Market Overview

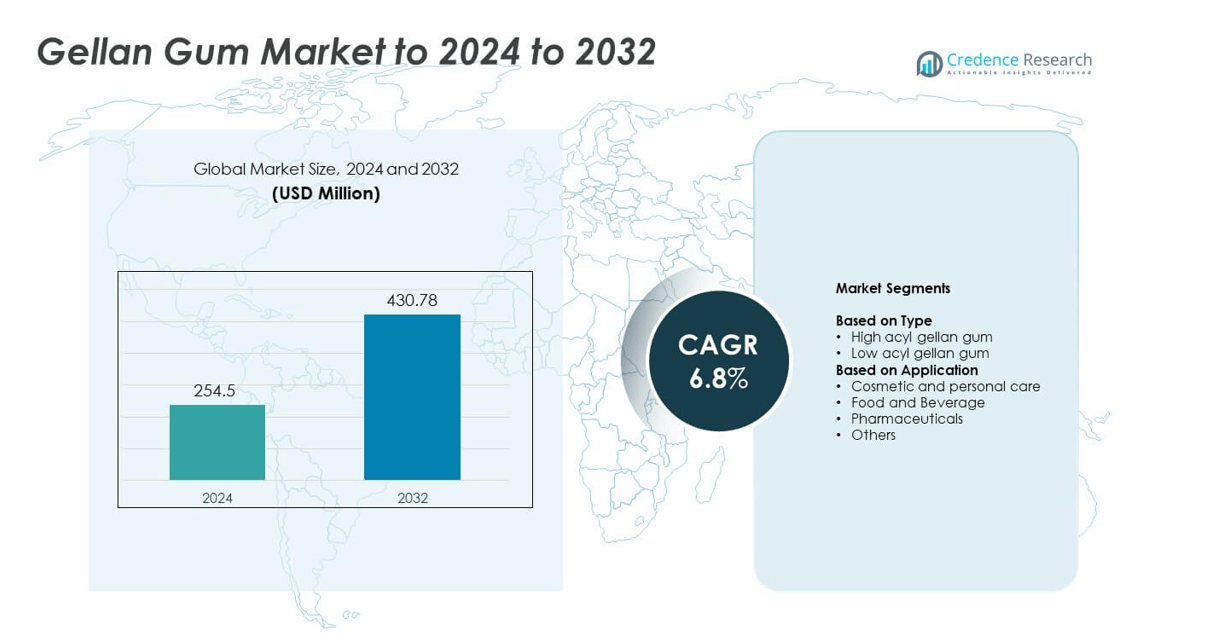

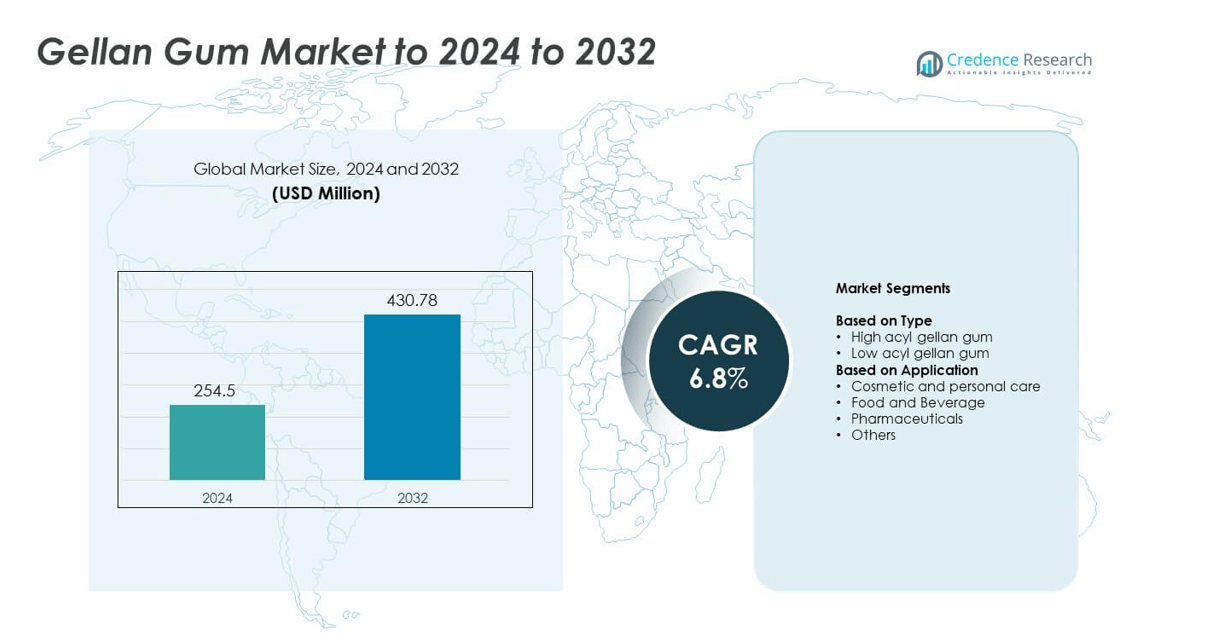

Gellan Gum Market size was valued USD 254.5 Million in 2024 and is anticipated to reach USD 430.78 Million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gellan Gum Market Size 2024 |

USD 254.5 Million |

| Gellan Gum Market, CAGR |

6.8% |

| Gellan Gum Market Size 2032 |

USD 430.78 Million |

The Gellan Gum Market is shaped by major players such as Meron, Brova, Gino Gums Stabilizers, Sinofi Ingredients, Merck, Zhejiang Tech-Way Biotechnology, Ceamsa, Foodchem International Corporation, and CP Kelco. These companies compete through advancements in fermentation efficiency, wider functional grades, and strong global distribution networks. North America leads the market with about 34% share in 2024 due to high demand in beverages, dairy alternatives, pharmaceuticals, and premium personal care products. Asia Pacific follows closely with rising consumption in functional foods and expanding ingredient manufacturing capacity, strengthening its position as a fast-growing regional hub.

Market Insights

- Gellan Gum Market reached USD 254.5 Million in 2024 and will climb to USD 430.78 Million by 2032, growing at a CAGR of 6.8%.

- Market growth is driven by rising demand for clean-label stabilizers and strong use in food and beverage products, where high-acyl gellan gum holds about 58% share due to its texture and suspension performance.

- Key trends include expansion in plant-based beverages, fortified drinks, and increasing adoption in controlled-release pharmaceutical formulations and premium personal care gels.

- Competition remains strong as major manufacturers enhance fermentation efficiency, develop specialty grades, and strengthen supply networks to address price volatility and challenges from cheaper alternative hydrocolloids.

- North America leads with nearly 34% share, followed by Europe at about 28% and Asia Pacific at roughly 30%, supported by rapid growth in functional foods; the food and beverage segment dominates overall application demand with about 62% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

