Market Overview:

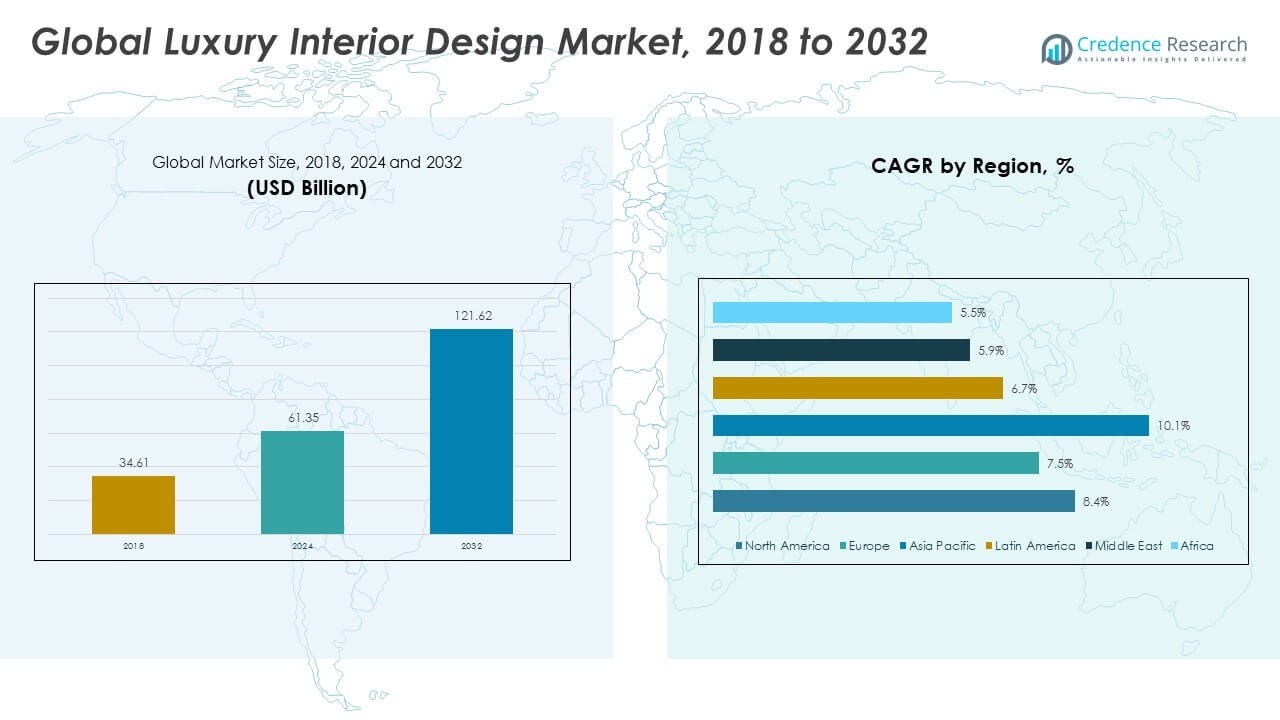

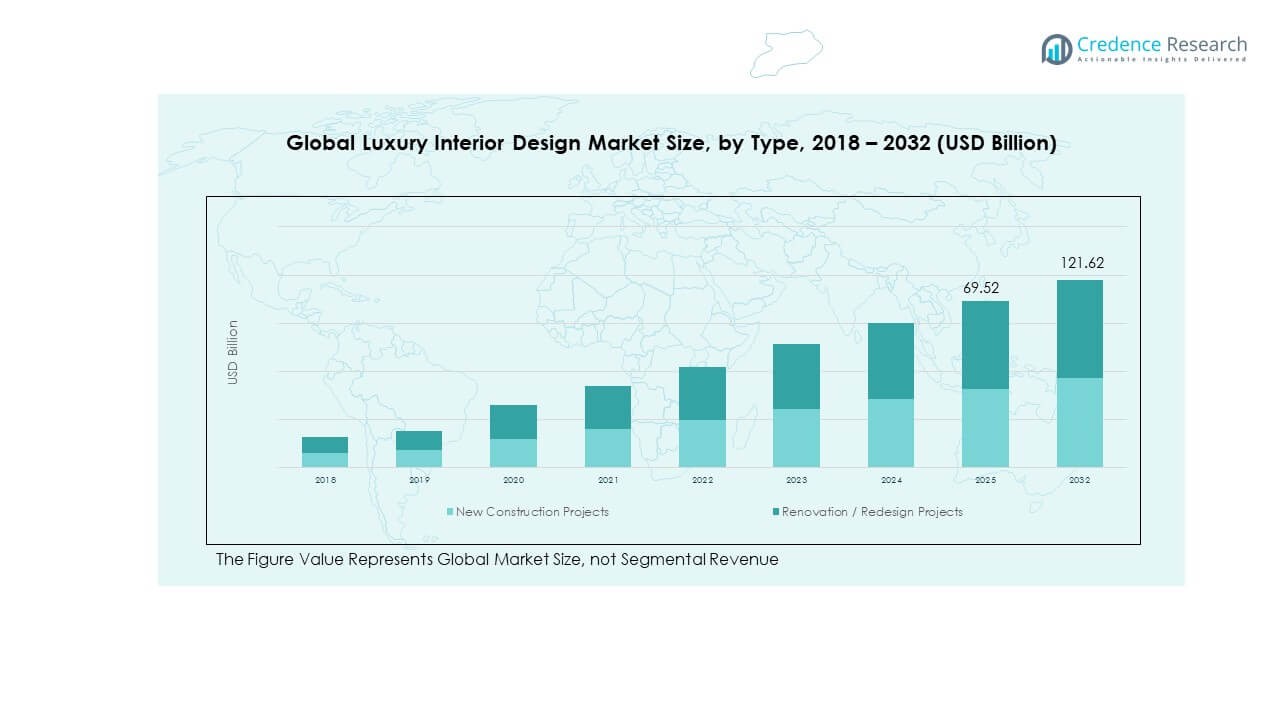

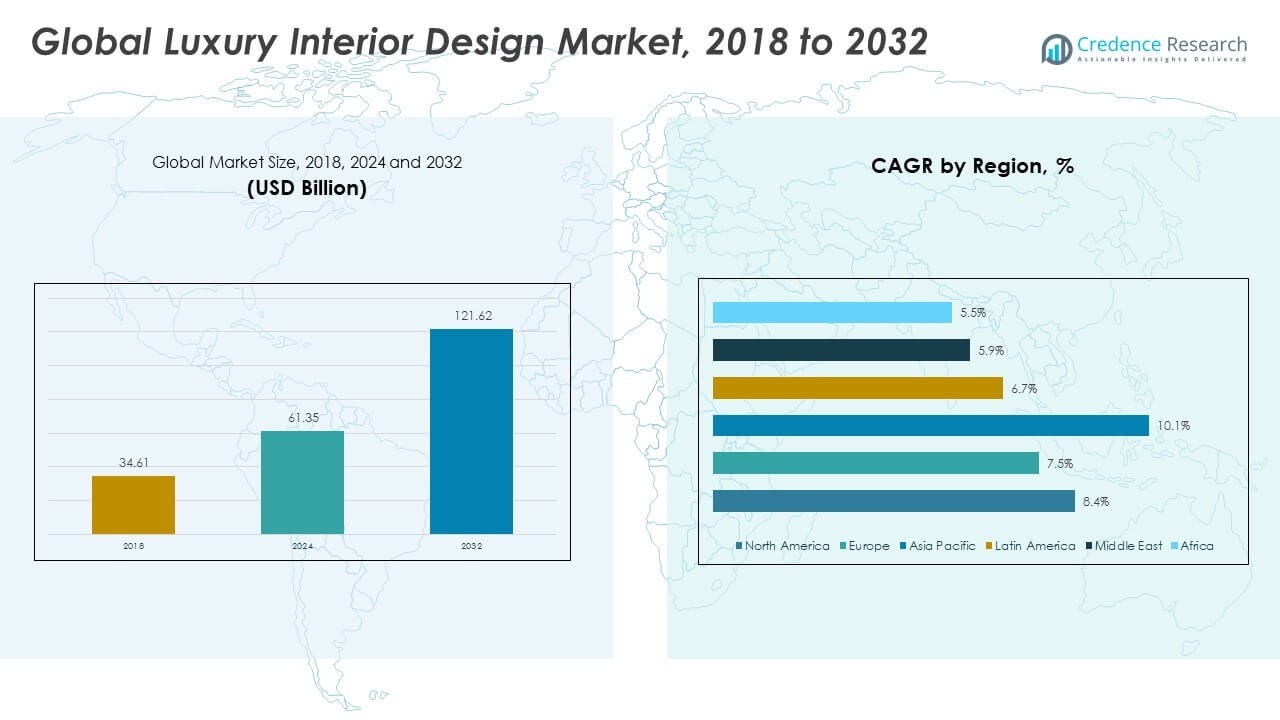

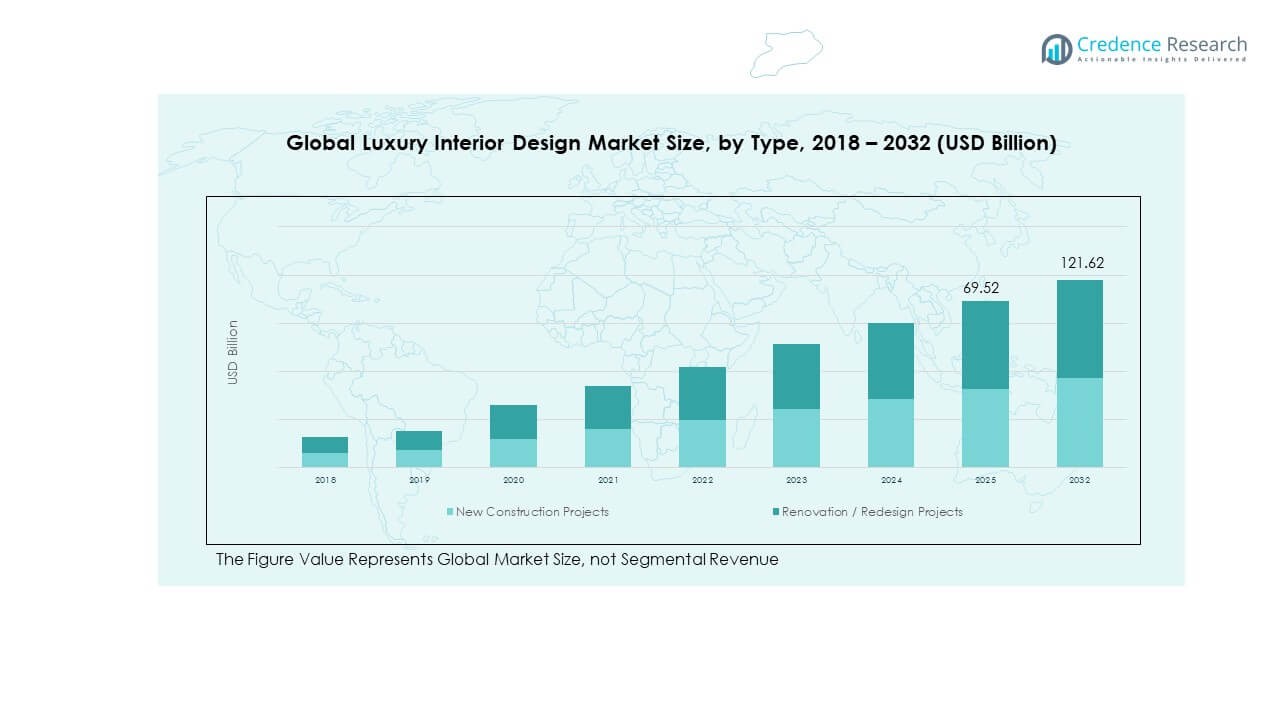

The Global Luxury Interior Design Market size was valued at USD 34.61 billion in 2018, reached USD 61.35 billion in 2024, and is anticipated to reach USD 121.62 billion by 2032, at a CAGR of 8.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Interior Design Market Size 2024 |

USD 61.35 Billion |

| Luxury Interior Design Market, CAGR |

8.32% |

| Luxury Interior Design Market Size 2032 |

USD 121.62 Billion |

The growth of the Global Luxury Interior Design Market is driven by rising disposable incomes and an increasing desire for personalized, high-end living spaces. Urbanization, along with the demand for smart home integration and eco-friendly designs, further accelerates market expansion. High-net-worth individuals seek bespoke, premium interiors that reflect their style, pushing designers to innovate continuously. Technological advancements and sustainability trends also shape the market, contributing to its robust growth.

