Market Overview

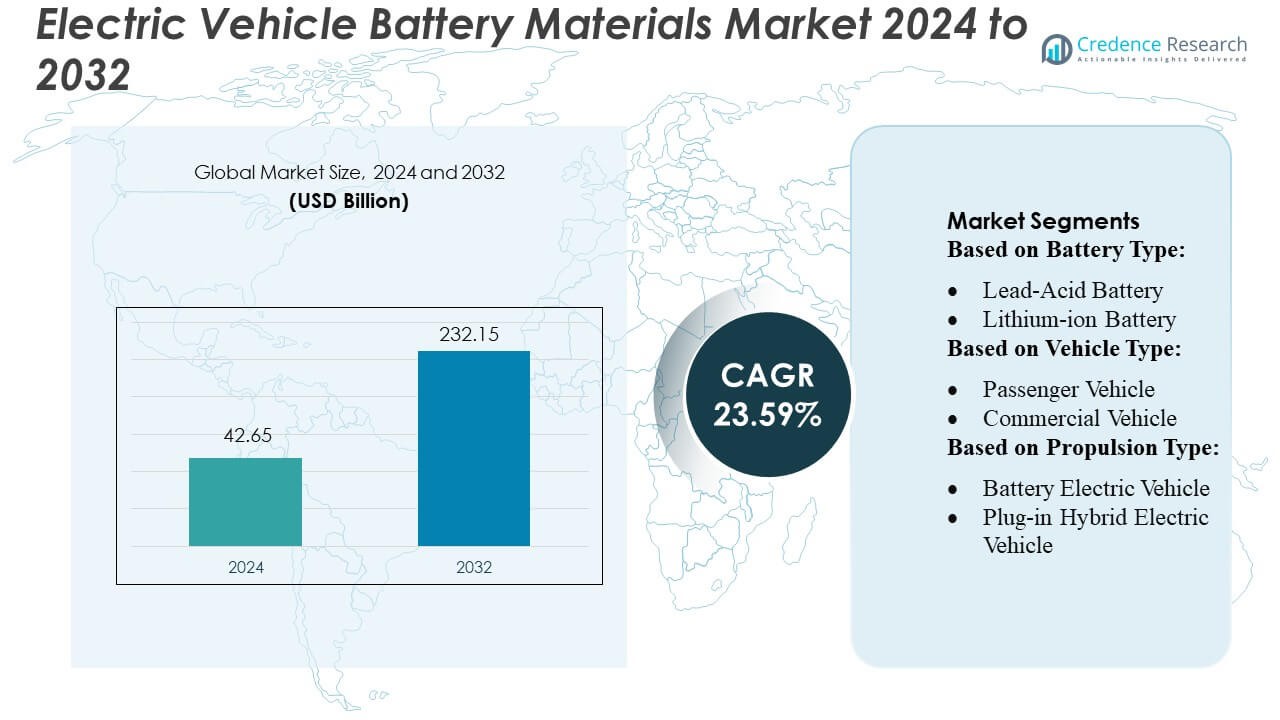

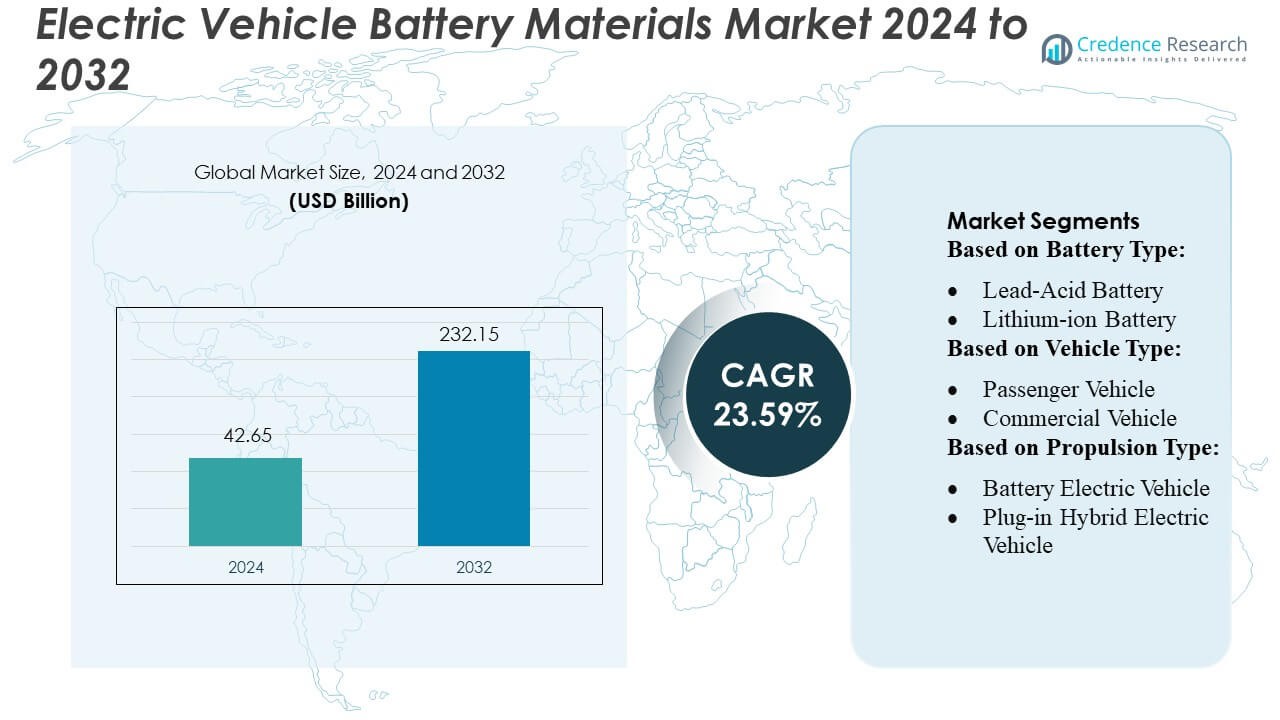

Electric Vehicle Battery Materials Market size was valued USD 42.65 billion in 2024 and is anticipated to reach USD 232.15 billion by 2032, at a CAGR of 23.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Materials Market Size 2024 |

USD 42.65 Billion |

| Electric Vehicle Battery Materials Market, CAGR |

23.59% |

| Electric Vehicle Battery Materials Market Size 2032 |

USD 232.15 Billion |

The Electric Vehicle Battery Materials market is dominated by leading companies such as Hitachi, Ltd., Panasonic Corp., LG Energy Solution, Toshiba Corporation, BYD Motors, EnerSys, Inc., Contemporary Amperex Technology Co., Limited, Samsung SDI Co., Ltd., SK on Co., Ltd, and Mitsubishi Corporation. These players focus on technological innovation, large-scale manufacturing, and strategic partnerships to strengthen their market positions. The market emphasizes advancements in energy density, cost reduction, and sustainable sourcing of critical materials like lithium, cobalt, and nickel. Regionally, Asia-Pacific leads the global market, capturing approximately 57 % of total market share, driven by extensive battery production infrastructure, supportive government policies, and high EV adoption rates. The combination of established supply chains and continued investment in research and development ensures that both the top players and the leading region remain pivotal to global market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Vehicle Battery Materials Market size was valued at USD 42.65 billion in 2024 and is projected to reach USD 232.15 billion by 2032, growing at a CAGR of 23.59% during the forecast period.

