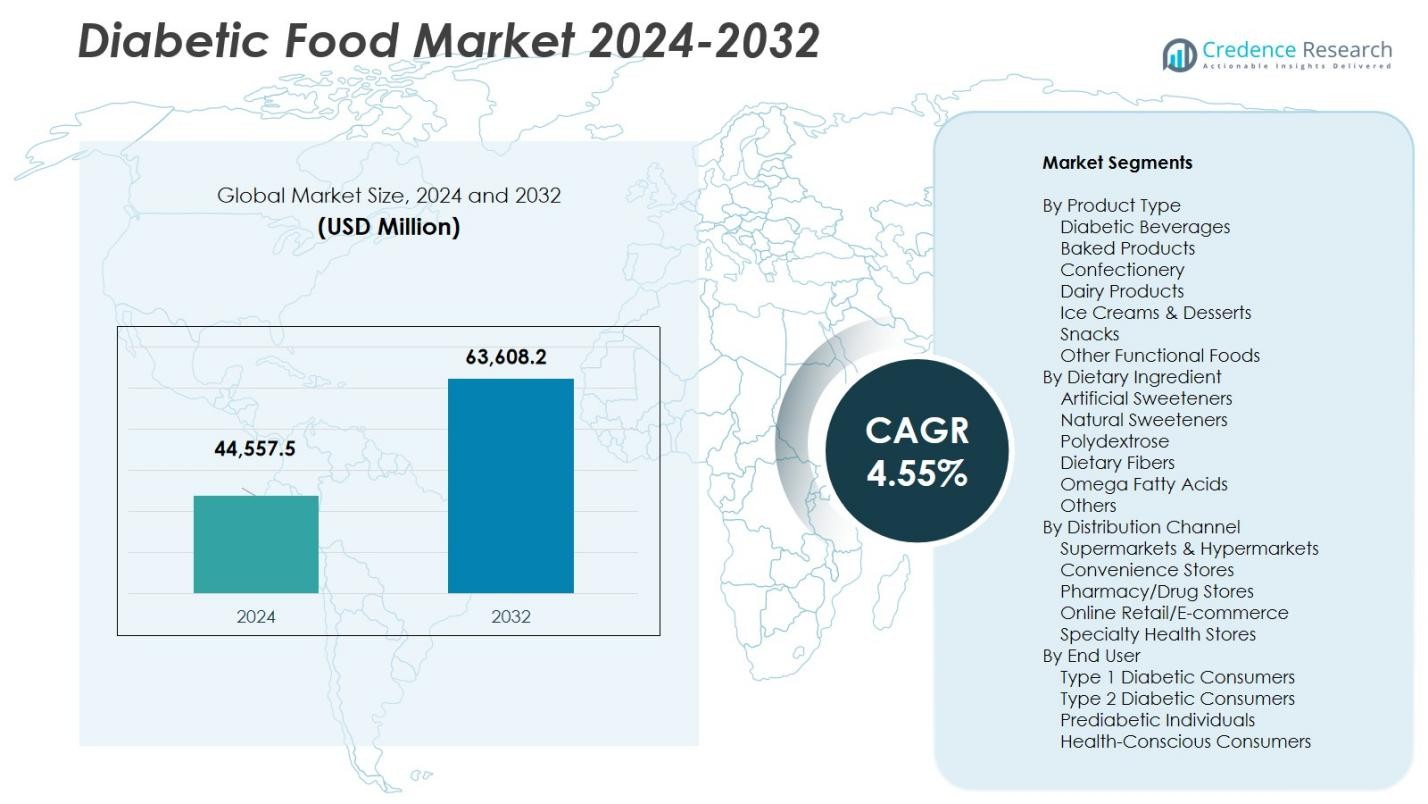

Diabetic Food Market size was valued at USD 44,557.5 million in 2024 and is anticipated to reach USD 63,608.2 million by 2032, at a CAGR of 4.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diabetic Food Market Size 2024 |

USD 44,557.5 Million |

| Diabetic Food Market, CAGR |

4.55% |

| Diabetic Food Market Size 2032 |

USD 63,608.2 Million |

Diabetic Food Market growth is driven by the strong presence of leading players such as Nestlé SA, Danone SA, Unilever Group, PepsiCo Inc., Mars Inc., Kellogg Co., The Coca-Cola Co., Strauss Group Ltd., Fifty50 Foods, and David Chapman’s Ice Cream Ltd., all of which continue expanding product portfolios focused on sugar-free, low-calorie, and functional nutrition categories. These companies leverage innovation in natural sweeteners, clean-label formulations, and fortified product lines to strengthen market performance. Regionally, North America leads the Diabetic Food Market with a 34% share, supported by advanced retail networks, high consumer awareness, and a strong focus on diabetes management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diabetic Food Market reached USD 44,557.5 million in 2024 and is projected to hit USD 63,608.2 million by 2032, growing at a CAGR of 4.55%.

