Market Overview

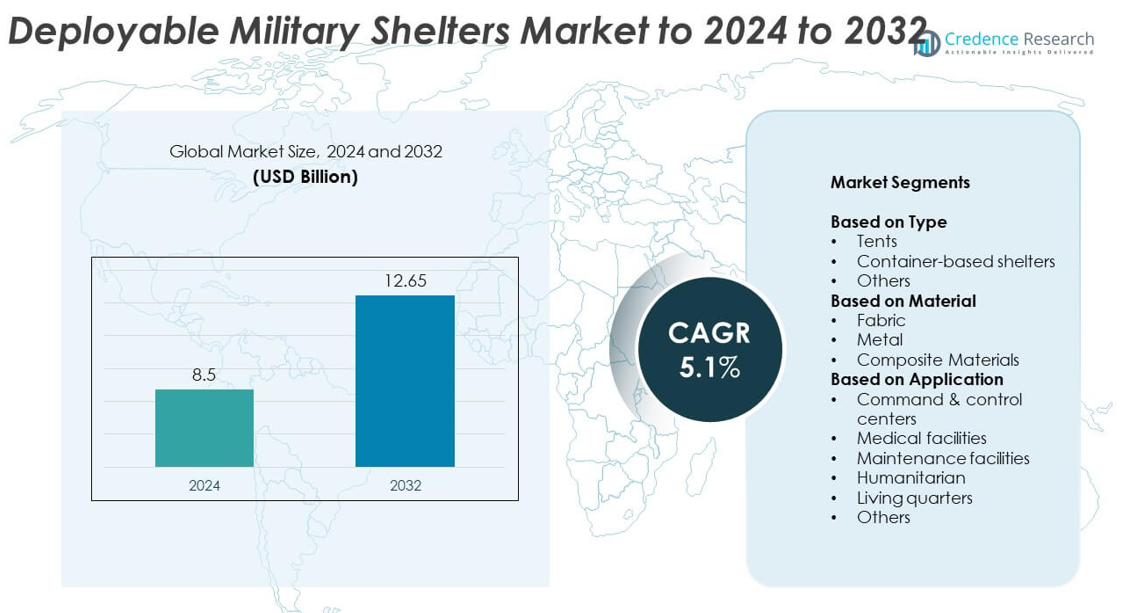

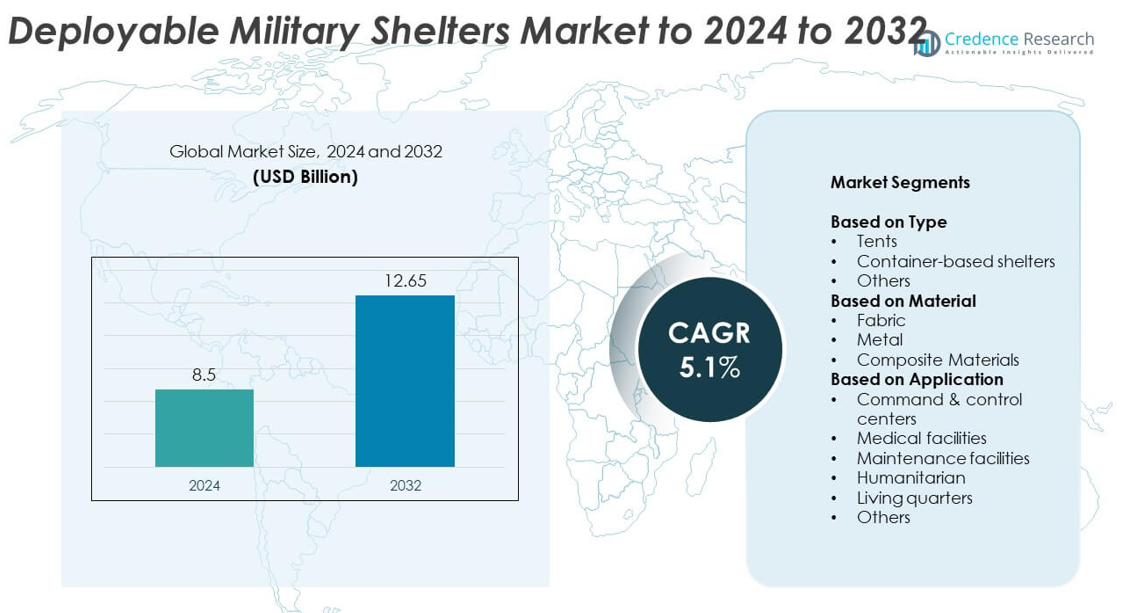

Deployable Military Shelters market size was valued at USD 8.5 billion in 2024 and is anticipated to reach USD 12.65 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Deployable Military Shelters market Size 2024 |

USD 8.5 billion |

| Deployable Military Shelters market, CAGR |

5.1% |

| Deployable Military Shelters market Size 2032 |

USD 12.65 billion |

The deployable military shelters market is led by prominent players such as Weatherhaven Global Resources, HDT Global, Losberger, AAR, Camel Manufacturing, and Alaska Structures. These companies dominate through technological innovation, global supply capabilities, and strategic partnerships with defense organizations. They focus on producing modular, durable, and rapidly deployable shelters designed for diverse field conditions and mission types. North America remains the leading region, capturing 38% of the global market share in 2024, supported by high defense spending and continuous modernization programs. Europe follows with 29%, driven by NATO initiatives and cross-border military collaborations.

Market Insights

- The deployable military shelters market was valued at USD 8.5 billion in 2024 and is expected to reach USD 12.65 billion by 2032, growing at a CAGR of 5.1% during the forecast period.

- Rising defense spending, rapid deployment needs, and increasing humanitarian operations are driving global demand for modular and mobile shelter systems.

- The market is witnessing trends toward lightweight composite materials, IoT-enabled monitoring, and energy-efficient solar-integrated designs enhancing operational performance.

- Competition is strong, with companies focusing on durability, logistics efficiency, and long-term contracts with defense agencies; the tents segment dominates with a 46% share.

- North America leads with 38% of the market share, followed by Europe at 29% and Asia-Pacific at 23%, driven by modernization programs, regional conflicts, and disaster response initiatives worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The tents segment dominated the deployable military shelters market in 2024 with a 46% share. Their lightweight design, quick setup, and cost-effectiveness make them ideal for rapid deployment across diverse terrains. Tents are widely used for field operations, disaster relief, and temporary command posts. Growing defense modernization programs and increased participation in peacekeeping missions are driving demand for advanced modular tent systems. Rising adoption of integrated tent designs with HVAC systems and solar panels further strengthens the segment’s dominance in both military and humanitarian applications.

- For instance, HDT Global’s Base-X 305 shelter, with its 18-foot clear span and rapid deployment capability, is a versatile shelter solution. It is commonly used for mobile Command and Control (C2) and medical setups, with personnel capacity varying depending on the specific application and internal configuration

By Material

The fabric segment led the market in 2024, accounting for 41% of the total share. High-strength, weather-resistant fabrics like polyester and PVC-coated textiles enable flexibility and fast installation in extreme environments. Their lightweight nature simplifies transportation, making them preferred for forward operating bases and temporary shelters. Increasing use of advanced materials with UV resistance and flame retardancy enhances durability. The growing demand for energy-efficient, insulated fabric shelters to reduce operational costs and ensure troop comfort under harsh conditions continues to boost this segment’s market share globally.

- For instance, the Alaska Structures Small Shelter System was successfully tested to withstand a 20 psf snow load and 80 mph sustained winds (100 mph gusts). For rain, it was tested to a load of 4 inches per hour with 40 mph winds.

By Application

The living quarters segment held the largest share of 38% in 2024, driven by expanding military deployments and extended field missions. Deployable living units provide essential housing solutions with integrated sanitation and climate control systems. Rising investments in soldier welfare and improved field accommodation standards are accelerating demand for modular and expandable living facilities. Additionally, the growing use of reconfigurable shelters for multi-purpose accommodation supports operational flexibility. Defense forces across North America and Europe are increasingly upgrading to energy-efficient and climate-adaptive living shelters to improve personnel readiness and comfort.

Key Growth Drivers

Rising Global Defense Expenditure

Increasing defense budgets across major economies is a key growth driver for deployable military shelters. Nations are enhancing rapid deployment capabilities to support forward bases, humanitarian missions, and disaster relief operations. Growing investments in modular infrastructure and mobile command centers by the U.S., China, and NATO countries fuel market expansion. The rising need for flexible, easily transportable shelter systems that ensure operational readiness in remote and hostile environments continues to strengthen global demand for deployable military shelters.

