Market overview

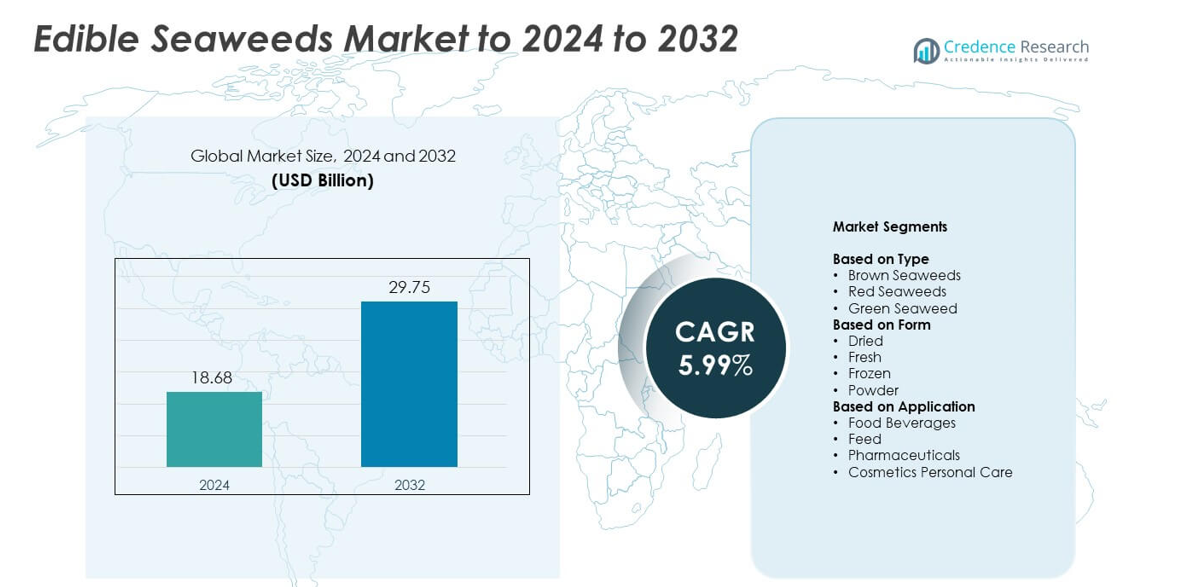

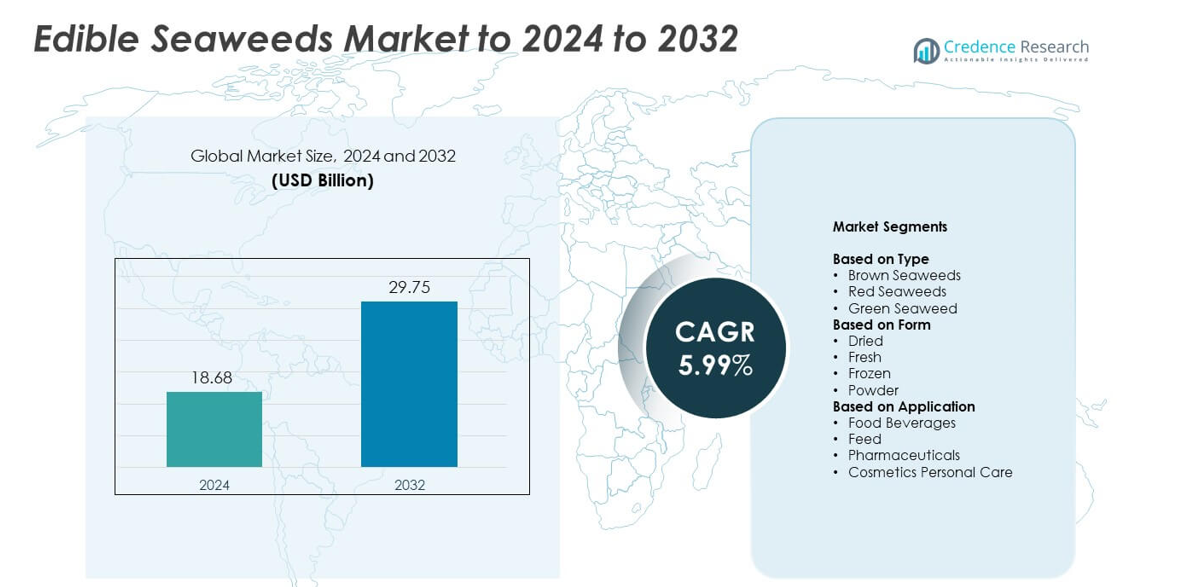

Edible Seaweeds market size was valued USD 18.68 Billion in 2024 and is anticipated to reach USD 29.75 Billion by 2032, at a CAGR of 5.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Edible Seaweeds Market Size 2024 |

