Market Overview

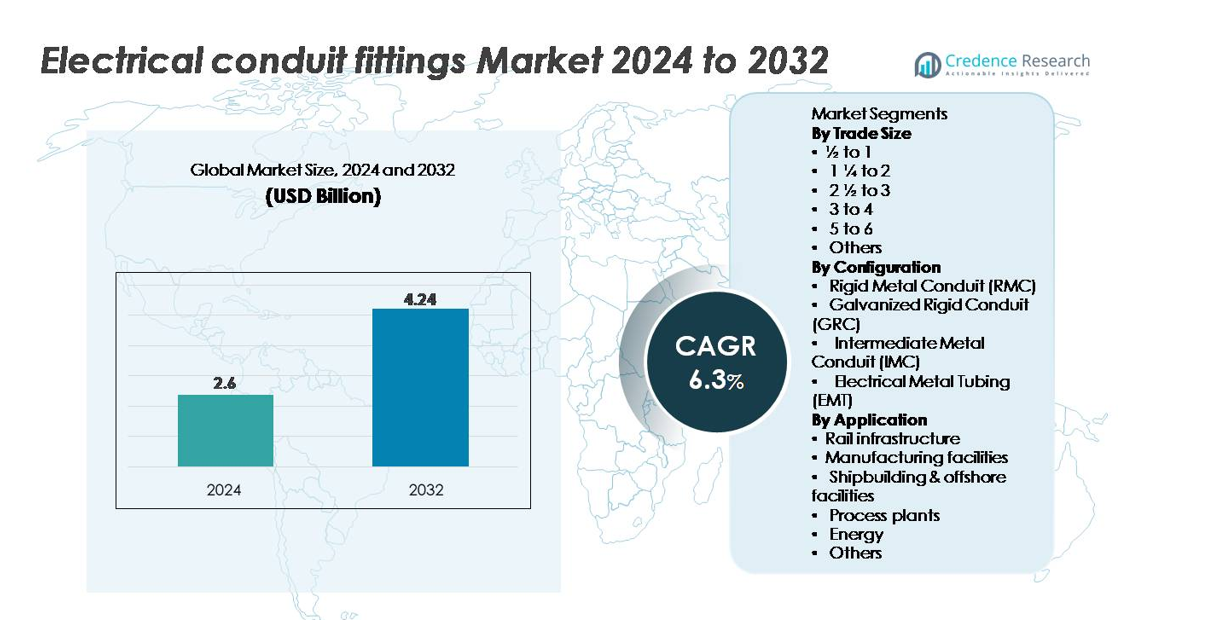

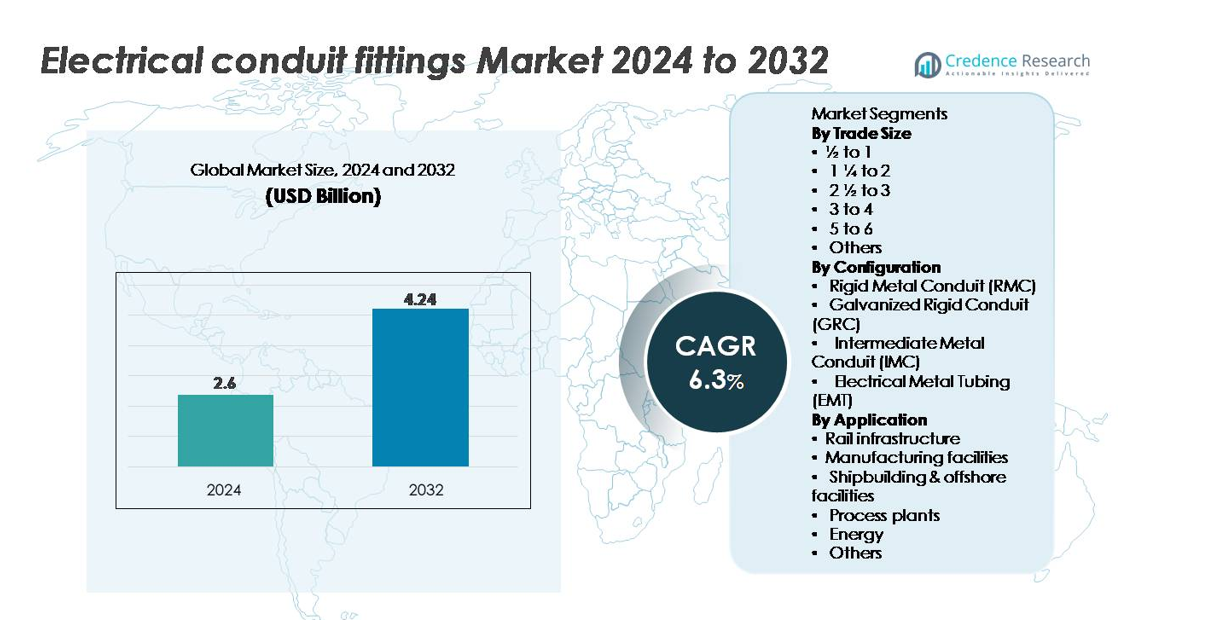

The electrical conduit fitting market was valued at USD 2.6 billion in 2024 and is projected to reach USD 4.24 billion by 2032, expanding at a CAGR of 6.3% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Conduit Fittings Market Size 2024 |

USD 2.6 billion |

| Electrical Conduit Fittings Market, CAGR |

6.3% |

| Electrical Conduit Fittings Market Size 2032 |

USD 4.24 billion |

The electrical conduit fitting market is shaped by strong competition among global manufacturers such as Techno Flex, Gibson Stainless & Specialty, Nucor Tubular Products, Legrand, American Conduit, HellermannTyton, Schneider Electric, Flexa, Anamet Electrical, and Atkore, each leveraging material innovation, corrosion-resistant designs, and extensive distribution networks to strengthen market penetration. Asia-Pacific leads the global market with a 36% share, driven by rapid industrialization, large-scale construction, and expanding power infrastructure. North America and Europe follow, supported by stringent electrical safety standards and modernization of commercial and industrial facilities. Companies continue to compete through advanced manufacturing, certification compliance, and engineered fittings tailored for high-performance applications across diverse installation environments

Market Insights

- The electrical conduit fitting market was valued at USD 2.6 billion in 2024 and is projected to reach USD 4.24 billion by 2032, registering a CAGR of 6.3% during the forecast period.

- Strong demand is driven by rapid commercial construction, industrial electrification, and stringent safety regulations that accelerate adoption of EMT, IMC, GRC, and RMC-compatible fittings across diverse wiring systems.

- Key trends include rising preference for corrosion-resistant stainless steel and coated fittings, expansion of modular and tool-less connector designs, and increasing use of digital planning tools like BIM for accurate conduit routing.

- Competition intensifies among major players such as Techno Flex, Gibson Stainless & Specialty, Nucor Tubular Products, Legrand, American Conduit, HellermannTyton, Schneider Electric, Flexa, Anamet Electrical, and Atkore, each strengthening portfolios and distribution networks.