Regionally, North America leads the market, driven by a strong presence of affluent consumers and a booming real estate sector. Europe follows closely, with established demand for luxury designs in both residential and commercial sectors. The Asia Pacific region is rapidly emerging, especially in countries like China and India, where urbanization and increasing wealth contribute to a rise in luxury interior projects. The Middle East and Latin America are also witnessing growth, fueled by a demand for high-end, sophisticated interiors in both residential and commercial spaces.

Market Insights:

- The Global Luxury Interior Design Market was valued at USD 34.61 billion in 2018, reached USD 61.35 billion in 2024, and is projected to reach USD 121.62 billion by 2032, growing at a CAGR of 8.32%.

- North America, Europe, and Asia Pacific are the top three regions dominating the market, with North America leading due to its large population of high-net-worth individuals and significant demand in residential and commercial sectors. Europe follows with strong demand in established markets like the UK and France, while Asia Pacific is rapidly growing due to urbanization and increasing affluence in countries like China and India.

- Asia Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and growing demand for luxury residential and commercial interiors. This region’s market share is expected to increase substantially in the coming years.

- The market share distribution between New Construction Projects and Renovation/Redesign Projects shows a significant share for both, with Renovation/Redesign Projects capturing a substantial portion of the market, as homeowners and businesses invest in enhancing existing spaces.

- Segment-wise, the residential sector holds the largest market share, with increasing demand for luxury homes. The commercial segment is also growing steadily, as businesses seek high-end, functional interiors that represent their brand identity and cater to the needs of affluent clients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Disposable Incomes

Increased disposable income among high-net-worth individuals (HNWI) is a primary driver for the growth of the Global Luxury Interior Design Market. With more people able to afford luxury services, demand for bespoke, high-end interior designs continues to rise. These individuals seek to personalize their living and working spaces, favoring unique and custom-made designs that reflect their status. As incomes increase, so does the willingness to invest in sophisticated, luxury interiors. This shift results in higher demand for materials and services that cater to this exclusive market segment.

Urbanization and Changing Lifestyles

Urbanization plays a significant role in shaping the Global Luxury Interior Design Market. As cities continue to grow, there is a surge in demand for upscale residential and commercial spaces. This growth is especially noticeable in metropolitan areas, where individuals are willing to spend on luxury to reflect their elevated lifestyles. The demand for smart homes and urban penthouses is rising, and luxury interior design is seen as a necessary part of creating an ideal living environment. Urban areas are fast becoming hubs for luxury, driving further growth in interior design.

- For instance, Brizo exhibited at the 2024 Kitchen & Bath Industry Show (KBIS), unveiling the Kintsu® Kitchen Collection and its advanced water-purification technology—reverse osmosis systems now integrated into premium urban installations. Brizo’s products, including kitchen faucets, consistently meet or exceed U.S. and California state water efficiency regulations, with maximum flow rates of 1.8 gallons per minute, compared to the industry standard of 2.2 gpm.

Technological Advancements in Design

Innovations in technology have significantly impacted the Global Luxury Interior Design Market. Advanced design software, 3D modeling, and augmented reality tools allow interior designers to create more complex, high-quality designs that cater to individual preferences. Clients are now able to visualize their projects before execution, making the process more efficient and personalized. These technological advancements help designers offer cutting-edge solutions and remain competitive in the luxury market, aligning with the growing need for futuristic designs and smart homes.

Sustainability and Personalization

Sustainability is becoming a key factor in the Global Luxury Interior Design Market, with consumers seeking eco-friendly materials and energy-efficient designs. The growing trend toward sustainable living has led to a rise in demand for interior designs that prioritize the environment. Alongside sustainability, consumers are increasingly seeking personalized and customized designs, choosing unique pieces over mass-produced items. This shift toward individuality and eco-consciousness has spurred luxury interior designers to incorporate green technologies, upcycled materials, and energy-efficient systems in their designs, meeting both aesthetic and environmental needs.

