Market Overview

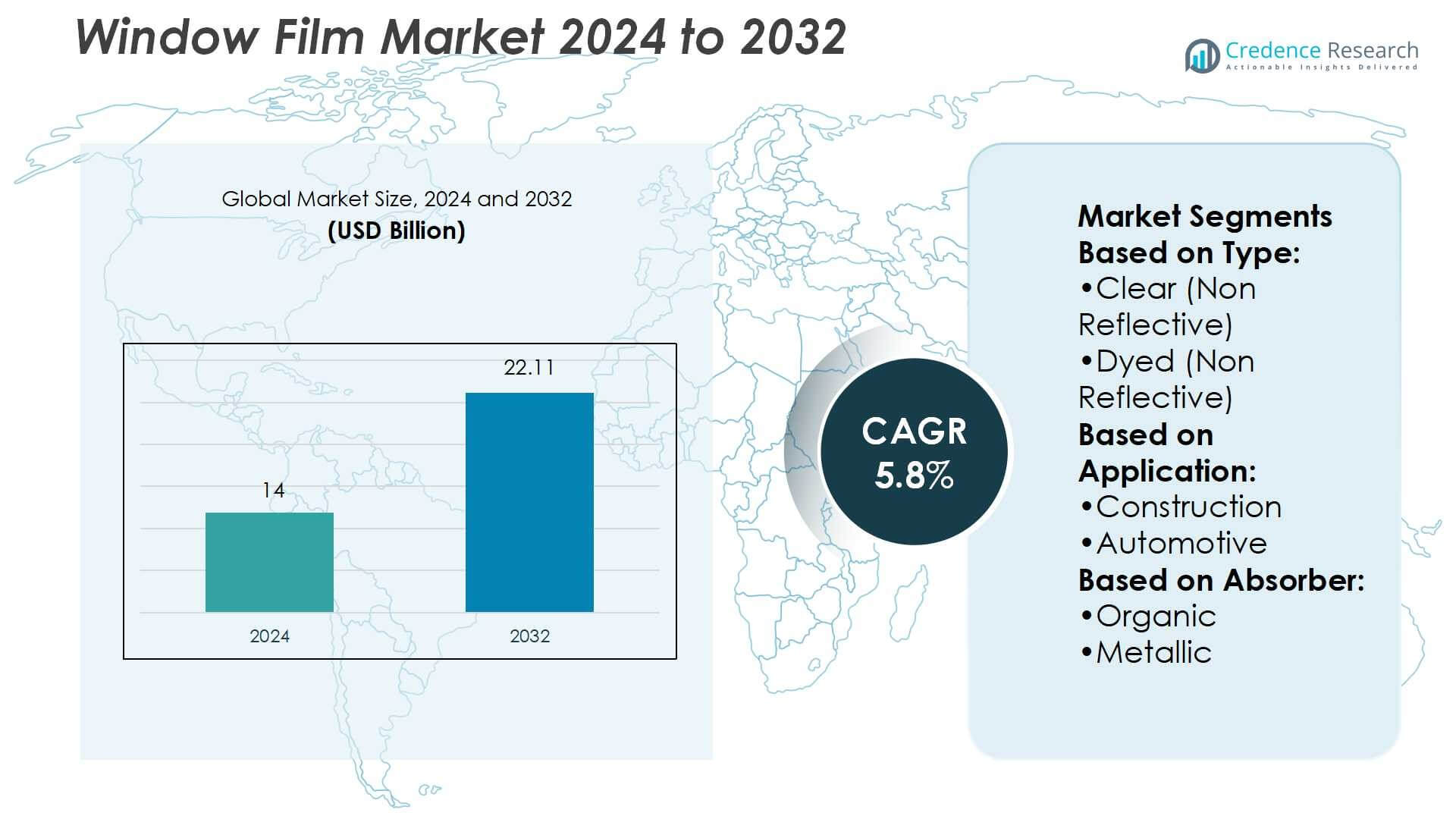

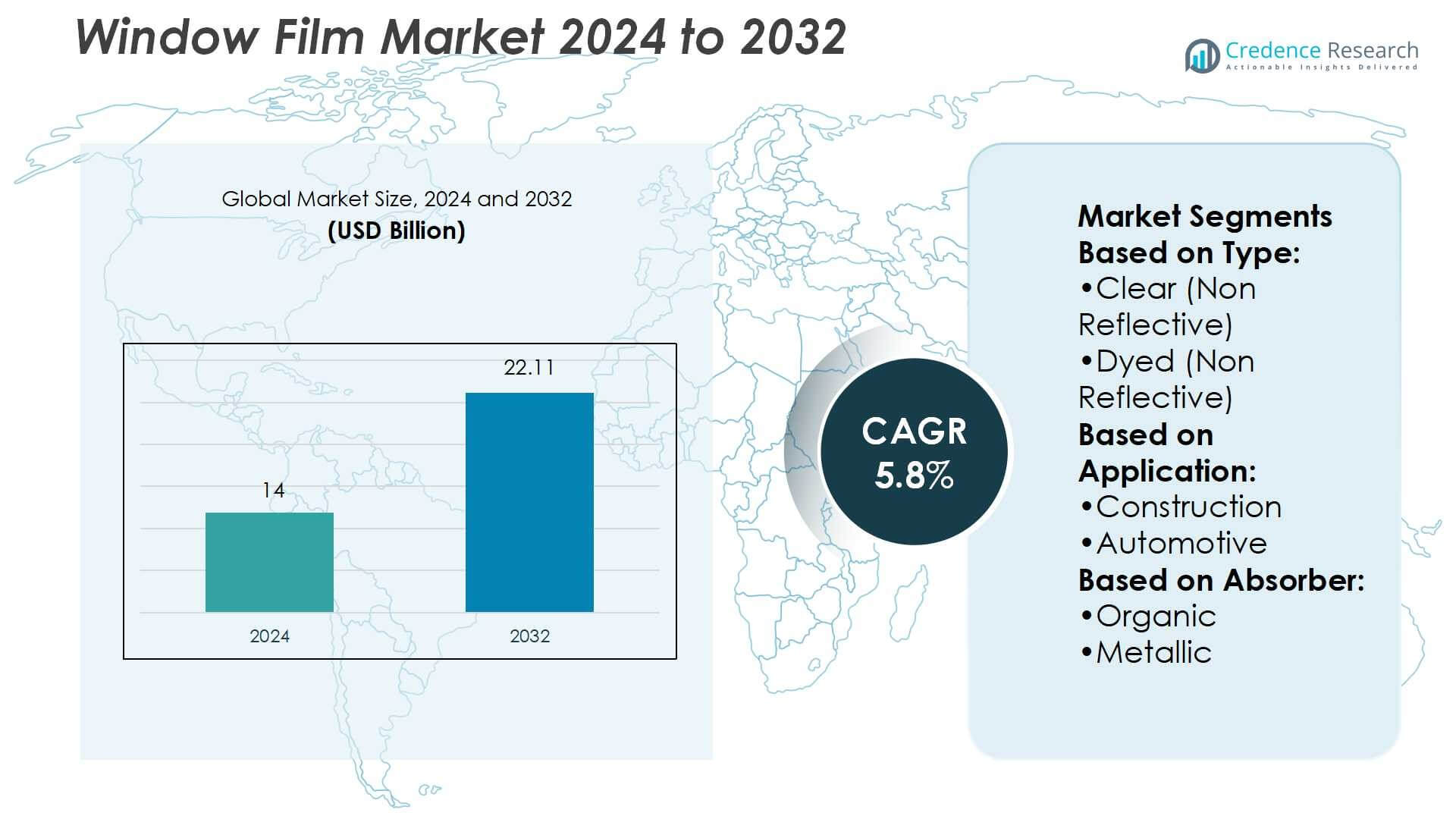

Window Film Market size was valued USD 14 billion in 2024 and is anticipated to reach USD 22.11 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Window Film Market Size 2024 |

USD 14 Billion |

| Window Film Market, CAGR |

5.8% |

| Window Film Market Size 2032 |

USD 22.11 Billion |

The window film market is shaped by key players including 3M, Eastman Performance Films, Avery Dennison Corporation, Johnson Window Films, Garware Suncontrol Film, Lintec Corporation, Madico, Decorative Films, Deposition Technology Innovations, and Dexerials Corporation. These companies compete through product innovation, advanced material development, and global distribution strategies to serve diverse applications in automotive, construction, and decorative sectors. Asia-Pacific emerges as the leading region, commanding a 34% share of the global market, driven by rapid urbanization, strong automotive production, and increasing adoption of energy-efficient building solutions. This regional dominance highlights both scale and innovation-led growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The window film market was valued at USD 14 billion in 2024 and is projected to reach USD 22.11 billion by 2032, growing at a CAGR of 5.8%.