High acyl gellan gum leads this segment with about 58% share in 2024 due to strong demand in applications requiring flexible, elastic, and heat-stable gels. Food manufacturers use high acyl grades to achieve smooth textures in dairy products, plant-based beverages, and sauces. Low acyl gellan gum grows steadily because it forms firm, brittle gels suited for confectionery, bakery fillings, and pharmaceutical suspensions. Rising adoption of clean-label stabilizers and consistent performance in varied pH environments supports broader usage across both categories.

- For instance, Nestlé reports that consumers drink about 6,100 cups of Nescafé every second worldwide, which is equal to approximately 192.5 billion cups per year.

By Application

Food and beverage dominates this segment with nearly 62% share in 2024 as producers rely on gellan gum for stabilization, suspension, and texture enhancement in dairy alternatives, ready-to-drink beverages, bakery products, and functional foods. This category benefits from the expansion of vegan and low-sugar formulations where gellan gum replaces traditional hydrocolloids. Cosmetics and personal care show solid growth due to rising use in serums and gels, while pharmaceutical applications expand with increased adoption in controlled-release formulations and oral suspensions.

- For instance, Unilever operates 300 factories and uses 700 third-party manufacturers globally, producing a wide range of food, beverage, and personal-care products. Gellan gum is a common stabilizer and suspension agent used in the food industry, including in some of Unilever’s products.

Key Growth Drivers

Rising demand for clean-label ingredients

Growing preference for clean-label and plant-derived additives drives strong adoption of gellan gum in foods, beverages, and personal care products. Manufacturers select gellan gum because it delivers stable textures without synthetic chemicals. This shift aligns with global consumer focus on natural formulations and reduced additive lists. Clean-label reformulation across dairy alternatives, nutritional drinks, and premium skincare supports long-term gains for gellan gum producers.