- For example, Poliform’s 2024 Sustainability Report confirms a 94% waste recovery rate and the adoption of renewable energy and circular economy practices in production. The company’s ‘Ecotech’ fabric, a certified alternative to animal-derived materials, is made of 69% bio-based raw materials and 31% recycled cotton.

Market Trends

Smart Home Integration

Smart home technology is increasingly integrated into luxury interior designs, elevating the level of sophistication in residential and commercial spaces. The Global Luxury Interior Design Market benefits from the growing demand for automation systems, including voice-activated devices, smart lighting, and climate control systems. These technologies make living spaces more functional and convenient, allowing for seamless integration of advanced features while maintaining a luxurious aesthetic. Consumers are opting for designs that blend high-tech elements with premium materials, creating a futuristic and functional environment.

- For example, Lutron Electronics’ flagship HomeWorks QSX processor, announced in 2019, integrates the control of lighting, shades, and climate for luxury homes. The system provides secure compatibility for both legacy and next-gen devices.

Minimalist Luxury Design

Minimalism has become a significant trend in luxury interior design, emphasizing simplicity and functionality. The focus on clean lines, open spaces, and neutral color palettes is shifting away from cluttered, extravagant decor. This style appeals to modern sensibilities and the desire for calm, serene living environments. In the Global Luxury Interior Design Market, this trend sees the use of high-quality materials such as marble, glass, and metal to achieve a sleek, minimalist aesthetic. It aligns with consumers’ increasing preference for quality over quantity, emphasizing timeless beauty rather than fleeting trends.

Sustainability in Luxury Design

Sustainability continues to be a defining trend in the Global Luxury Interior Design Market, with an increasing number of consumers demanding environmentally friendly solutions. Eco-conscious consumers are driving the market towards the use of sustainable materials such as recycled wood, bamboo, and energy-efficient fixtures. Designers are now incorporating green elements into their projects, which align with the growing demand for luxury that also respects the planet. The use of organic and locally sourced materials in high-end interiors is expected to continue as more people value sustainable practices without compromising on quality.

Artisanal and Custom Designs

The demand for artisanal and custom-made designs is expanding within the luxury market. Consumers are increasingly seeking one-of-a-kind pieces to reflect their personal taste and uniqueness. The Global Luxury Interior Design Market is benefiting from this trend, as high-end designers create exclusive, hand-crafted furniture, lighting, and other decor items. These bespoke designs not only cater to the desire for personalization but also represent a shift towards craftsmanship and quality. The emphasis on artisanal pieces offers a more authentic and luxurious touch to interior spaces.

- For instance, Minotti’s 2025 collection showcases its commitment to Italian artisan craftsmanship: each custom furnishing piece is handmade by master artisans in its Meda, Italy studio, according to company guidelines.

Market Challenges Analysis

High Costs of Luxury Materials

One of the significant challenges facing the Global Luxury Interior Design Market is the high cost of materials. Luxury interior design often requires expensive raw materials such as rare woods, high-quality stones, and custom-designed fixtures. These materials are costly to source, and this can inflate the overall price of the project. For some consumers, these costs may be prohibitive, limiting the market’s potential customer base. The rising costs of labor and transportation also contribute to the high price points of luxury interior design services, making it less accessible to some high-net-worth individuals.

Design Trends and Consumer Preferences

The rapidly changing design trends and evolving consumer preferences pose another challenge for the Global Luxury Interior Design Market. What is considered luxurious today may not hold the same appeal in the future. As consumers increasingly seek unique, personalized interiors, designers must constantly innovate to meet new demands. The need to stay ahead of design trends while maintaining a timeless aesthetic can be difficult. Designers must balance client expectations with evolving market trends, requiring them to be flexible and adaptive in their approach.

Market Opportunities

Expanding Demand in Emerging Markets

There are significant growth opportunities in emerging markets for the Global Luxury Interior Design Market. Countries in Asia-Pacific, the Middle East, and Latin America are seeing a rise in affluence, with more individuals seeking luxury living experiences. As these markets mature, the demand for luxury interior design services is expected to grow exponentially. This shift presents an opportunity for luxury interior design firms to expand their presence in these regions, tapping into new, high-potential markets where there is an increasing desire for sophisticated, high-end designs.

Increasing Interest in Sustainable Luxury

The growing trend towards sustainability offers an opportunity for the Global Luxury Interior Design Market to innovate. Consumers increasingly expect sustainable luxury, and this trend is not limited to eco-friendly materials. It extends to energy-efficient designs and the integration of renewable energy sources into interior projects. As the demand for sustainable luxury grows, interior designers can capitalize on this shift by offering environmentally conscious solutions. This opportunity allows them to position themselves as leaders in the intersection of luxury and sustainability, appealing to a broader, eco-conscious clientele.

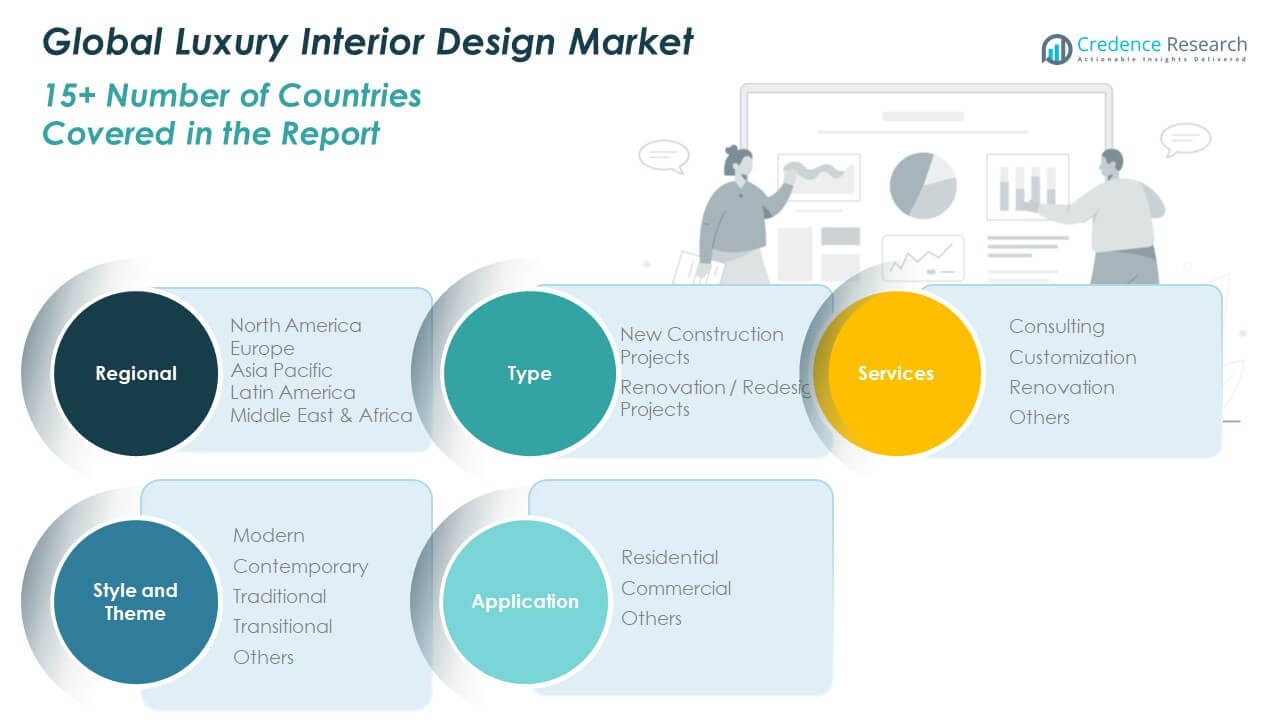

Market Segmentation Analysis:

The Global Luxury Interior Design Market is divided into several key segments, providing a comprehensive range of services and design styles to meet the diverse needs of high-net-worth individuals and businesses.

By Type, the market is segmented into New Construction Projects and Renovation/Redesign Projects. New construction projects involve the design of luxury interiors for newly built homes, offices, and commercial spaces. Renovation or redesign projects focus on transforming and upgrading existing spaces to align with modern luxury standards, offering clients an opportunity to revitalize their surroundings.

By Services, the market includes Consulting, Customization, Renovation, and other specialized offerings. Consulting services help clients define their design vision and provide expert guidance. Customization allows for personalized designs, creating unique and one-of-a-kind interiors. Renovation services focus on updating or modifying existing interiors to enhance their luxury appeal.

- For instance, Clutch’s October 2025 rankings featured several top interior design firms recognized for their excellence in commercial office renovations, space planning, and use of sustainable materials. These firms consistently deliver large-scale projects within tight timelines, showcasing their expertise in transforming digital solutions agency spaces.

By Style and Theme, the market includes Modern, Contemporary, Traditional, Transitional, and other niche styles. Modern designs emphasize minimalism and sleek lines, while contemporary styles combine elements of various trends. Traditional designs incorporate classical elements, and transitional styles blend modern and traditional designs for a balanced, timeless appeal.

By Application, the market is divided into Residential, Commercial, and Others. Residential design focuses on private homes and luxury living spaces, while commercial designs cater to upscale offices, hotels, and retail environments, all requiring sophisticated, functional, and high-end aesthetics.

- For instance, luxury smart home integrator projects recognized by CE Pro’s Home of the Year Awards 2024 included a residential installation by Mozaic Audio Video Integration, which featured seamless smart lighting, climate automation, and over 30 connected zones in a single luxury residence, showcasing advanced technology integration in real high-end living spaces.

Segmentation:

By Type

- New Construction Projects

- Renovation / Redesign Projects

By Services

- Consulting

- Customization

- Renovation

- Others

By Style and Theme

- Modern

- Contemporary

- Traditional

- Transitional

- Others

By Application

- Residential

- Commercial

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Luxury Interior Design Market size was valued at USD 15.13 billion in 2018, reached USD 26.55 billion in 2024, and is anticipated to reach USD 52.78 billion by 2032, growing at a CAGR of 8.4% during the forecast period. North America holds a significant share of the market, driven by the high demand for luxury residential and commercial spaces. The region benefits from a large population of affluent consumers and growing real estate investments. The U.S. is the largest contributor to the market, with major cities like New York, Los Angeles, and Miami being key hubs for luxury interior design. The market is further supported by increasing adoption of smart home technologies and sustainable luxury designs, contributing to the region’s robust growth.

Europe

The Europe Global Luxury Interior Design Market size was valued at USD 9.91 billion in 2018, reached USD 16.93 billion in 2024, and is anticipated to reach USD 31.62 billion by 2032, growing at a CAGR of 7.5% during the forecast period. Europe remains a strong market due to its rich architectural heritage and high demand for luxury design in residential, commercial, and hospitality sectors. Countries like the UK, France, Italy, and Germany are particularly notable for their traditional and modern luxury design preferences. Luxury interior designers in Europe also emphasize sustainability, incorporating eco-friendly materials and energy-efficient solutions into their designs.

Asia Pacific

The Asia Pacific Global Luxury Interior Design Market size was valued at USD 6.37 billion in 2018, reached USD 12.29 billion in 2024, and is anticipated to reach USD 27.72 billion by 2032, growing at a CAGR of 10.1% during the forecast period. This region is witnessing rapid urbanization and an increasing number of affluent individuals, particularly in China, India, and Japan. The growing demand for luxury residential and commercial spaces, especially in major cities like Shanghai, Tokyo, and Mumbai, is driving market growth. Additionally, Asia Pacific consumers are increasingly adopting Western luxury trends, blending modern design with traditional elements, leading to further expansion in the market.

Latin America

The Latin America Global Luxury Interior Design Market size was valued at USD 1.67 billion in 2018, reached USD 2.92 billion in 2024, and is anticipated to reach USD 5.13 billion by 2032, growing at a CAGR of 6.7% during the forecast period. The market is gaining traction due to rising disposable incomes and a growing interest in high-end living environments in countries like Brazil, Mexico, and Argentina. Luxury interior design services are becoming increasingly popular in upscale residential and commercial projects, particularly in urban areas. Additionally, there is a growing trend toward integrating local cultural aesthetics with modern luxury design elements.

Middle East

The Middle East Global Luxury Interior Design Market size was valued at USD 0.94 billion in 2018, reached USD 1.52 billion in 2024, and is anticipated to reach USD 2.53 billion by 2032, growing at a CAGR of 5.9% during the forecast period. The region’s luxury interior design market is expanding due to booming real estate development, especially in countries like the UAE and Saudi Arabia. Luxury hotels, resorts, and residential spaces dominate the demand for interior design services. The growing number of high-net-worth individuals, coupled with an affinity for lavish, opulent living spaces, continues to drive the market’s growth.

Africa

The Africa Global Luxury Interior Design Market size was valued at USD 0.59 billion in 2018, reached USD 1.14 billion in 2024, and is anticipated to reach USD 1.83 billion by 2032, growing at a CAGR of 5.5% during the forecast period. While still in its nascent stages compared to other regions, the African market for luxury interior design is steadily growing. Countries like South Africa and Nigeria are leading the way in terms of luxury real estate and interior design. The rising middle class, coupled with increased foreign investment in luxury housing and hotels, is fueling demand for sophisticated, high-end interior design solutions.

Key Player Analysis:

- Aecom

- Gensler

- Jacobs Engineering Group Inc.

- Perkins and Will

- Stantec Inc.

- Areen Design Services Ltd

- IA Interior Architects

Competitive Analysis:

The Global Luxury Interior Design Market is characterized by a diverse competitive landscape, featuring both established global firms and specialized boutique studios. Key players such as Gensler, HOK, Perkins+Will, Hirsch Bedner Associates (HBA), and Stantec dominate the market through their extensive portfolios and global presence. These firms offer comprehensive services across residential, commercial, and hospitality sectors, often integrating sustainable practices and innovative technologies into their designs. Their ability to deliver large-scale, high-end projects has solidified their positions as industry leaders. In parallel, boutique studios like Kelly Hoppen Interiors, Pierre Yovanovitch Mobilier, and David Collins Studio cater to a niche segment of affluent clients seeking personalized and exclusive design solutions. These firms differentiate themselves through bespoke designs, attention to detail, and a deep understanding of client preferences, often resulting in high client retention and referrals. The market is also witnessing the emergence of digitally native design platforms and AI-driven tools, such as RoomDiffusion, which are reshaping design processes by offering rapid prototyping and customization. These technological advancements are enabling firms to enhance efficiency and meet the growing demand for personalized luxury interiors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In October 2025, GMG, a global well-being company, launched Modora, a new luxury home concept that expands its home division and further strengthens its position in the UAE’s rapidly growing interiors and lifestyle retail sector. This strategic launch marks the first anniversary of GMG’s Home division, reflecting the company’s investment in premium interiors and its commitment to supporting local talent, suppliers, and industry innovation across the retail value chain.

- In September 2025, Perkins and Will announced a major merger with Architecture Plus Information (A+I), expanding its presence in New York City to meet increasing demand for high-end, amenity-rich luxury spaces. This merger, effective mid-September, strategically positions Perkins and Will for deeper penetration into data-driven, premium workplace and lifestyle interior design markets, supporting robust growth in luxury residential and commercial segments.

Report Coverage:

The research report offers an in-depth analysis based on Type, Services, Style and Theme and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for personalized luxury interiors will drive growth in the residential sector as consumers seek unique, high-end designs.

- Technological advancements in smart home systems and sustainability will influence design trends, boosting market innovation.

- Increased investment in luxury real estate, particularly in emerging markets, will expand opportunities for luxury interior designers.

- Growing awareness of eco-friendly designs will encourage more sustainable practices in luxury interior design projects.

- The integration of AI and digital tools in design processes will enhance personalization and efficiency, shaping the market’s future.

- The rise in disposable incomes globally, especially in Asia-Pacific and Latin America, will lead to an increase in luxury interior design services.

- Evolving consumer preferences toward minimalist and multifunctional luxury interiors will redefine design concepts in high-end spaces.

- The hospitality sector will continue to be a major contributor, with hotels and resorts investing in high-end, experiential interiors.

- Increased globalization will expand the reach of luxury interior design firms, allowing them to cater to international clients.

- Competitive pressures will drive firms to innovate continuously, focusing on high-quality craftsmanship and premium customer experiences.