Market Overview:

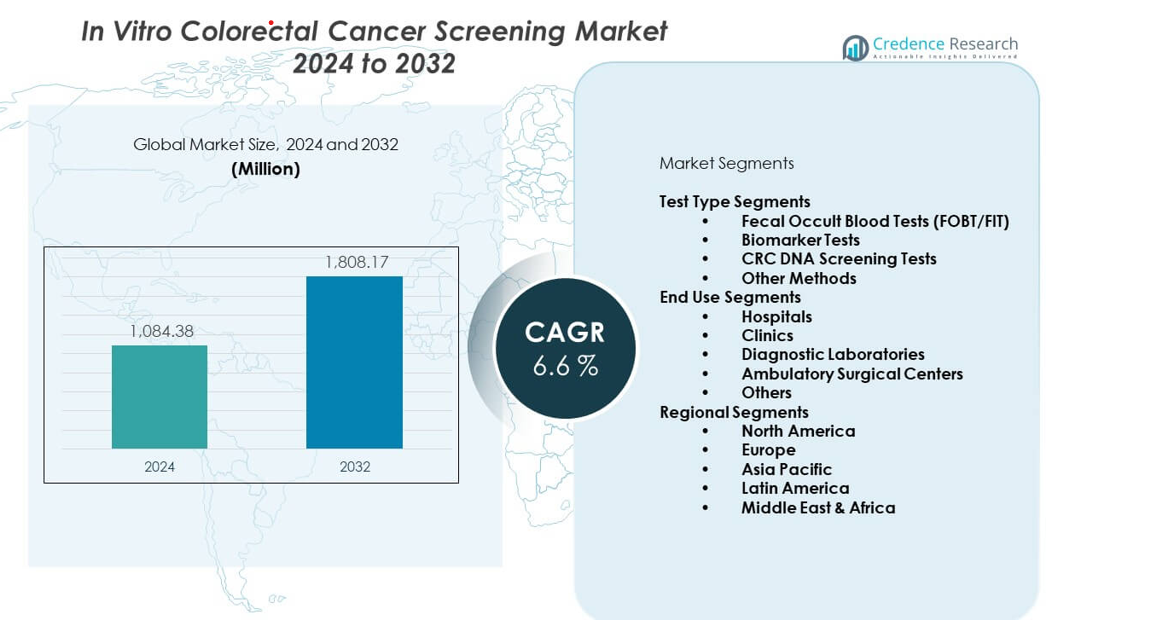

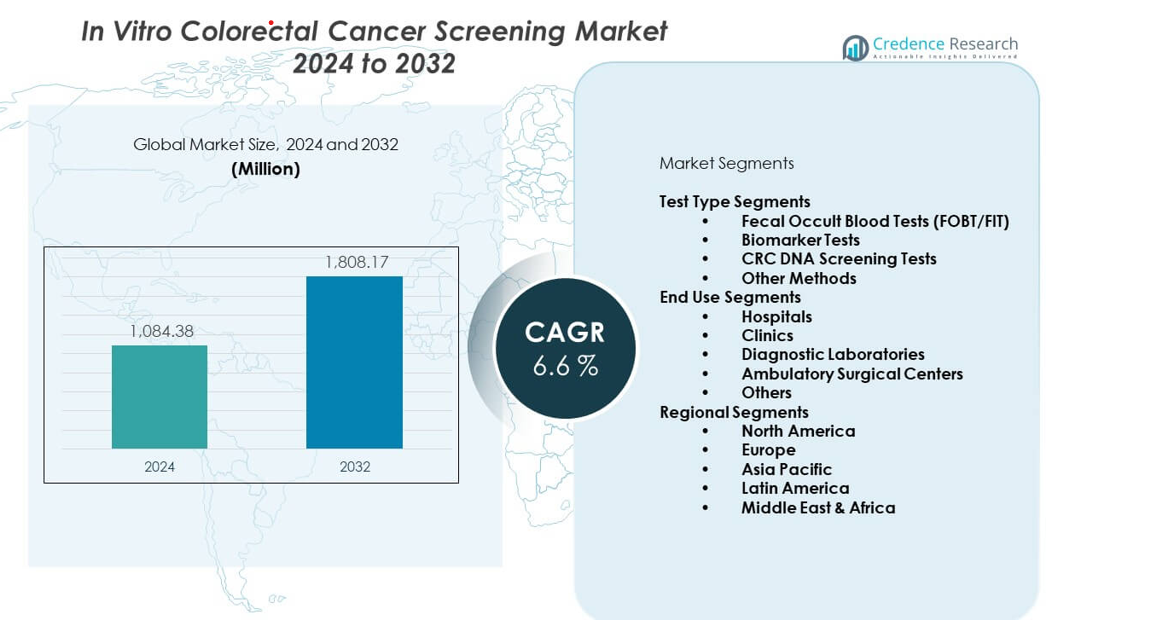

The In vitro colorectal cancer screening market is projected to grow from USD 1,084.38 million in 2024 to USD 1,808.17 million by 2032, with a CAGR of 6.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Vitro Colorectal Cancer Screening Market Size 2024 |

USD 1,084.38 million |

| In Vitro Colorectal Cancer Screening Market, CAGR |

6.6% |

| In Vitro Colorectal Cancer Screening Market Size 2032 |

USD 1,808.17 million |

Strong demand rises due to wider awareness of early cancer detection. Screening labs adopt advanced molecular tools that improve diagnostic accuracy. Healthcare systems push non-invasive kits for higher patient comfort. Governments expand coverage for population-based screening programs. Research groups develop markers that help detect tumors earlier. Hospitals prefer automated platforms that lower manual errors. Growth strengthens as payers support simple testing pathways.

North America leads due to strong screening adoption and mature clinical programs. Europe follows with high compliance supported by structured national initiatives. Asia Pacific emerges rapidly as healthcare access expands across large populations. China and India show rising uptake driven by improved lab capacity. Latin America grows steadily through better diagnostic funding. The Middle East begins to progress with new cancer awareness campaigns. Africa remains early-stage but gains momentum through expanding lab networks.

Market Insights:

- The In vitro colorectal cancer screening market is valued at USD 1,084.38 million in 2024 and is projected to reach USD 1,808.17 million by 2032, growing at a 6.6% CAGR driven by strong adoption of early-detection tools.

- North America holds about 40% share due to mature screening programs, Europe accounts for 30% with strong national guidelines, and Asia Pacific reaches 22% supported by expanding diagnostic capacity.

- Asia Pacific remains the fastest-growing region with its 22% share strengthened by rising CRC prevalence, improved infrastructure, and growing government-backed screening initiatives.

- FOBT/FIT leads the test type distribution with roughly 55% share, supported by affordability and integration into routine screening pathways.

- Hospitals remain the dominant end-use segment with nearly 40% share, driven by structured screening workflows and advanced diagnostic resources.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Need for Early Detection Supported by Expanding Screening Programs

Growing public focus on early tumor identification strengthens demand across global health systems. Hospitals prefer non-invasive kits that support higher compliance among older adults. Policymakers promote community outreach to raise awareness about screening routines. Laboratories install automated analyzers that deliver faster processing outcomes. Research groups explore new biomarkers that refine sensitivity for small tumor fragments. Insurance bodies widen access through updated reimbursement lists. Clinicians use structured guidelines that push routine assessments. The In vitro colorectal cancer screening market gains steady momentum through sustained public health prioritization.

- For instance, Roche’s cobas e 801 analyzer processes up to 300 tests per hour, improving throughput for large centers.