- Market growth is driven by rising diabetes prevalence, increasing demand for low-calorie foods, and strong uptake of diabetic beverages, which lead the product type segment with a 30% share.

- Key trends include the shift toward natural sweeteners, growth of clean-label products, and rapid expansion of online retail, enabling broader access to diabetic-friendly formulations.

- Major players such as Nestlé SA, Danone SA, Unilever Group, PepsiCo Inc., Mars Inc., and Kellogg Co. strengthen market presence through innovation, new product launches, and diversified sugar-free offerings.

- Regionally, North America leads with a 34% share, followed by Europe at 29% and Asia-Pacific at 23%, while Latin America and the Middle East & Africa collectively account for the remaining market share.

Market Segmentation Analysis:

By Product Type

Diabetic beverages hold the dominant position in the product type segment with a 30% market share, driven by strong consumer demand for sugar-free soft drinks, flavored waters, and functional beverages that support glycemic control. Baked products account for 18%, supported by rising adoption of low-sugar bread and cookies. Confectionery contributes 14%, while dairy products represent 12% due to growing interest in low-sugar yogurt and milk variants. Ice creams and desserts hold 10%, snacks account for 9%, and other functional foods capture 7%, reflecting their expanding role in weight and glucose management.

- For instance, Nestlé has developed technology to reduce fat and sugar in milk powder by up to 60% without compromising taste.

By Dietary Ingredient

Artificial sweeteners dominate the dietary ingredient segment with a 35% market share, driven by their widespread use in beverages, bakery items, and confectionery due to high sweetness intensity and low caloric value. Natural sweeteners hold 25%, supported by clean-label preferences and rising health concerns over synthetic additives. Dietary fibers account for 15% as consumers seek improved digestion and satiety. Polydextrose holds 10%, while omega fatty acids represent 8% due to demand for heart-health benefits. The remaining 7% comes from other specialty ingredients that enhance functional value in diabetic food formulations.

- For instance, Stevia and monk fruit are increasingly adopted by the broader food and beverage industry in reduced-sugar products, including confections and bakery items, to meet consumer demand for recognizable, plant-based ingredients.

By Distribution Channel

Supermarkets and hypermarkets lead the distribution channel segment with a 38% market share, supported by broad product availability, strong merchandising, and high consumer traffic. Online retail/e-commerce follows with 22%, propelled by convenience, subscription models, and growing digital awareness of diabetic-friendly foods. Convenience stores hold 18% due to demand for on-the-go snacks and beverages. Pharmacy and drug stores contribute 15% as consumers associate diabetic foods with health-care guidance. Specialty health stores capture the remaining 7%, serving niche buyers seeking premium, functional, and medically oriented diabetic food products.

Key Growth Drivers

Rising Global Prevalence of Diabetes

The rapid rise in diabetes and prediabetes cases globally remains a central driver of the diabetic food market. Growing awareness of glycemic control and early diagnosis encourages consumers to incorporate sugar-free, low-calorie, and low-glycemic food options into their daily diets. Government health campaigns and medical recommendations further reinforce the need for healthier eating patterns. Manufacturers respond by expanding product portfolios tailored to diabetic requirements, strengthening market penetration. As the diabetic population continues to expand, demand for specialized food products grows consistently across regions and age groups.

- For instance, Danone India launched Protinex Diabetes Care, a high-fiber, low glycemic index dietary formula, partnering with Apollollo 24|7 to promote diabetes management through personalized coaching and nutrition plans in 2024

Shift Toward Healthier and Functional Eating

A substantial shift toward preventive health and functional nutrition strongly fuels market growth. Consumers increasingly seek foods that support long-term wellness, promote metabolic stability, and aid weight management. This shift drives demand for diabetic-friendly snacks, beverages, and functional foods enriched with fibers, natural sweeteners, and added nutrients. Brands invest in clean-label, low-sugar, and nutritionally dense formulations to align with rising health consciousness. Improved health literacy, digital wellness platforms, and lifestyle changes deepen consumer engagement with diabetic food solutions, widening market appeal beyond diabetic individuals.

- For instance, Beyond Food, an emerging Indian brand, offers a range of diabetic-friendly snacks that are free from added sugars, made from clean, plant-based ingredients, and tested for low glycemic impact, appealing to both diabetic and health-conscious consumers.