- Growth is driven by rising global EV adoption, government incentives, and increasing demand for high-performance, long-life batteries using materials like lithium, cobalt, and nickel.

- The market is shaped by technological trends, including advancements in energy density, battery lifespan, cost reduction, recycling, and sustainable material sourcing.

- Competitive intensity is high, with key players such as Hitachi, Panasonic, LG Energy Solution, Toshiba, BYD, EnerSys, CATL, Samsung SDI, SK on, and Mitsubishi leveraging innovation, large-scale production, and strategic partnerships to strengthen positions.

- Regionally, Asia-Pacific leads with approximately 57% share, followed by Europe and North America, while lithium-ion batteries dominate the segment share due to widespread adoption in electric vehicles.

Market Segmentation Analysis:

By Battery Type

Lithium-ion batteries dominate the EV battery materials market, accounting for the largest share due to their high energy density, longer lifecycle, and compatibility with fast-charging technologies. Lead-acid and nickel-metal hydride batteries maintain niche applications in low-cost and hybrid vehicles, while sodium-ion and other emerging chemistries are gaining attention for sustainable alternatives. Growth in lithium-ion adoption is driven by technological advancements in cathode and anode materials, as well as increasing investments in high-capacity cell manufacturing, which enhance performance and reduce per-kilowatt-hour costs, making them the preferred choice for passenger and commercial EVs.

- For instance, Hitachi announced a lithium‑ion battery cell achieving an energy density of 335 Wh/kg, coupled with a power density of 1600 W/kg — enabling an electric vehicle to roughly double its driving range on a single charge compared with earlier generations.

By Vehicle Type

Passenger vehicles hold the dominant share of the EV battery materials market, fueled by rising consumer adoption of electric cars and government incentives promoting zero-emission vehicles. Commercial vehicles, including buses and trucks, represent a smaller but rapidly growing segment due to electrification initiatives in logistics and public transportation. Demand in passenger EVs is largely driven by advances in lightweight and high-energy battery materials, extended driving range, and faster charging capabilities, while commercial EVs prioritize durability and cost-efficiency of battery materials to support longer operational cycles and reduced total cost of ownership.

- For instance, Panasonic’s battery‑arm Panasonic Energy Co., Ltd. began mass production at a new automotive lithium‑ion battery factory in Kansas — a facility aiming for an annual production capacity of approximately 32 GWh.

By Propulsion Type

Battery Electric Vehicles (BEVs) lead the market in terms of battery material consumption, supported by their fully electric architecture and growing global adoption. Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) contribute a smaller share, primarily in regions where charging infrastructure is limited. Fuel Cell Electric Vehicles (FCEVs) are an emerging segment focused on hydrogen-based propulsion. Market growth for BEVs is driven by continuous improvements in lithium-ion and solid-state battery materials, regulatory mandates for emission reduction, and investments in next-generation cathode and electrolyte technologies that enhance energy density, safety, and lifecycle performance.

Key Growth Drivers

- Rising EV Adoption and Government Initiatives

The rapid adoption of electric vehicles globally is a primary driver for the EV battery materials market. Governments are enforcing stringent emission regulations and offering incentives such as subsidies and tax benefits, encouraging consumers and manufacturers to shift from internal combustion engines to electric alternatives. This policy support accelerates demand for advanced battery materials like lithium, nickel, and cobalt, ensuring higher production capacity. Automotive OEMs are increasingly investing in localizing battery supply chains, reducing dependence on imports, and enhancing overall market growth.

- For instance, LG Energy Solution has recently expanded its cylindrical‑battery offering with its next‑generation “46‑series” cells (including formats like 4680, 4695, 46120). According to the company, these 46‑series batteries deliver over five times the energy output and more than six times the capacity compared with its conventional 2170 cylindrical cells.

- Technological Advancements in Battery Materials

Continuous innovation in battery chemistry, such as high-nickel cathodes, silicon-based anodes, and solid-state electrolytes, drives market expansion. These advancements improve energy density, charging speed, and battery lifespan, making EVs more competitive with conventional vehicles. Material improvements also enhance safety and thermal stability, reducing performance degradation over time. Industry collaborations between battery manufacturers and material suppliers focus on optimizing resource efficiency and cost-effectiveness, directly boosting the demand for specialized materials in lithium-ion and emerging sodium-ion batteries.

- For instance, NTO‑anode battery achieves a volumetric energy density of 350 Wh/L (excluding tab and sealing area; 307 Wh/L including those) and a gravimetric energy density of 130 Wh/kg in a 50 Ah cell.

- Expansion of EV Charging Infrastructure

Growing investment in EV charging networks globally supports increased EV adoption and, consequently, higher demand for battery materials. Efficient and widespread charging infrastructure reduces range anxiety, encouraging consumers to transition to electric mobility. Enhanced infrastructure also incentivizes fleet operators and commercial vehicle manufacturers to adopt EVs, driving large-scale battery procurement. The integration of fast-charging technology and grid-compatible energy storage systems stimulates demand for high-performance and durable battery materials that support rapid energy transfer without compromising lifecycle or safety.

Key Trends & Opportunities

- Emergence of Next-Generation Batteries

The development of solid-state, lithium-sulfur, and sodium-ion batteries represents a significant opportunity in the EV battery materials market. These technologies offer higher energy density, faster charging, and improved safety compared to conventional lithium-ion batteries. Manufacturers are actively investing in R&D to commercialize these solutions, which can reduce dependence on critical metals like cobalt while improving cost-efficiency. Adoption of next-generation batteries is expected to open new market avenues for suppliers of innovative cathode, anode, and electrolyte materials, especially in passenger and commercial EV segments.

- For instance, BYD is developing a sulfide-based all-solid-state battery that targets an energy density of 400 Wh/kg and — when integrated into a vehicle — could enable a driving range exceeding 1,000 km.

- Sustainable and Recycled Materials

Sustainability trends are reshaping the EV battery materials industry, with increasing focus on recycled metals, eco-friendly cathodes, and low-impact production techniques. Companies are exploring closed-loop recycling to recover lithium, nickel, and cobalt from spent batteries, reducing raw material dependency. This approach addresses both environmental concerns and cost pressures, while regulatory frameworks increasingly favor green supply chains. Market players investing in recycled and ethically sourced materials can differentiate their offerings, enhance brand value, and tap into the growing demand for sustainable electric mobility solutions globally.

- For instance, EnerSys operates a global battery recycling program that — according to its own 2024 customer‑service documentation — can recover up to 95% of materials from its lithium‑ion batteries when processed through advanced recycling centers.

- Regional Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities due to growing urbanization, increasing EV adoption, and favorable government policies. Local manufacturing of battery materials and components is expanding to reduce import dependency and transportation costs. Companies focusing on these regions benefit from lower production costs and first-mover advantages. Rising demand for affordable passenger EVs and commercial electric vehicles in these markets drives the need for cost-effective, high-performance battery materials, encouraging strategic investments and partnerships between international and regional suppliers.

Key Challenges

- Raw Material Supply Constraints

Limited availability and geopolitical concentration of critical battery materials such as lithium, cobalt, and nickel pose a significant challenge. Fluctuating prices, export restrictions, and supply chain disruptions can increase production costs and delay battery manufacturing. Companies are pressured to secure long-term supply agreements, diversify sourcing, and invest in alternative chemistries. These challenges require strategic planning to maintain production continuity, meet growing EV demand, and reduce dependence on volatile international markets, which remains a critical barrier to scaling battery material production efficiently.

- High Production Costs and Technology Barriers

The high cost of advanced battery materials and complex manufacturing processes limits widespread adoption, particularly in price-sensitive markets. Production of high-nickel cathodes, silicon-based anodes, and solid-state electrolytes requires substantial capital investment, precision engineering, and specialized infrastructure. Additionally, scaling up next-generation batteries while maintaining performance, safety, and consistency remains challenging. These factors constrain market growth, requiring continuous R&D, cost optimization strategies, and collaboration between battery manufacturers and material suppliers to achieve economically viable solutions.

Regional Analysis

North America

North America holds approximately 17 % of the global EV battery materials market. The region’s growth is driven by rising electric vehicle adoption, government incentives, and investments in domestic battery and material production. The U.S. and Canada are expanding mining, refining, and manufacturing capacity to secure local supply chains. Increasing collaborations between automakers and battery material suppliers enhance innovation and reduce dependency on imports. North America’s focus on sustainability, energy storage, and electrification targets supports steady market growth while positioning it as a strategic player in the global EV battery materials ecosystem.

Europe

Europe accounts for around 22–25 % of the global EV battery materials market. Strong emissions regulations, ambitious EV adoption targets, and local battery gigafactory developments drive growth. Countries like Germany, France, and Sweden lead investments in advanced materials, recycling, and sustainable battery production. Localized supply chains reduce dependency on imports, while government incentives encourage private-sector participation. Europe’s focus on innovation, green energy policies, and circular economy initiatives strengthens its market position. Strategic collaborations between automakers and battery material producers further accelerate the development of high-performance EV batteries, maintaining the region’s significance in the global market.

Asia-Pacific

Asia-Pacific dominates the EV battery materials market with roughly 57 % share. China, Japan, South Korea, and India are major contributors due to large-scale battery manufacturing, abundant mineral resources, and strong government support. The region benefits from well-integrated supply chains, extensive R&D, and established production infrastructure. Rapid EV adoption and supportive policies boost demand for lithium, nickel, cobalt, and other critical materials. Asia-Pacific leads global innovation in battery chemistry and energy density improvements, ensuring continued market leadership. Its scale, vertical integration, and focus on cost efficiency reinforce its dominance in the global EV battery materials market.

