Market Overview

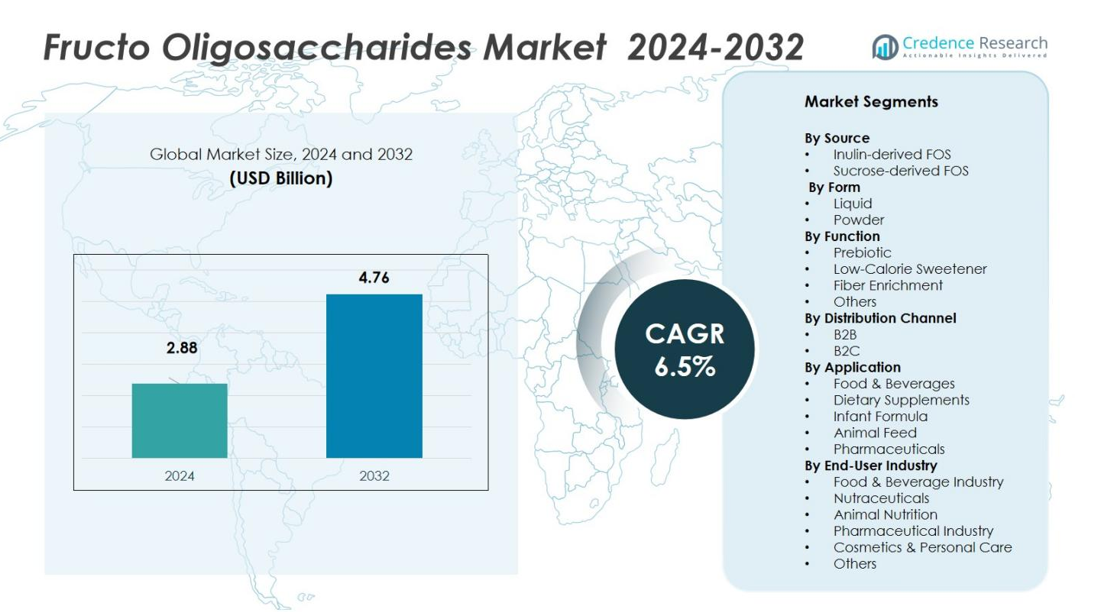

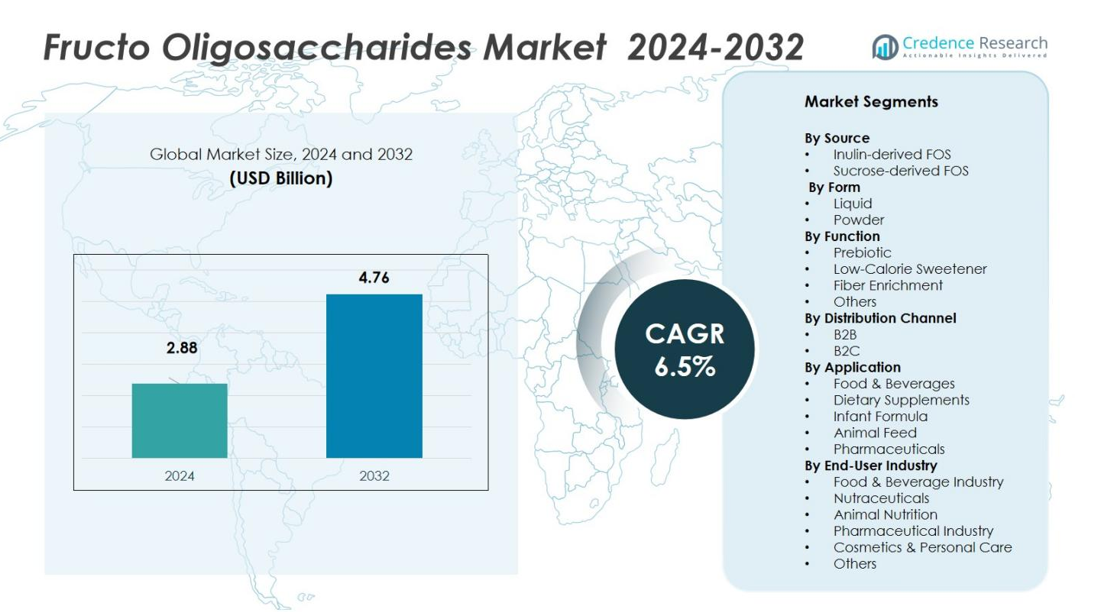

Fructo Oligosaccharides Market size was valued at USD 2.88 billion in 2024 and is anticipated to reach USD 4.76 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fructo Oligosaccharides Market Size 2024 |

