Market Overview

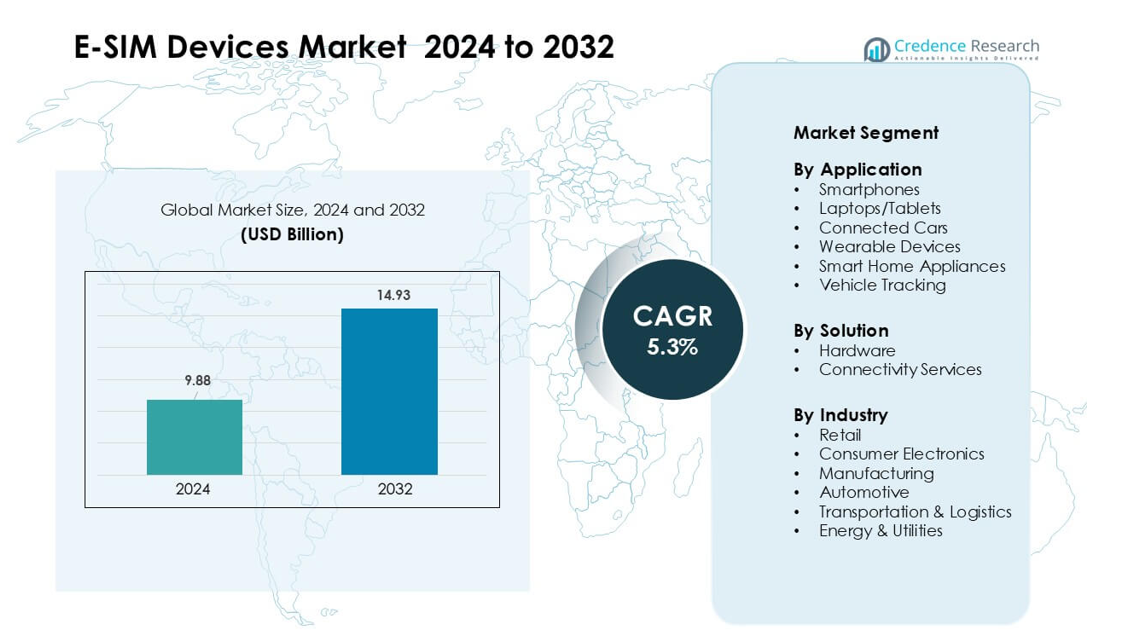

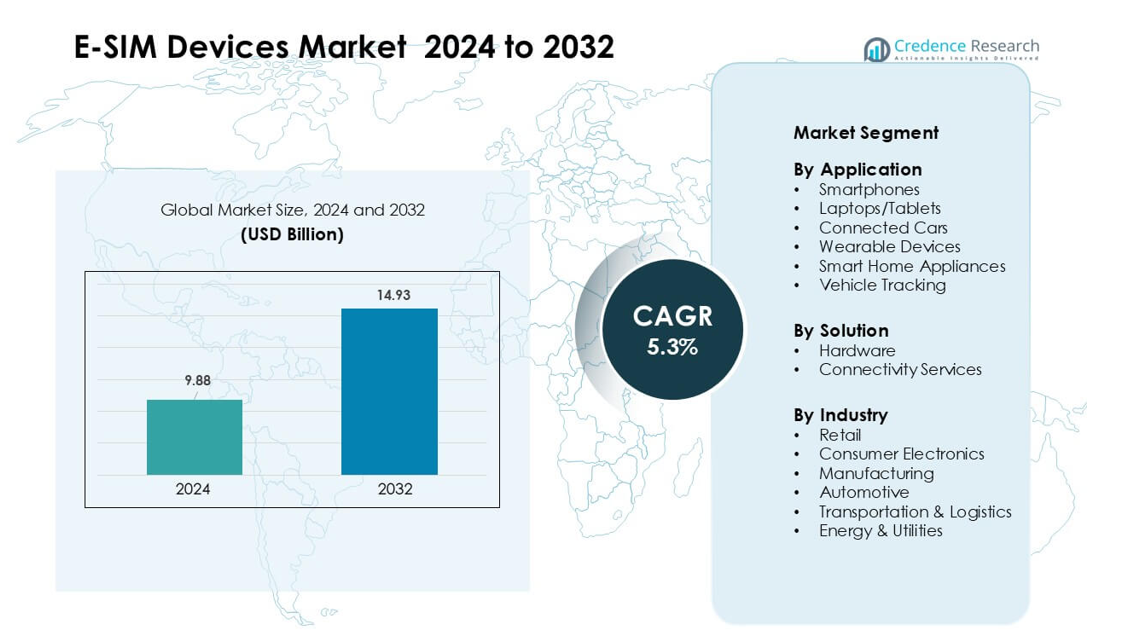

E-SIM Devices Market was valued at USD 9.88 billion in 2024 and is anticipated to reach USD 14.93 billion by 2032, growing at a CAGR of 5.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-SIM Devices Market Size 2024 |

USD 9.88 billion |

| E-SIM Devices Market, CAGR |

5.3% |

| E-SIM Devices Market Size 2032 |

USD 14.93 billion |

The E-SIM devices market is shaped by major players such as Sierra Wireless, Workz, Thales, Infineon Technologies AG, KORE Wireless, NXP Semiconductors, Arm Limited, STMicroelectronics, Deutsche Telekom AG, and Giesecke+Devrient GmbH. These companies drive growth through secure embedded hardware, remote-provisioning platforms, and strong alliances with global mobile operators. Their solutions support smartphones, wearables, connected vehicles, and large-scale IoT deployments. North America led the market in 2024 with about 38% share, driven by high consumer adoption of e-SIM smartphones, strong enterprise mobility demand, and wide operator support for digital connectivity services.

Market Insights

- The E-SIM Devices Market was valued at USD 9.88 billion in 2024 and is projected to reach USD 14.93 billion by 2032 at an 5.3% CAGR.

- Rising adoption of e-SIM smartphones and wearables drives demand, supported by remote provisioning and secure identity management features.

- Growing use of e-SIM in connected cars, logistics tracking, and IoT devices shapes major trends as companies shift toward multi-profile and cross-network connectivity.

- Key players such as Sierra Wireless and Thales compete through advanced embedded hardware, security modules, and partnerships with global operators, while hardware solutions held about 58% share.

