Market overview

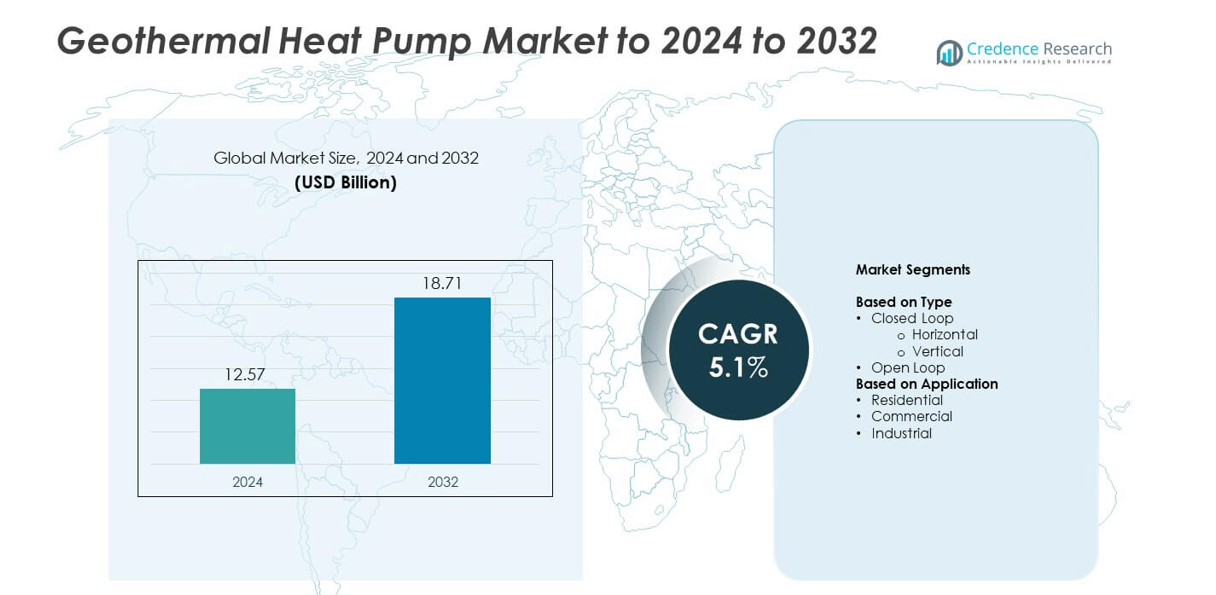

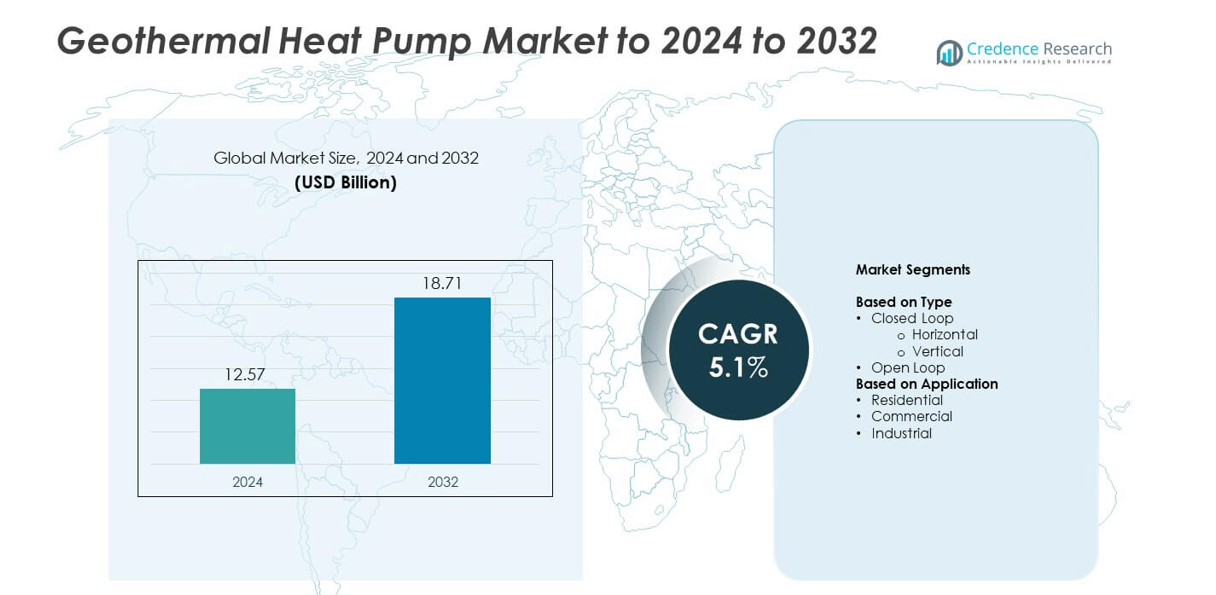

The Geothermal Heat Pump Market size was valued at USD 12.57 billion in 2024 and is anticipated to reach USD 18.71 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geothermal Heat Pump Market Size 2024 |

USD 12.57 billion |

| Geothermal Heat Pump Market, CAGR |

5.1% |

| Geothermal Heat Pump Market Size 2032 |

USD 18.71 billion |

The geothermal heat pump market is driven by key players such as Daikin, ClimateMaster, Inc., Viessmann, Carrier, Stiebel Eltron, Bosch, Glen Dimplex, and Vaillant Group. These companies focus on expanding their renewable heating portfolios through product innovation, advanced compressor technologies, and integration of smart energy systems. Strategic partnerships and investments in sustainable manufacturing further enhance their global reach. North America led the market with a 39% share in 2024, supported by government incentives and strong residential adoption, while Europe followed with 31%, driven by stringent emission regulations and widespread adoption of green building initiatives.

Market Insights

- The geothermal heat pump market was valued at USD 12.57 billion in 2024 and is projected to reach USD 18.71 billion by 2032, growing at a CAGR of 5.1%.

- Rising demand for energy-efficient heating and cooling systems, coupled with supportive government incentives and renewable energy targets, is driving market growth.

- Technological innovations in vertical closed-loop systems and integration with smart home solutions are shaping future adoption trends.

- The market is highly competitive, with major players focusing on expanding production capacity, product efficiency, and global distribution networks.

- North America held a 39% share in 2024, followed by Europe with 31% and Asia Pacific with 22%, while the closed-loop segment dominated overall with a 78% share due to higher operational efficiency and suitability for both residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The closed-loop segment dominated the geothermal heat pump market with a 78% share in 2024. Within this segment, vertical systems