USD 2.88 billion |

| Fructo Oligosaccharides Market, CAGR |

6.5% |

| Fructo Oligosaccharides Market Size 2032 |

USD 4.76 billion |

The Fructo Oligosaccharides Market is characterized by intense competition among major global players such as Cargill, Incorporated, Tate & Lyle PLC, BENEO GmbH, Roquette Frères, Meiji Holdings Co., Ltd., Ingredion Incorporated, FrieslandCampina Domo, COSUCRA Groupe Warcoing SA, Quantum Hi-Tech (China) Biological Co., Ltd., and Jarrow Formulas, Inc. These companies emphasize expanding product portfolios, improving extraction efficiency, and investing in advanced biotechnological processes to enhance purity and functionality. They also engage in strategic mergers, acquisitions, and collaborations to strengthen market presence and expand global reach. Asia Pacific leads the global market with a 34% share in 2024, driven by rapid urbanization, increasing health awareness, and high consumption of functional foods and beverages. North America follows with 28%, supported by rising demand for dietary supplements and prebiotic-enriched foods, while Europe holds 26%, benefiting from strong regulatory support and a growing preference for sustainable, plant-based nutrition across major economies.

Market Insights

- The Fructo Oligosaccharides Market was valued at USD 2.88 billion in 2024 and is projected to reach USD 4.76 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

- Rising demand for prebiotic and functional foods drives market growth, supported by consumer awareness of digestive and immune health benefits.

- Key trends include increased use of FOS in clean-label, low-calorie, and plant-based formulations across food, beverage, and nutraceutical sectors.

- The market is competitive, with major players such as Cargill, Tate & Lyle, BENEO, Roquette, and Ingredion investing in biotechnological advancements and sustainable production methods.

- Asia Pacific leads with 34% share, followed by North America at 28% and Europe at 26%, while the inulin-derived FOS segment dominates with 65% share due to abundant chicory root availability and strong application in dietary supplements and functional foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Inulin-derived FOS dominates the global Fructo Oligosaccharides Market, holding nearly 65% share in 2024. Its dominance is driven by the abundant availability of chicory root and its efficient extraction process, which supports large-scale production. The ingredient’s strong prebiotic functionality, higher fiber content, and clean-label appeal further strengthen its demand in food and beverage formulations. Sucrose-derived FOS, while growing steadily, remains secondary due to higher processing costs and limited raw material adaptability. However, technological improvements in enzymatic synthesis are gradually expanding its industrial application.

- For instance, Beneo introduced Beneo-scL85, a short-chain fructooligosaccharide (scFOS) ingredient in 2023, designed to reduce sugar content and boost dietary fiber in various food products, showcasing large-scale production capacity.

By Form

The powder segment leads the Fructo Oligosaccharides Market with approximately 58% market share in 2024. Powder FOS is widely preferred for its extended shelf life, ease of transportation, and compatibility with functional foods and supplements. It is commonly used in dairy products, bakery goods, and nutritional powders to enhance fiber intake. The liquid form segment follows, supported by its increasing use in beverages and infant formulas. The liquid type’s fast absorption and blending efficiency make it attractive for health drink manufacturers, especially in Asia-Pacific and Europe.

- For instance, Tereos introduced its powder FOS under the brand Actilight, which is used to enrich fiber content in bakery goods and breakfast cereals across Europe.

By Function

Prebiotic function accounts for the largest share, capturing nearly 60% of the Fructo Oligosaccharides Market in 2024. The growth stems from rising consumer awareness about gut health and immunity, driving FOS inclusion in probiotics and dietary supplements. Its ability to stimulate beneficial gut bacteria like Bifidobacteria and Lactobacillus boosts its popularity. Low-calorie sweeteners and fiber enrichment applications also contribute significantly, as FOS helps reduce sugar content in foods while improving texture and taste. Growing adoption in functional snacks and beverages further strengthens its role as a versatile ingredient in modern nutrition.

Key Growth Drivers

Rising Demand for Functional and Prebiotic Foods

The increasing consumer focus on digestive health and immunity is driving demand for prebiotic ingredients. Fructo oligosaccharides (FOS) are gaining traction in yogurts, nutrition bars, and dietary supplements due to their ability to enhance gut microflora and support immune balance. Food manufacturers are incorporating FOS into clean-label and plant-based products, responding to growing health-conscious trends. Expanding awareness of prebiotics’ benefits and supportive clinical studies continue to strengthen their inclusion across global food and beverage portfolios.

- For instance, FrieslandCampina introduced a range of yogurt drinks enriched with FOS, aimed at supporting gut health and immune function.