- North America led the market with nearly 38% share in 2024, driven by strong consumer electronics usage, while smartphones remained the dominant application segment with about 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Smartphones dominated the application segment in 2024 with about 46% share. Strong use of eSIM-enabled flagship models from major brands drove demand. Rising adoption came from easier carrier switching, global roaming support, and secure remote provisioning. Laptops and tablets grew as enterprises shifted to always-connected systems, while connected cars expanded due to telematics and safety needs. Wearables gained steady traction through compact eSIM form factors, and smart home appliances and vehicle tracking solutions advanced with rising IoT deployments across residential and fleet environments.

- For instance, connected-car adoption is high across major regions. Europe reached about 91% penetration in 2023 due to the eCall mandate, while North America stood near 85% the same year according to Berg Insight. China also reported strong uptake, with connected-car penetration estimated above 70% across new passenger vehicles.

By Solution

Hardware led the solution segment in 2024 with nearly 58% share. Growth came from wide integration of embedded UICC chips across smartphones, wearables, and automotive platforms. Manufacturers favored secure, tamper-resistant hardware for identity management and authentication. Connectivity services expanded fast as mobile operators pushed eSIM subscription bundles, remote SIM provisioning, and multi-profile management. Cloud-based orchestration tools supported switching between networks, helping enterprises reduce roaming fees and improve device uptime across distributed operations.