held the largest portion due to their efficiency in limited-space installations and consistent thermal exchange performance. Horizontal systems followed, preferred for residential projects with larger land availability. Open-loop systems accounted for a smaller share due to site and water availability limitations. Rising demand for sustainable HVAC solutions and government incentives supporting energy-efficient systems continue to drive adoption of vertical closed-loop systems across both urban and commercial developments.

- For instance, Montana State University’s geo-district features 264 boreholes with 56 miles of piping, designed for multi-building vertical closed-loop operation.

By Application

The residential segment led the geothermal heat pump market with a 54% share in 2024. Increasing household adoption of renewable heating and cooling technologies and rising energy costs boosted demand for these systems. Commercial applications followed, supported by growing green building initiatives and sustainability certifications such as LEED and BREEAM. Industrial use remained limited but is gaining attention for process heating efficiency. Supportive policy frameworks, combined with technological advances improving installation and payback periods, continue to strengthen residential and commercial deployment of geothermal heat pumps globally.

- For instance, Kensa delivered the “Heat the Streets” project, which included 102 boreholes to provide ground source systems to 96 homes and enable future connections for an additional 22 homes.

Key Growth Drivers

Rising Focus on Energy Efficiency

The growing shift toward energy-efficient and sustainable heating and cooling systems drives geothermal heat pump demand. Governments and institutions are promoting clean energy adoption through tax credits, subsidies, and energy performance mandates. These systems reduce energy consumption by up to 50% compared to conventional HVAC systems, making them attractive for residential and commercial applications. Rising awareness of carbon reduction goals and lifecycle cost savings further strengthens market expansion across both developed and developing economies.