- For instance, L’Oréal manages 37 manufacturing facilities worldwide and 152 fulfillment centers, supporting the production of over 7 billion products per year.

Expansion of plant-based and low-sugar formulations

The rapid rise of plant-based beverages, yogurt substitutes, and low-sugar foods strengthens market demand. Brands rely on gellan gum to create smooth, stable textures and achieve uniform suspension in nutrient-fortified drinks. This hydrocolloid offers reliable performance with reduced sugar, fat, or animal-based stabilizers. The global shift toward healthier diets and alternative protein products increases usage in both mainstream and specialty formulations.

- For instance, Coca-Cola sells approximately 2.2 billion beverage servings each day worldwide, including functional and enhanced-nutrition drinks (such as value-added dairy and plant-based beverages) that, like other products in the food and beverage industry, rely on hydrocolloid stabilizers for uniform suspension, stability, and texture.

Growing pharmaceutical and personal care applications

Pharmaceutical companies increase the use of gellan gum in oral suspensions, controlled-release formulations, and ophthalmic gels due to its high purity and strong gel-forming properties. Personal care brands also adopt it in serums and gels for texture enhancement and stabilization. Demand grows as companies replace synthetic polymers with biodegradable, skin-friendly options. This expansion across regulated and premium product categories boosts overall market growth.

Key Trends & Opportunities

Rising use in functional and fortified beverages

Strong growth in functional drinks, including electrolyte beverages, nutraceutical shots, and protein-rich formulations, fuels new opportunities for gellan gum. Producers use it to suspend nutrients, stabilize flavors, and improve mouthfeel in clear and low-viscosity liquids. This trend gains momentum as consumers adopt daily wellness beverages with active ingredients. Its compatibility with vitamins, minerals, and plant extracts positions gellan gum as a preferred stabilizer in premium beverage innovation.

- For instance, PepsiCo’s Pepsi Prebiotic Cola contains 30 calories in a 12-ounce can. Each can includes 5 grams of cane sugar and 3 grams of prebiotic fiber. This product illustrates how large beverage companies add measurable functional ingredients to new drinks.

Innovation in sustainable and biodegradable hydrocolloids

Sustainability-led reformulation encourages wider use of gellan gum as brands move away from synthetic stabilizers and environmentally intensive ingredients. Manufacturers explore new fermentation technologies to reduce production impact and increase supply resilience. Growing interest in biodegradable polymers also supports adoption in personal care, cosmetics, and select industrial applications. This trend opens long-term opportunities for companies investing in green manufacturing and specialty grade development.

- For instance, DSM cut CO₂ emissions at its Sisseln vitamin production facility by 50,000 tons per year after commissioning a biomass heat and power plant, showing how fermentation-based ingredient producers can lower their operational footprint while supplying global food and nutrition markets.

Expansion in advanced drug delivery systems

Pharmaceutical innovators explore new uses of gellan gum in ophthalmic gels, mucosal delivery, and site-specific release profiles due to its ionic responsiveness. Its ability to form strong, consistent gels enhances stability and dosing accuracy. Growth in chronic disease therapies and aging populations supports further adoption. Increased R&D investments in bio-compatible polymers position gellan gum as a key material in next-generation drug delivery systems.

Key Challenges

Price fluctuations and supply constraints

Gellan gum faces supply-side challenges due to dependence on fermentation inputs and specialized processing capacity. Raw material variability, energy costs, and limited global production sites contribute to unstable prices. Smaller manufacturers struggle to maintain consistent sourcing, especially during spikes in demand from food and pharmaceutical sectors. These fluctuations can slow adoption, especially among cost-sensitive product categories.

Competition from alternative hydrocolloids

The market faces competitive pressure from xanthan gum, guar gum, carrageenan, and pectin, which remain widely used due to lower costs and broad availability. Some applications still favor these alternatives for familiarity or established processing guidelines. The need for technical expertise to optimize gellan gum formulations can also deter smaller producers. This competitive environment requires continuous innovation to expand its application base and differentiate performance advantages.

Regional Analysis

North America

North America holds about 34% share in 2024 due to strong demand from food and beverage producers using gellan gum in dairy alternatives, fortified drinks, and clean-label formulations. The region benefits from advanced processing technologies and high adoption in pharmaceutical gels and personal care products. Growth remains steady as major manufacturers integrate gellan gum into low-sugar and plant-based product lines. Expanding nutraceutical consumption and strict quality standards further support wider use across the United States and Canada.

