| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Boiler Market Size 2024 |

USD 16,233.51 Million |

| Industrial Boiler Market, CAGR |

3.97% |

| Industrial Boiler Market Size 2032 |

USD 22,128.17 Million |

Market Overview

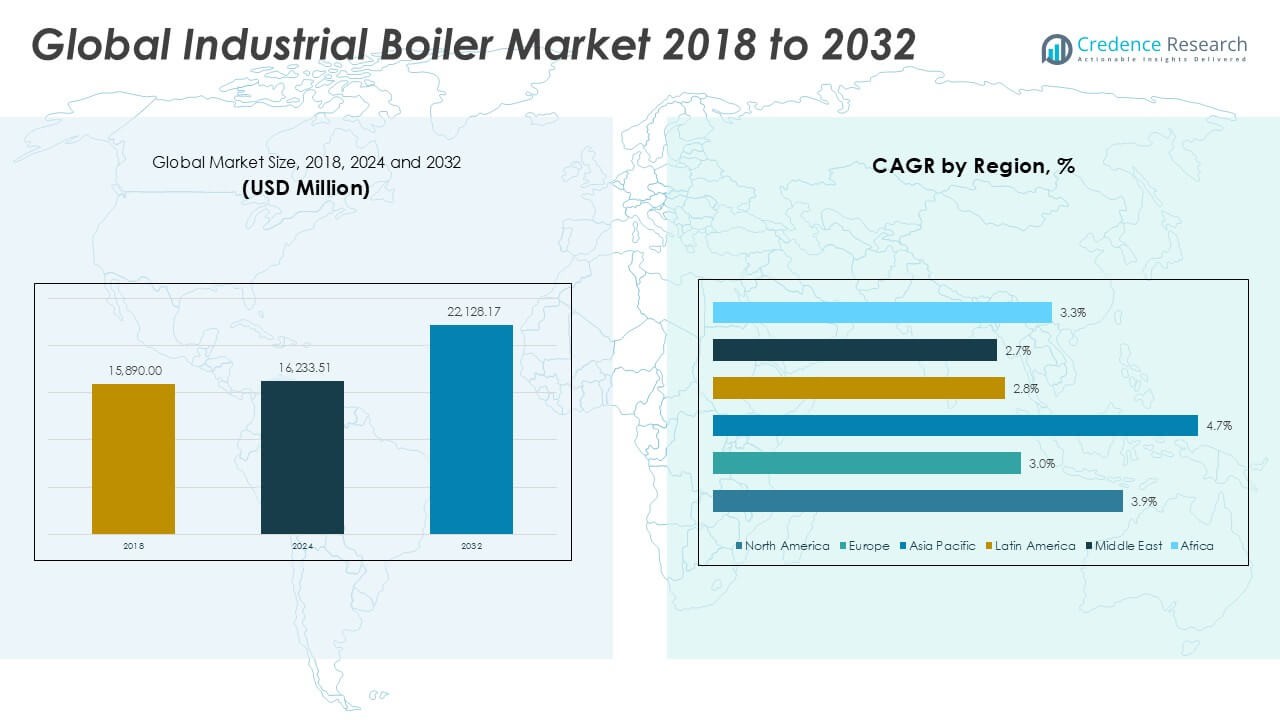

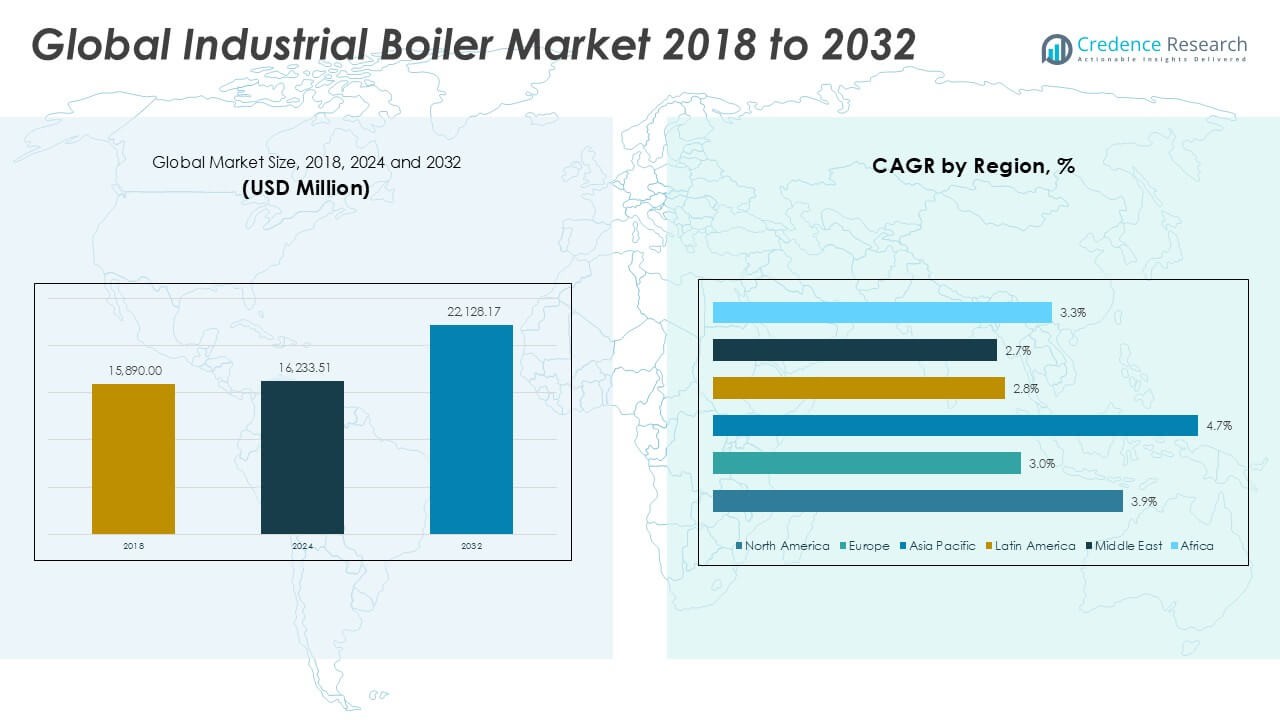

The Global Industrial Boiler Market is projected to grow from USD 16,233.51 million in 2024 to an estimated USD 22,128.17 million by 2032, registering a compound annual growth rate (CAGR) of 3.97% from 2025 to 2032.

The market growth is primarily fueled by the rising adoption of high-capacity boilers, increasing focus on reducing carbon emissions, and the ongoing shift towards cleaner energy sources such as natural gas and biomass. Additionally, advancements in boiler technology, including the development of smart and modular boilers, are contributing to improved operational efficiency and reduced fuel consumption. Growing regulatory pressure to meet stringent emission standards is also encouraging industries to upgrade to newer, environmentally compliant boiler systems.

Geographically, Asia Pacific dominates the global industrial boiler market, driven by rapid industrialization, urbanization, and growing energy demands in countries like China, India, and Japan. North America and Europe follow, with steady demand supported by technological advancements and stringent environmental regulations. Key players in the market include General Electric, Bosch Industriekessel GmbH, Cleaver-Brooks, Siemens AG, Mitsubishi Heavy Industries, and Forbes Marshall, who are focusing on product innovation, capacity expansion, and strategic partnerships to strengthen their market position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Industrial Boiler Market is projected to grow steadily from USD 16,233.51 million in 2024 to USD 22,128.17 million by 2032, with a CAGR of 3.97%.

- Increasing industrialization and expanding process industries are driving demand for reliable, high-capacity boilers worldwide.

- Rising regulatory pressure to reduce carbon emissions fuels adoption of energy-efficient and cleaner fuel boiler technologies.

- High initial investment and complex installation processes pose challenges, limiting rapid adoption among small and medium enterprises.

- Asia Pacific dominates the market with a 43.6% share in 2024, driven by rapid industrial growth in China, India, and Japan.

- North America maintains significant market share supported by advanced manufacturing infrastructure and stringent emission standards.

- Technological advancements like smart control systems and modular boilers create opportunities for enhanced operational efficiency and scalability.