Latin America

Latin America holds a smaller share of the EV battery materials market, mainly supplying critical minerals like lithium and cobalt. Countries such as Chile, Argentina, and Brazil are key raw material exporters supporting global battery production. The region is gradually developing local processing and manufacturing capabilities to capture more value within the supply chain. Growing interest from foreign investors and automakers is expected to expand infrastructure and downstream capabilities. While current market share remains modest, Latin America’s rich mineral resources and increasing investment in value-added production position it as an emerging contributor to the global EV battery materials sector.

Middle East & Africa

The Middle East & Africa account for roughly 4–6 % of the global EV battery materials market. Mineral-rich countries offer potential in lithium, cobalt, and nickel production, though regional manufacturing and processing remain limited. Emerging investments in renewable energy, battery energy storage systems, and strategic partnerships are gradually strengthening the market. Governments are initiating policies to attract industrial development and build local supply chains. While market maturity is low compared to other regions, the Middle East & Africa is expected to see gradual growth, leveraging resource availability and increasing participation in the global EV battery materials ecosystem.

Market Segmentations:

By Battery Type:

- Lead-Acid Battery

- Lithium-ion Battery

By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

By Propulsion Type:

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle Battery Materials market is highly competitive, led by key players such as Hitachi, Ltd., Panasonic Corp., LG Energy Solution, Toshiba Corporation, BYD Motors, EnerSys, Inc., Contemporary Amperex Technology Co., Limited, Samsung SDI Co., Ltd., SK on Co., Ltd, and Mitsubishi Corporation. The Electric Vehicle Battery Materials market is highly competitive, driven by rapid technological advancements, growing EV adoption, and increasing demand for high-performance, sustainable battery solutions. Companies focus on improving energy density, reducing production costs, and securing reliable supply chains for critical materials such as lithium, cobalt, and nickel. Innovation in next-generation battery chemistries, recycling technologies, and scalable manufacturing processes remains central to gaining a competitive edge. Strategic partnerships, joint ventures, and regional expansions enable firms to meet rising global demand while navigating regulatory frameworks and sustainability standards. The market’s dynamic nature encourages continuous improvement and agility, ensuring that leading players maintain their positions through technological leadership and operational efficiency.

Key Player Analysis

- Hitachi, Ltd.

- Panasonic Corp.

- LG Energy Solution

- Toshiba Corporation

- BYD Motors

- EnerSys, Inc.

- Contemporary Amperex Technology Co., Limited

- Samsung SDI Co., Ltd.

- SK on Co., Ltd

- Mitsubishi Corporation

Recent Developments

- In May 2025, Contemporary Amperex Technology Co. Limited (CATL) conducted an initial public offering (IPO) on the Hong Kong Stock Exchange, raising. This was the largest global listing of the year at the time.

- In March 2025, Belcor, a European company, developed nonwoven-based thermal and fire protection solutions. Belcor has filed a patent application for a new technology that integrates its Belcotex fibers with Svenska Aerogel’s Quartzene material. Its latest innovation aims to improve safety and thermal management in electric vehicle (EV) batteries.

- In February 2025, CATL and the German automaker the Volkswagen Group’s China business unit, agreed to strengthen their collaboration in the areas of battery research and development, new materials applications, and component development.

- In October 2024, LG Energy Solution signed a supply agreement with Ford Motor Company to provide 109 GWh of batteries for Ford’s electric commercial vans in Europe. The batteries will be supplied from LG’s Poland facility, with production commencing in 2026, highlighting LG’s commitment to supporting the electrification of commercial vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Propulsion Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance battery materials will continue to grow with rising EV adoption globally.

- Innovation in lithium-ion and next-generation battery chemistries will drive market expansion.

- Recycling and sustainable sourcing of critical minerals will gain increasing importance.

- Regional production capacity is expected to expand to reduce dependency on imports.

- Strategic partnerships between automakers and battery material suppliers will strengthen supply chains.

- Advances in energy density and battery lifespan will enhance EV efficiency and appeal.

- Government incentives and supportive policies will accelerate investment in battery materials.

- Cost reduction initiatives will make EVs more affordable and boost material demand.

- Emerging markets will increasingly contribute to global battery material production.

- Technological and regulatory innovations will shape a competitive and sustainable market landscape.