Market Overview

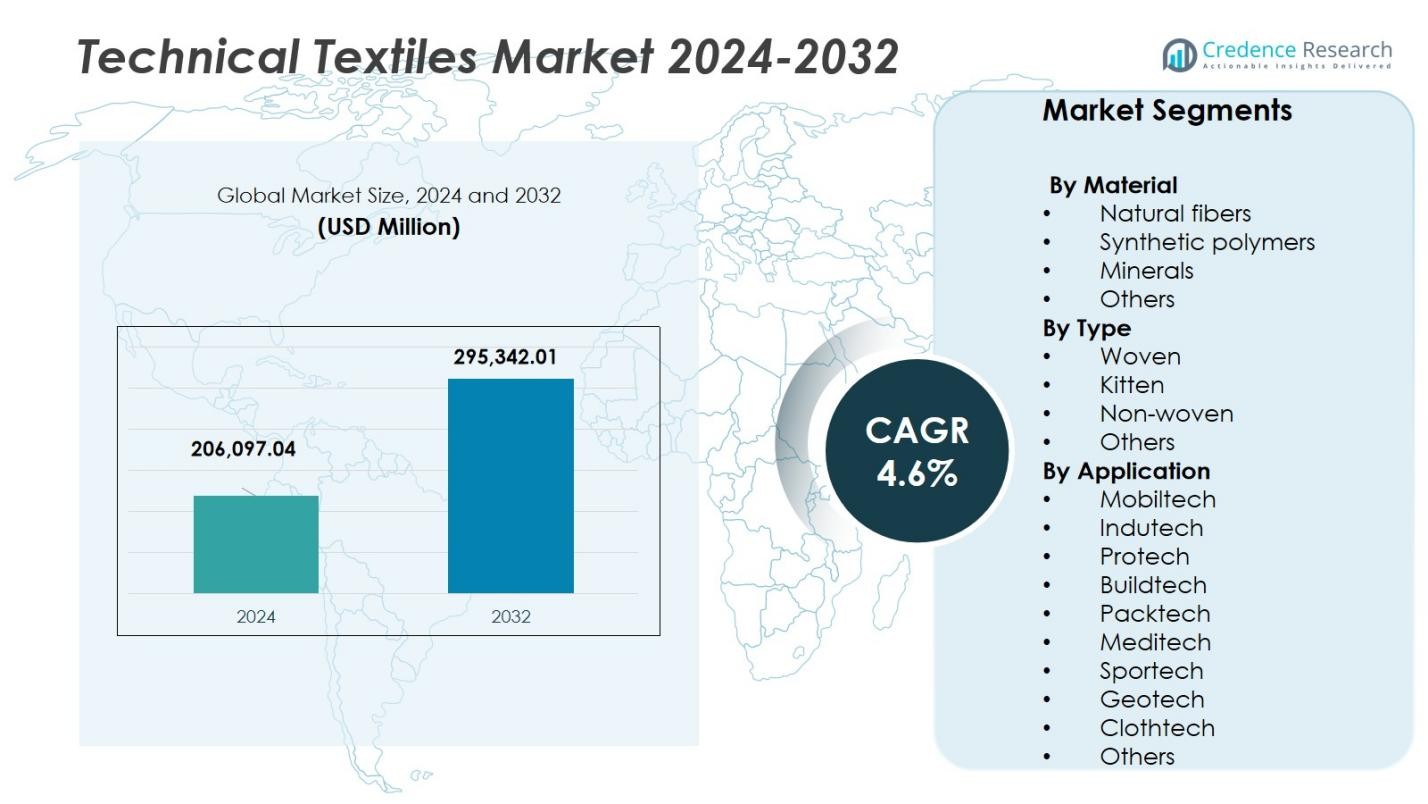

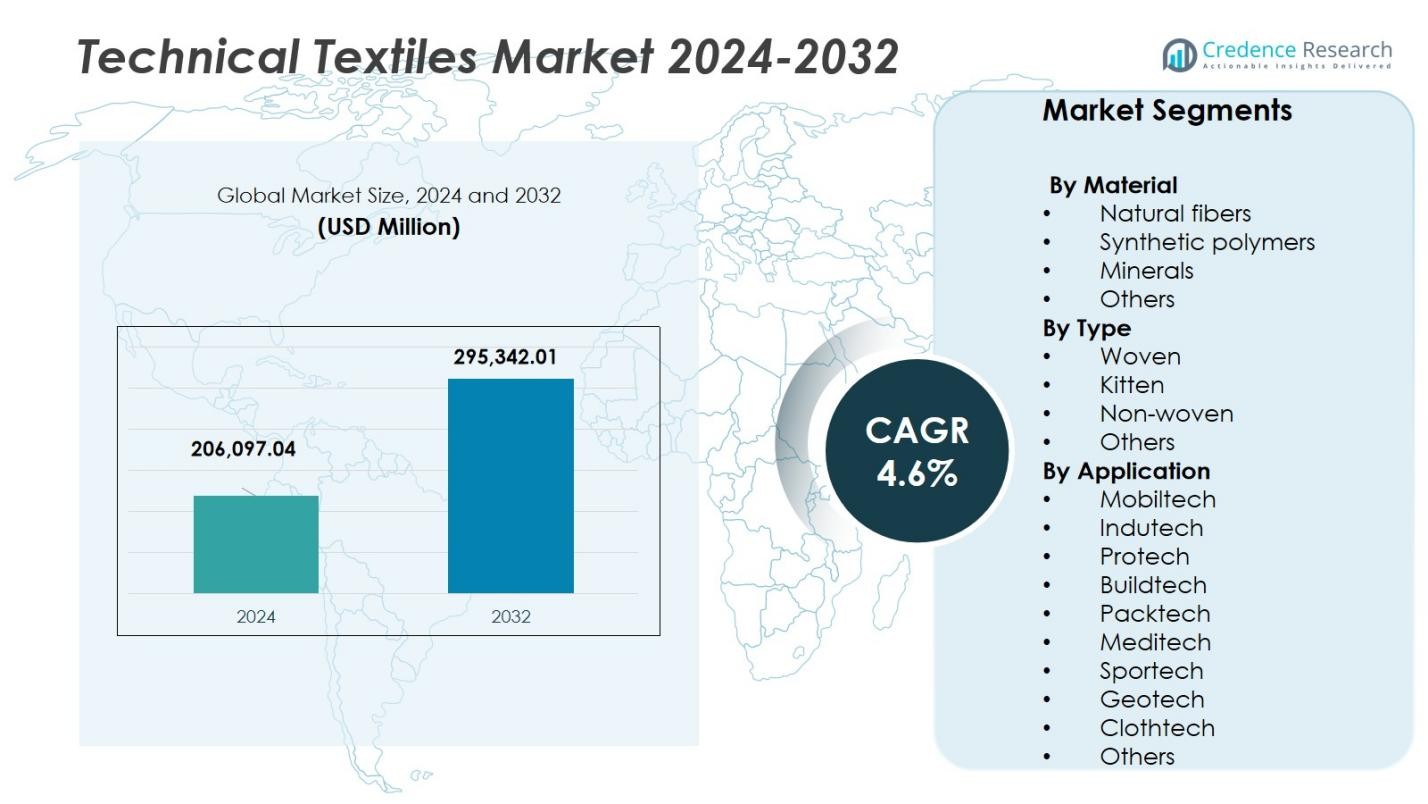

The Technical Textiles Market size was valued at USD 206,097.04 million in 2024 and is anticipated to reach USD 295,342.01 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Technical Textiles Market Size 2024 |

USD 206,097.04 Million |

| Technical Textiles Market, CAGR |

4.6% |

| Technical Textiles Market Size 2032 |

USD 295,342.01 Million |

The technical textiles market is driven by key players such as Asahi Kasei Corporation, DuPont de Nemours, Inc., Freudenberg Performance Materials, Milliken & Company, Mitsui Chemicals, Inc., and Baltex Ltd. These companies lead innovation in high-performance textiles, focusing on advanced materials such as smart fabrics, protective coatings, and non-woven textiles for various applications. Their strategic investments in research and development, along with robust global distribution networks, enable them to cater to growing demand in industries like automotive, healthcare, and construction. Regionally, Asia Pacific holds the largest market share at 36.46% in 2024, supported by rapid industrialization and growing applications across sectors. North America follows with a 21.6% market share, fueled by technological advancements, strong regulatory support, and high demand for specialized textiles in healthcare, aerospace, and automotive industries. These regions continue to lead market growth due to technological innovation and expanding end-user industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global technical textiles market was valued at USD 206,097.04 million in 2024 and is projected to grow to USD 295,342.01 million by 2032 at a CAGR of 4.6 %.