Market Drivers

Rising Demand from Rapid Industrialization and Process Industries Expansion

The Global Industrial Boiler Market is gaining momentum due to the steady rise of industrialization in emerging economies. Industries such as food processing, chemical manufacturing, and pulp and paper are continuously expanding their production capacities. It is witnessing growing installations of industrial boilers to support high-volume, continuous operations. The need for reliable steam and heat sources in large-scale manufacturing is pushing industries to adopt more efficient and durable boiler systems. Emerging countries like China and India are focusing on industrial growth, which supports the increasing demand for industrial boilers. The rising investments in industrial infrastructure and manufacturing plants worldwide are further driving the requirement for efficient heating solutions.

- For instance, in 2024, China installed 15,000 new industrial boilers and India installed 12,000, while the global number of new installations reached 50,000, reflecting the scale of industrial expansion and demand for boiler systems.

Growing Focus on Energy Efficiency and Emission Control Regulations

The Global Industrial Boiler Market is supported by the increasing pressure on industries to meet strict emission standards. Governments across North America, Europe, and Asia Pacific are enforcing regulations to minimize carbon emissions and improve energy efficiency. It is encouraging companies to shift to energy-efficient boiler technologies that consume less fuel and emit fewer pollutants. High-efficiency boilers are becoming a preferred choice due to their ability to reduce operational costs and comply with evolving environmental standards. The push for sustainable manufacturing processes is leading to the adoption of low-emission boiler systems across several industries. It is driving boiler manufacturers to offer advanced systems with lower fuel consumption and enhanced thermal efficiency.

- For instance, in 2024, North America installed 12,000 energy-efficient boilers, Europe added 15,000 low-emission units, and Asia Pacific saw 18,000 new energy-efficient boiler installations, demonstrating the widespread adoption of advanced, compliant technologies.

Technological Advancements Enhancing Boiler Performance and Safety

The Global Industrial Boiler Market is experiencing growth through ongoing technological innovations. New boiler systems offer better automation, real-time performance monitoring, and safer operations. It is benefiting from the introduction of modular boilers, which provide flexible and scalable heating solutions with minimal installation time. Advanced control systems are supporting users in achieving precise temperature and pressure control, improving overall process efficiency. Companies are increasingly adopting smart boilers to optimize maintenance schedules and extend equipment life. The development of low-NOx and high-capacity boilers is helping industries meet their energy demands while reducing environmental impact.

Rising Adoption of Clean Fuels and Biomass-Based Boiler Systems

The Global Industrial Boiler Market is progressing due to the shift towards clean fuel options such as natural gas, biomass, and other renewable energy sources. Industries are increasingly adopting biomass-fired boilers to reduce dependency on fossil fuels. It is supporting the market growth by meeting both sustainability goals and fuel cost reduction strategies. The availability of government incentives for renewable energy adoption is promoting the use of biomass and low-emission boilers. Industries in developed and developing regions are focusing on fuel diversification to ensure energy security and regulatory compliance. Boiler manufacturers are responding by offering flexible designs that can operate on a variety of fuel types.

Market Trends

Increasing Shift Towards Natural Gas-Fired and Biomass Boilers

The Global Industrial Boiler Market is witnessing a growing preference for natural gas-fired and biomass boiler systems. It is moving away from coal-based boilers due to strict emission regulations and rising environmental concerns. Many industries are adopting natural gas and biomass options to achieve cleaner combustion and lower carbon footprints. Biomass boilers are gaining popularity in food processing, pulp and paper, and textile industries for their ability to utilize renewable fuel sources. The steady rise in gas infrastructure development is supporting the switch to natural gas in industrial sectors. Companies are focusing on adopting flexible boiler designs that can operate on multiple fuel types to meet changing energy policies.

- For instance, in the United States, the oil and gas sector accounted for the largest share of industrial boiler installations in 2024, with natural gas being the preferred fuel due to its high availability and lower emissions compared to coal.

Growing Integration of Smart Control Systems and Automation Technologies

The Global Industrial Boiler Market is advancing with the integration of smart technologies and automation systems. It is embracing digital control systems that improve operational accuracy and enable real-time monitoring. Smart boilers with automated controls help reduce manual intervention and ensure higher process safety. Industrial users prefer these advanced systems to optimize energy consumption and enhance boiler efficiency. Remote monitoring and predictive maintenance features are becoming essential to prevent unplanned downtime. Boiler manufacturers are incorporating intelligent control solutions to support industries in achieving consistent heating performance with improved fuel management.

