Market Overview:

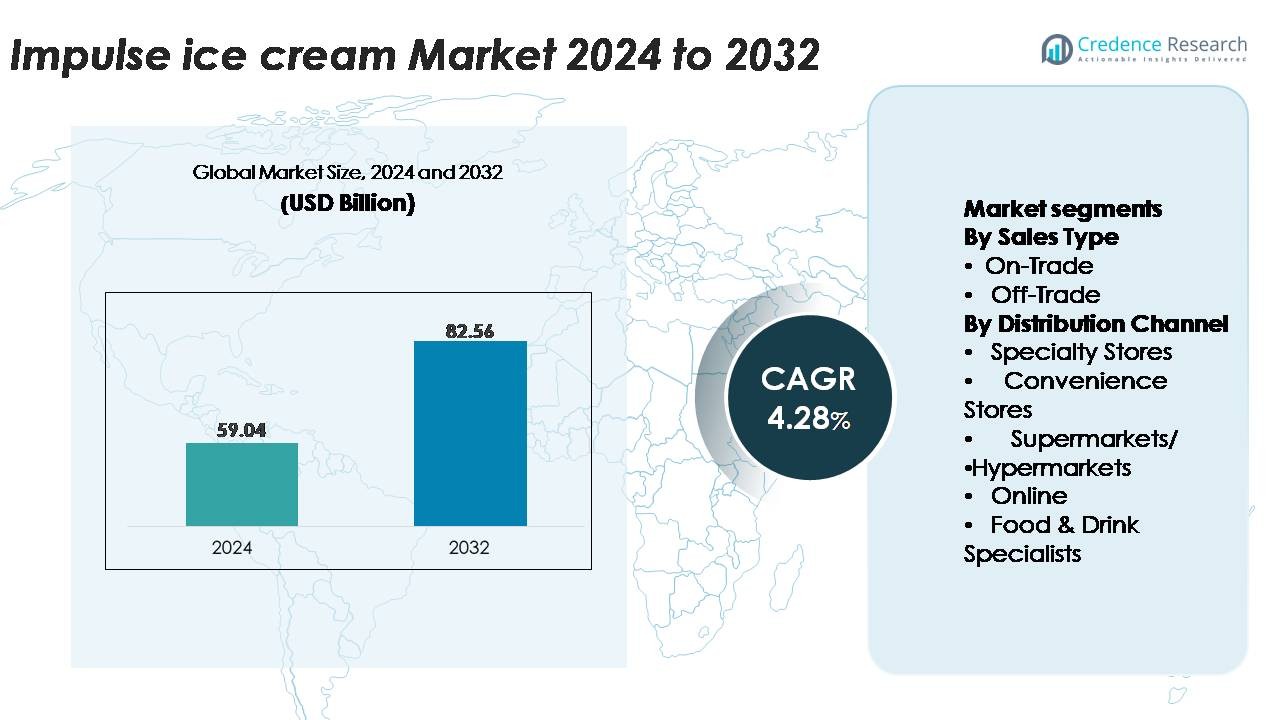

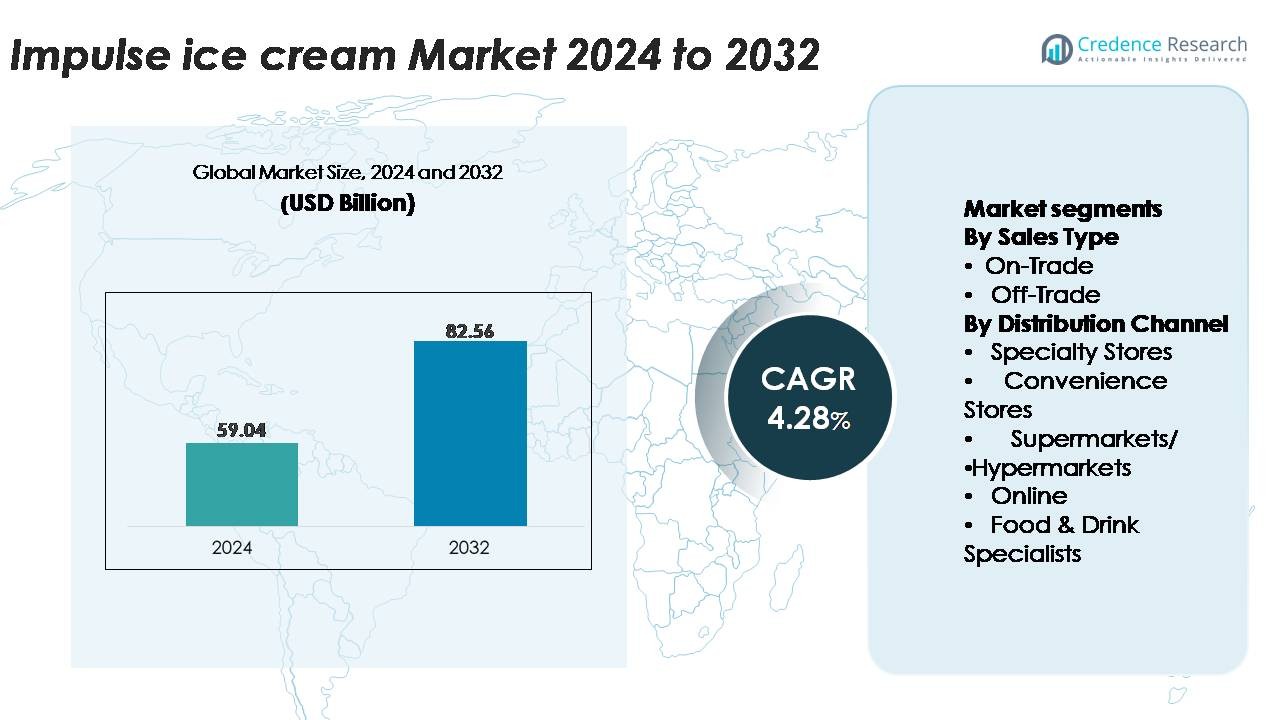

The global impulse ice cream market was valued at USD 59.04 billion in 2024 and is projected to reach USD 82.56 billion by 2032, expanding at a CAGR of 4.28% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Impulse Ice Cream Market Size 2024 |

USD 59.04 Billion |

| Impulse Ice Cream Market, CAGR |

4.28% |

| Impulse Ice Cream Market Size 2032 |

USD 82.56 Billion |

The impulse ice cream market is shaped by a strong mix of global and regional leaders, including Vadilal Industries Limited, Baskin-Robbins, Nestlé S.A., Pure Ice Cream Co LLC, International Dairy Queen, Turkey Hill Dairy, IFFCO, Direct Wholesale Foods, General Mills, and Unilever Group. These companies compete through flavour innovation, premium product lines, and extensive freezer placement strategies across retail environments. Asia-Pacific leads the market with approximately 34% share, driven by rapid urbanisation, rising disposable income, and expanding modern retail chains. North America and Europe follow as key regions, supported by high consumer affinity for premium single-serve novelties and robust cold-chain infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The impulse ice cream market reached USD 59.04 billion in 2024 and is projected to hit USD 82.56 billion by 2032, expanding at a CAGR of 4.28% over the forecast period.

- Growing urbanisation, higher on-the-go snacking, and strong demand for single-serve formats drive category expansion, with the off-trade segment holding the dominant share due to wide freezer placement in supermarkets, hypermarkets, and convenience stores.

