Market Overview

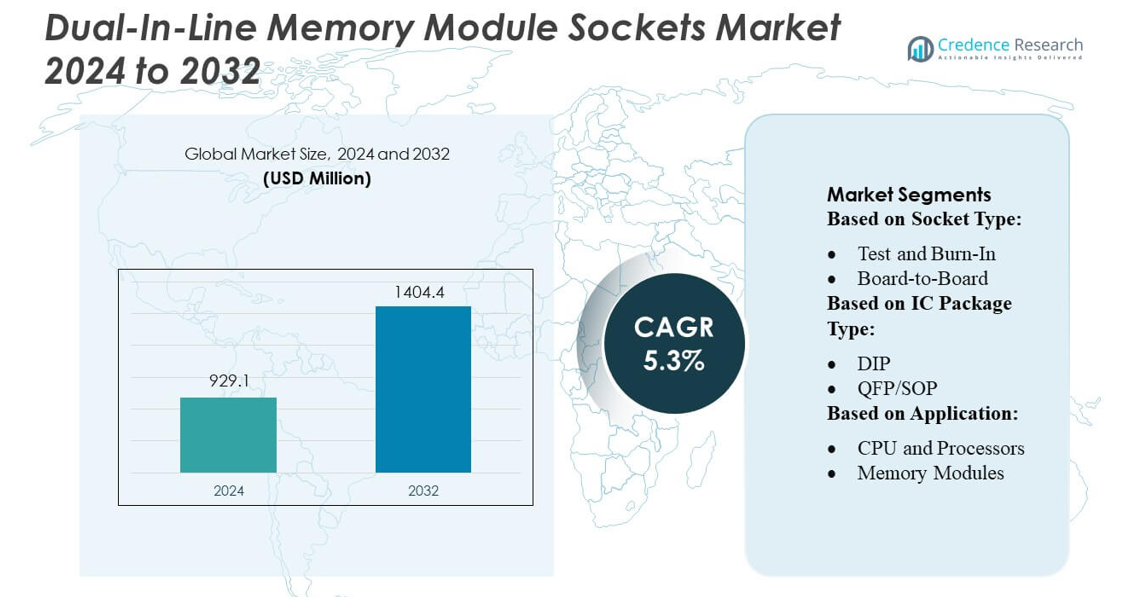

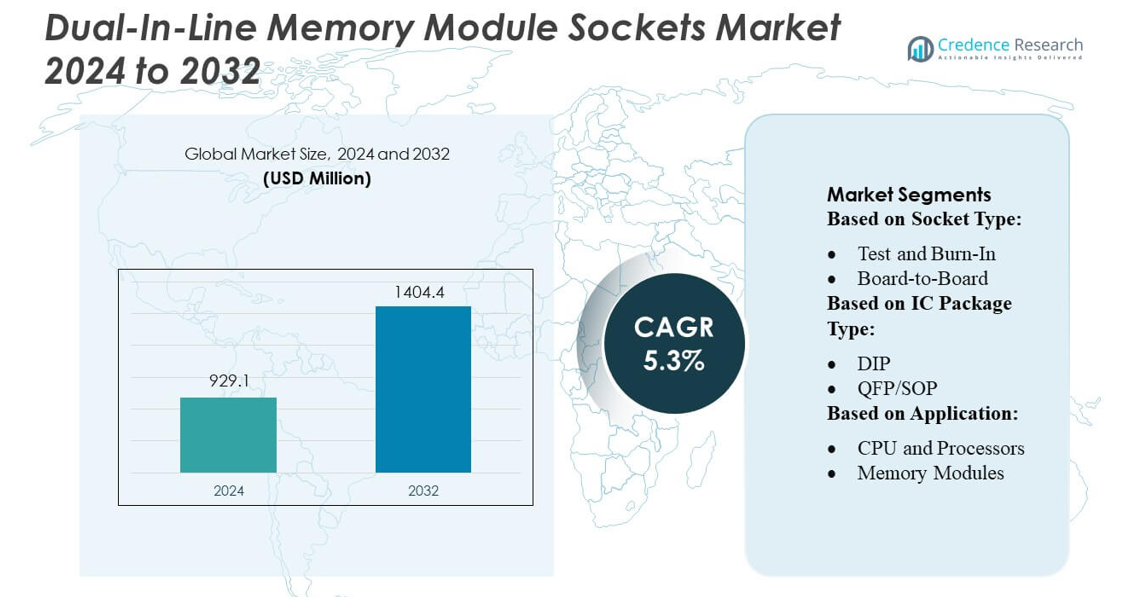

Dual-In-Line Memory Module Sockets Market size was valued USD 929.1 million in 2024 and is anticipated to reach USD 1404.4 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual-In-Line Memory Module Sockets Market Size 2024 |