- For instance, in 2023, the U.S. industrial sector accounted for 60.5% of the global demand for boiler control solutions, driven by the need for efficient and reliable operations in manufacturing, chemical processing, and power generation industries.

Expansion of Modular and Packaged Boiler Installations

The Global Industrial Boiler Market is expanding with the rising adoption of modular and packaged boiler units. It is meeting the growing demand for quick installation, scalability, and compact design in space-constrained industrial facilities. Modular boilers offer flexibility to adjust capacity based on changing production requirements. Industries are opting for packaged systems to minimize on-site construction and speed up commissioning. Packaged boilers are preferred in sectors like food processing, chemical, and pharmaceutical where operational efficiency and mobility are critical. The demand for compact, high-capacity systems is increasing across both small and large-scale manufacturing plants.

Rising Investment in Renewable Energy-Fired Boiler Projects

The Global Industrial Boiler Market is evolving through increasing investments in renewable energy-fired boiler solutions. It is supporting the shift towards sustainable energy sources such as waste heat, biofuels, and agricultural residues. Industries are focusing on reducing reliance on traditional fossil fuels to achieve lower operational costs and regulatory compliance. Boiler manufacturers are developing systems compatible with various renewable fuel types to meet specific industrial needs. Renewable energy-based boilers are gaining acceptance in countries promoting circular economy practices and energy recovery from waste. This trend is driving innovation in boiler designs that can efficiently process diverse renewable feedstocks.

Market Challenges

High Initial Investment and Complex Installation Processes Limiting Market Growth

The Global Industrial Boiler Market faces challenges due to the high initial investment required for advanced and large-capacity boiler systems. It demands significant capital for procurement, installation, and setup, which can restrict small and medium-sized industries from adopting modern boilers. Complex installation processes often lead to extended project timelines and higher operational disruptions. The need for skilled labor and specialized equipment further increases installation costs. Many industries delay boiler upgrades due to the financial burden and potential production downtime. The cost factor remains a major barrier, especially for companies with limited budgets.

- For instance, a 2023 survey by the American Boiler Manufacturers Association found that the average cost for installing a new industrial boiler system in the United States ranged from $350,000 to $1,200,000, with installation times frequently exceeding 16 weeks due to labor and equipment requirements.

Stringent Regulatory Compliance and Rising Maintenance Requirements Creating Pressure

The Global Industrial Boiler Market is dealing with strict regulatory compliance related to emissions and safety standards. It is under continuous pressure to meet evolving government policies across various regions. Regular inspections, emission checks, and maintenance schedules increase operational complexity. Frequent updates in environmental norms force industries to upgrade or replace boiler systems, creating financial and operational strain. Rising maintenance costs and the need for specialized service personnel limit adoption in cost-sensitive markets. Industries must balance regulatory compliance with operational efficiency, which remains a persistent challenge in sustaining long-term boiler usage.

Market Opportunities

Expansion of Green Energy Projects and Demand for Biomass-Fired Boilers Creating New Growth Avenues

The Global Industrial Boiler Market has strong opportunities with the rising demand for biomass-fired boilers and renewable energy integration. It is gaining attention from industries focusing on reducing carbon emissions and adopting sustainable energy sources. Biomass-fired boilers offer fuel flexibility and support green energy targets in sectors like paper, textiles, and food processing. Government policies promoting renewable energy adoption provide long-term growth potential for biomass and waste-to-energy boiler projects. Companies investing in circular economy practices are driving the need for boilers compatible with agricultural and industrial residues. The increasing focus on energy diversification supports the rising deployment of biomass and clean-fuel boilers.

Advancements in Smart Boiler Technology and Growing Demand for Modular Systems

The Global Industrial Boiler Market holds significant potential through advancements in smart boiler systems and modular designs. It is attracting industries looking for automated solutions with real-time monitoring and predictive maintenance features. Smart control systems improve operational efficiency and help industries maintain consistent heating performance. Modular boiler designs provide flexibility, faster installation, and scalability to meet changing production demands. Growing demand for compact, high-capacity boilers in space-constrained facilities further expands the adoption of modular units. Boiler manufacturers developing smart and flexible systems can capitalize on this rising market demand.

