Market Overview:

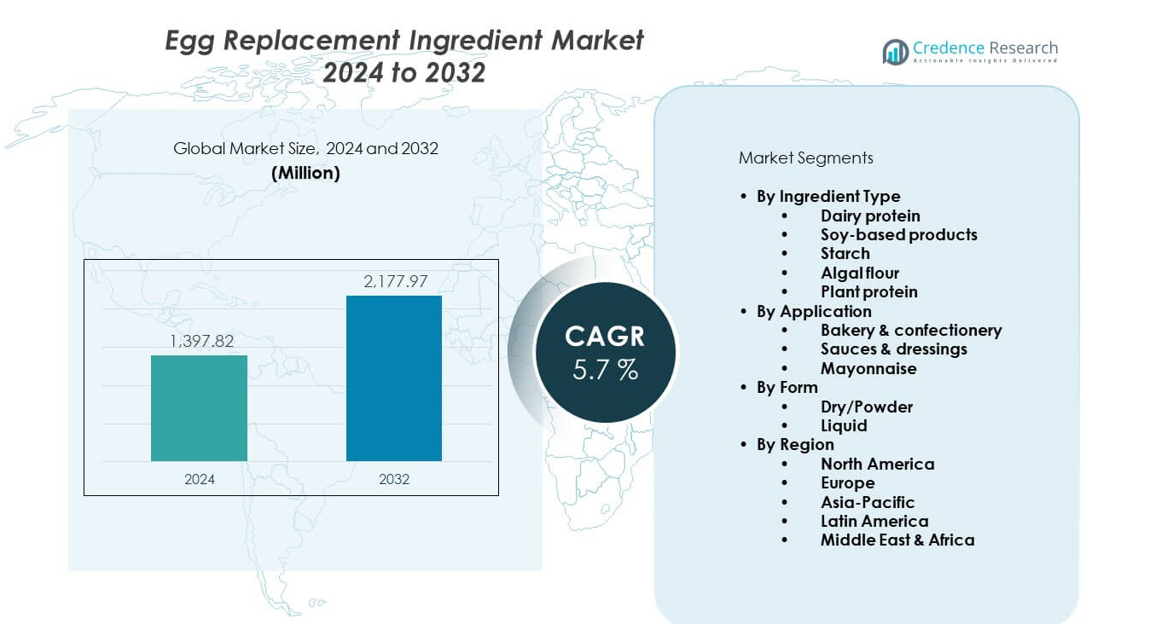

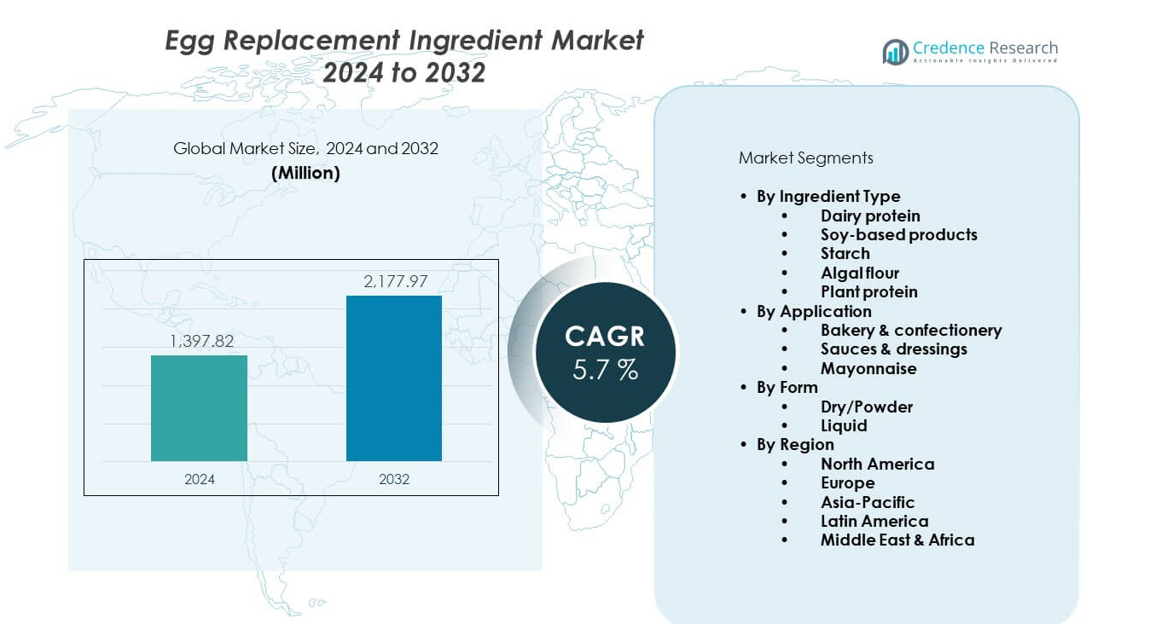

The Egg replacement ingredient market is projected to grow from USD 1,397.82 million in 2024 to an estimated USD 2,177.97 million by 2032, with a CAGR of 5.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egg Replacement Ingredient Market Size 2024 |

USD 1,397.82 million |

| Egg Replacement Ingredient Market, CAGR |

5.7% |

| Egg Replacement Ingredient Market Size 2032 |

USD 2,177.97 million |

Growth is driven by strong interest in healthier diets and rising egg-allergy cases. Food processors use plant proteins to reduce cost swings linked with egg supply. Bakeries, ready-to-eat meals, and vegan brands adopt these ingredients to improve texture and binding. Manufacturers also expand pea, soy, and starch-based blends to support product stability. Cleaner labels increase trust among consumers who seek simple and natural components.

North America leads due to strong plant-based food adoption and high innovation rates among producers. Europe follows as food firms shift toward sustainable and vegan formulas. Asia-Pacific is emerging because customers seek affordable and allergy-friendly choices. Growth in countries like India, China, and Japan comes from wider use across bakery and packaged foods. Latin America and the Middle East show steady interest as awareness of plant-based diets grows.

Market Insights:

- The market stands at USD 1,397.82 million in 2024 and is projected to reach USD 2,177.97 million by 2032, progressing at a 7% CAGR, supported by rising demand for plant-based and allergen-free ingredients across bakery, sauces, and processed foods.

- North America leads with the highest share, supported by mature plant-based adoption and active reformulation by major food manufacturers, while Europe follows due to strong clean-label compliance; Asia-Pacific ranks third with rapid growth driven by expanding bakery and packaged food sectors.

- Asia-Pacific emerges as the fastest-growing region, supported by rising urban consumption, wider retail penetration, and increasing interest in allergy-friendly and vegan products across China, India, and Southeast Asia.