Expansion of Health and Wellness Industry

The global wellness industry’s rapid growth boosts FOS consumption in fortified foods and nutraceuticals. Consumers seeking natural and low-calorie alternatives prefer FOS for its mild sweetness and minimal glycemic response. Manufacturers in functional beverages and dietary supplements are integrating FOS to improve texture and fiber content. The increasing prevalence of obesity and diabetes accelerates this trend, with companies developing FOS-based formulations that promote metabolic health and calorie reduction without compromising taste or stability.

- For instance, GNC has launched a line of digestive health supplements featuring FOS as a key prebiotic ingredient to support gut health and metabolic wellness.

Technological Advancements in FOS Production

Advances in enzymatic synthesis and fermentation have made FOS production more efficient and cost-effective. Improved extraction techniques from inulin and sucrose sources enhance purity levels and yield. Manufacturers are adopting biotechnological processes that reduce waste and energy use, aligning with sustainability goals. These innovations allow large-scale production and broader application in pharmaceuticals, animal nutrition, and infant foods. Continuous R&D investments from ingredient producers are expected to expand product quality and customization, boosting FOS market penetration worldwide.

Key Trends & Opportunities

Integration into Plant-Based and Clean-Label Products

Plant-based diets and clean-label demands are creating major opportunities for FOS inclusion. Consumers prefer natural fiber sources that improve gut health while maintaining transparency in ingredients. FOS blends well with plant proteins and dairy alternatives, improving taste and texture profiles. Manufacturers are leveraging this compatibility to launch prebiotic-rich vegan yogurts, smoothies, and snacks. The trend aligns with global health movements emphasizing sustainable nutrition, giving FOS a vital role in the evolving plant-based food ecosystem.

- For instance, Wellme, a Shanghai startup, introduced chickpea-based vegan yogurts incorporating FOS and probiotics, aimed at improving immunity and gut health in the Chinese market.

Growth in Infant and Geriatric Nutrition Applications

The expanding infant formula and elderly nutrition sectors are driving new FOS applications. In infant formulas, FOS helps mimic the prebiotic effect of human milk oligosaccharides, promoting healthy gut development. For older adults, FOS-enriched foods aid digestion and calcium absorption. Global brands are investing in clinical research to enhance FOS formulations for specific age groups. This rising adoption across life-stage nutrition products represents a major long-term opportunity for manufacturers focusing on personalized health solutions.

- For instance, Abbott Nutrition launched Ensure with added FOS, demonstrating benefits for calcium absorption and digestive comfort in elderly consumers based on company-led studies.

Key Challenges

High Production Costs and Limited Raw Material Availability

The high cost of FOS production, especially for inulin-derived sources, poses a significant challenge. Extraction and purification processes require advanced technology and consistent access to raw materials like chicory root. Seasonal fluctuations in supply and energy-intensive manufacturing increase overall costs. Smaller producers face difficulty competing with established players that benefit from economies of scale. These constraints can limit price competitiveness, especially in emerging markets where cost-sensitive consumers dominate functional food consumption.

Regulatory Barriers and Labeling Constraints

Complex regulations surrounding prebiotic claims and food labeling limit market expansion. Different countries have varying definitions and approvals for FOS usage, creating compliance challenges for global brands. The lack of harmonized standards delays product launches and increases certification costs. Additionally, health claims related to digestive or immune benefits often require rigorous clinical validation. These restrictions discourage smaller manufacturers from entering the market and slow the adoption of FOS-enriched products across new regions and product categories.

Regional Analysis

North America

North America holds a 28% share of the global Fructo Oligosaccharides Market in 2024, driven by strong demand for functional and prebiotic foods. Rising health awareness and the prevalence of digestive disorders encourage the use of FOS in dietary supplements and fortified foods. The U.S. leads regional consumption due to its mature nutraceutical industry and clean-label trend adoption. Food manufacturers increasingly integrate FOS into low-sugar products to cater to diabetic and obese consumers. Canada and Mexico also witness growth supported by expanding functional beverage markets and a shift toward gut-friendly nutrition.

Europe

Europe accounts for a 26% market share in the Fructo Oligosaccharides Market, supported by established food and nutrition industries. The region’s regulatory support for dietary fibers and prebiotic labeling fosters adoption in dairy and bakery segments. Countries like Germany, France, and the U.K. lead the consumption due to a growing preference for natural sweeteners and digestive health products. European manufacturers focus on sustainable sourcing of inulin-based FOS from chicory roots, enhancing local production efficiency. The increasing trend of plant-based and organic nutrition further fuels FOS demand across food and nutraceutical applications.

