Market Overview

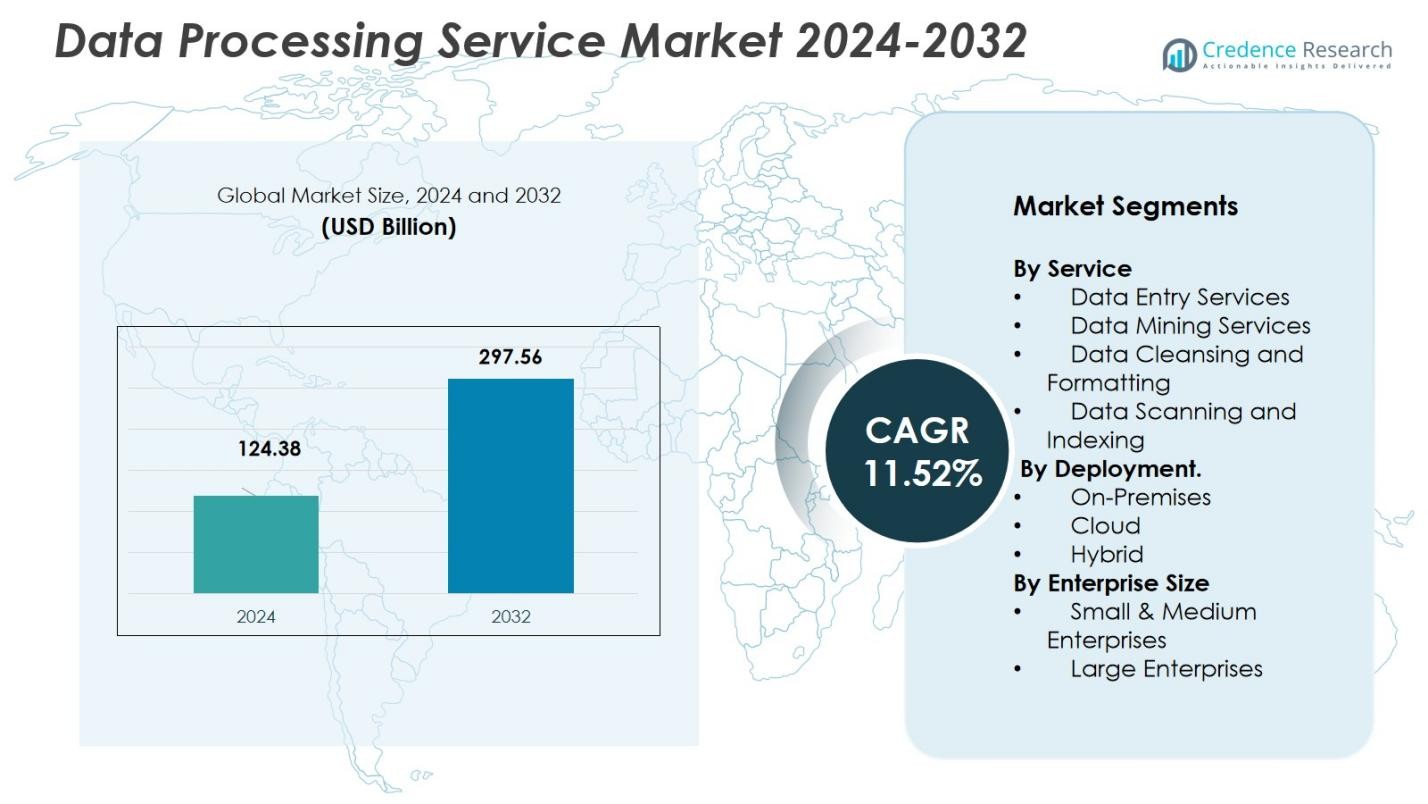

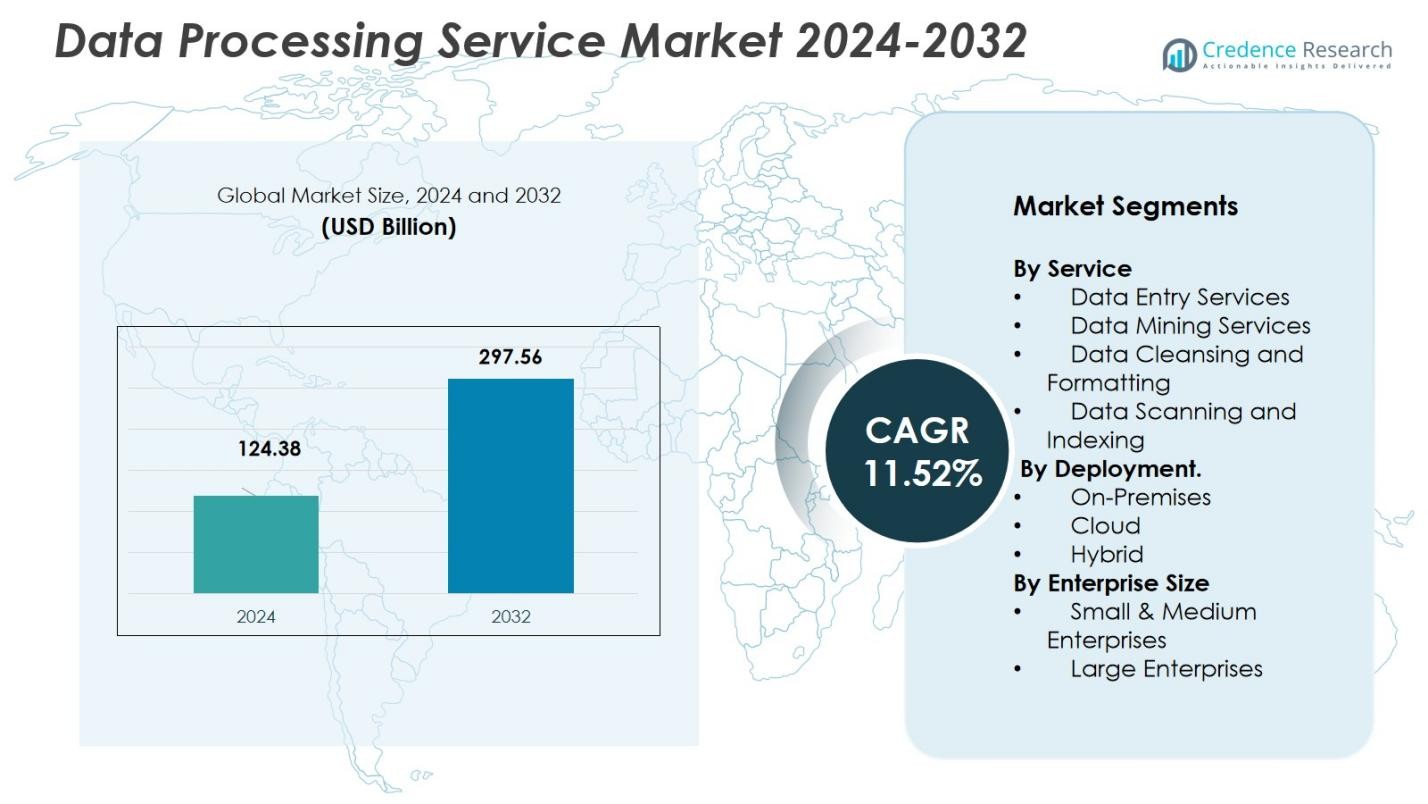

The Data Processing Service Market size was valued at USD 124.38 Billion in 2024 and is anticipated to reach USD 297.56 Billion by 2032, at a CAGR of 11.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Processing Service Market Size 2024 |

USD 124.38 Billion |

| Data Processing Service Market, CAGR |

11.52% |

| Data Processing Service Market Size 2032 |

USD 297.56 Billion |

The Data Processing Service Market is dominated by key players such as Microsoft, Teradata, SAP, Informatica, and Palantir Technologies. Microsoft and SAP lead the market, leveraging their extensive cloud infrastructures and enterprise solutions to cater to large organizations requiring advanced data processing capabilities. Teradata and Informatica also hold significant shares, with strong offerings in data analytics, mining, and cleansing services. The market is geographically dominated by North America, which holds a 40% share in 2024, driven by robust IT infrastructure, cloud adoption, and significant demand across sectors like healthcare, finance, and retail. Europe follows with a 30% share, benefiting from stringent data regulations and an increasing shift towards cloud and hybrid deployment models. Asia-Pacific, with a 20% share, is the fastest-growing region, fueled by the rise of digitalization and cloud adoption, particularly in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Processing Service Market was valued at USD 124.38 Billion in 2024 and is expected to grow at a CAGR of 11.52%, reaching USD 297.56 Billion by 2032.