- Bakery and confectionery hold the largest segment share, driven by the need for stable aeration, moisture retention, and structure across breads, cakes, pastries, and sweet goods.

- Dry or powder formats account for the dominant form share, favored for long shelf life, easy storage, and strong suitability for large-scale industrial mixing and processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Shift Toward Plant-Based and Allergen-Free Food Choices

The Egg replacement ingredient market benefits from a strong shift toward plant-based eating. Many food makers prefer these substitutes to meet vegan and vegetarian demand. It supports allergen-free claims that attract families seeking safer choices. Brands upgrade formulas to match texture and taste in multiple food items. Rising awareness of clean labels pushes adoption. Food processors introduce pea, soy, and starch blends for better structure. Demand spreads across bakery and packaged meal categories. Wider retail access boosts customer confidence.

- For instance, Ingredion expanded its plant-protein capacity in Nebraska to produce metric tons of pea protein annually, supporting clean-label and allergen-free food applications across major bakery and snack manufacturers.

Rising Demand for Cost Stability and Supply-Chain Security in Food Production

The Egg replacement ingredient market gains traction due to price stability needs. Food firms face frequent swings in egg supply due to weather, disease, and logistics. It helps processors maintain steady production without disruptions. Manufacturers turn to plant proteins to avoid high raw-material volatility. More businesses value long shelf life offered by substitutes. Cost planning improves as supply becomes predictable. Firms scale production with lower risk levels. These benefits lift adoption across large and mid-sized food companies.

- For instance, French company Roquette’s pea-protein facility in Canada produces 125,000 metric tons of yellow peas each year, helping manufacturers stabilize sourcing and reduce exposure to egg-supply volatility.