USD 929.1 million |

| Dual-In-Line Memory Module Sockets Market, CAGR |

5.3% |

| Dual-In-Line Memory Module Sockets Market Size 2032 |

USD 1404.4 million |

The Dual-In-Line Memory Module Sockets Market is dominated by key players such as Intel Corporation, Micron Technology Inc., Rambus Inc., Smart Modular Technologies, Inc., SK Hynix, Inc., Viking Technology Inc., Netlist, Inc., Aries Electronics, AgigA Tech, Inc., and HPE. These companies maintain a strong competitive position through continuous innovation, high-quality socket designs, and strategic partnerships with OEMs and memory module manufacturers. They focus on improving signal integrity, thermal management, and compatibility with next-generation computing systems, addressing both server and high-performance workstation requirements. Regionally, Asia Pacific leads the market with a significant share of approximately 37%, driven by robust electronics manufacturing, increasing demand for consumer and enterprise computing devices, and expansion of data center infrastructure. The combination of technological advancements and growing regional demand ensures that these leading players remain at the forefront of the global DIMM sockets market.

Market Insights

- The Dual-In-Line Memory Module Sockets Market size was valued at USD 929.1 million in 2024 and is expected to reach USD 1404.4 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Market growth is driven by rising demand for high-performance computing systems, expansion of data centers, and increasing adoption of memory-intensive servers and workstations across enterprise and consumer segments.

- Key players focus on continuous innovation, advanced socket designs, thermal management, signal integrity improvements, and partnerships with OEMs and memory module manufacturers to strengthen their competitive position.

- Market restraints include supply chain challenges, high production costs, and compatibility issues with legacy systems, which may limit rapid adoption in some regions.

- Regionally, Asia Pacific leads with approximately 37% market share, followed by North America and Europe, driven by strong electronics manufacturing, growing IT infrastructure, and increasing demand for enterprise and consumer computing devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Socket Type:

The DIMM sockets market by socket type is led by the Board-to-Board/Through-Hole segment, holding the largest market share due to its widespread adoption in high-performance computing and server systems. These sockets provide reliable mechanical stability and high signal integrity, which are critical for large-scale memory modules. Growth is driven by increasing demand for robust memory interconnect solutions in data centers and enterprise servers, where durability and thermal resistance are essential. Test and Burn-In sockets also see demand for quality assurance processes, but their market presence is secondary to Board-to-Board/Through-Hole solutions.

- For instance, Intel’s server platforms based on the Intel Server Board S2600WF use up to 24 DDR4 DIMM slots (12 per CPU) to support RDIMM/LRDIMM memory configurations.

By IC Package Type:

Within IC package types, the DIP (Dual In-line Package) segment dominates the DIMM sockets market, accounting for the largest share. Its popularity stems from simplicity, cost-effectiveness, and compatibility with legacy systems, particularly in industrial and embedded applications. Drivers include the ongoing need for reliable memory connections in consumer electronics, industrial control systems, and servers where DIP-based memory modules remain standard. QFP/SOP and other surface-mount package types are growing in specialized applications due to miniaturization trends, but they remain niche compared to the extensive adoption of DIP packages in mainstream computing.

- For instance, Micron’s 168-pin SDRAM DIMM module MT8LSDT3264AY supports 256 MB capacities, with memory clock speeds of 133 MHz and CAS latencies of 2 or 3, while operating at +3.3 V.

By Application:

In terms of applications, CPU and processor memory modules represent the dominant sub-segment, capturing the majority market share. The growth is fueled by rising deployment of high-performance computing systems, servers, and gaming platforms that require large-capacity, high-speed memory modules. Memory modules for general-purpose electronics and embedded systems follow, driven by expanding IoT, AI, and edge computing requirements. The increasing need for memory scalability, reduced latency, and energy efficiency in processor-based systems continues to propel adoption, making CPU-focused DIMM sockets the primary driver of market expansion.

Key Growth Drivers

Rising Demand for High-Performance Computing Systems

The DIMM sockets market is significantly driven by the increasing deployment of high-performance computing (HPC) systems, servers, and data centers. These systems demand reliable, high-speed memory interconnections to support large-capacity memory modules, low latency, and efficient heat dissipation. As enterprises and cloud service providers expand infrastructure for AI, big data, and analytics applications, the need for robust memory sockets grows, directly boosting adoption. Enhanced durability, signal integrity, and compatibility with advanced processors make DIMM sockets a critical component in modern computing architectures.

- For instance, Rambus’s Gen4 DDR5 Registering Clock Driver (RCD) reached a data rate of 7200 MT/s, delivering roughly a 50% memory bandwidth boost over earlier DDR5 solutions.