- Asia-Pacific leads with 36% share, followed by North America at 32% and Europe at 24%, while EMT remains the dominant configuration segment and ½ to 1 inch trade size accounts for the highest installation volume.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Trade Size

Trade sizes ½ to 1 inch form the dominant sub-segment in the electrical conduit fitting market, driven by their extensive use in residential and light-commercial wiring projects where compact circuits and branch connections are common. Their high throughput in renovation and small-scale construction ensures continuous demand, while compatibility with EMT and IMC systems strengthens adoption across contractors. Larger trade sizes such as 1¼ to 2 inches and 2½ to 3 inches support industrial cabling but remain secondary due to lower installation frequency. Sizes above 3 inches primarily serve specialized heavy-duty applications.

- For instance, Atkore produces EMT and IMC steel conduit that meets UL-797 and UL-1242 standards across its U.S. manufacturing network. The company operates over 60 manufacturing and distribution sites globally, supporting consistent quality and high-volume conduit supply.

By Configuration

Electrical Metal Tubing (EMT) emerges as the leading configuration, supported by its lightweight design, fast installation characteristics, and strong preference in commercial buildings and industrial fit-outs. EMT’s bendability and lower material cost compared to rigid metal conduits make it the first choice for large electrical contractors seeking installation efficiency. Rigid Metal Conduit (RMC) and Galvanized Rigid Conduit (GRC) dominate in harsh and hazardous environments, offering superior corrosion protection, while Intermediate Metal Conduit (IMC) provides a balanced option for weight-sensitive industrial installations.

- For instance, Gibson Stainless & Specialty produces 316 stainless-steel conduit fittings with a typical tensile strength of 515 MPa and a 205 MPa yield rating. These mechanical properties support reliable performance in harsh petrochemical and offshore environments where corrosion resistance is critical.