- The increasing volume and complexity of data generated globally, along with businesses’ need to efficiently process and analyze data, drive market growth, particularly in cloud-based and hybrid deployment models.

- The integration of AI and machine learning into data processing services accelerates growth by providing automation, advanced analytics, and deeper insights for businesses across sectors.

- Large enterprises dominate the market, holding a significant share due to the scale of their data operations, while small and medium enterprises are gradually increasing adoption, driven by more accessible cloud-based solutions.

- North America holds the largest market share, around 40% in 2024, followed by Europe at 30%, with Asia-Pacific showing the highest growth potential due to increasing digitalization and cloud adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service:

The Data Processing Service Market is segmented by service type into Data Entry Services, Data Mining Services, Data Cleansing and Formatting, and Data Scanning and Indexing. Among these, Data Entry Services holds the dominant share, contributing 35.2% of the market in 2024. This dominance is driven by the increasing need for businesses to process and manage large volumes of data efficiently. Data Mining Services also experience significant growth, fueled by the demand for insights that drive business intelligence and strategic decision-making. The rising adoption of AI technologies to automate data processing further drives the market.

- For instance, Amazon employs data mining in its recommendation engine, analyzing browsing patterns and purchase history via collaborative filtering to suggest relevant products in real time.

By Deployment:

The Data Processing Service Market is divided into On-Premises, Cloud, and Hybrid deployment models. Cloud deployment leads the market with a share of 52.3% in 2024, driven by its flexibility, cost-effectiveness, and scalability. Organizations are increasingly adopting cloud-based services to enhance their data processing capabilities while reducing infrastructure costs. Hybrid models also show strong growth, as businesses seek a balance between the control of on-premises systems and the scalability of the cloud. The trend toward digital transformation and cloud migration supports the expansion of cloud deployment.

- For instance, in hybrid deployments, companies like Turbonomic use AI-driven platforms to optimize performance and compliance across hybrid clouds, helping enterprises such as Lockheed Martin and JP Morgan manage workloads between public and private clouds for better efficiency and flexibility.

By Enterprise Size:

The Data Processing Service Market is categorized into Small & Medium Enterprises (SMEs) and Large Enterprises. Large Enterprises dominate the market with a share of 63.7% in 2024. This is primarily driven by the scale and complexity of data operations in large organizations, which require advanced data processing services to manage and analyze vast amounts of data. SMEs are increasingly adopting data processing services as they seek to enhance their operations, but their share remains lower due to budgetary constraints and resource limitations compared to large enterprises. The need for enhanced operational efficiency drives large enterprises’ investment in data processing solutions.

Key Growth Drivers

Increasing Data Volumes and Complexity

The rapid growth in data generation across industries is a major driver of the Data Processing Service Market. As businesses collect vast amounts of data from various sources such as IoT devices, social media, and customer interactions, the need to efficiently process and analyze this data has surged. Organizations are seeking data processing solutions that can handle large-scale, complex datasets in real-time, allowing them to derive actionable insights and make informed decisions. This exponential rise in data volumes fuels the demand for advanced processing services.

- For instance, Netflix uses Apache Kafka to manage over 1.3 trillion events daily, ensuring real-time data streaming and processing to optimize user experience.

Adoption of Cloud Computing and AI Integration

Cloud computing has become a key enabler of the Data Processing Service Market, contributing significantly to its growth. The increasing shift to cloud-based platforms for data storage and processing allows businesses to scale operations seamlessly and access powerful computing resources. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) with data processing services is driving efficiency in data analysis. AI-powered algorithms can automate data management tasks, enhance data accuracy, and provide deeper insights, further accelerating the adoption of these services.

- For instance, Google Cloud’s AI tools have been used to streamline large-scale data workflows by automating predictive analytics, significantly reducing manual intervention while improving insight generation.