Market Segmentation Analysis

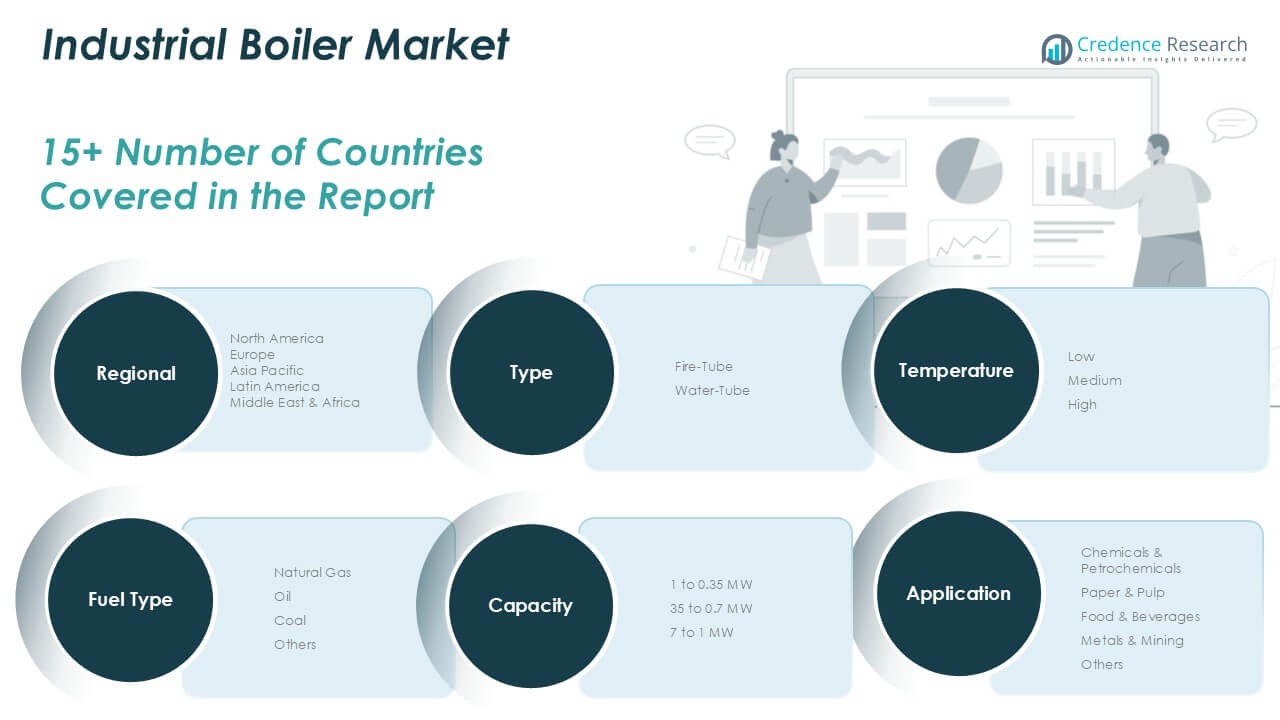

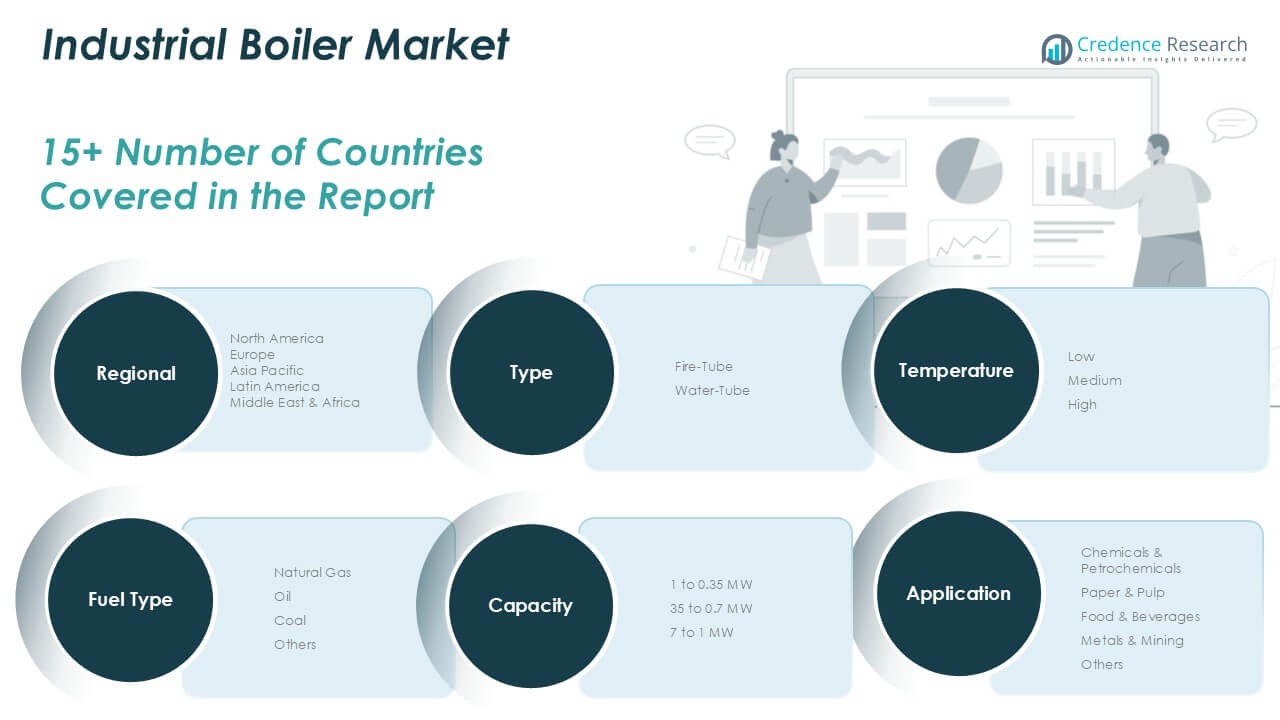

By Type

The Global Industrial Boiler Market is segmented into fire-tube and water-tube boilers. Fire-tube boilers hold a significant market share due to their compact design, easy installation, and suitability for low to medium-pressure applications. Water-tube boilers are gaining traction in industries that require high-pressure steam and large heating capacities. It is experiencing steady demand across heavy-duty industries such as chemicals, metals, and petrochemicals. Water-tube boilers provide better heat transfer and can handle fluctuating loads efficiently. The growing need for high-capacity, energy-efficient systems is driving the preference for water-tube boilers in large-scale industrial operations.

- For instance, company surveys show that in 2024, 35,000 fire-tube boilers and 28,000 water-tube boilers were installed globally, with water-tube boilers averaging a capacity of 50 tons per hour and fire-tube boilers averaging 15 tons per hour.

By Application

The Global Industrial Boiler Market is segmented into chemicals & petrochemicals, paper & pulp, food & beverages, metals & mining, and others. The chemicals & petrochemicals segment dominates due to its continuous need for high-temperature processing and large volumes of steam. It is witnessing growing demand in the food & beverages sector driven by stringent safety and hygiene requirements. The paper & pulp industry consistently uses boilers for production processes requiring sustained heat supply. Metals & mining operations depend on high-pressure boilers for smelting, refining, and metal extraction. Each application sector contributes uniquely to the stable expansion of the market.

- For instance, government data indicate the chemicals & petrochemicals sector generated a steam volume of 500,000 tons per hour, while the food & beverages sector operated 22,000 boiler units in 2024.

By Temperature

The Global Industrial Boiler Market is categorized by low, medium, and high temperature segments. Low-temperature boilers are commonly used in food processing and other light industrial applications. Medium-temperature boilers serve the paper, textile, and beverage industries where moderate steam pressure is essential. It is observing significant demand for high-temperature boilers from chemical, petrochemical, and power generation industries that require large, continuous heat supply. High-temperature boilers offer higher efficiency and can support complex industrial processes. Industries are increasingly selecting temperature-specific systems based on their operational needs.

By Fuel Type

The Global Industrial Boiler Market is segmented by natural gas, oil, coal, and others. Natural gas-fired boilers lead the market due to their lower emissions and cost-effective operation. It is gradually moving away from coal-fired systems due to rising environmental concerns and strict emission regulations. Oil-fired boilers are still in use where natural gas supply is limited. The “others” segment includes biomass and waste heat boilers, which are gaining market share due to sustainability goals. Industries are focusing on fuel diversification to balance cost, availability, and regulatory compliance.