Asia Pacific

Asia Pacific dominates the Fructo Oligosaccharides Market with a 34% share in 2024, emerging as the fastest-growing region. High population density, rising disposable income, and increasing awareness of gut health drive strong demand in China, Japan, and India. The expansion of functional beverages and infant nutrition industries boosts FOS consumption. Japanese and South Korean companies lead innovation in FOS-enriched dairy and health drinks. Growing health-conscious urban populations and government campaigns promoting fiber intake further support market growth. Local production advancements and affordable distribution channels sustain Asia Pacific’s leadership in global FOS trade.

Latin America

Latin America captures a 7% share of the Fructo Oligosaccharides Market, with Brazil and Mexico driving regional growth. Rising demand for low-calorie sweeteners and prebiotic foods supports market expansion across bakery, dairy, and beverage sectors. The growing prevalence of obesity and diabetes encourages consumers to adopt functional ingredients like FOS for better digestion and calorie management. Local manufacturers are investing in partnerships to expand product portfolios and meet health-driven consumer preferences. Increased awareness of gut health and government focus on nutrition labeling contribute to gradual adoption across the region.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the Fructo Oligosaccharides Market, supported by a growing demand for health-oriented food products. Urbanization and rising disposable income encourage consumers to choose functional foods and dietary supplements enriched with FOS. South Africa, the UAE, and Saudi Arabia lead consumption due to expanding retail and e-commerce channels. Import dependence remains high, but increasing awareness of digestive wellness drives adoption in dairy and beverage products. Regional investments in food processing and nutritional innovation are expected to strengthen market penetration further.

Market Segmentations:

By Source

- Inulin-derived FOS

- Sucrose-derived FOS

By Form

By Function

- Prebiotic

- Low-Calorie Sweetener

- Fiber Enrichment

- Others

By Distribution Channel

By Application

- Food & Beverages

- Dietary Supplements

- Infant Formula

- Animal Feed

- Pharmaceuticals

By End-User Industry

- Food & Beverage Industry

- Nutraceuticals

- Animal Nutrition

- Pharmaceutical Industry

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fructo Oligosaccharides Market features major players such as Cargill, Incorporated, Tate & Lyle PLC, BENEO GmbH, Roquette Frères, Meiji Holdings Co., Ltd., Ingredion Incorporated, FrieslandCampina Domo, COSUCRA Groupe Warcoing SA, Quantum Hi-Tech (China) Biological Co., Ltd., and Jarrow Formulas, Inc. These companies focus on expanding product portfolios, enhancing purity levels, and improving extraction efficiency through advanced biotechnological processes. Strategic partnerships and acquisitions are key growth approaches to strengthen global distribution networks and meet rising demand for prebiotic ingredients. Leading players invest heavily in R&D to develop customized FOS solutions targeting applications in infant formula, dietary supplements, and functional foods. Sustainability and clean-label trends drive innovation toward eco-friendly sourcing and low-energy manufacturing. Regional expansion, particularly in Asia Pacific and Europe, remains a strategic focus, as firms aim to capture emerging health-conscious consumer bases and diversify applications in both food and pharmaceutical sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill, Incorporated

- Tate & Lyle PLC

- BENEO GmbH

- Roquette Frères

- Meiji Holdings Co., Ltd.

- Ingredion Incorporated

- FrieslandCampina Domo

- COSUCRA Groupe Warcoing SA

- Quantum Hi-Tech (China) Biological Co., Ltd.

- Jarrow Formulas, Inc.

Recent Developments

- In May 2023, BENEO introduced Beneo scL85, a universal short-chain FOS ingredient developed for sugar reduct.

- In 2024, Meiji launched a new functional chocolate line in Japan where fructo oligosaccharides (FOS) replace added sugar. One variant features 50% less sugar, while another eliminates added sugar entirely, supporting gut health and calorie reduction.

- In 2024, Galam Group highlighted its GOFOS™ short-chain FOS product for sugar reduction and prebiotic applications at the IFT FIRST event

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Function, Distribution Channel, Application, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for prebiotic ingredients will continue to rise due to growing gut health awareness.

- Food and beverage manufacturers will expand FOS use in clean-label and plant-based products.

- Advancements in enzymatic and fermentation technologies will lower production costs.

- Asia Pacific will remain the fastest-growing region with expanding nutraceutical consumption.

- The pharmaceutical sector will increasingly adopt FOS for functional and therapeutic applications.

- Strategic collaborations between ingredient suppliers and food brands will strengthen global reach.

- Sustainability initiatives will drive adoption of eco-friendly and energy-efficient FOS production.

- Consumer demand for low-calorie sweeteners will boost FOS use in sugar-free formulations.

- Product diversification will expand applications in infant, sports, and elderly nutrition.

- Regulatory harmonization and clear labeling standards will support international market expansion.