Digital Transformation and Automation Across Industries

As industries undergo digital transformation, the demand for data processing services has surged. Organizations are automating various functions, from customer service to supply chain management, to enhance operational efficiency. The growing focus on automation, data-driven decision-making, and improving customer experiences has prompted businesses to invest in data processing solutions that offer speed, scalability, and accuracy. The drive to improve operational workflows and the competitive need for real-time data insights are propelling the adoption of data processing services across diverse sectors.

Key Trends & Opportunities

Shift to Hybrid Deployment Models

The trend toward hybrid deployment models is gaining momentum in the Data Processing Service Market. As businesses look for more flexibility in their data management strategies, hybrid models, which combine on-premises and cloud infrastructures, are becoming increasingly popular. This approach allows organizations to take advantage of the scalability and cost-effectiveness of the cloud while maintaining control over sensitive data through on-premises solutions. The rise of hybrid deployments presents a significant opportunity for service providers to offer tailored solutions that meet the unique needs of various enterprises.

- For instance, IBM’s Cloud Paks offer a hybrid platform that integrates containerized software for seamless workload portability between clouds and on-premises.

Integration of Real-Time Data Processing

The need for real-time data processing is becoming more critical as industries strive for faster decision-making. With advancements in edge computing and streaming analytics, businesses are increasingly processing data in real time to drive timely insights. This trend is particularly relevant in sectors like healthcare, finance, and manufacturing, where the ability to act quickly based on up-to-the-minute data can significantly impact outcomes. As organizations invest in real-time data processing capabilities, there is a growing opportunity for service providers to develop and deploy solutions that support this demand.

- For instance, Siemens improved manufacturing productivity by 20% and reduced downtime by 15% by using AI-driven real-time data enrichment to monitor and adjust production lines.

Key Challenges

Data Security and Privacy Concerns

One of the significant challenges facing the Data Processing Service Market is the issue of data security and privacy. As businesses handle sensitive customer information, financial data, and proprietary business insights, there is a growing need to ensure that data is processed and stored securely. With stringent data protection regulations like GDPR and CCPA, companies must navigate complex compliance requirements. Any data breach or non-compliance could result in significant financial penalties and reputational damage, making data security a top priority for organizations and service providers alike.

High Operational Costs and Resource Constraints for SMEs

While large enterprises dominate the adoption of data processing services, small and medium-sized enterprises (SMEs) face challenges in terms of cost and resource constraints. Implementing sophisticated data processing solutions requires substantial financial investment, specialized infrastructure, and skilled personnel, which can be difficult for SMEs to afford. Additionally, many SMEs lack the internal resources to manage complex data processing operations, limiting their ability to leverage these services fully. This challenge presents a barrier to market growth, as SMEs remain hesitant to adopt advanced data processing solutions.

Regional Analysis

North America

North America commands a leading position in the Data Processing Service Market, accounting for 40% of total global revenue in 2024. The region’s dominance stems from broad adoption of cloud-based data processing, mature IT infrastructure, and deep penetration of AI and big data analytics across sectors such as finance, healthcare, and retail. Heavy investments in digital transformation and a high concentration of major service providers further strengthen North America’s market lead.

Europe

In Europe, the Data Processing Service Market holds 30% share of global revenue in 2024. The region benefits from increasing demand for secure and compliant data processing solutions driven by stringent data-privacy regulations and strong enterprise demand for digital transformation. Enterprises are accelerating migration to cloud and hybrid models while investing in data cleansing, mining, and analytics services. This pushes Europe’s position as a stable, mature market with sustained demand for reliable processing services.

Asia-Pacific

Asia-Pacific registers a 20% share of the global Data Processing Service Market in 2024. The region leads in growth momentum thanks to rising internet penetration, rapid digitalization across industries, and expanding e-commerce and IoT adoption in countries like China and India. Demand for scalable, cost-effective cloud-based data processing solutions grows rapidly as enterprises embrace big data, AI, and cloud infrastructure to support expansion. Asia-Pacific’s dynamic economic growth and favorable regulatory environment fuel strong demand for data processing services.

Latin America

Latin America contributes 6.4% of the global data processing and hosting services market revenue as of 2023-2024. The region is gradually embracing digital transformation, with businesses increasingly outsourcing data processing to reduce in-house infrastructure costs and improve operational agility. Growth in sectors such as banking, retail, and public services is supporting demand for data entry, cleansing, and hosting services. Although adoption remains lower than in more mature regions, Latin America offers growing potential as cloud and data-driven models gain traction among enterprises.