- Premiumisation, flavour innovation, and rising adoption of digital commerce platforms shape key market trends as brands introduce artisanal, plant-based, and low-sugar variants supported by quick-commerce delivery networks.

- Competition intensifies as major players such as Unilever Group, Nestlé S.A., Baskin-Robbins, General Mills, and Vadilal Industries focus on product diversification and distribution optimisation, while cost pressures linked to cold-chain maintenance act as a key restraint.

- Asia-Pacific leads with ~34% share, followed by North America (~32%) and Europe (~28%), supported by strong retail penetration, while Latin America (~4%) and Middle East & Africa (~2%) show steady growth potential.

Market Segmentation Analysis:

By Sales Type

The sales type segmentation is led by the Off-Trade channel, which holds the dominant share due to its extensive presence across supermarkets, hypermarkets, and convenience stores that offer immediate accessibility to impulse ice cream products. Off-trade sales gain strong traction from high-visibility freezer placements, multi-brand assortments, and frequent promotional pricing that stimulates spontaneous purchase behaviour. These outlets also benefit from strong supply chain consistency and broad geographic penetration, ensuring product availability across both urban and semi-urban regions. In contrast, the On-Trade segment including cafés, restaurants, cinemas, entertainment venues, and leisure outlets continues to expand owing to rising consumption of frozen desserts during social activities and out-of-home experiences.

- For instance, Unilever one of the world’s largest impulse ice-cream suppliers operates more than 3 million branded freezers globally, enabling deep penetration across modern trade and small-format retail.

By Distribution Channel

Across distribution channels, Supermarkets/Hypermarkets dominate the market, driven by wide assortments, branded freezer sections, and consistent product availability that reinforce category visibility. Their ability to support national launches, run volume-driven promotions, and provide high shopper footfall makes them central to impulse ice cream sales. Convenience Stores follow closely, benefiting from their proximity-based model and strong on-the-go appeal, particularly among urban consumers. Specialty Stores and Food & Drink Specialists contribute to premiumisation by offering artisanal and gourmet varieties, while the Online channel is emerging rapidly as an opportunity area due to the rise of quick-commerce platforms and improved cold-chain-enabled home delivery.

- For instance, Walmart operates more than 4,600 stores in the U.S., each equipped with multiple dedicated freezer aisles that significantly boost impulse frozen dessert turnover.

Key Growth Drivers:

Rising On-the-Go Consumption and Urban Lifestyle Acceleration

Rapid urbanisation, longer working hours, and increasing mobility have significantly boosted demand for convenient, ready-to-eat indulgence products. Impulse ice cream benefits directly from this shift, as consumers gravitate toward quick treats during transit, shopping, recreation, or social outings. Busy lifestyles elevate the appeal of single-serve, handheld formats such as sticks, cups, cones, and bars that require no preparation. The expansion of convenience stores, petrol stations, transit retail points, and vending machines reinforces this behaviour by placing impulse ice creams within immediate reach. Seasonal temperature spikes in urban areas, combined with rising footfall in outdoor entertainment venues, further contribute to spontaneous purchase patterns. Manufacturers increasingly target city-centric consumers through rapid delivery apps, branded chillers, and micro-freezer placements in high-traffic zones. Collectively, these elements position impulse ice cream as a preferred indulgent refreshment for the modern, time-pressed consumer.

- For instance, Nestlé does have a significant vending machine presence, but its network is primarily focused on hot and cold beverages (like coffee and tea) and has involved strategic partnerships and acquisitions over the years.

Product Innovation in Flavours, Formats, and Sensory Experience

Continuous innovation across flavours, textures, and product formats remains a primary demand catalyst in the impulse ice cream category. Brands actively introduce gourmet flavours, exotic ingredients, layered desserts, inclusions such as nuts or chocolate chips, and specialised textures like mochi, gelato-style blends, and aerated creams to elevate sensory appeal. Innovation also extends to portion sizes, handheld formats, and novelty shapes designed to capture attention and stimulate impulse buying. Health-oriented variants such as low-calorie, high-protein, vegan, lactose-free, and reduced-sugar options broaden consumer reach and generate new demand from health-conscious demographics. Packaging upgrades, including insulated wrappers, sustainable materials, and vibrant designs, boost shelf visibility and enhance convenience. Limited-edition seasonal launches and brand collaborations create excitement and repeat trial. Such consistent innovation keeps the category dynamic and strengthens growth by aligning products with evolving consumer preferences.

- For instance, Unilever’s Gloucester ice-cream facility one of its largest global production sites manufactures over 1.5 million handheld ice-cream sticks per day, enabling rapid rollout of new formats and seasonal launches across impulse channels.

Strengthening Retail Infrastructure and Cold Chain Expansion

The modernisation of cold chain logistics and expansion of organised retail infrastructure significantly drive market growth by improving product availability and freshness. Large supermarket chains, hypermarkets, and convenience store networks increasingly allocate dedicated freezer space for branded impulse ice creams, improving visibility and maintaining ideal storage temperatures. Enhanced freezer technologies with energy-efficient compressors and temperature-stabilising systems reduce product wastage and enable reliable distribution even in warmer climates. Growth in last-mile cold delivery capabilities through e-commerce and quick-commerce platforms ensures that impulse ice creams reach consumers rapidly without compromising quality. Manufacturers invest in advanced refrigerated transport and strategically placed distribution hubs to maintain product integrity across long distances. This strengthened infrastructure supports wider geographic penetration, enabling brands to serve suburban, semi-urban, and high-demand tourist zones effectively. The improved cold chain ecosystem directly enhances sales consistency and expands market coverage for impulse ice cream products.

Key Trends & Opportunities:

Premiumisation and Experiential Consumption Gains

Premiumisation is reshaping the impulse ice cream segment as consumers increasingly seek elevated indulgence, artisanal craftsmanship, and gourmet-quality ingredients. Brands respond by introducing richer formulations, indulgent mix-ins, coated layers, single-origin chocolates, and chef-inspired flavour profiles that offer a more luxurious treat experience. Premium handheld bars, gelato sticks, and mochi-based offerings cater to consumers who associate ice cream with self-reward and sensory enjoyment. Experiential consumption trends including limited-edition launches, visually appealing formats, and storytelling around ingredients create differentiation and drive higher willingness to pay. Health-aligned premium ice creams with natural ingredients or functional benefits add further opportunity. As consumers trade up from standard options toward more sophisticated treats, premiumisation becomes a strong upside potential for boosting margins and brand equity in the impulse ice cream category.

- For instance, The General Mills-owned Häagen-Dazs production plant in Tilloy-lès-Mofflaines (near Arras), France, manufactures over 75 million litres of premium ice cream annually, enabling large-scale rollout of artisanal-style, high-fat-content formulations central to premium impulse ranges”.

Rapid Growth of Digital Commerce, Home Delivery, and Micro-Fulfilment

E-commerce and quick-delivery platforms represent one of the most prominent emerging opportunities for impulse ice cream. The growth of 10–30-minute delivery services, frozen dessert fulfilment hubs, and app-based personalised recommendations enables brands to reach consumers beyond traditional retail touchpoints. Digital platforms allow targeted promotions, exclusive online-only flavours, and bundled offers that enhance convenience for home-based treat consumption. The integration of insulated packaging and temperature-controlled delivery boxes ensures product integrity, overcoming past limitations for frozen deliveries. This channel also supports subscription-based models, allowing consumers to receive curated packs of single-serve indulgence snacks. With the rising digital adoption among younger demographics, online retail becomes a strategic route for demand expansion, enabling brands to engage customers through dynamic digital marketing, influencer promotions, and real-time purchase triggers.

- For instance, Unilever’s Ice-Cream Now (ICNOW) team operates in more than 40 countries, and its “eB2B” cloud platform now serves over 500,000 retailers and 6,000 sales-representatives in five emerging markets, enabling real-time ordering and fulfilment of frozen-dessert inventory.

Key Challenges:

High Sensitivity to Temperature, Storage Integrity, and Supply Chain Costs

Impulse ice cream relies heavily on strict temperature control throughout production, transportation, storage, and retail display. Any deviation from ideal freezing conditions can degrade texture, create ice crystals, or compromise overall quality. Maintaining reliable cold chain operations particularly in regions with high temperatures or limited refrigeration infrastructure raises operational costs for both manufacturers and retailers. Energy-intensive freezers, refrigerated transport fleets, and specialised packaging increase the cost structure of the category. In the retail environment, frequent door openings, inadequate freezer maintenance, or power fluctuations may lead to product spoilage. These challenges put pressure on margins and limit expansion into underdeveloped or hot-climate regions where cold chain inconsistencies remain prevalent.

Rising Competition from Healthier Snacking Alternatives

While impulse ice cream remains a popular indulgence option, it increasingly competes with a growing portfolio of healthier snacks such as frozen yogurts, protein bars, vegan desserts, fruit-based snacks, and low-sugar beverages. Consumers who prioritise wellness, calorie control, or functional nutrition may shift away from traditional indulgent ice cream variants, especially in markets with high obesity or diabetes awareness. Regulatory pressures related to sugar content, labelling requirements, and advertising to children further intensify the challenge. Brands must invest in reformulation, natural ingredients, and health-forward alternatives to retain relevance in health-conscious segments. This competitive landscape demands continuous innovation to balance indulgence with wellness expectations while differentiating impulse ice cream from other emerging snacking categories.

Regional Analysis:

North America

North America holds around 32% of the impulse ice cream market, driven by strong consumer preference for premium indulgence products, widespread availability across supermarkets and convenience stores, and high penetration of single-serve novelty formats. The region benefits from advanced cold-chain infrastructure that ensures consistent product quality across retail environments. Seasonal demand peaks during summer months, supported by extensive promotional campaigns and brand partnerships. The presence of established ice cream manufacturers and continuous innovation in flavours, textures, and health-aligned formulations further reinforces North America’s leadership in the category.

Europe

Europe accounts for approximately 28% of the global market, supported by strong consumption of artisanal, dairy-rich, and novelty ice cream formats across Western and Northern Europe. High demand for premium gelato, low-sugar options, and clean-label ingredients drives innovation in the region. Countries such as Italy, Germany, France, and the U.K. exhibit strong retail infrastructure, enabling steady off-trade sales. Europe’s mature frozen dessert culture, combined with rising summer tourism and increased impulse purchases at urban transit points, continues to sustain market expansion. Sustainability-focused packaging trends further shape product development across key markets.

Asia-Pacific

Asia-Pacific leads the global market with roughly 34% share, supported by rapid urbanisation, rising disposable incomes, and a strong youth demographic that drives impulse snacking behaviour. Expanding modern retail infrastructure, growing convenience store chains, and the proliferation of quick-commerce platforms accelerate product accessibility across city clusters. China, India, Japan, and Southeast Asian countries contribute significantly to sales through high-volume single-serve formats. Warm climate conditions, increasing on-the-go snacking, and strong brand localisation strategies further strengthen regional growth. Premiumisation, innovative flavours, and value packs also gain traction across emerging urban centres.

Latin America

Latin America holds about 4% of the impulse ice cream market, with growth concentrated in Brazil, Mexico, Argentina, and Chile. Rising middle-class purchasing power and increasing availability of affordable single-serve sticks and cones support category expansion. Informal retail continues to play a significant role, especially in neighbourhood stores and street kiosks. Warmer climate conditions boost seasonal and year-round consumption, while multinational brands expand freezer placements through partnerships with small retailers. Although economic fluctuations challenge consumer spending, promotional pricing and value-driven offerings attract strong household demand across the region.

Middle East & Africa

The Middle East & Africa region represents approximately 2% of the market but shows strong long-term potential driven by rising modern retail penetration and increasing disposable incomes in GCC economies. Hot climatic conditions create consistent demand for cold indulgent snacks, particularly in urban centres such as Dubai, Riyadh, and Johannesburg. The expansion of supermarkets, convenience stores, and shopping malls enhances product accessibility. However, growth is moderated by limited cold-chain infrastructure in certain African markets. International brands increasingly invest in local manufacturing, flavour localisation, and freezer deployments to strengthen category presence.

Market Segmentations:

By Sales Type

By Distribution Channel

- Specialty Stores

- Convenience Stores

- Supermarkets/Hypermarkets

- Online

- Food & Drink Specialists

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the impulse ice cream market is characterized by a mix of global brands, regional manufacturers, and local artisanal producers competing across price tiers and product formats. Leading companies focus on strengthening brand visibility through extensive freezer placements, flavour innovation, and seasonal limited-edition launches that stimulate impulse purchases. Global players invest heavily in product diversification, including premium bars, novelty shapes, dairy-free options, and low-sugar variants to address evolving consumer preferences. Strategic acquisitions, co-branding initiatives, and digital marketing campaigns enhance market penetration, while strong distributor partnerships ensure widespread off-trade availability. Regional manufacturers leverage local flavours, competitive pricing, and flexible distribution models to capture market share in emerging economies. Increasing retail consolidation and the rise of quick-commerce platforms further intensify competition, compelling brands to optimise cold-chain efficiency and improve packaging durability. Collectively, these dynamics create an environment where innovation, availability, and price–value positioning determine competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Vadilal Industries Limited

- Baskin-Robbins

- Nestlé S.A.

- Pure Ice Cream Co LLC

- International Dairy Queen, Inc.

- Turkey Hill Dairy

- IFFCO

- Direct Wholesale Foods

- General Mills

- Unilever Group

Recent Developments:

- In November 2025, IFFCO Group Participated in Gulfood Manufacturing 2025 showcasing its premium ice-cream brand London Dairy and emphasised innovation with a display of high-capacity freezing equipment for new formats.

- In May 2025, Pure Ice Cream Co LLC Began construction on an AED 80 million production facility at Dubai Industrial City to boost capacity and support exports. Government of Dubai Media Office.

Report Coverage:

The research report offers an in-depth analysis based on Sales type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness stronger demand for single-serve premium formats as consumers seek indulgent yet convenient treats.

- Brands will expand flavour innovation with global, artisanal, and limited-edition variants to drive trial and repeat purchases.

- Health-oriented impulse ice creams, including low-sugar, high-protein, and plant-based options, will gain greater traction.

- Quick-commerce and e-grocery platforms will increase category visibility through rapid cold-chain delivery.

- Manufacturers will invest in energy-efficient freezers and sustainable packaging to meet environmental expectations.

- Retailers will allocate more freezer space for novelty formats as impulse buying rises in urban and transit zones.

- Brand collaborations with confectionery, bakery, and beverage companies will create hybrid dessert concepts.

- Emerging markets will experience faster penetration as cold-chain logistics and modern retail networks expand.

- AI-driven demand forecasting and personalised promotions will strengthen product placement and conversion rates.

- Competition will intensify as global and regional players accelerate diversification and localisation strategies.