USD 18.68 Billion |

| Edible Seaweeds Market, CAGR |

15.99% |

| Edible Seaweeds Market Size 2032 |

USD 29.75 Billion |

The edible seaweeds market includes major participants such as Qingdao Gather Great Ocean Algae Industry Group, Great Southern Ocean, Marinova, PhycoHealth, Sea Forest, Tasmanian Seafood Seduction, Acadian Seaplants, The Seaweed Company, Gelymar, and Australian Seaweed Institute. These companies strengthen their positions through advanced aquaculture systems, strong extraction capabilities, and expanding product portfolios in food, supplements, and personal care. Asia Pacific leads the market with about 39% share due to large-scale cultivation and strong regional consumption. North America follows with nearly 27% share, driven by rising demand for nutrient-dense foods, while Europe holds close to 24% share supported by growing interest in clean-label and sustainable ingredients.

Market Insights

- The edible seaweeds market reached USD 18.68 Billion in 2024 and is projected to hit USD 29.75 Billion by 2032, growing at a CAGR of 5.99%.

• Rising demand for nutrient-rich, plant-based, and clean-label foods drives strong adoption, with brown seaweeds holding about 52% share due to wide use in food processing and functional products.

• Key trends include higher use of seaweed powders in supplements, expansion of sustainable aquaculture, and increased adoption in plant-based snacks, beverages, and fortified foods.

• Market competition intensifies as producers invest in advanced cultivation systems, improve extraction capabilities, and expand value-added applications across food, wellness, and personal care categories.

• Asia Pacific leads with about 39% share due to large-scale farming and high consumption, followed by North America at nearly 27% and Europe at around 24%, supported by strong demand for healthy, natural, and eco-friendly ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Brown seaweeds dominated the Edible Seaweeds market in 2024 with nearly 52% share. Buyers favored this category due to its high alginate content, strong demand in food stabilizers, and wide use in Asian cuisines. Red seaweeds grew at a steady pace as carrageenan applications increased in dairy and plant-based products. Green seaweeds expanded with rising interest in nutrient-rich snacks. Growth across the type segment was supported by expanding vegan diets, clean-label trends, and rising consumption of natural thickeners and mineral-rich ingredients.

- For instance, Acadian Seaplants, a company known for pioneering land-based seaweed cultivation, grows colored variants of Chondrus crispus for the Japanese salad market. The company operates its facility year-round, producing a total annual crop of over a million kilograms (more than 1,000 tonnes).

By Form

Dried seaweeds led the Edible Seaweeds market in 2024 with about 58% share. This form remained dominant because dried products offer longer shelf life, easy transport, and strong use in packaged foods, soups, and seasonings. Fresh seaweeds gained momentum in salads and premium retail formats, while frozen formats attracted demand in bulk foodservice. Powdered seaweed saw increased use in supplements and functional foods. Rising adoption of shelf-stable ingredients and strong penetration in Asian retail supported the continued dominance of the dried category.

- For instance, the total global seaweed industry utilizes approximately 35.8 million tonnes of wet seaweed annually (as of 2019 data).

By Application

Food and beverages remained the leading application segment in 2024 with nearly 61% share. The segment held dominance due to high use in snacks, sushi, soups, condiments, and functional food blends. Feed applications expanded with rising inclusion in livestock nutrition for better gut health, while pharmaceuticals used seaweed compounds for antioxidant and anti-inflammatory benefits. Cosmetics and personal care grew with demand for natural moisturizers and mineral-rich extracts. Growth across applications was driven by rising health awareness and broader acceptance of seaweed as a clean and nutrient-dense ingredient.

Key Growth Drivers

Rising demand for nutrient-rich foods

The Edible Seaweeds market grows as consumers seek natural, nutrient-dense ingredients rich in vitamins, minerals, fiber, and antioxidants. Seaweeds gain strong traction in snacks, soups, plant-based meals, and fortified products. Growing health awareness, urban dietary shifts, and preference for low-calorie and sustainable food options support wider use across retail and foodservice channels. Increased promotion of immunity-supporting foods and expanding vegan consumption further strengthen their adoption within mainstream diets.

- For instance, GreenWave’s model shows that a 20-acre regenerative ocean farm can produce about 60 tons of kelp annually, demonstrating how nutrient-dense seaweed can be grown at meaningful food scales

Expansion of plant-based and functional food categories

Rapid growth in plant-based diets drives higher use of seaweeds as clean-label stabilizers, natural flavor enhancers, and functional additives. Food brands incorporate seaweed extracts into dairy alternatives, sauces, beverages, and protein-rich formulations to meet rising demand for natural ingredients. Functional foods benefit from seaweed’s bioactive compounds that support digestion, energy, and metabolic health. This shift toward transparent labeling, natural textures, and sustainable sourcing continues to push seaweed integration across product innovations.