Europe

Europe accounts for nearly 28% share in 2024, supported by strong regulatory emphasis on clean-label formulations and rising consumer preference for natural hydrocolloids. Food processors adopt gellan gum in plant-based yogurts, organic beverages, and specialty bakery products. The region sees growing application in premium skincare and dermatology products as brands shift toward biodegradable stabilizers. Demand increases across Germany, France, and the United Kingdom as manufacturers reformulate to replace synthetic gums and meet sustainability goals.

Asia Pacific

Asia Pacific leads future expansion with about 30% share in 2024 driven by rapid growth in functional beverages, convenience foods, and pharmaceutical manufacturing. China, Japan, South Korea, and India show strong uptake as companies use gellan gum for suspension stability in nutritional drinks and textural improvement in ready-to-eat foods. Rising personal care production and expanding fermentation-based ingredient industries enhance regional supply capacity. Increasing disposable income and preference for healthier formulations strengthen long-term demand.

Latin America

Latin America holds around 5% share in 2024, supported by rising use of gellan gum in dairy products, flavored beverages, and confectionery. Countries such as Brazil and Mexico adopt gellan gum for stabilizing fruit-based drinks and improving texture in low-cost foods. The region also shows growth in cosmetics as local brands shift toward natural thickeners. Limited production capacity and higher import dependence restrict faster expansion, yet improving retail demand and food processing modernization offer steady opportunities.

Middle East and Africa

Middle East and Africa represent nearly 3% share in 2024, with demand concentrated in processed foods, bakery fillings, and pharmaceutical suspensions. Growth comes from increasing consumption of packaged beverages and greater interest in clean-label ingredients across Gulf countries. South Africa and the UAE experience rising adoption in personal care gels and fortified drinks. Dependence on imports limits widespread adoption, but expanding food manufacturing and rising health awareness support moderate long-term market growth.

Market Segmentations:

By Type

- High acyl gellan gum

- Low acyl gellan gum

By Application

- Cosmetic and personal care

- Food and Beverage

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gellan Gum Market features strong competition among major players such as Meron, Brova, Gino Gums Stabilizers, Sinofi Ingredients, Merck, Zhejiang Tech-Way Biotechnology, Ceamsa, Foodchem International Corporation, and CP Kelco. Companies operate with a focus on product purity, consistent gel strength, and enhanced functional performance to meet rising demand across food, pharmaceutical, and personal care applications. Manufacturers invest in fermentation advancements to improve yield and maintain supply stability. Many firms expand their portfolios with high-acyl and low-acyl grades tailored for specialized textures and suspension needs. Strategic moves include capacity expansion, regional distribution strengthening, and collaborations to support clean-label solutions. Producers also align with sustainability goals through energy-efficient processes and renewable input sourcing, helping them remain competitive in both mature and emerging markets.

[cr_cta type=”customize_now”

Key Player Analysis

- Meron

- Brova

- Gino Gums Stabilizers

- Sinofi Ingredients

- Merck

- Zhejiang Tech-Way Biotechnology

- Ceamsa

- Foodchem International Corporation

- CP Kelco

Recent Developments

- In 2025, Sinofi Ingredients highlighted its capabilities for supplying E418 gellan gum globally.

- In 2025, Merck completed the acquisition of SpringWorks Therapeutics, a move that expands its rare tumor business and highlights significant M&A activity in the broader life sciences sector, which utilizes gellan gum in various applications.

- In 2023, CP Kelco expanded its gellan gum production capacity at its facilities in Okmulgee, Oklahoma, and Wulian, China, to meet growing global demand, particularly from plant-based and clean-label applications

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as clean-label adoption rises across major industries.

- Demand will increase in plant-based beverages and dairy alternatives due to wider reformulation.

- Pharmaceutical applications will expand as controlled-release and ophthalmic gels gain acceptance.

- Personal care brands will use more gellan gum to replace synthetic thickeners.

- Functional and fortified beverages will drive higher usage for suspension and stability needs.

- Manufacturers will invest in improved fermentation technologies to enhance supply efficiency.

- Biodegradable hydrocolloid development will create new opportunities in premium segments.

- Asia Pacific will emerge as the fastest-growing region due to strong food innovation.

- Competition with alternative gums will push producers to focus on performance-based differentiation.

- Strategic partnerships will increase as companies target growth in specialty and regulated applications.