Expansion of Consumer Electronics and Gaming Applications

Consumer electronics and gaming platforms are another major growth driver for DIMM sockets. The rising adoption of high-speed PCs, gaming laptops, and graphics-intensive devices necessitates reliable memory module connections. Gaming applications, in particular, require low-latency and high-density memory to ensure performance stability. Growth in home computing and entertainment sectors, coupled with frequent hardware upgrades, sustains demand for DIMM sockets. Manufacturers are focusing on improving mechanical endurance and thermal resistance to meet these performance and reliability expectations.

- For instance, SMART launched a family of DDR5 modules supporting data rates from 4800 MT/s up to 6400 MT/s, doubling bandwidth compared to DDR4 standards.

Industrial and Embedded System Applications

The industrial and embedded systems segment contributes to market growth as industries adopt reliable memory solutions for automation, robotics, and IoT deployments. DIMM sockets support ruggedized and long-life memory modules used in industrial control, medical equipment, and transportation systems. Demand is driven by the need for durable, heat-resistant, and high-reliability memory interconnections that function under harsh environmental conditions. Expansion in smart manufacturing and industrial IoT initiatives further reinforces the need for specialized DIMM socket solutions in critical operational environments.

Key Trends & Opportunities

Miniaturization and High-Density Memory Sockets

A prominent trend in the DIMM sockets market is the development of miniaturized, high-density socket designs to accommodate compact, high-capacity memory modules. This trend aligns with the growing demand for space-efficient server boards, ultrathin laptops, and edge computing devices. Manufacturers are innovating to improve signal integrity and thermal management while reducing footprint. Opportunities exist in designing advanced sockets for next-generation DDR memory standards and multi-channel memory architectures, addressing both consumer electronics and enterprise computing needs.

- For instance, SK Hynix shipped the industry’s first 24‑Gb DDR5 DRAM chips in 2021 — raising per‑chip density by 50% over 16‑Gb predecessors, and enabling 48 GB and 96 GB module configurations for servers and data centers.

Integration with Next-Generation Memory Technologies

Integration with emerging memory technologies, such as DDR5 and LPDDR variants, presents significant market opportunities. DIMM sockets are evolving to support higher data transfer rates, lower power consumption, and improved heat dissipation. Early adoption in server and HPC markets creates avenues for differentiation through high-performance socket solutions. The shift toward memory-intensive AI, machine learning, and graphics applications further drives the need for advanced socket designs, enabling manufacturers to capitalize on the growing requirement for high-speed, scalable memory infrastructure.

- For instance, Viking Technology has advanced next‑generation memory integration by delivering DDR5 modules that support densities up to 256 GB per module — enabling substantial memory capacity in both enterprise servers and compact systems.

Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Eastern Europe provide growth opportunities due to expanding IT infrastructure, cloud computing adoption, and consumer electronics penetration. Increasing investments in smart cities, digital transformation, and gaming industries boost demand for high-performance memory solutions. DIMM socket manufacturers can leverage these regions for business expansion through localized production, tailored solutions, and strategic partnerships with system integrators. The growing awareness of energy efficiency and reliability in memory systems further strengthens market prospects.

Key Challenges

Technological Complexity and Compatibility Issues

The DIMM sockets market faces challenges related to technological complexity and compatibility with diverse memory standards. Rapid evolution of DDR memory generations and emerging memory technologies demands continuous innovation in socket design. Ensuring backward compatibility while maintaining high signal integrity, thermal performance, and mechanical reliability increases R&D costs. Manufacturers must balance innovation with standardization, and delayed adaptation to new memory specifications may limit adoption. Compatibility issues with legacy systems and mixed memory architectures pose additional hurdles for seamless integration across computing platforms.

Intense Competition and Price Pressure

Intense competition among socket manufacturers exerts significant price pressure on the DIMM sockets market. Companies face challenges in differentiating products while maintaining cost-effectiveness and meeting stringent quality standards. Competition from low-cost manufacturers in emerging regions, combined with global supply chain volatility, can impact margins and limit profitability. Market participants must invest in technological upgrades, efficient production processes, and strategic partnerships to retain market share while navigating aggressive pricing dynamics. This competitive environment underscores the need for innovation-focused, value-added socket solutions.

Regional Analysis

North America

North America holds about 30% of the global DIMM sockets market. The region benefits from advanced IT infrastructure, widespread use of servers, and strong cloud computing adoption. Enterprises and cloud providers drive steady demand for DIMM sockets in desktops, workstations, and servers. Major OEMs and memory module suppliers ensure consistent supply. Growth is steady due to ongoing upgrades in high-performance computing and data centers. The region remains a mature market with stable demand, supported by innovation in memory technologies and integration into enterprise and industrial applications.