By Capacity

The Global Industrial Boiler Market is segmented into 1 to 0.35 MW, 0.35 to 0.7 MW, and 0.7 to 1 MW capacity ranges. Boilers with 0.7 to 1 MW capacity dominate the market due to their ability to meet medium to large-scale industrial heating requirements. It is experiencing growing installations of lower-capacity boilers in small manufacturing units and food processing plants. Medium-capacity boilers are commonly used in chemical and textile industries where consistent steam output is critical. Industries select boiler capacity based on production scale, energy consumption patterns, and space availability. Demand across all capacity ranges supports market diversification and equipment customization.

Segments

Based on Type

Based on Application

- Chemicals & Petrochemicals

- Paper & Pulp

- Food & Beverages

- Metals & Mining

- Others

Based on Temperature

Based on Fuel Type

- Natural Gas

- Oil

- Coal

- Others

Based on Capacity

- 1 to 0.35 MW

- 35 to 0.7 MW

- 7 to 1 MW

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Industrial Boiler Market

The Industrial Boiler Market in North America is projected to grow from USD 4,262.82 million in 2024 to USD 5,784.08 million by 2032, registering a CAGR of 3.9%. It holds approximately 26.3% of the global market share in 2024. The region benefits from advanced manufacturing infrastructure and increasing demand for energy-efficient and low-emission boilers. The United States drives most of the demand with strong growth in the food processing, chemical, and petrochemical sectors. Canada is also contributing steadily, with industries focusing on natural gas-fired boiler systems to reduce carbon footprints. The market is strengthening through the adoption of smart and modular boiler systems across key industries.

Europe Industrial Boiler Market

The Industrial Boiler Market in Europe is expected to grow from USD 2,991.39 million in 2024 to USD 3,767.38 million by 2032, at a CAGR of 3.0%. It accounts for approximately 18.4% of the global market share in 2024. Countries like Germany, France, and the UK lead the market with strong demand for energy-efficient and low-emission boilers. It faces a shift toward clean fuels, supported by the region’s strict emission control regulations. European industries prefer natural gas and biomass-fired boilers to align with sustainability goals. The focus on reducing coal dependency and upgrading aging boiler systems supports steady market expansion.

Asia Pacific Industrial Boiler Market

The Industrial Boiler Market in Asia Pacific is set to grow from USD 7,075.31 million in 2024 to USD 10,182.12 million by 2032, with the highest CAGR of 4.7% among all regions. It holds the largest share of 43.6% in the global market in 2024. China, India, and Japan are key contributors, driven by rapid industrialization and rising energy demands. Industries across the region rely heavily on both large-capacity and high-temperature boilers to support high-volume production. The growing shift from coal to natural gas and biomass systems is creating new opportunities. Asia Pacific remains the most dynamic and fast-evolving market for industrial boilers.

Latin America Industrial Boiler Market

The Industrial Boiler Market in Latin America is projected to increase from USD 835.86 million in 2024 to USD 1,039.36 million by 2032, growing at a CAGR of 2.8%. It represents 5.1% of the global market share in 2024. Brazil and Mexico lead the regional demand, supported by food processing, chemical, and paper industries. It is experiencing steady adoption of small and medium-capacity boilers suitable for localized manufacturing units. Rising investments in clean energy and energy-efficient solutions are gradually shaping the market landscape. Natural gas-fired boilers are becoming preferred due to lower emissions and cost benefits.

Middle East Industrial Boiler Market

The Industrial Boiler Market in the Middle East is expected to grow from USD 607.03 million in 2024 to USD 750.27 million by 2032, with a CAGR of 2.7%. It accounts for 3.7% of the global market share in 2024. Countries like Saudi Arabia and the UAE dominate the market, driven by petrochemical and energy sector demand. It faces moderate growth due to increasing preferences for cleaner, high-efficiency boiler systems. The Middle East focuses on natural gas as a primary fuel to align with emission control objectives. Demand for high-capacity boilers supports infrastructure and industrial expansion projects in the region.