- For instance, one major market-tracker reported that hardware made up about 60.4% of the global e-SIM market in 2024. The large share came from rising use of embedded chipsets across phones, wearables, cars, and IoT devices. Strong demand for secure hardware modules helped keep hardware ahead of software and services.

By Industry

Consumer electronics dominated the industry segment in 2024 with about 52% share. Strong demand rose from eSIM-enabled smartphones, tablets, smartwatches, and connected home devices. Users adopted these products for seamless activation, broader network choices, and reduced reliance on physical SIM slots. Automotive and transportation & logistics sectors expanded with telematics, fleet tracking, and remote diagnostics. Energy and utilities increased uptake for grid monitoring and smart meters, while manufacturing and retail grew due to supply-chain visibility and asset-tracking needs powered by reliable cellular connectivity.

Key Growth Drivers

Growing Adoption in Consumer Electronics

Demand for e-SIM devices grows as smartphone, smartwatch, and tablet makers integrate embedded SIM technology into mainstream models. Brands push e-SIM to support slimmer designs and improve durability by removing physical trays. Users gain simple activation, better roaming options, and instant carrier switching, which accelerates global acceptance. Growth expands further as multi-device ecosystems rely on seamless connectivity, and enterprises deploy e-SIM laptops for secure remote work. The rise of connected wearables in health, fitness, and communication adds steady momentum. Wider 5G coverage also boosts e-SIM use because manufacturers align next-generation devices with embedded connectivity.

- For instance, Google enabled e-SIM transfer on Pixel devices in 2023, allowing users to move e-SIM profiles between phones without scanning QR codes

Expansion of IoT and M2M Deployments

Rapid IoT growth across automotive, logistics, utilities, and industrial systems drives strong demand for e-SIM devices. Companies prefer e-SIM for long-life assets because remote provisioning cuts the need for manual SIM replacement. Fleet managers use e-SIM tracking to improve routing, safety, and operational control. Utilities adopt e-SIM smart meters for stable connectivity and lower field-service costs. Industrial firms benefit from secure identity management across automated systems. As governments support smart-city projects, connected sensors and cameras rely on embedded SIMs for secure and stable network links, creating large-scale expansion opportunities.

- For instance, the GSMA’s eSIM architecture uses a hardware-based secure element as the Root of Trust, which supports strong device identity and zero-trust authentication—capabilities already applied in industrial IoT platforms from companies such as Siemens and Schneider Electric for secure remote monitoring and control

Rising Need for Remote Provisioning and Global Connectivity

Enterprises and consumers adopt e-SIM devices because remote provisioning removes activation delays and supports instant profile updates. This benefit is vital for travelers, global businesses, and logistics networks that operate across multiple operators. Manufacturers use e-SIM to reduce physical component failures and extend device life. Multi-profile support helps organizations switch networks when coverage or cost changes. Cloud-based platforms simplify subscription management at scale, strengthening adoption across distributed workforces. As operators expand e-SIM support worldwide, users gain consistent international connectivity, which elevates demand across both personal and enterprise device categories.

Key Trends & Opportunities

Growth of Multi-Device and Cross-Platform Connectivity

A major trend emerges as consumers use multiple connected product phones, wearables, laptops, and home devices that sync through e-SIM for unified connectivity. Tech ecosystems benefit because e-SIM simplifies activation across all linked devices. Premium wearables grow fast as health-tracking, fitness, and communication features rely on constant network access. Device makers explore new compact designs because e-SIM reduces hardware space needs. Smart-home automation and entertainment systems also gain from embedded connectivity, creating wider opportunities across residential markets. This shift supports long-term growth as users expect frictionless multi-device experiences.

- For instance, Apple’s cellular Apple Watch models—such as the Apple Watch Series 8—use an embedded eSIM to maintain LTE connectivity without a physical SIM, and the device can be activated through the iPhone’s eSIM setup process using Apple’s remote provisioning system.

