Market Overview

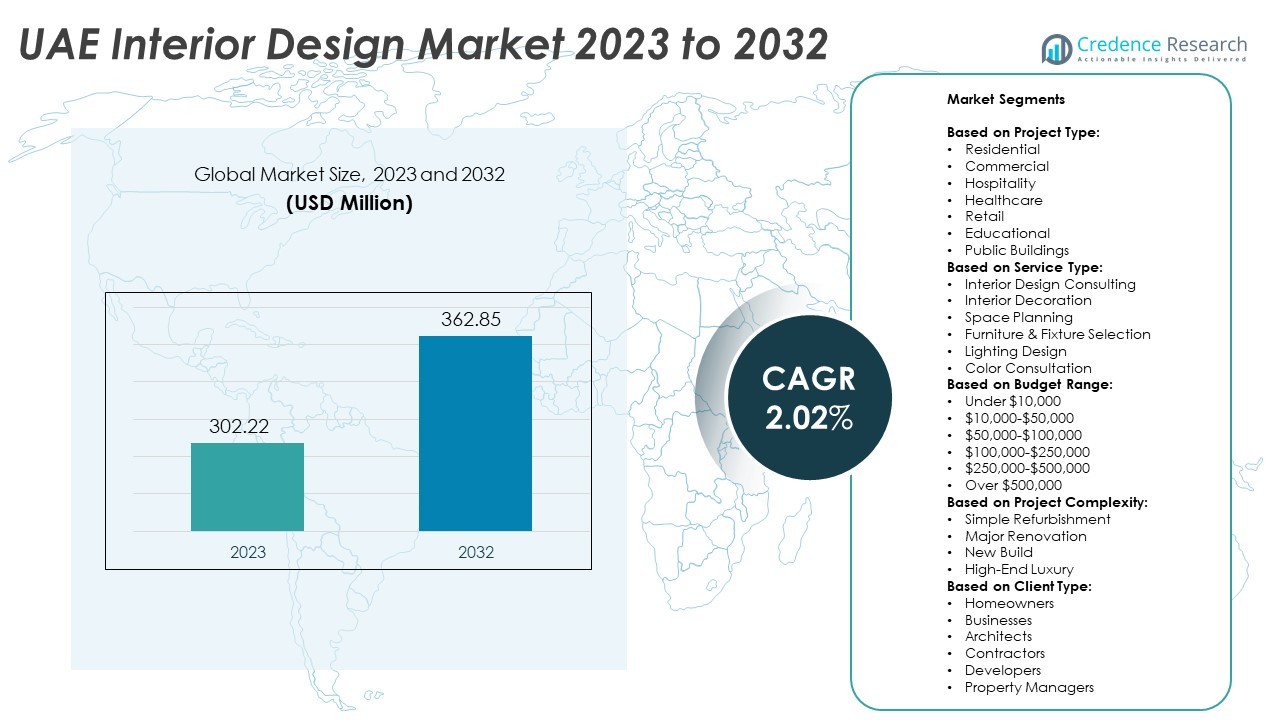

The UAE Interior Design Market size was valued at USD 302.22 million in 2023 and is anticipated to reach USD 362.85 million by 2032, growing at a CAGR of 2.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Interior Design Market Size 2024 |

USD 302.22 Million |

| UAE Interior Design Market, CAGR |

2.02% |

| UAE Interior Design Market Size 2032 |

USD 362.85 Million |

The UAE Interior Design market experiences strong growth driven by rapid urbanization, luxury residential and commercial developments, and expanding hospitality and retail sectors. Rising consumer awareness of aesthetics, lifestyle trends, and smart home integration increases demand for customized, functional, and sustainable interiors. It benefits from government initiatives, smart city projects, and infrastructure expansion, creating opportunities for modern and energy-efficient design solutions. The market trends highlight adoption of minimalistic, contemporary, and eco-friendly designs.

The UAE Interior Design market shows strong concentration in Dubai and Abu Dhabi, driven by luxury real estate, commercial projects, and hospitality developments. Sharjah and the northern emirates present steady growth through mid-range residential and small-scale commercial projects. It benefits from urbanization, infrastructure expansion, and rising consumer demand for modern, functional, and sustainable interiors across all regions. Key players driving the market include Gensler, Perkins and Will, Jacobs Engineering Group Inc., and Areen Design Services Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Interior Design market was valued at USD 302.22 million in 2023 and is expected to reach USD 362.85 million by 2032, growing at a CAGR of 2.02% during the forecast period.

- Rapid urbanization, luxury residential developments, and expansion of commercial and hospitality sectors drive strong demand for professional interior design services across the UAE.

- Rising consumer preference for modern, minimalistic, and sustainable interiors supports adoption of eco-friendly materials, smart home integration, and customized furniture and décor solutions.

- Key market trends include increased use of advanced lighting systems, space optimization, smart technology integration, and personalized services that reflect client lifestyles and brand identity.

- Competitive landscape features global and regional players such as Gensler, Perkins and Will, Jacobs Engineering Group Inc., and Areen Design Services Ltd., who focus on innovation, bespoke solutions, and technology-driven designs to maintain leadership.

- High project costs, limited availability of skilled professionals, and compliance with regulatory standards present challenges that restrict market expansion and operational efficiency for smaller firms.

- Geographical analysis indicates strong market concentration in Dubai and Abu Dhabi due to high-value projects, while Sharjah and northern emirates show steady growth from mid-range residential and commercial projects, offering opportunities for cost-effective and functional interior solutions.

Market Drivers

Rising Urbanization and Residential Development

The UAE Interior Design market benefits from rapid urbanization and the growth of residential projects across major cities. Demand for high-quality apartments, villas, and mixed-use developments drives the need for innovative interior design solutions. Developers increasingly focus on aesthetic appeal and functional layouts to attract premium buyers. It encourages collaboration with interior design firms for customized offerings. Residential projects in Dubai, Abu Dhabi, and Sharjah support continuous business opportunities. Enhanced lifestyle expectations among residents further strengthen market demand. Designers leverage modern materials and space optimization techniques to meet evolving consumer preferences.

- For instance, Hirsch Bedner Associates completed the interior fit-out for a 250-room five-star hotel in Abu Dhabi in 2023, implementing energy-efficient LED lighting and custom-designed furnishings throughout the 180,000-square-foot property.

Expansion of Commercial and Hospitality Sectors

Commercial offices, hotels, and retail spaces contribute significantly to market growth. Companies prioritize well-designed workspaces that improve employee productivity and brand identity. The hospitality sector invests in luxurious interiors to enhance guest experiences and differentiate offerings. It creates opportunities for specialized services in lighting, furniture, and thematic décor. Retail outlets adopt contemporary designs to attract and retain customers. The UAE’s positioning as a regional business hub fosters consistent demand for professional interior design. Integration of smart technologies and sustainable materials further elevates project standards.

- For instance, Hirsch Bedner Associates completed the interior design for Abu Dhabi – Yas Island, delivering 499 guest rooms and 12,000 square meters of public spaces with LED lighting and custom furniture.

Government Initiatives and Smart City Projects

Government policies promoting infrastructure development and smart city initiatives support market expansion. Investments in urban planning, commercial hubs, and cultural centers generate design requirements across multiple sectors. It allows interior designers to contribute to functional, aesthetic, and energy-efficient environments. Public-private collaborations strengthen opportunities in large-scale projects. Sustainable and green building standards encourage the use of eco-friendly materials and innovative design practices. National tourism and real estate strategies amplify commercial and hospitality interior projects. The alignment with international design standards attracts global expertise and technology.

Increasing Consumer Awareness and Lifestyle Trends

Changing lifestyle preferences drive interest in personalized and premium interior design solutions. Consumers seek modern, minimalistic, and technologically integrated interiors. It creates demand for bespoke furniture, décor, and space optimization services. Social media and design platforms influence trends and purchasing decisions. Rising disposable incomes support investments in luxury and high-quality interiors. Designers adopt creative approaches to meet client expectations and differentiate services. Continuous innovation and trend adaptation remain central to sustaining market growth.

Market Trends

Adoption of Sustainable and Eco-Friendly Designs

The UAE Interior Design market increasingly embraces sustainable and eco-friendly solutions. Designers prioritize materials with low environmental impact, including recycled, renewable, and energy-efficient products. It encourages projects that reduce carbon footprints and comply with green building certifications. Residential and commercial clients demand interiors that combine aesthetics with environmental responsibility. Sustainable lighting, furniture, and HVAC solutions gain significant attention. It allows firms to differentiate offerings and appeal to environmentally conscious consumers. Industry players invest in research and technology to implement innovative sustainable design practices.

- For instance, Summertown Interiors completed its Dubai headquarters fit-out achieving LEED Gold certification, reducing CO₂ emissions by 30 tonnes annually through sustainable material selection and efficient energy systems.

Integration of Smart Home and Office Technologies

Smart technology drives a key trend within the market. Automation systems, IoT-enabled devices, and AI-based solutions enhance functionality, comfort, and efficiency. It enables real-time control of lighting, climate, and security in residential and commercial spaces. Clients increasingly prefer integrated solutions that combine convenience with modern aesthetics. Smart furniture and adaptive layouts strengthen design versatility. Interior designers collaborate with tech providers to deliver seamless experiences. Market growth aligns with rising adoption of connected solutions in the UAE’s urban developments.

- For instance, Büro If completed the minimalist interior design of the DIFC Office Complex, delivering 5,200 square meters of modular workspaces and open-plan layouts with 150 custom furniture pieces.

Rise of Minimalistic and Contemporary Styles

Minimalistic and contemporary design trends dominate current consumer preferences. Clean lines, neutral color palettes, and open layouts appeal to modern lifestyles. It encourages space optimization while maintaining visual sophistication. Residential and office spaces reflect simplicity without compromising elegance or functionality. Designers focus on modular furniture, multifunctional spaces, and subtle décor elements. Market participants incorporate modern art and bespoke finishes to enhance appeal. Trends emphasize practicality, comfort, and a premium yet understated aesthetic.

Focus on Luxury and Customization

Luxury and personalized design services continue to gain traction. High-net-worth individuals and premium hospitality clients seek unique, tailor-made interiors. It drives demand for bespoke furniture, custom lighting, and curated décor solutions. Personalization reflects cultural influences, lifestyle preferences, and brand identity. Designers leverage advanced tools, 3D modeling, and virtual reality to visualize client-specific concepts. Luxury projects highlight quality, exclusivity, and attention to detail. The trend strengthens the market’s value proposition and fosters long-term client relationships.

Market Challenges Analysis

High Project Costs and Budget Constraints

The UAE Interior Design market faces challenges from rising project costs and strict budget limitations. Premium materials, advanced technologies, and skilled labor contribute to higher overall expenses. It creates pressure on designers to balance quality and cost-effectiveness while meeting client expectations. Small and medium-sized enterprises often struggle to access high-end solutions due to financial constraints. Fluctuating material prices and import tariffs further impact project planning. Designers must optimize resource allocation and identify cost-efficient alternatives. Maintaining project timelines without compromising design quality remains a continuous challenge.

Shortage of Skilled Professionals and Regulatory Compliance

Limited availability of experienced interior designers and specialized contractors poses another key challenge. It restricts the market’s capacity to handle large-scale residential and commercial projects efficiently. Firms face difficulties in sourcing skilled personnel proficient in modern technologies and sustainable design practices. Compliance with local regulations, building codes, and safety standards adds complexity to project execution. Navigating permits, certifications, and approvals can delay timelines and increase operational costs. Training programs and knowledge transfer initiatives remain essential to mitigate skill gaps. Sustaining high service standards while adhering to regulatory requirements demands strategic planning and operational discipline.

Market Opportunities

Expansion in Residential and Luxury Segments

The UAE Interior Design market presents opportunities through growth in residential and luxury sectors. Rising demand for premium villas, apartments, and high-end developments drives need for sophisticated interior solutions. It allows designers to offer customized layouts, bespoke furniture, and exclusive décor elements. High disposable incomes and increasing lifestyle expectations encourage investment in personalized interiors. Collaboration with real estate developers strengthens market reach and client engagement. Innovative designs that combine functionality, aesthetics, and cultural influences enhance project value. Expanding residential portfolios across urban and suburban areas provides consistent business opportunities.

Integration of Technology and Smart Solutions

Technology adoption offers significant potential within the market. Smart homes, automated systems, and IoT-enabled solutions enhance efficiency, comfort, and user experience. It enables designers to provide integrated solutions that align with modern living and commercial needs. Virtual reality and 3D modeling facilitate client visualization and decision-making. Sustainable technology applications, including energy-efficient lighting and eco-friendly materials, create differentiation. Interior firms can leverage technological innovations to deliver premium, future-ready solutions. Growing interest in connected and adaptive environments supports long-term market expansion.

Market Segmentation Analysis:

By Project Type:

The UAE Interior Design market demonstrates diverse demand across multiple project types, reflecting the country’s dynamic urban landscape. Residential projects account for a significant share, driven by luxury villas, apartments, and high-end residential communities. It encourages designers to create customized layouts, bespoke furniture, and aesthetic interiors that enhance livability. Commercial projects, including offices and co-working spaces, focus on productivity, brand representation, and modern work environments. Hospitality projects, comprising hotels and resorts, require luxury, thematic designs, and premium guest experiences. Healthcare facilities demand functional, hygienic, and patient-centric interiors. Retail spaces prioritize layouts that improve customer engagement and optimize product display. Educational institutions and public buildings emphasize durability, compliance, and efficient space utilization while maintaining contemporary aesthetics.

- For instance, Studio Focus completed 60 luxury apartments in Dubai Hills Estate, incorporating modular kitchens and automated lighting across 7,500 square meters.

By Service Type:

Service segmentation highlights the critical role of specialized offerings in driving market growth. Interior design consulting remains fundamental, guiding clients through planning, concept development, and design strategy. It ensures alignment between client vision and practical implementation. Interior decoration services enhance visual appeal through furnishings, artwork, and décor elements. Space planning optimizes layouts for functionality, circulation, and ergonomic efficiency. Furniture and fixture selection caters to style, comfort, and durability requirements. Lighting design and color consultation provide ambiance, mood enhancement, and thematic consistency, strengthening overall design impact. Service diversification enables firms to address client-specific needs effectively.

- For instance, The Design Bureau executed interiors for 2 Signature Villas on Palm Jumeirah, each spanning approximately 1,800 square meters, featuring bespoke furniture, integrated smart home systems, and automated lighting solutions. The project included custom-designed 120 pieces of furniture, 75 LED lighting installations, and 12 smart automation zones per villa.

By Budget Range:

Budget segmentation reflects varying project scales and investment capacity. Projects under $10,000 cater to small residential or office spaces requiring basic enhancements. It supports cost-effective solutions with focus on essential design elements. Mid-range projects between $10,000 and $250,000 include residential renovations, small commercial, and boutique hospitality setups, requiring moderate customization and premium finishes. High-budget projects between $250,000 and $500,000 emphasize luxury interiors, technological integration, and detailed customization. Projects over $500,000 target premium villas, large-scale commercial offices, and luxury hotels, demanding end-to-end design solutions, bespoke furniture, and advanced lighting and smart systems. Budget-oriented segmentation allows interior designers to tailor services and maintain operational efficiency across diverse client profiles.

Segments:

Based on Project Type:

- Residential

- Commercial

- Hospitality

- Healthcare

- Retail

- Educational

- Public Buildings

Based on Service Type:

- Interior Design Consulting

- Interior Decoration

- Space Planning

- Furniture & Fixture Selection

- Lighting Design

- Color Consultation

Based on Budget Range:

- Under $10,000

- $10,000-$50,000

- $50,000-$100,000

- $100,000-$250,000

- $250,000-$500,000

- Over $500,000

Based on Project Complexity:

- Simple Refurbishment

- Major Renovation

- New Build

- High-End Luxury

Based on Client Type:

- Homeowners

- Businesses

- Architects

- Contractors

- Developers

- Property Managers

Based on the Geography:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain

Regional Analysis

Dubai

Dubai holds the largest share of the UAE Interior Design market, accounting for 40% of the total market. The city’s rapid urbanization, luxury real estate projects, and international business presence drive high demand for premium residential and commercial interiors. It supports a wide range of design services, including bespoke furniture, smart home integration, and advanced lighting solutions. The hospitality and retail sectors in Dubai heavily invest in thematic and experiential designs to attract global clientele. It attracts international interior design firms due to its dynamic market and high-value projects. Residential communities, including villas and upscale apartments, continue to generate consistent demand. Designers leverage Dubai’s diverse client base to implement innovative trends, eco-friendly materials, and smart technologies.

Abu Dhabi

Abu Dhabi contributes a significant 25% market share in the UAE Interior Design market. The city’s large-scale governmental, cultural, and hospitality projects create opportunities for advanced interior design services. It emphasizes high-quality, functional, and aesthetically appealing designs across commercial, residential, and public infrastructure. Luxury hotels, resorts, and corporate offices in Abu Dhabi require customized solutions that enhance user experience and brand value. It encourages adoption of sustainable practices and modern technologies in large-scale developments. Cultural and heritage projects also stimulate demand for bespoke and thematic interiors. Interior design firms focus on integrating innovative layouts, energy-efficient lighting, and premium materials to meet client expectations.

Sharjah

Sharjah holds approximately 15% of the UAE Interior Design market. The region experiences steady growth through mid-range residential and commercial projects. It emphasizes functional, practical, and cost-efficient interior solutions, catering to small and medium-sized enterprises as well as residential clients. It allows designers to implement modern designs while maintaining affordability. Educational and healthcare facilities also contribute to Sharjah’s interior design demand. Local regulations and cultural considerations influence design choices, encouraging compliance and adaptive planning. Firms expand portfolios by offering a balance of aesthetics, efficiency, and budget-sensitive solutions.

Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain

Collectively, these northern emirates account for the remaining 20% of the UAE Interior Design market. The market is primarily driven by residential development, small-scale commercial projects, and government infrastructure initiatives. It presents opportunities for cost-effective design services, modular layouts, and functional interiors. Hospitality and retail sectors contribute modestly to the regional market. Designers focus on practical solutions with modern aesthetics to attract emerging clients. Regional growth benefits from expanding urbanization, improved infrastructure, and rising consumer awareness. Investment in sustainable and smart solutions gradually increases demand in these areas, supporting long-term market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Areen Design Services Ltd

- Cannon Design

- Framework Studio

- Gensler

- Hirsch Bedner Associates

- IA Interior Architects

- Jacobs Engineering Group Inc.

- NELSON & Associates Interior Design and Space Planning Inc.

- Perkins and Will

- Büro Kif

- Stantec Inc

Competitive Analysis

Key players in the UAE Interior Design market include Gensler, Perkins and Will, Jacobs Engineering Group Inc., Areen Design Services Ltd, IA Interior Architects, Cannon Design, Hirsch Bedner Associates, Stantec Inc, NELSON & Associates Interior Design and Space Planning Inc., and Büro Kif. These leading firms leverage their global expertise and regional presence to secure high-value residential, commercial, and hospitality projects across the UAE.They focus on delivering customized solutions, integrating smart technologies, sustainable materials, and advanced lighting and furniture systems. It enables them to cater to diverse client requirements while maintaining premium service quality. Collaborative partnerships with real estate developers, hospitality groups, and corporate clients strengthen their market positioning.Innovation and design excellence remain central to competitive differentiation, with firms investing in virtual reality, 3D modeling, and project visualization tools to enhance client engagement. It allows faster decision-making, precise execution, and superior project outcomes. Strategic expansion into emerging regions such as northern emirates provides growth opportunities while reinforcing brand presence.Operational efficiency, skilled workforce management, and adherence to regulatory standards further enhance competitiveness. It ensures consistent delivery of high-quality projects and long-term client relationships. These factors collectively consolidate the dominance of key players in the UAE Interior Design market while driving market evolution through innovation and tailored service offerings.

Recent Developments

- In 2025, Gensler collaborated on the interior design of a mixed-use commercial and residential development in Downtown Dubai, focusing on smart office spaces and sustainable materials.

- In 2024, AECOM was announced as the Silver Sponsor for the Design Middle East Awards and Design Forum 2024, which was held on November 22 at Hilton Al Habtoor City Al Joud Ballroom, Dubai.

- In October 2023, Algedra Group introduced AI-driven smart home interior solutions in the UAE, enhancing automation and energy efficiency in luxury residences. This innovation integrates AI with modern aesthetics to elevate user experience.

- In July 2023, Depa Group secured a large-scale hospitality interior fit-out contract in Dubai, reinforcing its position as a leading provider of high-end design and execution services in the region.

- In March 2023, Luxe Interior Studio launched a sustainable furniture line made from recycled materials, aligning with the UAE’s commitment to green building initiatives and eco-friendly interiors.

- In January 2023, Godwin Austen Johnson (GAJ) completed the renovation of a major commercial complex in Abu Dhabi, incorporating biophilic design elements to enhance occupant well-being and workplace productivity.

Market Concentration & Characteristics

The UAE Interior Design market demonstrates a moderately concentrated structure, dominated by leading international and regional firms that cater to high-value residential, commercial, and hospitality projects. It features a competitive landscape where established players such as Gensler, Perkins and Will, and Areen Design Services Ltd leverage global expertise, innovative design solutions, and technology integration to maintain market leadership. Smaller and mid-sized firms focus on niche segments, including boutique hotels, luxury villas, and specialized corporate offices, offering personalized services to differentiate themselves. It reflects strong client demand for contemporary, functional, and sustainable interiors, driving adoption of smart home technologies, ergonomic layouts, and eco-friendly materials. The market exhibits dynamic characteristics, with frequent collaborations between designers, real estate developers, and contractors to deliver high-quality, tailored solutions. Project complexity, client expectations, and premium pricing create barriers for new entrants while reinforcing the competitive advantage of established companies. It also shows flexibility in adapting to emerging trends such as minimalistic design, luxury customization, and experiential retail spaces, highlighting the evolving nature of client preferences and investment priorities within the UAE.

Report Coverage

The research report offers an in-depth analysis based on Project Type, Service Type, Budget Range, Project Complexity, Client Type, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE Interior Design market will continue to grow with increasing demand for luxury residential and commercial projects.

- Sustainable and eco-friendly interior solutions will gain greater adoption across all segments.

- Integration of smart home and IoT technologies will become a standard feature in premium projects.

- Boutique hotels and experiential hospitality spaces will drive niche market opportunities.

- Corporate offices will focus on flexible, ergonomic, and collaborative workspace designs.

- Regional expansion into northern emirates will create new project opportunities for mid-sized firms.

- Digital tools such as 3D visualization and virtual reality will enhance client engagement and project planning.

- High-end retail spaces will increasingly adopt immersive and thematic interior concepts.

- Demand for customized furniture, lighting, and décor will grow to reflect client individuality.

- Partnerships between designers, developers, and technology providers will strengthen market innovation and service delivery.