- For instance, Zeppelin Mobile Systeme offers a 3:1 expandable container shelter, an ISO 20 ft model, which increases its usable working area to approximately 27 m².

Expansion of Humanitarian and Peacekeeping Operations

Expanding international humanitarian and peacekeeping missions significantly boost the adoption of deployable shelters. Defense and aid organizations require quickly assembled structures for medical aid, refugee accommodation, and disaster response. The increasing frequency of natural disasters and cross-border conflicts drives procurement of modular shelters with enhanced mobility. Governments and agencies like the UN are emphasizing flexible, reusable, and climate-resilient shelter systems to meet diverse operational requirements across regions.

- For instance, BLU-MED Response Systems supplies rugged ECUs in 2.5-ton and 5-ton capacities to climate-control deployable medical tents used in relief missions.

Advancements in Modular and Composite Materials

Innovations in materials and design are enhancing the performance of military shelters. The use of composite materials, high-strength fabrics, and corrosion-resistant metals improves durability and reduces logistics costs. Advanced modular systems with integrated power, HVAC, and communication setups enable rapid deployment and reconfiguration. Growing adoption of lightweight, insulated materials also supports sustainability goals by lowering energy consumption. These technological improvements drive modernization efforts across military infrastructure globally.

Key Trends and Opportunities

Integration of Smart Technologies

The integration of smart technologies such as IoT-enabled monitoring, energy management, and automation is transforming deployable shelter systems. Military bases now demand connected infrastructure for real-time temperature, power, and security control. These advancements enhance situational awareness and operational efficiency in field environments. The increasing adoption of digital and self-sustaining shelters offers major opportunities for manufacturers to develop next-generation command and medical units with improved survivability and functionality.

- For instance, New Sun Road reported 10–20% higher solar usage from AI/IoT microgrid control across three hybrid sites, improving energy management for field camps.

Growing Focus on Sustainability and Energy Efficiency

Sustainability has become a major trend in deployable shelter design. Militaries worldwide are transitioning toward eco-friendly, energy-efficient systems powered by solar modules and advanced insulation materials. This shift reduces fuel consumption and logistical dependency in remote deployments. The demand for shelters with low carbon footprints and minimal maintenance requirements continues to rise, creating new opportunities for producers of hybrid and green military infrastructure solutions.

- For instance, Solar Stik expeditionary hybrid systems are configurable up to 10 kW, enabling generator-light, renewable-heavy shelter power.

Key Challenges

High Procurement and Maintenance Costs

High initial procurement and lifecycle maintenance costs remain major challenges for deployable shelter adoption. Advanced materials and integrated systems increase the overall expense of production and upkeep. Budget limitations in developing regions often restrict large-scale modernization programs. Additionally, logistical costs associated with transport, setup, and repair in extreme conditions further add to total operational expenditure, hindering adoption among smaller defense forces.

Regulatory and Logistical Complexities

Deployable military shelters face challenges related to varied international standards and logistic constraints. Complex defense procurement regulations slow down acquisition processes across regions. Transporting large modular shelters through difficult terrains and ensuring compliance with safety and climate standards complicates deployment. Moreover, delays in approvals for field testing and cross-border shipments impact the timely implementation of military infrastructure projects, limiting market scalability.

Regional Analysis

North America

North America held the largest share of 38% in the deployable military shelters market in 2024. The region benefits from strong defense spending by the United States and Canada, emphasizing rapid deployment capabilities and advanced modular infrastructure. Frequent overseas operations and disaster relief missions further drive demand for mobile shelters. Key manufacturers are investing in lightweight, energy-efficient, and technology-integrated designs to enhance field performance. The U.S. Department of Defense continues to modernize temporary shelter systems, supporting long-term market expansion across military and humanitarian applications.

Europe

Europe accounted for 29% of the global deployable military shelters market share in 2024. The growth is supported by NATO modernization programs and increased defense budgets across major nations, including the United Kingdom, Germany, and France. The region emphasizes energy-efficient, climate-adaptive shelters suitable for diverse terrains. Ongoing participation in peacekeeping missions and cross-border training exercises strengthens product demand. European manufacturers are developing modular shelters with enhanced insulation and transport flexibility, aligning with sustainability goals and military mobility requirements.

Asia-Pacific

Asia-Pacific captured 23% of the deployable military shelters market share in 2024. Rising border security concerns and large-scale military expansions in China, India, and South Korea drive regional growth. Increasing natural disaster occurrences also accelerate demand for quick-deploy humanitarian shelters. Governments are investing in advanced mobile infrastructure for both defense and relief missions. The adoption of durable, weather-resistant, and easy-to-assemble shelters continues to rise, supported by regional manufacturing advancements and domestic defense production initiatives under modernization programs.

Latin America

Latin America held a 6% share of the deployable military shelters market in 2024. The region’s growth is driven by rising defense modernization in Brazil, Mexico, and Colombia. Military and emergency response units are increasingly adopting mobile shelters for field operations and disaster management. Government-led initiatives to strengthen border control and humanitarian response capacity further contribute to market demand. However, limited defense budgets and reliance on imported equipment slightly constrain large-scale adoption, though regional collaborations are improving accessibility to cost-efficient shelter systems.

Middle East & Africa

The Middle East and Africa region accounted for 4% of the global deployable military shelters market in 2024. Demand is driven by ongoing defense expansion and regional conflicts requiring rapid-deployment infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are investing in modular shelters for operational bases and humanitarian relief missions. The region’s harsh climatic conditions create strong demand for heat-resistant, insulated structures. Strategic partnerships with Western defense suppliers are enhancing local production capabilities, supporting steady market penetration despite challenging geopolitical conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Tents

- Container-based shelters

- Others

By Material

- Fabric

- Metal

- Composite Materials

By Application

- Command & control centers

- Medical facilities

- Maintenance facilities

- Humanitarian

- Living quarters

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The deployable military shelters market features key players such as Weatherhaven Global Resources, HDT Global, Losberger, Camel Manufacturing, Western Shelter Systems, Saab, UTS Systems, AAR, Rapid Deployable Systems, Alaska Structures, Litefighter Systems, General Dynamics, Rubb Buildings, Marshall Aerospace and Defense Group, Sprung Structures, Outdoor Venture, W5 Solutions, and CAMSS Shelters. The competitive landscape is characterized by continuous innovation in lightweight, modular, and rapidly deployable structures. Companies focus on enhancing durability, mobility, and energy efficiency through the use of advanced composite and insulated materials. Strategic collaborations with defense organizations and government procurement agencies support long-term supply contracts and technology upgrades. Firms are emphasizing cost-effective logistics, integrated communication systems, and multi-environment adaptability to meet diverse military and humanitarian requirements. The increasing integration of IoT-enabled systems and renewable energy solutions is reshaping competitive differentiation, while strong aftersales service and customization capabilities remain critical for market leadership.

Key Player Analysis

- Weatherhaven Global Resources

- HDT Global

- Losberger

- Camel Manufacturing

- Western Shelter Systems

- Saab

- UTS Systems

- AAR

- Rapid Deployable Systems

- Alaska Structures

- Litefighter Systems

- General Dynamics

- Rubb Buildings

- Marshall Aerospace and Defense Group

- Sprung Structures

- Outdoor Venture

- W5 Solutions

- CAMSS Shelters

Recent Developments

- In 2024, W5 Solutions received a SEK 80 million order for deployable military shelter systems from an unnamed major European defense company.

- In 2023, Weatherhaven Global Resources Provided a new Headquarters Shelter System to the Canadian Armed Forces to replace their older Tent Expandable Modular System (TEMS).

- In 2023, Alaska Structures launched new multi-purpose, rapidly deployable military shelter systems in various sizes.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

1. Increasing defense modernization programs will boost demand for advanced modular shelter systems.

2. Integration of IoT and smart monitoring solutions will enhance operational efficiency in field deployments.

3. Rising humanitarian and disaster relief missions will expand non-combat shelter applications.

4. Development of lightweight composite materials will improve mobility and durability of shelters.

5. Growing focus on energy-efficient designs will encourage adoption of solar-powered and insulated shelters.

6. Expansion of NATO and UN peacekeeping operations will sustain long-term market growth.

7. Defense forces will increasingly invest in climate-adaptive and reconfigurable shelter systems.

8. Regional manufacturing collaborations will reduce procurement costs and improve supply reliability.

9. Technological innovations will lead to faster deployment and improved logistic performance.

10. Increased use of 3D printing and modular automation will transform future military shelter production.