Expansion of Connected Vehicles and Smart Mobility Solutions

e-SIM technology becomes central to connected-car systems, enabling telematics, diagnostics, e-call functions, and over-the-air updates. Automakers adopt e-SIM to meet safety and regulatory needs, while mobility providers use it to manage fleets and shared vehicles. EV infrastructure, charging stations, and vehicle-to-grid communication platforms also benefit from constant connectivity. The shift toward autonomous and semi-autonomous systems increases reliance on secure network links, creating sustained demand. New mobility services such as ride-sharing, rental fleets, and logistics platforms gain efficiency through e-SIM-enabled real-time tracking and analytics.

- For instance, BMW integrates an embedded eSIM supplied through Deutsche Telekom across its ConnectedDrive platform, enabling eCall emergency functions that automatically transmit crash location and vehicle data to responders, with Europe’s eCall system requiring transmission within 25 seconds of airbag deployment

Key Challenges

Limited Global Standardization and Operator Support

Uneven adoption of e-SIM standards across operators creates compatibility gaps. Some regions still rely on physical SIM systems, slowing market expansion. Users face activation limits when carriers restrict multi-profile support or delay e-SIM onboarding. Device makers must build region-specific versions, raising costs and development time. Enterprises with cross-border deployments deal with inconsistent provisioning systems, which complicates large-scale IoT rollouts. These issues reduce the flexibility benefits of e-SIM and slow adoption in markets with fragmented telecom policies.

Security Risks and Complex Subscription Management

e-SIM architecture must protect user identities and remote provisioning processes, creating demand for robust security frameworks. Cyberattacks targeting IoT systems raise concerns about unauthorized access to embedded profiles. Enterprises managing thousands of devices face challenges in monitoring, updating, and securing connectivity profiles. Remote provisioning errors can interrupt service, causing downtime in critical applications like logistics or industrial systems. As M2M deployments grow, companies require stronger encryption, authentication tools, and lifecycle-management platforms to reduce operational risk and maintain trust in e-SIM solutions.

Regional Analysis

North America

North America led the E-SIM devices market in 2024 with about 38% share. Growth came from strong adoption of e-SIM smartphones, wearables, and connected laptops supported by major telecom operators. Enterprises used e-SIM for remote device management, secure authentication, and multi-profile networks, boosting demand across IT, logistics, and automotive sectors. The region’s mature 5G coverage improved device performance and strengthened integration in IoT platforms. Rising deployment of connected cars and fleet-tracking systems also expanded usage. Continuous operator support and high consumer readiness kept North America ahead in large-scale e-SIM activation.

Europe

Europe captured nearly 31% share in 2024, driven by strong regulatory backing for remote provisioning and digital connectivity. Major smartphone and IoT manufacturers introduced e-SIM models early, helping the region scale adoption. Automotive players used e-SIM for e-call compliance, telematics, and over-the-air diagnostics, boosting demand across Germany, France, and the U.K. Enterprises leveraged e-SIM for cross-border connectivity, reducing roaming and operational costs. Wearable devices and smart-home systems gained traction as consumers preferred seamless activation and flexible operator switching. Growing 5G expansion further supported e-SIM penetration across key EU markets.

Asia-Pacific

Asia-Pacific accounted for about 24% share in 2024 and recorded the fastest growth. High smartphone penetration, strong consumer electronics manufacturing, and rapid 5G rollout supported large-scale e-SIM adoption. China, South Korea, and Japan led device production, integrating e-SIM into premium phones, wearables, and tablets. Automotive makers expanded e-SIM use for connected cars, while logistics firms relied on remote provisioning for fleet monitoring. India and Southeast Asia saw rising demand for low-cost e-SIM devices as operators upgraded networks. Expanding IoT deployments across smart cities and industrial setups created strong future growth potential.