- Growing demand for energy efficiency in construction and automotive industries is a key driver, as films reduce cooling costs, improve comfort, and enhance UV protection.

- Advanced trends include adoption of nanotechnology and ceramic-based films that offer superior clarity, durability, and non-interference with electronic devices, creating opportunities in premium applications.

- The competitive landscape is shaped by global leaders investing in product innovation, while regional players compete through affordability, though challenges include strict regulations on visible light transmission and pricing pressures.

- Asia-Pacific dominates with a 34% regional share, supported by urbanization and high automotive production, while the automotive segment leads overall applications with a 42% share, reflecting strong consumer demand for safety, comfort, and performance benefits.

Market Segmentation Analysis:

By Type

In the window film market, the vacuum-coated (reflective) films dominate with the largest share, accounting for over 38% of total sales. Their popularity stems from superior heat rejection, UV protection, and glare reduction, making them highly suitable for both automotive and construction applications. Rising energy efficiency standards further strengthen their adoption, particularly in commercial buildings seeking to reduce cooling costs. Although clear and dyed films remain cost-effective options, reflective films drive the segment due to advanced durability, enhanced performance, and compliance with green building certifications.

- For instance, Johnson Window Films’ Supreme IR series incorporates infrared-absorbing nano-ceramic technology capable of blocking up to 97% of infrared radiation. However, its Total Solar Energy Rejection (TSER) rating reaches a maximum of 66% in its darkest legal shade (SUPR 05).

By Application

The automotive segment leads the window film market, holding nearly 42% of the market share. Growth is driven by rising demand for UV protection, passenger comfort, and vehicle aesthetics. Consumers increasingly prefer tinted and reflective films to improve cabin cooling efficiency and protect interiors from fading. Additionally, stricter regulations on vehicle fuel efficiency indirectly support adoption by reducing air-conditioning load. While construction and decorative graphics segments show steady growth, automotive applications dominate due to higher volume installations, aftermarket customization, and technological integration in premium vehicles.

- For instance,The “SUNROOF 50” variant is one of several available in the Sunroof-Moonroof Film series, which also includes a “SUNROOF 70” variant with slightly different specifications, such as 70% visible light transmittance and 48% total heat rejection.

By Absorber

Among absorber types, metallic films command the dominant position with a 36% market share. These films deliver high heat rejection, improved strength, and enhanced durability, making them preferred in both automotive and commercial construction projects. Metallic absorbers reflect solar energy efficiently, lowering energy consumption and extending lifespan compared to organic variants. Inorganic ceramic films are emerging as a premium alternative due to superior clarity and non-interference with electronic devices. However, metallic films continue to dominate due to their cost-effectiveness, strong performance profile, and widespread availability across end-use applications.

Key Growth Drivers

Rising Energy Efficiency Demand

Energy-efficient solutions are becoming critical across residential, commercial, and automotive sectors. Window films play a vital role in reducing energy consumption by minimizing heat gain and improving insulation. Governments and organizations are promoting sustainable building materials, encouraging adoption of reflective and high-performance films. The cost savings on cooling systems further support demand. As energy regulations tighten worldwide, window films are increasingly viewed as an affordable and scalable solution, driving market growth across construction and transportation industries.

- For instance, Lintec products are certified for optical stability with scratch resistance. The 2 mil SR PET UV Block Permanent Window Film offers approximately 0.0508 mm thickness (2 mil), designed for UV-curable inks with good dimensional stability.