By Application

Manufacturing facilities represent the dominant application segment, driven by continuous expansion of automated production lines, extensive machinery wiring, and stringent safety requirements for enclosed electrical systems. High power-load distribution, equipment interconnections, and control room cabling significantly increase demand for heavy-duty conduit fittings. Rail infrastructure and process plants follow, supported by large-scale electrification upgrades and stringent compliance norms. Shipbuilding and offshore facilities require corrosion-resistant conduit solutions, while the energy sector particularly substations and renewable energy assets utilizes robust configurations to support long-distance, high-reliability cabling networks.

Key Growth Drivers

Expansion of Commercial, Industrial, and Infrastructure Construction

Rising global investment in commercial, industrial, and public infrastructure development serves as a major growth catalyst for electrical conduit fittings. Rapid construction of commercial complexes, logistics hubs, data centers, and healthcare facilities drives higher consumption of secure wiring systems. Industrial expansions involving manufacturing lines, automation equipment, and high-load electrical networks further strengthen demand for conduit fittings capable of supporting heavy mechanical stress, corrosive exposure, and long cable runs. Urban infrastructure upgrades such as smart transportation systems, metro rail corridors, and utility modernization programs continue to adopt structured conduit-based wiring to meet compliance and safety norms. Renovation and retrofitting activities in aging facilities also increase replacement demand for connectors, couplings, elbows, and compression fittings. The cumulative effect of ongoing construction activity and rising regulatory pressure for safe, enclosed wiring significantly supports long-term market expansion.

- For instance, Legrand reports a global portfolio of over 300,000 product references supported by manufacturing operations across nearly 90 countries. This network enables steady supply of wiring devices, cable-management systems, and conduit accessories for commercial and industrial projects.

Increasing Focus on Electrical Safety and Regulatory Compliance

Growing emphasis on electrical safety across commercial, industrial, and high-risk environments continues to push adoption of conduit fittings designed to protect wiring integrity. Regulatory bodies such as the NEC, IEC, and regional authorities enforce strict standards related to mechanical protection, grounding continuity, corrosion resistance, and fire safety. Industries involving high temperatures, vibration, chemicals, or explosion-prone atmospheres increasingly require rigid metallic conduit systems and reinforced fittings. Insurance-driven compliance audits further accelerate replacement of outdated wiring accessories. As organizations strengthen EHS (Environment, Health, and Safety) programs, they prioritize conduit fittings that minimize risk of arc faults, short circuits, moisture ingress, and cable degradation. The necessity for code-compliant installations in warehouses, plants, public buildings, and transportation sectors positions safety regulations as a key market driver.

- For instance, Schneider Electric operates globally in electrical distribution and energy-management systems. Its product range covers low-voltage distribution gear, switches, sockets, switchboards and related components used in residential, commercial and industrial settings.

Electrification of Industrial Processes and Rise of Automation

The growing shift toward electrification of industrial processes and adoption of Industry 4.0 technologies significantly increases the need for robust conduit infrastructure. Automated production lines, robotics, CNC machinery, and high-density control wiring require secure routing solutions capable of protecting sensitive cables from abrasion, vibration, and EMI exposure. Electrification of pumping systems, HVAC units, mining equipment, and power-distribution assets also expands heavy-duty conduit fitting usage. The integration of sensing devices, IoT nodes, and monitoring systems in factory environments results in more cabling density, prompting demand for precise junction fittings, expansion couplings, and grounding accessories. As industries transition toward smart, digitally enabled operations, the need for reliable, organized, and scalable wiring frameworks strengthens the adoption of advanced conduit fittings.

Key Trends and Opportunities

Growth of Corrosion-Resistant and Specialty Material Fittings

A key market trend revolves around increasing demand for corrosion-resistant fittings made from stainless steel, hot-dip galvanized steel, PVC-coated metals, and advanced polymer composites. Industries such as shipbuilding, offshore energy, petrochemicals, and wastewater treatment require fittings capable of withstanding saltwater exposure, chemical splash, and high humidity. The rise of cleanrooms, pharmaceuticals, and food processing facilities also boosts adoption of hygienic, easy-to-clean conduit systems. Manufacturers are expanding portfolios to include fittings with enhanced sealing mechanisms, improved thread integrity, and high-grade coatings. This trend creates strong opportunities for suppliers developing specialized material technologies to meet environmental, thermal, and mechanical performance requirements across harsh operating conditions.

Digitization of Electrical Planning and Rise of Pre-Engineered Installation Systems

An emerging opportunity lies in the adoption of digital construction tools such as BIM-based electrical routing, 3D layout optimization, and automated bill-of-material generation which increases demand for standardized, precision-engineered conduit fittings. Pre-engineered fitting kits, modular assemblies, and quick-connect accessories accelerate installation speed, reduce labor cost, and enhance consistency across large building projects. Contractors increasingly prefer fittings compatible with automated bending tools, robotic installation systems, and smart tagging for asset tracking. As construction firms digitalize workflows and adopt prefabrication practices, suppliers offering integrated, installation-ready conduit fitting systems stand to gain a competitive edge.