Middle East & Africa

The Middle East & Africa region accounts for 5% of global market revenue in 2024. Market growth in this region is underscored by increasing investments in IT infrastructure, rising cloud adoption, and expanding digital services in both private and public sectors. Governments and enterprises in sectors such as telecom, finance, and energy are gradually embracing data processing services to support digital transformation and operational efficiency. Although absolute share remains small compared to leading regions, growth prospects remain promising as infrastructure and digital maturity improve.

Market Segmentations:

By Service

- Data Entry Services

- Data Mining Services

- Data Cleansing and Formatting

- Data Scanning and Indexing

By Deployment.

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Data Processing Service Market is highly competitive, featuring prominent players such as Microsoft, Teradata, SAP, Informatica, and Palantir Technologies. These companies lead the market by offering scalable and flexible cloud-based services, advanced data analytics, and AI-driven solutions. Microsoft and Hewlett Packard Enterprise dominate with their robust infrastructure and hybrid models, catering to large enterprises seeking reliable and secure data processing solutions. Meanwhile, Teradata and SAP leverage long-standing relationships with enterprises, providing comprehensive data management systems that support complex workflows. Palantir and Informatica differentiate themselves by offering specialized data mining, cleansing, and advanced analytics services, targeting clients who require flexibility and quick deployment. As the demand for seamless data integration and processing grows, these companies continue to innovate, creating a dynamic and evolving competitive environment in the market.

Key Player Analysis

- Palantir Technologies

- Microsoft

- TIBCO Software

- Snowflake

- Capgemini

- SAS Institute

- Informatica

- Teradata

- SAP

- Hewlett Packard Enterprise

Recent Developments

- In October 2025, Snowflake and Palantir Technologies announced a strategic partnership to enable enterprise‑ready AI and analytics, strengthening data pipelines and accelerating AI‑driven data processing capabilities.

- In July 2025, Teradata rolled out its ModelOps update to the ClearScape Analytics platform, enhancing support for agentic AI and generative AI workloads—signaling its intent to modernize data processing services for AI‑driven enterprise analytics.

- In June 2025, Informatica launched a new Master Data Management (MDM) SaaS extension for Snowflake AI Data Cloud, enabling enterprises to consolidate master and transactional data across multiple domains directly into Snowflake.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service, Deployment, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly benefit from continuous growth in global data generation as enterprises accumulate larger volumes of structured and unstructured data, demand for scalable, efficient processing services will surge, driving expansion of the Data Processing Service Market.

- Growing cloud migration across industries will propel demand for cloud-based data processing services, as organizations seek flexibility, reduced infrastructure costs, and rapid scalability to handle fluctuating data workloads.

- Integration of AI, ML, and advanced analytics into data processing workflows will expand service value enabling predictive insights, automation, and enhanced decision-making, which will attract enterprises toward sophisticated processing solutions.

- Adoption of hybrid deployment models will rise, allowing firms to combine on-premises and cloud environments balancing control, compliance, and scalability thereby broadening market uptake.

- Expansion in emerging economies driven by digitalization, e-commerce growth, IoT deployments, and increasing enterprise IT investment will open new geographic markets for data processing services.

- Demand for real-time and near-real-time data processing will grow, especially in sectors such as finance, telecommunication and manufacturing where prompt data-driven decisions and analytics are critical.

- Small and medium enterprises (SMEs) will gradually increase adoption due to more accessible cloud-based data services and lower entry barriers, expanding market depth beyond large enterprises.

- Service providers offering specialized, customizable data cleansing, mining, and indexing services will capture niche demand particularly for sectors handling complex or semi-structured data driving segmentation growth.

- Regulatory compliance and data-governance requirements especially for privacy, security, and data-residency will fuel demand for compliant, managed data processing services, positioning providers who meet standards advantageously.

- Continuous innovation in data-management platforms, edge computing, and decentralized storage infrastructure will create new business models and services, enabling broader adoption and long-term market resilience.

Market Segmentation Analysis:

Market Segmentation Analysis: