Market Overview:

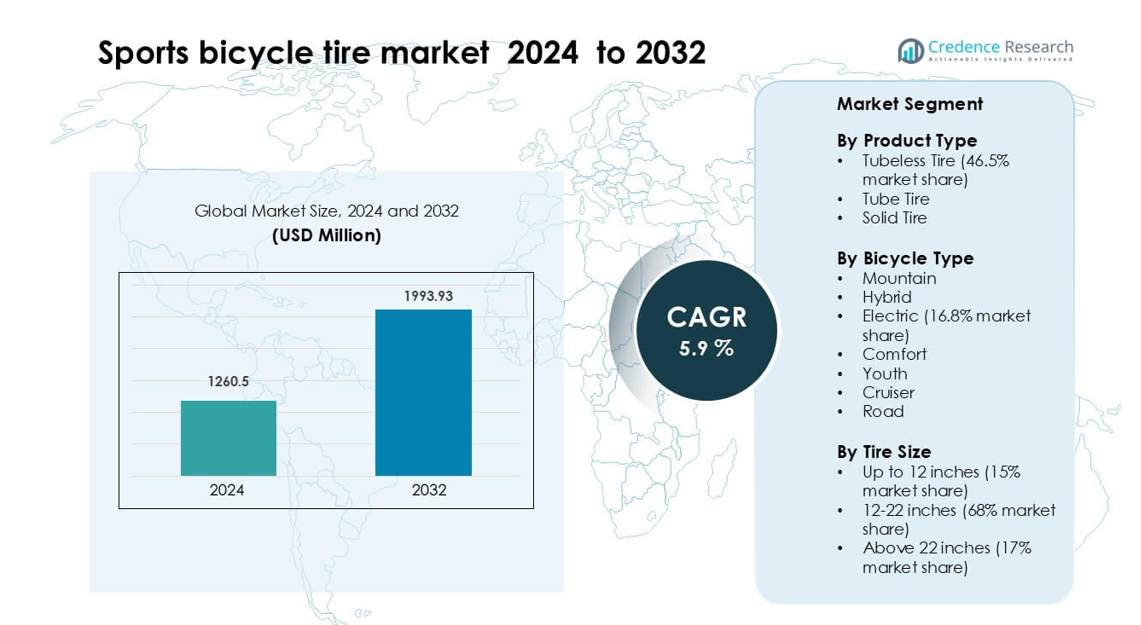

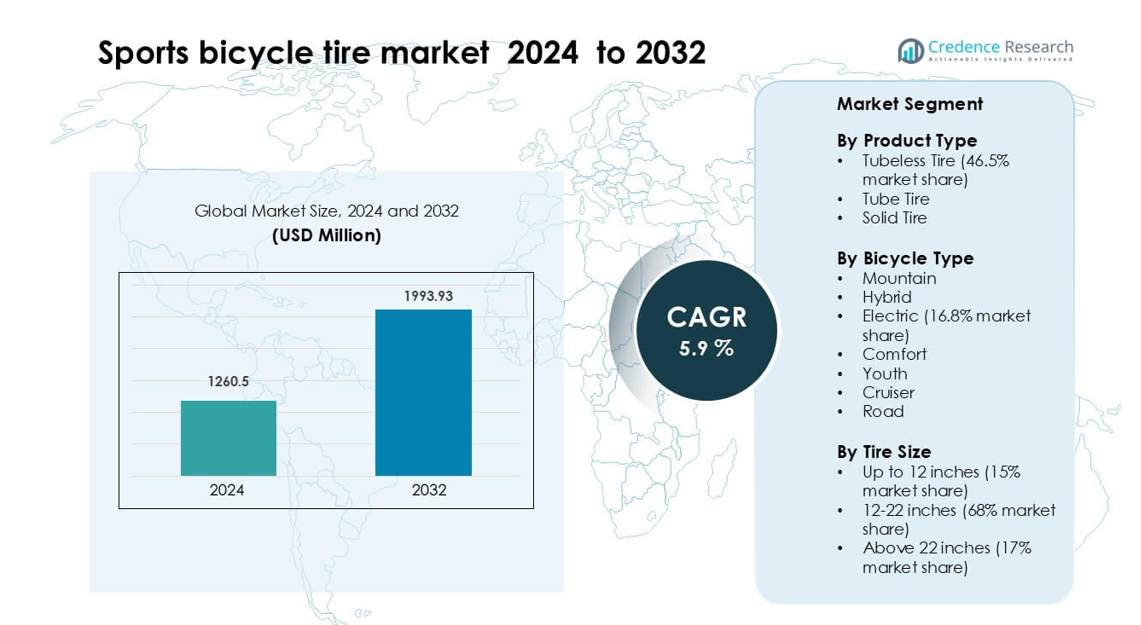

Sports bicycle tire market was valued at USD 1260.5 million in 2024 and is anticipated to reach USD 1993.93 million by 2032, growing at a CAGR of 5.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sports Bicycle Tire Market Size 2024 |

USD 1260.5 million |

| Sports Bicycle Tire Market, CAGR |

5.9% |

| Sports Bicycle Tire Market Size 2032 |

USD 1993.93 million |

The sports bicycle tire market is shaped by leading players such as Vittoria Industries, Pirelli Tyre S.p.A., Hangzhou Zhongce Rubber, Maxxis International, Michelin, Schwalbe, Bridgestone Corporation, Continental AG, Kenda Tires, and CST (Cheng Shin Rubber). These companies compete through advanced compounds, tubeless technologies, and performance-focused designs that meet the needs of road, mountain, gravel, and electric bicycles. Europe stands as the leading region with about 32% market share, supported by strong cycling culture, extensive infrastructure, and high adoption of premium performance tires across both OEM and replacement channels.

Market Insights

- The sports bicycle tire market is valued at around USD 1,260.5 million in 2024 and is expected to grow at a CAGR of approximately 5.9 %.

- Growth is driven by increasing tubeless tire adoption (46.5% share by product type) and rising e-bike use (16.8% share by bicycle type).

- Emerging trends include wider tire sizes with 12–22inch segment dominating at 68% share and tubeless/off-road technology upgrades gaining traction.

- Competitive landscape features major players like Vittoria Industries, Pirelli Tyre S.p.A., Hangzhou Zhongce Rubber, Maxxis International, Michelin, Schwalbe, Bridgestone Corporation, Continental AG, Kenda Tires, and CST (Cheng Shin Rubber) refining performance and price models.

- Restraints involve premium pricing limiting adoption in cost-sensitive regions and raw material cost volatility pressuring margin expansion.

- Regional analysis shows Europe leads with about 32% share, while Asia-Pacific follows with around 28% due to strong local manufacturing and growing bicycle usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

tubeless tires lead the sports bicycle tire market with 46.5% share. Riders prefer tubeless designs because they reduce pinch flats and allow lower operating pressures. These benefits deliver better traction, comfort, and handling on varied terrains. Manufacturers respond by expanding tubeless ranges across premium and mid-range lines. Tube tires remain relevant in entry-level and budget bicycles due to lower upfront costs. Solid tires occupy a niche in rental, urban, and utility segments. The overall mix is shifting steadily toward performance-focused tubeless systems.

- For instance, Continental’s Grand Prix 5000 S TR tubeless-ready tire in the 700×25 C size weighs 250 g, according to its 2023-24 product catalogue.

By Bicycle Type

electric models account for about 16.8% of demand. They form the most influential growth segment in sports bicycle tires. E-bikes require durable, puncture-resistant tires that handle higher torque and speed. Brands develop reinforced casings, grippier treads, and higher load ratings for electric platforms. Mountain and hybrid bicycles continue to generate strong baseline volume. They serve performance and recreational categories worldwide. Comfort, cruiser, youth, and road bicycles add diversity through city riding and training uses. Together, these segments push manufacturers toward specialized compounds and construction tuned to each riding style.

- For instance, Schwalbe’s Marathon E-Plus Smart DualGuard tire is ECE-R75 certified for e-bikes up to 50 km/h and, depending on the size, supports a maximum load up to 136 kg per tire.

By Tire Size

the 12–22 inches segment dominates the sports bicycle tire market. It holds around 68% share. This range covers most mountain, hybrid, youth, and many commuter bicycles. It supports broad replacement and OEM demand. Riders in this band seek balanced performance between rolling efficiency, grip, and comfort. Up to 12 inches, holding about 15% share, serves kids’ and specialty compact bicycles. Above 22 inches, with nearly 17% share, targets large-format and performance builds. These outer ranges grow steadily as niche and custom cycling communities expand.

Key Growth Drivers

Rising Popularity of Cycling and Outdoor Recreation

Growing interest in fitness, wellness, and outdoor recreation strongly drives the sports bicycle tire market. More consumers adopt cycling for exercise, commuting, and leisure, increasing both OEM and replacement tire demand. Governments promote cycling infrastructure through bike lanes, urban trails, and bike-sharing schemes, which encourages higher usage intensity and faster tire wear. Organized events such as mountain biking races, gran fondos, and endurance rides further stimulate uptake of performance-focused tires. This broader participation base, combined with higher mileage per rider, leads to recurring replacement cycles and sustained volume growth across premium, mid-range, and entry-level tire categories.

- For instance, in the City of London, the number of daily cyclists in the Square Mile rose from 89,000 in 2022 to 139,000 in October 2024, driven by expanded cycle paths and dockless hire bikes.

Expansion of E-Bikes and Performance-Oriented Bicycles

Rapid penetration of electric bicycles and high-performance sports bikes is a key growth engine for the sports bicycle tire market. E-bikes place greater torque and load on tires, requiring reinforced casings, puncture protection, and specialized compounds. This technical need pushes average selling prices higher and accelerates product upgrades. Performance segments such as mountain, gravel, and road racing also favor advanced tread designs and lightweight constructions. Riders in these categories replace tires more frequently for optimized grip and rolling resistance. OEMs increasingly specify premium tires on new builds to differentiate models and meet rider expectations, further expanding value growth beyond pure volume increases.

- For instance, Michelin’s E-Wild tyres for e-MTB feature a durable Gravity Shield casing and deliver robustness for high-torque off-road use. The specific weight for the 27.5″ x 2.60″ size depends on the specific tire: the front tire weighs approximately 1,000 g, while the reinforced rear tire weighs more, around 1,220 g to 1,275 g.

Technological Advancements in Tire Materials and Design

Advances in rubber compounds, casing fabrics, and tubeless technology significantly support market expansion in sports bicycle tires. Manufacturers use high-silica and dual-compound treads to balance rolling efficiency with cornering grip. Tubeless-ready constructions and improved bead designs reduce punctures and enable lower pressures, enhancing control on rough terrain. Lightweight yet strong carcasses based on high-thread-count fabrics help reduce rotational mass without sacrificing durability. Integration of reflective sidewalls, low-rolling-resistance layers, and eco-friendlier materials also appeals to safety- and sustainability-conscious consumers. These innovations justify premium pricing, encourage riders to trade up from basic tires, and create clear performance differentiation across product lines.

Key Trend and Opportunity

Growing Adoption of Tubeless and Wider Tires

One of the strongest trends in the sports bicycle tire market is the shift toward tubeless systems and wider tire profiles. Riders favor tubeless setups for improved puncture resistance and the ability to run lower pressures, which enhance comfort and grip. Wider tires, particularly in gravel, mountain, and even endurance road segments, provide better stability on mixed surfaces and poor road conditions. OEM bicycle platforms increasingly come tubeless-ready, accelerating mainstream adoption. This transition drives demand for compatible rims, sealants, and premium tire models. The trend also encourages repeat purchases as riders experiment with different widths and tread patterns to optimize performance for specific terrains and riding styles.

- For instance, Maxxis supports this wider, tubeless trend with its Wide Trail (WT) construction specifically for its 2.40″ and 2.50″ tubeless-ready MTB tyres optimized for 30–35 mm internal rim widths.

Urban Mobility, Bike-Sharing, and Micro-Mobility

Rising urbanization and interest in sustainable mobility create strong opportunities for the sports bicycle tire market. City planners promote cycling and micro-mobility to reduce congestion and emissions. This environment supports growth in commuter, hybrid, and e-bike fleets, including shared and rental models. These use cases demand durable, puncture-resistant tires capable of handling high utilization and varied rider profiles. Rental operators often replace tires proactively to maintain safety and uptime, adding recurring institutional demand. There is also room for specialized urban tread designs for wet grip, cut resistance, and low rolling resistance. As more cities integrate bicycles into public transport systems, tire volumes and replacement cycles in these segments should continue to rise.

Key Challenge

Price Sensitivity and Competition from Low-Cost Manufacturers

Price sensitivity remains a significant challenge in the sports bicycle tire market, particularly in emerging economies and entry-level segments. Many consumers focus on initial cost rather than long-term performance, which favors low-cost manufacturers and generic brands. This dynamic puts pressure on margins for established players who invest heavily in R&D and branding. Online marketplaces also intensify price competition by exposing buyers to a wide range of cheaper alternatives. To maintain share, premium brands must clearly communicate performance benefits, durability, and safety advantages. However, convincing budget-conscious riders to trade up can be difficult, slowing adoption of advanced technologies in lower-priced tiers.

Raw Material Volatility and Supply Chain Disruptions

Fluctuations in raw material prices and supply chain disruptions pose ongoing risks for the sports bicycle tire market. Natural rubber, synthetic rubber, and specialty chemicals are subject to price swings driven by weather events, geopolitical factors, and energy costs. Logistics challenges, shipping delays, and regional production bottlenecks can further strain availability, especially during demand spikes. These issues complicate inventory planning and lead to higher production costs, which may not be fully passed on to consumers due to competitive pricing pressure. Manufacturers need robust sourcing strategies, diversification of suppliers, and regional production footprints to mitigate these risks and maintain reliable supply to OEMs and aftermarket channels.

Regional Analysis

North America

North America represents around 24% share of the global sports bicycle tire market, mirroring broader bicycle tire dynamics. Demand benefits from strong recreational cycling culture, growing gravel and mountain biking participation, and rising e-bike adoption. Extensive trail networks, bike parks, and commuting corridors in the United States and Canada support higher tire replacement cycles. Premium brands see solid uptake of tubeless and puncture-resistant models as riders prioritize safety and performance. The United States remains the key country, accounting for roughly 6% of the worldwide bicycle tire market value, and aftermarket sales remain robust.

Europe

Europe accounts for about 32% share of the global sports bicycle tire market, giving the region a leading revenue position. Strong cycling cultures in Germany, the Netherlands, Denmark, and the Nordics sustain high per-capita bicycle ownership. Extensive urban bike lanes and long-distance touring routes boost mileage and accelerate tire replacement needs. Policy measures under the EU Green Deal and national cycling strategies continue to promote active mobility. As a result, premium road, gravel, and commuting tires see steady demand from both OEMs and aftermarket channels, while bike-sharing fleets further support replacement cycles.

Asia Pacific

Asia Pacific holds roughly 28% share of global sports bicycle tire revenue and leads overall volume growth. Large bicycle fleets in China, India, Japan, and Southeast Asia underpin strong baseline demand. Urban congestion, fuel costs, and air-quality concerns encourage commuters to adopt bicycles and e-bikes. Regional manufacturers such as Cheng Shin, Kenda, and Hangzhou Zhongce supply OEMs worldwide, reinforcing the area’s production strength. Rapid growth in organized cycling events, mountain biking destinations, and youth participation continues to push demand for performance-oriented and mid-priced tire lines across diverse terrains and usage segments.

Latin America

Latin America accounts for about 8% share of the global sports bicycle tire market, but offers meaningful growth potential. Countries such as Brazil, Mexico, Colombia, and Chile promote cycling for commuting, leisure, and tourism. Expanding urban cycle paths and car-free initiatives encourage greater bicycle usage, supporting higher tire replacement volumes. Mountain biking and road racing communities grow in key cities and resort regions, driving interest in premium and mid-range products. However, price sensitivity keeps strong demand for durable, value-oriented tires, particularly within youth, commuter, and informal delivery rider segments across major cities.

Middle East & Africa

The Middle East and Africa together represent roughly 8% share of the global sports bicycle tire market, with uneven development across countries. Wealthier Gulf states invest in cycling tracks, desert trails, and endurance events that support premium road and mountain bike tire demand. In contrast, many African markets still treat bicycles primarily as affordable transport, favoring robust, puncture-resistant products. Rising health consciousness, tourism cycling routes, and urban congestion gradually increase interest in sports and fitness cycling. Imports dominate supply, though local assemblers and distributors play an important role in reaching price-sensitive customers.

Market Segmentations:

By Product Type

- Tubeless Tire (46.5% market share)

- Tube Tire

- Solid Tire

By Bicycle Type

- Mountain

- Hybrid

- Electric (16.8% market share)

- Comfort

- Youth

- Cruiser

- Road

By Tire Size

- Up to 12 inches (15% market share)

- 12-22 inches (68% market share)

- Above 22 inches (17% market share)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sports bicycle tire market features a mix of global leaders and specialized performance brands competing on innovation, durability, and rider-specific design. Key companies such as Vittoria Industries, Pirelli Tyre S.p.A., Hangzhou Zhongce Rubber, Maxxis International, Michelin, Schwalbe, Bridgestone Corporation, Continental AG, Kenda Tires, and CST (Cheng Shin Rubber) shape the competitive environment through advanced compounds, tubeless-ready constructions, and segment-focused tread technologies. Many brands invest in high-silica rubber, lightweight casings, and reinforced sidewalls to serve mountain, road, gravel, and e-bike categories. Partnerships with professional cycling teams strengthen brand credibility and drive adoption among performance riders. OEM collaborations remain central, with manufacturers securing long-term supply agreements to equip premium and mid-tier bicycles. Companies also expand digital retail presence, offering broader online catalogs and customized tire selectors to enhance consumer engagement. Competition continues to intensify as riders seek better grip, puncture protection, and comfort across varied terrains and riding conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vittoria Industries

- Pirelli Tyre S.p.A.

- Hangzhou Zhongce Rubber

- Maxxis International

- Michelin

- Schwalbe

- Bridgestone Corporation

- Continental AG

- Kenda Tires

- CST (Cheng Shin Rubber)

Recent Developments

- In November 2025, Vittoria Industries Vittoria launched the recycled Terreno Pro gravel tyre range, built with about 92 % renewable and recyclable materials and a new T-Score system for terrain rating. The tyres claim higher speed, grip, and puncture resistance than the earlier Terreno Endurance line and are already used by pro riders at top gravel events.

- In June 2024, Pirelli Tyre S.p.A. Pirelli introduced the P Zero Race TLR RS, its fastest road racing bicycle tyre, using the new SmartEVO² compound and SpeedCORE construction for lower rolling resistance and better wet grip. A parallel FSC® announcement confirmed this tyre as the first bicycle tyre to use FSC-certified natural rubber, produced at Pirelli’s Bollate plant in Italy.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Bicycle Type, Tire size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more riders adopt cycling for fitness and daily commuting.

- E-bike growth will increase the need for reinforced and puncture-resistant tires.

- Tubeless technology will gain wider acceptance across road, gravel, and mountain categories.

- Manufacturers will use advanced compounds to improve grip, durability, and rolling efficiency.

- Wider tire formats will become more common due to comfort and stability benefits.

- Sustainability efforts will expand with eco-friendly materials and recycling programs.

- OEM partnerships will strengthen as brands integrate higher-performance tires into new models.

- Digital retail channels will support faster adoption of premium and specialized tire lines.

- Urban mobility programs will boost demand for durable commuter and hybrid tires.

- Competitive pressure will drive continuous innovation in lightweight casings and tread design.