Rising Use of Advanced Molecular Technologies for Higher Diagnostic Accuracy

Growth accelerates due to rapid adoption of molecular assays that boost precision. Labs select DNA-based tests that help detect cancer risk in early stages. Developers design platforms that lower false-negative rates across diverse populations. Automated sequencing tools improve workflow speed for high-volume centers. Hospitals shift toward assays with stronger predictive value for treatment planning. Vendors upgrade chemistries that enhance tumor signal detection. Research institutes support trials that validate next-generation biomarkers. It drives greater confidence among healthcare professionals.

- For instance, Exact Sciences’ Cologuard test demonstrates 92% sensitivity for colorectal cancer and 42% sensitivity for advanced precancerous lesions, as confirmed by its FDA summary.

Expansion of Home-Based Screening Driving Wider Patient Participation Rates

Demand increases as home kits build comfort for individuals avoiding hospital visits. Users prefer simple sample-collection tools that reduce clinic load. Vendors design compact systems tailored for remote settings. Health agencies encourage widespread distribution to underserved groups. Digital platforms guide users with stepwise instructions for correct testing. Labs gain more samples from regions with limited clinical access. Adoption climbs through strong awareness campaigns that highlight convenience. The In vitro colorectal cancer screening market benefits from improved reach across rural zones.

Growing Investment in Cancer Prevention Programs Strengthening Large-Scale Adoption

Governments allocate funds to support structured national cancer prevention strategies. Public hospitals integrate regular screening cycles into primary care pathways. Training programs help clinicians maintain quality across testing workflows. Screening centers expand infrastructure for higher daily throughput. Academic bodies support studies that measure population-level outcomes. Funding groups encourage innovation through grants for diagnostic development. Partnerships with private labs improve sample handling capacity. It supports long-term screening sustainability in high-risk regions.

Market Trends:

Shift Toward Multi-Analyte Platforms Improving Comprehensive Cancer Assessment

Vendors create platforms that analyze multiple markers within one run. Labs favor consolidated workflows that lower operational complexity. Developers enhance assay profiles to include risk-specific markers. Providers promote bundled testing options for broader patient groups. Hospitals seek solutions that combine molecular and immunochemical results. Research labs test hybrid panels that improve detection stability. Developers refine test chemistry to increase consistency across samples. The In vitro colorectal cancer screening market follows demand for integrated diagnostic models.

- For instance, Guardant Health’s Shield blood-based test analyzes over 500 genomic and epigenomic features per sample, as referenced in published validation studies.

Adoption of AI Tools Supporting Automated Interpretation and Risk Prediction

AI systems help labs detect subtle mutations linked to early tumor growth. Developers launch tools that process large genomic datasets with improved clarity. Hospitals adopt software that flags patient-specific probabilities with better accuracy. Screening centers integrate automation to reduce manual reading errors. Vendors enhance platforms for scalable digital evaluation. Researchers validate models that support stronger clinical decision-making. Clinicians appreciate tools that improve turn-around timelines. It encourages broader digital acceptance across diagnostic pathways.

- For instance, Siemens Healthineers’ AI-Rad Companion platform has demonstrated up to 20% improvement in diagnostic consistency across clinical sites, based on multi-center evaluations published by the company.

Growth of Digital Reporting Solutions Simplifying Patient Communication and Record Access

Hospitals use electronic dashboards to help patients understand screening results. Labs transmit digital reports that shorten communication gaps. Providers prefer structured templates that improve clarity for clinical use. Patients access secure portals for record tracking. Vendors upgrade systems to support mobile-friendly formats. Digital workflows reduce printing steps across busy labs. Health systems link reports to electronic medical records for better continuity. The In vitro colorectal cancer screening market benefits from strong digital transformation momentum.

Rising Interest in Preventive Oncology Research Enhancing Screening Innovation Pipelines

Research bodies invest in projects exploring novel biomarker libraries. Clinical teams support longitudinal studies tracking genetic changes over time. Universities strengthen collaboration with diagnostic developers. Labs validate new markers for diverse ethnic groups. Funding agencies encourage projects focused on high-risk cohorts. Early-stage incubation centers help start-ups refine screening concepts. Hospitals join multi-center trials improving scientific evidence. It fosters a robust innovation cycle across global research networks.

Market Challenges Analysis:

High Operational Costs and Limited Access Across Low-Resource Regions

The In vitro colorectal cancer screening market faces challenges linked to cost-heavy instruments and specialized workflows. Smaller hospitals struggle to maintain equipment due to high service expenses. Labs in rural regions lack trained professionals to run complex assays. Market penetration slows in areas where reimbursement rules remain unclear. Patient uptake drops when screening centers operate with limited capacity. Policymakers find it difficult to standardize protocols across fragmented systems. Developers face hurdles scaling advanced platforms in low-income areas. It restricts widespread uniform adoption in underserved populations.

Variation in Test Accuracy and Limited Public Awareness Affecting Screening Uptake

Labs report inconsistent outcomes when older immunochemical kits lack sensitivity. Users remain unaware of early screening benefits in many developing regions. Doctors face difficulty convincing patients to complete routine assessments. Cultural barriers reduce acceptance of stool-based testing methods. Hospitals with limited outreach programs experience slower enrollment. Developers struggle to align test reliability across diverse genetic profiles. Governments find it challenging to launch sustained education campaigns. It creates gaps that restrict full-scale screening coverage.

Market Opportunities:

Expansion Potential Across High-Risk Population Groups Through Tailored Testing Approaches

Opportunities grow as health systems design tests for genetic risk clusters. Hospitals enhance screening cycles for families with hereditary cancer traits. Labs refine marker panels supporting earlier detection timelines. Vendors introduce simplified kits that attract younger adults. Public health bodies include risk-based strategies in national plans. Governments support programs for remote communities with limited hospital access. Research groups design validation studies for ethnicity-specific biomarkers. The In vitro colorectal cancer screening market gains room for strong expansion.

Rising Scope for Integrated Digital Ecosystems Supporting Scalable Screening Models

Growth potential increases as hospitals invest in digital tools for unified workflows. Labs adopt remote-reporting features that smooth patient tracking. Developers launch AI-backed assistants improving operator confidence. Health systems link screening platforms to telehealth programs. Vendors design scalable cloud-based modules for regional networks. Investors target startups offering flexible diagnostic technologies. It enables smoother expansion across both public and private institutions.

Market Segmentation Analysis:

Test Type Segments

The In vitro colorectal cancer screening market is shaped by diverse test types that support broad screening needs across global healthcare systems. Fecal Occult Blood Tests (FOBT/FIT) remain widely used due to their simple workflow and strong integration into routine population-based programs. Biomarker Tests gain traction through innovations that offer stronger accuracy and higher detection confidence for early-stage lesions. CRC DNA Screening Tests strengthen diagnostic value with sensitivity that helps identify precancerous changes. Other Methods contribute through emerging serological and molecular platforms that help expand options for risk-based screening pathways. It gains steady adoption as clinicians seek solutions that fit both high-volume and personalized screening environments.

- For instance, the FDA notes that stool DNA tests such as Cologuard deliver a specificity of 87% for cancer and advanced precancerous lesions, reinforcing clinical confidence.

End Use Segments

End-use adoption spans hospitals, clinics, diagnostic laboratories, ambulatory surgical centers, and other healthcare settings. Hospitals lead through structured screening integration that supports early case identification and referral workflows. Clinics provide accessible screening points for routine patient visits, helping raise overall participation. Diagnostic Laboratories experience rapid growth due to their ability to manage high testing volumes and support outsourced molecular analysis. Ambulatory Surgical Centers contribute by offering pre-procedure assessments and streamlined referrals. Other end users extend adoption across community networks where early detection programs continue to expand.

- For instance, Quest Diagnostics processes more than 550,000 tests per day across its national network, enabling high-volume CRC screening support through FIT and DNA-based platforms.

Segmentation:

Test Type Segments

- Fecal Occult Blood Tests (FOBT/FIT)

- Biomarker Tests

- CRC DNA Screening Tests

- Other Methods

End Use Segments

- Hospitals

- Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the In vitro colorectal cancer screening market, accounting for about 40% of global demand. Strong screening mandates guide consistent adoption across hospitals and diagnostic centers. Healthcare systems support early testing through well-established reimbursement structures. Manufacturers benefit from mature infrastructure that helps accelerate product deployment. Awareness programs improve participation among high-risk groups. Partnerships between labs and insurers raise compliance with routine screening cycles. It maintains leadership through continuous investment in preventive oncology.

Europe

Europe represents roughly 30% of global share, supported by structured national screening programs across major countries. Governments maintain organized pathways that guide routine testing for adults over specific age thresholds. Hospitals integrate advanced molecular tests into standardized care protocols. Diagnostic labs expand capacity to manage rising stool-based and DNA-based screening volumes. Public health bodies reinforce preventive efforts through awareness campaigns across diverse populations. Strong collaboration between research institutes and industry supports biomarker innovation. It sustains growth through high adoption of evidence-backed screening models.

Asia Pacific

Asia Pacific accounts for about 22% of global share and stands as the fastest-growing region. Rising colorectal cancer prevalence increases demand for scalable and cost-effective screening tools. Governments expand screening initiatives across urban and semi-urban populations. Hospitals improve diagnostic infrastructure to manage higher test volumes. Private labs grow rapidly due to outsourcing trends and expanding molecular capabilities. Awareness efforts strengthen participation as aging populations increase risk levels. It gains strong momentum through growing healthcare investment and wider access to testing technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Exact Sciences Corporation

- Abbott Laboratories

- Hoffmann-La Roche AG

- Epigenomics AG

- Beckman Coulter Inc.

- Sysmex Corporation

- Siemens Healthineers AG

- Quest Diagnostics Incorporated

- Guardant Health, Inc.

- MDxHealth SA

- Eiken Chemical Co., Ltd.

- Randox Laboratories Ltd.

- Oncocyte Corporation

- bioMérieux SA

- QIAGEN N.V.

Competitive Analysis:

The In vitro colorectal cancer screening market features strong competition driven by innovation in molecular diagnostics and early detection technologies. Major companies strengthen their position with DNA-based tests, biomarker assays, and automated laboratory systems. Firms invest in R&D to improve sensitivity and ease of use across high-volume settings. New entrants focus on blood-based biomarkers, challenging established stool test providers. Strategic partnerships support global expansion and validation studies. Hospitals and diagnostic labs influence competition through adoption preferences. It remains dynamic due to rapid technology upgrades and expanding preventive healthcare programs.

Recent Developments:

- In August 2025, Exact Sciences acquired exclusive rights to Freenome’s blood-based colorectal cancer screening tests and the underlying technology for colorectal cancer, subject to customary regulatory approvals.

- Abbott Laboratories announced in November 2025 that it would acquire Exact Sciences Corporation for approximately $21 billion, marking Abbott’s largest healthcare acquisition in two years. The acquisition adds a new growth vertical to Abbott’s cancer diagnostics portfolio and positions the company to lead in the fast-growing $60 billion U.S. cancer screening and precision oncology diagnostics segments.

Report Coverage:

The research report offers an in-depth analysis based on Test Type Segments and End Use Segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of molecular and DNA-based screening tools.

- Rising focus on home-based kits for wider participation.

- Expanding integration of AI tools in diagnostic workflows.

- Increasing investment in biomarker research.

- Strengthening role of digital reporting in patient communication.

- Higher demand from aging populations in developing countries.

- Stronger collaborations between labs and technology firms.

- Wider adoption of blood-based CRC detection assays.

- Rising healthcare expenditure across emerging regions.

- Growing emphasis on preventive oncology programs.