Latin America

Latin America held around 4% share in 2024 and showed gradual expansion. Major economies like Brazil and Mexico adopted e-SIM smartphones supported by growing operator partnerships. Wearables and connected consumer devices also gained traction as users sought easier activation and flexible plans. Fleet-tracking platforms in logistics and mining industries drove e-SIM use for real-time monitoring. However, slower regulatory progress and uneven network quality limited faster growth. As 4G and 5G coverage improves, the region is expected to scale e-SIM adoption across smart mobility, industrial IoT, and consumer electronics.

Middle East & Africa

The Middle East & Africa region captured nearly 3% share in 2024, with adoption led by the UAE, Saudi Arabia, and South Africa. Telecom operators expanded e-SIM support for premium smartphones and wearables, attracting affluent consumers and frequent travelers. Governments deployed connected-device solutions for smart-city, surveillance, and utility projects, increasing demand for embedded connectivity. Fleet-tracking and logistics operations in oil, gas, and transport sectors relied on e-SIM for secure provisioning. Growth remained slower in emerging markets due to limited device availability, though rising 5G rollout is expected to improve adoption.

Market Segmentations:

By Application

- Smartphones

- Laptops/Tablets

- Connected Cars

- Wearable Devices

- Smart Home Appliances

- Vehicle Tracking

By Solution

- Hardware

- Connectivity Services

By Industry

- Retail

- Consumer Electronics

- Manufacturing

- Automotive

- Transportation & Logistics

- Energy & Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the e-SIM devices market features leading players such as Sierra Wireless, Workz, Thales, Infineon Technologies AG, KORE Wireless, NXP Semiconductors, Arm Limited, STMicroelectronics, Deutsche Telekom AG, and Giesecke+Devrient GmbH. These companies compete through secure embedded hardware, remote provisioning platforms, multi-profile management, and strong partnerships with global mobile operators. Device makers rely on advanced chipsets, authentication modules, and interoperability standards provided by these firms to support connected smartphones, wearables, vehicles, and IoT assets. Vendors focus on security certifications, power efficiency, and smaller form factors to meet rising demand across consumer and industrial systems. Many players expand through collaborations with telecom carriers to deliver scalable connectivity services for cross-border devices. Growing use of e-SIM in automotive telematics, logistics tracking, smart meters, and enterprise mobility increases competition as companies enhance software tools, cloud orchestration, and lifecycle management solutions to secure larger market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Deutsche Telekom AG: Deutsche Telekom became the first European operator to enable direct eSIM profile transfer between Android and iOS devices, simplifying device switching and boosting consumer adoption of eSIM-only services.

- In May 2025, Giesecke+Devrient GmbH: Giesecke+Devrient partnered with GCT Semiconductor to launch a GSMA SGP.32-based eSIM solution for IoT devices, supporting multi-network connectivity and remote provisioning for large, global IoT deployments.

- In June 2024, STMicroelectronics: STMicroelectronics launched the ST4SIM-300 embedded SIM, one of the first eSIMs compliant with the new GSMA SGP.32 eSIM for IoT standard, targeting scalable, remotely managed connectivity for industrial and IoT devices

Report Coverage

The research report offers an in-depth analysis based on Application, Solution, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- E-SIM adoption will rise as more smartphone and wearable makers shift to embedded connectivity.

- Remote provisioning will become standard across consumer and enterprise devices.

- Connected vehicles will expand use of e-SIM for telematics, diagnostics, and safety functions.

- IoT deployments in logistics, utilities, and manufacturing will boost large-scale e-SIM activation.

- Multi-profile support will improve flexibility for global travelers and cross-border enterprises.

- Device designs will grow slimmer as manufacturers remove physical SIM trays.

- Telecom operators will increase e-SIM support to strengthen digital onboarding.

- Smart-home ecosystems will use e-SIM to enhance automation and continuous connectivity.

- Security upgrades and stronger authentication tools will improve trust in embedded SIM solutions.

- Growth in 5G networks will accelerate adoption across high-performance consumer and industrial devices.