Growing Preference for Clean Labels and Natural Formulations Across Packaged Foods

The Egg replacement ingredient market expands through strong clean-label demand. Consumers prefer fewer additives and transparent labels in daily foods. It encourages brands to use natural binders and emulsifiers. More companies launch simplified ingredient lists to meet new standards. Plant-based options help reduce synthetic content in prepared meals. Brands highlight natural claims in advertising efforts. Food makers upgrade recipes for better appeal in retail aisles. These actions drive interest from health-focused buyers.

High Adoption Across Bakery, Desserts, and Ready-Meal Categories in Global Manufacturing

The Egg replacement ingredient market gains momentum from bakery and dessert growth. Producers adopt substitutes to maintain texture in bread, cakes, and pastries. It supports consistent results across frozen and ready-to-eat goods. Wider product availability increases development across gluten-free lines. Companies experiment with new blends to improve aeration and moisture. Demand rises in convenience food due to functional versatility. More brands craft premium recipes with plant-based components. This shift accelerates sector expansion.

Market Trends:

Rapid Expansion of Hybrid Formulations Combining Multiple Plant Proteins for Better Functionality

The Egg replacement ingredient market sees strong interest in hybrid blends. Producers mix pea, chickpea, and faba proteins for balanced performance. It improves binding strength and stability in processed foods. Research teams optimize formulas for specific textures. More brands upgrade bakery goods with refined combinations. Firms test blends to match whipping or gelling traits. Hybrid development attracts innovation funding. Food makers adopt these solutions for wider versatility.

Growing Penetration of Vegan Bakery and Specialty Foods Across Retail and Foodservice Channels

The Egg replacement ingredient market benefits from rising vegan bakery activity. Retail aisles carry more muffins, pastries, and breads without eggs. It supports cafes and restaurants that serve plant-focused menus. Foodservice operators expand dessert options for diverse customers. Specialty brands launch niche products for flexible diets. More stores allocate shelf space to vegan formats. Demand rises due to lifestyle changes. Production volumes grow across multiple regions.

- For instance, Kerry Group launched its Biobake™ EgR enzyme system across various regions (specifically in Europe, as of its launch), supporting bakery manufacturers seeking egg-reduction formulations with improved cost-effectiveness, consistent quality, and enhanced texture performance. The company also offers the Golden Gloss premium bakery glaze solution, a vegan, egg-free alternative utilizing pea protein to provide a consistent golden shine on products like brioche and croissants.

Technological Refinements Improving Texture, Moisture Retention, and Heat Stability in Food Applications

The Egg replacement ingredient market records strong gains from new technologies. R&D teams enhance heat stability for cooking and baking. It helps maintain structure across long processing cycles. Firms refine moisture-retention traits for softer textures. More brands test precision formulations in controlled settings. Producers fine-tune granule size for smooth blending. Better processing tools support consistent batches. These improvements attract manufacturers seeking premium outputs.

Increase in Label Claims Focused on Sustainability, Clean Processing, and Environmental Benefits

The Egg replacement ingredient market aligns with strong sustainability trends. Companies promote lower environmental footprints linked with plant sources. It supports clean processing standards across modern factories. More brands highlight responsible sourcing in marketing content. Consumers value reduced resource use in their food choices. Packaging reflects eco-friendly messaging for higher appeal. Demand rises among climate-aware shoppers. This trend strengthens sector reputation.

Market Challenges Analysis:

Complex Functional Requirements Across Bakery and Processed Foods Creating Performance Gaps

The Egg replacement ingredient market faces challenges linked with product complexity. Many baked foods rely on unique traits supplied by eggs. It becomes difficult to match aeration and texture in certain recipes. Formulations require precise protein ratios for stable performance. Manufacturers invest time in trials before launch. Cost pressure grows due to extended development cycles. Some products fail to meet sensory expectations. These hurdles limit full replacement in select categories.

High Need for Consumer Education, Cost Parity, and Smooth Integration Across Manufacturing Lines

The Egg replacement ingredient market encounters issues tied to consumer acceptance. Many buyers still prefer traditional recipes. It takes consistent branding to change perceptions. Businesses struggle with cost parity in some markets. Manufacturers must retool processes for smooth integration. Training improves reliability but demands resources. Product consistency varies across regions. These issues slow adoption in conservative food sectors.