Product Innovation and Sweetener Advancements

Product innovation particularly in sweetener technologies significantly accelerates diabetic food adoption. Advances in natural sweeteners like stevia and monk fruit, along with enhanced artificial sweetener blends, allow manufacturers to create better-tasting sugar-free products. These innovations improve flavor, texture, and product stability, addressing common taste barriers. Enhanced R&D capabilities enable diversified product applications in bakery, confectionery, dairy, and beverages. As companies refine low-calorie sweetening systems and functional ingredient blends, diabetic food offerings become more appealing to mainstream consumers, increasing acceptance and expanding market reach.

Key Trends & Opportunities

Expansion of Clean-Label and Natural Ingredient Products

The clean-label movement creates compelling opportunities for diabetic food manufacturers. Consumers increasingly prefer products with transparent ingredient lists, natural formulations, and minimal artificial additives. This shift drives demand for foods made with plant-based sweeteners, whole grains, and dietary fibers that support metabolic health. Companies reformulate products to replace artificial sweeteners with natural alternatives and emphasize functional benefits on packaging. Clean-label positioning enhances consumer trust, encourages premium product adoption, and allows brands to differentiate in a competitive marketplace, making it a major trend shaping future product development.

- For instance, Ingredion Incorporated launched NOVATION Indulge 2940 in early 2024—a clean-label starch designed to provide texture and stability while enabling low-sugar formulations suitable for diabetic-friendly foods.

Growth of Online Retail and Personalized Nutrition

The rapid growth of e-commerce and personalized nutrition platforms presents valuable opportunities for the diabetic food market. Online retail expands consumer access to diverse diabetic-friendly options and facilitates subscription-based purchasing. Digital tools, such as glycemic monitoring apps and AI-driven diet planners, enable tailored food recommendations that improve dietary compliance. Brands leverage online channels to test new formulations, gather consumer insights, and target niche segments more effectively. As digital engagement strengthens, online distribution becomes a strategic avenue for expanding reach and enhancing brand visibility in global markets.

- For instance, the Whole Body Digital Twin® mobile app integrates continuous glucose monitoring with AI to provide personalized dietary recommendations, helping users tailor their food choices for improved glycemic control and better compliance.

Key Challenges

High Production Costs and Ingredient Prices

The diabetic food market faces notable challenges related to high production costs and expensive functional ingredients. Natural sweeteners, dietary fibers, and specialized formulations require advanced processing technologies, increasing overall manufacturing expenditure. Premium inputs and extensive R&D efforts contribute to elevated retail prices, reducing affordability for budget-sensitive consumers. Manufacturers must balance cost-efficiency with product quality to remain competitive. These financial pressures are especially restrictive in emerging markets, where price sensitivity is high. As a result, cost-related barriers continue to slow broader adoption of diabetic food products.

Consumer Taste Preferences and Limited Awareness

Consumer hesitation toward diabetic food products remains a significant challenge. Taste perceptions, lingering concerns about artificial sweeteners, and unfamiliarity with natural sugar substitutes hinder adoption. Many consumers believe sugar-free products lack flavor or offer inferior sensory experiences. In emerging markets, limited awareness of diabetic-friendly options and inadequate product visibility further restrict growth. Brands must invest in taste-enhancing technologies, sensory improvement, and consumer education to shift perceptions. Expanding distribution and conducting awareness campaigns are essential steps to overcoming these obstacles and improving long-term market acceptance.

Regional Analysis

North America

North America leads the diabetic food market with a 34% market share, driven by high diabetes prevalence, strong consumer awareness, and widespread availability of low-sugar and sugar-free products. Manufacturers in the U.S. and Canada actively invest in product innovation, especially in beverages, snacks, and functional foods formulated with natural sweeteners. Robust retail infrastructure and expanding online grocery platforms further accelerate demand. Government-supported nutrition programs and rising health-conscious lifestyles strengthen the regional market. The presence of major industry players and continuous product launches ensures strong market momentum across both mainstream and specialty segments.

Europe

Europe holds a 29% market share, supported by strong regulatory frameworks promoting reduced sugar intake and clean-label food consumption. Countries such as Germany, the U.K., and France exhibit high demand for diabetic-friendly baked goods, beverages, and dairy products. Consumers prioritize natural sweeteners and functional ingredients, encouraging manufacturers to expand product offerings with stevia-based formulations and fiber-enriched foods. The growing elderly population and increasing diabetes prevalence reinforce market growth. Retail chains and specialty health stores enhance product penetration across the region, while sustained innovation in low-glycemic recipes strengthens Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific accounts for a 23% market share, driven by rising diabetes rates and rapidly expanding health awareness across China, India, Japan, and Southeast Asian nations. Urbanization, changing diets, and higher disposable incomes contribute to increased demand for diabetic-friendly snacks, beverages, and bakery products. Local and international brands are investing in affordable formulations using natural sweeteners to cater to diverse consumer segments. Online retail growth and digital health platforms play a pivotal role in product accessibility. As lifestyle-related diseases escalate, the region’s demand for functional, low-sugar, and clean-label diabetic foods continues to grow swiftly.

Latin America

Latin America represents a 9% market share, supported by growing recognition of diabetes as a major public health concern, particularly in Brazil and Mexico. Rising health awareness and government initiatives promoting reduced sugar consumption are encouraging consumers to shift toward diabetic-friendly food alternatives. Manufacturers are expanding product lines in beverages, dairy, and confectionery using natural sweeteners that appeal to regional taste preferences. Although price sensitivity remains a challenge, increased retail penetration and the influence of international brands are improving product accessibility. Gradual improvements in economic conditions and healthcare awareness continue to strengthen market growth.

Middle East & Africa

The Middle East & Africa region accounts for a 5% market share, driven by rising diabetes prevalence and increasing demand for healthier food options. Consumers in Gulf countries show strong interest in low-sugar beverages, fortified foods, and diabetic-friendly bakery products. Economic diversification efforts and rising urban lifestyles further contribute to market expansion. However, limited product availability and higher pricing pose challenges in several African markets. International brands are entering the region through modern retail chains and e-commerce platforms, improving visibility and accessibility. Growing health education initiatives continue to support steady market development.

Market Segmentations:

By Product Type

- Diabetic Beverages

- Baked Products

- Confectionery

- Dairy Products

- Ice Creams & Desserts

- Snacks

- Other Functional Foods

By Dietary Ingredient

- Artificial Sweeteners

- Natural Sweeteners

- Polydextrose

- Dietary Fibers

- Omega Fatty Acids

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacy/Drug Stores

- Online Retail/E-commerce

- Specialty Health Stores

By End User

- Type 1 Diabetic Consumers

- Type 2 Diabetic Consumers

- Prediabetic Individuals

- Health-Conscious Consumers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive Landscape in the diabetic food market features major players such as Nestlé SA, Danone SA, Unilever Group, PepsiCo Inc., Mars Inc., Kellogg Co., The Coca-Cola Co., Strauss Group Ltd., Fifty50 Foods, and David Chapman’s Ice Cream Ltd. The market remains highly competitive as global and regional manufacturers invest in new formulations, natural sweetener technologies, and product diversification to capture growing demand from diabetic and health-conscious consumers. Companies increasingly focus on clean-label positioning, reduced sugar content, and functional nutritional benefits to strengthen brand differentiation. Strategic partnerships, acquisitions, and continuous expansion of product portfolios—especially in beverages, snacks, and dairy categories—support market leadership. Digital marketing, e-commerce penetration, and personalized nutrition platforms further enhance competitive advantage by improving consumer engagement and distribution reach. As innovation accelerates, companies leverage R&D capabilities to replicate sugar-like taste profiles while maintaining low-glycemic attributes, reinforcing their position in an evolving and fast-growing market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PepsiCo Inc.

- Strauss Group Ltd.

- Mars Inc.

- Nestlé SA

- Unilever Group

- Danone SA

- The Coca-Cola Co.

- Kellogg Co.

- David Chapman’s Ice Cream Ltd.

- Fifty50 Foods

Recent Developments

- In February 2024, Season Health partnered with Froedtert & the Medical College of Wisconsin Health Network to launch a six-month diabetes program built on a food-as-medicine approach.

- In February 2024, Shwapno, one of Bangladesh’s largest retail chains, introduced a “Diabetic Corner” to better serve diabetic customers and promote awareness. Initially launched in its Gulshan and Banani outlets, the initiative is planned for nationwide expansion.

- In April 2023, Nestlé’s Lean Cuisine introduced a new line of frozen meals tailored for diabetic consumers. Each meal follows American Diabetes Association nutrition guidelines, offering no added sugar and 400 calories or fewer per entrée.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Dietary Ingredient, Distribution Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as global diabetes cases rise and awareness of dietary management strengthens.

- Manufacturers will increase adoption of natural sweeteners to meet clean-label and health-conscious consumer expectations.

- Functional and fortified diabetic foods will gain traction as consumers seek added metabolic and nutritional benefits.

- Online retail and personalized nutrition platforms will drive stronger product visibility and targeted engagement.

- Product innovation will accelerate, focusing on improved taste profiles and sugar-like sensory experiences.

- Plant-based and high-fiber diabetic foods will see growing demand as wellness trends intensify.

- Emerging markets will offer new growth opportunities as awareness and retail infrastructure improve.

- Companies will invest more in sustainable ingredient sourcing and transparent labeling practices.

- Partnerships between food manufacturers and health-tech firms will shape new product development strategies.

- The competitive landscape will intensify as global brands and niche players expand portfolios and market presence.