- The market driver includes rising demand for high‑performance and sustainable textiles in automotive, healthcare, and construction applications, boosting adoption of synthetic polymers (45 % material share) and non‑woven types (40 % type share).

- Key trends highlight the expansion of smart and intelligent textiles integrating sensors and electronics, and the strong growth of the Meditech application segment accounting for 25 % share, reflecting increased demand for medical textiles.

- Company competition is shaped by major players such as Asahi Kasei, DuPont, Freudenberg Performance Materials, Milliken & Company, and Mitsui Chemicals, leveraging R&D, global reach, and tailored solutions to stay ahead.

- Market restraints include high production costs, complex material requirements, and regional regulatory compliance which slow adoption, particularly in regions with smaller market shares such as Latin America (4.8 %) and Middle East & Africa (4‑5 %).

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material:

The technical textiles market is primarily segmented by material into natural fibers, synthetic polymers, minerals, and others. Among these, synthetic polymers hold the dominant share, accounting for 45% of the market. This dominance is driven by their superior durability, flexibility, and resistance to harsh environmental conditions, making them ideal for a wide range of applications, from automotive to medical textiles. Natural fibers follow, driven by the increasing demand for sustainable and eco-friendly materials. The growth of synthetic polymers is also supported by advancements in polymer technology, further expanding their market share.

- For instance, DuPont supplies high-performance technical textile products leveraging robust synthetic polymers for automotive and industrial uses.

By Type:

The technical textiles market by type is divided into woven, knitted, non-woven, and other textile forms. Non-woven fabrics dominate this segment with a market share of 40%. Their versatility, cost-effectiveness, and ease of production make them suitable for various applications, including hygiene products, medical textiles, and automotive interiors. Woven fabrics follow closely, driven by their strong structural integrity and widespread use in the industrial sector. The increasing demand for non-woven materials in healthcare and environmental applications further accelerates the growth of this segment.

- For instance, Kimberly-Clark is a prominent player producing non-woven fabrics extensively used in hygiene products such as diapers and adult incontinence items, recognized for their softness and absorbency.

By Application:

The market for technical textiles is segmented by application into Mobiltech, Indutech, Protech, Buildtech, Packtech, Meditech, Sportech, Geotech, Clothtech, and others. Among these, Meditech holds the largest market share, accounting for 25%. This segment’s dominance is attributed to the increasing demand for medical textiles, including surgical gowns, wound care products, and healthcare equipment. The growth of the aging population, along with advancements in healthcare technologies, drives the growth in this sub-segment. Meditech’s continued expansion is further fueled by the increasing emphasis on hygiene and patient safety across healthcare systems globally.

Key Growth Drivers

Increasing Demand for Functional and High-Performance Textiles

The growing need for functional and high-performance textiles is one of the major drivers of the technical textiles market. These textiles offer specialized properties such as durability, fire resistance, and moisture-wicking capabilities, making them essential for applications in sectors like automotive, healthcare, and defense. As industries seek materials that provide enhanced functionality and safety, the demand for advanced technical textiles continues to rise. This trend is particularly evident in the automotive and medical sectors, where these textiles are crucial for improving performance and safety standards.

- For instance, Toray Industries produces advanced carbon fiber composite textiles widely used in automotive applications for enhanced durability and lightweight performance.

Rising Focus on Sustainability and Eco-friendly Products

Sustainability is a critical growth driver in the technical textiles market, with increasing awareness of environmental concerns leading to a shift toward eco-friendly materials. Consumers and industries alike are prioritizing sustainable solutions, and manufacturers are responding by developing textiles from renewable resources, biodegradable fibers, and recycled materials. This demand for sustainable products is accelerating innovation and adoption across various applications, such as in the construction, automotive, and fashion industries. As governments and organizations implement stricter environmental regulations, the need for eco-friendly technical textiles will likely continue to grow.

- For instance, Pure Waste Textiles Ltd, founded in Finland, produces high-quality fabrics from 100% recycled textile waste, significantly lowering environmental impact through certifications such as OEKO-TEX and GRS.