Asia Pacific

Asia Pacific leads with around 35–38% market share and is the fastest-growing region. Strong electronics manufacturing in China, Japan, India, and South Korea fuels demand for DIMM sockets. Growth is driven by consumer electronics, PCs, servers, and semiconductor expansion. Rapid adoption of advanced memory technologies and increasing enterprise and data center requirements support market expansion. The region dominates both production and consumption, making it the global hub for memory module innovation and deployment. Rising digitalization and increasing computing needs continue to strengthen its market position.

Europe

Europe accounts for about 25% of the market. Demand comes from industrial automation, enterprise computing, and memory-intensive applications in automotive, defense, and consumer electronics. While growth is moderate compared to Asia Pacific, established markets like Germany, the UK, and France provide steady demand. The region focuses on quality and reliability, with strong adoption of advanced memory modules in servers and desktops. Investments in high-performance computing and industrial applications maintain consistent consumption of DIMM sockets, ensuring Europe remains a significant contributor to the global market.

Latin America

Latin America holds roughly 5% of the market. Growth is gradual as enterprises and data centers modernize IT infrastructure. Demand mainly comes from server installations and mid-range computing systems. Market expansion is cautious but steady, driven by rising digital adoption and enterprise upgrades. Limited local manufacturing keeps the region dependent on imports, but growing IT investments signal increasing opportunities. Latin America’s market is smaller than Asia or North America but presents long-term growth potential as more businesses adopt advanced computing solutions.

Middle East & Africa

The Middle East & Africa accounts for about 5% of the market. Adoption is modest, but investments in digital infrastructure, data centers, and government modernization projects support growth. Demand comes from public sector, enterprise, and telecom hardware upgrades. Supply-chain constraints and economic factors slow rapid expansion, but gradual market development continues. Increasing use of computing hardware and memory modules for enterprise and industrial applications presents opportunities. Growth is steady and will rise as digitalization and IT modernization expand across the region, making it a small but promising market.

Market Segmentations:

By Socket Type:

- Test and Burn-In

- Board-to-Board

By IC Package Type:

By Application:

- CPU and Processors

- Memory Modules

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Dual-In-Line Memory Module Sockets Market include Intel Corporation, Micron Technology Inc., Rambus Inc., Smart Modular Technologies, Inc., SK Hynix, Inc., Viking Technology Inc., Netlist, Inc., Aries Electronics, AgigA Tech, Inc., and HPE. The Dual-In-Line Memory Module Sockets Market is highly competitive and driven by rapid technological innovation, increasing demand for high-performance computing, and the need for reliable memory solutions. Companies focus on product differentiation through improved signal integrity, thermal management, and compatibility with advanced server and workstation systems. Strategic initiatives such as mergers, acquisitions, collaborations, and expansion into emerging regions are commonly employed to enhance market presence. Continuous investment in research and development allows manufacturers to introduce next-generation socket designs that support higher memory speeds and capacities. Additionally, adherence to industry standards and quality certifications is critical to maintain customer trust and ensure interoperability across computing platforms. The market dynamics are shaped by evolving end-user requirements, technological advancements, and the push for energy-efficient, high-performance memory solutions, creating opportunities for innovation and growth across all segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Indichip Semiconductors announced a joint venture (JV) with Japan’s Yitoa Micro Technology, signed an MoU with the Andhra Pradesh government to set up India’s first private semiconductor manufacturing facility.

- In October 2024, Micron launched its Crucial DDR5 CUDIMM and CSODIMM memory modules, a new category of clock driver memory designed to boost performance in AI PCs and high-end workstations.

- In October 2024, Würth Elektronik launched the WR-COM USB 3.1 PD Type C – Power Only SMT socket to comply with the new European Interface Standardization for USB-C. This SMT component is designed exclusively for power delivery, allowing devices to communicate with the power supply to automatically determine and receive the maximum charging power, supporting up to (240)W in Extended Power Range (EPR) mode.

- In August 2024, SMART Modular Technologies released DDR5 Registered DIMMs (RDIMMs) with a conformal coating for liquid immersion servers, combining high performance with enhanced protection against corrosion and environmental threats

Report Coverage

The research report offers an in-depth analysis based on Socket Type, IC Package Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of high-performance computing systems will drive increased demand for DIMM sockets.

- Growth in cloud data centers will create opportunities for memory module expansion.

- Advances in memory technology will lead to the development of more efficient and reliable sockets.

- Expansion of server and enterprise IT infrastructure will support market growth.

- Emerging markets will witness rising adoption of advanced computing and memory solutions.

- Demand for energy-efficient and high-speed memory modules will shape socket design innovations.

- Integration of AI and machine learning applications will increase memory requirements.

- Standardization and compatibility with next-generation platforms will become critical.

- Continuous R&D will drive new socket designs for enhanced performance.

- Strategic collaborations and partnerships will strengthen global market presence.