Market Opportunities:

Rising Scope for Innovation Across Plant Proteins, Fermentation Inputs, and Functional Fibers

The Egg replacement ingredient market holds strong innovation potential. New protein crops support unique functional traits. It enables companies to expand options across multiple food lines. Fermentation inputs improve stability and flavor. Functional fibers enhance moisture control in bakery goods. More brands invest in R&D to build competitive portfolios. These advancements support wider adoption across retail and foodservice.

Growing Demand in Emerging Regions with Expanding Bakery, Packaged Food, and Health-Focused Segments

The Egg replacement ingredient market gains opportunities across emerging regions. Rising urban diets support interest in safe and stable ingredients. It aligns with higher awareness of clean food choices. Bakery and ready-meal sectors grow at a fast pace. Local producers seek reliable raw materials. More retailers promote plant-based goods. This momentum helps global companies expand distribution.

Market Segmentation Analysis:

By Ingredient Type

The Egg replacement ingredient market shows strong diversity across ingredient types, with dairy proteins supplying reliable whipping and gelling properties for bakery and dessert items. Soy-based products support binding and emulsification in processed foods that require stable structure. Starch helps maintain viscosity and moisture in sauces, confectionery, and baked goods. Algal flour gains traction due to natural emulsification and nutrient density that fit clean-label needs. Plant proteins expand quickly because producers focus on vegan and allergen-friendly formulations across multiple product lines. It supports flexible development for bakery, snacks, and ready meals.

- For instance, Cargill’s WavePure® seaweed powder range from red grasses/seaweeds provides texture stability in vegan dairy alternatives and confectionery. Plant proteins expand quickly because producers focus on vegan and allergen-friendly formulations across multiple product lines. It supports flexible development for bakery, snacks, and ready meals.

By Application

Bakery and confectionery remain the largest application area due to the need for stable texture in breads, pastries, and sweet products. These items depend on aeration, moisture retention, and structural integrity supplied by functional blends. Sauces and dressings use these ingredients to maintain flow consistency and flavor balance without eggs. It helps manufacturers achieve clean-label claims while keeping texture uniform in cold and hot processing. Mayonnaise requires high-performance emulsifiers that secure spreadability and hold under varied production conditions. Producers rely on refined blends to match traditional profiles.

- For instance, Kerry Group launched its SucculencePB technology that delivers up to a 74 % reduction in fat and a 97 % reduction in saturated fat for plant-based burger applications—showing real functionality in texture and flow replacement outside direct egg contexts. Sauces and dressings use these.

By Form

Dry or powder forms lead due to longer shelf life, easy storage, and smooth integration in industrial mixing lines. Manufacturers prefer powders for high-volume bakery, sauces, and confectionery batches that require uniform distribution. It also supports transport efficiency across global supply chains. Liquid forms serve ready-to-use applications where immediate emulsification and simplified handling matter. These formats fit dressings, dips, and sauces that demand quick blending with minimal steps. Both formats support wide formulation flexibility across retail and foodservice sectors.

Segmentation:

By Ingredient Type

- Dairy protein

- Soy-based products

- Starch

- Algal flour

- Plant protein

By Application

- Bakery & confectionery

- Sauces & dressings

- Mayonnaise

By Form

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The egg replacement ingredient market holds its largest regional share in North America due to strong adoption of plant-based and allergen-free food products. The region benefits from active reformulation efforts by major food manufacturers that seek cleaner labels and stable supply chains. It gains further support from growth in vegan bakery and ready-meal categories that require consistent functional performance. Retailers expand shelf space for egg-free options, which increases product visibility and trial rates. Foodservice operators upgrade menus to respond to rising dietary preferences. Strong innovation networks across the United States and Canada enhance product quality and support wider market penetration.