Growing Automotive Applications

The automotive industry remains a key growth driver for the window film market. Rising consumer demand for UV protection, glare reduction, and passenger comfort has led to higher adoption in both OEM and aftermarket applications. Films also extend the life of vehicle interiors by preventing fading and material degradation. Premium vehicles increasingly integrate advanced ceramic and metallic films for superior performance. With global automotive sales recovering and customization trends rising, demand for high-quality window films is expected to strengthen further.

- For instance, Solyx’s UltraCool-LE3570 Low-E IR/UV film delivers verified UV transmission of < 1%, visible light transmission (VLT) of 37%, and rejects 72% of infrared radiation.

Increased Awareness of Health and Safety Benefits

Consumers are becoming more aware of the health and safety benefits provided by window films. These products block harmful UV rays, reducing risks of skin damage and protecting furnishings from deterioration. Safety films also enhance glass strength, minimizing shattering risks during accidents or natural disasters. Such benefits align with consumer focus on wellness and safety, making films a preferred solution in residential, commercial, and automotive applications. Growing awareness campaigns and product innovations continue to expand this demand base globally.

Key Trends & Opportunities

Adoption of Advanced Nanotechnology Films

The development of nanotechnology-based films presents a major trend in the market. These films offer superior clarity, high UV protection, and better thermal performance without affecting visibility. Inorganic ceramic nanofilms, in particular, are gaining traction for their durability and non-interference with electronic signals. Their application in high-end automotive and commercial spaces highlights significant growth opportunities. As manufacturers expand their product lines with innovative coatings, demand for advanced films is expected to accelerate.

- For instance, 3M’s Automotive Window Film Crystalline Series uses a proprietary multilayer optical film (MOF) with over 200 nano-layers thinner than a standard Post-it® note. It rejects up to 99% of infrared rays and up to 64% of total solar energy.

Growing Decorative and Aesthetic Applications

Beyond functional benefits, decorative and aesthetic applications are creating new opportunities in the window film market. Graphic and decorative films are increasingly used in residential, retail, and office spaces for branding, privacy, and interior design enhancements. Demand is growing in urban areas where space optimization and style differentiation are priorities. These films combine visual appeal with practical features such as UV blocking, fueling adoption across construction and design projects. This trend is expected to widen the consumer base significantly.

- For instance, The SpectraSelect Performance VS20 SR CDF film, from LLumar (an Eastman brand), allows 23% visible light transmittance (VLT). It blocks over 99% of UV radiation and has a Light-to-Solar-Heat-Gain Ratio (LSG) of 0.22.

Key Challenges

Regulatory and Legal Restrictions

The market faces challenges due to varying regulations on window film usage, particularly in the automotive sector. Many countries impose limits on visible light transmission (VLT), restricting the degree of tint allowed on vehicle windows. Non-compliance can lead to penalties, discouraging adoption among consumers. Manufacturers must continually adapt product specifications to meet diverse regional standards. These legal complexities increase operational costs and pose barriers to consistent market penetration.

High Competition and Price Sensitivity

Intense competition among global and regional players creates significant price pressure in the market. Consumers often prioritize affordability, leading to strong demand for low-cost alternatives over advanced, high-performance films. This limits revenue potential for manufacturers offering premium solutions. Additionally, counterfeit and substandard products further erode pricing structures and consumer trust. Balancing innovation with competitive pricing remains a major challenge for sustaining profitability in the highly fragmented window film market.

Regional Analysis

North America

North America holds a 32% share of the global window film market, driven by strong demand in both construction and automotive applications. The region benefits from widespread adoption of energy-efficient building materials supported by green building certifications and government initiatives. Automotive aftermarket customization also plays a key role, with consumers investing in UV protection and aesthetic enhancements. The United States dominates regional sales due to high urbanization and strict energy regulations. Canada and Mexico show steady growth, supported by infrastructure modernization and rising vehicle ownership, further strengthening the region’s market position.