- For instance, Atkore offers Revit-compatible BIM files for more than 2,000 conduit, strut, and cable-management products through its official BIM library, enabling accurate digital electrical-routing and automated bill-of-material generation in large construction projects.

Rising Investments in Renewable Energy and Power Infrastructure

The global shift toward renewable energy including solar farms, wind plants, hydrogen facilities, and battery-energy storage projects creates substantial opportunities for electrical conduit fittings tailored for outdoor, high-voltage, and vibration-intensive settings. Renewable installations require extensive cabling networks for inverters, substations, transformers, and monitoring devices, driving demand for robust conduit fittings that withstand UV, moisture, and thermal cycles. Grid modernization initiatives, including substation upgrades and underground cabling programs, further support adoption. As energy transition accelerates, conduit fittings used in power-distribution architecture experience sustained long-term growth.

- For instance, ABB’s Elastimold™ solid-dielectric underground distribution system includes 15 kV, 25 kV, and 35 kV rated components tested to IEEE 386 standards, which are deployed in solar and wind substations that require conduit-compatible terminations capable of withstanding outdoor thermal cycling and high-voltage stress.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

The conduit fitting market faces significant challenges stemming from volatile steel, aluminum, and polymer prices, which directly impact manufacturing costs and pricing stability. Supply chain disruptions from geopolitical instability, freight constraints, or shortages of galvanized steel further strain production cycles and delivery timelines. Manufacturers face rising expenses related to coatings, threading processes, and precision machining. These fluctuations limit profit margins, complicate long-term contracting, and pressure suppliers to diversify sourcing. Smaller manufacturers struggle to maintain competitiveness against large players with vertically integrated supply chains, magnifying raw material dependency as a major industry challenge.

Labor Shortages and Installation Skill Gaps in Electrical Contracting

A persistent shortage of trained electricians and skilled installers poses operational challenges, particularly in industrial and large-scale commercial projects that rely heavily on conduit-based wiring. Inadequate skill levels result in installation errors, longer project timelines, and higher rework costs, reducing overall productivity. Complex conduit layouts especially involving rigid metal systems, hazardous-area compliance, and precision bending require technicians with specialized expertise. As construction demand grows faster than workforce availability, contractors increasingly face delays and capacity constraints. This shortage pressures manufacturers to offer simplified, modular, and tool-less fitting designs to mitigate installation complexity.

Regional Analysis

North America

North America holds around 32% of the electrical conduit fitting market, driven by robust commercial construction, modernization of utility grids, and strong adherence to NEC regulatory standards. The U.S. leads regional demand due to extensive investments in data centers, logistics infrastructure, and industrial automation. Large-scale renovation of aging electrical systems in manufacturing, transportation, and institutional facilities further accelerates replacement demand for conduit fittings. High adoption of EMT and rigid metal conduits, combined with rising spending on renewable power installations, strengthens long-term market growth across the region.

Europe

Europe captures an estimated 24% share, fueled by strict electrical safety regulations, continuous industrial modernization, and rapid expansion of rail, renewable energy, and public infrastructure projects. Countries such as Germany, the UK, France, and the Nordics drive demand for corrosion-resistant and fire-rated conduit fittings used across advanced manufacturing, process industries, and smart building networks. Ongoing retrofitting of old commercial structures and renewed investments in offshore wind projects support uptake of metallic and specialty-coated fittings. Emphasis on sustainability, energy efficiency, and EN/IEC compliance reinforces Europe’s position as a technically mature market.

Asia-Pacific

Asia-Pacific leads the global market with approximately 36% share, supported by large-scale urbanization, expanding industrial corridors, and high public spending on transportation, rail, and energy infrastructure. China, India, Japan, and Southeast Asia exhibit strong demand for EMT, IMC, and GRC systems across factories, commercial buildings, and utility networks. The region’s booming manufacturing sector especially electronics, automotive, and chemicals drives extensive use of conduit-based wiring for high-density electrical installations. Government-led smart city programs and rapid growth in renewable energy assets further amplify the need for durable, scalable conduit fittings.