Technological Advancements in Textile Manufacturing

Technological advancements in textile manufacturing are significantly driving the growth of the technical textiles market. Innovations such as smart textiles, which incorporate electronic components for enhanced functionality, are revolutionizing industries like healthcare, sports, and defense. The integration of automation and advanced textile processing techniques, such as 3D weaving and laser cutting, is improving the efficiency and quality of production. These advancements not only enable the creation of more versatile materials but also reduce production costs, making technical textiles more accessible to a wider range of applications.

Key Trends & Opportunities

Growth of Smart and Intelligent Textiles

Smart textiles, which integrate sensors and electronics to provide interactive and responsive functionalities, represent a significant trend in the technical textiles market. The increasing use of these textiles in healthcare, sports, and military applications presents substantial growth opportunities. Wearable medical devices, fitness trackers, and health-monitoring clothing are becoming increasingly popular, enabling real-time data collection and improving patient care. As advancements in sensor technology and connectivity continue to evolve, the demand for smart textiles is expected to grow rapidly, creating new market opportunities for manufacturers and innovators in the industry.

- For instance, Sensoria Inc. offers smart sportswear embedded with sensors that provide real-time feedback and personalized recommendations to athletes, enhancing performance and health monitoring.

Expansion of Technical Textiles in the Healthcare Sector

The healthcare sector offers considerable opportunities for technical textiles, particularly in the areas of wound care, surgical gowns, and hygiene products. With an aging global population and a growing emphasis on patient safety, there is an increasing demand for medical textiles that provide higher levels of hygiene, comfort, and protection. Technical textiles such as antimicrobial fabrics, absorbent wound dressings, and sterile surgical garments are critical in meeting these needs. The healthcare sector’s continuous expansion and focus on patient care are driving the growth of technical textiles tailored to this market.

- For instance, Tytex produces wound fixation garments that aid healing by keeping wound dressings in place and protecting sensitive skin, widely used in hospitals globally.

Key Challenges

High Production Costs and Material Complexity

One of the main challenges facing the technical textiles market is the high production costs associated with specialized materials and manufacturing processes. The complex nature of producing advanced technical textiles, especially those requiring unique fibers or coating treatments, can significantly increase production expenses. Moreover, the integration of high-performance features such as conductivity, water resistance, or fire resistance further complicates manufacturing. These cost barriers can limit the widespread adoption of technical textiles, particularly for small and medium-sized enterprises (SMEs) with limited budgets for innovation.

Regulatory and Standards Compliance

The technical textiles industry faces significant challenges related to regulatory compliance and meeting the stringent standards set by various industries. Each application of technical textiles, whether in automotive, healthcare, or construction, is subject to different regulatory frameworks concerning safety, environmental impact, and performance. Navigating these diverse regulations can be time-consuming and costly for manufacturers. Moreover, the lack of universally recognized standards across global markets can create barriers to entry for companies looking to expand internationally, limiting the overall growth potential of the market.

Regional Analysis

Asia Pacific

In 2024, the Asia Pacific region commanded a market share of 36.46 % in the global technical textiles market. This leadership position stems from its expansive manufacturing base, rapid industrialisation and rising applications across automotive, construction and healthcare sectors. Domestic demand in countries such as China and India, bolstered by government initiatives, underpins strong growth in mobiltech, buildtech and meditech segments. The region’s cost‑competitive production environment and improving infrastructure investment further reinforce the steady adoption of technical textiles and support ongoing expansion of its market presence.

North America

The North America region held 21.6 % of the global technical textiles market in 2024. Growth in this region is driven by innovation in high‑performance textiles, advanced manufacturing and application in sectors such as aerospace, healthcare and automotive. Strong demand for smart textiles, protective fabrics and filtration media contributes to the region’s competitive edge. Regulatory support and sizeable R&D investments in the United States and Canada further enable technological advancements, enabling North America to maintain a significant share in the global market despite slower volume growth compared to emerging regions.

Europe

In the European region, the market share for technical textiles is estimated at around 20‑25 % in 2024. The region benefits from well‑developed automotive, construction and medical end‑use industries, where technical textiles are used extensively for lightweighting, sustainability and performance enhancement. Stringent environmental regulation and a focus on circular materials place Europe at the forefront of innovation in eco‑friendly technical textiles. Ongoing modernization of infrastructure and health systems, coupled with digitalisation of manufacturing, continue to support Europe’s stable growth in the sector.