Europe

Europe accounts for 27% of the global window film market, supported by stringent environmental regulations and increasing adoption of sustainable construction practices. Countries such as Germany, France, and the UK are leading adopters due to energy-saving mandates and rising awareness of UV protection. The region is also witnessing strong growth in decorative and graphic films, driven by commercial and retail applications. Automotive demand remains robust, with premium vehicles integrating advanced films for performance and safety. EU directives on carbon neutrality continue to encourage replacement of conventional glazing with high-performance films.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share, making it the leading region. High urbanization, rapid infrastructure development, and rising vehicle production underpin this growth. China, Japan, South Korea, and India are key contributors, with construction projects increasingly adopting reflective and ceramic films to reduce cooling loads. The automotive industry drives significant demand, particularly in markets with hot climates. Expanding middle-class consumption and government support for energy efficiency further fuel adoption. The region also leads in production capacity, with manufacturers expanding exports to meet growing international demand.

Latin America

Latin America represents 4% of the global window film market, showing steady but limited growth. Brazil and Mexico are the primary contributors, supported by expanding automotive sales and rising investments in modern construction. The region benefits from hot climatic conditions, driving demand for films that reduce heat and UV exposure. However, price sensitivity remains high, favoring low-cost alternatives over advanced solutions. Growing awareness of energy efficiency and safety features is gradually improving adoption. Local distributors and aftermarket channels play a critical role in market penetration across residential and automotive sectors.

Middle East & Africa

The Middle East & Africa region accounts for 3% of the global window film market, with demand concentrated in the Gulf countries and South Africa. High temperatures drive strong adoption in both commercial construction and automotive applications, where films provide essential cooling benefits. The UAE and Saudi Arabia lead due to large-scale infrastructure projects and premium vehicle sales. However, limited consumer awareness in certain African markets restrains growth. Increasing investments in smart city projects and expanding construction sectors are expected to create opportunities for reflective and ceramic films in the coming years.

Market Segmentations:

By Type:

- Clear (Non Reflective)

- Dyed (Non Reflective)

By Application:

By Absorber:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the window film market features such as Johnson Window Films, Garware Suncontrol Film, Lintec Corporation, Decorative Films, 3M, Eastman Performance Films, Avery Dennison Corporation, Madico, Deposition Technology Innovations, and Dexerials Corporation. The window film market remains highly competitive, characterized by technological innovation, product diversification, and regional expansion strategies. Manufacturers are increasingly focusing on advanced materials such as ceramic and nanotechnology-based films to enhance performance, durability, and energy efficiency. The market is fragmented, with both global leaders and regional players competing through pricing strategies, product quality, and distribution strength. Strong emphasis is placed on meeting regulatory requirements, particularly for energy efficiency and automotive safety standards. Companies are also leveraging partnerships, acquisitions, and R&D investments to strengthen their positions, address diverse customer needs, and capture emerging growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2024, Automotive Glass Experts (AGE) announced a strategic supplier agreement with Johnson Window Films to enhance its offerings and provide a comprehensive range of window film applications as a complementary service in its workstations.

- In August 2024, its Home Electrification and Appliance Rebates (HEAR) program was launched by Arizona which is designed to help low- and middle-income households save on energy-efficient HVAC equipment and other appliances.

- In September 2023, Pella expanded its popular Hidden Screen to the Lifestyle Series wood windows, now available exclusively at Lowe’s. As the exclusive home improvement retailer for the Hidden Screen, Lowe’s offers Pella’s Lifestyle Series double-hung wood windows both online at Lowes.com and in over 1,700 stores nationwide.

- In August 2023, Solar Art announced acquisition of Layr, a window film manufacturing company. Layr has wide customer base including office buildings, schools and high-end retailers. This acquisition helped Solar Art to expand its business East Coast region with infrastructure in New York.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Absorber and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The window film market will expand with rising demand for energy-efficient building materials.

- Automotive adoption will grow as consumers prioritize UV protection, comfort, and safety.

- Decorative films will gain popularity in residential and commercial interior applications.

- Nanotechnology and ceramic-based films will drive innovation and premium product demand.

- Stringent regulations on energy efficiency will accelerate use in construction projects.

- Asia-Pacific will remain the leading region due to rapid urbanization and vehicle production.

- Aftermarket sales will strengthen as customization and replacement demand increases.

- Smart and switchable films will create opportunities in high-end architectural and automotive sectors.

- Distribution networks will expand to penetrate price-sensitive and emerging markets.

- Competition will intensify as global players and regional firms invest in R&D and capacity.