Europe

Europe accounts for the second-largest share, driven by strict clean-label standards and high consumer interest in sustainable ingredient choices. Producers reformulate bakery, dressings, and spread categories to align with evolving regulatory expectations. It gains momentum from strong demand in Germany, France, the United Kingdom, and the Nordic countries, where plant-forward diets continue to rise. Manufacturers adopt natural emulsifiers and plant proteins to reduce reliance on conventional egg supplies. Retail expansion of vegan and allergen-friendly lines delivers steady growth across mainstream channels. Ongoing investment in R&D improves the functional performance needed across the region’s diverse food-processing landscape.

Asia-Pacific, Latin America, and Middle East & Africa

Asia-Pacific records the fastest growth share due to rapid expansion in bakery, confectionery, and packaged food sectors. Rising urbanization and growing awareness of allergy-friendly diets support sustained uptake across China, India, Japan, and Southeast Asia. Latin America maintains a moderate share supported by rising demand for cost-efficient ingredients that secure stability in sauces and bakery applications. It benefits from producers that seek flexible formulations suitable for varied processing conditions. The Middle East & Africa hold a smaller but steady share, driven by the expansion of modern retail formats and a growing interest in egg-free bakery products. Emerging manufacturers in these regions adopt functional blends to improve product consistency and diversify their offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill

- Ingredion

- Kerry Group

- Arla Foods Ingredients

- Corbion

- Archer Daniels Midland Company (ADM)

Competitive Analysis:

The Egg replacement ingredient market features strong competition driven by innovation in plant proteins, starch systems, and natural emulsifiers. Key players expand portfolios to meet clean-label and allergen-free requirements across bakery, sauces, and ready-meal categories. It pushes companies to invest in advanced processing technologies and regional capacity upgrades. Larger firms strengthen global reach through integrated supply chains, while niche producers focus on specialized blends that match whipping, binding, and emulsifying functions. Competitive intensity rises as manufacturers pursue collaborations with food processors to refine texture, flavor, and stability in final products.

Recent Developments:

- In September 2025, ADM announced a joint venture with Alltech to enhance its animal nutrition business. ADM will contribute its 11 U.S. feed mills to the venture, while Alltech will provide 18 feed mills in the U.S. and 15 in Canada. Alltech will hold the majority stake (60% ownership), and the joint venture will be overseen by a board with equal representation from both firms. This transaction aligns with ADM’s strategy to diversify its animal nutrition business into higher-growth and higher-margin specialty animal nutrition ingredients. The companies expect to complete the transaction and formally launch the joint venture in the first quarter of 2026.

- In May 2025, Ingredion promoted its VITESSENCE® pea protein as a clean-label, allergen-free, and shelf-stable egg replacement solution across bakery, dairy, snacks, beverages, and savory applications. This initiative was launched in response to soaring egg prices, which increased by 53% between January 2024 and early 2025, driving manufacturers to seek cost-effective alternatives like plant-based egg substitutes to stay competitive and manage supply chain volatility.

- In April 2025, Corbion launched Vantage™ 12E and Vantage™ 11E, two innovative egg replacers designed specifically for bakery manufacturers. These patent-pending solutions provide superior moisture retention, structure, and mouthfeel while offering cost savings and supply stability to help bakeries mitigate the risks of fluctuating egg prices and avian flu-related supply disruptions. The products are part of Corbion’s comprehensive portfolio of egg replacement products, which includes whole egg extenders, egg white substitutes, and allergen-friendly egg wash alternatives.

Report Coverage:

The research report offers an in-depth analysis based on By Ingredient Type (Dairy protein, Soy-based products, Starch, Algal flour, Plant protein), By Application (Bakery & confectionery, Sauces & dressings, Mayonnaise), and By Form (Dry/Powder, Liquid). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises for clean-label and allergen-free ingredients across bakery and processed foods.

- Plant-protein innovation strengthens functionality for binding, aeration, and moisture retention.

- Growth accelerates in vegan and flexitarian food categories across global markets.

- Manufacturers adopt hybrid formulations that combine proteins, fibers, and starches.

- Foodservice chains expand menus with egg-free bakery and dressing options.

- Investment in fermentation-based ingredients increases due to performance advantages.

- Emerging regions gain traction through rising packaged food consumption.

- Companies upgrade sustainability practices across sourcing and production.

- Dry and powder formats gain wider industrial preference for stability and storage benefits.

- Collaborations grow between ingredient suppliers and food processors to refine product performance.