Latin America

Latin America accounts for roughly 5% of global demand, shaped by expanding industrial activities, mining operations, and infrastructure upgrades across Brazil, Mexico, Chile, and Colombia. Increasing investments in oil & gas, hydroelectric power, and transportation networks support greater usage of rugged conduit fittings suitable for high-vibration and corrosive environments. Urban expansion and modernization of commercial buildings also contribute to steady adoption. However, economic fluctuations and slower construction cycles limit broader market penetration. As regional safety codes strengthen and private-sector industrialization grows, demand for standardized conduit systems is expected to rise.

Middle East & Africa

The Middle East & Africa region holds close to 3% share, driven by ongoing construction megaprojects, oil & gas facility development, and utility expansion programs. GCC countries including Saudi Arabia, the UAE, and Qatar boost demand for heavy-duty, corrosion-resistant conduit fittings used in high-temperature and hazardous industrial environments. Africa’s growing power distribution and mining sectors drive incremental adoption, though infrastructure gaps constrain rapid scaling. Increasing investments in commercial real estate, renewable energy, and industrial zones support moderate long-term growth, especially for galvanized and rigid metal conduit systems capable of withstanding harsh climatic conditions.

Market Segmentations:

By Trade Size

- ½ to 1

- 1 ¼ to 2

- 2 ½ to 3

- 3 to 4

- 5 to 6

- Others

By Configuration

- Rigid Metal Conduit (RMC)

- Galvanized Rigid Conduit (GRC)

- Intermediate Metal Conduit (IMC)

- Electrical Metal Tubing (EMT)

By Application

- Rail infrastructure

- Manufacturing facilities

- Shipbuilding & offshore facilities

- Process plants

- Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electrical conduit fitting market is characterized by a mix of global manufacturers and regional specialists competing through product quality, material innovation, and compliance-driven engineering. Leading players focus on expanding portfolios of EMT, IMC, GRC, and RMC-compatible fittings while integrating corrosion-resistant coatings, high-strength alloys, and precision threading technologies to meet stringent installation standards. Companies strengthen market presence through strategic distribution networks, contractor partnerships, and training programs that support efficient field installation. Competition intensifies as manufacturers introduce modular, quick-connect, and tool-less fittings that reduce labor time and improve alignment accuracy in large commercial and industrial projects. Firms also invest in digital catalogues, BIM-compatible product libraries, and automated manufacturing systems to enhance consistency and supply reliability. With rising infrastructure demand and tightening electrical safety regulations, companies with strong technical credibility, certification compliance, and robust after-sales support maintain a clear competitive advantage across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

Recent Developments

- In August 2025, Techno Flex expanded its manufacturing footprint with a new, state-of-the-art facility in the SEZ at Pithampur, Madhya Pradesh. This expansion is aimed at increasing capacity for conduit pipes and fittings and supporting both domestic and export markets.

- In July 9, 2025, Gibson Stainless & Specialty, Inc. announced product-line enhancements targeting the food & beverage sector shifting from paper labels to laser marking and extending female ports to fully enclose male threads for hygienic, debris-free conduit fittings.

- In May 2024, Atkore issued Environmental Product Declarations (EPDs) for its stainless steel, galvanized steel, and PVC conduits and fittings. Verified by an independent third party, the EPDs outlined the environmental impacts throughout the product lifecycle, including greenhouse gas emissions and energy consumption. This initiative highlights Atkore’s commitment to sustainability, helping customers make informed decisions and support green building certifications.

Report Coverage

The research report offers an in-depth analysis based on Trade size, Configruation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as large commercial, industrial, and infrastructure projects continue adopting enclosed wiring systems for enhanced safety and durability.

- Rising automation and electrification in manufacturing facilities will increase the need for high-performance conduit fittings supporting dense, vibration-prone electrical networks.

- Adoption of corrosion-resistant and specialty material fittings will accelerate as offshore, marine, and process industries expand and tighten compliance requirements.

- Digital construction tools such as BIM and prefabrication workflows will drive demand for standardized, installation-ready conduit fitting solutions.

- Smart buildings and advanced HVAC, security, and energy-management systems will boost uptake of adaptable conduit fittings for integrated electrical routing.

- Growth in renewable energy solar, wind, hydrogen, and storage assets will expand applications requiring outdoor-grade, UV-resistant, and heavy-duty fittings.

- Manufacturers will increasingly invest in modular, quick-connect, and tool-less designs to reduce labor time amid persistent electrical workforce shortages.

- Sustainability initiatives will encourage development of recyclable materials, low-emission coatings, and longer-life conduit systems.

- Strengthening regulatory standards across global markets will accelerate replacement of outdated wiring hardware with code-compliant fittings.

- Expanding distribution networks and e-commerce channels will improve product availability and accelerate adoption across small contractors and regional construction markets.