- For instance, in Montana State University’s campus-wide energy strategy, the combination of geothermal heat pump systems and other building energy efficiency systems led to a 25% reduction in campus building energy use intensity between 2007 and 2023.

Supportive Government Incentives and Policies

Regulatory incentives and renewable energy programs are major catalysts for geothermal heat pump installations. Many countries have implemented favorable policies, including grants, rebates, and low-interest financing, to encourage green technology adoption. The U.S. Investment Tax Credit and EU Green Deal targets continue to stimulate installations in new and retrofit projects. These initiatives enhance cost competitiveness and accelerate market penetration, particularly in regions emphasizing carbon neutrality and sustainable infrastructure development.

- For instance, the “Heat the Streets” project, a collaborative effort involving Kensa Utilities, drilled boreholes totaling 11,319 meters of depth.

Technological Advancements in System Design

Innovations in compressor efficiency, smart control integration, and hybrid system configurations are improving geothermal heat pump performance. Modern systems now integrate IoT-based monitoring and adaptive control, optimizing energy use across varying climate conditions. Advancements in drilling and ground loop design have also reduced installation costs and time. These technological improvements have made geothermal systems more accessible to homeowners and commercial facilities, broadening their market reach and long-term adoption potential.

Key Trends and Opportunities

Integration with Smart and Hybrid Energy Systems

The integration of geothermal heat pumps with smart home systems and hybrid renewable technologies is an emerging trend. Combining geothermal systems with solar PV or energy storage allows users to achieve near-zero energy buildings. Advanced monitoring tools enhance real-time performance tracking and predictive maintenance, improving system efficiency and lifespan. This trend aligns with growing consumer demand for intelligent, connected, and eco-efficient home energy solutions.

- For instance, in a Mitsubishi Electric WR2 geothermal project on the Mornington Peninsula, a system was installed that used a 12.5 kW air-to-water booster unit and evacuated solar tubes for domestic hot water, two 25 kW heat-exchange units for the spa, and ducted indoor units for space heating and cooling.

Expansion in Commercial and Institutional Projects

The increasing focus on sustainability certifications and green building standards is expanding opportunities in commercial and institutional sectors. Schools, hospitals, and office complexes are increasingly adopting geothermal solutions to meet carbon reduction targets and operational efficiency goals. Long-term energy savings and low maintenance costs make geothermal systems a preferred choice for large-scale infrastructure. This trend is further reinforced by rising investments in public sector energy efficiency programs.

- For instance, the Montana State University campus energy districts utilized 56 miles of piping across its geothermal network, which serves multiple buildings.

Key Challenges

High Initial Installation Costs

The high upfront investment remains a primary challenge for widespread geothermal heat pump adoption. Drilling and loop installation contribute significantly to system costs, particularly in dense urban areas. Although operational savings offset expenses over time, the initial capital requirement often deters small-scale residential users. Limited financial awareness and inconsistent incentive structures further slow market expansion in cost-sensitive regions.

Lack of Skilled Workforce and Technical Awareness

The shortage of trained professionals for installation and maintenance limits market scalability. Many regions lack adequate expertise in system design and ground loop configuration, affecting efficiency and reliability. In addition, low consumer awareness about the long-term benefits of geothermal technology hinders adoption. Expanding technical training programs and awareness campaigns is essential to support the industry’s sustainable growth and ensure consistent performance outcomes.

Regional Analysis

North America

North America dominated the geothermal heat pump market with a 39% share in 2024, supported by rising demand for sustainable heating and cooling solutions. The United States leads the region, driven by federal tax credits, renewable energy programs, and growing adoption in residential retrofits. Canada follows, emphasizing carbon-neutral construction and green infrastructure initiatives. Expanding consumer awareness, coupled with declining installation costs and supportive policies like the Energy Star program, continues to enhance market penetration. The region’s strong technological base and presence of key manufacturers further reinforce its leadership position in the global market.

Europe

Europe accounted for 31% of the geothermal heat pump market share in 2024, fueled by stringent carbon emission regulations and renewable energy directives. Countries such as Germany, Sweden, and France are at the forefront of adoption, supported by subsidies and energy efficiency mandates. The EU’s Green Deal and renewable heat incentives have accelerated installations in both residential and commercial sectors. Widespread adoption of zero-emission building policies and retrofitting of existing structures further boost demand. Increasing preference for low-carbon heating alternatives strengthens Europe’s status as a key regional market for geothermal systems.

Asia Pacific

Asia Pacific held a 22% share of the geothermal heat pump market in 2024, with rapid urbanization and climate-conscious infrastructure driving installations. China, Japan, and South Korea lead adoption through investments in renewable energy and sustainable housing projects. The region benefits from growing government incentives and public-private partnerships promoting low-emission building systems. Rising energy costs and expanding middle-class awareness of eco-friendly technologies are supporting residential applications. Technological advancements and foreign investments in green infrastructure are expected to further enhance Asia Pacific’s role in global market growth over the forecast period.

Latin America

Latin America captured a 5% share of the geothermal heat pump market in 2024, with development primarily concentrated in Mexico, Brazil, and Chile. Government initiatives promoting renewable energy integration in building systems are fostering gradual adoption. Urban population growth and increasing construction of energy-efficient housing create moderate opportunities. However, high upfront installation costs and limited technical expertise slow broader penetration. Ongoing sustainability efforts and regional energy diversification plans are expected to drive future geothermal deployment across both residential and commercial sectors in emerging economies.

Middle East and Africa

The Middle East and Africa accounted for a 3% share of the geothermal heat pump market in 2024, reflecting early-stage adoption. Rising awareness of energy conservation, combined with large-scale commercial projects in the UAE and South Africa, supports market potential. Regional governments are exploring geothermal integration in new developments to reduce grid dependency and emissions. However, limited geothermal resource mapping and high setup costs constrain market growth. Future expansion will depend on regional policy support, research initiatives, and increasing participation in sustainable infrastructure programs.

Market Segmentations:

By Type

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The geothermal heat pump market is led by major players such as Daikin, ClimateMaster, Inc., Viessmann, Carrier, Stiebel Eltron, Bosch, Glen Dimplex, Vaillant Group, Ingersoll Rand (Trane), NIBE, Dandelion, OCHSNER, Robert Bosch LLC, Spectrum Manufacturing, Bard HVAC, and Maritime Geothermal. The competitive landscape is characterized by continuous innovation, energy efficiency advancements, and integration of smart technologies to enhance system performance. Leading manufacturers focus on expanding their renewable heating portfolios through R&D investments and strategic partnerships. Many companies are also strengthening their regional presence by establishing production facilities and service networks in high-demand markets. Product diversification and compliance with sustainability standards such as LEED and Energy Star remain central to their strategies. Additionally, collaborations with builders, utilities, and government programs are enabling market leaders to capture a growing share of residential and commercial installations, positioning geothermal technology as a key component of future clean energy solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin

- ClimateMaster, Inc.

- Viessmann

- Carrier

- Stiebel Eltron

- Bosch

- Glen Dimplex

- Vaillant Group

- Ingersoll Rand (Trane)

- NIBE

- Dandelion

- OCHSNER

- Robert Bosch LLC

- Spectrum Manufacturing

- Bard HVAC

- Maritime Geothermal

Recent Developments

- In 2024, Bosch presented its IDS Ultra cold-climate air-source heat pump, At CES in January, which is designed for high-efficiency heating in areas with cold winters

- In 2024, Daikin introduced the Daikin Altherma 4 H, a residential air-to-water heat pump using the natural refrigerant R-290 (propane).

- In 2024, Dandelion Energy launched its new Dandelion Geo heat pump, described as a revolutionary residential geothermal heat pump.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of geothermal heat pumps will rise as nations push for carbon-neutral goals.

- Technological advances will enhance system efficiency and lower installation costs.

- Smart and hybrid geothermal systems will gain popularity in residential projects.

- Commercial and institutional applications will expand through green building initiatives.

- Government subsidies and tax incentives will continue supporting market penetration.

- Integration with solar and storage systems will create new energy management models.

- Urban retrofitting projects will drive replacement demand in developed economies.

- Emerging economies will witness growth as awareness of clean energy increases.

- Workforce training and technical standardization will improve system reliability.

- Long-term focus on sustainable HVAC solutions will solidify geothermal technology’s global presence.