- For instance, AquAgri operates a seaweed liquid extract and powder unit with capacity for 5,000 kiloliters of liquid extract and 100 metric tons of powder, feeding into food and agri-input applications.

Strong industry use in hydrocolloids and bioproducts

The market expands as manufacturers use seaweed-derived hydrocolloids such as alginate, agar, and carrageenan in food processing and industrial applications. These compounds provide gelling, thickening, and stabilizing functions that replace synthetic additives. Demand increases in bakery, confectionery, beverages, and biopolymer production. Growth in biodegradable packaging, pharmaceutical formulations, and personal care supports large-scale uptake. Strong R&D efforts and improved extraction technologies enhance production efficiency and global supply reliability.

Key Trends & Opportunities

Rising adoption in premium nutrition and supplements

Seaweed powders and extracts gain wider use in dietary supplements due to strong mineral content, natural iodine levels, and antioxidant profiles. Brands launch seaweed-based capsules, gummies, and blends targeting thyroid support, gut health, and immunity. Growing consumer shift toward natural wellness products creates new opportunities for high-purity and organic seaweed extracts. Expanding e-commerce sales and clean-label preferences support long-term growth in premium nutrition categories.

- For instance, ALGAplus, a company specializing in organic seaweed production, is implementing new production systems with the goal of reaching 160 tons of fresh seaweed per year across its facilities, according to a 2022 report from the AquaVitae project.

Integration in sustainable and eco-friendly consumer products

Growing focus on sustainability increases demand for seaweed-derived ingredients in eco-friendly packaging, cosmetics, and biodegradable materials. Seaweeds grow without freshwater or fertilizers, making them an attractive low-impact crop. Innovation in biofilms, natural emulsifiers, and plant-based skincare expands new commercial avenues. Government initiatives supporting marine farming and carbon-absorbing crops also strengthen industry opportunities. This trend drives broader cross-industry adoption beyond food.

- For instance, Carbon Kapture’s seaweed farm concept in Mulroy Bay is designed with the potential to scale to 250 hectares and grow around 11,000 tonnes of seaweed per year, aimed at producing carbon-sequestering bioproducts like biochar and improving local water quality and biodiversity.

Expanding use in global cuisines and foodservice innovation

Global restaurants and foodservice chains adopt seaweed ingredients in fusion dishes, snacks, and flavor enhancers, supporting mainstream acceptance beyond traditional Asian cuisine. Chef-led innovations encourage new formats such as chips, noodles, seasonings, and beverage infusions. Rising interest in umami-rich natural ingredients further boosts demand. International retail exposure and social media-driven food trends create strong opportunities for expanded culinary applications.

Key Challenges

Supply chain vulnerability and seasonal fluctuations

The Edible Seaweeds market faces supply constraints due to seasonal harvesting, unpredictable ocean conditions, and regional climate variations. Variations in temperature, salinity, and water quality impact yield and consistency. Heavy reliance on coastal farming regions leads to periodic shortages and unstable pricing. Limited processing facilities in emerging markets also restrict large-scale production. These challenges require better marine cultivation management and expanded farming zones.

Quality standardization and contamination risks

Ensuring consistent quality remains a challenge as seaweeds can absorb heavy metals and contaminants from polluted waters. Variability in nutrient levels and moisture content affects product uniformity across regions. Lack of global standards for cultivation, processing, and testing increases compliance complexity for exporters. Food safety regulations for seaweed-based ingredients continue to tighten, pushing producers to improve traceability and adopt advanced purification techniques to meet international market requirements.

Regional Analysis

North America

North America held about 27% share of the edible seaweeds market in 2024. Demand increased as consumers adopted nutrient-rich foods, plant-based diets, and clean-label ingredients. The region saw strong use of seaweed snacks, supplements, and fortified beverages, supported by rising retail availability and product innovation. Growth intensified as companies expanded seaweed farming projects along the U.S. and Canadian coasts to reduce import dependence. Foodservice chains also introduced seaweed-based dishes, strengthening mainstream acceptance. Continued interest in sustainable and low-impact crops supports steady regional expansion.

Europe

Europe accounted for nearly 24% share in 2024, driven by high demand for functional, organic, and low-calorie foods. The region expanded seaweed use in bakery, dairy alternatives, sauces, and nutritional supplements. Increasing consumer focus on clean-label and environmentally responsible ingredients helped boost consumption. Several countries advanced seaweed cultivation projects in the Atlantic region, improving supply and supporting regional food security goals. Partnerships between research institutes and food manufacturers strengthened product development. Rising interest in sustainable marine resources supports continued growth across European markets.

Asia Pacific

Asia Pacific dominated the market with around 39% share in 2024, driven by long-standing culinary traditions and large-scale seaweed farming operations. Strong consumption across China, Japan, South Korea, and Southeast Asia supported the region’s leadership. Food manufacturers leveraged seaweeds in snacks, soups, seasonings, beverages, and functional products. Rising export activity, expanding aquaculture capacity, and government-backed marine farming programs reinforced supply strength. Rapid urbanization and growing preference for natural and nutrient-dense foods further boosted regional demand, solidifying Asia Pacific’s position as the key growth hub.

Latin America

Latin America held close to 6% share of the edible seaweeds market in 2024. Demand increased as health-conscious consumers adopted seaweed snacks, natural thickeners, and plant-based products. Chile strengthened its role as a major regional producer due to established coastal farming and export capabilities. Growing interest in eco-friendly foods and marine-based nutrition supported wider adoption across Brazil, Mexico, and Argentina. Local companies also expanded processing capacity for seaweed powders and extracts used in supplements and food formulations. Rising awareness of seaweed’s nutritional value fuels ongoing regional growth.

Middle East and Africa

The Middle East and Africa accounted for about 4% share in 2024, driven by rising interest in nutrient-dense, sustainable ingredients. Urban consumers adopted seaweed-based snacks, supplements, and functional beverages as part of healthier diets. Import-driven supply supported most regional consumption, while small-scale coastal farming expanded in selected African nations. Food manufacturers used seaweed extracts in sauces, seasonings, and fortified products, enhancing category visibility. Growing awareness of natural superfoods and wider distribution through modern retail channels contribute to steady market development across the region.

Market Segmentations:

By Type

- Brown Seaweeds

- Red Seaweeds

- Green Seaweed

By Form

- Dried

- Fresh

- Frozen

- Powder

By Application

- Food Beverages

- Feed

- Pharmaceuticals

- Cosmetics Personal Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the edible seaweeds market is shaped by companies such as Qingdao Gather Great Ocean Algae Industry Group, Great Southern Ocean, Marinova, PhycoHealth, Sea Forest, Tasmanian Seafood Seduction, Acadian Seaplants, The Seaweed Company, Gelymar, and Australian Seaweed Institute. The market features strong competition driven by advanced aquaculture practices, improved harvesting efficiency, and continuous product innovation across food, nutraceuticals, and personal care categories. Producers focus on refining extraction technologies to deliver high-quality hydrocolloids, powders, and functional ingredients that meet growing clean-label demand. Many companies expand global footprints by strengthening supply chains, securing long-term farming contracts, and developing sustainable cultivation programs to address rising environmental expectations. Strategic collaborations with food manufacturers, biotech firms, and research institutes support new applications and enhance value-added product lines. The shift toward premium nutrition, plant-based formulations, and eco-friendly materials further intensifies competition while encouraging investment in scalable, low-impact seaweed farming systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qingdao Gather Great Ocean Algae Industry Group

- Great Southern Ocean

- Marinova

- PhycoHealth

- Sea Forest

- Tasmanian Seafood Seduction

- Acadian Seaplants

- The Seaweed Company

- Gelymar

- Australian Seaweed Institute

Recent Developments

- In 2025, Gelymar S.A. (Chile) continues to advance sustainable and artisanal harvesting techniques for high-quality seaweed, especially Red Luga (Gigartina skottsbergii), harvested by skilled divers along the southern Chilean coast in regions like Chiloé Island as of January 2025.

- In 2025, Marinova continues to expand its focus on advanced extraction methods for bioactive compounds from seaweed, contributing to the growing demand for functional foods and nutraceuticals.

- In 2025, Acadian reaffirmed its commitment to sustainable seaweed solutions contributing to stronger ecosystems and responsible food systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The edible seaweeds market will grow as demand rises for natural, nutrient-rich foods.

- Plant-based diets will expand seaweed use in snacks, beverages, and fortified meals.

- Advances in aquaculture will improve yield stability and reduce supply volatility.

- Seaweed-derived hydrocolloids will gain stronger adoption in clean-label formulations.

- Premium nutrition products will use more seaweed powders and bioactive extracts.

- Sustainable marine farming will attract higher investment across major coastal regions.

- Foodservice chains will introduce more seaweed-based dishes to meet rising consumer interest.

- Cosmetic and personal care brands will integrate more seaweed ingredients for natural benefits.

- Growing regulatory support will encourage standardized cultivation and safer processing.

- Global expansion of seaweed-based bioproducts will open new commercial opportunities beyond food and beverages.