Latin America

The Latin America region accounted for 4.8 % of the global technical textiles market in 2024. The modest share reflects limited industrial scale but growing opportunity, particularly in Brazil and Mexico, where infrastructure spending and healthcare expansion are driving demand for buildtech, meditech and protech textiles. Regional manufacturers are increasingly exploring technical textile applications as part of export‑oriented strategies. However, constraints such as lower local manufacturing capacity and raw‑material sourcing challenges limit faster growth expansion in the near term.

Middle East & Africa

The Middle East & Africa (MEA) region holds 4% of the global technical textiles market in 2024. Growth in this region is supported by increasing investments in infrastructure, defence, oil & gas and healthcare, all of which demand technical textile solutions such as geotextiles, protective fabrics and medical disposables. Government initiatives targeting economic diversification and industrialisation are gradually opening opportunities for domestic and global players. However, slower industrial evolution, logistical challenges and reliance on imports continue to restrain the region from capturing a larger share of the global market.

Market Segmentations:

By Material

- Natural fibers

- Synthetic polymers

- Minerals

- Others

By Type

- Woven

- Kitten

- Non-woven

- Others

By Application

- Mobiltech

- Indutech

- Protech

- Buildtech

- Packtech

- Meditech

- Sportech

- Geotech

- Clothtech

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the technical textiles market is shaped by major players such as Asahi Kasei Corporation, DuPont, Freudenberg Performance Materials, Huntsman International LLC, Mitsui Chemicals, Inc. and Milliken & Company. These firms drive the market through deep R&D investment, vertically integrated capabilities and global distribution networks. They focus on high‑value segments—such as automotive, medical and protective textiles—where performance and innovation command premium pricing. At the same time, cost pressure from regional low‑cost producers in Asia forces these leading companies to continuously optimize manufacturing efficiency and enhance product differentiation. Strategic collaborations, acquisitions and the introduction of sustainable and smart textile solutions further sharpen competitive dynamics, pushing firms to both expand their geographic reach and upgrade their product portfolios to stay ahead.

Key Player Analysis

- Milliken & Company

- Freudenberg Performance Materials

- Huntsman International

- Khosla Profil

- Du Pont

- Heathcoat Fabrics

- Asahi Kasei

- Filspec

- Baltex

- Mitsui Chemicals

Recent Developments

- In September 2024, Freudenberg Performance Materials announced the acquisition of major parts of Heytex Group, enhancing its coated technical textiles business and expanding production in Germany and China.

- In September 2025, Milliken & Company acquired the assets of Highland Industries, Inc. (USA), broadening its portfolio of reinforcement fabrics in the technical textiles sector.

- In July 2025, TEXTILCOLOR AG acquired Schoeller Technologies AG (Switzerland), strengthening its innovations in high-performance textile chemicals and expanding its brand-partnership capabilities within technical textiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly benefit from growing demand across sectors such as automotive lightweighting, medical disposables, and infrastructure development, driving sustained expansion.

- Innovation will shift toward smart and functional textiles embedding sensors, electronics and connectivity to meet emerging requirements in wearables, protective gear and healthcare devices.

- Sustainability will become central, with manufacturers investing in recycled and bio‑based fibres, circular supply‑chains and low‑impact production processes to respond to regulatory and consumer pressures.

- Growth will be supported by expanding applications in emerging markets, where rising industrialisation, urbanisation and infrastructure spending will create new opportunities for technical textiles.

- Customisation and niche applications will gain traction, as end‑users seek tailored fabric solutions for unique performance demands in sectors such as defence, aerospace and specialty construction.

- Digitisation and Industry 4.0 technologies will drive manufacturing efficiency and enable predictive quality control, while structures such as 3D weaving and automated finishing will enhance throughput.

- Partnerships and ecosystem collaborations will become more common, as textile producers, electronics firms and end‑users co‑develop integrated solutions and address market complexity together.

- Supply‑chain resilience will improve, as companies diversify sourcing, localise production and integrate raw‑material recycling to mitigate raw‑material volatility and geopolitical disruption.

- The segmentation of technical textiles will broaden, with growth in less traditional domains including protective sports textiles, geotextiles for sustainable infrastructure and packaging solutions opening fresh revenue streams.

- Pricing pressure and material substitution will challenge margins, driving firms to focus on value‑added, performance‑differentiated products rather than commodity offerings.

Market Segmentation Analysis:

Market Segmentation Analysis: