Market Overview

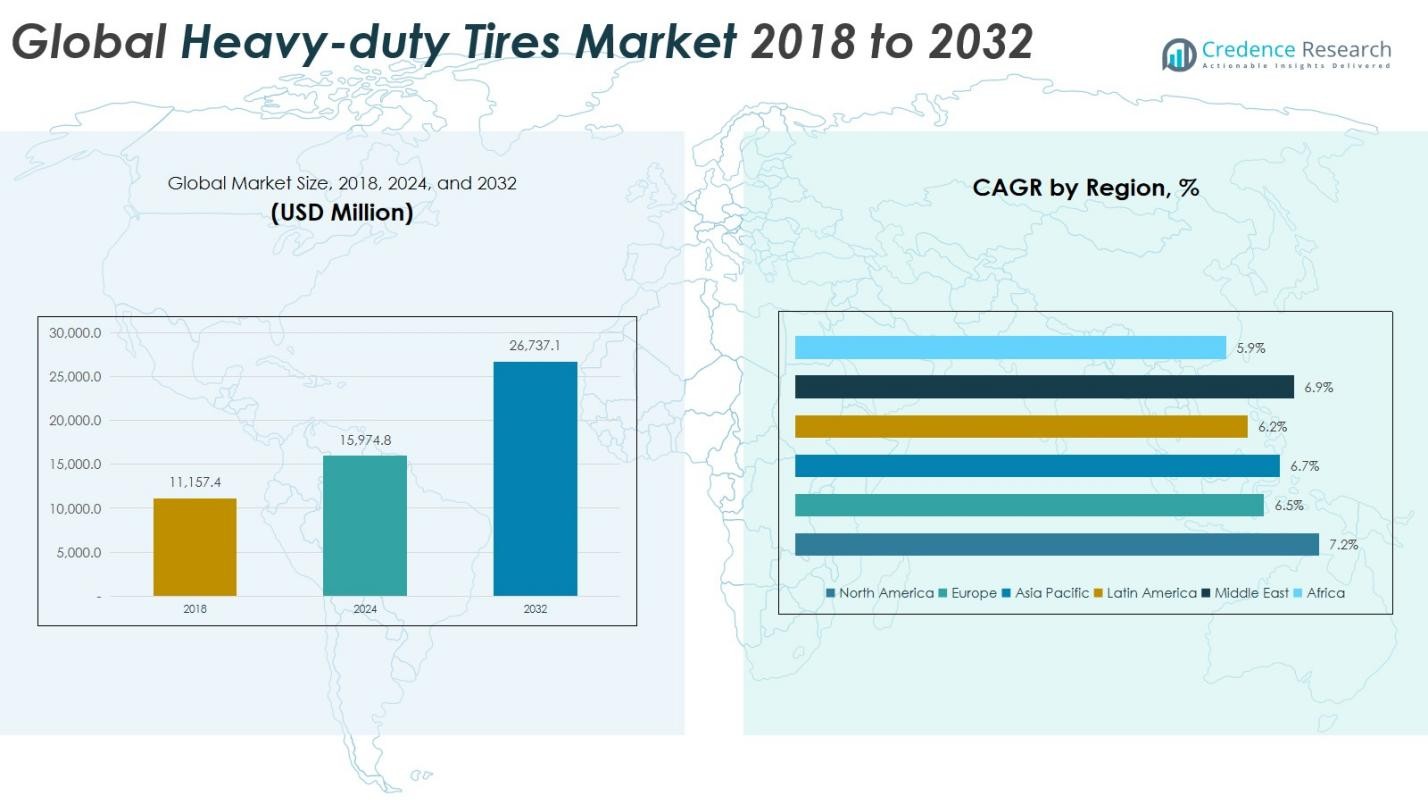

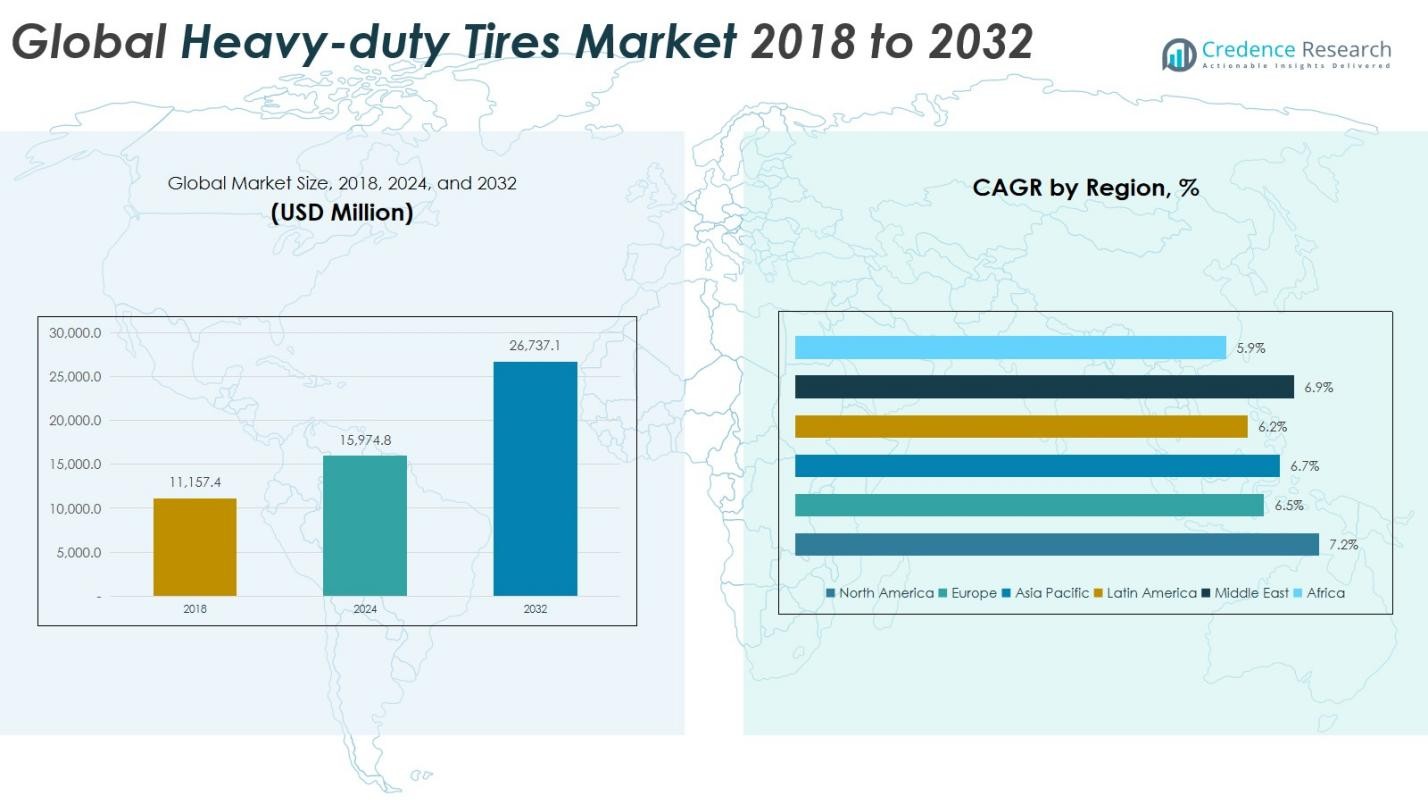

Global Heavy-duty Tires Market size was valued at USD 11,157.4 Million in 2018 and is expected to reach USD 15,974.8 Million in 2024. The market is anticipated to grow further, reaching USD 26,737.1 Million by 2032, at a CAGR of 6.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy-duty Tires Market Size 2024 |

USD 15,974.8 Million |

| Heavy-duty Tires Market, CAGR |

6.70% |

| Heavy-duty Tires Market Size 2032 |

USD 26,737.1 Million |

The Global Heavy-duty Tires Market is highly competitive, with leading players including Bridgestone Corporation, Continental Tires, Balkrishna Industries Limited, Titan Tire Corporation, Sumitomo Rubber Industries, Ralson Tires, MRF, Yokohama, and JK Tyre & Industries Ltd. These companies focus on innovation, durability, and fuel-efficient tire solutions for construction, mining, and agricultural machinery, strengthening their market positions. Asia Pacific emerges as the leading region, holding approximately 34% of the global market share in 2024, driven by rapid industrialization, infrastructure expansion, and mechanization in agriculture. Europe follows with around 28% share, supported by technological advancements and regulatory compliance, while North America accounts for roughly 22%, bolstered by strong OEM demand and aftermarket growth. Strategic partnerships, R&D investment, and expansion into emerging markets remain key strategies for top players to maintain and enhance their market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Heavy-duty Tires Market was valued at USD 15,974.8 Million in 2024 and is projected to reach USD 26,737.1 Million by 2032, growing at a CAGR of 6.70%. The Construction & Mining Machinery segment dominates with 42% share.

- Market growth is driven by increasing infrastructure projects, expansion in mining and industrial sectors, and mechanization in agriculture and forestry, which boost demand for durable, high-performance tires.

- Key trends include rising adoption of digital and e-commerce sales channels, advanced tire technologies with fuel efficiency and longer lifespan, and integration of smart tire solutions for performance monitoring and predictive maintenance.

- The market is highly competitive, led by Bridgestone, Continental, Balkrishna Industries, Titan Tire Corporation, Sumitomo Rubber Industries, Ralson Tires, MRF, Yokohama, and JK Tyre, focusing on innovation, partnerships, and expansion into emerging markets.

- Regionally, Asia Pacific leads with 34% share, followed by Europe at 28% and North America at 22%, driven by industrialization, urbanization, and strong OEM and aftermarket demand.

Market Segmentation Analysis:

By Vehicle

The Construction & Mining Machinery segment dominates the vehicle category, capturing 42% of the market share in 2024. This growth is driven by rising global infrastructure projects, mining activities, and increased demand for durable, high-performance tires capable of withstanding harsh terrains. Industrial Vehicles hold a significant share as well, supported by expanding logistics and warehousing operations, while Agricultural & Forestry Machinery demand is steadily growing due to mechanization trends in farming and forestry. Overall, the segment’s growth is fueled by advancements in tire technology and increasing replacement cycles.

For instance, Toyota Material Handling’s 2024 electric forklift line uses Continental’s solid tires designed for high load-bearing capacity and reduced downtime in 24/7 logistics operations.

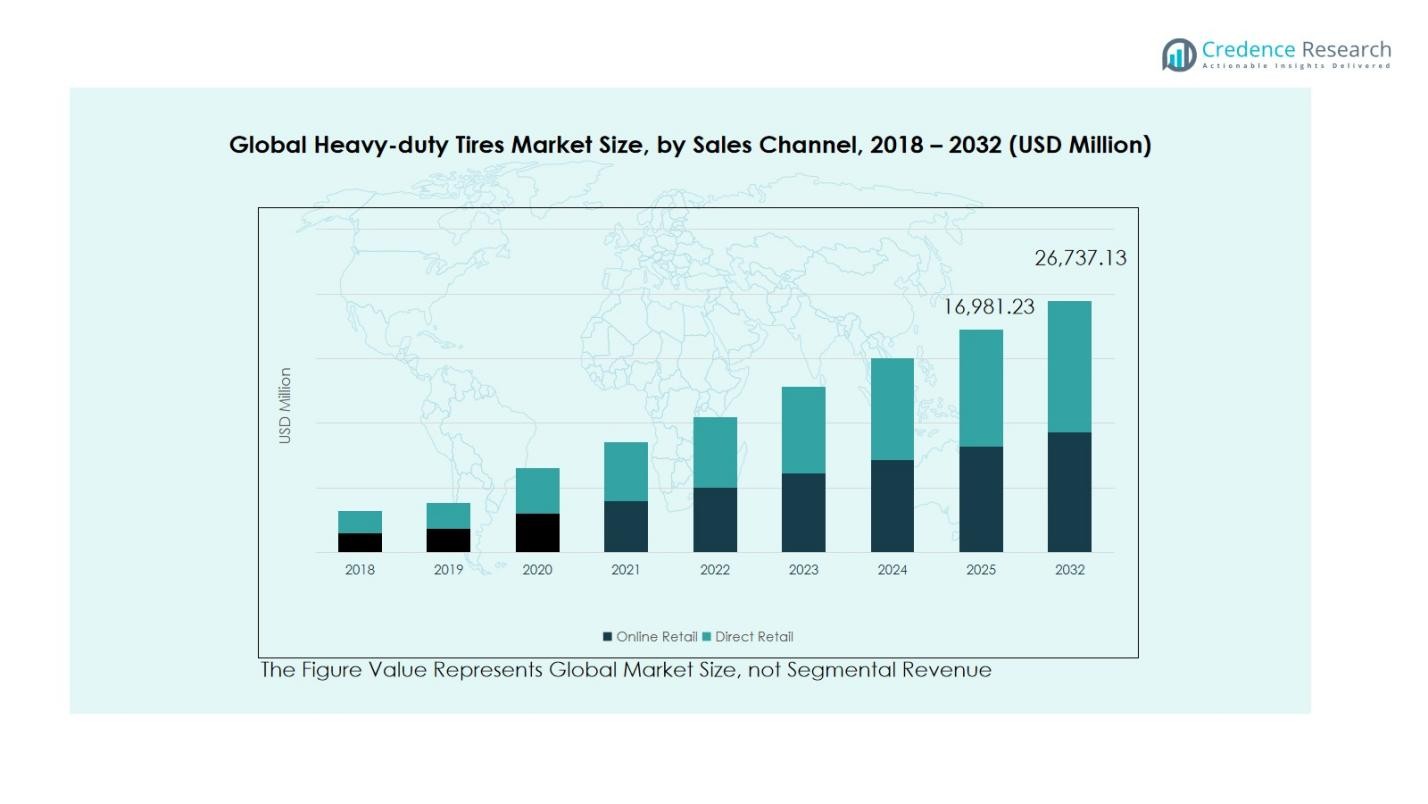

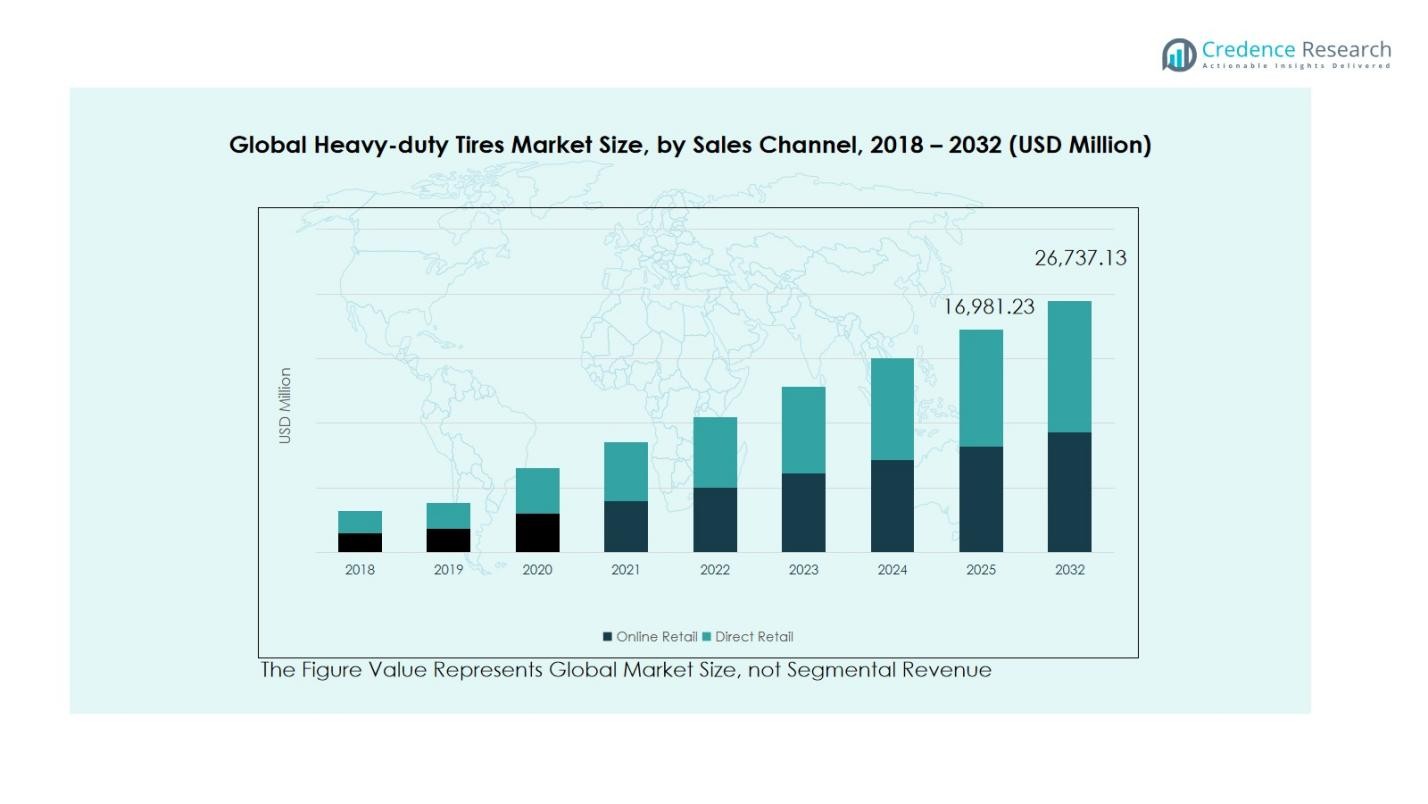

By Sales Channel

Direct Retail leads the sales channel segment, accounting for roughly 65% of market revenue. This dominance is driven by strong relationships between tire manufacturers and commercial fleet operators, enabling bulk purchases and timely delivery. Online Retail is rapidly emerging, holding about 35% share, propelled by digital transformation and increasing e-commerce adoption in the commercial tire industry. The convenience of online procurement, broader product selection, and competitive pricing are key drivers for online sales, particularly in regions with growing logistics and construction activities.

For instance, Goodyear leverages its direct relationships with logistics companies to fulfill large commercial tire orders efficiently, maintaining a significant market presence.

By End User

The Original Equipment Manufacturer (OEM) segment dominates the end-user category with 58% market share. OEM demand is fueled by expanding global vehicle production, particularly in construction, mining, and agricultural machinery sectors. Aftermarket accounts for 42%, driven by tire replacement cycles, maintenance requirements, and fleet upgrades. Growth in the aftermarket is further supported by rising awareness of tire safety and performance standards. Overall, OEM sales continue to lead, benefiting from long-term manufacturer contracts and increasing global demand for heavy-duty machinery.

Key Growth Drivers

Rising Infrastructure and Construction Activities

The global heavy-duty tires market is driven by expanding infrastructure and construction projects across emerging and developed regions. Increasing demand for durable tires capable of handling heavy loads and rough terrains in mining, road construction, and industrial operations fuels market growth. Governments’ focus on public infrastructure investments, coupled with urbanization and industrial expansion, further supports demand. Advanced tire technologies that enhance performance, longevity, and fuel efficiency are encouraging adoption among fleet operators, particularly in regions witnessing rapid construction and mining activity growth.

For instance, Bridgestone has developed advanced OTR (off-the-road) tires that support massive mining machines and construction equipment, enhancing safety and operational efficiency in extreme conditions.

Growth in Mining and Industrial Sectors

The mining and industrial sectors are significant contributors to the heavy-duty tires market. Rising mineral exploration, increased extraction activities, and industrialization require robust, high-performance tires for heavy machinery. Mining operations demand tires that can endure extreme conditions, while industrial logistics and warehousing expand tire replacement cycles. Technological innovations, such as improved tread design and heat-resistant compounds, enhance efficiency and safety. This trend drives market adoption across regions with abundant mining resources and industrial growth, boosting overall market revenue.

For instance, BKT’s MINE STAR bias-ply tires, designed for underground mining, feature high cut, chip, and puncture resistance, extending tire life cycles in tough environments.

Mechanization of Agriculture and Forestry

Mechanized agriculture and forestry are fueling demand for heavy-duty tires in tractors, harvesters, and forestry machinery. Modernization of agricultural practices in regions like North America, Europe, and Asia Pacific has increased reliance on high-performance tires to improve operational efficiency and reduce downtime. These tires offer better traction, load-bearing capacity, and durability, aligning with sustainable and precision farming practices. Government incentives and adoption of advanced machinery in agriculture further drive market expansion, making agricultural and forestry machinery a key growth segment within the heavy-duty tires industry.

Key Trends & Opportunities

Digitalization and E-Commerce Sales Channels

The heavy-duty tires market is increasingly leveraging digital platforms and e-commerce channels to reach end-users directly. Online procurement offers convenience, real-time availability, and competitive pricing, creating opportunities to expand customer reach, especially among small and medium fleet operators. Manufacturers are adopting online platforms for sales, service, and aftermarket solutions, driving revenue growth. This digital transformation also enables data-driven demand forecasting and inventory management, creating efficiency in operations and enhancing customer experience.

For instance, Apollo Tyres launched an e-commerce portal offering a “buy online, fit offline” model where customers purchase tires online and schedule fitting at nearby dealer locations, initially serving major Indian cities and enhancing customer convenience with uniform pricing and technical support.

Technological Advancements in Tire Design

Innovation in tire materials, tread patterns, and performance characteristics presents significant market opportunities. Manufacturers are focusing on developing long-lasting, fuel-efficient, and environmentally sustainable tires. Advanced designs improve traction, reduce wear, and optimize operational efficiency for construction, mining, and agricultural machinery. Rising adoption of smart tire technologies, such as sensors for real-time monitoring and predictive maintenance, further strengthens market growth potential. This focus on innovation creates differentiation among key players and encourages fleet operators to invest in high-performance heavy-duty tires.

For instance, Goodyear’s SightLine technology incorporates sensors that detect rain and ice, enhancing automatic braking systems and enabling predictive tire maintenance through real-time data on pressure, temperature, and tread wear.

Key Challenges

High Manufacturing and Raw Material Costs

The heavy-duty tires market faces challenges due to rising production and raw material costs, including rubber, steel, and synthetic compounds. Fluctuations in commodity prices affect profitability and may limit price competitiveness. Manufacturers must balance cost pressures while maintaining product quality and performance standards. High costs can also impact the adoption of advanced tire technologies in price-sensitive markets, slowing overall market growth. Effective supply chain management and strategic sourcing are critical to mitigate cost-related challenges.

Stringent Regulatory and Environmental Norms

Compliance with environmental regulations and safety standards poses a challenge for heavy-duty tire manufacturers. Increasing restrictions on emissions, tire recycling, and sustainable manufacturing practices require investment in R&D and adherence to global norms. Non-compliance can lead to penalties and affect market reputation. Additionally, differing regulations across regions create complexity for global manufacturers, necessitating adaptation of products and processes to meet diverse legal requirements. This regulatory environment can slow product launches and increase operational costs.

Regional Analysis

North America

North America held a significant share of the global heavy-duty tires market, valued at USD 2,417.81 million in 2018. The region is expected to reach USD 3,566.49 million in 2024 and USD 6,203.01 million by 2032, growing at a CAGR of 7.2%. Market growth is driven by increasing infrastructure projects, modernization of construction and mining equipment, and a strong industrial base. OEM demand for high-performance tires and a mature aftermarket segment further support expansion. The North American market remains competitive, with major players focusing on technological innovation, fleet partnerships, and sustainable tire solutions to enhance market penetration.

Europe

Europe accounted for a notable share of the heavy-duty tires market, with a valuation of USD 3,186.56 million in 2018. The market is projected to grow to USD 4,502.16 million in 2024 and USD 7,400.84 million by 2032, at a CAGR of 6.5%. Expansion is supported by infrastructure development, industrial automation, and increasing demand for durable tires in construction, mining, and agricultural sectors. Regulatory compliance, adoption of environmentally sustainable tire technologies, and rising replacement cycles drive market growth. European manufacturers focus on advanced tire solutions, reinforcing the region’s position as a key contributor to global revenue.

Asia Pacific

Asia Pacific is a leading region in the heavy-duty tires market, valued at USD 3,805.79 million in 2018. The market is expected to reach USD 5,441.48 million in 2024 and USD 9,090.62 million by 2032, growing at a CAGR of 6.7%. Growth is driven by rapid urbanization, industrialization, and expansion in construction, mining, and agricultural activities across China, India, Japan, and Southeast Asia. Mechanization in agriculture and rising infrastructure investments fuel demand for high-performance tires. Strong OEM adoption and growing aftermarket requirements enhance revenue potential, positioning Asia Pacific as a dominant global market.

Latin America

Latin America held a moderate market share, valued at USD 816.72 million in 2018, and is projected to reach USD 1,139.92 million in 2024 and USD 1,842.19 million by 2032, at a CAGR of 6.2%. Market growth is supported by expanding mining operations, construction projects, and agricultural mechanization in countries such as Brazil and Argentina. Rising replacement cycles and fleet modernization further drive demand for heavy-duty tires. Local manufacturers and international players are focusing on improving distribution channels and offering durable, high-performance products tailored to challenging terrains and operational needs in the region.

Middle East

The Middle East market was valued at USD 644.90 million in 2018 and is projected to reach USD 932.24 million in 2024 and USD 1,580.16 million by 2032, growing at a CAGR of 6.9%. Growth is driven by robust infrastructure and construction activities, rising industrial operations, and expanding mining projects across GCC countries, Turkey, and Israel. Demand for high-performance tires capable of withstanding harsh climatic conditions is increasing. OEM contracts, aftermarket replacements, and technological innovations in tire durability and traction enhance market expansion in this region, making the Middle East a growing contributor to global revenue.

Africa

Africa accounted for a smaller share of the global heavy-duty tires market, valued at USD 285.63 million in 2018, projected to reach USD 392.52 million in 2024 and USD 620.30 million by 2032, at a CAGR of 5.9%. Market growth is driven by rising construction activities, mining expansion, and mechanization in agriculture across South Africa, Egypt, and other regions. Increasing aftermarket demand, fleet upgrades, and adoption of durable, all-terrain tires support market expansion. Challenges such as limited infrastructure and regulatory complexities exist, but growing industrialization and mining projects present significant long-term growth opportunities in the African market.

Market Segmentations:

By Vehicle

- Construction & Mining Machinery

- Industrial Vehicles

- Agricultural & Forestry Machinery

By Sales Channel

- Direct Retail

- Online Retail

By End User

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global heavy-duty tires market is led by key players such as Bridgestone Corporation, Continental Tires, Balkrishna Industries Limited, Titan Tire Corporation, Sumitomo Rubber Industries, Ralson Tires, MRF, Yokohama, and JK Tyre & Industries Ltd. Market competition is intense, driven by technological innovation, product differentiation, and expansion into emerging markets. Companies are investing in research and development to offer tires with improved durability, fuel efficiency, and traction for construction, mining, and agricultural machinery. Strategic partnerships, acquisitions, and expansion of distribution networks are common to enhance market reach. Additionally, manufacturers are focusing on environmentally sustainable tires and smart tire technologies to meet regulatory requirements and evolving customer demands. Overall, the market is highly fragmented, with both global and regional players striving to strengthen their position through innovation, cost efficiency, and enhanced service offerings.

Key Player Analysis

Recent Developments

- In July 2024, Yokohama Rubber Co., Ltd. agreed to acquire the OTR (off-the-road) tire business of Goodyear Tire & Rubber Company (priced at US$905 million) to bolster its heavy-duty / off-highway tyre segment.

- In December 2024, CEAT Ltd. announced it will acquire the Camso brand’s off-highway tyres and tracks business from Michelin S.A. (for approx. US$225 million) to expand into heavy-duty / off-highway segments.

- In 2025, ZC Rubber launched its “X-Elite Series” of heavy-duty tyres aimed at truck applications in Southeast Asia.

- In June 2025, CEAT acquired a high-performance heavy-duty prime-mover (a Scania 460 G truck) to bolster its R&D and testing capabilities for commercial vehicle tyres globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Sales Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for heavy-duty tires will continue to grow with increasing global infrastructure and construction projects.

- Expansion in mining and industrial operations will drive the need for durable, high-performance tires.

- Mechanization in agriculture and forestry will create consistent demand for specialized tires.

- Adoption of advanced tire technologies, including fuel-efficient and long-lasting designs, will accelerate market growth.

- E-commerce and digital sales channels will enhance accessibility and streamline procurement for end-users.

- OEM contracts will remain a key driver, supporting long-term market stability

- Aftermarket demand will rise due to tire replacement cycles and fleet modernization.

- Sustainability initiatives and environmentally friendly tire solutions will shape product development.

- Technological innovations, such as smart tire sensors, will improve performance monitoring and maintenance.

- Emerging markets in Asia Pacific, Middle East, and Latin America will offer significant growth opportunities.