Africa Industrial Boiler Market

The Industrial Boiler Market in Africa is forecasted to grow from USD 461.10 million in 2024 to USD 604.96 million by 2032, at a CAGR of 3.3%. It holds 2.8% of the global market share in 2024. South Africa remains the leading contributor, supported by mining, metals, and food processing industries. It is gradually adopting energy-efficient and small-capacity boiler systems to meet regional industrial requirements. The use of coal-fired boilers remains in some areas, but there is increasing interest in natural gas and biomass options. Investments in industrial infrastructure and rising energy demands support the steady growth of the African market.

Key players

- Thermax Ltd.

- Siemens AG

- Bharat Heavy Electricals Ltd.

- Forbes Marshall

- Mitsubishi Heavy Industries, Ltd.

- Harbin Electric Corporation

- Cheema Boilers Limited

- IHI Corporation

- Dongfang Electric Corporation Ltd.

- AC Boilers

Competitive Analysis

The Global Industrial Boiler Market is highly competitive with the presence of well-established international and regional players. It is led by companies focusing on product innovation, fuel flexibility, and advanced control systems to meet evolving customer demands. Thermax Ltd., Siemens AG, and Bharat Heavy Electricals Ltd. maintain strong market positions with their broad product portfolios and significant project execution capabilities. Mitsubishi Heavy Industries, Forbes Marshall, and IHI Corporation offer specialized solutions with high operational efficiency and lower emissions. Harbin Electric Corporation and Dongfang Electric Corporation Ltd. continue to strengthen their positions in Asia through large-scale industrial contracts. Cheema Boilers Limited and AC Boilers focus on delivering customized and energy-efficient systems. The market competition is shaped by strategic collaborations, technology upgrades, and capacity expansion initiatives aimed at addressing both global and regional industrial requirements.

Recent Developments

- On May 10, 2024, Thermax Ltd. did announce a 20.5% increase in its Q4 net profit. This growth was primarily attributed to robust demand for their electric boilers, heat pumps, and industrial infrastructure solutions. Specifically, sales of these industrial products rose by 23% to ₹12.07 billion during the quarter

- On February 13, 2025, Bharat Heavy Electricals Limited (BHEL) secured a significant order to supply a supercritical steam generator and boiler island package for the 2×660 MW Raghunathpur Thermal Power Station Phase-II. The order was placed by Damodar Valley Corporation (DVC) through international competitive bidding. BHEL is also already executing the turbine and generator package for this project.

- On June 18, 2025, IHI Corporation received the President’s Award at CIMAC Congress 2025 for their ammonia-fueled engine technology. The award recognized their presentation on the technology, which significantly reduces greenhouse gas emissions. This marked the first time a Japanese entity had won the prestigious award, highlighting a significant achievement for Japan’s engine industry. The award was presented at the CIMAC Congress in Zurich, Switzerland.

Market Concentration and Characteristics

The Global Industrial Boiler Market shows moderate concentration with a mix of large multinational corporations and strong regional players. It is characterized by high entry barriers due to significant capital requirements, complex technology, and strict regulatory compliance. The market favors companies with extensive product portfolios, advanced manufacturing capabilities, and strong after-sales support. It demands continuous innovation to meet the growing need for energy efficiency, low emissions, and fuel flexibility. Product customization, smart control integration, and modular designs are key characteristics shaping buyer preferences. The market supports long-term contracts, and established players benefit from strong client relationships and proven project expertise.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Temperature, Fuel Type, Capacity and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Industrial Boiler Market will experience steady growth driven by rising industrialization and increasing energy demands worldwide.

- Adoption of eco-friendly and energy-efficient boiler technologies will accelerate, supporting industries’ efforts to reduce carbon footprints.

- Natural gas-fired and biomass boilers will gain market share due to their lower emissions and alignment with global sustainability goals.

- Technological advancements in smart control systems and automation will improve operational efficiency and reduce downtime.

- Modular and packaged boilers will become increasingly popular due to their flexibility, compact design, and faster installation time.

- Emerging economies in Asia Pacific will continue to lead market growth, fueled by expanding manufacturing sectors and urbanization.

- Stricter environmental regulations will drive replacement of older, less efficient boilers with advanced, compliant systems.

- Increased investment in renewable energy-based boiler projects will open new avenues for growth, especially in regions promoting circular economy practices.

- Rising demand for customized boiler solutions will encourage manufacturers to focus on product innovation and diverse fuel compatibility.

- The market will see enhanced collaboration between technology providers and end-users to develop integrated, sustainable heating solutions.